Key Insights

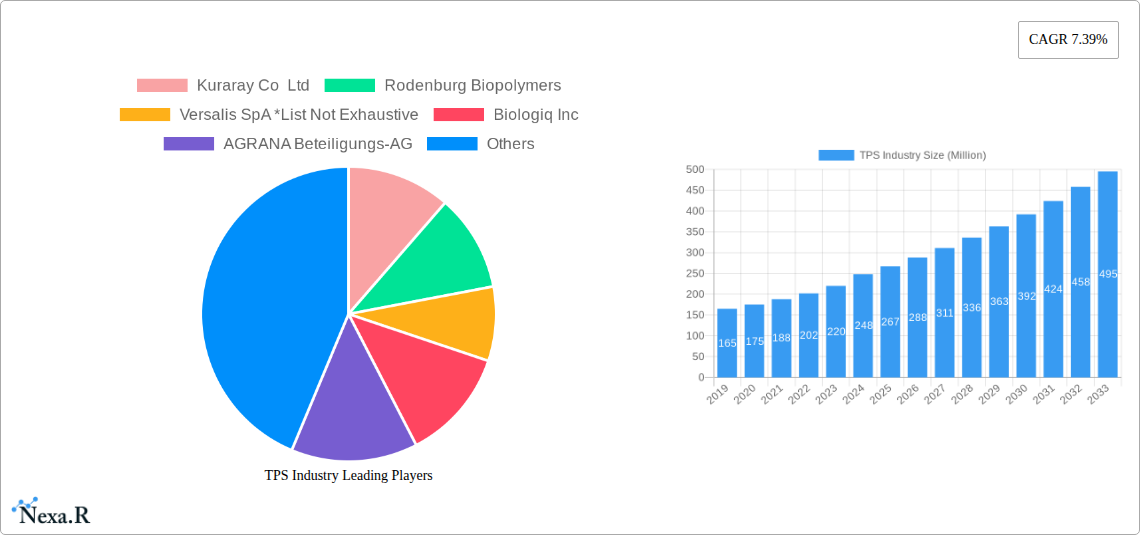

The Thermoplastic Starch (TPS) market is experiencing robust expansion, driven by increasing consumer demand for sustainable packaging solutions and growing environmental consciousness. With a projected market size of approximately $248 million in 2024, and a compelling Compound Annual Growth Rate (CAGR) of 7.9% during the forecast period (2025-2033), the industry is poised for significant growth. This upward trajectory is primarily fueled by the superior biodegradability and compostability of TPS compared to conventional petroleum-based plastics. Key applications such as bags and films are leading the demand, benefiting from the versatility and cost-effectiveness of TPS. Furthermore, advancements in 3D printing technology are unlocking new avenues for TPS utilization, further contributing to market expansion. The manufacturing sector, particularly extrusion molding, is a critical enabler of this growth, facilitating the production of high-quality TPS products.

TPS Industry Market Size (In Million)

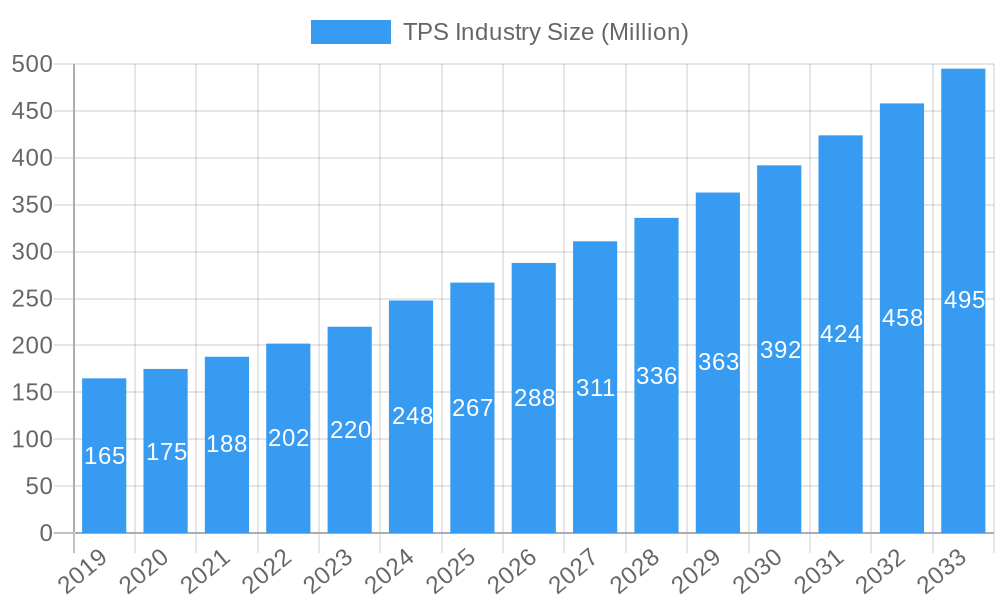

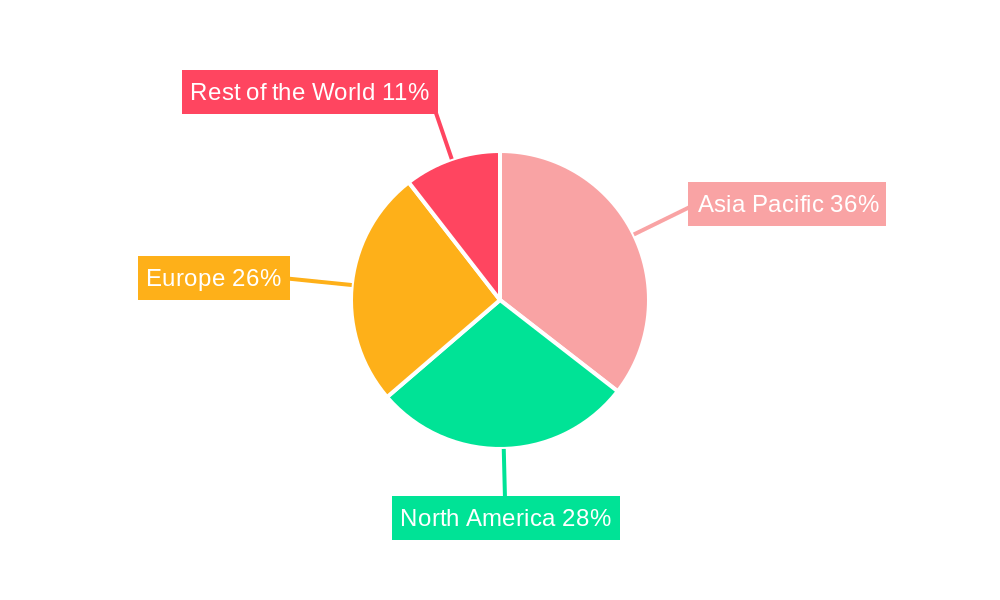

The global Thermoplastic Starch market is characterized by dynamic regional trends and a competitive landscape. Asia Pacific, led by economies like China and India, is anticipated to be a significant growth engine due to rapid industrialization and a rising middle class with increasing purchasing power and environmental awareness. North America and Europe are also substantial markets, driven by stringent environmental regulations and a strong preference for eco-friendly alternatives. Restraints for the market include the potential for price volatility of raw starch, and the need for further research and development to enhance properties like water resistance and mechanical strength for certain high-performance applications. However, ongoing innovation and strategic collaborations among key players such as Kuraray Co Ltd, Rodenburg Biopolymers, and Versalis SpA are expected to overcome these challenges, paving the way for a sustainable and expanding TPS industry.

TPS Industry Company Market Share

Unlocking the Future of Sustainable Materials: TPS Industry Market Dynamics, Growth, and Opportunities (2019-2033)

This comprehensive report offers an in-depth analysis of the Thermoplastic Starch (TPS) industry, a rapidly evolving sector at the forefront of sustainable material innovation. Focusing on critical market dynamics, growth trajectories, and key players, this report provides actionable insights for stakeholders seeking to navigate and capitalize on the burgeoning demand for eco-friendly bioplastics. With a study period spanning from 2019 to 2033, and detailed analysis for the base and estimated year of 2025, this report leverages high-traffic keywords and an expert understanding of parent and child markets to deliver unparalleled visibility and engagement. All values are presented in million units for clear quantitative understanding.

TPS Industry Market Dynamics & Structure

The Thermoplastic Starch (TPS) industry is characterized by a dynamic interplay of innovation, regulatory push, and evolving consumer preferences for sustainable alternatives. Market concentration is moderate, with a mix of established chemical giants and agile bioplastic specialists vying for market share. Technological innovation remains a primary driver, focusing on enhancing the mechanical properties, processability, and biodegradability of TPS to compete with conventional plastics. Regulatory frameworks, particularly those promoting circular economy principles and plastic waste reduction, are increasingly shaping market entry and product development strategies. Competitive product substitutes include other biodegradable polymers like PLA, PHA, and PBS, as well as conventional petroleum-based plastics, posing a constant challenge for TPS adoption. End-user demographics are shifting towards environmentally conscious consumers and businesses seeking sustainable supply chain solutions. Merger and acquisition (M&A) trends are indicative of consolidation and strategic partnerships aimed at expanding product portfolios and manufacturing capabilities.

- Market Concentration: Moderate, with key players investing in R&D and capacity expansion.

- Technological Innovation Drivers: Improved barrier properties, enhanced flexibility, and cost-effective production methods.

- Regulatory Frameworks: Government mandates for compostability, recycled content, and reduced single-use plastics are accelerating adoption.

- Competitive Product Substitutes: Poly Lactic Acid (PLA), Polyhydroxyalkanoates (PHA), Polybutylene Succinate (PBS), and traditional plastics.

- End-User Demographics: Growing demand from the packaging, automotive, and consumer goods sectors driven by sustainability goals.

- M&A Trends: Strategic acquisitions to bolster bio-based offerings and expand market reach.

TPS Industry Growth Trends & Insights

The global TPS market is poised for significant expansion, driven by a confluence of escalating environmental concerns and proactive policy initiatives worldwide. Projections for the base year 2025 indicate a robust market size, with substantial growth anticipated through the forecast period extending to 2033. The adoption rates of TPS are steadily increasing across various applications, particularly in the packaging sector, where its biodegradability and compostability offer compelling advantages over conventional materials. Technological disruptions, including advancements in starch modification and compounding techniques, are continuously improving the performance characteristics of TPS, making it a more viable alternative for a wider range of end-uses. Consumer behavior is undergoing a palpable shift, with a growing preference for products manufactured using sustainable and environmentally friendly materials. This trend is a powerful catalyst, compelling manufacturers to integrate TPS into their product offerings. The CAGR for the TPS industry is projected to remain strong, reflecting its increasing market penetration as a sustainable material solution. The market's evolution is also influenced by the development of hybrid materials that combine TPS with other biopolymers to achieve specific performance attributes. The historical data from 2019-2024 showcases an upward trajectory, setting a strong foundation for future growth. Key to this growth is the continuous innovation in making TPS suitable for high-barrier applications in food packaging, a significant segment of the parent market.

Dominant Regions, Countries, or Segments in TPS Industry

The global TPS market is witnessing dynamic growth across several key regions and segments, with specific manufacturing types and applications emerging as dominant drivers. The Extrusion Molding manufacturing type is a primary contributor to the market's expansion, owing to its efficiency and versatility in producing a wide array of TPS products. This technique is extensively utilized in the production of Films and Bags, which represent the most significant application segments within the TPS industry. The burgeoning demand for sustainable packaging solutions, driven by consumer preference and stringent environmental regulations, is a major factor fueling the growth of these applications. Countries within Europe, particularly Germany and the Netherlands, are at the forefront of TPS adoption, supported by strong governmental policies promoting bioplastics and a well-established waste management infrastructure that facilitates composting. North America, with its growing awareness of environmental issues and increasing investments in bio-based materials, is also demonstrating substantial market potential. Asia-Pacific, while still in its nascent stages of widespread TPS adoption, presents immense growth opportunities due to its large population and rapidly industrializing economies actively seeking sustainable alternatives. The Films segment, encompassing food packaging films, agricultural films, and industrial films, is expected to maintain its leadership position due to its broad applicability and the urgent need for biodegradable alternatives to conventional plastic films. Similarly, Bags, including shopping bags, garbage bags, and industrial packaging bags, are witnessing robust demand. The 3D Print application, though currently a smaller segment, is showing promising growth as additive manufacturing technologies advance and the demand for sustainable 3D printing materials increases.

- Dominant Manufacturing Type: Extrusion Molding, enabling efficient production of films, bags, and other forms.

- Leading Applications:

- Films: Essential for sustainable food packaging, agriculture, and industrial wrapping.

- Bags: High demand for biodegradable shopping bags, refuse sacks, and packaging.

- Key Regional Drivers:

- Europe: Strong regulatory support, advanced composting infrastructure, and high consumer awareness.

- North America: Growing environmental consciousness and increasing investment in bio-based materials.

- Asia-Pacific: Significant untapped potential and growing adoption in emerging economies.

- Growth Potential of 3D Print: Emerging as a niche but rapidly expanding application for sustainable material innovation.

TPS Industry Product Landscape

The Thermoplastic Starch (TPS) product landscape is characterized by continuous innovation aimed at enhancing performance and expanding applications. Key product developments focus on improving moisture resistance, mechanical strength, and thermal stability to rival conventional plastics. Advanced compounding techniques and the incorporation of plasticizers and other additives are crucial in tailoring TPS for specific end-uses. Unique selling propositions of TPS products include their biodegradability, compostability, and origin from renewable resources, offering a compelling eco-friendly alternative. Technological advancements are enabling the development of TPS-based materials for demanding applications such as durable packaging, single-use cutlery, and even components in the automotive and electronics sectors. The ongoing research into blends and composites further broadens the applicability and performance spectrum of TPS.

Key Drivers, Barriers & Challenges in TPS Industry

The TPS industry is propelled by several key drivers and faces distinct barriers and challenges that shape its growth trajectory.

Key Drivers:

- Environmental Regulations: Increasing governmental mandates and incentives for biodegradable and compostable materials are a primary growth catalyst.

- Consumer Demand for Sustainability: A growing global consciousness about plastic pollution and a preference for eco-friendly products are fueling market adoption.

- Renewable Resource Availability: Starch, a primary feedstock for TPS, is abundantly available and a renewable resource, contributing to a more sustainable supply chain.

- Technological Advancements: Continuous innovation in starch modification and processing techniques is improving the performance and cost-effectiveness of TPS.

Barriers & Challenges:

- Performance Limitations: Compared to some conventional plastics, TPS can exhibit lower moisture resistance and mechanical strength, limiting its use in certain high-performance applications.

- Cost Competitiveness: While production costs are decreasing, TPS can still be more expensive than some petroleum-based plastics, impacting its widespread adoption, especially in price-sensitive markets.

- Limited Infrastructure for Composting: The effective disposal of compostable materials relies on industrial composting facilities, which are not universally available, posing a challenge for end-of-life management.

- Supply Chain Volatility: Fluctuations in starch prices and availability can impact production costs and supply chain stability.

Emerging Opportunities in TPS Industry

Emerging opportunities in the TPS industry lie in untapped market segments and the development of innovative applications. The automotive sector, seeking lightweight and sustainable materials for interior components, presents a significant growth avenue. The development of advanced TPS formulations with enhanced barrier properties will unlock new possibilities in flexible food packaging, particularly for sensitive products requiring extended shelf life. Furthermore, the increasing interest in bio-based construction materials and textiles offers fertile ground for TPS-based innovations. The rise of the circular economy model is also creating opportunities for enhanced end-of-life solutions, including advanced recycling and upcycling technologies for TPS products.

Growth Accelerators in the TPS Industry Industry

Several catalysts are poised to accelerate the long-term growth of the TPS industry. Technological breakthroughs in enzyme-assisted starch modification are yielding TPS with superior mechanical properties and processability. Strategic partnerships between starch producers, biopolymer manufacturers, and end-product converters are crucial for fostering innovation and streamlining the value chain. Market expansion strategies targeting developing economies, where the demand for sustainable alternatives is rapidly growing, will also play a pivotal role. Furthermore, the integration of TPS into hybrid materials and composites will unlock novel functionalities and broaden its application spectrum, driving substantial market growth.

Key Players Shaping the TPS Industry Market

- Kuraray Co Ltd

- Rodenburg Biopolymers

- Versalis SpA

- Biologiq Inc

- AGRANA Beteiligungs-AG

- Biotec Biologische Naturverpackungen GmbH & Co KG

- Cardia Bioplastics

- Grupa Azoty SA

- Biome Bioplastics Limited

- Great Wrap

Notable Milestones in TPS Industry Sector

- October 2023: Versalis announced its acquisition of Novamont SpA. Through this acquisition, Versalis aimed to strengthen its bio-based product portfolio significantly, enhancing its market position in sustainable materials.

- March 2023: Great Wrap announced the launch of the world's first compostable pallet wrap manufactured using food waste. The company completed commercial trials and is expected to establish the largest stretch wrap manufacturing facility in the country. The 10,000-sq. m plant located in Tullamarine is equipped with a state-of-the-art cast extruding line for the film. Currently, the facility is running at a capacity of 5,000 tons. The company has confirmed that by year-end, its capacity is expected to double to 10,000 tons and is expected to reach 20,000 tons by 2025, marking a significant expansion in sustainable packaging production.

In-Depth TPS Industry Market Outlook

The TPS industry market outlook is exceptionally promising, fueled by a synergistic combination of environmental imperative and technological advancement. Growth accelerators such as enhanced starch processing techniques, the development of high-performance TPS blends, and strategic collaborations across the value chain will propel market expansion. Untapped markets in developing economies and innovative applications in sectors like construction and textiles offer significant future potential. The increasing focus on the circular economy will further drive demand for sustainable and compostable materials, solidifying TPS's role as a key player in the transition towards a more sustainable future. Stakeholders are well-positioned to capitalize on this robust growth by investing in R&D, expanding production capacities, and forging strategic partnerships.

TPS Industry Segmentation

-

1. Manufacturing Type

- 1.1. Extrusion Molding

-

2. Application

- 2.1. Bags

- 2.2. Films

- 2.3. 3D Print

- 2.4. Other Applications

TPS Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. NORDIC Countries

- 3.6. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

TPS Industry Regional Market Share

Geographic Coverage of TPS Industry

TPS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Packaging Industry; Favorable Government Policies Promoting Bio-plastics

- 3.3. Market Restrains

- 3.3.1. Multiple Technical Constrains Associated with TPS

- 3.4. Market Trends

- 3.4.1. Films Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TPS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 5.1.1. Extrusion Molding

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bags

- 5.2.2. Films

- 5.2.3. 3D Print

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 6. Asia Pacific TPS Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 6.1.1. Extrusion Molding

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bags

- 6.2.2. Films

- 6.2.3. 3D Print

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 7. North America TPS Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 7.1.1. Extrusion Molding

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bags

- 7.2.2. Films

- 7.2.3. 3D Print

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 8. Europe TPS Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 8.1.1. Extrusion Molding

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bags

- 8.2.2. Films

- 8.2.3. 3D Print

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 9. Rest of the World TPS Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 9.1.1. Extrusion Molding

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bags

- 9.2.2. Films

- 9.2.3. 3D Print

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kuraray Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rodenburg Biopolymers

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Versalis SpA *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Biologiq Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AGRANA Beteiligungs-AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Biotec Biologische Naturverpackungen GmbH & Co KG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cardia Bioplastics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Grupa Azoty SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Biome Bioplastics Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Great Wrap

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kuraray Co Ltd

List of Figures

- Figure 1: Global TPS Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global TPS Industry Volume Breakdown (kilotons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific TPS Industry Revenue (undefined), by Manufacturing Type 2025 & 2033

- Figure 4: Asia Pacific TPS Industry Volume (kilotons), by Manufacturing Type 2025 & 2033

- Figure 5: Asia Pacific TPS Industry Revenue Share (%), by Manufacturing Type 2025 & 2033

- Figure 6: Asia Pacific TPS Industry Volume Share (%), by Manufacturing Type 2025 & 2033

- Figure 7: Asia Pacific TPS Industry Revenue (undefined), by Application 2025 & 2033

- Figure 8: Asia Pacific TPS Industry Volume (kilotons), by Application 2025 & 2033

- Figure 9: Asia Pacific TPS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific TPS Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific TPS Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: Asia Pacific TPS Industry Volume (kilotons), by Country 2025 & 2033

- Figure 13: Asia Pacific TPS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific TPS Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America TPS Industry Revenue (undefined), by Manufacturing Type 2025 & 2033

- Figure 16: North America TPS Industry Volume (kilotons), by Manufacturing Type 2025 & 2033

- Figure 17: North America TPS Industry Revenue Share (%), by Manufacturing Type 2025 & 2033

- Figure 18: North America TPS Industry Volume Share (%), by Manufacturing Type 2025 & 2033

- Figure 19: North America TPS Industry Revenue (undefined), by Application 2025 & 2033

- Figure 20: North America TPS Industry Volume (kilotons), by Application 2025 & 2033

- Figure 21: North America TPS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America TPS Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: North America TPS Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America TPS Industry Volume (kilotons), by Country 2025 & 2033

- Figure 25: North America TPS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America TPS Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe TPS Industry Revenue (undefined), by Manufacturing Type 2025 & 2033

- Figure 28: Europe TPS Industry Volume (kilotons), by Manufacturing Type 2025 & 2033

- Figure 29: Europe TPS Industry Revenue Share (%), by Manufacturing Type 2025 & 2033

- Figure 30: Europe TPS Industry Volume Share (%), by Manufacturing Type 2025 & 2033

- Figure 31: Europe TPS Industry Revenue (undefined), by Application 2025 & 2033

- Figure 32: Europe TPS Industry Volume (kilotons), by Application 2025 & 2033

- Figure 33: Europe TPS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe TPS Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe TPS Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe TPS Industry Volume (kilotons), by Country 2025 & 2033

- Figure 37: Europe TPS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe TPS Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World TPS Industry Revenue (undefined), by Manufacturing Type 2025 & 2033

- Figure 40: Rest of the World TPS Industry Volume (kilotons), by Manufacturing Type 2025 & 2033

- Figure 41: Rest of the World TPS Industry Revenue Share (%), by Manufacturing Type 2025 & 2033

- Figure 42: Rest of the World TPS Industry Volume Share (%), by Manufacturing Type 2025 & 2033

- Figure 43: Rest of the World TPS Industry Revenue (undefined), by Application 2025 & 2033

- Figure 44: Rest of the World TPS Industry Volume (kilotons), by Application 2025 & 2033

- Figure 45: Rest of the World TPS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Rest of the World TPS Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Rest of the World TPS Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World TPS Industry Volume (kilotons), by Country 2025 & 2033

- Figure 49: Rest of the World TPS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World TPS Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TPS Industry Revenue undefined Forecast, by Manufacturing Type 2020 & 2033

- Table 2: Global TPS Industry Volume kilotons Forecast, by Manufacturing Type 2020 & 2033

- Table 3: Global TPS Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global TPS Industry Volume kilotons Forecast, by Application 2020 & 2033

- Table 5: Global TPS Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global TPS Industry Volume kilotons Forecast, by Region 2020 & 2033

- Table 7: Global TPS Industry Revenue undefined Forecast, by Manufacturing Type 2020 & 2033

- Table 8: Global TPS Industry Volume kilotons Forecast, by Manufacturing Type 2020 & 2033

- Table 9: Global TPS Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global TPS Industry Volume kilotons Forecast, by Application 2020 & 2033

- Table 11: Global TPS Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global TPS Industry Volume kilotons Forecast, by Country 2020 & 2033

- Table 13: China TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 15: India TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 17: Japan TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Japan TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 19: South Korea TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 21: ASEAN Countries TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: ASEAN Countries TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 25: Global TPS Industry Revenue undefined Forecast, by Manufacturing Type 2020 & 2033

- Table 26: Global TPS Industry Volume kilotons Forecast, by Manufacturing Type 2020 & 2033

- Table 27: Global TPS Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global TPS Industry Volume kilotons Forecast, by Application 2020 & 2033

- Table 29: Global TPS Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global TPS Industry Volume kilotons Forecast, by Country 2020 & 2033

- Table 31: United States TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: United States TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 33: Canada TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Canada TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 35: Mexico TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Mexico TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 37: Global TPS Industry Revenue undefined Forecast, by Manufacturing Type 2020 & 2033

- Table 38: Global TPS Industry Volume kilotons Forecast, by Manufacturing Type 2020 & 2033

- Table 39: Global TPS Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global TPS Industry Volume kilotons Forecast, by Application 2020 & 2033

- Table 41: Global TPS Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global TPS Industry Volume kilotons Forecast, by Country 2020 & 2033

- Table 43: Germany TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Germany TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 45: United Kingdom TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 47: Italy TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Italy TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 49: France TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: France TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 51: NORDIC Countries TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: NORDIC Countries TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 55: Global TPS Industry Revenue undefined Forecast, by Manufacturing Type 2020 & 2033

- Table 56: Global TPS Industry Volume kilotons Forecast, by Manufacturing Type 2020 & 2033

- Table 57: Global TPS Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global TPS Industry Volume kilotons Forecast, by Application 2020 & 2033

- Table 59: Global TPS Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global TPS Industry Volume kilotons Forecast, by Country 2020 & 2033

- Table 61: South America TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: South America TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

- Table 63: Middle East and Africa TPS Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Middle East and Africa TPS Industry Volume (kilotons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TPS Industry?

The projected CAGR is approximately 8.51%.

2. Which companies are prominent players in the TPS Industry?

Key companies in the market include Kuraray Co Ltd, Rodenburg Biopolymers, Versalis SpA *List Not Exhaustive, Biologiq Inc, AGRANA Beteiligungs-AG, Biotec Biologische Naturverpackungen GmbH & Co KG, Cardia Bioplastics, Grupa Azoty SA, Biome Bioplastics Limited, Great Wrap.

3. What are the main segments of the TPS Industry?

The market segments include Manufacturing Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Packaging Industry; Favorable Government Policies Promoting Bio-plastics.

6. What are the notable trends driving market growth?

Films Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Multiple Technical Constrains Associated with TPS.

8. Can you provide examples of recent developments in the market?

October 2023: Versalis announced its acquisition of Novamont SpA. Through this acquisition, Versalis aimed to strengthen its bio-based product portfolio significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in kilotons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TPS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TPS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TPS Industry?

To stay informed about further developments, trends, and reports in the TPS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence