Key Insights

Brazil's tractor machinery market, valued at approximately $1.71 billion in 2024, is poised for sustained expansion. This growth is fueled by increasing agricultural land under cultivation, government initiatives promoting farming modernization, and a rising demand for efficient, high-performance tractors. The market's projected Compound Annual Growth Rate (CAGR) of 2.79% from 2024 onwards signals a robust outlook, notwithstanding potential challenges such as fluctuating commodity prices and economic volatility affecting farmer investment.

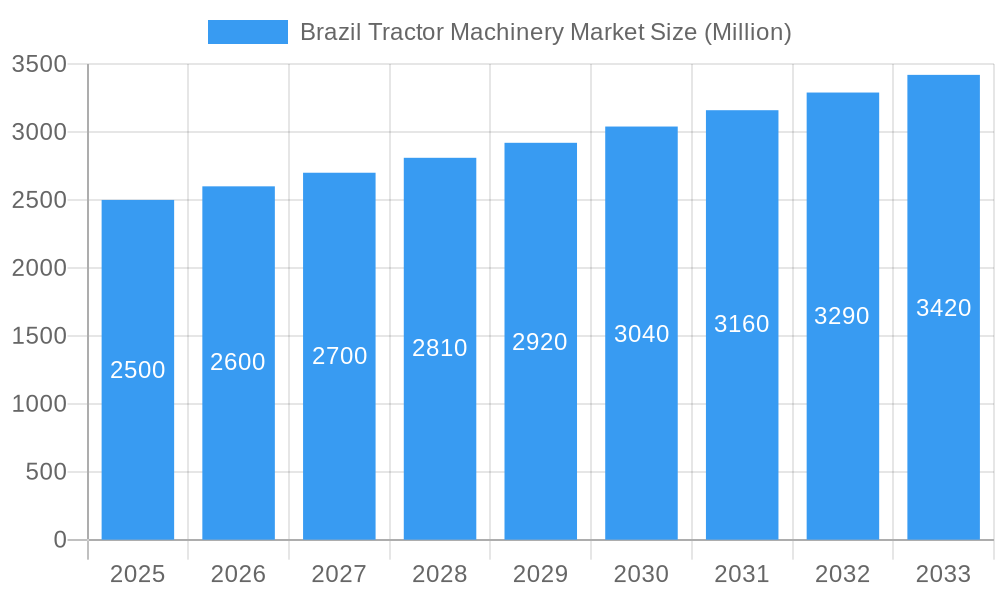

Brazil Tractor Machinery Market Market Size (In Billion)

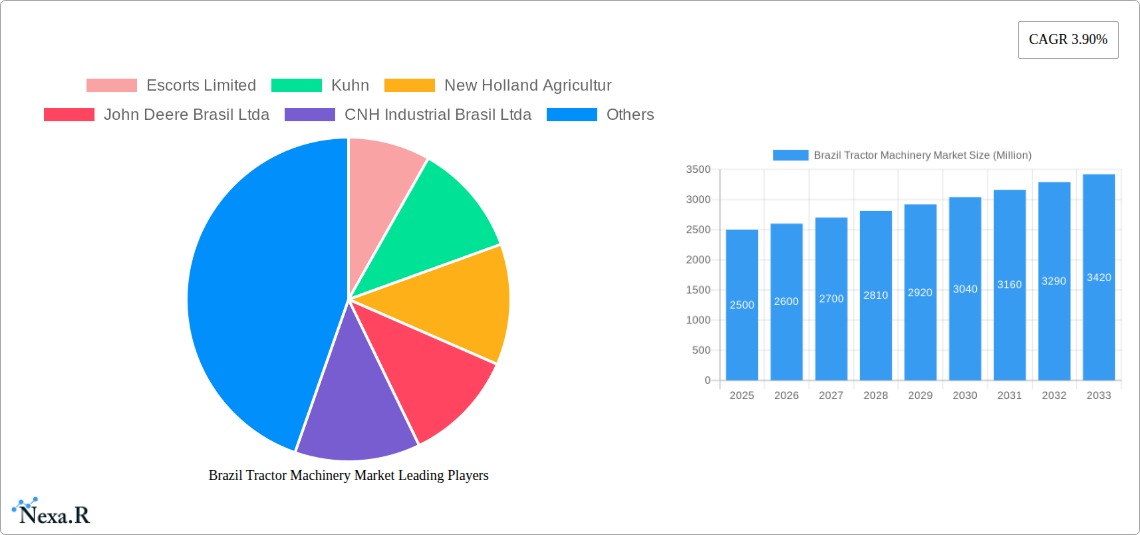

Segment analysis indicates a strong preference for tractors with engine power ranging from 81-130 HP, aligning with prevalent farm sizes and crop types in Brazil. Row crop tractors currently lead the application segment, driven by the nation's significant production of soybeans and sugarcane. However, the orchard tractor segment is anticipated to experience notable growth, supported by the expanding fruit and nut production sector. Leading competitors, including Escorts Limited, John Deere, and Mahindra & Mahindra, are actively pursuing market leadership through innovation in tractor technology, financing solutions, and after-sales services. Market success will hinge on a stable macroeconomic environment and continued government support for agricultural development.

Brazil Tractor Machinery Market Company Market Share

The forecast period (2024-2033) anticipates a gradual market size increase, reflecting projected growth in agricultural production and advancements in tractor technology. While the historical period (2019-2024) may have encountered volatility, the long-term forecast indicates a positive trajectory. Intense competition among established and emerging players will continue to shape market dynamics. An increasing emphasis on sustainable agriculture and the integration of precision farming technologies are expected to be key growth drivers. Detailed segmentation by engine power and application offers strategic insights for stakeholders to identify opportunities and refine marketing efforts.

Brazil Tractor Machinery Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil tractor machinery market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented by engine power (Less than 80 HP, 81-130 HP, Above 130 HP) and application (Row Crop Tractors, Orchard Tractors, Other Applications). The total market size is projected to reach xx Million units by 2033.

Brazil Tractor Machinery Market Dynamics & Structure

The Brazilian tractor machinery market is characterized by a moderately concentrated landscape, with key players like John Deere, CNH Industrial, and Mahindra & Mahindra holding significant market share. Technological innovation, driven by the need for increased efficiency and precision agriculture, is a key driver. Government regulations, particularly those focused on environmental sustainability and safety, influence market dynamics. The market faces competition from substitute technologies, such as drones for agricultural applications. The predominantly agricultural end-user demographic significantly impacts market demand, while mergers and acquisitions (M&A) activity further shapes the competitive landscape. The historical period saw xx M&A deals, with an average deal value of xx Million USD.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Focus on precision farming technologies, automation, and fuel efficiency.

- Regulatory Framework: Emphasis on emission standards and safety regulations.

- Competitive Substitutes: Emerging technologies like drones and robotics pose a competitive threat.

- End-User Demographics: Predominantly large-scale commercial farms and agricultural cooperatives.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios and market reach. Significant consolidation expected in the forecast period.

Brazil Tractor Machinery Market Growth Trends & Insights

The Brazilian tractor machinery market witnessed a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven primarily by rising agricultural output, government support for the sector, and favorable credit conditions. Market penetration remains relatively low compared to developed nations, indicating significant growth potential. Technological disruptions, such as the adoption of precision farming technologies and autonomous tractors, are accelerating market evolution. Consumer behavior shifts towards higher-powered, technologically advanced tractors are also influencing market growth. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a projected size of xx Million units by 2033.

Dominant Regions, Countries, or Segments in Brazil Tractor Machinery Market

The South and Southeast regions of Brazil dominate the tractor machinery market due to their extensive agricultural lands and high concentration of large-scale farms. Within the segments, the "81-130 HP" engine power segment exhibits the highest growth rate driven by increasing demand for medium-sized tractors suitable for diverse farming operations. The "Row Crop Tractors" application segment leads in terms of market share and growth potential, reflecting the prevalence of row crop cultivation in Brazil.

- Key Drivers: Favorable agricultural policies, supportive infrastructure, rising farm incomes, and increased adoption of precision agriculture techniques.

- Dominance Factors: High agricultural production, large land holdings, and established agricultural practices.

- Growth Potential: Untapped market in smaller farms and increased demand for technologically advanced equipment.

Brazil Tractor Machinery Market Product Landscape

The Brazilian tractor machinery market offers a range of tractors with varying engine power, features, and functionalities. Innovations include advanced GPS-guided systems, automated steering, and fuel-efficient engines. These advancements enhance operational efficiency, precision, and reduce environmental impact. Tractors are increasingly equipped with telematics systems enabling remote monitoring and data analysis, optimizing farm management and maintenance.

Key Drivers, Barriers & Challenges in Brazil Tractor Machinery Market

Key Drivers: Growing agricultural sector, government incentives, technological advancements, and rising demand for efficient machinery. The expansion of agricultural exports is a significant factor.

Key Barriers & Challenges: Economic instability, fluctuations in commodity prices, import tariffs, and competition from used machinery imports. Supply chain disruptions are also impacting availability and cost. This has resulted in a xx% increase in the price of tractors in the past year.

Emerging Opportunities in Brazil Tractor Machinery Market

Emerging opportunities lie in precision agriculture technology adoption, increasing demand for specialized tractors (e.g., orchard tractors), and expansion into underserved regions. The integration of smart farming solutions and data analytics presents a significant growth opportunity. There is potential for growth in the rental market for tractors, making advanced technology accessible to smaller farms.

Growth Accelerators in the Brazil Tractor Machinery Market Industry

Technological advancements, strategic partnerships between tractor manufacturers and agricultural technology companies, and government initiatives promoting agricultural modernization are key growth accelerators. Expanding into new markets and offering tailored financing solutions can further stimulate market growth. Increased investments in research and development will drive innovation and enhance competitiveness.

Key Players Shaping the Brazil Tractor Machinery Market Market

- Escorts Limited

- Kuhn

- New Holland Agriculture

- John Deere Brasil Ltda

- CNH Industrial Brasil Ltda

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- AGCO do Brasil

Notable Milestones in Brazil Tractor Machinery Market Sector

- July 2022: Mahindra & Mahindra expands its Brazilian assembly plant, doubling production capacity for Arjun and Novo tractor models. This signifies a strong commitment to the Brazilian market and boosts local production.

- December 2021: The IDB provides a USD 1.2 billion credit facility to enhance Brazilian agricultural production and technology adoption. This substantial investment fosters sector growth and modernization.

In-Depth Brazil Tractor Machinery Market Market Outlook

The Brazilian tractor machinery market exhibits robust growth potential, driven by the country's expanding agricultural sector and technological advancements. Strategic opportunities exist for companies to invest in research and development, expand their product portfolios, and leverage partnerships to capitalize on the growing demand for efficient and advanced agricultural machinery. The long-term outlook remains positive, with continued growth anticipated throughout the forecast period.

Brazil Tractor Machinery Market Segmentation

-

1. Engine Power

- 1.1. Less than 80 HP

- 1.2. 81 to 130 HP

- 1.3. Above 130 HP

-

2. Application

- 2.1. Row Crop Tractors

- 2.2. Orchard Tractors

- 2.3. Other Applications

-

3. Engine Power

- 3.1. Less than 80 HP

- 3.2. 81 to 130 HP

- 3.3. Above 130 HP

-

4. Application

- 4.1. Row Crop Tractors

- 4.2. Orchard Tractors

- 4.3. Other Applications

Brazil Tractor Machinery Market Segmentation By Geography

- 1. Brazil

Brazil Tractor Machinery Market Regional Market Share

Geographic Coverage of Brazil Tractor Machinery Market

Brazil Tractor Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Labor Shortage Resulting in Farm Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Tractor Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Power

- 5.1.1. Less than 80 HP

- 5.1.2. 81 to 130 HP

- 5.1.3. Above 130 HP

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Row Crop Tractors

- 5.2.2. Orchard Tractors

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Engine Power

- 5.3.1. Less than 80 HP

- 5.3.2. 81 to 130 HP

- 5.3.3. Above 130 HP

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Row Crop Tractors

- 5.4.2. Orchard Tractors

- 5.4.3. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Engine Power

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Escorts Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 New Holland Agricultur

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 John Deere Brasil Ltda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CNH Industrial Brasil Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tractors and Farm Equipment Limited (TAFE)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claas KGaA mbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kubota Agricultural Machinery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AGCO do Brasil

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Escorts Limited

List of Figures

- Figure 1: Brazil Tractor Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Tractor Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Tractor Machinery Market Revenue billion Forecast, by Engine Power 2020 & 2033

- Table 2: Brazil Tractor Machinery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Brazil Tractor Machinery Market Revenue billion Forecast, by Engine Power 2020 & 2033

- Table 4: Brazil Tractor Machinery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Brazil Tractor Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Brazil Tractor Machinery Market Revenue billion Forecast, by Engine Power 2020 & 2033

- Table 7: Brazil Tractor Machinery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Brazil Tractor Machinery Market Revenue billion Forecast, by Engine Power 2020 & 2033

- Table 9: Brazil Tractor Machinery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Brazil Tractor Machinery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Tractor Machinery Market?

The projected CAGR is approximately 2.79%.

2. Which companies are prominent players in the Brazil Tractor Machinery Market?

Key companies in the market include Escorts Limited, Kuhn, New Holland Agricultur, John Deere Brasil Ltda, CNH Industrial Brasil Ltda, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, AGCO do Brasil.

3. What are the main segments of the Brazil Tractor Machinery Market?

The market segments include Engine Power, Application, Engine Power, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Labor Shortage Resulting in Farm Mechanization.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

July 2022: Mahindra & Mahindra, one of the world's largest tractor manufacturers, has expanded an assembly plant in Brazil as part of its strategic global growth. The company intends to double its manufacturing capacity for Arjun and Novo tractor models by establishing its latest assembly base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Tractor Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Tractor Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Tractor Machinery Market?

To stay informed about further developments, trends, and reports in the Brazil Tractor Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence