Key Insights

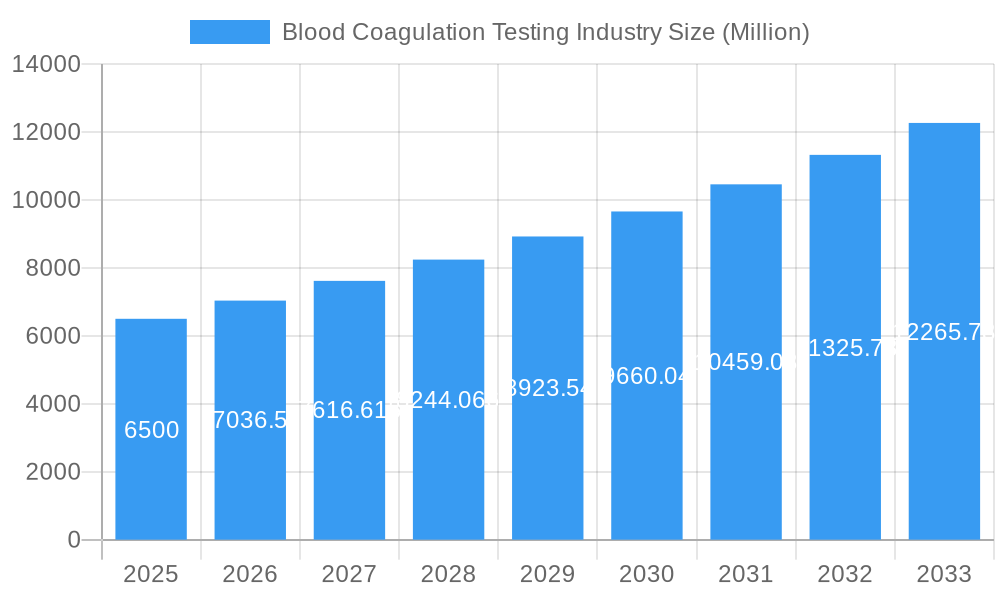

The global Blood Coagulation Testing Market is poised for robust expansion, projected to reach an estimated value of USD 6,500 million by 2025. This significant growth is underpinned by a Compound Annual Growth Rate (CAGR) of 8.10% during the forecast period of 2025-2033. The market's dynamism is fueled by several key drivers, including the increasing prevalence of cardiovascular diseases, bleeding disorders, and thrombotic conditions, which necessitate accurate and timely coagulation testing for diagnosis and management. Furthermore, advancements in diagnostic technologies, such as the development of sophisticated laboratory analyzers and user-friendly point-of-care testing (POCT) systems, are enhancing diagnostic capabilities and expanding access to testing, particularly in remote or underserved areas. The growing adoption of automated systems within hospitals and diagnostic centers, driven by their efficiency and accuracy, is a significant contributor to market expansion. Moreover, a heightened awareness among healthcare professionals and patients regarding the importance of coagulation monitoring for patient safety during surgery, anticoagulant therapy, and critical care settings is further propelling market growth.

Blood Coagulation Testing Industry Market Size (In Billion)

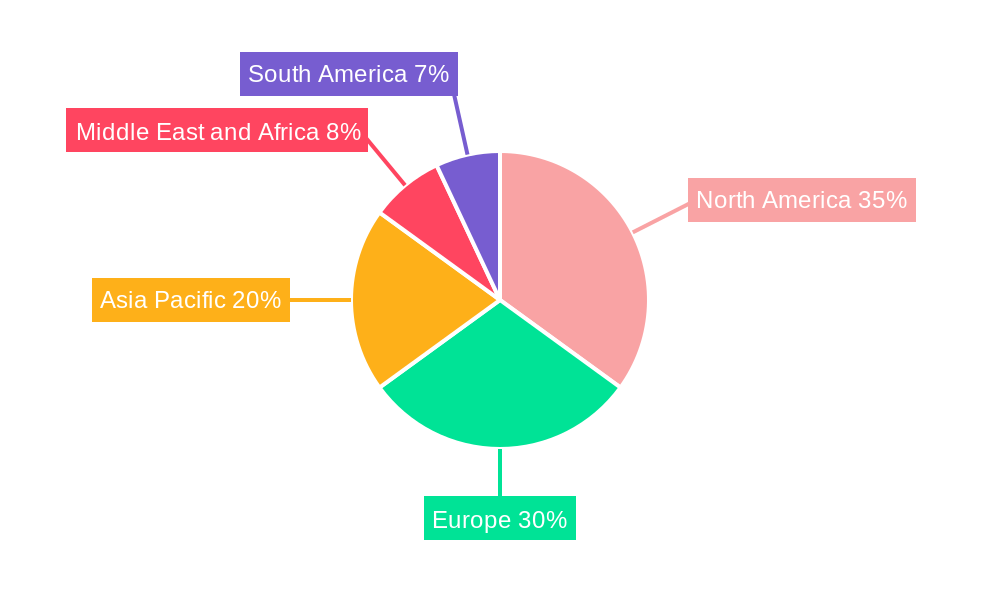

The market is segmented across various product types, tests, and end-users, reflecting its diverse applications. Laboratory analyzers, encompassing automated, semi-automated, and manual systems, hold a dominant share due to their comprehensive diagnostic capabilities. Point-of-Care Testing (POCT) systems are emerging as a rapidly growing segment, offering on-the-spot results and improved patient convenience. Key tests driving the market include Activated Partial Thromboplastin Time (aPTT), D-Dimer, Fibrinogen, and Prothrombin Time (PT) tests, crucial for assessing various aspects of the coagulation cascade. Hospitals and diagnostic centers represent the primary end-users, leveraging these testing solutions for patient care. Geographically, North America and Europe currently lead the market, owing to well-established healthcare infrastructures and high adoption rates of advanced diagnostic technologies. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditure, a rising patient population, and the expanding network of diagnostic facilities. Despite the promising outlook, certain restraints, such as the high cost of advanced diagnostic equipment and stringent regulatory requirements, may pose challenges to market expansion in specific regions.

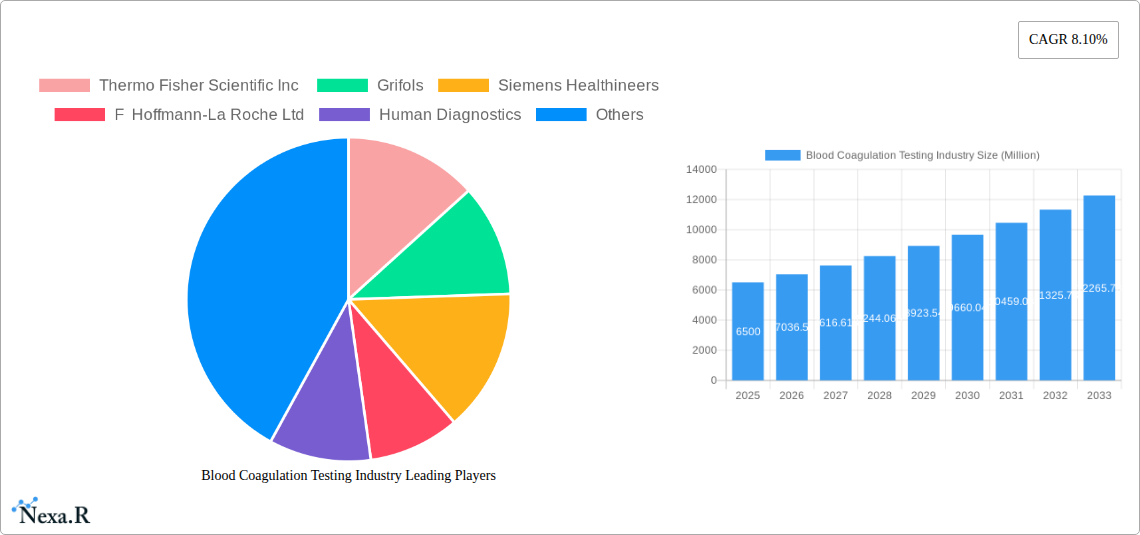

Blood Coagulation Testing Industry Company Market Share

Blood Coagulation Testing Industry: Comprehensive Market Analysis, Forecast & Opportunities (2019-2033)

This in-depth report delivers a critical analysis of the global Blood Coagulation Testing market, providing actionable insights for stakeholders. We forecast a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, projecting the market to reach USD XXXX Million units by 2033. Our analysis covers the historical period from 2019-2024, with a base year of 2025 and an estimated year of 2025, offering a complete view of market evolution. Explore market dynamics, growth drivers, regional dominance, product segmentation, key challenges, and emerging opportunities within the blood coagulation testing market, hemostasis diagnostics market, and in vitro diagnostics (IVD) for coagulation sectors. This report is essential for understanding the competitive landscape, including key players like Thermo Fisher Scientific Inc, Grifols, Siemens Healthineers, F Hoffmann-La Roche Ltd, Human Diagnostics, GE Healthcare, Danaher Corporation, NIHON KOHDEN CORPORATION, Abbott, Bio-Rad Laboratories, Sysmex Corporation, and Werfen.

Blood Coagulation Testing Industry Market Dynamics & Structure

The blood coagulation testing industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demands. Market concentration is moderately high, with several multinational corporations holding significant shares. Technological advancements, particularly in automation and point-of-care (POC) testing, are primary drivers, enabling faster, more accurate, and accessible diagnostics. Regulatory bodies worldwide play a crucial role in ensuring product safety and efficacy, influencing product development and market entry strategies. The competitive landscape features both established giants and agile innovators vying for market dominance.

- Market Concentration: Dominated by a few key players, but with increasing opportunities for niche providers.

- Technological Innovation Drivers: Automation, miniaturization, improved assay sensitivity, and AI integration in diagnostic interpretation.

- Regulatory Frameworks: Strict adherence to FDA, CE, and other regional guidelines for product approval and market access.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in other diagnostic modalities can indirectly impact demand.

- End-User Demographics: A shift towards decentralized testing and increased demand from hospitals and diagnostic centers for high-throughput solutions.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding product portfolios and geographical reach. For instance, in November 2022, Enzyre secured USD 11.9 million in Series A funding, signaling investor confidence in new hemostasis diagnostic technologies.

Blood Coagulation Testing Industry Growth Trends & Insights

The blood coagulation testing market is experiencing significant expansion, driven by increasing incidences of thromboembolic and hemorrhagic disorders, coupled with a growing emphasis on early disease detection and management. The global market size is projected to witness substantial growth from an estimated USD XXXX Million units in 2025 to USD XXXX Million units by 2033, reflecting a robust CAGR of XX%. This growth is fueled by rising healthcare expenditures, an aging global population prone to coagulation-related conditions, and a greater awareness among healthcare professionals and patients about the importance of timely and accurate hemostasis testing.

Technological disruptions are at the forefront of market evolution. The widespread adoption of automated laboratory analyzers is a key trend, enhancing efficiency and reducing human error in high-volume settings. Concurrently, the burgeoning point-of-care testing (POC) segment is transforming patient care by enabling rapid diagnostics at the bedside or in remote locations. This has particular implications for managing critical conditions and for patients with chronic diseases requiring frequent monitoring. Consumer behavior shifts are also evident, with an increasing preference for less invasive diagnostic methods and home-based testing solutions, as exemplified by Enzyre's funding round aimed at facilitating home testing for hemophilia patients. Furthermore, the development of novel diagnostic markers and companion diagnostics for targeted therapies is expected to create new avenues for market growth. The integration of artificial intelligence (AI) and machine learning in interpreting coagulation test results promises to further refine diagnostic accuracy and clinical decision-making, underpinning the sustained growth trajectory of the coagulation diagnostics market.

Dominant Regions, Countries, or Segments in Blood Coagulation Testing Industry

North America currently holds a dominant position in the global blood coagulation testing industry, driven by a confluence of factors including high healthcare expenditure, advanced healthcare infrastructure, and the early adoption of innovative diagnostic technologies. The United States, in particular, represents a significant market share due to its large patient population, robust research and development landscape, and stringent regulatory approval processes that often set global benchmarks. This region’s dominance is further amplified by the presence of major industry players and their substantial investment in R&D, leading to a continuous stream of new product launches and market-ready innovations.

Within product segmentation, Laboratory Analyzers, especially Automated Systems, represent the largest and fastest-growing segment. These systems are crucial for hospitals and large diagnostic centers requiring high throughput and precision in testing. The demand for automated coagulation analyzers is propelled by the increasing volume of diagnostic tests performed daily and the need to streamline laboratory workflows. The Point-of-Care Testing Systems segment, while smaller, is exhibiting the highest growth rate, driven by the demand for rapid diagnostics in emergency settings, critical care units, and remote healthcare facilities. This segment’s expansion is directly linked to improving patient outcomes through faster treatment initiation.

In terms of tests, the Prothrombin Time (PT) Test and Activated Partial Thromboplastin Time (aPTT) remain foundational, consistently driving market volume due to their critical role in monitoring anticoagulant therapies and assessing intrinsic and extrinsic coagulation pathways. The D-Dimer Test is witnessing accelerated growth, fueled by its increasing utilization in diagnosing and ruling out deep vein thrombosis (DVT) and pulmonary embolism (PE), conditions with rising prevalence globally. The Fibrinogen Test also contributes significantly, especially in assessing risk for thrombotic events and managing disseminated intravascular coagulation (DIC).

Among end-users, Hospitals constitute the largest market segment, owing to their comprehensive diagnostic needs and the critical nature of coagulation testing in inpatient care, surgical procedures, and intensive care units. Diagnostic Centers follow closely, driven by the increasing trend of outsourcing diagnostic services and the growing demand for specialized hemostasis testing. The overall market growth in North America is underpinned by supportive government policies, a well-established reimbursement system for diagnostic tests, and a strong emphasis on evidence-based medicine.

Blood Coagulation Testing Industry Product Landscape

The blood coagulation testing industry offers a diverse and evolving product landscape, crucial for diagnosing and managing bleeding and thrombotic disorders. Laboratory analyzers, ranging from sophisticated fully automated systems to semi-automated and manual instruments, form the backbone of diagnostic laboratories, providing accurate and high-throughput testing capabilities. Point-of-care testing (POC) systems are revolutionizing patient care by enabling rapid, decentralized diagnostics, offering immediate results for critical decision-making. Key tests include Activated Partial Thromboplastin Time (aPTT), D-Dimer, Fibrinogen, and Prothrombin Time (PT) tests, each essential for assessing different aspects of the coagulation cascade. Innovations are focused on enhancing assay sensitivity, reducing turnaround times, minimizing reagent consumption, and improving user-friendliness. The integration of advanced software for data management and analysis further elevates the performance and clinical utility of these products.

Key Drivers, Barriers & Challenges in Blood Coagulation Testing Industry

Key Drivers:

- Rising prevalence of coagulation disorders: Increasing incidences of deep vein thrombosis, pulmonary embolism, and hemophilia drive demand for diagnostic tests.

- Technological advancements: Development of automated analyzers and point-of-care testing devices enhances efficiency and accessibility.

- Aging population: Age-related health conditions often correlate with an increased risk of coagulation-related diseases.

- Growing healthcare expenditure: Increased investment in diagnostics and patient care globally fuels market growth.

Barriers & Challenges:

- High cost of advanced instruments: The initial investment for sophisticated analyzers can be a barrier for smaller healthcare facilities.

- Regulatory hurdles: Stringent approval processes in different regions can delay market entry for new products.

- Skilled workforce requirement: Operating and maintaining advanced coagulation testing equipment necessitates trained personnel.

- Reimbursement policies: Inconsistent reimbursement policies across different healthcare systems can impact test adoption rates.

- Supply chain disruptions: Global supply chain issues can affect the availability of reagents and components, impacting production and distribution. The competitive pressure from established players can also be a significant challenge for new entrants.

Emerging Opportunities in Blood Coagulation Testing Industry

Emerging opportunities in the blood coagulation testing industry are centered on advancing diagnostic capabilities and expanding access. The growing demand for personalized medicine is creating a niche for companion diagnostics that can guide targeted anticoagulant therapies. Furthermore, the development of novel point-of-care systems capable of performing a wider range of hemostasis assays with improved accuracy presents a significant opportunity for decentralized diagnostics, particularly in remote or underserved areas. The increasing focus on home-based patient monitoring for chronic conditions like hemophilia, as highlighted by Enzyre's funding, opens up avenues for user-friendly, portable diagnostic devices. Leveraging artificial intelligence for predictive analytics in coagulation disorders also offers substantial potential for early intervention and improved patient outcomes.

Growth Accelerators in the Blood Coagulation Testing Industry Industry

Long-term growth in the blood coagulation testing industry is being propelled by continuous technological breakthroughs and strategic market expansion initiatives. The development of next-generation hemostasis systems, such as HemoSonics' Quantra Hemostasis System with its QStat Cartridge, which expands diagnostic capabilities for point-of-care applications, signifies a major growth accelerator. Strategic partnerships between diagnostic companies and pharmaceutical firms are creating synergistic opportunities for integrated diagnostic and therapeutic solutions. Furthermore, the increasing global adoption of advanced automated laboratory analyzers and the expansion of POC testing networks in developing economies are significantly broadening the market reach and accelerating adoption rates. The growing emphasis on preventative healthcare and proactive disease management further solidifies the demand for reliable coagulation testing.

Key Players Shaping the Blood Coagulation Testing Industry Market

- Thermo Fisher Scientific Inc

- Grifols

- Siemens Healthineers

- F Hoffmann-La Roche Ltd

- Human Diagnostics

- GE Healthcare

- Danaher Corporation

- NIHON KOHDEN CORPORATION

- Abbott

- Bio-Rad Laboratories

- Sysmex Corporation

- Werfen

Notable Milestones in Blood Coagulation Testing Industry Sector

- December 2022: HemoSonics received 510(k) market clearance from the US FDA for its Quantra Hemostasis System with QStat Cartridge, enhancing its diagnostic capabilities as a next-generation whole-blood hemostasis system covering a wide variety of clinical indications.

- November 2022: Enzyre, a Dutch company focused on ambulant diagnostic technology for blood coagulation testing, successfully raised USD 11.9 million (EUR 12 million) in Series A funding to advance home testing solutions for hemophilia patients.

In-Depth Blood Coagulation Testing Industry Market Outlook

The blood coagulation testing industry is poised for sustained and significant growth, driven by an ongoing wave of innovation and expanding global healthcare infrastructure. Future market potential lies in the continued integration of artificial intelligence for enhanced diagnostic accuracy and predictive capabilities, alongside the proliferation of highly sensitive and specific assays. Strategic opportunities will arise from addressing unmet needs in developing markets through affordable and accessible point-of-care solutions. Collaborations focusing on the development of advanced companion diagnostics for novel anticoagulant therapies will also be pivotal. The industry's outlook is characterized by a strong emphasis on improving patient outcomes through faster, more precise, and increasingly decentralized diagnostic testing, ensuring its vital role in modern healthcare.

Blood Coagulation Testing Industry Segmentation

-

1. Product

-

1.1. Laboratory Analyzers

- 1.1.1. Automated Systems

- 1.1.2. Semi-automated Systems

- 1.1.3. Manual Systems

- 1.2. Point-of-Care Testing Systems

-

1.1. Laboratory Analyzers

-

2. Test

- 2.1. Activated Partial Thromboplastin Time

- 2.2. D-Dimer Test

- 2.3. Fibrinogen Test

- 2.4. Prothrombin Time (PT) Test

- 2.5. Other Te

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostic Centers

- 3.3. Other En

Blood Coagulation Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Blood Coagulation Testing Industry Regional Market Share

Geographic Coverage of Blood Coagulation Testing Industry

Blood Coagulation Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Blood Clotting Disorders; Technological Advancements for Medical Treatment; Rising Adoption of Automated Hemostasis Equipment

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness in Developing Countries; Stringent Government Regulation

- 3.4. Market Trends

- 3.4.1. The Point-of-Care Testing Systems Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Laboratory Analyzers

- 5.1.1.1. Automated Systems

- 5.1.1.2. Semi-automated Systems

- 5.1.1.3. Manual Systems

- 5.1.2. Point-of-Care Testing Systems

- 5.1.1. Laboratory Analyzers

- 5.2. Market Analysis, Insights and Forecast - by Test

- 5.2.1. Activated Partial Thromboplastin Time

- 5.2.2. D-Dimer Test

- 5.2.3. Fibrinogen Test

- 5.2.4. Prothrombin Time (PT) Test

- 5.2.5. Other Te

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Centers

- 5.3.3. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Laboratory Analyzers

- 6.1.1.1. Automated Systems

- 6.1.1.2. Semi-automated Systems

- 6.1.1.3. Manual Systems

- 6.1.2. Point-of-Care Testing Systems

- 6.1.1. Laboratory Analyzers

- 6.2. Market Analysis, Insights and Forecast - by Test

- 6.2.1. Activated Partial Thromboplastin Time

- 6.2.2. D-Dimer Test

- 6.2.3. Fibrinogen Test

- 6.2.4. Prothrombin Time (PT) Test

- 6.2.5. Other Te

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostic Centers

- 6.3.3. Other En

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Laboratory Analyzers

- 7.1.1.1. Automated Systems

- 7.1.1.2. Semi-automated Systems

- 7.1.1.3. Manual Systems

- 7.1.2. Point-of-Care Testing Systems

- 7.1.1. Laboratory Analyzers

- 7.2. Market Analysis, Insights and Forecast - by Test

- 7.2.1. Activated Partial Thromboplastin Time

- 7.2.2. D-Dimer Test

- 7.2.3. Fibrinogen Test

- 7.2.4. Prothrombin Time (PT) Test

- 7.2.5. Other Te

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Centers

- 7.3.3. Other En

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Laboratory Analyzers

- 8.1.1.1. Automated Systems

- 8.1.1.2. Semi-automated Systems

- 8.1.1.3. Manual Systems

- 8.1.2. Point-of-Care Testing Systems

- 8.1.1. Laboratory Analyzers

- 8.2. Market Analysis, Insights and Forecast - by Test

- 8.2.1. Activated Partial Thromboplastin Time

- 8.2.2. D-Dimer Test

- 8.2.3. Fibrinogen Test

- 8.2.4. Prothrombin Time (PT) Test

- 8.2.5. Other Te

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostic Centers

- 8.3.3. Other En

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Laboratory Analyzers

- 9.1.1.1. Automated Systems

- 9.1.1.2. Semi-automated Systems

- 9.1.1.3. Manual Systems

- 9.1.2. Point-of-Care Testing Systems

- 9.1.1. Laboratory Analyzers

- 9.2. Market Analysis, Insights and Forecast - by Test

- 9.2.1. Activated Partial Thromboplastin Time

- 9.2.2. D-Dimer Test

- 9.2.3. Fibrinogen Test

- 9.2.4. Prothrombin Time (PT) Test

- 9.2.5. Other Te

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostic Centers

- 9.3.3. Other En

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Blood Coagulation Testing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Laboratory Analyzers

- 10.1.1.1. Automated Systems

- 10.1.1.2. Semi-automated Systems

- 10.1.1.3. Manual Systems

- 10.1.2. Point-of-Care Testing Systems

- 10.1.1. Laboratory Analyzers

- 10.2. Market Analysis, Insights and Forecast - by Test

- 10.2.1. Activated Partial Thromboplastin Time

- 10.2.2. D-Dimer Test

- 10.2.3. Fibrinogen Test

- 10.2.4. Prothrombin Time (PT) Test

- 10.2.5. Other Te

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Diagnostic Centers

- 10.3.3. Other En

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Grifols

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Healthineers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Hoffmann-La Roche Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Human Diagnostics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Healthcare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NIHON KOHDEN CORPORATION

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio-Rad Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sysmex Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Werfen

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific Inc

List of Figures

- Figure 1: Global Blood Coagulation Testing Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Blood Coagulation Testing Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Blood Coagulation Testing Industry Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Blood Coagulation Testing Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Blood Coagulation Testing Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Blood Coagulation Testing Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Blood Coagulation Testing Industry Revenue (undefined), by Test 2025 & 2033

- Figure 8: North America Blood Coagulation Testing Industry Volume (K Unit), by Test 2025 & 2033

- Figure 9: North America Blood Coagulation Testing Industry Revenue Share (%), by Test 2025 & 2033

- Figure 10: North America Blood Coagulation Testing Industry Volume Share (%), by Test 2025 & 2033

- Figure 11: North America Blood Coagulation Testing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Blood Coagulation Testing Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Blood Coagulation Testing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Blood Coagulation Testing Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Blood Coagulation Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Blood Coagulation Testing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Blood Coagulation Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Blood Coagulation Testing Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Blood Coagulation Testing Industry Revenue (undefined), by Product 2025 & 2033

- Figure 20: Europe Blood Coagulation Testing Industry Volume (K Unit), by Product 2025 & 2033

- Figure 21: Europe Blood Coagulation Testing Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Blood Coagulation Testing Industry Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe Blood Coagulation Testing Industry Revenue (undefined), by Test 2025 & 2033

- Figure 24: Europe Blood Coagulation Testing Industry Volume (K Unit), by Test 2025 & 2033

- Figure 25: Europe Blood Coagulation Testing Industry Revenue Share (%), by Test 2025 & 2033

- Figure 26: Europe Blood Coagulation Testing Industry Volume Share (%), by Test 2025 & 2033

- Figure 27: Europe Blood Coagulation Testing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Blood Coagulation Testing Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Blood Coagulation Testing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Blood Coagulation Testing Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Blood Coagulation Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Blood Coagulation Testing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Blood Coagulation Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Blood Coagulation Testing Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Blood Coagulation Testing Industry Revenue (undefined), by Product 2025 & 2033

- Figure 36: Asia Pacific Blood Coagulation Testing Industry Volume (K Unit), by Product 2025 & 2033

- Figure 37: Asia Pacific Blood Coagulation Testing Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Blood Coagulation Testing Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific Blood Coagulation Testing Industry Revenue (undefined), by Test 2025 & 2033

- Figure 40: Asia Pacific Blood Coagulation Testing Industry Volume (K Unit), by Test 2025 & 2033

- Figure 41: Asia Pacific Blood Coagulation Testing Industry Revenue Share (%), by Test 2025 & 2033

- Figure 42: Asia Pacific Blood Coagulation Testing Industry Volume Share (%), by Test 2025 & 2033

- Figure 43: Asia Pacific Blood Coagulation Testing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Blood Coagulation Testing Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Blood Coagulation Testing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Blood Coagulation Testing Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Blood Coagulation Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Blood Coagulation Testing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Blood Coagulation Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Blood Coagulation Testing Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Blood Coagulation Testing Industry Revenue (undefined), by Product 2025 & 2033

- Figure 52: Middle East and Africa Blood Coagulation Testing Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: Middle East and Africa Blood Coagulation Testing Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East and Africa Blood Coagulation Testing Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East and Africa Blood Coagulation Testing Industry Revenue (undefined), by Test 2025 & 2033

- Figure 56: Middle East and Africa Blood Coagulation Testing Industry Volume (K Unit), by Test 2025 & 2033

- Figure 57: Middle East and Africa Blood Coagulation Testing Industry Revenue Share (%), by Test 2025 & 2033

- Figure 58: Middle East and Africa Blood Coagulation Testing Industry Volume Share (%), by Test 2025 & 2033

- Figure 59: Middle East and Africa Blood Coagulation Testing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 60: Middle East and Africa Blood Coagulation Testing Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa Blood Coagulation Testing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Blood Coagulation Testing Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Blood Coagulation Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East and Africa Blood Coagulation Testing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Blood Coagulation Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Blood Coagulation Testing Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Blood Coagulation Testing Industry Revenue (undefined), by Product 2025 & 2033

- Figure 68: South America Blood Coagulation Testing Industry Volume (K Unit), by Product 2025 & 2033

- Figure 69: South America Blood Coagulation Testing Industry Revenue Share (%), by Product 2025 & 2033

- Figure 70: South America Blood Coagulation Testing Industry Volume Share (%), by Product 2025 & 2033

- Figure 71: South America Blood Coagulation Testing Industry Revenue (undefined), by Test 2025 & 2033

- Figure 72: South America Blood Coagulation Testing Industry Volume (K Unit), by Test 2025 & 2033

- Figure 73: South America Blood Coagulation Testing Industry Revenue Share (%), by Test 2025 & 2033

- Figure 74: South America Blood Coagulation Testing Industry Volume Share (%), by Test 2025 & 2033

- Figure 75: South America Blood Coagulation Testing Industry Revenue (undefined), by End User 2025 & 2033

- Figure 76: South America Blood Coagulation Testing Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America Blood Coagulation Testing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Blood Coagulation Testing Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Blood Coagulation Testing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: South America Blood Coagulation Testing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Blood Coagulation Testing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Blood Coagulation Testing Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 4: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 5: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 12: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 13: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 25: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 26: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 27: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: France Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Spain Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 44: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 45: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 46: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 47: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 48: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: India Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Australia Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Korea Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 64: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 65: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 66: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 67: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 68: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: GCC Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: South Africa Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 78: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 79: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Test 2020 & 2033

- Table 80: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Test 2020 & 2033

- Table 81: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 82: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global Blood Coagulation Testing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Global Blood Coagulation Testing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Brazil Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: Argentina Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Blood Coagulation Testing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Blood Coagulation Testing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Coagulation Testing Industry?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Blood Coagulation Testing Industry?

Key companies in the market include Thermo Fisher Scientific Inc , Grifols, Siemens Healthineers, F Hoffmann-La Roche Ltd, Human Diagnostics, GE Healthcare, Danaher Corporation, NIHON KOHDEN CORPORATION, Abbott, Bio-Rad Laboratories, Sysmex Corporation, Werfen.

3. What are the main segments of the Blood Coagulation Testing Industry?

The market segments include Product, Test, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Blood Clotting Disorders; Technological Advancements for Medical Treatment; Rising Adoption of Automated Hemostasis Equipment.

6. What are the notable trends driving market growth?

The Point-of-Care Testing Systems Segment is Expected to Hold a Significant Market Share Over The Forecast Period..

7. Are there any restraints impacting market growth?

Lack of Awareness in Developing Countries; Stringent Government Regulation.

8. Can you provide examples of recent developments in the market?

In December 2022, HemoSonics received 510 (k) market clearance for its Quantra Hemostasis System with QStat Cartridge from the US FDA. The company stated that the QStat Cartridge assay increases Quantra's overall diagnostic capabilities. The new next-generation whole-blood hemostasis system covers the widest variety of clinical indications of any point-of-care hemostasis analyzer in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blood Coagulation Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blood Coagulation Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blood Coagulation Testing Industry?

To stay informed about further developments, trends, and reports in the Blood Coagulation Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence