Key Insights

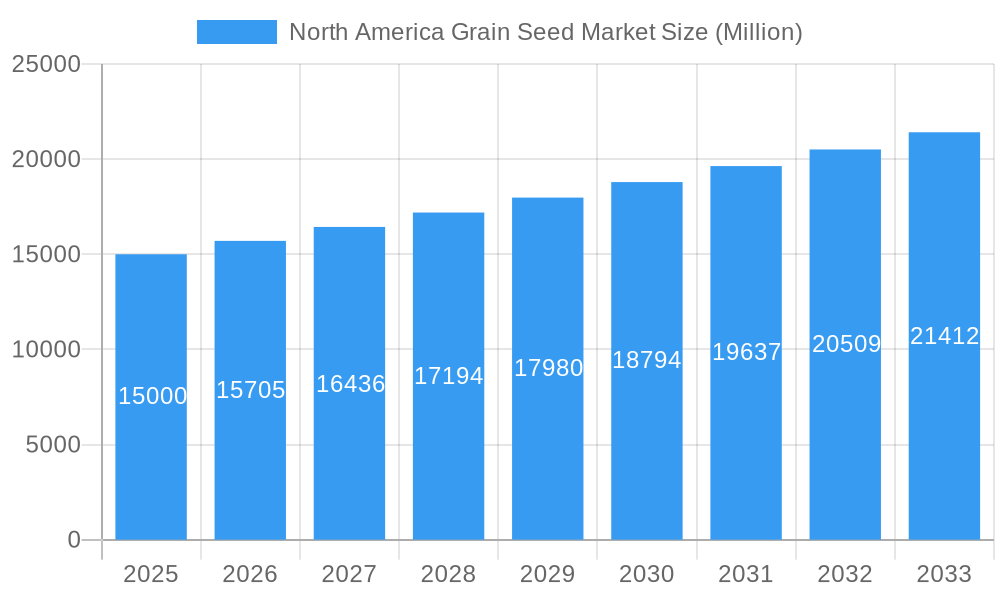

The North American grain seed market, encompassing corn, rice, sorghum, wheat, and other cereals, is poised for robust expansion. Driven by escalating food and feed demand, alongside the widespread adoption of advanced breeding technologies such as hybrids, the market is projected to grow. The market size is estimated at $43.24 billion, with a compound annual growth rate (CAGR) of 5.3% from the base year 2025 to 2033. Key growth catalysts include a rising global population, increasing per capita grain consumption, and the growing demand for biofuels, all stimulating agricultural production. Furthermore, significant advancements in seed breeding and genetics are yielding high-performance, disease-resistant, and climate-resilient grain varieties, further propelling market expansion. Hybrid seeds are a dominant segment, reflecting a clear preference for enhanced crop yields and predictability. Geographically, the United States leads the market, followed by Canada and Mexico, owing to extensive agricultural land and established grain production infrastructure.

North America Grain Seed Market Market Size (In Billion)

The competitive landscape features prominent players like Land O’Lakes Inc., Bayer AG, and Syngenta Group, who are actively engaged in research and development, strategic collaborations, and market expansion initiatives. However, market growth is subject to challenges such as fluctuating commodity prices, evolving government regulations, and potential climate change impacts. The increasing emphasis on sustainable agricultural practices and the integration of precision agriculture technologies are expected to positively shape the market's trajectory.

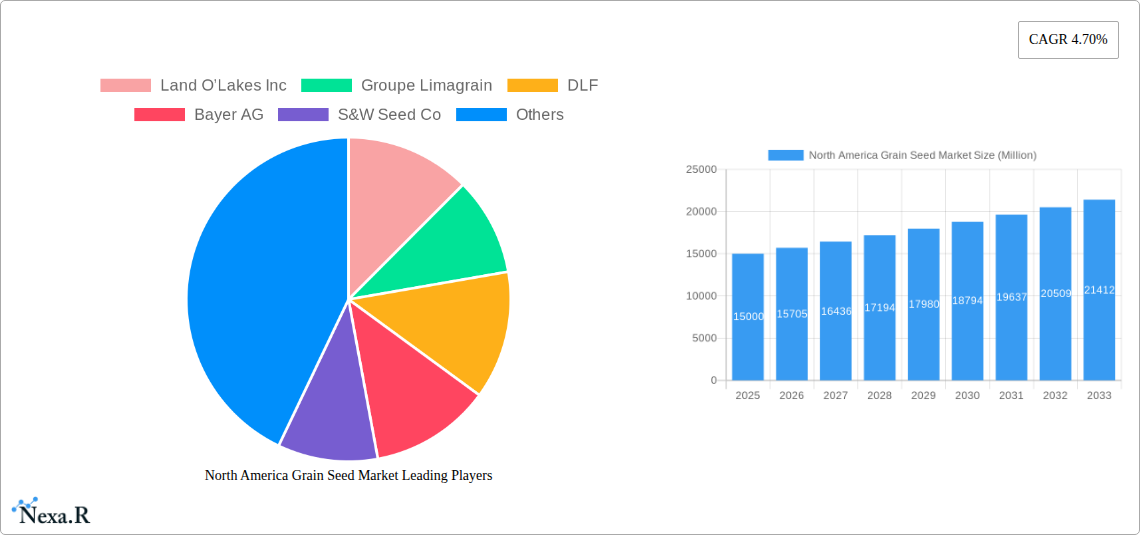

North America Grain Seed Market Company Market Share

Despite the positive outlook, several restraints influence market dynamics. Agricultural commodity price volatility can impact farmer purchasing decisions. Stringent government regulations governing seed production and distribution may also affect market expansion. Moreover, the potential adverse effects of climate change, including extreme weather events and water scarcity, pose challenges to grain production and seed demand. Nevertheless, ongoing innovation in seed breeding and the increasing adoption of precision farming techniques are anticipated to mitigate these challenges. Open-pollinated varieties, while holding a smaller market share, are expected to maintain their niche due to consumer demand for organically produced grains and a focus on biodiversity. The continued development and adoption of drought-tolerant and pest-resistant varieties are critical for the long-term sustainability and growth of the North American grain seed market.

North America Grain Seed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America grain seed market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by crop (Corn, Rice, Sorghum, Wheat, Other Grains & Cereals), traits (Other Traits, Open Pollinated Varieties & Hybrid Derivatives), breeding technology (Hybrids), and country (United States, Canada, Mexico, Rest of North America). The market size is valued in Million units.

North America Grain Seed Market Dynamics & Structure

The North America grain seed market is characterized by a moderately concentrated landscape with several multinational corporations and regional players dominating the market. Market share distribution amongst the top players is estimated at xx%. Technological innovation, particularly in gene editing and hybrid seed development, is a key driver, while regulatory frameworks concerning genetically modified organisms (GMOs) significantly influence market dynamics. Competitive product substitutes, such as organic seeds, are gaining traction, while end-user demographics (primarily large-scale commercial farms) shape demand patterns. The past five years have seen xx M&A deals, reflecting consolidation efforts within the sector.

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share.

- Technological Innovation: Gene editing, hybrid development, and precision breeding are key drivers.

- Regulatory Framework: GMO regulations influence market access and adoption rates.

- Competitive Substitutes: Organic and conventional seed alternatives exert competitive pressure.

- End-User Demographics: Large-scale commercial farms dominate the market.

- M&A Activity: xx M&A deals in the past five years, indicating industry consolidation.

North America Grain Seed Market Growth Trends & Insights

The North America grain seed market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by factors such as increasing demand for high-yielding seeds, technological advancements, and favorable government policies supporting agricultural innovation. Market penetration of hybrid seeds is approximately xx%, expected to rise to xx% by 2033. Technological disruptions, including the adoption of precision agriculture and gene-editing technologies, are significantly shaping market growth. Consumer behavior shifts towards sustainable and climate-resilient agriculture are influencing seed selection, driving demand for improved varieties. The market size is projected to reach xx million units by 2025 and xx million units by 2033.

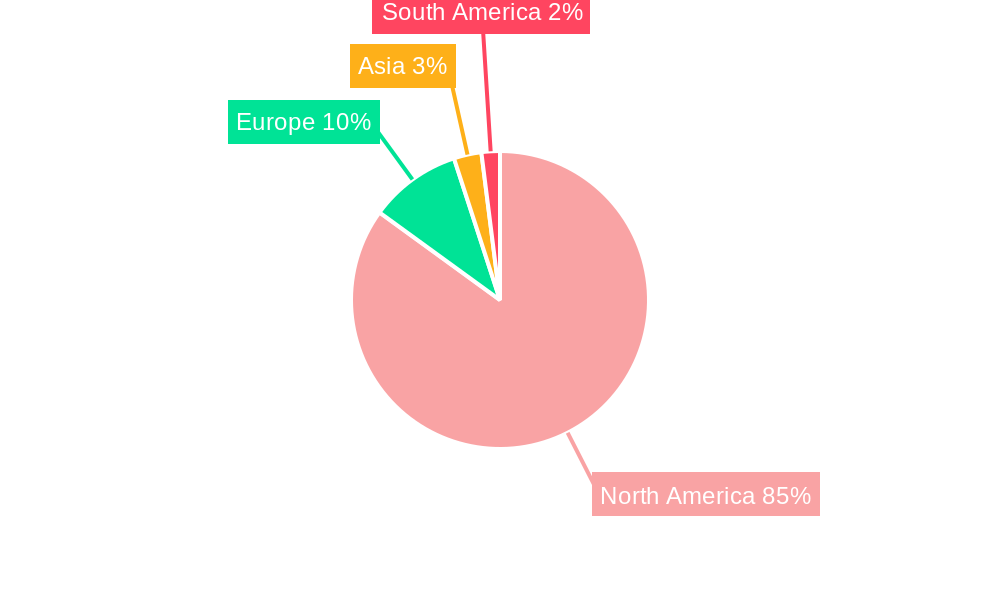

Dominant Regions, Countries, or Segments in North America Grain Seed Market

The United States dominates the North America grain seed market, accounting for approximately xx% of the total market share in 2025, driven by its large-scale agricultural production and extensive adoption of advanced technologies. Corn is the leading crop segment, followed by wheat and soybeans. The Hybrid breeding technology segment holds the largest market share.

- United States: Largest market share due to extensive agricultural production and technological adoption.

- Corn: Leading crop segment driven by high demand and extensive acreage.

- Hybrids: Dominant breeding technology owing to superior yield and disease resistance.

- Key Growth Drivers: Government support for agricultural innovation, favorable climate conditions (in specific regions), and increasing demand for high-yielding crops.

North America Grain Seed Market Product Landscape

The North American grain seed market showcases a diverse product landscape, featuring high-yielding hybrid varieties, GMO seeds engineered for pest resistance and herbicide tolerance, and open-pollinated varieties catering to specific niche markets. Product innovations focus on enhancing yield potential, improving stress tolerance (drought, disease), and incorporating desirable traits like improved nutritional content. Key performance metrics include germination rates, yield per acre, and disease resistance levels. Unique selling propositions often center around superior genetics, advanced trait combinations, and robust technical support offered by seed companies.

Key Drivers, Barriers & Challenges in North America Grain Seed Market

Key Drivers:

- Technological advancements in seed breeding and genetic modification.

- Rising demand for high-yielding and climate-resilient crops.

- Government support for agricultural research and development.

Key Challenges & Restraints:

- Regulatory hurdles related to GMO approvals and labeling.

- Supply chain disruptions impacting seed availability and pricing.

- Intense competition among seed companies, leading to price pressures.

- Climate change impacts on crop yields and seed production.

Emerging Opportunities in North America Grain Seed Market

- Growing demand for organic and non-GMO seeds.

- Expansion of precision agriculture techniques improving seed usage efficiency.

- Development of seeds tailored to specific regional climates and soil conditions.

- Increased focus on enhancing nutritional value in grains.

Growth Accelerators in the North America Grain Seed Market Industry

Long-term growth in the North America grain seed market is fueled by continued technological innovation, strategic partnerships between seed companies and agricultural technology providers, and expansion into new markets, particularly those with emerging agricultural sectors. Strategic collaborations and acquisitions will accelerate market growth.

Key Players Shaping the North America Grain Seed Market Market

Notable Milestones in North America Grain Seed Market Sector

- March 2023: Corteva Agriscience introduced gene-editing technology for enhanced corn hybrid disease resistance.

- March 2023: Pioneer Seeds (Corteva Agriscience) launched 44 new corn hybrid varieties with Vorceed Enlist technology for corn rootworm management.

- March 2023: Corteva Agriscience released Vorceed Enlist corn products, anticipated to become a leading triple-stack offering.

In-Depth North America Grain Seed Market Market Outlook

The North America grain seed market exhibits significant growth potential driven by increasing global food demand, the need for climate-resilient agriculture, and ongoing advancements in seed technology. Strategic investments in research and development, coupled with effective marketing and distribution strategies, will be crucial for companies to capture market share and achieve sustained growth. The market presents opportunities for both established players and new entrants to innovate and expand their market presence.

North America Grain Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Insect Resistant Hybrids

- 1.1.4. Other Traits

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Crop

- 2.1. Corn

- 2.2. Rice

- 2.3. Sorghum

- 2.4. Wheat

- 2.5. Other Grains & Cereals

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.1.2. Herbicide Tolerant Hybrids

- 3.1.3. Insect Resistant Hybrids

- 3.1.4. Other Traits

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. Crop

- 4.1. Corn

- 4.2. Rice

- 4.3. Sorghum

- 4.4. Wheat

- 4.5. Other Grains & Cereals

North America Grain Seed Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Grain Seed Market Regional Market Share

Geographic Coverage of North America Grain Seed Market

North America Grain Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Grain Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Insect Resistant Hybrids

- 5.1.1.4. Other Traits

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Crop

- 5.2.1. Corn

- 5.2.2. Rice

- 5.2.3. Sorghum

- 5.2.4. Wheat

- 5.2.5. Other Grains & Cereals

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.1.2. Herbicide Tolerant Hybrids

- 5.3.1.3. Insect Resistant Hybrids

- 5.3.1.4. Other Traits

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by Crop

- 5.4.1. Corn

- 5.4.2. Rice

- 5.4.3. Sorghum

- 5.4.4. Wheat

- 5.4.5. Other Grains & Cereals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Land O’Lakes Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe Limagrain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DLF

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 S&W Seed Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KWS SAAT SE & Co KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanta Seeds - UPL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Syngenta Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Land O’Lakes Inc

List of Figures

- Figure 1: North America Grain Seed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Grain Seed Market Share (%) by Company 2025

List of Tables

- Table 1: North America Grain Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 2: North America Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 3: North America Grain Seed Market Revenue billion Forecast, by Crop 2020 & 2033

- Table 4: North America Grain Seed Market Volume Kiloton Forecast, by Crop 2020 & 2033

- Table 5: North America Grain Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 6: North America Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 7: North America Grain Seed Market Revenue billion Forecast, by Crop 2020 & 2033

- Table 8: North America Grain Seed Market Volume Kiloton Forecast, by Crop 2020 & 2033

- Table 9: North America Grain Seed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Grain Seed Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 11: North America Grain Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 12: North America Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 13: North America Grain Seed Market Revenue billion Forecast, by Crop 2020 & 2033

- Table 14: North America Grain Seed Market Volume Kiloton Forecast, by Crop 2020 & 2033

- Table 15: North America Grain Seed Market Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 16: North America Grain Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 17: North America Grain Seed Market Revenue billion Forecast, by Crop 2020 & 2033

- Table 18: North America Grain Seed Market Volume Kiloton Forecast, by Crop 2020 & 2033

- Table 19: North America Grain Seed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Grain Seed Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 21: United States North America Grain Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United States North America Grain Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Grain Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Grain Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Grain Seed Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Grain Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Grain Seed Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the North America Grain Seed Market?

Key companies in the market include Land O’Lakes Inc, Groupe Limagrain, DLF, Bayer AG, S&W Seed Co, KWS SAAT SE & Co KGaA, Advanta Seeds - UPL, Syngenta Grou, Corteva Agriscience, BASF SE.

3. What are the main segments of the North America Grain Seed Market?

The market segments include Breeding Technology, Crop, Breeding Technology, Crop.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.24 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, which helps in providing resistance to multiple diseases.March 2023: Pioneer Seeds, a subsidiary of Corteva Agriscience, launched 44 new corn seed hybrid varieties with new Vorceed Enlist corn technology to help manage corn rootworms.March 2023: Corteva Agriscience released the Vorceed Enlist corn products to selected farmers in 2023, and it is anticipated to become the leading triple-stack offering from Corteva in high corn rootworm areas in the later part of the decade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Grain Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Grain Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Grain Seed Market?

To stay informed about further developments, trends, and reports in the North America Grain Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence