Key Insights

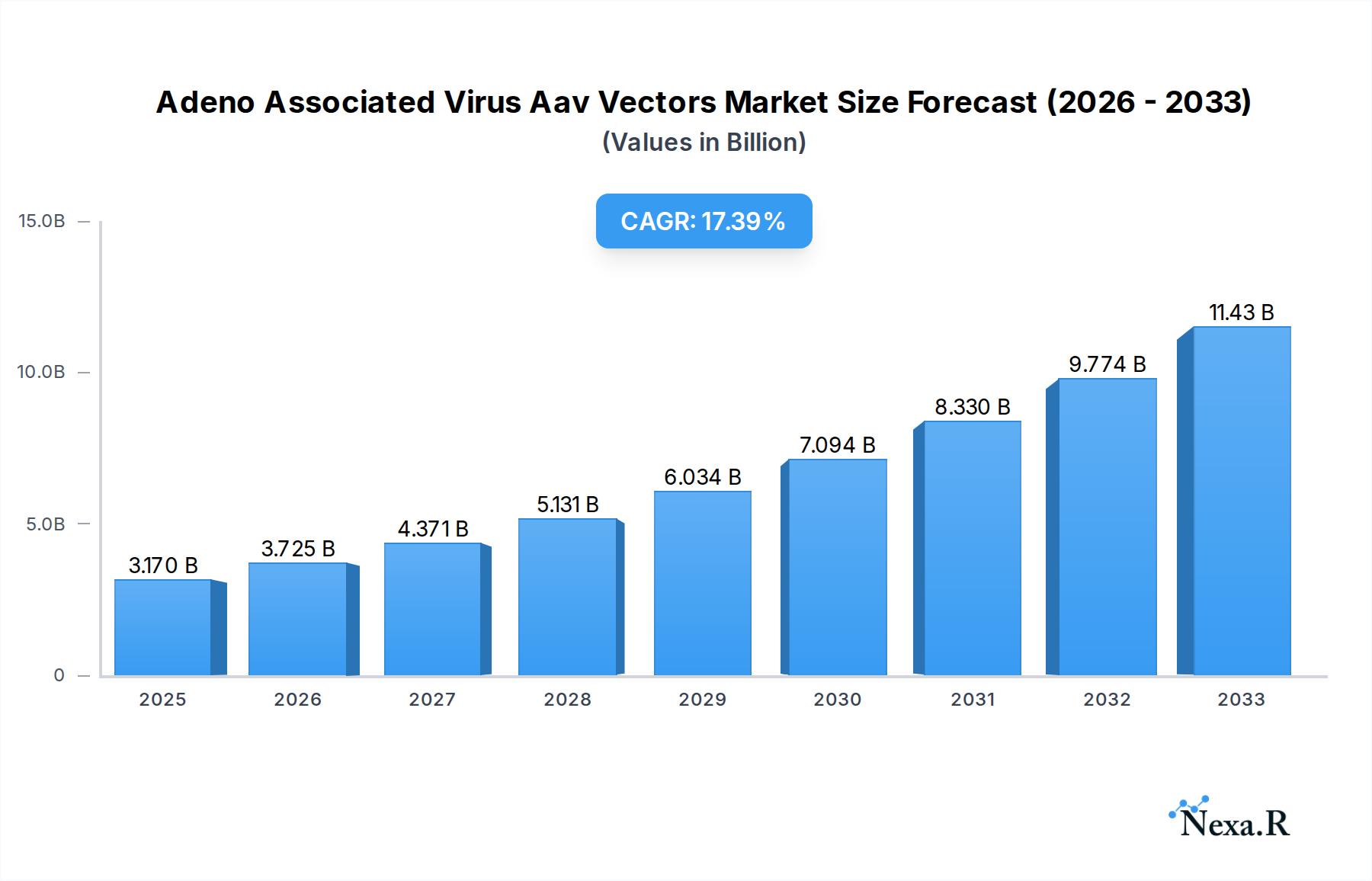

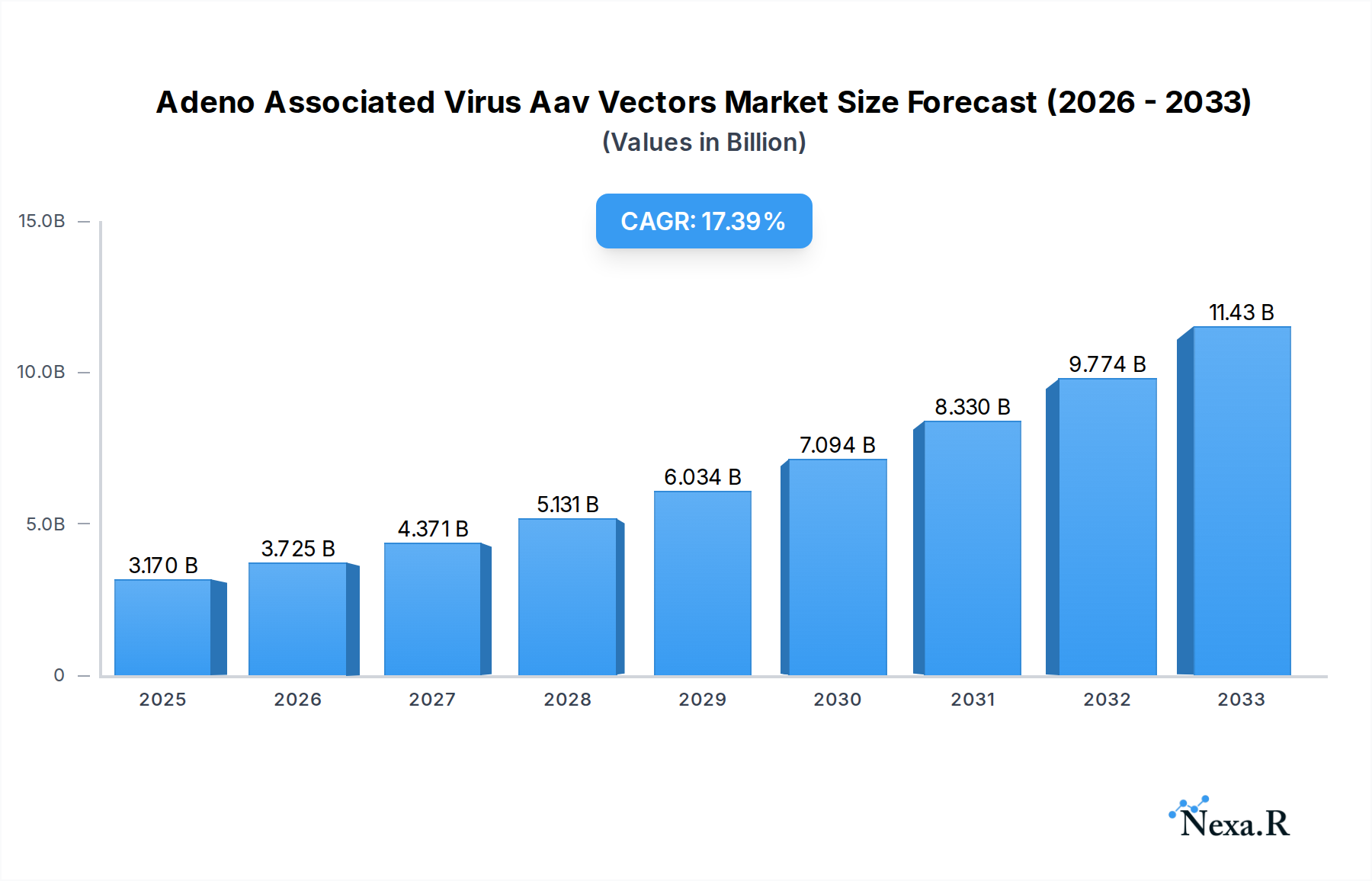

The Adeno-Associated Virus (AAV) vector market is poised for substantial growth, driven by its critical role in gene therapy development and a surging demand for innovative treatments. This market, valued at an estimated $3.17 billion in 2025, is projected to expand at a robust compound annual growth rate (CAGR) of 17.6% through 2033. This remarkable expansion is fueled by the increasing prevalence of genetic disorders, the growing pipeline of AAV-based gene therapies, and significant investments in research and development by leading biopharmaceutical companies. Key applications within medical institutions and research institutes are driving this demand, with a notable trend towards custom-made AAV vectors to meet the specific needs of complex therapeutic interventions. The increasing adoption of gene therapy for rare diseases and chronic conditions, coupled with advancements in manufacturing technologies to ensure scalability and cost-effectiveness, are also significant contributors to this upward trajectory.

Adeno Associated Virus Aav Vectors Market Size (In Billion)

The market's growth is further propelled by technological advancements in vector design and production, leading to improved efficacy and safety profiles of AAV-based therapies. The increasing focus on personalized medicine and the development of novel gene editing techniques have created fertile ground for AAV vectors. While the market enjoys strong drivers, certain restraints, such as the high cost of AAV vector production and complex regulatory pathways for gene therapies, necessitate continuous innovation and strategic partnerships. However, the overwhelming potential of AAV vectors in addressing unmet medical needs across a wide spectrum of diseases, from neurological disorders to inherited metabolic diseases and certain cancers, underscores the optimistic outlook. Major players like Lonza, Thermo Fisher Scientific, and Oxford Biomedica are at the forefront, investing heavily in expanding their manufacturing capacities and R&D efforts to capitalize on this dynamic and rapidly evolving market.

Adeno Associated Virus Aav Vectors Company Market Share

Adeno Associated Virus Aav Vectors Market Dynamics & Structure

The Adeno-Associated Virus (AAV) vectors market is characterized by a dynamic interplay of technological innovation, stringent regulatory landscapes, and evolving end-user demands. Market concentration is moderately fragmented, with a mix of established players and emerging biotech firms vying for market share. Technological innovation is primarily driven by advancements in gene editing technologies, improved AAV serotype engineering for enhanced tissue tropism, and more efficient production methods. Regulatory frameworks, particularly those governed by bodies like the FDA and EMA, play a crucial role in shaping market access and approval timelines for gene therapies utilizing AAV vectors. Competitive product substitutes are relatively limited within the direct gene therapy delivery space, but advancements in alternative viral vectors (e.g., lentiviral vectors) and non-viral delivery systems present potential long-term competition. End-user demographics are predominantly focused on medical institutions and research institutes engaged in therapeutic development and preclinical studies. Merger and acquisition (M&A) trends are on the rise as larger pharmaceutical companies seek to bolster their gene therapy pipelines and gain access to AAV vector manufacturing capabilities.

- Market Concentration: Moderately fragmented, with significant innovation from mid-sized and specialty AAV vector developers.

- Technological Innovation Drivers: Enhanced gene editing integration, novel serotype discovery, improved payload capacity, and scalable manufacturing processes.

- Regulatory Frameworks: Strict preclinical and clinical trial requirements, stringent manufacturing quality controls (GMP), and evolving guidelines for gene therapy approvals.

- Competitive Product Substitutes: Lentiviral vectors for certain applications, non-viral gene delivery methods (liposomes, nanoparticles) showing promise for specific therapeutic areas.

- End-User Demographics: Academic and government research institutions, pharmaceutical and biotechnology companies, contract research organizations (CROs), and specialized gene therapy developers.

- M&A Trends: Increasing strategic acquisitions by large pharma to secure AAV vector manufacturing and IP, and consolidation among specialized AAV vector service providers. Estimated M&A deal volume in the past two years: XX billion.

Adeno Associated Virus Aav Vectors Growth Trends & Insights

The Adeno-Associated Virus (AAV) vectors market is projected for substantial growth, driven by the burgeoning field of gene therapy and the increasing clinical success of AAV-based therapeutics. The market size is expected to witness a compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated value of XX billion by the end of the forecast period. This growth is underpinned by a significant rise in adoption rates by both research institutions and commercial entities seeking to develop treatments for rare genetic disorders, neurodegenerative diseases, and certain types of cancer. Technological disruptions are continuously improving the efficiency, safety, and specificity of AAV vectors, leading to the development of next-generation therapies with broader therapeutic applications.

Consumer behavior shifts are evident in the increasing willingness of patients and healthcare providers to embrace gene-based therapies, driven by the potential for one-time curative treatments. The robust pipeline of AAV-based gene therapies in various stages of clinical trials, coupled with an increasing number of FDA-approved AAV therapies, is a testament to this trend. Market penetration for AAV vectors, while still in its growth phase, is rapidly expanding as manufacturing capacities scale up and cost efficiencies are realized. The historical period (2019-2024) has laid the groundwork, marked by significant preclinical advancements and the initial wave of regulatory approvals, setting the stage for accelerated expansion. The estimated market size for the base year 2025 is projected to be XX billion, reflecting strong momentum.

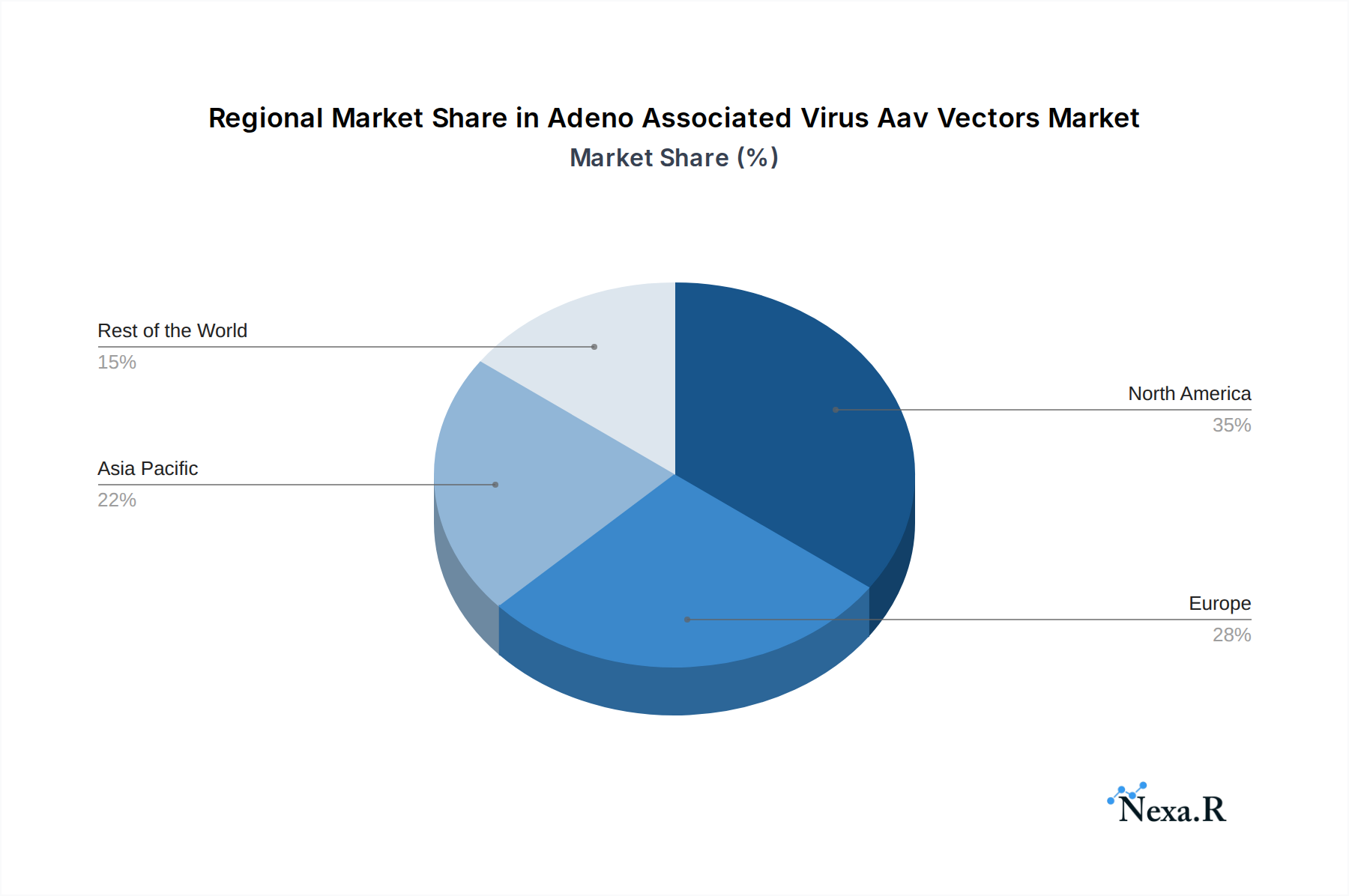

Dominant Regions, Countries, or Segments in Adeno Associated Virus Aav Vectors

North America, specifically the United States, has emerged as the dominant region in the Adeno-Associated Virus (AAV) vectors market. This dominance is propelled by a confluence of factors, including robust government funding for biomedical research, a highly developed pharmaceutical and biotechnology industry, a well-established regulatory framework that supports innovation, and a large patient population with unmet medical needs. The presence of leading research institutions and gene therapy companies, coupled with significant venture capital investment, further solidifies North America's leading position.

Within the Application segment, Medical Institutions are the primary drivers of market growth. These institutions are at the forefront of clinical trials, developing novel AAV-based therapies for a wide range of genetic diseases, neurological disorders, and ophthalmological conditions. The increasing number of AAV vector-based clinical trials initiated and conducted in the US and Canada significantly contributes to the demand for custom-made and pre-made AAV vectors.

Regarding the Type segment, Custom-made AAV vectors hold a substantial market share due to the highly specific requirements of gene therapy applications. Researchers and developers often need bespoke vectors tailored to particular gene sequences, target tissues, and therapeutic goals. However, the market for Pre-made AAV vectors is also witnessing significant expansion, driven by the need for readily available research tools and standardized vectors for early-stage research and preclinical studies, offering faster turnaround times and cost-effectiveness for routine experiments. The market share for Custom-made AAV vectors is estimated at XX% in 2025, while Pre-made vectors account for XX%.

- Dominant Region: North America (USA)

- Key Drivers: High R&D expenditure, strong regulatory support for gene therapy, presence of leading pharmaceutical and biotech firms, substantial venture capital funding, and a large patient pool for rare diseases.

- Market Share (North America): Estimated XX% in 2025.

- Dominant Application Segment: Medical Institutions

- Key Drivers: Leading clinical trial activity, demand for novel gene therapies, collaboration between academia and industry, and patient advocacy groups driving research.

- Market Share (Medical Institutions): Estimated XX% in 2025.

- Dominant Type Segment: Custom-made AAV Vectors

- Key Drivers: Precision engineering for specific therapeutic targets, tailored gene payloads, and the unique nature of many genetic disorders requiring bespoke solutions.

- Market Share (Custom-made): Estimated XX% in 2025.

Adeno Associated Virus Aav Vectors Product Landscape

The Adeno-Associated Virus (AAV) vector product landscape is characterized by a continuous stream of innovation aimed at enhancing efficacy, safety, and manufacturability. Products range from well-characterized serotypes like AAV1, AAV2, AAV5, AAV6, AAV8, and AAV9, each with specific tissue tropisms, to novel engineered capsids designed for improved transduction of hard-to-reach tissues or to evade pre-existing immunity. Emerging product innovations include self-complementary AAV (scAAV) vectors for faster transgene expression, dual-vector systems for complex genetic manipulations, and vectorized gene editing tools. Performance metrics focus on transduction efficiency, transgene expression levels, immunogenicity, and biosafety profiles. Unique selling propositions often lie in the ability to produce high-titer, clinical-grade AAV vectors under GMP conditions, along with comprehensive analytical characterization services.

Key Drivers, Barriers & Challenges in Adeno Associated Virus Aav Vectors

The Adeno-Associated Virus (AAV) vectors market is propelled by several key drivers, including the rapid advancement of gene therapy, the increasing prevalence of genetic disorders, and the growing number of clinical trials demonstrating the therapeutic potential of AAV vectors. Technological breakthroughs in AAV engineering, such as improved serotype selection and capsid design, are also significant accelerators. Furthermore, supportive government initiatives and substantial investment in biotechnology research foster innovation and market expansion.

However, the market faces significant barriers and challenges. The high cost of AAV vector development and manufacturing remains a primary restraint, limiting accessibility for some patients and institutions. Regulatory hurdles, including the rigorous approval processes for gene therapies and the need for stringent quality control, can lead to lengthy development timelines. Manufacturing scalability and consistent production of clinical-grade AAV vectors at sufficient titers also present technical challenges. Moreover, potential immunogenicity issues associated with AAV vectors and the risk of off-target effects require careful consideration and mitigation strategies. Supply chain complexities for raw materials and specialized reagents can also impact production timelines and costs.

Emerging Opportunities in Adeno Associated Virus Aav Vectors

Emerging opportunities in the Adeno-Associated Virus (AAV) vectors market are vast and multifaceted. The expansion of AAV vector applications beyond rare genetic diseases into more prevalent conditions like cardiovascular diseases, metabolic disorders, and chronic pain presents a significant untapped market. The development of next-generation AAV capsids engineered for improved immune evasion and enhanced transduction of specific cell types is creating new therapeutic avenues. Furthermore, the integration of AAV vectors with advanced gene editing technologies like CRISPR-Cas9 is opening doors for precise in vivo gene correction. Opportunities also lie in developing more cost-effective and scalable manufacturing platforms to reduce the overall cost of gene therapies. The growing global demand for advanced therapeutics, particularly in emerging economies, represents another fertile ground for market expansion.

Growth Accelerators in the Adeno Associated Virus Aav Vectors Industry

The long-term growth of the Adeno-Associated Virus (AAV) vectors industry is significantly accelerated by a combination of technological breakthroughs, strategic partnerships, and evolving market strategies. The continuous refinement of AAV capsid engineering, leading to enhanced tissue tropism, reduced immunogenicity, and improved packaging capacity, is a primary growth catalyst. The successful translation of AAV-based therapies from preclinical studies to regulatory approvals and commercialization fuels further investment and research. Strategic partnerships between AAV vector developers, pharmaceutical giants, and academic institutions are crucial for accelerating drug development pipelines and expanding manufacturing capabilities. Furthermore, the development of innovative manufacturing processes, including upstream and downstream optimization, is crucial for increasing production yields and reducing costs, thereby making AAV-based therapies more accessible.

Key Players Shaping the Adeno Associated Virus Aav Vectors Market

- Lonza

- Addgene

- Takara

- Charles River Laboratories

- SIRION Biotech

- Thermo Fisher Scientific

- OriGene Technologies

- Cell Biolabs

- GenScript

- VectorBuilder

- GeneCopoeia

- AMSBIO

- Creative Biogene

- BPS Bioscience

- Oxford Biomedica

- FUJIFILM Diosynth Biotechnologies

- Aldevron

Notable Milestones in Adeno Associated Virus Aav Vectors Sector

- 2021: FDA approval of an AAV-based gene therapy for Spinal Muscular Atrophy (SMA), marking a significant milestone for in vivo gene therapy.

- 2022: Continued advancements in AAV capsid engineering, with the development of novel serotypes demonstrating enhanced tropism for specific organs like the liver and central nervous system.

- 2023: Increased investment in AAV vector manufacturing capacity by major pharmaceutical companies to meet growing demand.

- 2023 (Month XX): Successful completion of pivotal clinical trials for AAV-based treatments for inherited retinal diseases, showing promising efficacy.

- 2024: Emergence of AAV vectors as key delivery vehicles for gene editing technologies, enabling in vivo correction of genetic defects.

- 2024 (Month XX): Acquisition of a specialized AAV vector manufacturing company by a large biopharmaceutical firm, indicating industry consolidation.

In-Depth Adeno Associated Virus Aav Vectors Market Outlook

The Adeno-Associated Virus (AAV) vectors market is poised for exceptional growth, driven by the transformative potential of gene therapy. Future market potential is significantly influenced by the accelerating pace of technological innovation, particularly in the design of novel AAV capsids with enhanced therapeutic profiles and reduced immunogenicity. The growing pipeline of AAV-based clinical candidates across a wide spectrum of diseases, from rare genetic disorders to more prevalent chronic conditions, will be a primary demand driver. Strategic collaborations between AAV vector manufacturers, gene therapy developers, and large pharmaceutical companies will be crucial for scaling up production and ensuring market access. Furthermore, advancements in cost-effective manufacturing processes are expected to broaden the accessibility of these advanced therapies. The outlook points towards a substantial expansion of the AAV vector market, solidifying its position as a cornerstone of modern medicine.

Adeno Associated Virus Aav Vectors Segmentation

-

1. Application

- 1.1. Medical Institutions

- 1.2. Research Institute

-

2. Type

- 2.1. Custom-made

- 2.2. Pre-made

Adeno Associated Virus Aav Vectors Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Adeno Associated Virus Aav Vectors Regional Market Share

Geographic Coverage of Adeno Associated Virus Aav Vectors

Adeno Associated Virus Aav Vectors REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Institutions

- 5.1.2. Research Institute

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Custom-made

- 5.2.2. Pre-made

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Institutions

- 6.1.2. Research Institute

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Custom-made

- 6.2.2. Pre-made

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Institutions

- 7.1.2. Research Institute

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Custom-made

- 7.2.2. Pre-made

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Institutions

- 8.1.2. Research Institute

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Custom-made

- 8.2.2. Pre-made

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Institutions

- 9.1.2. Research Institute

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Custom-made

- 9.2.2. Pre-made

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Adeno Associated Virus Aav Vectors Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Institutions

- 10.1.2. Research Institute

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Custom-made

- 10.2.2. Pre-made

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lonza

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Addgene

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Takara

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charles River Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SIRION Biotech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thermo Fisher Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OriGene Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cell Biolabs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GenScript

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VectorBuilder

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GeneCopoeia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AMSBIO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Creative Biogene

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BPS Bioscience

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Oxford Biomedica

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 FUJIFILM Diosynth Biotechnologies

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Aldevron

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Lonza

List of Figures

- Figure 1: Global Adeno Associated Virus Aav Vectors Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Adeno Associated Virus Aav Vectors Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Adeno Associated Virus Aav Vectors Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Adeno Associated Virus Aav Vectors Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Adeno Associated Virus Aav Vectors Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Adeno Associated Virus Aav Vectors Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Adeno Associated Virus Aav Vectors Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Adeno Associated Virus Aav Vectors Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Adeno Associated Virus Aav Vectors Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Adeno Associated Virus Aav Vectors Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Adeno Associated Virus Aav Vectors Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Adeno Associated Virus Aav Vectors Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Adeno Associated Virus Aav Vectors Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Adeno Associated Virus Aav Vectors Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Adeno Associated Virus Aav Vectors Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Adeno Associated Virus Aav Vectors Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Adeno Associated Virus Aav Vectors Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Adeno Associated Virus Aav Vectors Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Adeno Associated Virus Aav Vectors Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Adeno Associated Virus Aav Vectors Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Adeno Associated Virus Aav Vectors Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Adeno Associated Virus Aav Vectors Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Adeno Associated Virus Aav Vectors Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Adeno Associated Virus Aav Vectors Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Adeno Associated Virus Aav Vectors Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Adeno Associated Virus Aav Vectors Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Adeno Associated Virus Aav Vectors Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Adeno Associated Virus Aav Vectors Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adeno Associated Virus Aav Vectors?

The projected CAGR is approximately 17.6%.

2. Which companies are prominent players in the Adeno Associated Virus Aav Vectors?

Key companies in the market include Lonza, Addgene, Takara, Charles River Laboratories, SIRION Biotech, Thermo Fisher Scientific, OriGene Technologies, Cell Biolabs, GenScript, VectorBuilder, GeneCopoeia, AMSBIO, Creative Biogene, BPS Bioscience, Oxford Biomedica, FUJIFILM Diosynth Biotechnologies, Aldevron.

3. What are the main segments of the Adeno Associated Virus Aav Vectors?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adeno Associated Virus Aav Vectors," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adeno Associated Virus Aav Vectors report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adeno Associated Virus Aav Vectors?

To stay informed about further developments, trends, and reports in the Adeno Associated Virus Aav Vectors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence