Key Insights

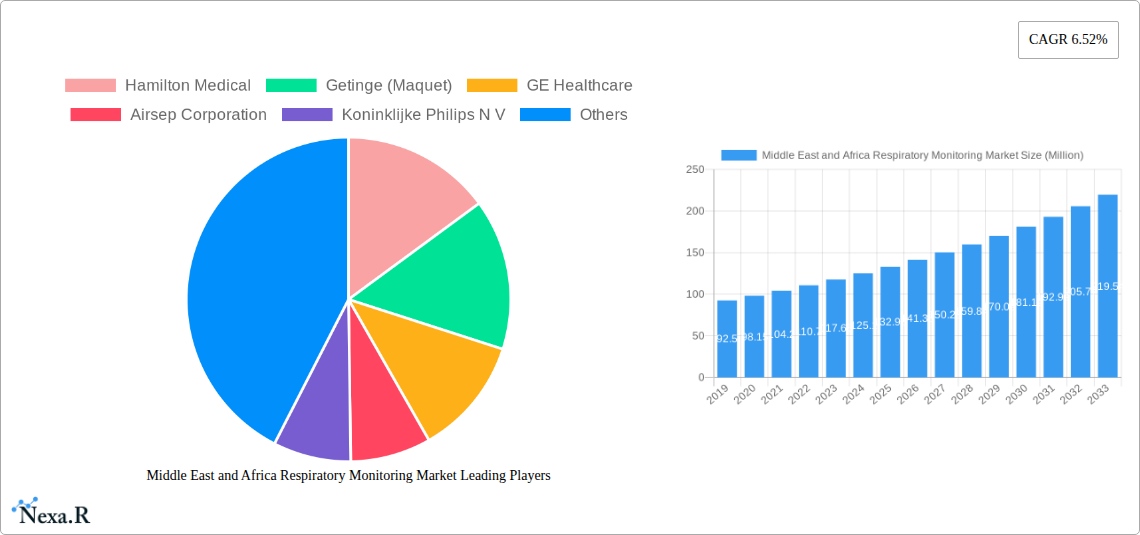

The Middle East and Africa (MEA) Respiratory Monitoring Market is poised for significant expansion, projected to reach an estimated USD 139.47 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.52%. This growth trajectory, expected to continue through 2033, is fueled by a confluence of escalating respiratory diseases, increasing healthcare infrastructure development across the region, and a growing awareness among both healthcare providers and patients regarding the critical role of accurate respiratory monitoring. The rising prevalence of conditions like asthma, COPD, and sleep apnea, exacerbated by factors such as air pollution, aging populations, and lifestyle changes, creates a sustained demand for advanced diagnostic and monitoring devices. Furthermore, government initiatives aimed at improving public health outcomes and the expanding healthcare spending in key MEA economies are providing a fertile ground for market players.

Middle East and Africa Respiratory Monitoring Market Market Size (In Million)

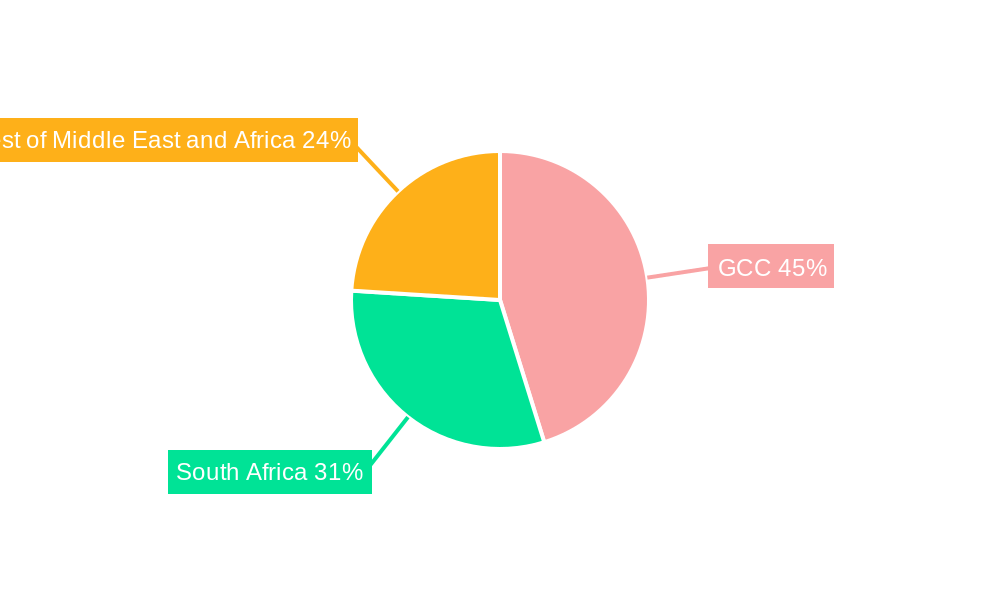

The market's expansion is also being shaped by the diversification of device types and the strategic importance of geographical segments. Spirometers and pulse oximeters are expected to remain dominant due to their widespread use in diagnosing and managing common respiratory ailments. The increasing demand for home healthcare and remote patient monitoring is driving the adoption of sleep test devices and portable gas analyzers. Geographically, the GCC countries, with their advanced healthcare systems and high disposable incomes, are leading the market, followed by South Africa and the rest of the Middle East and Africa, where burgeoning healthcare sectors and a growing patient pool present considerable untapped potential. Key market players are actively investing in research and development, expanding their product portfolios, and forging strategic partnerships to enhance their market penetration and cater to the evolving needs of this dynamic region.

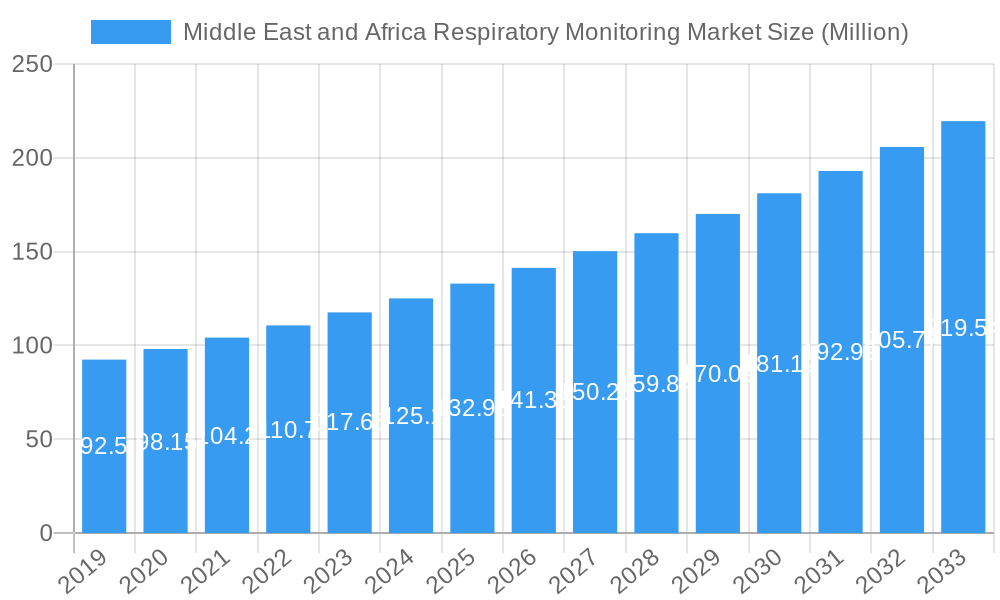

Middle East and Africa Respiratory Monitoring Market Company Market Share

This in-depth report provides a detailed analysis of the Middle East and Africa Respiratory Monitoring Market, encompassing a comprehensive review of its dynamics, growth trends, regional dominance, product landscape, and key players. With a study period from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights for stakeholders seeking to understand and capitalize on the evolving respiratory monitoring sector in this dynamic region.

Middle East and Africa Respiratory Monitoring Market Dynamics & Structure

The Middle East and Africa (MEA) respiratory monitoring market is characterized by a moderately concentrated landscape, with key players investing heavily in technological innovation to address the rising prevalence of respiratory diseases and the growing demand for advanced diagnostic and therapeutic solutions. Regulatory frameworks are evolving across the region, with increasing emphasis on patient safety and device efficacy, influencing product development and market entry strategies.

- Market Concentration: Dominated by a mix of global and regional manufacturers, the market sees significant contributions from established players like GE Healthcare and Philips, alongside agile local innovators.

- Technological Innovation Drivers: The primary drivers include the miniaturization of devices, integration of AI for data analysis, remote patient monitoring capabilities, and the development of non-invasive monitoring technologies for chronic respiratory conditions.

- Regulatory Frameworks: Varying across countries, regulations are gradually aligning with international standards, requiring robust clinical validation and quality management systems for market approval.

- Competitive Product Substitutes: While advanced respiratory monitors offer superior diagnostics, basic diagnostic tools and traditional clinical assessments still represent a degree of substitution, particularly in price-sensitive markets.

- End-User Demographics: The increasing burden of lifestyle-related respiratory illnesses like COPD and asthma, coupled with aging populations, fuels demand across both hospital and homecare settings.

- M&A Trends: Consolidation is anticipated to increase as larger players seek to expand their product portfolios and geographical reach, acquiring smaller, innovative companies to gain a competitive edge. An estimated 5-8 M&A deals are projected within the historical period, focusing on synergistic product lines.

Middle East and Africa Respiratory Monitoring Market Growth Trends & Insights

The MEA Respiratory Monitoring Market is projected to witness robust growth, driven by a confluence of increasing respiratory disease prevalence, expanding healthcare infrastructure, and heightened awareness regarding early diagnosis and management. The market size is estimated to reach approximately USD 1.5 Billion units by the end of the forecast period, with a Compound Annual Growth Rate (CAGR) of around 7.5% from 2025 to 2033. Technological advancements, particularly in non-invasive monitoring and AI-driven diagnostics, are significantly influencing adoption rates.

The growing number of chronic respiratory disease patients, including asthma, COPD, and cystic fibrosis, is a primary catalyst. Furthermore, the increasing incidence of respiratory infections, exacerbated by environmental factors and population density in urban centers, is propelling the demand for effective monitoring devices. The adoption of remote patient monitoring solutions is on an upward trajectory, facilitated by improved internet connectivity and the need for continuous patient oversight, especially in managing chronic conditions. This shift towards home-based care reduces the burden on healthcare facilities and empowers patients with greater control over their health.

Technological disruptions are revolutionizing the market. The development of portable, user-friendly spirometers, advanced sleep test devices capable of discreet home use, and sophisticated capnographs for real-time ventilation monitoring are enhancing diagnostic accuracy and patient comfort. Pulse oximeters are becoming more integrated into wearable technology, allowing for continuous and unobtrusive monitoring. Gas analyzers are evolving with increased sensitivity and portability for industrial and clinical applications. Consumer behavior is also shifting, with a greater emphasis on preventative healthcare and proactive health management. Individuals are increasingly seeking accessible diagnostic tools for early detection and self-monitoring, driving the demand for over-the-counter and home-use respiratory devices. The rising disposable income in key MEA economies is further supporting the uptake of advanced healthcare technologies.

Dominant Regions, Countries, or Segments in Middle East and Africa Respiratory Monitoring Market

The Middle East and Africa Respiratory Monitoring Market is witnessing significant growth across its diverse geographical and product segments. Within the geographical landscape, the GCC (Gulf Cooperation Council) region is emerging as a dominant force, driven by substantial healthcare investments, a high prevalence of lifestyle-related respiratory illnesses, and the rapid adoption of advanced medical technologies. Countries like Saudi Arabia, the UAE, and Qatar are at the forefront, with robust government initiatives to enhance healthcare infrastructure and accessibility.

- GCC Dominance: The GCC market is estimated to hold approximately 40% of the MEA respiratory monitoring market share by 2025. This dominance is fueled by a high per capita healthcare expenditure and a growing expatriate population susceptible to respiratory ailments.

- Key Drivers in GCC:

- Economic Policies: Favorable government policies promoting healthcare sector development and private sector participation.

- Infrastructure: Advanced hospital facilities and diagnostic centers equipped with cutting-edge technology.

- Awareness & Affluence: High public awareness and the financial capacity to invest in advanced diagnostic and therapeutic solutions.

- Lifestyle Diseases: Increasing prevalence of conditions like asthma and COPD linked to urban living and pollution.

- Key Drivers in GCC:

In terms of Type of Device, Pulse Oximeters are anticipated to exhibit the highest growth and market penetration, accounting for an estimated 25% of the total device segment by 2025. This is attributed to their versatility, portability, and increasing integration into various healthcare settings, from critical care units to home monitoring.

- Pulse Oximeter Growth Drivers:

- Versatility: Essential for monitoring oxygen saturation in patients with various respiratory and cardiovascular conditions.

- Portability & Affordability: Enabling widespread use in hospitals, clinics, and homecare settings.

- Technological Advancements: Integration into wearable devices and continuous monitoring solutions.

- Pandemic Impact: Heightened demand and awareness during global health crises.

While the GCC leads, South Africa represents a significant and growing market, driven by its comparatively developed healthcare system and a substantial burden of respiratory diseases. The Rest of Middle East and Africa region, though fragmented, presents vast untapped potential, particularly with improving healthcare access and the increasing focus on essential medical equipment. The adoption of Spirometers and Sleep Test Devices is also steadily growing across all MEA sub-regions, reflecting a broader commitment to diagnosing and managing respiratory health.

Middle East and Africa Respiratory Monitoring Market Product Landscape

The MEA Respiratory Monitoring Market is characterized by continuous product innovation aimed at enhancing diagnostic accuracy, patient comfort, and ease of use. Key advancements include the development of intelligent spirometers with cloud connectivity for seamless data management, highly sensitive gas analyzers for precise blood gas analysis, and compact, user-friendly sleep test devices enabling at-home diagnostics. Pulse oximeters are increasingly integrated into wearable technology, offering continuous, unobtrusive monitoring and early detection of vital sign abnormalities. Capnographs are becoming more sophisticated, providing real-time ventilation status for critical care patients. The focus is on portable, battery-operated devices, catering to diverse healthcare settings and the growing demand for homecare solutions across the region.

Key Drivers, Barriers & Challenges in Middle East and Africa Respiratory Monitoring Market

Key Drivers:

- Rising Prevalence of Respiratory Diseases: Increasing rates of asthma, COPD, and other respiratory ailments due to environmental pollution, lifestyle changes, and aging populations are the primary growth engines.

- Technological Advancements: Innovations in portable, connected, and AI-enabled monitoring devices are enhancing diagnostic capabilities and patient care.

- Expanding Healthcare Infrastructure: Government investments and private sector participation are leading to the establishment of advanced healthcare facilities and increased access to medical technology.

- Growing Awareness: Heightened awareness among patients and healthcare professionals about the importance of early diagnosis and continuous monitoring for respiratory conditions.

Barriers & Challenges:

- High Cost of Advanced Devices: The significant price tag of cutting-edge respiratory monitoring equipment can be a barrier to adoption in resource-limited settings.

- Limited Healthcare Access and Infrastructure: Uneven distribution of healthcare facilities and trained personnel, particularly in rural and remote areas of Africa.

- Regulatory Hurdles and Standardization: Complex and varying regulatory landscapes across different MEA countries can impede market entry and product approval.

- Reimbursement Policies: Inconsistent or underdeveloped reimbursement policies for respiratory monitoring devices can affect their uptake.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and timely delivery of essential respiratory monitoring equipment.

Emerging Opportunities in Middle East and Africa Respiratory Monitoring Market

Emerging opportunities lie in the development of more affordable and accessible respiratory monitoring solutions tailored for low-resource settings. The increasing demand for remote patient monitoring presents a significant avenue for growth, particularly for chronic disease management. Integration of artificial intelligence and machine learning for predictive diagnostics and personalized treatment plans holds immense potential. Furthermore, partnerships with local healthcare providers and governments can accelerate market penetration and foster the adoption of advanced respiratory monitoring technologies. The growing homecare market also offers a substantial opportunity for user-friendly, non-invasive devices.

Growth Accelerators in the Middle East and Africa Respiratory Monitoring Market Industry

Key growth accelerators for the MEA Respiratory Monitoring Market include strategic collaborations between global manufacturers and local distributors to enhance market reach and after-sales support. The increasing focus on telehealth and digital health initiatives by regional governments is creating a conducive environment for connected respiratory monitoring devices. Furthermore, ongoing research and development leading to miniaturized, more accurate, and cost-effective devices will fuel adoption. The growing emphasis on preventative healthcare and wellness programs further bolsters the demand for diagnostic tools.

Key Players Shaping the Middle East and Africa Respiratory Monitoring Market Market

- Hamilton Medical

- Getinge (Maquet)

- GE Healthcare

- Airsep Corporation

- Koninklijke Philips N V

- Medtronic PLC

- Resmed Inc

- Siemens Healthineers AG

- Dräger

Notable Milestones in Middle East and Africa Respiratory Monitoring Market Sector

- July 2022: SmileTrain, in partnership with Lifebox, launched the Lifebox-Smile Train pulse oximeter to improve access to pulse oximetry for anesthesia and critical care in African countries.

- May 2022: Masimo Corporation launched a health watch functioning as a pulse oximeter, expanding its availability outside the United States to several countries, including Europe and the MEA.

In-Depth Middle East and Africa Respiratory Monitoring Market Market Outlook

The future outlook for the MEA Respiratory Monitoring Market is exceptionally promising, driven by sustained demand for advanced diagnostic and monitoring solutions. Growth accelerators, including technological breakthroughs in AI and IoT integration, coupled with strategic market expansion initiatives and robust partnerships, are poised to fuel significant market expansion. The increasing healthcare expenditure and a growing emphasis on preventative care across the region create a fertile ground for innovative products. Stakeholders can anticipate a dynamic market landscape with substantial opportunities for investment and growth, particularly in the realm of remote patient monitoring and personalized respiratory care solutions.

Middle East and Africa Respiratory Monitoring Market Segmentation

-

1. Type of Device

- 1.1. Spirometers

- 1.2. Peak Flow Meters

- 1.3. Sleep Test Devices

- 1.4. Gas Analyzers

- 1.5. Pulse Oximeters

- 1.6. Capnographs

- 1.7. Other Types of Devices

-

2. Geography

- 2.1. GCC

- 2.2. South Africa

- 2.3. Rest of Middle East and Africa

Middle East and Africa Respiratory Monitoring Market Segmentation By Geography

- 1. GCC

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East and Africa Respiratory Monitoring Market Regional Market Share

Geographic Coverage of Middle East and Africa Respiratory Monitoring Market

Middle East and Africa Respiratory Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Number of Chronic Obstructive Pulmonary Disease Patients (COPD)

- 3.2.2 Asthma

- 3.2.3 TB

- 3.2.4 etc.; Urbanization and Growing Pollution Levels; Development of Advanced Technologies

- 3.3. Market Restrains

- 3.3.1. Reimbursement Concerns

- 3.4. Market Trends

- 3.4.1. Pulse Oximeter Expected to Witness Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Respiratory Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Spirometers

- 5.1.2. Peak Flow Meters

- 5.1.3. Sleep Test Devices

- 5.1.4. Gas Analyzers

- 5.1.5. Pulse Oximeters

- 5.1.6. Capnographs

- 5.1.7. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. GCC

- 5.2.2. South Africa

- 5.2.3. Rest of Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. GCC

- 5.3.2. South Africa

- 5.3.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. GCC Middle East and Africa Respiratory Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Spirometers

- 6.1.2. Peak Flow Meters

- 6.1.3. Sleep Test Devices

- 6.1.4. Gas Analyzers

- 6.1.5. Pulse Oximeters

- 6.1.6. Capnographs

- 6.1.7. Other Types of Devices

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. GCC

- 6.2.2. South Africa

- 6.2.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South Africa Middle East and Africa Respiratory Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Spirometers

- 7.1.2. Peak Flow Meters

- 7.1.3. Sleep Test Devices

- 7.1.4. Gas Analyzers

- 7.1.5. Pulse Oximeters

- 7.1.6. Capnographs

- 7.1.7. Other Types of Devices

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. GCC

- 7.2.2. South Africa

- 7.2.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Rest of Middle East and Africa Middle East and Africa Respiratory Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Spirometers

- 8.1.2. Peak Flow Meters

- 8.1.3. Sleep Test Devices

- 8.1.4. Gas Analyzers

- 8.1.5. Pulse Oximeters

- 8.1.6. Capnographs

- 8.1.7. Other Types of Devices

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. GCC

- 8.2.2. South Africa

- 8.2.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Hamilton Medical

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Getinge (Maquet)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GE Healthcare

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Airsep Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Koninklijke Philips N V

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Medtronic PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Resmed Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Healthineers AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Dräger

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Hamilton Medical

List of Figures

- Figure 1: Middle East and Africa Respiratory Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Respiratory Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 8: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 9: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 14: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 15: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 20: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 21: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Respiratory Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Respiratory Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Respiratory Monitoring Market?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the Middle East and Africa Respiratory Monitoring Market?

Key companies in the market include Hamilton Medical, Getinge (Maquet), GE Healthcare, Airsep Corporation, Koninklijke Philips N V, Medtronic PLC, Resmed Inc, Siemens Healthineers AG, Dräger.

3. What are the main segments of the Middle East and Africa Respiratory Monitoring Market?

The market segments include Type of Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Chronic Obstructive Pulmonary Disease Patients (COPD). Asthma. TB. etc.; Urbanization and Growing Pollution Levels; Development of Advanced Technologies.

6. What are the notable trends driving market growth?

Pulse Oximeter Expected to Witness Strong Growth.

7. Are there any restraints impacting market growth?

Reimbursement Concerns.

8. Can you provide examples of recent developments in the market?

In July 2022, SmileTrain, a non-profit organization, launched the Lifebox-Smile Train pulse oximeter with its partner Lifebox to scale access to pulse oximetry for anesthesia and critical care in African countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Respiratory Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Respiratory Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Respiratory Monitoring Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Respiratory Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence