Key Insights

The Russian laundry appliance market, valued at approximately $11.12 billion in the base year 2025, is projected to experience substantial growth with a Compound Annual Growth Rate (CAGR) of 1.0%. Key growth drivers include rising disposable incomes, particularly in urban areas, fostering demand for advanced and premium appliances. A growing consumer preference for convenience and time-saving solutions is accelerating the adoption of automatic washing machines and dryers. The expansion of e-commerce further enhances market accessibility, offering a wider array of products and brands. Challenges such as economic volatility and currency fluctuations may impact consumer spending and import costs. The market is segmented, with freestanding washing machines leading in demand due to price sensitivity, while built-in models show strong growth potential in higher-income segments. Prominent brands such as LG, Samsung, Bosch, and Electrolux maintain strong market positions through brand recognition, innovation, and effective distribution. Regional disparities exist, with Western Russia showing higher adoption of premium appliances and Eastern Russia demonstrating demand for more affordable options.

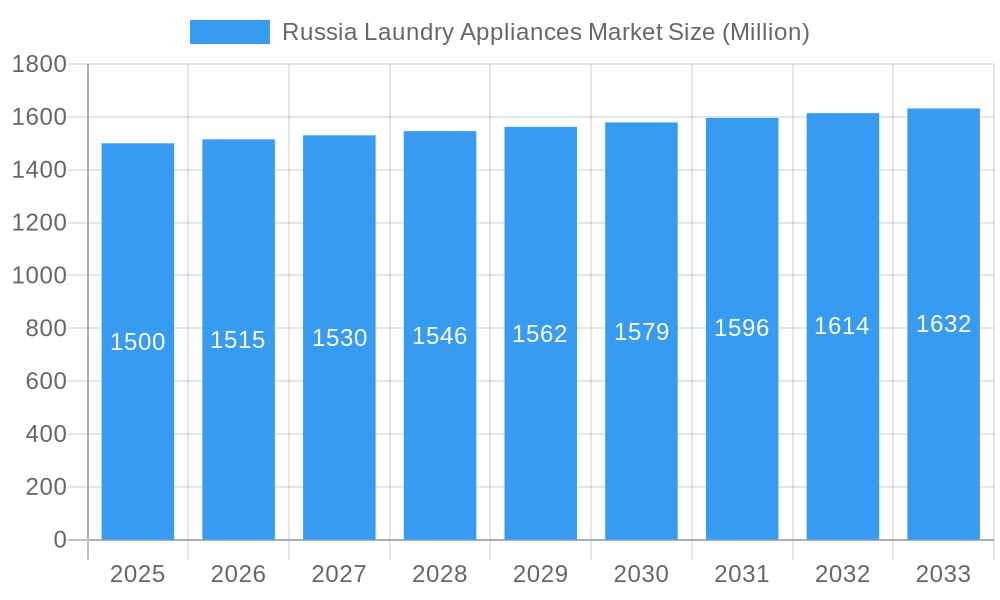

Russia Laundry Appliances Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, supported by infrastructure development and increasing urbanization. Product innovation, emphasizing energy efficiency and smart features, will be a critical differentiator. The proliferation of e-commerce and omnichannel retail strategies will deepen market penetration. Intense competition is expected, with leading players focusing on product diversification and regional customization. Despite potential economic challenges, the Russian laundry appliance market is poised for positive growth, driven by persistent consumer demand for efficient and convenient laundry solutions.

Russia Laundry Appliances Market Company Market Share

Russia Laundry Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia laundry appliances market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The report segments the market by type (freestanding, built-in), product (washing machines, dryers, electric smoothing irons, other products), technology (automatic, semi-automatic/manual, other technologies), and distribution channel (multi-brand stores, exclusive stores, online, other channels). Key players analyzed include LG, Candy, Atlant, Indesit, Hotpoint, Electrolux, Haier, Beko, Gorenje, Bosch, and Samsung (list not exhaustive). This report is invaluable for industry professionals, investors, and market strategists seeking to understand the dynamics and future potential of this evolving market.

Russia Laundry Appliances Market Dynamics & Structure

The Russia laundry appliances market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Technological innovation, primarily focusing on energy efficiency and smart features, is a key driver. However, regulatory frameworks and import tariffs influence market access and pricing. Competitive pressures stem from both domestic and international brands offering substitute products. The end-user demographic skews towards urban households with rising disposable incomes. Recent M&A activity, though not directly within the laundry appliances sector itself, reflects broader industry trends in technological integration.

- Market Concentration: xx% held by top 5 players in 2025.

- Technological Innovation: Focus on energy-efficient motors, smart connectivity, and improved washing performance.

- Regulatory Framework: Import duties and safety standards impact market access and pricing.

- Competitive Substitutes: Limited, with primary competition coming from other appliance brands.

- End-User Demographics: Primarily urban households with increasing disposable incomes.

- M&A Trends: Limited direct M&A activity within the laundry appliances sector in Russia, but broader industry trends point toward consolidation and technological integration. (e.g., The LG Electronics acquisition of AppleMango, while not directly impacting the laundry sector, showcases a trend toward technology integration relevant to the appliance industry).

Russia Laundry Appliances Market Growth Trends & Insights

The Russia laundry appliances market is projected to experience steady growth over the forecast period. Driven by factors such as rising disposable incomes, urbanization, and increasing preference for modern appliances, the market size is estimated at xx million units in 2025, with a projected CAGR of xx% from 2025 to 2033. Adoption rates for automatic washing machines are increasing, while the semi-automatic segment remains significant. Technological disruptions, particularly in the areas of smart home integration and energy-efficient technologies, are driving market innovation and consumer demand. Changes in consumer behavior, such as increased awareness of sustainability and convenience, influence purchase decisions.

Dominant Regions, Countries, or Segments in Russia Laundry Appliances Market

The Moscow and St. Petersburg regions represent the most significant segments of the Russia laundry appliances market, driven by high population density, higher disposable incomes, and well-developed infrastructure. Within product segments, washing machines dominate, followed by dryers and electric smoothing irons. The automatic washing machine technology segment exhibits the highest growth potential due to consumer preference for convenience and efficiency. Multi-brand stores are the dominant distribution channel, offering wide reach and consumer choice.

- Key Drivers: Urbanization, rising disposable incomes, and improved retail infrastructure in major cities.

- Dominance Factors: High population density, increased consumer spending, and established retail networks in major urban centers.

- Market Share & Growth Potential: Moscow and St. Petersburg combined hold xx% of the market share in 2025, projected to grow to xx% by 2033. The automatic washing machine segment holds the largest market share with the highest growth rate.

Russia Laundry Appliances Market Product Landscape

The Russia laundry appliances market offers a diverse range of products, with a focus on energy-efficient models and increasing incorporation of smart features such as app-based controls and remote diagnostics. Manufacturers are emphasizing features such as larger capacities, faster wash cycles, and improved drying performance. Unique selling propositions frequently highlight energy savings, ease of use, and technological advancements.

Key Drivers, Barriers & Challenges in Russia Laundry Appliances Market

Key Drivers: Rising disposable incomes, increased urbanization, improved retail infrastructure, and growing awareness of convenience and energy efficiency are key drivers. Government initiatives promoting energy-efficient appliances further stimulate market growth.

Key Barriers & Challenges: Economic fluctuations and geopolitical instability may impact consumer spending and investment. Import tariffs and supply chain disruptions can affect product availability and pricing. Intense competition from both domestic and international brands creates pricing pressures. xx% of the market is impacted by supply chain disruptions in 2025.

Emerging Opportunities in Russia Laundry Appliances Market

Untapped markets in smaller cities and rural areas present significant growth opportunities. The increasing popularity of smart home technology creates demand for connected appliances. Evolving consumer preferences towards sustainability and eco-friendly products drive innovation in energy-efficient models.

Growth Accelerators in the Russia Laundry Appliances Market Industry

Technological advancements in energy efficiency, improved washing performance, and smart home integration are key catalysts for long-term growth. Strategic partnerships between manufacturers and retailers expand market reach and consumer access. Government initiatives promoting energy efficiency and sustainable consumption further accelerate market expansion.

Key Players Shaping the Russia Laundry Appliances Market Market

- LG

- Candy

- Atlant

- Indesit

- Hotpoint

- Electrolux

- Haier

- Beko

- Gorenje

- Bosch

- Samsung

Notable Milestones in Russia Laundry Appliances Market Sector

- June 2022: LG Electronics' acquisition of AppleMango, while focused on EV chargers, highlights the broader trend of technological integration within the broader appliance sector. This indirectly positions LG for future opportunities in smart home appliance integration.

- February 2022: Bosch's acquisition of a stake in Autozilla Solutions indicates a focus on B2B eCommerce within the automotive sector, which may lead to future collaborations or technology transfer, indirectly influencing the supply chains and efficiencies for larger appliance manufacturers.

In-Depth Russia Laundry Appliances Market Market Outlook

The Russia laundry appliances market is poised for sustained growth, driven by the factors outlined above. Strategic opportunities exist for companies that can leverage technological innovation, establish strong distribution networks, and cater to evolving consumer preferences. The market's future potential is significant, particularly in the segments of smart home appliances and energy-efficient models.

Russia Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Freestanding

- 1.2. Built-in

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Smoothing Irons

- 2.4. Other Products

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic/ Manual

- 3.3. Other Technologies

-

4. Distribution Channel

- 4.1. Multi-Brand Stores

- 4.2. Exclusive Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Russia Laundry Appliances Market Segmentation By Geography

- 1. Russia

Russia Laundry Appliances Market Regional Market Share

Geographic Coverage of Russia Laundry Appliances Market

Russia Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. The Washing Machine Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Laundry Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Freestanding

- 5.1.2. Built-in

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Smoothing Irons

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic/ Manual

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-Brand Stores

- 5.4.2. Exclusive Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Candy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Atlant

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indesit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hotpoint

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haier**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beko

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gorenje

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Samsung

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Russia Laundry Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Laundry Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russia Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Russia Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Russia Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Russia Laundry Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Russia Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Russia Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: Russia Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Russia Laundry Appliances Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Laundry Appliances Market?

The projected CAGR is approximately 1%.

2. Which companies are prominent players in the Russia Laundry Appliances Market?

Key companies in the market include LG, Candy, Atlant, Indesit, Hotpoint, Electrolux, Haier**List Not Exhaustive, Beko, Gorenje, Bosch, Samsung.

3. What are the main segments of the Russia Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

The Washing Machine Segment Dominates the Market.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

June 2022: LG Electronics announced the acquisition of the South Korean EV charger solutions provider, AppleMango, jointly with GS Energy and GS Neotek. The acquisition is expected to accelerate the growth of LG's EV charging solution business and enable the company to take advantage of future business opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the Russia Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence