Key Insights

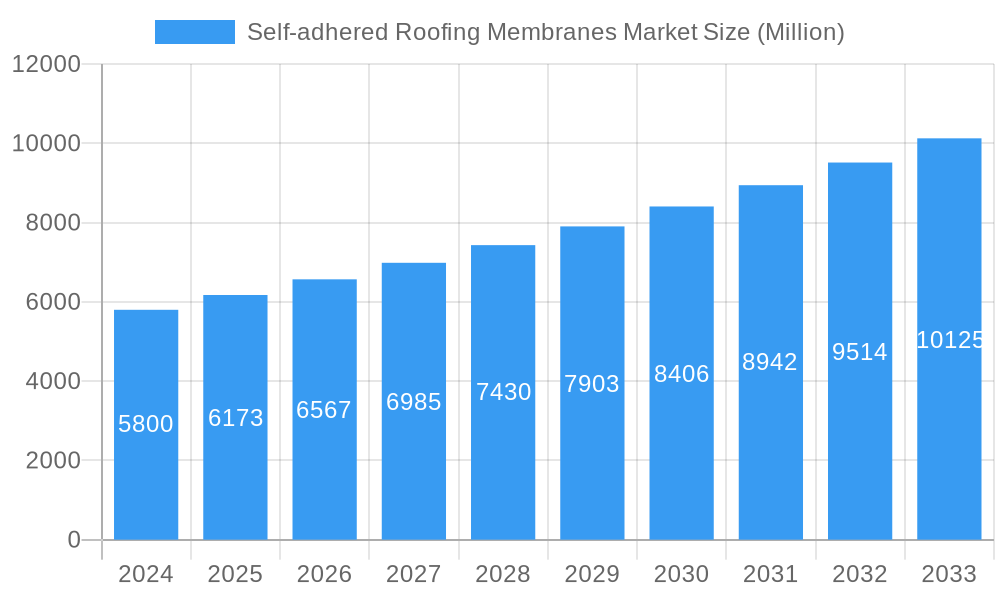

The global Self-adhered Roofing Membranes market is poised for significant expansion, projected to reach USD 5.8 billion in 2024, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth is propelled by several key drivers, including the increasing demand for energy-efficient and sustainable building materials, coupled with the inherent advantages of self-adhered membranes such as ease of installation, reduced labor costs, and enhanced durability. The product segment is dominated by Thermoplastic Polyolefin (TPO) and Ethylene Propylene Diene Monomer (EPDM) due to their superior weather resistance and longevity, while Polyvinyl Chloride (PVC) and Modified Bitumen (Mod-Bit) continue to hold substantial shares owing to their cost-effectiveness and proven performance. The residential and commercial construction sectors are primary application areas, with growing interest from institutional and infrastructural projects seeking reliable and long-term roofing solutions. Geographically, North America and Europe currently lead the market due to stringent building codes and a high adoption rate of advanced roofing technologies. However, the Asia Pacific region is expected to witness the fastest growth, driven by rapid urbanization, increasing construction activities, and rising disposable incomes.

Self-adhered Roofing Membranes Market Market Size (In Billion)

The market faces certain restraints, such as the initial cost of some advanced self-adhered membrane products compared to traditional roofing methods, and the potential for performance degradation under extreme environmental conditions if not properly installed or maintained. Nevertheless, ongoing technological advancements in adhesive technologies and material science are addressing these limitations, leading to improved product performance and expanded application possibilities. Key players like Soprema Inc., Firestone Building Products Company LLC, and GAF are investing heavily in research and development to introduce innovative products and expand their market reach. Emerging trends include the development of "cool roofing" membranes that reflect solar radiation, contributing to reduced building energy consumption, and the integration of smart technologies for real-time performance monitoring. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at enhancing product portfolios and gaining a larger market share.

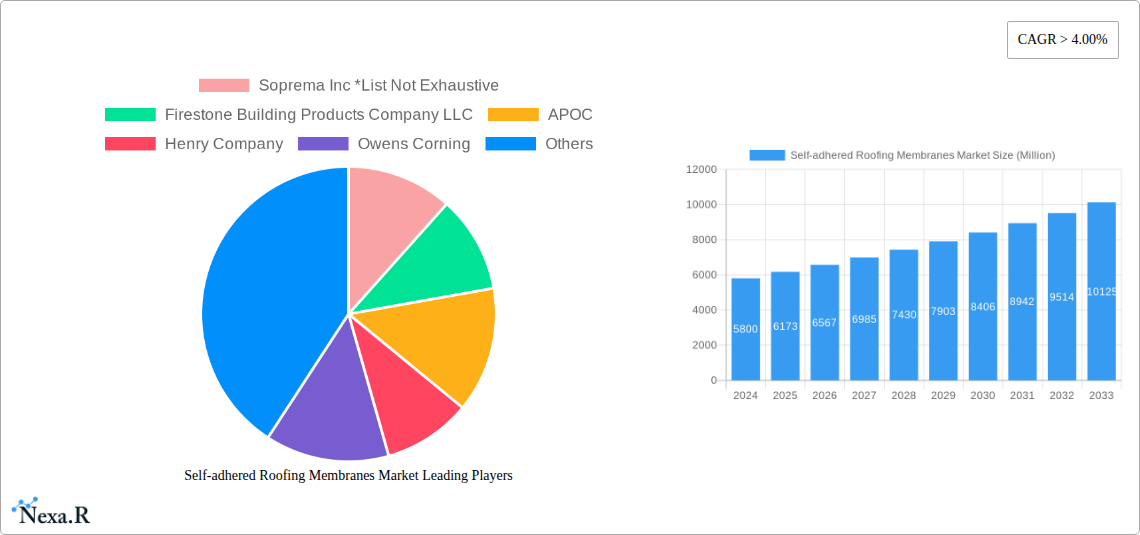

Self-adhered Roofing Membranes Market Company Market Share

Report Description: Self-Adhered Roofing Membranes Market - Forecast to 2033

This comprehensive report offers an in-depth analysis of the Self-Adhered Roofing Membranes Market, a critical segment within the global construction and building materials industry. The market is experiencing robust growth driven by increasing demand for durable, energy-efficient, and easily installable roofing solutions across residential, commercial, and infrastructural applications. This report forecasts significant expansion from USD 15.8 billion in 2025 to an estimated USD 23.5 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.9% during the forecast period (2025-2033).

We delve into the intricate dynamics of the parent market, Global Roofing Materials Market, and its vital child market, Self-Adhered Roofing Membranes Market, providing unparalleled insights for stakeholders. The study encompasses a detailed historical analysis from 2019-2024 and forecasts up to 2033, with 2025 serving as the base and estimated year.

Key segments analyzed include:

- Product Type: Thermoplastic Polyolefin (TPO), Ethylene Propylene Diene Monomer (EPDM), Polyvinyl Chloride (PVC), Modified Bitumen (Mod-Bit), and Other Product Types.

- Application: Residential, Commercial, Institutional, and Infrastructural.

Leading companies shaping this dynamic market include: Soprema Inc, Firestone Building Products Company LLC, APOC, Henry Company, Owens Corning, GAF, Sika AG, Carlisle SynTec Systems, Johns Manville, and Icopal Ltd (BMI Group), among others.

This report is an essential resource for manufacturers, suppliers, distributors, investors, and other industry professionals seeking to understand current trends, future opportunities, and competitive strategies within the self-adhered roofing membranes sector.

Self-Adhered Roofing Membranes Market Dynamics & Structure

The Self-Adhered Roofing Membranes Market exhibits a moderately consolidated structure, characterized by the presence of established global players and a growing number of regional manufacturers. Technological innovation is a primary driver, with continuous advancements in material science leading to enhanced durability, UV resistance, and ease of installation. Regulatory frameworks, particularly concerning energy efficiency and sustainable building practices, are increasingly influencing product development and adoption. Competitive product substitutes, such as mechanically fastened membranes and liquid-applied systems, present ongoing challenges, necessitating clear differentiation through performance and cost-effectiveness. End-user demographics reveal a rising preference for low-maintenance, long-lifespan roofing solutions, particularly in commercial and residential sectors. Mergers and acquisitions (M&A) trends are notable, with larger companies strategically acquiring smaller innovators to expand their product portfolios and market reach. For instance, the acquisition of Firestone Building Products by LafargeHolcim in January 2021 for USD 3.4 billion underscores this consolidation trend. Innovation barriers include the high cost of research and development for novel materials and the lengthy approval processes for new products in some regions.

- Market Concentration: Moderately consolidated with leading players holding significant market share.

- Technological Innovation: Driven by demand for enhanced performance, sustainability, and ease of application.

- Regulatory Frameworks: Influencing product standards, particularly for energy efficiency and environmental impact.

- Competitive Substitutes: Mechanically fastened membranes, liquid-applied systems, and traditional asphalt roofing.

- End-User Demographics: Growing preference for durability, low maintenance, and sustainability.

- M&A Trends: Strategic acquisitions to gain market share, technology, and product diversification.

- Innovation Barriers: High R&D costs, stringent building codes, and market acceptance of new technologies.

Self-Adhered Roofing Membranes Market Growth Trends & Insights

The Self-Adhered Roofing Membranes Market is poised for substantial expansion, with its market size projected to grow from an estimated USD 15.8 billion in 2025 to USD 23.5 billion by 2033. This growth is underpinned by a compelling CAGR of 4.9% during the forecast period (2025-2033). The historical period (2019-2024) witnessed steady adoption rates, fueled by increasing awareness of the benefits associated with these roofing systems, including their fast installation, reduced labor costs, and excellent waterproofing capabilities. Technological disruptions are continuously enhancing the performance of these membranes. Advancements in polymer formulations for TPO and PVC membranes are leading to improved UV resistance and flexibility, while developments in adhesive technologies are ensuring stronger, more reliable bonds even in challenging environmental conditions.

Consumer behavior shifts are also playing a crucial role. Building owners and contractors are increasingly prioritizing long-term value and reduced lifecycle costs, making self-adhered membranes an attractive option over traditional methods. The growing emphasis on green building initiatives and energy-efficient structures further accelerates market penetration. For instance, the ability of certain self-adhered membranes to contribute to cool roofing systems, reflecting solar heat and reducing building energy consumption, is a significant selling point. The market penetration of self-adhered membranes is expected to deepen across all application segments. In the commercial sector, the demand for quick project completion and minimal disruption to business operations favors these systems. The residential sector benefits from their durability and aesthetic versatility. Infrastructural projects, such as bridges and tunnels, are increasingly specifying self-adhered membranes for their superior waterproofing and longevity. The evolution of the market is also marked by a growing demand for specialized membranes designed for specific climates and building requirements, such as those offering enhanced fire resistance or wind uplift performance. The increasing adoption of sustainable and recycled materials in the manufacturing process will further bolster market appeal.

Dominant Regions, Countries, or Segments in Self-Adhered Roofing Membranes Market

The Commercial application segment is currently the dominant force driving growth within the Self-Adhered Roofing Membranes Market. This segment is expected to continue its leadership trajectory throughout the forecast period. The robust demand for high-performance roofing solutions in the construction of office buildings, retail spaces, warehouses, and industrial facilities underpins this dominance. Key drivers include the need for rapid project completion, reduced labor costs, and enhanced building performance, all of which are inherent advantages of self-adhered membranes. Furthermore, the increasing trend towards large-scale commercial developments in emerging economies, coupled with stringent building codes emphasizing durability and weather resistance, further bolsters the market share of this segment.

- Commercial Segment Dominance: Driven by new construction and re-roofing projects for office complexes, retail centers, and industrial facilities.

- Key Drivers: Faster installation times, lower labor requirements, superior waterproofing, and contribution to LEED certification and energy efficiency goals.

- Market Share: Estimated to hold over 40% of the total market by 2025.

- Growth Potential: Significant opportunities in developing economies and retrofitting older commercial structures.

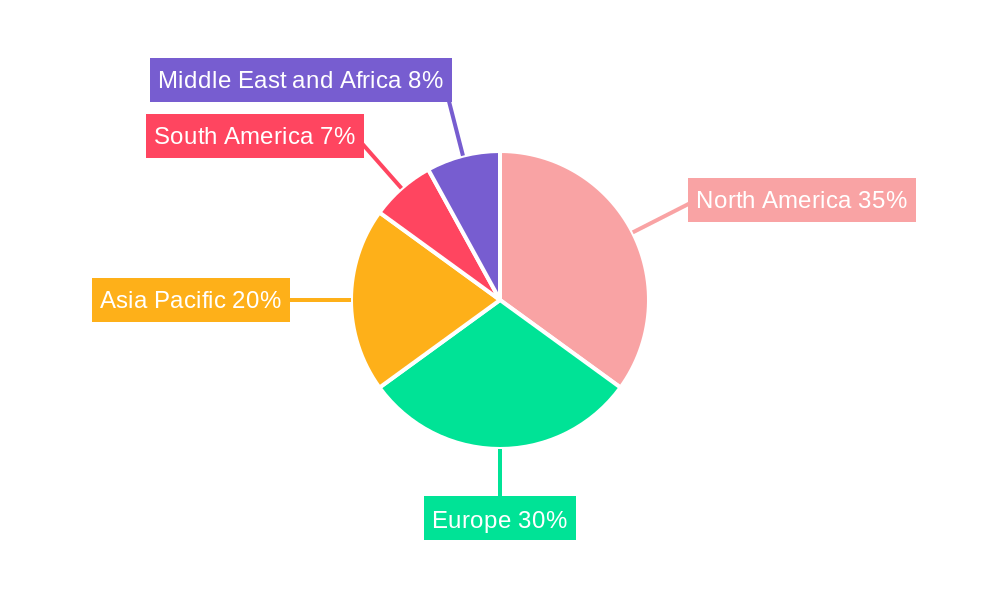

Geographically, North America is anticipated to remain the leading region, owing to its mature construction industry, high disposable incomes, and stringent building regulations promoting energy-efficient and durable roofing. The presence of major manufacturers and a strong demand for both residential and commercial re-roofing projects contribute to its dominance.

- North America's Regional Leadership: Strong adoption rates in the U.S. and Canada due to established construction markets and building codes.

- Key Drivers: High rate of re-roofing activities, government incentives for energy-efficient buildings, and a strong preference for long-lasting roofing solutions.

- Market Share: Projected to account for approximately 35% of the global market in 2025.

- Growth Potential: Continued growth driven by infrastructure development and the renovation of existing building stock.

Within product types, Thermoplastic Polyolefin (TPO) membranes are emerging as a frontrunner, gaining significant traction due to their cost-effectiveness, excellent durability, UV resistance, and ease of installation. The growing environmental consciousness and the demand for single-ply membranes that are energy-efficient and recyclable further propel TPO's market share.

- TPO as a Leading Product Type: Increasingly favored for its performance-to-cost ratio and environmental benefits.

- Key Drivers: Energy efficiency (cool roof properties), heat-weldable seams for superior integrity, resistance to chemicals and punctures, and growing environmental regulations.

- Market Share: Expected to grow at a CAGR of over 5.5% during the forecast period.

- Growth Potential: Expanding applications in both commercial and residential sectors, particularly in warmer climates.

Self-Adhered Roofing Membranes Market Product Landscape

The product landscape of the Self-Adhered Roofing Membranes Market is characterized by continuous innovation aimed at enhancing performance and ease of application. Manufacturers are developing advanced formulations for TPO, EPDM, and PVC membranes with superior UV stability, increased flexibility at low temperatures, and enhanced puncture resistance. Adhesive technologies are also evolving, offering stronger bonding capabilities that reduce the risk of wind uplift and delamination, even in harsh weather conditions. Unique selling propositions often revolve around extended warranty periods, fire resistance ratings, and the incorporation of recycled content. Technological advancements are focusing on developing "cool roof" membranes that reflect solar radiation, contributing to energy savings and reduced urban heat island effects.

Key Drivers, Barriers & Challenges in Self-Adhered Roofing Membranes Market

Key Drivers: The Self-Adhered Roofing Membranes Market is propelled by several key factors. Technological advancements in material science are yielding membranes with superior durability, weather resistance, and ease of installation. Growing global awareness of energy efficiency in buildings is a significant driver, with self-adhered membranes often contributing to cool roof solutions. Stringent building codes promoting longer lifespans and lower maintenance requirements for roofing systems also favor these products. The increasing pace of commercial and residential construction projects globally, especially in emerging economies, fuels demand. Furthermore, the cost-effectiveness and reduced labor requirements associated with self-adhered installation compared to traditional methods are major catalysts for adoption.

Key Barriers & Challenges: Despite the growth trajectory, the market faces certain barriers and challenges. The initial cost of some high-performance self-adhered membranes can be a deterrent for budget-conscious projects, especially when compared to conventional asphaltic roofing. Competition from well-established mechanically fastened roofing systems and liquid-applied membranes poses an ongoing challenge. Supply chain disruptions, fluctuating raw material prices, and the availability of skilled labor for specialized installation can also impact market growth. Regulatory hurdles and the need for adherence to diverse building codes across different regions can create complexity for manufacturers and installers. The perception of self-adhered membranes as a premium product in certain markets can also limit widespread adoption.

Emerging Opportunities in Self-Adhered Roofing Membranes Market

Emerging opportunities within the Self-Adhered Roofing Membranes Market lie in several key areas. The increasing global focus on sustainable construction practices presents a significant opportunity for manufacturers developing membranes with high recycled content and excellent recyclability. The expansion of the green building sector and certifications like LEED will drive demand for these environmentally friendly options. Another promising avenue is the development of "smart" roofing membranes integrated with sensors for real-time performance monitoring and predictive maintenance. Untapped markets in developing regions with a growing middle class and increasing construction activities offer substantial growth potential. Furthermore, innovative applications in specialized infrastructural projects, such as solar farms and water management systems, can open new market segments. Evolving consumer preferences for aesthetically pleasing and low-maintenance roofing solutions also present opportunities for product differentiation and premium pricing.

Growth Accelerators in the Self-Adhered Roofing Membranes Market Industry

The long-term growth of the Self-Adhered Roofing Membranes Market is being accelerated by several transformative factors. Continuous technological breakthroughs in polymer chemistry and adhesive formulations are leading to membranes that are lighter, stronger, and more resistant to extreme weather conditions. Strategic partnerships between membrane manufacturers and building envelope consultants are fostering greater adoption of integrated roofing solutions. Market expansion strategies, including aggressive product development and penetration into previously underserved geographical regions, are key growth accelerators. The increasing demand for energy-efficient buildings and the global push for sustainable construction practices are creating a favorable regulatory and economic environment. Furthermore, the development of membranes with enhanced fire resistance and acoustic insulation properties will broaden their appeal across diverse building types, acting as significant growth catalysts.

Key Players Shaping the Self-Adhered Roofing Membranes Market Market

- Soprema Inc

- Firestone Building Products Company LLC

- APOC

- Henry Company

- Owens Corning

- GAF

- Sika AG

- Carlisle SynTec Systems

- Johns Manville

- Icopal Ltd (BMI Group)

Notable Milestones in Self-Adhered Roofing Membranes Market Sector

- January 2021: LafargeHolcim signed an agreement to acquire Firestone Building Products from Bridgestone Americas. This acquisition is a milestone in LafargeHolcim's transformation to become the global leader in innovative and sustainable building solutions. The estimated cost of this transaction was valued at USD 3.4 billion.

In-Depth Self-Adhered Roofing Membranes Market Market Outlook

The Self-Adhered Roofing Membranes Market is set for a dynamic future, characterized by sustained growth driven by innovation and increasing demand for high-performance, sustainable building solutions. Growth accelerators such as advancements in material science, leading to more durable and energy-efficient membranes, will continue to shape the market. Strategic partnerships and expanding market reach into developing economies offer significant opportunities for market players. The global commitment to green building practices and stricter energy regulations will further boost the adoption of self-adhered systems, particularly those offering cool roofing benefits and incorporating recycled content. The outlook is positive, with continued technological evolution and a growing emphasis on lifecycle value poised to drive further market penetration and value creation.

Self-adhered Roofing Membranes Market Segmentation

-

1. Product Type

- 1.1. Thermoplastic Polyolefin (TPO)

- 1.2. Ethylene Propylene Diene Monomer (EPDM)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Modified Bitumen (Mod-Bit)

- 1.5. Other Product Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

- 2.4. Infrastructural

Self-adhered Roofing Membranes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Self-adhered Roofing Membranes Market Regional Market Share

Geographic Coverage of Self-adhered Roofing Membranes Market

Self-adhered Roofing Membranes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Construction Expenditure in the North American Region; Advantages Over Traditional Roofing Membranes

- 3.3. Market Restrains

- 3.3.1. Low Performance in Cold Weather Conditions; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential Construction is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Thermoplastic Polyolefin (TPO)

- 5.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Modified Bitumen (Mod-Bit)

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.2.4. Infrastructural

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Thermoplastic Polyolefin (TPO)

- 6.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 6.1.3. Polyvinyl Chloride (PVC)

- 6.1.4. Modified Bitumen (Mod-Bit)

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Institutional

- 6.2.4. Infrastructural

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Thermoplastic Polyolefin (TPO)

- 7.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 7.1.3. Polyvinyl Chloride (PVC)

- 7.1.4. Modified Bitumen (Mod-Bit)

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Institutional

- 7.2.4. Infrastructural

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Thermoplastic Polyolefin (TPO)

- 8.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 8.1.3. Polyvinyl Chloride (PVC)

- 8.1.4. Modified Bitumen (Mod-Bit)

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Institutional

- 8.2.4. Infrastructural

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Thermoplastic Polyolefin (TPO)

- 9.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 9.1.3. Polyvinyl Chloride (PVC)

- 9.1.4. Modified Bitumen (Mod-Bit)

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Institutional

- 9.2.4. Infrastructural

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Self-adhered Roofing Membranes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Thermoplastic Polyolefin (TPO)

- 10.1.2. Ethylene Propylene Diene Monomer (EPDM)

- 10.1.3. Polyvinyl Chloride (PVC)

- 10.1.4. Modified Bitumen (Mod-Bit)

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Institutional

- 10.2.4. Infrastructural

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Soprema Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Firestone Building Products Company LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 APOC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henry Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GAF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sika AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carlisle SynTec Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johns Manville

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Icopal Ltd (BMI Group)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Soprema Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Self-adhered Roofing Membranes Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Self-adhered Roofing Membranes Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Self-adhered Roofing Membranes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Self-adhered Roofing Membranes Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Self-adhered Roofing Membranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Self-adhered Roofing Membranes Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Self-adhered Roofing Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Self-adhered Roofing Membranes Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Self-adhered Roofing Membranes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Self-adhered Roofing Membranes Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Self-adhered Roofing Membranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Self-adhered Roofing Membranes Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Self-adhered Roofing Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Self-adhered Roofing Membranes Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Self-adhered Roofing Membranes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Self-adhered Roofing Membranes Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Self-adhered Roofing Membranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Self-adhered Roofing Membranes Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Self-adhered Roofing Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Self-adhered Roofing Membranes Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Self-adhered Roofing Membranes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Self-adhered Roofing Membranes Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Self-adhered Roofing Membranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Self-adhered Roofing Membranes Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Self-adhered Roofing Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Self-adhered Roofing Membranes Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Self-adhered Roofing Membranes Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Self-adhered Roofing Membranes Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Self-adhered Roofing Membranes Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Self-adhered Roofing Membranes Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Self-adhered Roofing Membranes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Self-adhered Roofing Membranes Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Self-adhered Roofing Membranes Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-adhered Roofing Membranes Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Self-adhered Roofing Membranes Market?

Key companies in the market include Soprema Inc *List Not Exhaustive, Firestone Building Products Company LLC, APOC, Henry Company, Owens Corning, GAF, Sika AG, Carlisle SynTec Systems, Johns Manville, Icopal Ltd (BMI Group).

3. What are the main segments of the Self-adhered Roofing Membranes Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Construction Expenditure in the North American Region; Advantages Over Traditional Roofing Membranes.

6. What are the notable trends driving market growth?

Residential Construction is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

Low Performance in Cold Weather Conditions; Other Restraints.

8. Can you provide examples of recent developments in the market?

In January 2021, LafargeHolcim signed an agreement to acquire Firestone Building Products from Bridgestone Americas. This acquisition is a milestone in LafargeHolcim's transformation to become the global leader in innovative and sustainable building solutions. The estimated cost of this transaction was valued at USD 3.4 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-adhered Roofing Membranes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-adhered Roofing Membranes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-adhered Roofing Membranes Market?

To stay informed about further developments, trends, and reports in the Self-adhered Roofing Membranes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence