Key Insights

The global Multiplex Assays Market is projected for robust expansion, anticipated to reach $1.5 billion by 2033, driven by a CAGR of 7.8% from a base year of 2025. This growth reflects the increasing demand for advanced diagnostic and research tools. Key drivers include the rising prevalence of chronic diseases, the imperative for personalized medicine, and significant advancements in genomic and proteomic research. Pharmaceutical, biopharmaceutical companies, and contract research organizations (CROs) are primary end-users, leveraging multiplex assays for efficient drug discovery, clinical trials, and biomarker identification. The inherent advantage of detecting multiple analytes simultaneously enhances efficiency and cost-effectiveness, fostering widespread adoption.

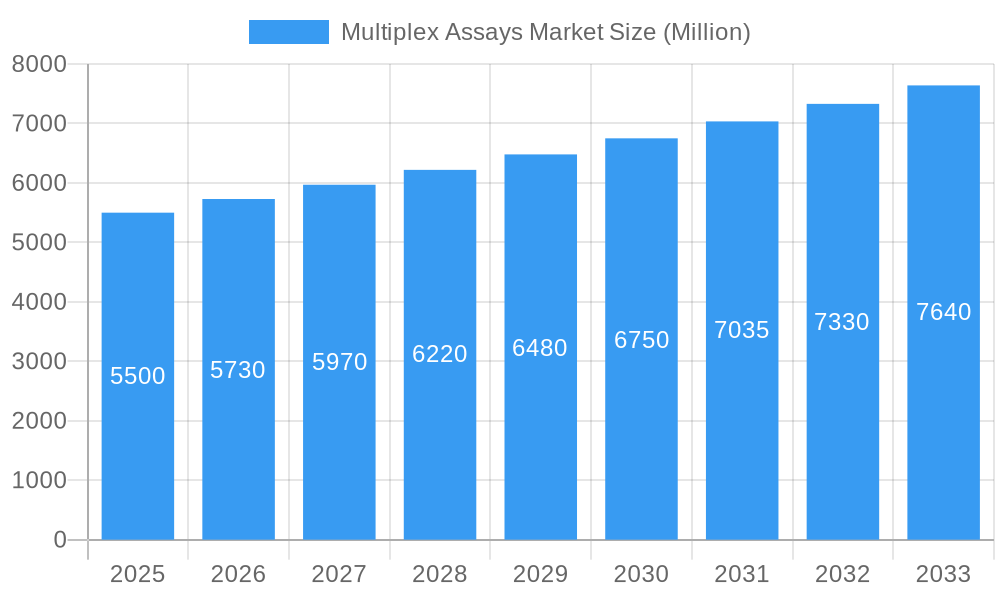

Multiplex Assays Market Market Size (In Billion)

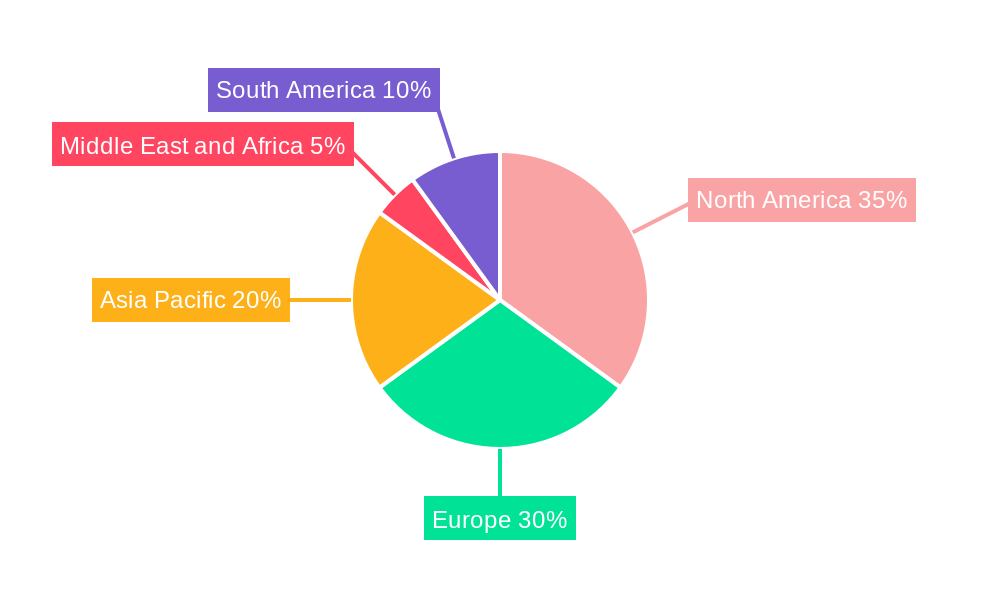

The market is segmented by type (Cell-Based, Protein, Nucleic Acid Assays), technology (Multiplex Real-Time PCR, Flow Cytometry, others), and end-user. North America and Europe currently lead due to established healthcare infrastructure and substantial R&D investment. However, the Asia Pacific region, particularly China and India, is a high-growth area, spurred by increasing healthcare expenditure and a burgeoning biopharmaceutical industry. While high initial costs for advanced platforms and the need for specialized expertise present challenges, ongoing technological innovation, strategic collaborations (e.g., Thermo Fisher Scientific, Luminex Corporation, Bio-Rad Laboratories), and expanding applications in infectious disease surveillance and cancer research are expected to propel market growth.

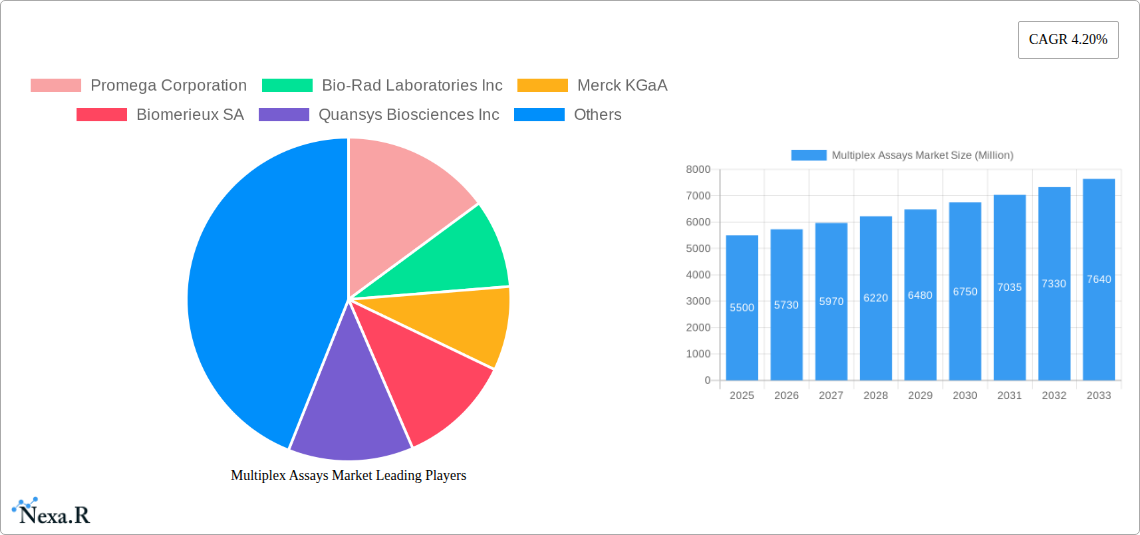

Multiplex Assays Market Company Market Share

Global Multiplex Assays Market Analysis: Size, Growth, and Forecast (2025-2033)

This comprehensive report provides an in-depth analysis of the global Multiplex Assays Market, a critical and rapidly evolving sector within life sciences and healthcare. Spanning the forecast period 2025-2033, with a base year of 2025, this study offers actionable insights into market dynamics, growth trends, key regions, product segments, and leading players. Optimized for search engines using keywords such as "multiplex PCR," "flow cytometry assays," "protein biomarker detection," "nucleic acid testing," and "cell-based assays," the report meticulously examines parent and child market segments for a granular understanding. All monetary values are presented in billions.

Multiplex Assays Market Market Dynamics & Structure

The Multiplex Assays Market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demands. Market concentration is moderate, with established players and emerging innovators vying for market share through continuous product development and strategic collaborations. Technological innovation drivers are primarily focused on increasing assay sensitivity, specificity, and throughput, alongside the development of user-friendly platforms for both research and clinical applications. Regulatory frameworks, such as those governed by the FDA and EMA, play a pivotal role in shaping market entry and product approval, emphasizing accuracy, safety, and efficacy. Competitive product substitutes, while present, are often outpaced by the inherent advantages of multiplexing in terms of efficiency and cost-effectiveness for complex biological analyses. End-user demographics are diverse, ranging from academic research institutions to pharmaceutical giants and diagnostic laboratories, each with unique requirements and adoption rates for multiplex assay technologies. Mergers and acquisitions (M&A) trends are notable as companies seek to expand their product portfolios, gain access to new markets, and consolidate their competitive positions. For instance, the historical period saw significant M&A activity aimed at acquiring novel multiplexing platforms or expanding into key application areas. The market exhibits a CAGR of approximately 12-15% from 2019-2033, with the base year 2025 estimated at $8,500 Million.

- Market Concentration: Moderate, with a blend of large, diversified corporations and specialized niche players.

- Technological Innovation Drivers: Enhanced sensitivity, multiplexing capacity, automation, miniaturization, and data analytics integration.

- Regulatory Frameworks: FDA, EMA, and other national regulatory bodies' guidelines for in vitro diagnostics (IVDs) and research reagents.

- Competitive Product Substitutes: Singleplex assays, traditional ELISA, and Western blotting, often outperformed in efficiency by multiplex solutions.

- End-User Demographics: Pharmaceutical & Biopharmaceutical Companies (35% market share), Contract Research Organizations (25%), Academic & Research Institutions (20%), Hospitals & Diagnostic Laboratories (15%), and Others (5%).

- M&A Trends: Strategic acquisitions to acquire advanced multiplexing technologies, expand into emerging markets, and bolster R&D capabilities. Notable deal volumes of $500-800 Million annually in the historical period.

Multiplex Assays Market Growth Trends & Insights

The global Multiplex Assays Market is poised for substantial growth, driven by escalating demand for advanced diagnostic tools, personalized medicine initiatives, and groundbreaking research in areas like oncology, infectious diseases, and drug discovery. The market size is projected to expand from an estimated $8,500 Million in 2025 to over $15,000 Million by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. Adoption rates for multiplex assays are accelerating across various end-user segments due to their ability to analyze multiple analytes simultaneously, significantly reducing sample volume requirements, time, and cost compared to traditional single-analyte methods. Technological disruptions, including advancements in microfluidics, digital PCR, and next-generation sequencing integration with multiplexing platforms, are further fueling market penetration. Consumer behavior shifts are increasingly favoring diagnostic solutions that offer comprehensive information from a single test, promoting earlier disease detection and more effective treatment strategies. The growing prevalence of chronic diseases and the rising investments in R&D for novel therapeutics are critical factors underpinning these positive growth trajectories. The integration of artificial intelligence and machine learning in analyzing complex multiplex assay data is also emerging as a significant trend, enhancing diagnostic accuracy and predictive capabilities, thus driving further adoption and market expansion.

Dominant Regions, Countries, or Segments in Multiplex Assays Market

North America, particularly the United States, currently holds a dominant position in the global Multiplex Assays Market, driven by its advanced healthcare infrastructure, substantial R&D investments by pharmaceutical and biotechnology companies, and a high prevalence of chronic diseases. The region's robust regulatory landscape, spearheaded by the Food and Drug Administration (FDA), fosters innovation while ensuring product safety and efficacy, thus accelerating the adoption of novel multiplex assay technologies. Within the parent market, Protein Multiplex Assays are emerging as a particularly strong segment, accounting for an estimated 40% of the market share in 2025, due to their critical role in biomarker discovery, drug development, and diagnostics for a wide range of diseases, including cancer and autoimmune disorders.

Technologically, Multiplex Real-Time PCR stands out as a key growth driver, representing approximately 35% of the technology segment in 2025. Its unparalleled sensitivity and specificity in detecting nucleic acids make it indispensable for infectious disease diagnostics, genetic testing, and gene expression analysis. The widespread application of multiplex PCR in areas like respiratory panel testing and COVID-19 diagnostics has further solidified its market dominance.

Among end-users, Pharmaceutical and Biopharmaceutical Companies are the largest contributors to the Multiplex Assays Market, commanding an estimated 38% market share in 2025. Their extensive use of multiplex assays in drug discovery, preclinical and clinical trials, and companion diagnostics significantly fuels market demand. The ability of these assays to screen large compound libraries, identify potential drug targets, and monitor treatment efficacy efficiently makes them invaluable tools in the drug development pipeline.

- Dominant Region: North America (USA leading)

- Key Drivers: High R&D spending, advanced healthcare infrastructure, strong regulatory support (FDA), high prevalence of chronic diseases, and significant presence of leading pharmaceutical and biotech companies.

- Market Share: Approximately 40% of the global market in 2025.

- Dominant Segment (Type): Protein Multiplex Assays

- Key Drivers: Crucial role in biomarker discovery, drug development, personalized medicine, and diagnostics for cancer, autoimmune diseases, and neurological disorders.

- Market Share: Estimated 40% in 2025.

- Dominant Segment (Technology): Multiplex Real-Time PCR

- Key Drivers: High sensitivity and specificity for nucleic acid detection, broad applications in infectious disease diagnostics (including viral and bacterial panels), genetic testing, and gene expression analysis.

- Market Share: Estimated 35% in 2025.

- Dominant Segment (End-User): Pharmaceutical and Biopharmaceutical Companies

- Key Drivers: Extensive use in drug discovery, high-throughput screening, target validation, preclinical and clinical trial sample analysis, and companion diagnostics development.

- Market Share: Estimated 38% in 2025.

Multiplex Assays Market Product Landscape

The Multiplex Assays Market product landscape is defined by continuous innovation focused on expanding the range of detectable analytes, improving assay performance, and enhancing user experience. Companies are actively developing high-density arrays and microfluidic platforms that enable simultaneous detection of hundreds of proteins, nucleic acids, or small molecules from a single sample. Key product innovations include automated sample-to-result systems for clinical diagnostics, highly sensitive immunoassay kits for biomarker quantification, and integrated platforms for comprehensive genomic and proteomic analysis. Applications span a wide spectrum, from infectious disease surveillance and cancer profiling to drug efficacy monitoring and immune response assessment. Performance metrics such as limit of detection (LOD), dynamic range, and assay throughput are constantly being pushed forward. Unique selling propositions revolve around cost-effectiveness, speed, reduced sample consumption, and the ability to generate more comprehensive biological insights compared to traditional single-analyte methods.

Key Drivers, Barriers & Challenges in Multiplex Assays Market

Key Drivers:

- Technological Advancements: Innovations in assay design, detection technologies (e.g., digital PCR, advanced fluorescence), and automation are continuously enhancing multiplex assay capabilities.

- Growing Demand for Personalized Medicine: The need for tailored treatments based on individual genetic makeup and disease profiles fuels the demand for comprehensive molecular and protein diagnostics.

- Rising Incidence of Chronic Diseases: The increasing global burden of diseases like cancer, cardiovascular disorders, and autoimmune conditions necessitates more efficient and accurate diagnostic tools.

- Increased R&D Investments: Significant funding from government agencies and private sectors in life sciences research drives the adoption of advanced multiplexing technologies.

Barriers & Challenges:

- High Initial Investment Costs: The sophisticated instrumentation and reagents required for multiplex assays can represent a significant capital expenditure for smaller laboratories.

- Complex Data Analysis: Interpreting the vast amount of data generated by multiplex assays often requires specialized bioinformatic expertise and software.

- Regulatory Hurdles: Obtaining regulatory approval for new multiplex diagnostic assays can be a lengthy and complex process, particularly for novel applications.

- Standardization Issues: Ensuring consistency and comparability of results across different platforms and laboratories remains a challenge for widespread adoption in clinical settings.

- Supply Chain Disruptions: Reliance on specialized reagents and components can make the market vulnerable to global supply chain disruptions, impacting availability and cost. (Estimated impact of 5-10% on production timelines).

Emerging Opportunities in Multiplex Assays Market

Emerging opportunities in the Multiplex Assays Market are centered around the expansion into new diagnostic areas and the development of novel applications. The growing interest in liquid biopsies for non-invasive cancer detection presents a significant avenue for multiplex assay development, enabling the simultaneous analysis of multiple cancer-related biomarkers in blood or other bodily fluids. Furthermore, the burgeoning field of microbiome analysis, where the simultaneous detection of numerous microbial species and their metabolic byproducts is crucial, offers substantial growth potential. The increasing demand for point-of-care multiplex diagnostic solutions, particularly in resource-limited settings, also represents an untapped market. Innovations in integrating multiplex assays with wearable devices and telehealth platforms are also poised to revolutionize remote patient monitoring and diagnostics. The development of cost-effective, user-friendly multiplex kits for specific niche applications, such as allergy testing or foodborne pathogen detection, is another area ripe for exploration.

Growth Accelerators in the Multiplex Assays Market Industry

Several key catalysts are accelerating long-term growth in the Multiplex Assays Market. Technological breakthroughs, such as advancements in microfluidics for ultra-low sample volume analysis and the development of highly multiplexed biosensor platforms, are expanding the capabilities and accessibility of these assays. Strategic partnerships between reagent manufacturers, instrument providers, and diagnostic companies are crucial for streamlining product development and market penetration. For instance, collaborations focused on developing integrated sample-to-answer solutions are simplifying workflows for end-users. Furthermore, the increasing global focus on infectious disease surveillance and rapid outbreak response, as highlighted by recent pandemics, is a significant market expansion strategy for multiplex PCR and immunoassay technologies. The continued growth of the biotechnology and pharmaceutical sectors, with their sustained investment in drug discovery and development pipelines, provides a foundational demand for advanced multiplexing solutions. The increasing adoption of companion diagnostics, which require precise molecular profiling, also acts as a powerful growth accelerator.

Key Players Shaping the Multiplex Assays Market Market

- Promega Corporation

- Bio-Rad Laboratories Inc

- Merck KGaA

- Biomerieux SA

- Quansys Biosciences Inc

- Seegene Inc

- Abcam plc

- Qiagen

- Hologic Corporation

- Thermo Fisher Scientific

- Luminex Corporation

- Perkin Elmer Inc

Notable Milestones in Multiplex Assays Market Sector

- November 2022: Milan Italy-based Sentinel Diagnostics launched SentiNat 200, a fully automated sample-to-result system, and Stat-Nat SN200 Real-Time PCR assays for the quantitative detection of 10 viruses. This launch significantly advanced automated diagnostics for infectious diseases.

- May 2022: InDevR, Inc. launched a multiplex VaxArray Pneumococcal Assay kit for rapid and accurate assessment of pneumococcal vaccines at all stages of manufacturing, including multivalent drug products. This innovation enhanced vaccine quality control and development.

- May 2022: Vela Diagnostics launched PathoKey MP UTI ID and AMR PCR Test for research use only. This multiplex PCR-based test allows for the in vitro detection and differentiation of 14 pathogens that cause urinary tract infections (UTI), as well as 14 antimicrobial resistance (AMR) genes encoding resistance to 5 antibiotics. This milestone expanded diagnostic capabilities for complex infections.

In-Depth Multiplex Assays Market Market Outlook

The future outlook for the Multiplex Assays Market is exceptionally bright, fueled by persistent technological innovation and an ever-growing demand for more comprehensive and efficient diagnostic solutions. Growth accelerators such as the expanding applications in personalized medicine, liquid biopsy, and the microbiome field will continue to drive market expansion. Strategic partnerships and collaborations will be instrumental in bringing novel, integrated solutions to market, simplifying complex workflows for researchers and clinicians alike. The increasing emphasis on rapid and accurate infectious disease detection, underscored by global health priorities, will further propel the adoption of multiplex PCR and immunoassay platforms. As regulatory pathways become more defined for complex diagnostic tests, and as data analytics capabilities continue to mature, the market is set to witness unprecedented growth, solidifying multiplex assays as a cornerstone of modern diagnostics and biomedical research. The estimated market value of $8,500 Million in 2025 is projected to see substantial growth in the coming years.

Multiplex Assays Market Segmentation

-

1. Type

- 1.1. Cell-Based Multiplex Assays

- 1.2. Protein Multiplex Assays

- 1.3. Nucleic Acid Multiplex Assays

-

2. Technology

- 2.1. Multiplex Real-Time PCR

- 2.2. Flow Cytometry

- 2.3. Other Technologies

-

3. End-User

- 3.1. Pharmaceutical and Biopharmaceutical Companies

- 3.2. Contract Research Organizations

- 3.3. Others

Multiplex Assays Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Multiplex Assays Market Regional Market Share

Geographic Coverage of Multiplex Assays Market

Multiplex Assays Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Personalized-Precision Medicine; Increasing Burden of Chronic Diseases; Distinct Advantages of Multiplex Assays Over Singleplex Assays

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment Coupled with Cumbersome and Complexity of the Procedure; Regulatory Constraints

- 3.4. Market Trends

- 3.4.1. Multiplex Real-Time PCR Segment is Expected to Hold a Major Share in the Multiplex Assays Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cell-Based Multiplex Assays

- 5.1.2. Protein Multiplex Assays

- 5.1.3. Nucleic Acid Multiplex Assays

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Multiplex Real-Time PCR

- 5.2.2. Flow Cytometry

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Pharmaceutical and Biopharmaceutical Companies

- 5.3.2. Contract Research Organizations

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cell-Based Multiplex Assays

- 6.1.2. Protein Multiplex Assays

- 6.1.3. Nucleic Acid Multiplex Assays

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Multiplex Real-Time PCR

- 6.2.2. Flow Cytometry

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Pharmaceutical and Biopharmaceutical Companies

- 6.3.2. Contract Research Organizations

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cell-Based Multiplex Assays

- 7.1.2. Protein Multiplex Assays

- 7.1.3. Nucleic Acid Multiplex Assays

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Multiplex Real-Time PCR

- 7.2.2. Flow Cytometry

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Pharmaceutical and Biopharmaceutical Companies

- 7.3.2. Contract Research Organizations

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cell-Based Multiplex Assays

- 8.1.2. Protein Multiplex Assays

- 8.1.3. Nucleic Acid Multiplex Assays

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Multiplex Real-Time PCR

- 8.2.2. Flow Cytometry

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Pharmaceutical and Biopharmaceutical Companies

- 8.3.2. Contract Research Organizations

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cell-Based Multiplex Assays

- 9.1.2. Protein Multiplex Assays

- 9.1.3. Nucleic Acid Multiplex Assays

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Multiplex Real-Time PCR

- 9.2.2. Flow Cytometry

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Pharmaceutical and Biopharmaceutical Companies

- 9.3.2. Contract Research Organizations

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Multiplex Assays Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cell-Based Multiplex Assays

- 10.1.2. Protein Multiplex Assays

- 10.1.3. Nucleic Acid Multiplex Assays

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Multiplex Real-Time PCR

- 10.2.2. Flow Cytometry

- 10.2.3. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Pharmaceutical and Biopharmaceutical Companies

- 10.3.2. Contract Research Organizations

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Promega Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio-Rad Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biomerieux SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quansys Biosciences Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seegene Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abcam plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qiagen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hologic Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thermo Fisher Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Luminex Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Perkin Elmer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Promega Corporation

List of Figures

- Figure 1: Global Multiplex Assays Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Multiplex Assays Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Multiplex Assays Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Multiplex Assays Market Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America Multiplex Assays Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Multiplex Assays Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: North America Multiplex Assays Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Multiplex Assays Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Multiplex Assays Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Multiplex Assays Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Multiplex Assays Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Multiplex Assays Market Revenue (billion), by Technology 2025 & 2033

- Figure 13: Europe Multiplex Assays Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Multiplex Assays Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: Europe Multiplex Assays Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Multiplex Assays Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Multiplex Assays Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Multiplex Assays Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Multiplex Assays Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Multiplex Assays Market Revenue (billion), by Technology 2025 & 2033

- Figure 21: Asia Pacific Multiplex Assays Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Multiplex Assays Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: Asia Pacific Multiplex Assays Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Multiplex Assays Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Multiplex Assays Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Multiplex Assays Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Multiplex Assays Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Multiplex Assays Market Revenue (billion), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Multiplex Assays Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Multiplex Assays Market Revenue (billion), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Multiplex Assays Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Multiplex Assays Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Multiplex Assays Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Multiplex Assays Market Revenue (billion), by Type 2025 & 2033

- Figure 35: South America Multiplex Assays Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Multiplex Assays Market Revenue (billion), by Technology 2025 & 2033

- Figure 37: South America Multiplex Assays Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America Multiplex Assays Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: South America Multiplex Assays Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Multiplex Assays Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Multiplex Assays Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Multiplex Assays Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Global Multiplex Assays Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global Multiplex Assays Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 24: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 25: Global Multiplex Assays Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 35: Global Multiplex Assays Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Multiplex Assays Market Revenue billion Forecast, by Type 2020 & 2033

- Table 40: Global Multiplex Assays Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 41: Global Multiplex Assays Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 42: Global Multiplex Assays Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Multiplex Assays Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Multiplex Assays Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Multiplex Assays Market?

Key companies in the market include Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Biomerieux SA, Quansys Biosciences Inc, Seegene Inc, Abcam plc, Qiagen, Hologic Corporation, Thermo Fisher Scientific, Luminex Corporation, Perkin Elmer Inc.

3. What are the main segments of the Multiplex Assays Market?

The market segments include Type, Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Personalized-Precision Medicine; Increasing Burden of Chronic Diseases; Distinct Advantages of Multiplex Assays Over Singleplex Assays.

6. What are the notable trends driving market growth?

Multiplex Real-Time PCR Segment is Expected to Hold a Major Share in the Multiplex Assays Market.

7. Are there any restraints impacting market growth?

High Cost of Equipment Coupled with Cumbersome and Complexity of the Procedure; Regulatory Constraints.

8. Can you provide examples of recent developments in the market?

In November 2022, Milan Italy-based Sentinel Diagnostics launched SentiNat 200, a fully automated sample-to-result system, and Stat-Nat SN200 Real-Time PCR assays for the quantitative detection of 10 viruses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Multiplex Assays Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Multiplex Assays Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Multiplex Assays Market?

To stay informed about further developments, trends, and reports in the Multiplex Assays Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence