Key Insights

The North America agricultural equipment market, projected at $115.58 billion in 2025, is poised for significant expansion. This growth is propelled by advancements in precision agriculture, including GPS-guided machinery and automation, which boost efficiency and crop yields. The increasing emphasis on sustainable farming, such as reduced tillage and water conservation, is driving demand for specialized equipment like advanced irrigation systems and precision planters. Government support for agricultural modernization further bolsters market development. Key equipment segments include 4WD farm tractors, irrigation machinery, and harvesting machinery. Leading companies like Deere & Company, Kubota Corporation, and AGCO Corporation are actively innovating and expanding their market presence.

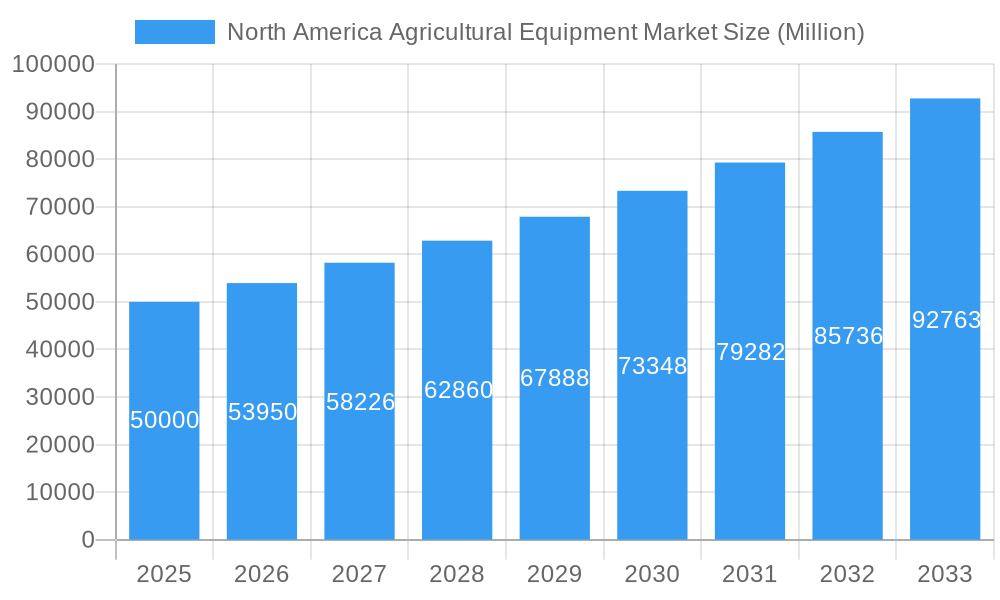

North America Agricultural Equipment Market Market Size (In Billion)

The market anticipates a compound annual growth rate (CAGR) of 4.1%, indicating substantial future potential through 2033. Challenges, such as the high initial investment for advanced technologies and the impact of commodity price volatility and weather patterns, may temper adoption. Nevertheless, sustained global food demand and the increasing integration of technology ensure a positive long-term outlook. The United States is expected to lead market growth due to its extensive agricultural sector, with Canada and Mexico also making significant contributions. Continuous evolution in farming practices and technologies will reshape the competitive landscape.

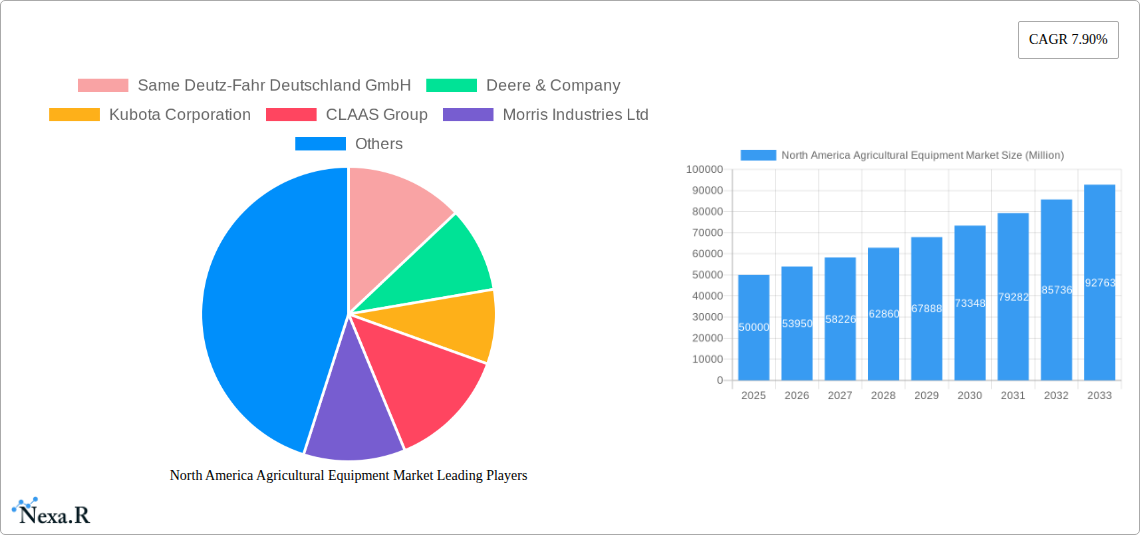

North America Agricultural Equipment Market Company Market Share

This report offers a comprehensive analysis of the North America agricultural equipment market for the 2019-2033 period. It examines market dynamics, growth drivers, key segments, and prominent players, providing critical insights for industry stakeholders. The analysis covers historical data (2019-2024), base year (2025), and projections (2025-2033). Market segmentation includes equipment types (4WD Farm Tractors, Irrigation Machinery, Harvesting Machinery, Haying and Forage Machinery, Other Types) and tractor types. Market values are presented in billion units.

North America Agricultural Equipment Market Dynamics & Structure

The North American agricultural equipment market is characterized by a moderately concentrated landscape, with key players like Deere & Company, AGCO Corporation, and CNH Industrial holding significant market share (estimated at xx%, xx%, and xx%, respectively, in 2025). Technological innovation, driven by factors like precision agriculture and automation, is a major growth driver. Stringent regulatory frameworks concerning emission standards and safety regulations impact the market, influencing equipment design and manufacturing processes. The market also faces competition from substitute products like drone technology for crop spraying and alternative irrigation systems. The end-user demographics are predominantly comprised of large-scale commercial farms, family farms, and agricultural cooperatives. M&A activity within the sector has been substantial in recent years, driven by strategic acquisitions aimed at expanding technological capabilities, geographic reach, and product portfolios. Between 2019 and 2024, an estimated xx M&A deals were recorded, predominantly focusing on technology integration and expansion into precision agriculture.

- Market Concentration: Moderately concentrated, dominated by a few large players.

- Technological Innovation: Precision agriculture, automation, and data analytics are key drivers.

- Regulatory Framework: Stringent emission and safety standards influencing equipment design.

- Competitive Substitutes: Drone technology, alternative irrigation systems.

- End-User Demographics: Large-scale commercial farms, family farms, and cooperatives.

- M&A Trends: Significant activity, driven by technology acquisition and market expansion.

North America Agricultural Equipment Market Growth Trends & Insights

The North American agricultural equipment market experienced substantial growth between 2019 and 2024, driven by factors such as increasing farm sizes, rising crop yields, and favorable government policies. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is expected to continue, albeit at a moderated pace, during the forecast period (2025-2033), reaching an estimated xx million units by 2033 and exhibiting a CAGR of xx%. This projected growth is attributed to ongoing technological advancements, precision farming adoption, and the increasing need for efficient and sustainable agricultural practices. Consumer behavior shifts towards precision agriculture and data-driven decision-making are further shaping market trends. The market penetration of automated equipment is projected to increase from xx% in 2025 to xx% by 2033, driven by the rising adoption of autonomous tractors and sprayers.

Dominant Regions, Countries, or Segments in North America Agricultural Equipment Market

The Midwestern United States remains the dominant region for agricultural equipment, driven by extensive arable land and high agricultural output. Within this region, states like Iowa, Illinois, and Nebraska account for a significant market share due to their high concentration of large-scale farms and robust agricultural infrastructure. The 4WD Farm Tractors segment dominates the overall market, followed by Harvesting Machinery and Irrigation Machinery. High demand for efficient and high-capacity tractors, along with increasing investment in modern harvesting technologies, are fueling the growth of these segments. Canada also holds a substantial market share, particularly in the western provinces known for their agricultural production.

- Key Drivers: Extensive arable land, high agricultural output, government support for agricultural modernization.

- Dominant Segments: 4WD Farm Tractors, Harvesting Machinery, Irrigation Machinery.

- Growth Potential: High in regions with significant agricultural activity and government support.

North America Agricultural Equipment Market Product Landscape

The agricultural equipment market showcases continuous innovation, with manufacturers introducing high-capacity, fuel-efficient, and technologically advanced machines. Precision farming technologies, such as GPS-guided tractors, automated sprayers, and yield monitoring systems, are gaining significant traction. These advancements offer improved operational efficiency, reduced input costs, and enhanced yield. The focus is increasingly shifting towards automation and autonomous systems to address labor shortages and optimize farming operations. Unique selling propositions include features like reduced fuel consumption, enhanced operator comfort, and improved precision in operations.

Key Drivers, Barriers & Challenges in North America Agricultural Equipment Market

Key Drivers:

- Technological advancements in precision agriculture and automation.

- Government subsidies and incentives promoting agricultural modernization.

- Increasing demand for high-capacity and efficient machinery.

Challenges and Restraints:

- High initial investment costs for advanced equipment.

- Supply chain disruptions impacting equipment availability and prices (estimated xx% increase in costs due to supply chain issues in 2022).

- Fluctuations in commodity prices affecting farmers' investment capacity.

- Regulatory compliance and emission standards.

Emerging Opportunities in North America Agricultural Equipment Market

- Growing adoption of data analytics and precision farming technologies.

- Increasing demand for sustainable and eco-friendly agricultural equipment.

- Expansion into niche segments, such as specialized equipment for horticulture and viticulture.

- Development of autonomous and robotic agricultural systems.

Growth Accelerators in the North America Agricultural Equipment Market Industry

Technological breakthroughs in automation, precision farming, and data analytics are driving long-term market growth. Strategic partnerships between equipment manufacturers and technology providers are fostering innovation and accelerating the adoption of new technologies. Expansion into emerging markets, including specialized segments and international markets, holds significant potential for growth.

Key Players Shaping the North America Agricultural Equipment Market Market

- Same Deutz-Fahr Deutschland GmbH

- Deere & Company

- Kubota Corporation

- CLAAS Group

- Morris Industries Ltd

- AGCO Corporation

- CNH Industrial NV

- Kverneland Group

- Vaderstad Industries Inc

- Netafim Irrigation Inc

Notable Milestones in North America Agricultural Equipment Sector

- August 2021: John Deere introduced the new 6155MH Tractor.

- April 2022: Deere & Company and GUSS Automation formed a joint venture.

- May 2022: AGCO acquired JCA Industries.

- October 2022: Kubota Canada Ltd opened new headquarters.

- November 2022: Kubota Canada Ltd unveiled the M7-4 diesel tractor.

- December 2022: CNH Industrial added new Automation and Autonomy Solutions.

In-Depth North America Agricultural Equipment Market Outlook

The North American agricultural equipment market is poised for sustained growth over the forecast period. Technological advancements, particularly in automation and precision agriculture, will continue to drive market expansion. Strategic partnerships, investments in R&D, and the increasing adoption of sustainable farming practices will further fuel market growth. Opportunities exist in developing advanced automation systems, expanding into niche markets, and focusing on providing comprehensive solutions to enhance farm productivity and efficiency. The market's future trajectory is strongly tied to technological innovation and its ability to address the evolving needs of a technologically-driven agricultural landscape.

North America Agricultural Equipment Market Segmentation

-

1. Type

-

1.1. Tractor

- 1.1.1. Less than 40 HP

- 1.1.2. 40 to 100 HP

- 1.1.3. Above 100 HP

- 1.1.4. 4 WD Farm Tractors

-

1.2. Equipment

- 1.2.1. Plows

- 1.2.2. Harrows

- 1.2.3. Cultivators and Tillers

- 1.2.4. Other Equipment

-

1.3. Irrigation Machinery

- 1.3.1. Sprinkler Irrigation

- 1.3.2. Drip Irrigation

- 1.3.3. Other Irrigation Machinery

-

1.4. Harvesting Machinery

- 1.4.1. Combine Harvesters

- 1.4.2. Forage Harvesters

- 1.4.3. Other Harvesting Machinery

-

1.5. Haying and Forage Machinery

- 1.5.1. Mowers

- 1.5.2. Balers

- 1.5.3. Other Haying and Forage Machinery

- 1.6. Other Types

-

1.1. Tractor

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Type

-

3.1. Tractor

- 3.1.1. Less than 40 HP

- 3.1.2. 40 to 100 HP

- 3.1.3. Above 100 HP

- 3.1.4. 4 WD Farm Tractors

-

3.2. Equipment

- 3.2.1. Plows

- 3.2.2. Harrows

- 3.2.3. Cultivators and Tillers

- 3.2.4. Other Equipment

-

3.3. Irrigation Machinery

- 3.3.1. Sprinkler Irrigation

- 3.3.2. Drip Irrigation

- 3.3.3. Other Irrigation Machinery

-

3.4. Harvesting Machinery

- 3.4.1. Combine Harvesters

- 3.4.2. Forage Harvesters

- 3.4.3. Other Harvesting Machinery

-

3.5. Haying and Forage Machinery

- 3.5.1. Mowers

- 3.5.2. Balers

- 3.5.3. Other Haying and Forage Machinery

- 3.6. Other Types

-

3.1. Tractor

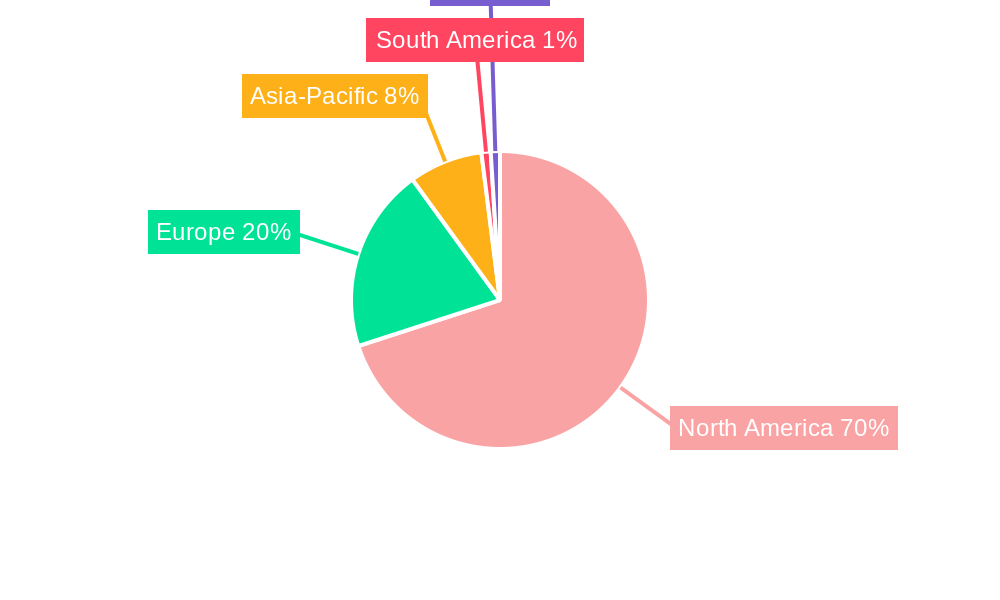

North America Agricultural Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Agricultural Equipment Market Regional Market Share

Geographic Coverage of North America Agricultural Equipment Market

North America Agricultural Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. High Adoption of and Innovations in Farm Machinery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tractor

- 5.1.1.1. Less than 40 HP

- 5.1.1.2. 40 to 100 HP

- 5.1.1.3. Above 100 HP

- 5.1.1.4. 4 WD Farm Tractors

- 5.1.2. Equipment

- 5.1.2.1. Plows

- 5.1.2.2. Harrows

- 5.1.2.3. Cultivators and Tillers

- 5.1.2.4. Other Equipment

- 5.1.3. Irrigation Machinery

- 5.1.3.1. Sprinkler Irrigation

- 5.1.3.2. Drip Irrigation

- 5.1.3.3. Other Irrigation Machinery

- 5.1.4. Harvesting Machinery

- 5.1.4.1. Combine Harvesters

- 5.1.4.2. Forage Harvesters

- 5.1.4.3. Other Harvesting Machinery

- 5.1.5. Haying and Forage Machinery

- 5.1.5.1. Mowers

- 5.1.5.2. Balers

- 5.1.5.3. Other Haying and Forage Machinery

- 5.1.6. Other Types

- 5.1.1. Tractor

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Tractor

- 5.3.1.1. Less than 40 HP

- 5.3.1.2. 40 to 100 HP

- 5.3.1.3. Above 100 HP

- 5.3.1.4. 4 WD Farm Tractors

- 5.3.2. Equipment

- 5.3.2.1. Plows

- 5.3.2.2. Harrows

- 5.3.2.3. Cultivators and Tillers

- 5.3.2.4. Other Equipment

- 5.3.3. Irrigation Machinery

- 5.3.3.1. Sprinkler Irrigation

- 5.3.3.2. Drip Irrigation

- 5.3.3.3. Other Irrigation Machinery

- 5.3.4. Harvesting Machinery

- 5.3.4.1. Combine Harvesters

- 5.3.4.2. Forage Harvesters

- 5.3.4.3. Other Harvesting Machinery

- 5.3.5. Haying and Forage Machinery

- 5.3.5.1. Mowers

- 5.3.5.2. Balers

- 5.3.5.3. Other Haying and Forage Machinery

- 5.3.6. Other Types

- 5.3.1. Tractor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Agricultural Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tractor

- 6.1.1.1. Less than 40 HP

- 6.1.1.2. 40 to 100 HP

- 6.1.1.3. Above 100 HP

- 6.1.1.4. 4 WD Farm Tractors

- 6.1.2. Equipment

- 6.1.2.1. Plows

- 6.1.2.2. Harrows

- 6.1.2.3. Cultivators and Tillers

- 6.1.2.4. Other Equipment

- 6.1.3. Irrigation Machinery

- 6.1.3.1. Sprinkler Irrigation

- 6.1.3.2. Drip Irrigation

- 6.1.3.3. Other Irrigation Machinery

- 6.1.4. Harvesting Machinery

- 6.1.4.1. Combine Harvesters

- 6.1.4.2. Forage Harvesters

- 6.1.4.3. Other Harvesting Machinery

- 6.1.5. Haying and Forage Machinery

- 6.1.5.1. Mowers

- 6.1.5.2. Balers

- 6.1.5.3. Other Haying and Forage Machinery

- 6.1.6. Other Types

- 6.1.1. Tractor

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Tractor

- 6.3.1.1. Less than 40 HP

- 6.3.1.2. 40 to 100 HP

- 6.3.1.3. Above 100 HP

- 6.3.1.4. 4 WD Farm Tractors

- 6.3.2. Equipment

- 6.3.2.1. Plows

- 6.3.2.2. Harrows

- 6.3.2.3. Cultivators and Tillers

- 6.3.2.4. Other Equipment

- 6.3.3. Irrigation Machinery

- 6.3.3.1. Sprinkler Irrigation

- 6.3.3.2. Drip Irrigation

- 6.3.3.3. Other Irrigation Machinery

- 6.3.4. Harvesting Machinery

- 6.3.4.1. Combine Harvesters

- 6.3.4.2. Forage Harvesters

- 6.3.4.3. Other Harvesting Machinery

- 6.3.5. Haying and Forage Machinery

- 6.3.5.1. Mowers

- 6.3.5.2. Balers

- 6.3.5.3. Other Haying and Forage Machinery

- 6.3.6. Other Types

- 6.3.1. Tractor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Agricultural Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tractor

- 7.1.1.1. Less than 40 HP

- 7.1.1.2. 40 to 100 HP

- 7.1.1.3. Above 100 HP

- 7.1.1.4. 4 WD Farm Tractors

- 7.1.2. Equipment

- 7.1.2.1. Plows

- 7.1.2.2. Harrows

- 7.1.2.3. Cultivators and Tillers

- 7.1.2.4. Other Equipment

- 7.1.3. Irrigation Machinery

- 7.1.3.1. Sprinkler Irrigation

- 7.1.3.2. Drip Irrigation

- 7.1.3.3. Other Irrigation Machinery

- 7.1.4. Harvesting Machinery

- 7.1.4.1. Combine Harvesters

- 7.1.4.2. Forage Harvesters

- 7.1.4.3. Other Harvesting Machinery

- 7.1.5. Haying and Forage Machinery

- 7.1.5.1. Mowers

- 7.1.5.2. Balers

- 7.1.5.3. Other Haying and Forage Machinery

- 7.1.6. Other Types

- 7.1.1. Tractor

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Tractor

- 7.3.1.1. Less than 40 HP

- 7.3.1.2. 40 to 100 HP

- 7.3.1.3. Above 100 HP

- 7.3.1.4. 4 WD Farm Tractors

- 7.3.2. Equipment

- 7.3.2.1. Plows

- 7.3.2.2. Harrows

- 7.3.2.3. Cultivators and Tillers

- 7.3.2.4. Other Equipment

- 7.3.3. Irrigation Machinery

- 7.3.3.1. Sprinkler Irrigation

- 7.3.3.2. Drip Irrigation

- 7.3.3.3. Other Irrigation Machinery

- 7.3.4. Harvesting Machinery

- 7.3.4.1. Combine Harvesters

- 7.3.4.2. Forage Harvesters

- 7.3.4.3. Other Harvesting Machinery

- 7.3.5. Haying and Forage Machinery

- 7.3.5.1. Mowers

- 7.3.5.2. Balers

- 7.3.5.3. Other Haying and Forage Machinery

- 7.3.6. Other Types

- 7.3.1. Tractor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Agricultural Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tractor

- 8.1.1.1. Less than 40 HP

- 8.1.1.2. 40 to 100 HP

- 8.1.1.3. Above 100 HP

- 8.1.1.4. 4 WD Farm Tractors

- 8.1.2. Equipment

- 8.1.2.1. Plows

- 8.1.2.2. Harrows

- 8.1.2.3. Cultivators and Tillers

- 8.1.2.4. Other Equipment

- 8.1.3. Irrigation Machinery

- 8.1.3.1. Sprinkler Irrigation

- 8.1.3.2. Drip Irrigation

- 8.1.3.3. Other Irrigation Machinery

- 8.1.4. Harvesting Machinery

- 8.1.4.1. Combine Harvesters

- 8.1.4.2. Forage Harvesters

- 8.1.4.3. Other Harvesting Machinery

- 8.1.5. Haying and Forage Machinery

- 8.1.5.1. Mowers

- 8.1.5.2. Balers

- 8.1.5.3. Other Haying and Forage Machinery

- 8.1.6. Other Types

- 8.1.1. Tractor

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Tractor

- 8.3.1.1. Less than 40 HP

- 8.3.1.2. 40 to 100 HP

- 8.3.1.3. Above 100 HP

- 8.3.1.4. 4 WD Farm Tractors

- 8.3.2. Equipment

- 8.3.2.1. Plows

- 8.3.2.2. Harrows

- 8.3.2.3. Cultivators and Tillers

- 8.3.2.4. Other Equipment

- 8.3.3. Irrigation Machinery

- 8.3.3.1. Sprinkler Irrigation

- 8.3.3.2. Drip Irrigation

- 8.3.3.3. Other Irrigation Machinery

- 8.3.4. Harvesting Machinery

- 8.3.4.1. Combine Harvesters

- 8.3.4.2. Forage Harvesters

- 8.3.4.3. Other Harvesting Machinery

- 8.3.5. Haying and Forage Machinery

- 8.3.5.1. Mowers

- 8.3.5.2. Balers

- 8.3.5.3. Other Haying and Forage Machinery

- 8.3.6. Other Types

- 8.3.1. Tractor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Agricultural Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tractor

- 9.1.1.1. Less than 40 HP

- 9.1.1.2. 40 to 100 HP

- 9.1.1.3. Above 100 HP

- 9.1.1.4. 4 WD Farm Tractors

- 9.1.2. Equipment

- 9.1.2.1. Plows

- 9.1.2.2. Harrows

- 9.1.2.3. Cultivators and Tillers

- 9.1.2.4. Other Equipment

- 9.1.3. Irrigation Machinery

- 9.1.3.1. Sprinkler Irrigation

- 9.1.3.2. Drip Irrigation

- 9.1.3.3. Other Irrigation Machinery

- 9.1.4. Harvesting Machinery

- 9.1.4.1. Combine Harvesters

- 9.1.4.2. Forage Harvesters

- 9.1.4.3. Other Harvesting Machinery

- 9.1.5. Haying and Forage Machinery

- 9.1.5.1. Mowers

- 9.1.5.2. Balers

- 9.1.5.3. Other Haying and Forage Machinery

- 9.1.6. Other Types

- 9.1.1. Tractor

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Tractor

- 9.3.1.1. Less than 40 HP

- 9.3.1.2. 40 to 100 HP

- 9.3.1.3. Above 100 HP

- 9.3.1.4. 4 WD Farm Tractors

- 9.3.2. Equipment

- 9.3.2.1. Plows

- 9.3.2.2. Harrows

- 9.3.2.3. Cultivators and Tillers

- 9.3.2.4. Other Equipment

- 9.3.3. Irrigation Machinery

- 9.3.3.1. Sprinkler Irrigation

- 9.3.3.2. Drip Irrigation

- 9.3.3.3. Other Irrigation Machinery

- 9.3.4. Harvesting Machinery

- 9.3.4.1. Combine Harvesters

- 9.3.4.2. Forage Harvesters

- 9.3.4.3. Other Harvesting Machinery

- 9.3.5. Haying and Forage Machinery

- 9.3.5.1. Mowers

- 9.3.5.2. Balers

- 9.3.5.3. Other Haying and Forage Machinery

- 9.3.6. Other Types

- 9.3.1. Tractor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Same Deutz-Fahr Deutschland GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Deere & Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kubota Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CLAAS Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Morris Industries Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 AGCO Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 CNH Industrial NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kverneland Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vaderstad Industries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Netafim Irrigation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Same Deutz-Fahr Deutschland GmbH

List of Figures

- Figure 1: North America Agricultural Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Agricultural Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: North America Agricultural Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Agricultural Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 7: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Agricultural Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Agricultural Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 11: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Agricultural Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Agricultural Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: North America Agricultural Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Agricultural Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 19: North America Agricultural Equipment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: North America Agricultural Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Equipment Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the North America Agricultural Equipment Market?

Key companies in the market include Same Deutz-Fahr Deutschland GmbH, Deere & Company, Kubota Corporation, CLAAS Group, Morris Industries Ltd, AGCO Corporation, CNH Industrial NV, Kverneland Group, Vaderstad Industries Inc, Netafim Irrigation Inc.

3. What are the main segments of the North America Agricultural Equipment Market?

The market segments include Type, Geography, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 115.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

High Adoption of and Innovations in Farm Machinery.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

December 2022: CNH Industrial added new Automation and Autonomy Solutions to the Ag Tech portfolio in Phoenix, Arizona, and the USA. These New Driverless Tillage and Driver Assist Harvest solutions from Raven, and Baler Automation from Case IH and New Holland, can deliver automation and autonomous equipment enhancements and help solve farmers' most significant challenges to increasing productivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Equipment Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence