Key Insights

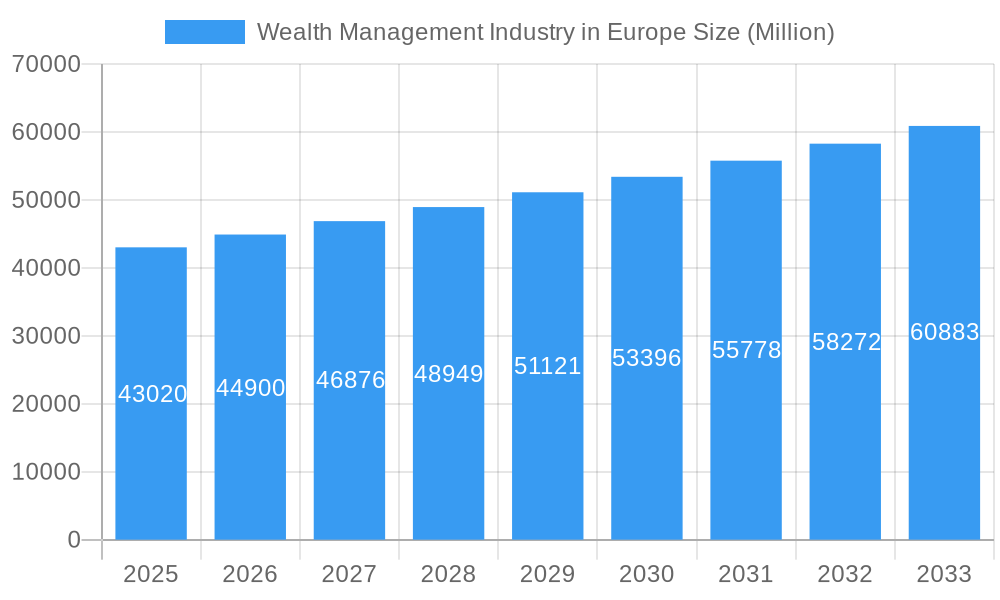

The European wealth management market, valued at €43.02 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing High-Net-Worth Individuals (HNWIs) population across major European economies like Germany, France, and the UK, coupled with a rising mass affluent segment, fuels demand for sophisticated wealth management services. Furthermore, favorable regulatory environments in certain regions and the increasing adoption of digital wealth management platforms are contributing to market expansion. Private banks and family offices remain dominant players, though competition from independent financial advisors and fintech companies is intensifying. The market's growth, however, faces certain challenges. Economic uncertainties, geopolitical risks, and evolving regulatory landscapes could impact investor sentiment and investment strategies. Moreover, maintaining profitability amid increasing operational costs and intense competition necessitates strategic innovation and efficiency improvements within wealth management firms. The continued growth will likely be driven by a focus on personalized services, sustainable investing options, and advanced technology integration across all client segments, from HNWIs to retail investors. By 2033, the market is projected to significantly expand, fueled by consistent growth in the HNWIs segment and the adoption of innovative solutions such as robo-advisors and AI-driven portfolio management across the retail and mass affluent client bases. This will lead to a more diverse and competitive market landscape, requiring continuous adaptation and innovation from established players and new entrants alike.

Wealth Management Industry in Europe Market Size (In Billion)

The segment breakdown reveals a significant contribution from HNWIs and private banking channels, though the retail and mass affluent segments also present substantial growth potential. The UK, Germany, and France are expected to remain key markets due to their large HNWIs populations and developed financial infrastructures. However, other European nations are also witnessing a rise in wealth, creating opportunities for expansion. The forecast period (2025-2033) will likely see significant investment in technological advancements, improved client experiences, and the development of new investment products catering to evolving client needs and preferences. The overall outlook for the European wealth management market remains positive, with opportunities for sustainable growth and profitability for firms capable of adapting to the evolving market dynamics.

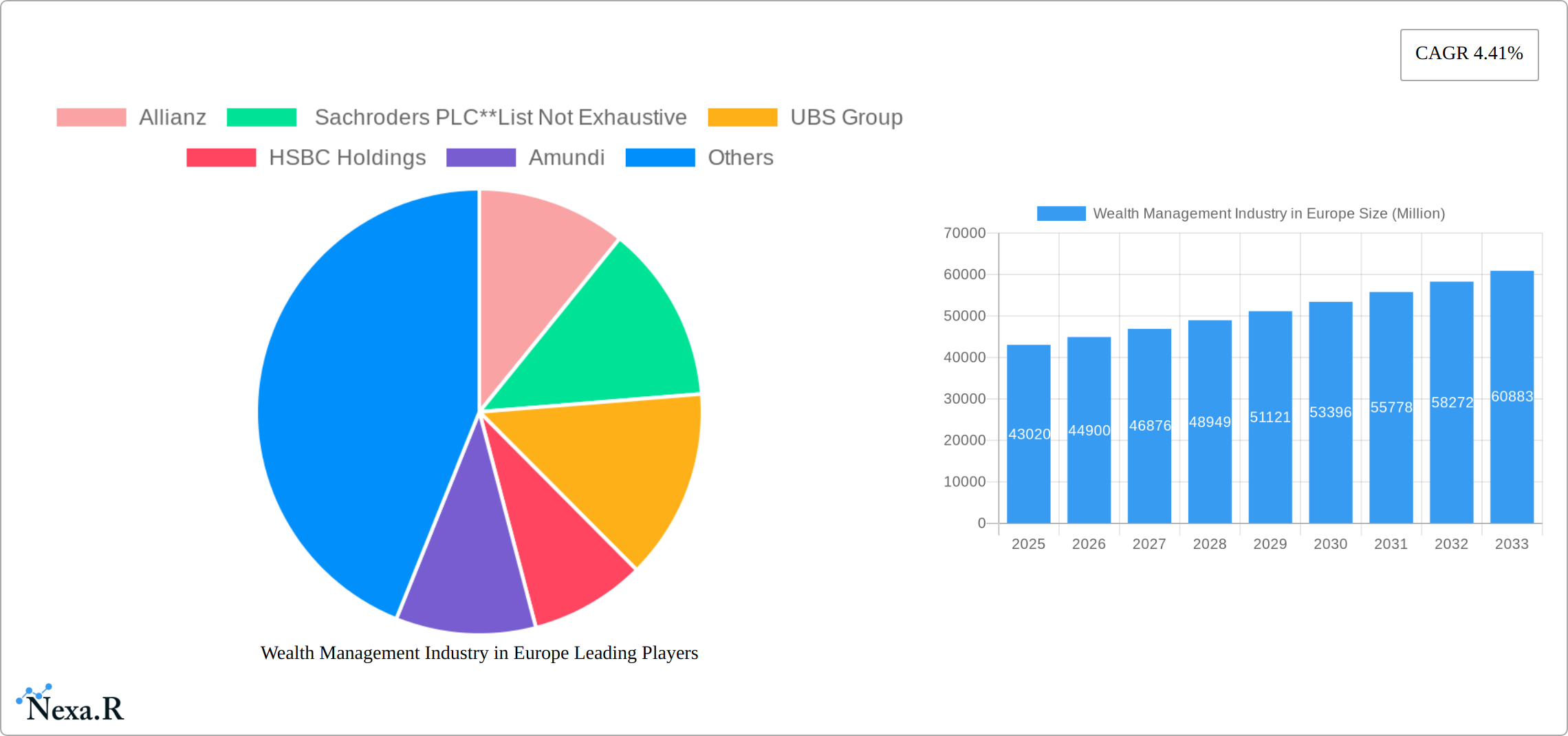

Wealth Management Industry in Europe Company Market Share

This comprehensive report provides a detailed analysis of the European wealth management industry, covering market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and expert insights to deliver actionable intelligence on this dynamic market.

Wealth Management Industry in Europe Market Dynamics & Structure

The European wealth management market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is high, with a few major players holding significant market share. Technological innovation, driven by the increasing adoption of fintech solutions and digitalization, is a key driver of change, alongside evolving regulatory frameworks (e.g., MiFID II) that impact operations and client interaction. While traditional private banking remains dominant, the rise of family offices and other wealth management firms presents a dynamic competitive landscape. The market witnesses considerable M&A activity, as evidenced by recent deals, although this is subject to regulatory scrutiny. Substitutes include robo-advisors and digital investment platforms, adding further competitive pressure. Demographic trends, particularly the aging population and growth of High Net Worth Individuals (HNWIs), significantly influence demand.

- Market Concentration: Top 5 players control approximately xx% of the market (2024).

- M&A Activity (2019-2024): xx deals totaling €xx million.

- Technological Innovation: Focus on AI-driven solutions, personalized portfolio management, and improved digital client onboarding.

- Regulatory Landscape: Stringent regulations impacting data privacy, client protection, and cross-border operations.

- End-User Demographics: Growing HNWIs and mass affluent segment driving market expansion.

Wealth Management Industry in Europe Growth Trends & Insights

The European wealth management market is undergoing a dynamic transformation, characterized by sustained growth driven by accumulating wealth, particularly among High Net Worth Individuals (HNWIs) and the mass affluent segments. While specific figures are subject to market fluctuations and data updates, the sector is anticipated to see significant expansion. This growth is being profoundly shaped by technological advancements, including the rise of sophisticated robo-advisory platforms and intuitive digital wealth management tools. These innovations are not only democratizing access to financial advice but also substantially increasing operational efficiency for both providers and clients. Concurrently, consumer preferences are evolving, with a clear shift towards highly personalized and digitally-enabled financial solutions. This paradigm shift necessitates that traditional wealth managers adapt their service models to meet these new expectations, with younger demographics being at the forefront of embracing digital platforms.

- Market Size (Current): Indicative figures suggest continued robust growth, with ongoing analysis to provide precise market valuations.

- Projected Market Size: Projections point towards substantial market expansion over the next decade, driven by both organic growth and strategic acquisitions.

- Compound Annual Growth Rate (CAGR): The market is expected to maintain a healthy CAGR, reflecting the sustained demand for wealth management services.

- Market Penetration (Digital Platforms): The adoption of digital platforms continues to rise, indicating a growing comfort and reliance on technology for financial management.

Dominant Regions, Countries, or Segments in Wealth Management Industry in Europe

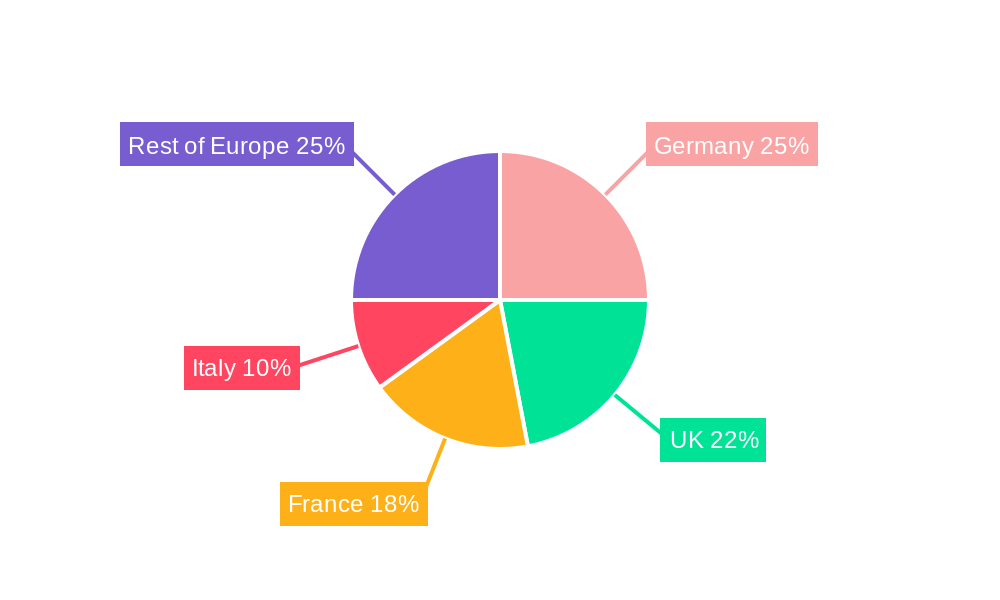

The UK, Germany, France, and Switzerland represent the most significant markets within Europe, driving overall growth. Among client types, HNWIs contribute the largest share of revenue, followed by the mass affluent segment. Private bankers constitute the largest segment of wealth management firms, although family offices are gaining prominence, driving growth in niche markets.

- Leading Region: Western Europe

- Leading Countries: UK, Germany, France, Switzerland

- Leading Client Type: HNWIs (xx% market share in 2024)

- Leading Wealth Management Firm Type: Private Bankers (xx% market share in 2024)

- Key Drivers: Strong economic performance in key regions, favorable regulatory environments, and increasing wealth concentration.

Wealth Management Industry in Europe Product Landscape

The product landscape within European wealth management is a sophisticated blend of established financial instruments and forward-thinking innovations. Core offerings continue to include comprehensive portfolio management, strategic investment advisory services, and detailed wealth planning. However, the market is increasingly defined by the integration of cutting-edge solutions such as advanced robo-advisors that leverage algorithms for automated investment, intuitive digital platforms offering seamless client experiences, and hyper-personalized financial planning tools. These newer offerings are instrumental in boosting both the accessibility and efficiency of wealth management. Performance is rigorously evaluated through key metrics including return on investment (ROI), meticulously calculated risk-adjusted returns, and paramountly, client satisfaction scores. The competitive edge for firms is increasingly found in their ability to deliver bespoke client service, seamlessly integrate cutting-edge technology, and possess deep, specialized expertise in niche areas of finance.

Key Drivers, Barriers & Challenges in Wealth Management Industry in Europe

Key Drivers: Increasing HNWIs, technological advancements (AI, blockchain), favorable regulatory changes in some regions.

Key Challenges: Intense competition (especially from fintech disruptors), regulatory complexities (e.g., GDPR, AML), cybersecurity threats, and economic uncertainty. These challenges impact profit margins (estimated reduction of xx% by 2033 due to increased compliance costs).

Emerging Opportunities in Wealth Management Industry in Europe

Untapped markets include the growing mass affluent segment and underserved geographical regions. Opportunities exist in sustainable and impact investing, as well as personalized wealth management solutions leveraging AI and big data. Evolving consumer preferences towards digital channels necessitate continuous innovation in technology and client experience.

Growth Accelerators in the Wealth Management Industry in Europe Industry

The trajectory of growth in the European wealth management sector is being significantly propelled by several key factors. Strategic collaborations and partnerships between established financial institutions and agile fintech companies are fostering an environment ripe for innovation and the development of novel solutions. Technological breakthroughs, such as the application of artificial intelligence (AI) for sophisticated investment strategy development and the use of blockchain technology to bolster security and transparency, are enhancing operational efficiency and building greater client trust. Furthermore, there is a substantial opportunity for growth by expanding services into previously underserved markets and by cultivating specialized wealth management offerings that are precisely tailored to the unique needs and preferences of distinct client segments.

Key Players Shaping the Wealth Management Industry in Europe Market

Notable Milestones in Wealth Management Industry in Europe Sector

- September 2022: The proposed acquisition of Wealthfront by UBS was officially terminated, marking a significant event in the consolidation landscape.

- 2021: Legal & General demonstrated its commitment to digital enhancement by launching the ONIX platform, designed to bolster digital capabilities for group income protection services catering to intermediaries.

In-Depth Wealth Management Industry in Europe Market Outlook

The European wealth management market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and the expansion of the HNWIs segment. Strategic partnerships and expansion into new market segments will be crucial for firms to maintain a competitive edge. The focus on digital transformation and personalized services will shape the future of the industry, presenting considerable opportunities for both established players and new entrants.

Wealth Management Industry in Europe Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Other Client Types

-

2. Wealth Management Firm

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Other Wealth Management Firms

Wealth Management Industry in Europe Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. United Kingdom

- 5. Rest of Europe

Wealth Management Industry in Europe Regional Market Share

Geographic Coverage of Wealth Management Industry in Europe

Wealth Management Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Other Wealth Management Firms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Italy Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Other Wealth Management Firms

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Germany Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Other Wealth Management Firms

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. France Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Other Wealth Management Firms

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Kingdom Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Other Wealth Management Firms

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Europe Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Other Wealth Management Firms

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sachroders PLC**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amundi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aegon N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Credit Suisse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Legal and General

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Wealth Management Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 3: Wealth Management Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 5: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 6: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 9: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 11: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 12: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 15: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 17: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 18: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Industry in Europe?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Wealth Management Industry in Europe?

Key companies in the market include Allianz, Sachroders PLC**List Not Exhaustive, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N V, Credit Suisse, Legal and General.

3. What are the main segments of the Wealth Management Industry in Europe?

The market segments include Client Type, Wealth Management Firm.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

September 2022: UBS was set to acquire the Millennial and Gen Z-focused Wealthfront. UBS and wealth management platform Wealthfront have pulled out of a proposed acquisition deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Industry in Europe?

To stay informed about further developments, trends, and reports in the Wealth Management Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence