Key Insights

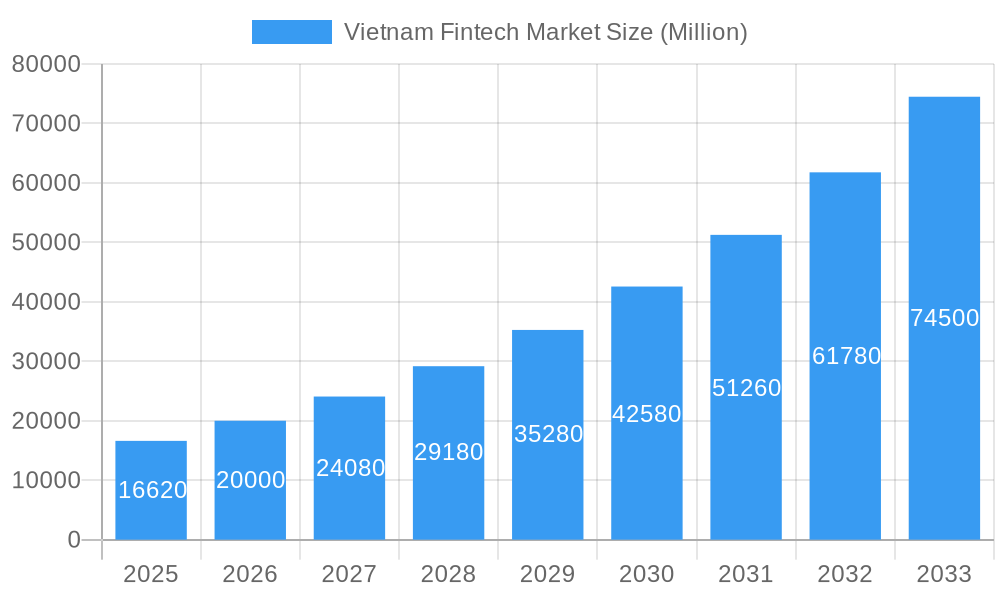

The Vietnam Fintech market is experiencing explosive growth, projected to reach a market size of $16.62 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 20.23% from 2025 to 2033. This robust expansion is fueled by several key drivers. The increasing smartphone penetration and internet access across Vietnam have created a fertile ground for digital financial services. A young and tech-savvy population readily adopts new technologies, contributing significantly to the market's dynamism. Furthermore, government initiatives promoting financial inclusion and digital transformation are accelerating the adoption of fintech solutions. The rising demand for convenient and accessible financial services, especially in underserved rural areas, further propels this growth. Competition among established players like MoMo, ZaloPay, and AirPay, as well as emerging fintech startups, fosters innovation and drives down costs, benefiting consumers. The market is segmented by services offered (e.g., payments, lending, investment), user demographics, and geographic regions. However, challenges remain, including cybersecurity concerns, data privacy regulations, and the need for robust consumer protection frameworks. Overcoming these hurdles will be critical for sustainable and responsible growth of the Vietnam Fintech market.

Vietnam Fintech Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued significant growth, driven by expanding e-commerce, the increasing popularity of mobile payments, and the growing demand for alternative lending solutions. The market's trajectory indicates considerable opportunities for both established fintech companies and new entrants. Strategic partnerships between fintech firms and traditional financial institutions are likely to become increasingly common, enhancing market reach and service offerings. Focus on enhancing security measures and addressing regulatory compliance will be paramount to maintaining consumer trust and ensuring long-term market stability. The ongoing development of innovative financial technologies, such as blockchain and artificial intelligence, will further shape the landscape of the Vietnam Fintech market in the coming years, presenting both challenges and exciting prospects for growth and innovation.

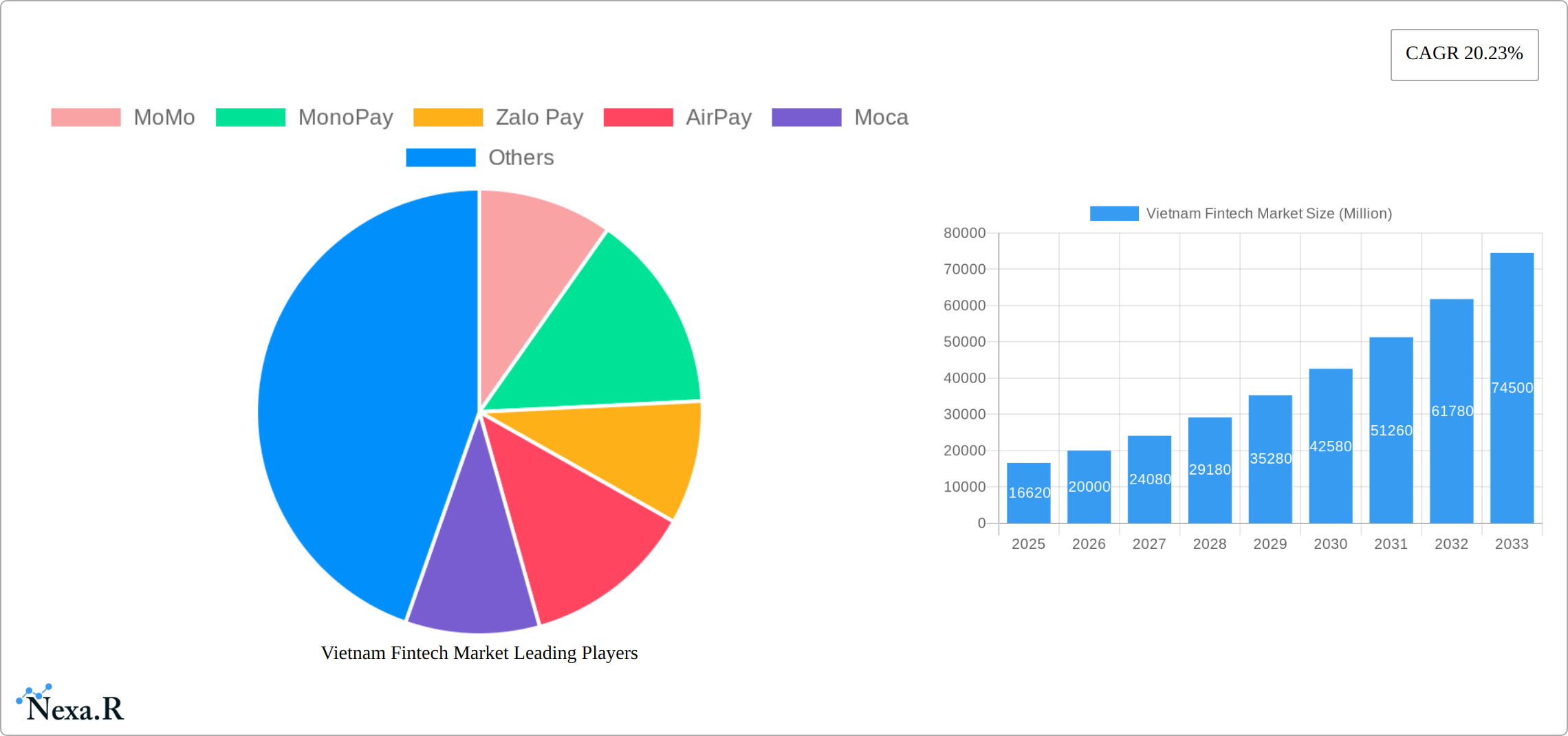

Vietnam Fintech Market Company Market Share

Vietnam Fintech Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the rapidly evolving Vietnam Fintech market, covering market dynamics, growth trends, key players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period covers 2019-2024. This report is essential for investors, businesses, and industry professionals seeking to understand and capitalize on the potential of Vietnam's dynamic fintech landscape. The report analyzes parent markets like digital payments and lending, and child markets including mobile payments and peer-to-peer lending. Market values are presented in millions.

Vietnam Fintech Market Dynamics & Structure

The Vietnam Fintech market exhibits a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is currently moderate, with several dominant players like MoMo and ZaloPay vying for market share alongside numerous smaller, specialized fintechs. Technological innovation, driven by a young, tech-savvy population and increasing smartphone penetration, is a key driver. However, regulatory frameworks remain a significant factor impacting market entry and expansion. The competitive landscape includes both established financial institutions and emerging fintechs, necessitating ongoing innovation to maintain a competitive edge. M&A activity is expected to increase, with larger players consolidating their positions and smaller companies seeking strategic partnerships.

- Market Concentration: Moderate, with a few dominant players and a large number of smaller companies. (xx% market share held by top 3 players in 2024)

- Technological Innovation: High, driven by mobile technology adoption and a young, tech-savvy population.

- Regulatory Framework: Evolving, impacting market entry and expansion.

- Competitive Substitutes: Traditional banking services, particularly in areas with lower technological penetration.

- End-User Demographics: Predominantly young, tech-savvy individuals in urban areas, with rapid expansion into rural markets.

- M&A Trends: Increasing consolidation among major players, strategic acquisitions anticipated to reach xx deals annually by 2033.

Vietnam Fintech Market Growth Trends & Insights

The Vietnam Fintech market is experiencing a dynamic surge, propelled by a confluence of powerful factors. The nation's rapidly increasing mobile and internet penetration, coupled with a burgeoning middle class that possesses growing disposable income, forms a fertile ground for digital financial services. Furthermore, proactive government initiatives aimed at fostering financial inclusion are actively expanding access to these innovative solutions. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of **[Insert Specific CAGR]%** from 2025 to 2033, culminating in an estimated value of **[Insert Specific Market Value] million** by 2033. This impressive expansion is primarily fueled by the widespread adoption of seamless digital payment solutions, the proliferation of accessible mobile lending platforms, and a significant uptick in investor interest and venture capital funding. Cutting-edge technological advancements, including the transformative potential of blockchain technology and the intelligence of Artificial Intelligence (AI), are acting as potent growth accelerators. Simultaneously, a marked shift in consumer behavior, favoring the unparalleled convenience and accessibility offered by fintech solutions, is further solidifying this upward trajectory. The market penetration of fintech services is anticipated to surpass **[Insert Specific Penetration Rate]%** by 2033, signaling substantial headroom for continued expansion. The average revenue per user (ARPU) is also on track for a significant increase throughout this forecast period, reflecting deeper engagement and a greater value derived from these services.

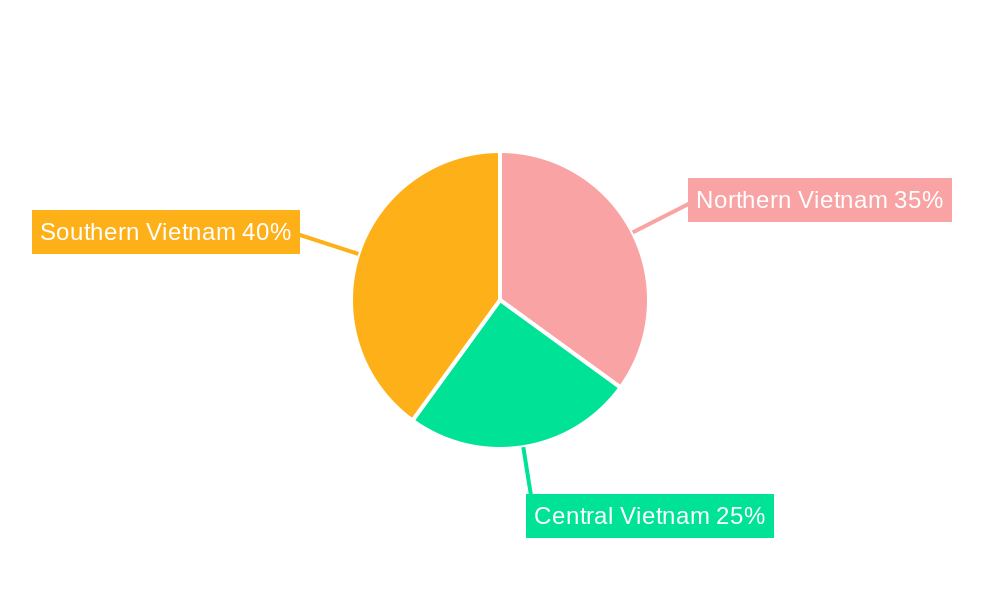

Dominant Regions, Countries, or Segments in Vietnam Fintech Market

Currently, major metropolitan hubs such as Ho Chi Minh City and Hanoi are at the forefront of the Vietnam Fintech market. This dominance is attributed to their higher rates of internet and smartphone penetration, a more developed technological infrastructure, and a concentration of digitally savvy consumers. However, the landscape is rapidly evolving, with significant growth potential emerging in rural and peri-urban areas. This expansion is largely driven by targeted financial inclusion initiatives that are actively broadening access to digital financial services for previously underserved populations. Within the market segments, digital payments stand out as the largest and fastest-growing category, demonstrating widespread consumer adoption. Concurrently, the lending and investment segments are also exhibiting strong and sustained growth, indicating a diversification of fintech service utilization.

- Key Drivers:

- High mobile and internet penetration rates, particularly in urban centers.

- Proactive government initiatives and supportive policies aimed at promoting financial inclusion and digital transformation.

- A growing middle class with increasing disposable income and a propensity for digital consumption.

- An evolving, yet increasingly supportive, regulatory framework designed to foster innovation and consumer protection within the fintech ecosystem.

- Dominance Factors:

- Higher levels of digital literacy and a greater receptiveness to technology adoption in urban demographics.

- Well-established infrastructure, including robust connectivity and a higher propensity for consumer spending.

- The strategic concentration of leading fintech companies, startups, and investment firms within major economic cities.

- Ho Chi Minh City's significant market share, estimated to exceed [Insert Specific Market Share]% as of 2024, highlighting its pivotal role in the market.

Vietnam Fintech Market Product Landscape

The Vietnamese Fintech landscape is characterized by a wide array of innovative products and services. Mobile payment apps like MoMo and ZaloPay dominate the market, offering a seamless user experience for everyday transactions. Lending platforms such as VayMuon cater to diverse borrowing needs, leveraging technology to streamline the loan process and broaden access to credit. These applications often integrate features such as investment opportunities, insurance products, and bill payment facilities, creating a comprehensive financial ecosystem within a single platform. Technological advancements like AI-powered fraud detection and blockchain-based security measures are enhancing product security and user trust.

Key Drivers, Barriers & Challenges in Vietnam Fintech Market

Key Drivers:

- Government Support: Initiatives promoting digitalization and financial inclusion are driving growth.

- Technological Advancements: Innovation in mobile payments, AI, and blockchain enhances the user experience and efficiency.

- Growing Middle Class: Increasing disposable incomes fuel demand for financial services.

Challenges and Restraints:

- Regulatory Uncertainty: Ongoing regulatory developments can create uncertainty for businesses.

- Cybersecurity Risks: The increasing digitalization of financial services necessitates strong cybersecurity measures.

- Digital Literacy Gaps: Addressing the digital literacy gap in rural areas is crucial for broader market penetration. (xx million individuals lacking digital literacy as of 2024)

Emerging Opportunities in Vietnam Fintech Market

Untapped opportunities exist in expanding financial services to underserved populations in rural areas. Innovative applications of technologies like blockchain for supply chain finance and AI for personalized financial advice are gaining traction. Evolving consumer preferences for personalized, user-friendly, and secure financial products create significant potential for specialized Fintech businesses.

Growth Accelerators in the Vietnam Fintech Market Industry

The Vietnam Fintech market is being propelled forward by transformative technological advancements. The increasing adoption of Open Banking principles is fostering greater collaboration and data sharing, leading to the development of more integrated and innovative financial services. Furthermore, the strategic integration of Artificial Intelligence (AI) across various fintech applications, from personalized financial advice to fraud detection, is significantly enhancing efficiency and user experience. Strategic partnerships and collaborations between agile fintech companies and established traditional financial institutions are proving to be a potent force, creating synergistic growth opportunities and expanding market reach. The deliberate expansion into underserved markets, facilitated by effective digital marketing strategies and comprehensive financial literacy programs, is crucial for achieving sustainable long-term market expansion and fostering broader financial inclusion.

Notable Milestones in Vietnam Fintech Market Sector

- July 2023: Backbase announces a strategic partnership with OBC (Orient Commercial Joint Stock Bank) to accelerate omni-channel banking transformation, enhancing customer experience and digital service delivery.

- February 2022: Visa collaborates with VNPAY, a leading Vietnamese e-payment gateway, to significantly improve and expand Vietnam's digital payments ecosystem, promoting greater adoption of cashless transactions.

In-Depth Vietnam Fintech Market Market Outlook

The Vietnam Fintech market is exceptionally well-positioned for sustained and accelerated growth in the coming years. This optimistic outlook is underpinned by the continuous evolution of technological advancements, a deeply ingrained and growing digital adoption rate across the population, and the unwavering support from government policies that champion innovation and financial inclusion. Strategic alliances between diverse market players, focused efforts to penetrate and serve rural and less-developed regions, and the continuous development of novel and customer-centric financial products will be instrumental in shaping the future trajectory of this dynamic market. Significant opportunities await forward-thinking companies that can adeptly navigate the evolving regulatory landscape, demonstrate a deep understanding of the diverse needs of various customer segments, and deliver truly impactful and accessible financial solutions.

Vietnam Fintech Market Segmentation

-

1. Digital Payments

- 1.1. Online Purchases

- 1.2. POS (Point of Sales) Purchases

-

2. Personal Finance

- 2.1. Digital Asset Management Services

- 2.2. Remittance/ International Monet Transfers

-

3. Alternative Financing

- 3.1. P2P Lending

- 3.2. SME Lending

- 3.3. Crowdfun

-

4. Insurtech

- 4.1. Online Life Insurance

- 4.2. Online Health Insurance

- 4.3. Online Motor Insurance

- 4.4. Online Other General Insurance

-

5. B2C Financial Services Market Places

- 5.1. Banking and Credit

- 5.2. Insurance

- 5.3. E-Commerce Purchase Financing

- 5.4. Other Front-End Fintech Solutions

Vietnam Fintech Market Segmentation By Geography

- 1. Vietnam

Vietnam Fintech Market Regional Market Share

Geographic Coverage of Vietnam Fintech Market

Vietnam Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population

- 3.4. Market Trends

- 3.4.1. Increasing Per Capita Income Witnessing Growth in Vietnam FinTech Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Digital Payments

- 5.1.1. Online Purchases

- 5.1.2. POS (Point of Sales) Purchases

- 5.2. Market Analysis, Insights and Forecast - by Personal Finance

- 5.2.1. Digital Asset Management Services

- 5.2.2. Remittance/ International Monet Transfers

- 5.3. Market Analysis, Insights and Forecast - by Alternative Financing

- 5.3.1. P2P Lending

- 5.3.2. SME Lending

- 5.3.3. Crowdfun

- 5.4. Market Analysis, Insights and Forecast - by Insurtech

- 5.4.1. Online Life Insurance

- 5.4.2. Online Health Insurance

- 5.4.3. Online Motor Insurance

- 5.4.4. Online Other General Insurance

- 5.5. Market Analysis, Insights and Forecast - by B2C Financial Services Market Places

- 5.5.1. Banking and Credit

- 5.5.2. Insurance

- 5.5.3. E-Commerce Purchase Financing

- 5.5.4. Other Front-End Fintech Solutions

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Digital Payments

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MoMo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MonoPay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zalo Pay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AirPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moca

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TIMA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VayMuon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TrustCircle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hudong

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TheBank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 WiCare

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dwealth**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 MoMo

List of Figures

- Figure 1: Vietnam Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Fintech Market Revenue Million Forecast, by Digital Payments 2020 & 2033

- Table 2: Vietnam Fintech Market Volume Billion Forecast, by Digital Payments 2020 & 2033

- Table 3: Vietnam Fintech Market Revenue Million Forecast, by Personal Finance 2020 & 2033

- Table 4: Vietnam Fintech Market Volume Billion Forecast, by Personal Finance 2020 & 2033

- Table 5: Vietnam Fintech Market Revenue Million Forecast, by Alternative Financing 2020 & 2033

- Table 6: Vietnam Fintech Market Volume Billion Forecast, by Alternative Financing 2020 & 2033

- Table 7: Vietnam Fintech Market Revenue Million Forecast, by Insurtech 2020 & 2033

- Table 8: Vietnam Fintech Market Volume Billion Forecast, by Insurtech 2020 & 2033

- Table 9: Vietnam Fintech Market Revenue Million Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 10: Vietnam Fintech Market Volume Billion Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 11: Vietnam Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Vietnam Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Vietnam Fintech Market Revenue Million Forecast, by Digital Payments 2020 & 2033

- Table 14: Vietnam Fintech Market Volume Billion Forecast, by Digital Payments 2020 & 2033

- Table 15: Vietnam Fintech Market Revenue Million Forecast, by Personal Finance 2020 & 2033

- Table 16: Vietnam Fintech Market Volume Billion Forecast, by Personal Finance 2020 & 2033

- Table 17: Vietnam Fintech Market Revenue Million Forecast, by Alternative Financing 2020 & 2033

- Table 18: Vietnam Fintech Market Volume Billion Forecast, by Alternative Financing 2020 & 2033

- Table 19: Vietnam Fintech Market Revenue Million Forecast, by Insurtech 2020 & 2033

- Table 20: Vietnam Fintech Market Volume Billion Forecast, by Insurtech 2020 & 2033

- Table 21: Vietnam Fintech Market Revenue Million Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 22: Vietnam Fintech Market Volume Billion Forecast, by B2C Financial Services Market Places 2020 & 2033

- Table 23: Vietnam Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Vietnam Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Fintech Market?

The projected CAGR is approximately 20.23%.

2. Which companies are prominent players in the Vietnam Fintech Market?

Key companies in the market include MoMo, MonoPay, Zalo Pay, AirPay, Moca, TIMA, VayMuon, TrustCircle, Hudong, TheBank, WiCare, Dwealth**List Not Exhaustive.

3. What are the main segments of the Vietnam Fintech Market?

The market segments include Digital Payments, Personal Finance, Alternative Financing, Insurtech, B2C Financial Services Market Places.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population.

6. What are the notable trends driving market growth?

Increasing Per Capita Income Witnessing Growth in Vietnam FinTech Industry.

7. Are there any restraints impacting market growth?

4.; Increasing Digital Adoption and Smartphone Penetration4.; Young and Tech-Savvy Population.

8. Can you provide examples of recent developments in the market?

July 2023: Backbase, the world’s largest omni-channel bank, has partnered with OBC to accelerate its omni-channel banking transformation, as announced in a signing ceremony.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Fintech Market?

To stay informed about further developments, trends, and reports in the Vietnam Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence