Key Insights

The Swedish non-life insurance market is projected for sustained expansion, driven by heightened awareness of risk protection needs across personal and commercial sectors. Factors contributing to this growth include an increasing frequency of severe weather events, leading to higher property damage claims, and advancements in risk assessment models and digital distribution channels. The growing adoption of insurance products by SMEs, particularly in cyber and business interruption coverage, further bolsters market prospects. Key product segments likely encompass motor, property, liability, and health insurance, serving both individual and corporate clients. Intense competition among established entities such as Länsförsäkringar, If Skadeforsakring, SEB Group, Folksam, and Trygg Hansa, alongside newer entrants and digital providers, fosters innovation.

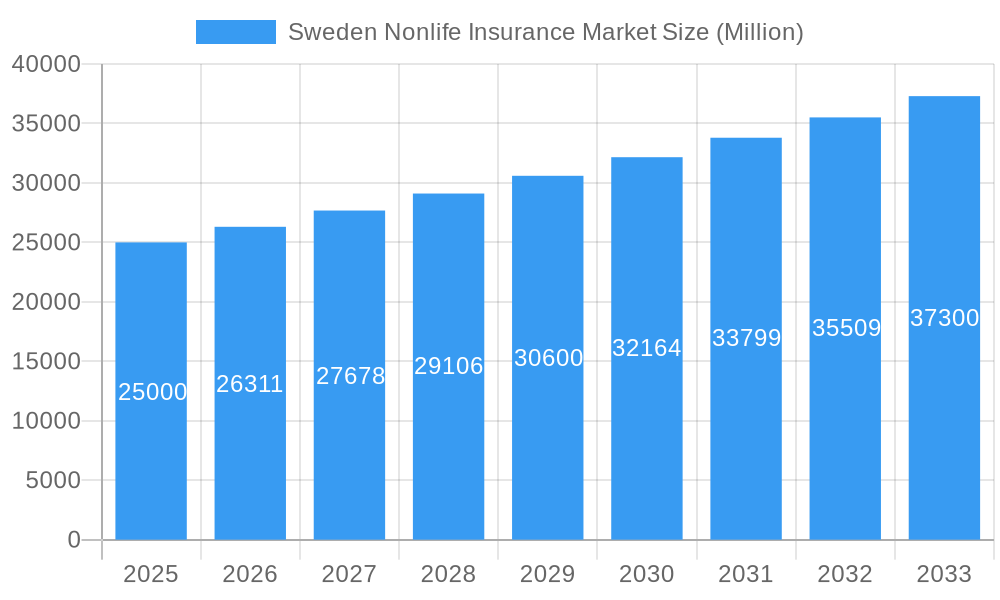

Sweden Nonlife Insurance Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued positive market performance. The Swedish non-life insurance market is valued at $9.7 billion, with a CAGR of 3.9% from the 2022 base year. The market is expected to grow significantly in the coming years, driven by evolving consumer demands and technological integration. Increased competition, further technological disruption, and a rising demand for specialized insurance solutions will characterize the market's evolution, presenting opportunities for growth and innovation.

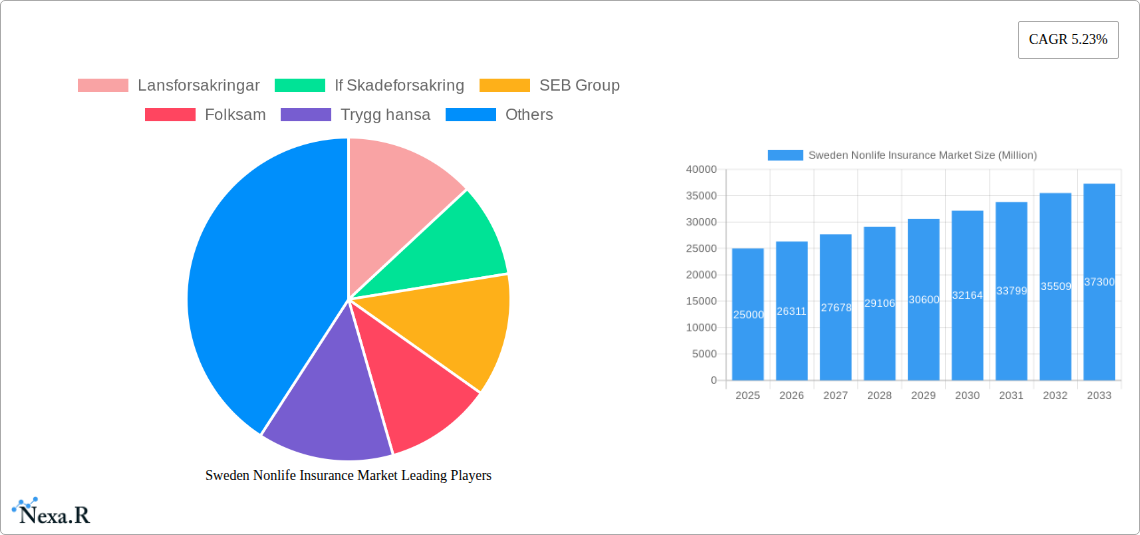

Sweden Nonlife Insurance Market Company Market Share

Sweden Non-Life Insurance Market: In-Depth Analysis (2022-2033)

This comprehensive report analyzes the Swedish non-life insurance market, detailing dynamics, growth trends, key players, and future projections. Focusing on the parent market (Sweden Insurance) and the non-life insurance segment, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The analysis covers the period from 2022 to 2033, with a base year of 2022 and a forecast period extending from 2025 to 2033. Market size is presented in billion units.

Sweden Nonlife Insurance Market Market Dynamics & Structure

The Swedish nonlife insurance market is characterized by a moderately concentrated landscape, with key players like Folksam, If Skadeforsakring, and Trygg Hansa holding significant market share. Technological advancements, particularly in InsurTech, are driving innovation, while a robust regulatory framework ensures market stability. The market experiences competitive pressure from product substitutes and evolving consumer preferences. Mergers and acquisitions (M&A) activity is moderately active, reflecting consolidation and expansion efforts.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: InsurTech adoption is steadily increasing, impacting claims processing, customer service, and product offerings. However, data security and integration challenges remain barriers.

- Regulatory Framework: Stringent regulations ensure consumer protection and market stability, while also influencing product development and pricing strategies.

- Competitive Landscape: Intense competition among established players and emerging InsurTech companies. Product differentiation and customer experience are key competitive factors.

- M&A Activity: The market has witnessed xx M&A deals in the historical period (2019-2024), primarily driven by consolidation and expansion into new segments. The acquisition of Mavera by Verisk in 2022 exemplifies this trend.

Sweden Nonlife Insurance Market Growth Trends & Insights

The Sweden nonlife insurance market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing insurance awareness, economic growth, and technological advancements. Market penetration is estimated at xx% in 2025, with further growth projected throughout the forecast period. Changing consumer behavior, particularly the rise of digital channels, is significantly influencing market dynamics. The market size is projected to reach xx Million in 2025 and xx Million by 2033. Technological disruptions, such as AI and IoT, are expected to further reshape the market landscape and accelerate growth.

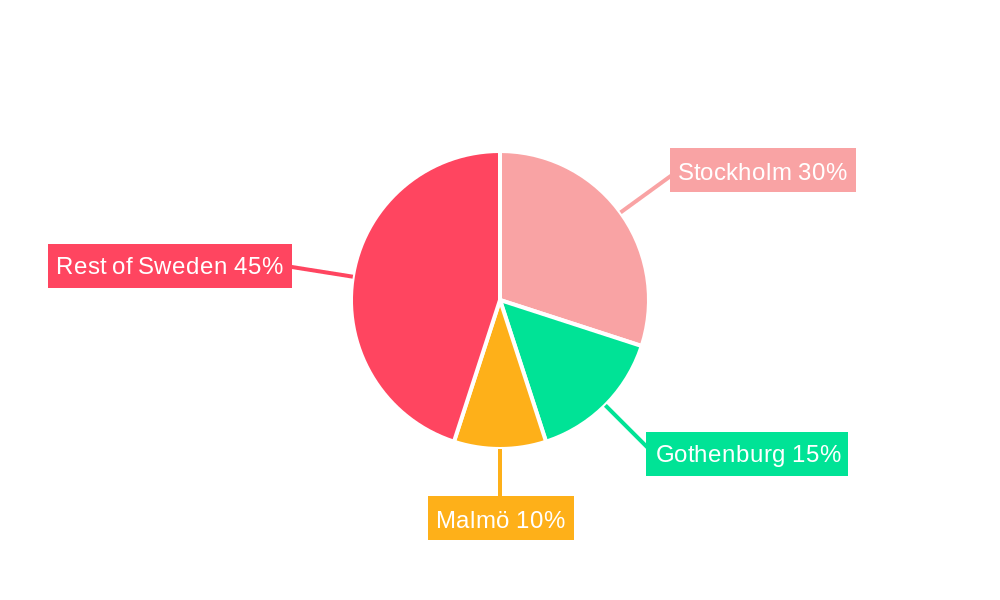

Dominant Regions, Countries, or Segments in Sweden Nonlife Insurance Market

The Stockholm region accounts for the largest market share within the Sweden nonlife insurance market, owing to higher population density, economic activity, and higher per capita income levels. Other significant regions include Gothenburg and Malmö. The motor insurance segment currently holds the largest market share, followed by property and casualty insurance.

- Key Drivers: Strong economic performance, robust infrastructure, and supportive government policies.

- Dominance Factors: High population density, concentrated economic activity, and a developed insurance culture.

- Growth Potential: Untapped potential in niche segments, such as cyber insurance and specialized risk coverage, presents opportunities for growth.

Sweden Nonlife Insurance Market Product Landscape

Product innovation is characterized by increased digitalization, personalized offerings, and bundled insurance packages. Telematics-based insurance, leveraging IoT data for risk assessment, is gaining traction. Insurers are focusing on improving customer experience through seamless online portals and mobile apps. These innovations aim to offer competitive pricing and personalized coverage, enhancing customer loyalty.

Key Drivers, Barriers & Challenges in Sweden Nonlife Insurance Market

Key Drivers:

- Increasing insurance awareness among consumers.

- Growing demand for specialized insurance products.

- Technological advancements in risk assessment and claims processing.

Key Challenges:

- Intense competition among insurance providers.

- Rising regulatory scrutiny and compliance costs.

- Potential economic downturns impacting consumer spending.

Emerging Opportunities in Sweden Nonlife Insurance Market

- Expansion into underserved segments (e.g., small and medium-sized businesses).

- Development of innovative insurance products tailored to specific customer needs.

- Leveraging big data and AI for enhanced risk management and personalized services.

Growth Accelerators in the Sweden Nonlife Insurance Market Industry

Technological advancements, strategic partnerships, and expansion into new geographic markets are key growth catalysts. The adoption of InsurTech solutions promises to increase efficiency, enhance customer experience, and open up new revenue streams. Strategic alliances with fintech and technology companies can foster innovation and accelerate market penetration.

Key Players Shaping the Sweden Nonlife Insurance Market Market

- Lansforsakringar

- If Skadeforsakring

- SEB Group

- Folksam

- Trygg Hansa

- Moderna försäkringar

- Dina försäkringar

- ICA försäkringar

- Telia

- Afa Försäkringar

- Alecta

Notable Milestones in Sweden Nonlife Insurance Market Sector

- December 2022: Verisk acquires Mavera, strengthening its presence in the Nordic personal injury claims management market.

- April 2022: Insurely partners with SEB to enhance transparency and accessibility in the insurance industry.

In-Depth Sweden Nonlife Insurance Market Market Outlook

The Sweden nonlife insurance market is poised for continued growth, driven by technological innovation and evolving consumer preferences. Strategic partnerships, expansion into new segments, and the adoption of InsurTech solutions will shape the future market landscape. Opportunities exist for both established players and new entrants to capture market share and drive innovation. The market is expected to show a steady growth trajectory throughout the forecast period, exceeding xx Million by 2033.

Sweden Nonlife Insurance Market Segmentation

-

1. Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non- life insurance

- 1.2.1. Motor

- 1.2.2. Home

- 1.2.3. Marine

- 1.2.4. Other insurance

-

1.1. Life insurance

-

2. Distribution channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Other Distribution Channels

Sweden Nonlife Insurance Market Segmentation By Geography

- 1. Sweden

Sweden Nonlife Insurance Market Regional Market Share

Geographic Coverage of Sweden Nonlife Insurance Market

Sweden Nonlife Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Knowledge of consumer protection in Insurance products; Fintech and Digital Insurance tools driving the market

- 3.3. Market Restrains

- 3.3.1. Increase in Knowledge of consumer protection in Insurance products; Fintech and Digital Insurance tools driving the market

- 3.4. Market Trends

- 3.4.1. Continuous Rise in Non-life Insurance Premiums Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Nonlife Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non- life insurance

- 5.1.2.1. Motor

- 5.1.2.2. Home

- 5.1.2.3. Marine

- 5.1.2.4. Other insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lansforsakringar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 If Skadeforsakring

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEB Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Folksam

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trygg hansa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moderna forsakringar

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dina forsakringar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ICA forsakringar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Afa Forsakringar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alecta**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lansforsakringar

List of Figures

- Figure 1: Sweden Nonlife Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Nonlife Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Nonlife Insurance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Sweden Nonlife Insurance Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 3: Sweden Nonlife Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Sweden Nonlife Insurance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Sweden Nonlife Insurance Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 6: Sweden Nonlife Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Nonlife Insurance Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Sweden Nonlife Insurance Market?

Key companies in the market include Lansforsakringar, If Skadeforsakring, SEB Group, Folksam, Trygg hansa, Moderna forsakringar, Dina forsakringar, ICA forsakringar, Telia, Afa Forsakringar, Alecta**List Not Exhaustive.

3. What are the main segments of the Sweden Nonlife Insurance Market?

The market segments include Type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Knowledge of consumer protection in Insurance products; Fintech and Digital Insurance tools driving the market.

6. What are the notable trends driving market growth?

Continuous Rise in Non-life Insurance Premiums Driving the Market.

7. Are there any restraints impacting market growth?

Increase in Knowledge of consumer protection in Insurance products; Fintech and Digital Insurance tools driving the market.

8. Can you provide examples of recent developments in the market?

In December 2022, Verisk a leading global data analytics provider acquired Mavera, a Sweden-based InsurTech firm with a strong regional presence and established customer base for its personal injury claims management platform. Acquisition of Nordic personal injury market leader Mavera will support verisk's expansion in Continental Europe

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Nonlife Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Nonlife Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Nonlife Insurance Market?

To stay informed about further developments, trends, and reports in the Sweden Nonlife Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence