Key Insights

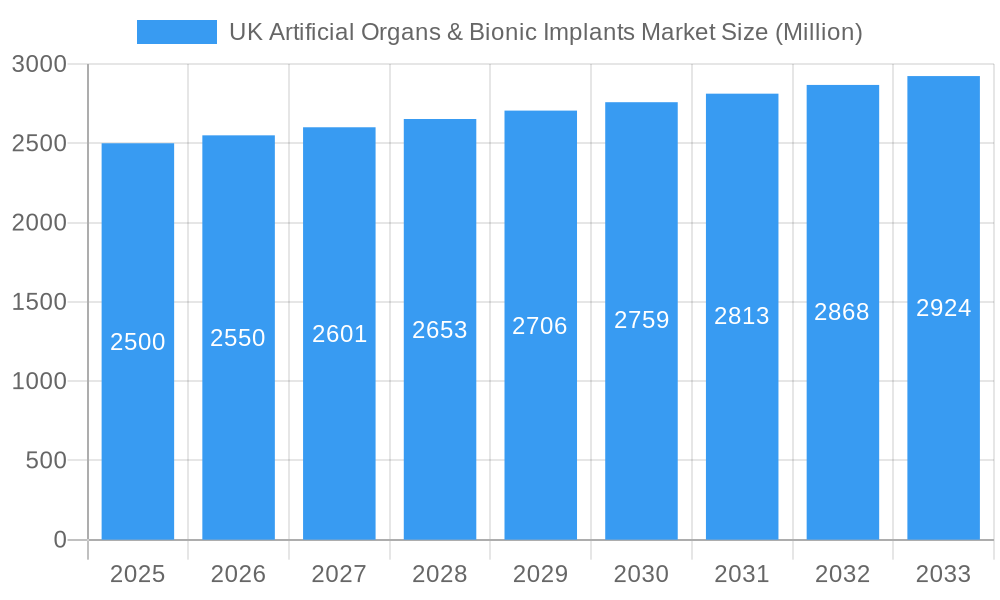

The United Kingdom's artificial organs and bionic implants market is experiencing robust expansion, driven by increasing life expectancies, a rising incidence of chronic diseases, and continuous advancements in medical technology. The market, currently valued at approximately £2,500 million, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8% from the base year 2025 through 2033. This growth is propelled by the escalating demand for solutions that significantly enhance the quality of life for individuals with organ failure or functional impairments. Key growth factors include an aging population necessitating advanced medical interventions and growing acceptance of bionic prosthetics and artificial organ replacements. Increased healthcare expenditure and ongoing research and development by leading companies further contribute to market expansion. The market is segmented into Artificial Organs, including artificial hearts, kidneys, and cochlear implants, and Bionics, encompassing ear, orthopedic, and cardiac bionic devices.

UK Artificial Organs & Bionic Implants Market Market Size (In Billion)

The UK market benefits from a strong healthcare infrastructure and a significant focus on innovation within the life sciences sector. However, high device costs, the requirement for specialized surgical expertise, and potential reimbursement challenges may influence adoption rates. Despite these restraints, the outlook for artificial organs and bionic implants in the UK remains positive. Enhanced bionic limbs offering greater dexterity and sensory feedback, alongside the development of more biocompatible and efficient artificial organs, are expected to broaden application scopes. Strategic collaborations between technology developers and healthcare providers, supported by government initiatives promoting medical innovation, will further accelerate market growth. The market is anticipated to reach approximately £48.75 billion by 2033, underscoring the sustained demand for these transformative medical technologies.

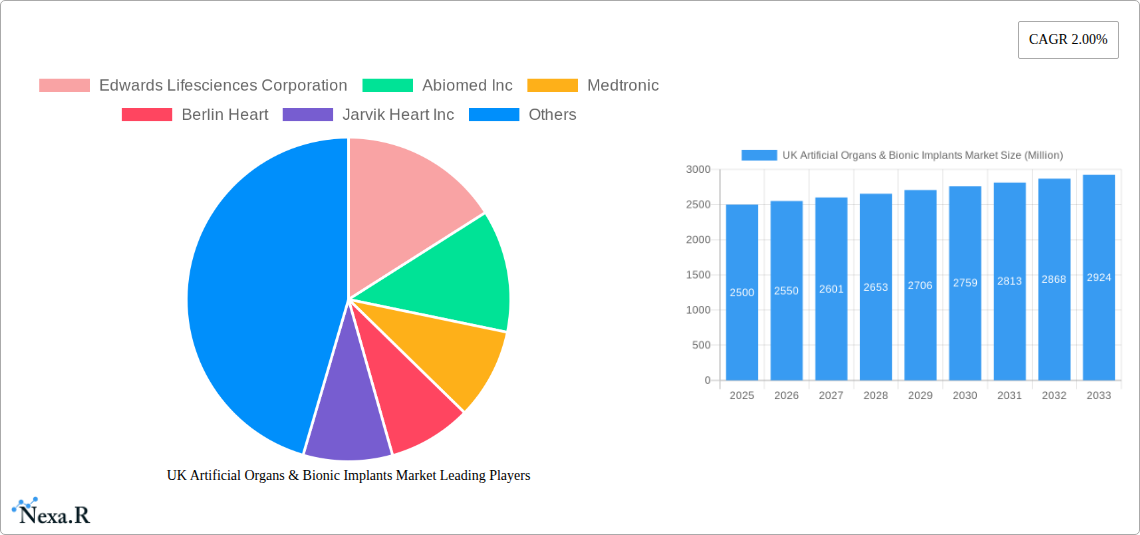

UK Artificial Organs & Bionic Implants Market Company Market Share

This comprehensive report offers essential insights into the UK Artificial Organs & Bionic Implants Market, designed for maximum search engine visibility and industry professional engagement.

Report Title: UK Artificial Organs & Bionic Implants Market: Innovation, Demand & Growth Forecast | 2025–2033

Report Description:

Gain critical insights into the dynamic UK Artificial Organs & Bionic Implants Market. This report, covering 2025–2033 with a base year of 2025, analyzes the evolving landscape of advanced medical technologies. Explore market size evolution, adoption trends, technological advancements, and consumer behavior shaping the UK artificial organ market and UK bionic implant market. Analyze key segments, including the artificial heart market UK, artificial kidney market UK, cochlear implants UK, ear bionics UK, orthopedic bionics UK, and cardiac bionics UK. Examine innovations in bionic prosthetics UK and advanced artificial organs. Understand critical drivers, barriers, challenges, and emerging opportunities. Featuring insights from leading companies like Edwards Lifesciences Corporation, Abiomed Inc, Medtronic, Berlin Heart, Jarvik Heart Inc, Ekso Bionics, Abbott, and Cochlear Ltd, this report is vital for stakeholders in the burgeoning UK medical device market and biotechnology UK sector.

UK Artificial Organs & Bionic Implants Market Market Dynamics & Structure

The UK Artificial Organs & Bionic Implants Market is characterized by a moderate to high concentration, with a few key players dominating segments like artificial hearts and advanced cochlear implants. Technological innovation is a significant driver, fueled by advancements in biomaterials, miniaturization, and sophisticated control systems for bionic limbs and organs. Regulatory frameworks, while stringent, are evolving to accommodate the rapid pace of innovation, balancing patient safety with the timely adoption of novel solutions. Competitive product substitutes are emerging, particularly in areas like advanced prosthetics that offer enhanced functionality and integration with the human nervous system, challenging traditional implant solutions. End-user demographics are shifting, with an aging population driving demand for artificial organs, while advancements in bionics appeal to a younger demographic experiencing limb loss due to accidents or congenital conditions. Mergers and acquisitions (M&A) are increasingly prevalent as larger companies seek to acquire innovative technologies and expand their portfolios. For instance, the acquisition of Oticon Medical by Cochlear signifies a strategic consolidation within the hearing implant sector.

- Market Concentration: Dominated by established players such as Medtronic and Edwards Lifesciences, with emerging innovators gaining traction.

- Technological Innovation Drivers: Advancements in AI-powered bionic limbs, 3D printing for custom organ scaffolds, and sophisticated neuro-interfacing for implants.

- Regulatory Frameworks: NICE guidelines and MHRA approvals play a crucial role in market access, with ongoing efforts to streamline processes for novel therapies.

- Competitive Product Substitutes: Advanced robotic prosthetics and regenerative medicine approaches present potential alternatives in the long term.

- End-User Demographics: Rising prevalence of chronic diseases (cardiac, renal) and increasing incidence of trauma leading to limb loss are key demand drivers.

- M&A Trends: Strategic acquisitions to gain access to cutting-edge technologies and expand market reach, evident in the hearing implants sector.

UK Artificial Organs & Bionic Implants Market Growth Trends & Insights

The UK Artificial Organs & Bionic Implants Market is poised for substantial growth, propelled by a confluence of increasing demand, groundbreaking technological advancements, and supportive healthcare policies. The market size evolution is directly linked to the rising incidence of organ failure and the growing acceptance of bionic solutions for limb restoration. Adoption rates for these sophisticated medical devices are steadily increasing, driven by improved clinical outcomes, enhanced quality of life for patients, and greater awareness among healthcare professionals and the public. Technological disruptions are at the forefront, with innovations in artificial intelligence enabling more intuitive control of bionic limbs and advanced materials leading to more biocompatible and durable artificial organs. For example, the development of brain-controlled bionic arms, as announced by the NHS, represents a significant leap forward, allowing for more natural and nuanced movements.

Consumer behavior shifts are also playing a crucial role. Patients are becoming more proactive in seeking advanced treatment options, and there is a growing demand for personalized solutions that cater to individual needs and preferences. This is particularly evident in the orthopedic bionic segment, where custom-fit prosthetics are becoming the norm. The market penetration of artificial organs, while still nascent for some types, is expected to rise significantly as research progresses and manufacturing scales up. The CAGR for this market is projected to be robust, reflecting the unmet medical needs and the continuous innovation pipeline. Furthermore, the integration of IoT and data analytics in bionic implants is enhancing their performance monitoring and predictive maintenance capabilities, further boosting their appeal. The increasing lifespan and improved functionality of these devices are leading to higher patient satisfaction and a greater willingness to undergo implantation procedures. The UK government’s commitment to advancing medical technology and improving patient care through initiatives like the NHS bionic arm program underscores the favorable market environment. The expansion of the UK medical technology market is a testament to the country's dedication to fostering innovation in this critical sector.

Dominant Regions, Countries, or Segments in UK Artificial Organs & Bionic Implants Market

Within the United Kingdom, the Artificial Organs segment, particularly Cochlear Implants and emerging Artificial Heart technologies, currently drives significant market growth. England, with its larger population base and concentration of leading medical research institutions and specialized treatment centers, is the dominant geographical area for both artificial organs and bionic implants. The National Health Service (NHS) infrastructure, coupled with substantial private healthcare investment, facilitates the adoption and accessibility of these advanced medical devices. The specific segments experiencing the most robust growth are:

- Cochlear Implants: Driven by a consistently high prevalence of hearing loss and advancements in implant technology that offer superior speech perception and sound quality. The willingness of the NHS to fund these procedures for eligible patients contributes significantly to their widespread adoption. Market share for cochlear implants is substantial, with ongoing innovation by companies like Cochlear Ltd pushing the boundaries of auditory restoration.

- Artificial Hearts: While still a nascent market compared to cochlear implants, the demand for total artificial hearts and ventricular assist devices (VADs) is growing due to the rising burden of end-stage heart failure. Technological improvements focusing on longevity, portability, and reduced invasiveness are accelerating adoption. Companies like Abiomed Inc and Medtronic are key players in this segment.

- Orthopedic Bionic: This segment is experiencing rapid expansion, particularly with the NHS's commitment to providing advanced bionic arms. The increasing sophistication of prosthetic limbs, offering greater dexterity and control, is making them a more viable and attractive option for amputees. The multi-grip capabilities highlighted in recent NHS announcements underscore the functional advancements driving demand.

- Ear Bionics (excluding Cochlear Implants): This encompasses a range of hearing solutions beyond traditional cochlear implants, including middle ear implants and bone conduction devices, catering to specific types of hearing loss and offering alternative solutions.

The dominance of these segments and regions is underpinned by several key drivers:

- Economic Policies: Government funding for healthcare research and development, along with initiatives aimed at improving patient access to advanced treatments, directly stimulates market growth.

- Infrastructure: The presence of world-class hospitals, specialized clinics, and a skilled workforce in the UK facilitates the implantation and long-term management of artificial organs and bionic implants.

- Disease Prevalence: High rates of cardiovascular diseases, renal failure, and age-related hearing loss create a sustained demand for artificial organ solutions. Similarly, the incidence of trauma and congenital conditions drives the need for advanced bionic prosthetics.

- Technological Adoption: The UK's progressive healthcare system and its receptiveness to adopting cutting-edge technologies ensure that innovations in artificial organs and bionics are evaluated and integrated into patient care pathways.

UK Artificial Organs & Bionic Implants Market Product Landscape

The UK Artificial Organs & Bionic Implants Market is distinguished by a continuous stream of product innovations aimed at enhancing functionality, biocompatibility, and patient comfort. In the artificial organ segment, advancements include next-generation artificial hearts with improved pumping mechanisms and longer battery life, alongside innovative artificial kidney technologies exploring miniaturization and more efficient filtration processes. Cochlear implants are witnessing breakthroughs in sophisticated sound processing algorithms and electrode designs, offering more natural hearing experiences. For bionic implants, the focus is on developing intuitive neuro-interfaces for prosthetic limbs, enabling a greater range of motion and sensory feedback. This includes multi-grip capabilities in bionic arms and advanced robotic joints for orthopedic applications.

- Artificial Heart Innovations: Extended lifespan VADs and improved total artificial heart designs for end-stage heart failure.

- Artificial Kidney Advancements: Focus on wearable or implantable dialysis devices for greater patient autonomy.

- Cochlear Implant Technology: Enhanced speech clarity in noisy environments and improved implantable device longevity.

- Bionic Prosthetics: AI-powered control systems for intuitive limb movement and development of sensory feedback mechanisms.

Key Drivers, Barriers & Challenges in UK Artificial Organs & Bionic Implants Market

Key Drivers:

The UK Artificial Organs & Bionic Implants Market is propelled by several critical factors. Technological advancements, particularly in AI, robotics, and biomaterials, are at the forefront, enabling the development of more sophisticated and effective devices. An aging population and the increasing prevalence of chronic diseases, such as heart failure and kidney disease, create a sustained and growing demand for artificial organs. Furthermore, the growing awareness and acceptance of bionic solutions for limb loss, coupled with supportive government initiatives and NHS funding for advanced technologies like brain-controlled bionic arms, are significant growth accelerators. The drive for improved patient quality of life and functional restoration is a core motivator for innovation and adoption.

- Technological Innovations: AI-driven bionics, advanced biocompatible materials, miniaturization.

- Demographic Shifts: Aging population and rising incidence of chronic diseases.

- Healthcare Policy Support: NHS funding and focus on advanced medical technologies.

- Patient Demand: Desire for improved quality of life and functional restoration.

Barriers & Challenges:

Despite the promising growth trajectory, the market faces significant hurdles. The high cost of research, development, and manufacturing of these advanced devices translates into substantial purchase and maintenance costs, creating an accessibility barrier for some patients and healthcare systems. Stringent regulatory approval processes, while crucial for patient safety, can be time-consuming and resource-intensive, potentially delaying market entry for new innovations. Supply chain disruptions, particularly for specialized components and raw materials, can impact production volumes and lead times. Moreover, the need for extensive surgical expertise and specialized post-operative care and rehabilitation presents a challenge in widespread implementation, requiring ongoing training and infrastructure development. Competitive pressures from both established players and emerging disruptors also necessitate continuous innovation and cost-efficiency.

- High Costs: Research, development, manufacturing, and maintenance expenses.

- Regulatory Hurdles: Lengthy and complex approval pathways.

- Supply Chain Issues: Dependence on specialized components and raw materials.

- Skilled Workforce & Infrastructure: Requirement for specialized surgical expertise and rehabilitation facilities.

- Reimbursement Challenges: Navigating payment models for novel and expensive treatments.

Emerging Opportunities in UK Artificial Organs & Bionic Implants Market

Emerging opportunities in the UK Artificial Organs & Bionic Implants Market lie in several key areas. The increasing integration of AI and machine learning in bionic devices offers vast potential for personalized and adaptive functionality, moving beyond pre-programmed movements. There's a significant opportunity in developing more affordable and accessible artificial organ solutions, particularly for conditions like chronic kidney disease, potentially through advancements in wearable or implantable artificial kidneys. The growing interest in regenerative medicine and tissue engineering also presents a long-term opportunity for bio-artificial organs that can integrate more seamlessly with the body. Furthermore, the expansion of home-based rehabilitation programs utilizing connected bionic devices for post-operative care offers convenience and improved patient outcomes. Untapped markets exist within specific rare organ failure conditions where current solutions are limited.

- AI & ML Integration: Developing smarter, adaptive bionic limbs and organs.

- Affordable Solutions: Creating cost-effective artificial kidneys and other organs.

- Regenerative Medicine: Advancing bio-artificial organs for better integration.

- Remote Rehabilitation: Expanding home-based care with connected bionic devices.

- Niche Organ Replacements: Addressing unmet needs in rare organ failure.

Growth Accelerators in the UK Artificial Organs & Bionic Implants Market Industry

The long-term growth of the UK Artificial Organs & Bionic Implants Market is significantly influenced by ongoing technological breakthroughs, strategic collaborations, and ambitious market expansion strategies. Continuous advancements in materials science are enabling the creation of more durable, biocompatible, and functional artificial organs and bionic components. The development of sophisticated neuro-interfacing techniques is a critical growth accelerator, allowing for more seamless and intuitive control of bionic prosthetics, akin to natural limb movement. Strategic partnerships between research institutions, medical device manufacturers, and healthcare providers are fostering a collaborative environment that accelerates the translation of laboratory innovations into clinical applications. Furthermore, the increasing focus on personalized medicine means that growth will be driven by the development of custom-fit bionic limbs and organs tailored to individual patient anatomy and needs. The global expansion of these technologies also presents opportunities for UK-based companies to lead in export markets.

- Breakthroughs in Neural Interfaces: Enabling naturalistic control of bionics.

- Strategic Partnerships: Fostering collaboration for faster innovation and adoption.

- Personalized Medicine: Development of custom-fit artificial organs and bionics.

- Global Market Expansion: Opportunities for UK companies to export leading-edge technologies.

Key Players Shaping the UK Artificial Organs & Bionic Implants Market Market

- Edwards Lifesciences Corporation

- Abiomed Inc

- Medtronic

- Berlin Heart

- Jarvik Heart Inc

- Ekso Bionics

- Abbott

- Cochlear Ltd

Notable Milestones in UK Artificial Organs & Bionic Implants Market Sector

- November 2022: NHS announced that brain-controlled bionic arms that mimic real hand movements will be offered to amputees on the NHS. The newly available bionic arms controlled by electrical brain signals have multi-grip capabilities, enabling a greater range of movements to make day-to-day tasks easier.

- April 2022: Oticon Medical's parent company, Demant, decided to discontinue its hearing implants business and, therefore, has negotiated an agreement with the intention to sell Oticon Medical to Cochlear.

In-Depth UK Artificial Organs & Bionic Implants Market Market Outlook

The future of the UK Artificial Organs & Bionic Implants Market is exceptionally promising, driven by a potent combination of accelerating technological innovation and escalating demand. Growth accelerators such as breakthroughs in AI-powered bionics that offer near-natural control and the continued development of advanced materials for more durable and biocompatible artificial organs will redefine patient care. Strategic partnerships between leading research institutions and industry giants are expected to streamline the path from development to clinical application, bringing life-changing technologies to market faster. The increasing emphasis on personalized medicine will fuel the demand for custom-engineered solutions, enhancing patient outcomes and satisfaction. As the UK continues to invest in its healthcare infrastructure and embrace cutting-edge medical advancements, the market is set for sustained expansion, offering substantial opportunities for innovation and improved quality of life for patients requiring artificial organs and bionic implants.

UK Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Other Bionics

-

1.1. Artificial Organ

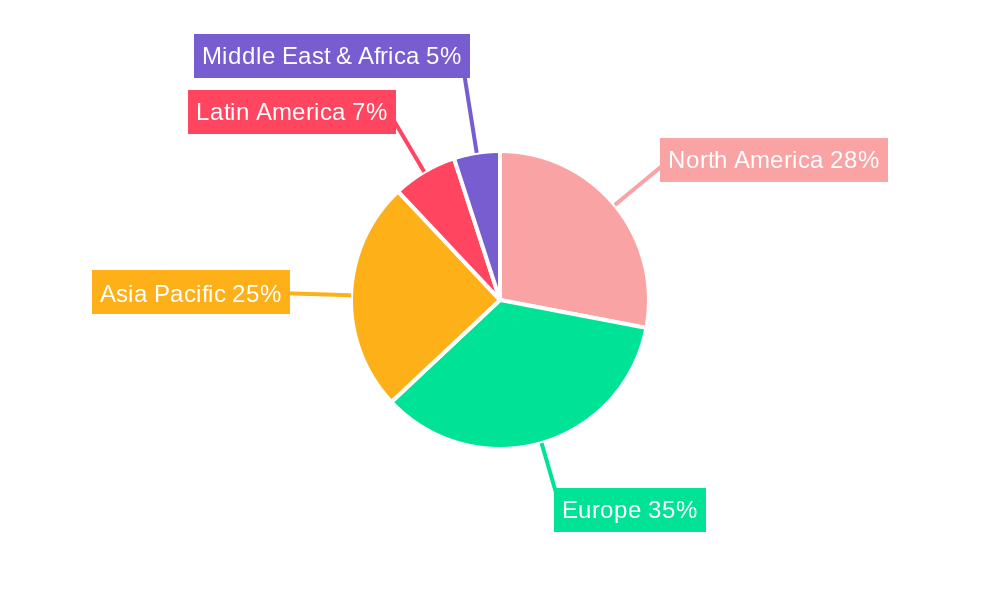

UK Artificial Organs & Bionic Implants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Artificial Organs & Bionic Implants Market Regional Market Share

Geographic Coverage of UK Artificial Organs & Bionic Implants Market

UK Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Incidence of Disabilities

- 3.2.2 Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Heart Segment is Estimated to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Other Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Artificial Organ

- 6.1.1.1. Artificial Heart

- 6.1.1.2. Artificial Kidney

- 6.1.1.3. Cochlear Implants

- 6.1.1.4. Other Organ Types

- 6.1.2. Bionics

- 6.1.2.1. Ear Bionics

- 6.1.2.2. Orthopedic Bionic

- 6.1.2.3. Cardiac Bionics

- 6.1.2.4. Other Bionics

- 6.1.1. Artificial Organ

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Artificial Organ

- 7.1.1.1. Artificial Heart

- 7.1.1.2. Artificial Kidney

- 7.1.1.3. Cochlear Implants

- 7.1.1.4. Other Organ Types

- 7.1.2. Bionics

- 7.1.2.1. Ear Bionics

- 7.1.2.2. Orthopedic Bionic

- 7.1.2.3. Cardiac Bionics

- 7.1.2.4. Other Bionics

- 7.1.1. Artificial Organ

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Artificial Organ

- 8.1.1.1. Artificial Heart

- 8.1.1.2. Artificial Kidney

- 8.1.1.3. Cochlear Implants

- 8.1.1.4. Other Organ Types

- 8.1.2. Bionics

- 8.1.2.1. Ear Bionics

- 8.1.2.2. Orthopedic Bionic

- 8.1.2.3. Cardiac Bionics

- 8.1.2.4. Other Bionics

- 8.1.1. Artificial Organ

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Artificial Organ

- 9.1.1.1. Artificial Heart

- 9.1.1.2. Artificial Kidney

- 9.1.1.3. Cochlear Implants

- 9.1.1.4. Other Organ Types

- 9.1.2. Bionics

- 9.1.2.1. Ear Bionics

- 9.1.2.2. Orthopedic Bionic

- 9.1.2.3. Cardiac Bionics

- 9.1.2.4. Other Bionics

- 9.1.1. Artificial Organ

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Artificial Organ

- 10.1.1.1. Artificial Heart

- 10.1.1.2. Artificial Kidney

- 10.1.1.3. Cochlear Implants

- 10.1.1.4. Other Organ Types

- 10.1.2. Bionics

- 10.1.2.1. Ear Bionics

- 10.1.2.2. Orthopedic Bionic

- 10.1.2.3. Cardiac Bionics

- 10.1.2.4. Other Bionics

- 10.1.1. Artificial Organ

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Edwards Lifesciences Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abiomed Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Berlin Heart

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jarvik Heart Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ekso Bionics*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cochlear Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: Global UK Artificial Organs & Bionic Implants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Artificial Organs & Bionic Implants Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Artificial Organs & Bionic Implants Market Revenue (billion), by Type 2025 & 2033

- Figure 7: South America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America UK Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Artificial Organs & Bionic Implants Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe UK Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global UK Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the UK Artificial Organs & Bionic Implants Market?

Key companies in the market include Edwards Lifesciences Corporation, Abiomed Inc, Medtronic, Berlin Heart, Jarvik Heart Inc, Ekso Bionics*List Not Exhaustive, Abbott, Cochlear Ltd.

3. What are the main segments of the UK Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities. Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics.

6. What are the notable trends driving market growth?

Artificial Heart Segment is Estimated to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

November 2022: NHS announced that brain-controlled bionic arms that mimic real hand movements will be offered to amputees on the NHS. The newly available bionic arms controlled by electrical brain signals have multi-grip capabilities, enabling a greater range of movements to make day-to-day tasks easier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the UK Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence