Key Insights

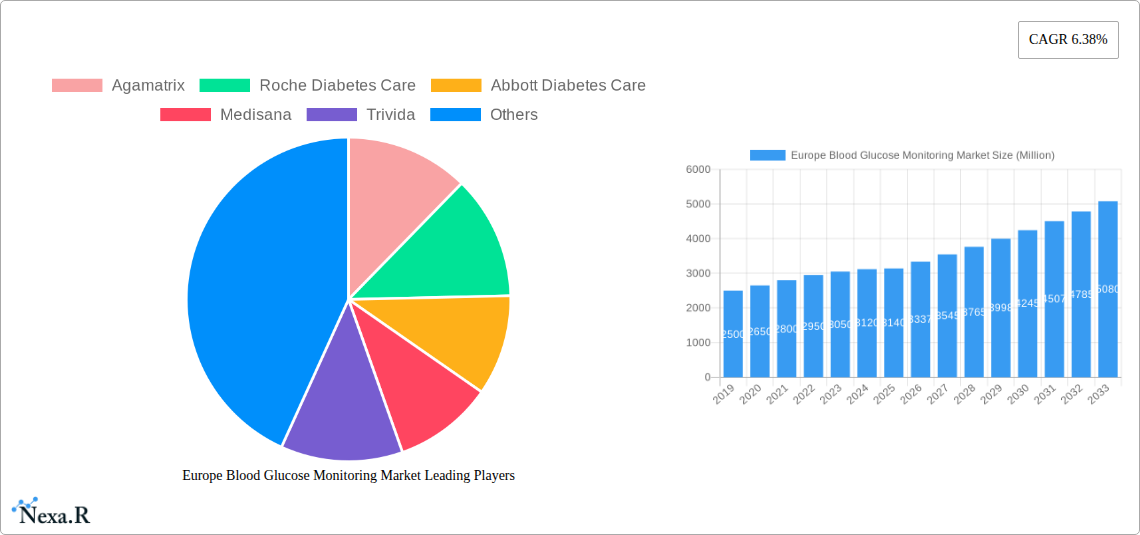

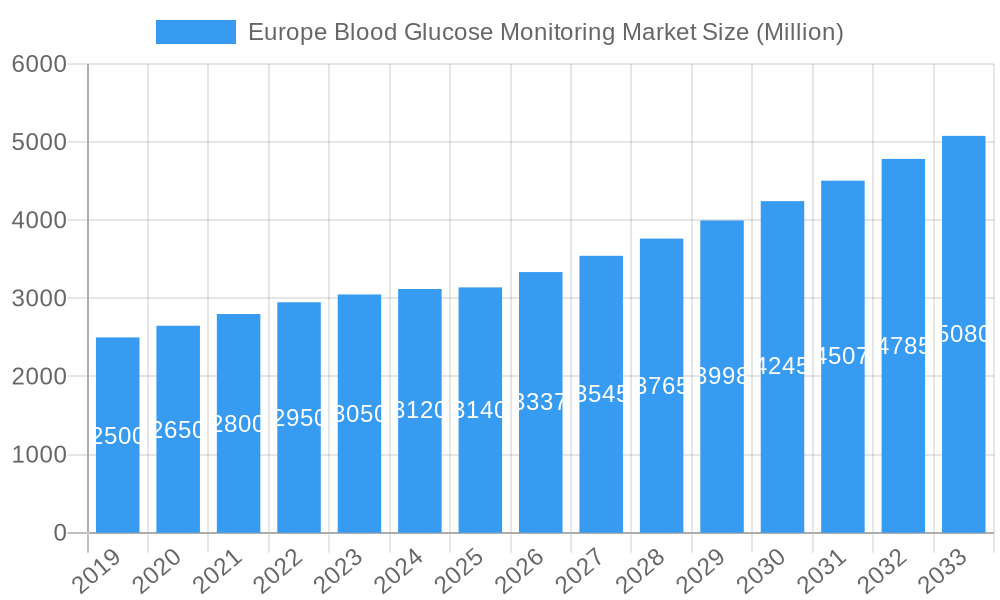

The European blood glucose monitoring market is poised for substantial growth, projected to reach USD 3.14 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 6.38% through 2033. This expansion is primarily fueled by the escalating prevalence of diabetes across the continent, coupled with a growing awareness and adoption of advanced monitoring technologies. Key drivers include the increasing demand for convenient and accurate self-monitoring solutions, the supportive regulatory landscape in many European nations, and a rising geriatric population more susceptible to diabetes. Furthermore, technological advancements leading to the development of less invasive and more user-friendly glucometer devices and test strips are significantly contributing to market penetration. The market is segmented into critical components such as glucometer devices, essential test strips, and lancets, each experiencing steady demand. Leading companies like Roche Diabetes Care, Abbott Diabetes Care, and Agamatrix are actively investing in research and development to innovate and capture market share in this dynamic environment.

Europe Blood Glucose Monitoring Market Market Size (In Billion)

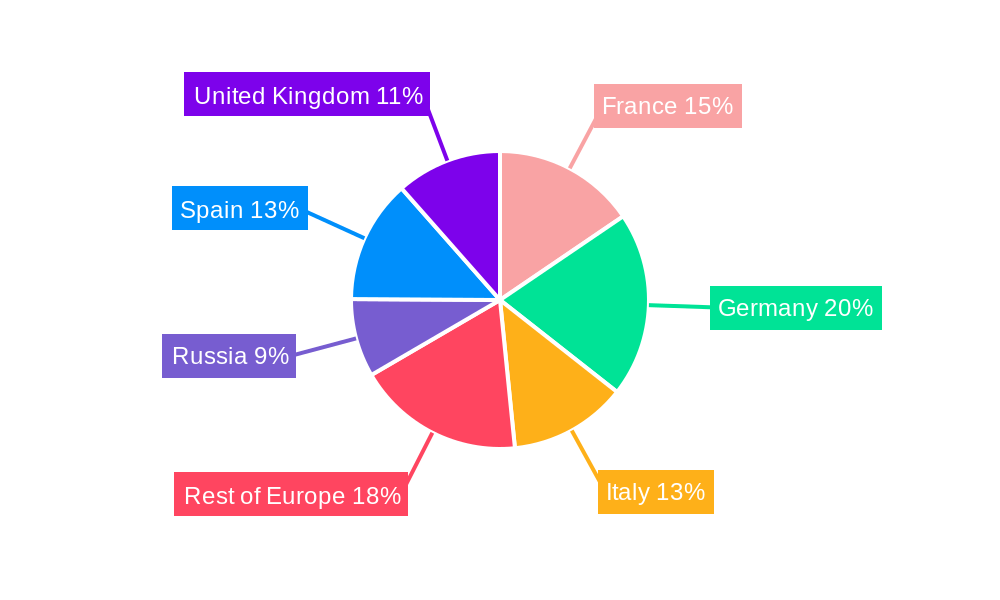

The market's growth trajectory is further influenced by emerging trends such as the integration of artificial intelligence and cloud connectivity in glucose monitoring systems, enabling better data management and personalized treatment plans. Continuous Glucose Monitoring (CGM) systems are gaining traction, offering a more comprehensive picture of glucose fluctuations compared to traditional finger-prick methods. However, certain restraints, including the high cost of advanced monitoring devices and the need for adequate reimbursement policies in some regions, could temper the market's full potential. Geographically, while specific regional data for France, Germany, Italy, Spain, the UK, Russia, and the Rest of Europe is detailed, the overall trend points towards a uniformly growing demand across these key markets, driven by national diabetes management programs and healthcare infrastructure development. The competitive landscape is characterized by the presence of both established global players and emerging regional manufacturers, all vying for dominance through product innovation and strategic partnerships.

Europe Blood Glucose Monitoring Market Company Market Share

Europe Blood Glucose Monitoring Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This report delivers an in-depth analysis of the Europe Blood Glucose Monitoring (BGM) market, providing critical insights into market dynamics, growth trends, regional dominance, product innovation, and competitive landscape. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers a robust forecast for the period 2025–2033 and a detailed look at the historical trends from 2019–2024. The market is segmented into Glucometer Devices, Test Strips, and Lancets, with a granular examination of parent and child market dynamics to maximize understanding. With an anticipated market size of XX Million Units in 2025, this report is an indispensable resource for stakeholders seeking to capitalize on the evolving European diabetes care sector.

Europe Blood Glucose Monitoring Market Market Dynamics & Structure

The Europe Blood Glucose Monitoring market exhibits a dynamic and evolving structure, characterized by increasing technological integration and a heightened focus on proactive diabetes management. Market concentration varies across segments, with established players holding significant shares in the Test Strips segment, while the Glucometer Devices segment sees a more dynamic competitive landscape driven by innovation. Technological innovation is a primary driver, with advancements in connectivity, accuracy, and ease of use reshaping product offerings. Regulatory frameworks, such as those from the European Medicines Agency (EMA), play a crucial role in ensuring product safety and efficacy, influencing market entry and product development strategies.

- Market Concentration: Moderate to high concentration in Test Strips due to established manufacturing processes and high repeat purchase rates. Emerging opportunities in smart glucometers are fostering greater competition.

- Technological Innovation Drivers: Miniaturization of devices, improved sensor technology for enhanced accuracy, development of Bluetooth-enabled glucometers for seamless data syncing with healthcare apps, and integration with continuous glucose monitoring (CGM) systems.

- Regulatory Frameworks: Strict adherence to EU medical device regulations (MDR) and data privacy laws (GDPR) are paramount for market participants.

- Competitive Product Substitutes: While direct substitutes for BGM devices are limited, the rise of CGM technologies presents a competitive alternative for certain patient demographics seeking continuous data insights.

- End-User Demographics: An aging population, increasing prevalence of Type 1 and Type 2 diabetes, and growing health consciousness among individuals with prediabetes are key demographic factors shaping demand.

- M&A Trends: Consolidation is observed as larger companies acquire innovative startups to enhance their product portfolios and expand market reach. The volume of M&A deals is projected to remain steady, driven by the strategic importance of digital health integration.

Europe Blood Glucose Monitoring Market Growth Trends & Insights

The Europe Blood Glucose Monitoring market is poised for significant expansion driven by a confluence of demographic shifts, technological advancements, and evolving healthcare paradigms. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated XX Million Units by the end of the forecast period. This robust growth trajectory is underpinned by an increasing diabetes prevalence across the continent, coupled with a growing awareness among individuals about the importance of regular glucose monitoring for effective diabetes management. The adoption rates of both traditional and advanced BGM devices are steadily rising, fueled by improved accessibility and increasing reimbursement for diabetes care technologies.

Technological disruptions are a major catalyst for market evolution. The integration of Bluetooth connectivity in glucometers, enabling seamless data transfer to smartphones and cloud-based platforms, is transforming how patients and healthcare providers manage diabetes. This allows for better tracking of glycemic trends, personalized treatment adjustments, and improved patient engagement. Furthermore, advancements in sensor technology are leading to more accurate and reliable readings, enhancing user confidence and driving the shift towards digital health solutions. Consumer behavior is also adapting, with a growing preference for user-friendly, connected devices that offer convenience and actionable insights. The emphasis is shifting from mere measurement to proactive health management, where BGM data plays a pivotal role in lifestyle modifications and preventing long-term complications.

The parent market for diabetes care technology is experiencing sustained growth, and the BGM segment within it is a critical component. As the understanding of diabetes management deepens, the demand for accurate and accessible monitoring solutions will only intensify. The penetration of BGM devices is expected to climb further, particularly in countries with developing healthcare infrastructures and a rising middle class. The focus on preventative healthcare and early detection of diabetes is also contributing to market expansion. Moreover, the increasing availability of affordable BGM solutions, alongside premium, feature-rich devices, caters to a diverse range of consumer needs and purchasing capacities. The shift towards home-based healthcare solutions further bolsters the demand for BGM devices, empowering individuals to take greater control of their health from the comfort of their homes. This sustained growth is a testament to the indispensable role of blood glucose monitoring in the broader fight against diabetes.

Dominant Regions, Countries, or Segments in Europe Blood Glucose Monitoring Market

The Europe Blood Glucose Monitoring market is experiencing robust growth, with distinct regional and segmental dynamics shaping its trajectory. Among the component segments, Test Strips currently hold a dominant position, driven by the recurring need for these consumables for accurate glucose measurement. The estimated market share for test strips in 2025 is projected to be XX%, reflecting their indispensable role in the BGM ecosystem. This dominance is attributed to several factors, including the high prevalence of diabetes requiring frequent testing, the established manufacturing base for test strips, and the high replacement rate.

Germany emerges as a dominant country within the European BGM market, contributing an estimated XX% to the overall market revenue in 2025. This leadership is fueled by a strong healthcare infrastructure, high public awareness regarding diabetes management, favorable reimbursement policies for diabetes care products, and a significant aging population prone to developing diabetes. The country also boasts a high adoption rate of advanced BGM technologies, reflecting its commitment to innovation in healthcare.

Dominant Segment (Component): Test Strips

- Drivers: High diabetes prevalence, frequent testing requirements, established manufacturing capabilities, and high consumption rates.

- Market Share (2025 Estimate): XX%

- Growth Potential: Continued steady growth driven by the fundamental need for testing.

Dominant Country: Germany

- Drivers: Robust healthcare infrastructure, high public health awareness, favorable reimbursement policies, aging population, and strong adoption of advanced technologies.

- Market Share (2025 Estimate): XX%

- Growth Potential: Sustained growth due to demographic factors and ongoing investment in healthcare innovation.

The dominance of Test Strips is further solidified by the fact that glucometer devices, while crucial, represent a one-time or infrequent purchase for many users. However, the growth potential for Glucometer Devices is significant, especially with the increasing adoption of smart and connected glucometers. The Lancets segment, while smaller in market share, remains essential for the functioning of traditional BGM devices and is expected to witness stable growth. The interplay between these segments is critical, with innovations in glucometers often driving demand for compatible test strips. Economic policies supporting diabetes care and public health initiatives aimed at early detection and management also play a pivotal role in shaping the market landscape across different European nations.

Europe Blood Glucose Monitoring Market Product Landscape

The Europe Blood Glucose Monitoring market is characterized by a diverse and rapidly evolving product landscape, driven by a commitment to enhancing accuracy, usability, and patient empowerment. Innovations are focused on miniaturization, improved connectivity, and user-centric design. Smart glucometers featuring Bluetooth connectivity are gaining traction, enabling seamless data synchronization with mobile applications and electronic health records, thereby facilitating better diabetes management. These devices often incorporate advanced sensor technologies for faster and more precise readings.

Unique selling propositions revolve around factors like minimal blood sample requirements, pain-free lancing mechanisms, and intuitive user interfaces. Technological advancements are also leading to the development of multi-parameter testing devices and integration with wearable health trackers. The performance metrics of these devices are continuously improving, with a focus on reducing error margins and providing real-time feedback to users.

Key Drivers, Barriers & Challenges in Europe Blood Glucose Monitoring Market

The Europe Blood Glucose Monitoring market is propelled by several key drivers that fuel its expansion. The increasing global prevalence of diabetes, coupled with a growing awareness of its associated complications, is the primary force driving demand for BGM devices and consumables. Technological advancements, particularly in the development of connected and smart glucometers, are enhancing user experience and data management capabilities, making monitoring more convenient and effective. Favorable reimbursement policies in many European countries for diabetes care products and the growing emphasis on home-based healthcare further accelerate market growth.

- Key Drivers: Rising diabetes prevalence, technological innovation (connected devices), increasing health awareness, favorable reimbursement policies, and the shift towards home healthcare.

Conversely, the market faces significant barriers and challenges that warrant careful consideration. The high cost of advanced BGM devices and associated consumables can be a deterrent for some segments of the population, impacting market penetration. Stringent regulatory approval processes, although essential for product safety, can lead to longer product development cycles and increased costs. The competitive landscape, while fostering innovation, also presents challenges in terms of market share acquisition and maintaining profitability. Furthermore, issues related to data security and privacy of sensitive health information collected by connected devices need to be addressed effectively.

- Key Barriers & Challenges: High cost of advanced devices, stringent regulatory hurdles, intense competition, data security and privacy concerns, and potential supply chain disruptions.

Emerging Opportunities in Europe Blood Glucose Monitoring Market

Emerging opportunities within the Europe Blood Glucose Monitoring market are abundant, driven by evolving consumer preferences and technological integration. The growing demand for personalized healthcare solutions presents a significant avenue for growth, with an increasing interest in BGM devices that can offer tailored insights and recommendations based on individual glucose profiles. The expansion of telemedicine and remote patient monitoring services offers a substantial opportunity for connected glucometers that facilitate real-time data sharing between patients and healthcare providers, enhancing chronic disease management.

Untapped markets within specific demographic groups, such as individuals with gestational diabetes or those at high risk of developing Type 2 diabetes, represent a fertile ground for targeted product development and marketing strategies. Innovative applications, including integration with AI-powered diabetes management platforms and wearable biosensors, are poised to revolutionize how glucose levels are monitored and managed. Evolving consumer preferences are leaning towards non-invasive or minimally invasive monitoring techniques, driving research and development in this area.

Growth Accelerators in the Europe Blood Glucose Monitoring Market Industry

Several critical factors are acting as growth accelerators for the Europe Blood Glucose Monitoring industry, propelling its expansion and innovation. The continuous pursuit of technological breakthroughs is paramount, with advancements in sensor accuracy, miniaturization, and data analytics playing a crucial role. The development of smart glucometers equipped with Bluetooth and Wi-Fi connectivity, enabling seamless data integration with mobile apps and electronic health records, is a significant accelerator, fostering improved patient engagement and adherence to treatment plans.

Strategic partnerships between BGM manufacturers, technology companies, and healthcare providers are also a key driver, fostering a collaborative ecosystem that accelerates product development and market adoption. Furthermore, the increasing focus on preventative healthcare and the growing awareness among individuals about the importance of proactive diabetes management are creating a sustained demand for reliable and user-friendly BGM solutions. Market expansion strategies, including entry into emerging European markets and the development of cost-effective solutions, are further contributing to the industry's robust growth trajectory.

Key Players Shaping the Europe Blood Glucose Monitoring Market Market

- Agamatrix

- Roche Diabetes Care

- Abbott Diabetes Care

- Medisana

- Trivida

- Acon

- Rossmax International

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia Diabetes Care

Notable Milestones in Europe Blood Glucose Monitoring Market Sector

- January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published improved glycemic control using a Bluetooth-connected blood glucose meter and a mobile diabetes app: Real-World Evidence from over 144,000 people with diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This highlights the growing importance of connected devices in diabetes management.

- January 2022: Roche launched its new point-of-care blood glucose monitor designed for hospital professionals, with a companion device shaped like a touchscreen smartphone that will run its own apps. The hand-held Cobas pulse includes an automated glucose test strip reader as well as a camera and touchscreen for logging other diagnostic results. It's designed to be used with patients of all ages, including neonates and people in intensive care. This innovation signifies a push towards integrated diagnostic solutions in clinical settings.

In-Depth Europe Blood Glucose Monitoring Market Market Outlook

The Europe Blood Glucose Monitoring market outlook is overwhelmingly positive, driven by sustained growth accelerators and significant future potential. The increasing prevalence of diabetes, coupled with a global shift towards preventative healthcare and personalized medicine, will continue to fuel the demand for advanced BGM solutions. The integration of artificial intelligence and machine learning into diabetes management platforms, powered by data from connected glucometers, promises to offer more predictive and proactive interventions. Strategic opportunities lie in expanding access to affordable yet accurate BGM devices in underserved European regions and further developing user-friendly, integrated digital health ecosystems. The continuous innovation in sensor technology and the pursuit of less invasive monitoring methods will undoubtedly shape the future landscape, making diabetes management more accessible and effective for millions.

Europe Blood Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Europe Blood Glucose Monitoring Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Rest of Europe

- 5. Russia

- 6. Spain

- 7. United Kingdom

Europe Blood Glucose Monitoring Market Regional Market Share

Geographic Coverage of Europe Blood Glucose Monitoring Market

Europe Blood Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Increasing Diabetes Prevalence is Driving the Europe self-monitoring Blood Glucose Devices Market in forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Rest of Europe

- 5.2.5. Russia

- 5.2.6. Spain

- 5.2.7. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. France Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Germany Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Italy Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of Europe Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Russia Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Spain Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Glucometer Devices

- 11.1.2. Test Strips

- 11.1.3. Lancets

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. United Kingdom Europe Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Component

- 12.1.1. Glucometer Devices

- 12.1.2. Test Strips

- 12.1.3. Lancets

- 12.1. Market Analysis, Insights and Forecast - by Component

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Agamatrix

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Roche Diabetes Care

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Abbott Diabetes Care

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Medisana

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Trivida

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Acon

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Rossmax International*List Not Exhaustive 7 2 Company Share Analysis

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bionime Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Arkray

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LifeScan

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Other Company Share Analyse

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Ascensia Diabetes Care

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Agamatrix

List of Figures

- Figure 1: Europe Blood Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Blood Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Europe Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Blood Glucose Monitoring Market?

The projected CAGR is approximately 6.38%.

2. Which companies are prominent players in the Europe Blood Glucose Monitoring Market?

Key companies in the market include Agamatrix, Roche Diabetes Care, Abbott Diabetes Care, Medisana, Trivida, Acon, Rossmax International*List Not Exhaustive 7 2 Company Share Analysis, Bionime Corporation, Arkray, LifeScan, Other Company Share Analyse, Ascensia Diabetes Care.

3. What are the main segments of the Europe Blood Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Increasing Diabetes Prevalence is Driving the Europe self-monitoring Blood Glucose Devices Market in forecast period.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published improved glycemic control using a Bluetooth-connected blood glucose meter and a mobile diabetes app: Real-World Evidence from over 144,000 people with diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes-one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Blood Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Blood Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Blood Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Europe Blood Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence