Key Insights

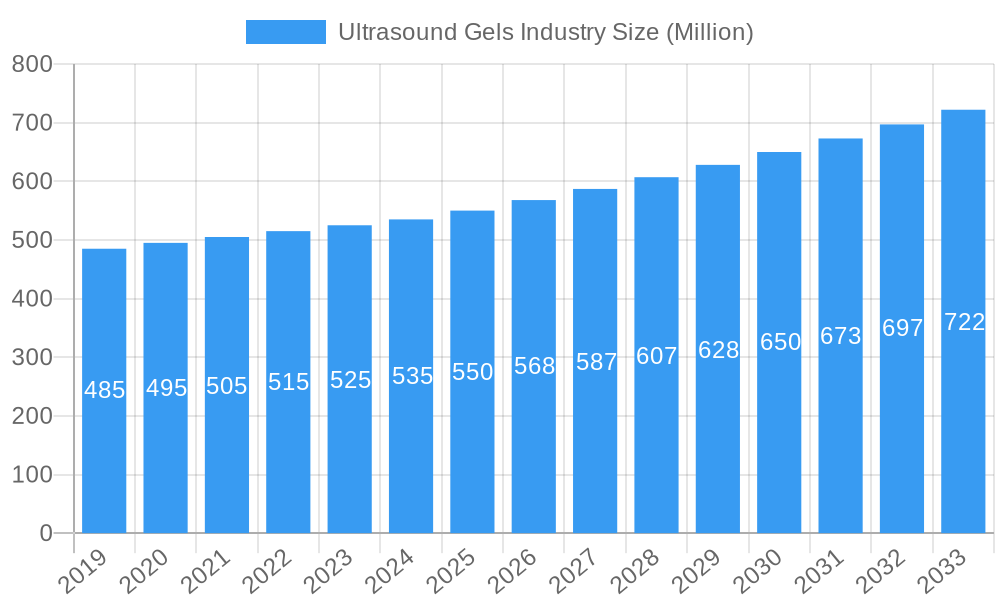

The global Ultrasound Gels market is projected for significant expansion, expected to reach a market size of 351.3 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. This growth is driven by the increased adoption of diagnostic imaging, particularly ultrasound, in healthcare. The rising incidence of chronic diseases and an aging global population are increasing demand for advanced diagnostic tools, making ultrasound gels a critical consumable. Advancements in ultrasound technology, enhancing image quality and diagnostic accuracy, also contribute to market growth. The focus on preventative healthcare and early disease detection further fuels the need for regular diagnostic screenings, boosting ultrasound gel consumption.

Ultrasound Gels Industry Market Size (In Million)

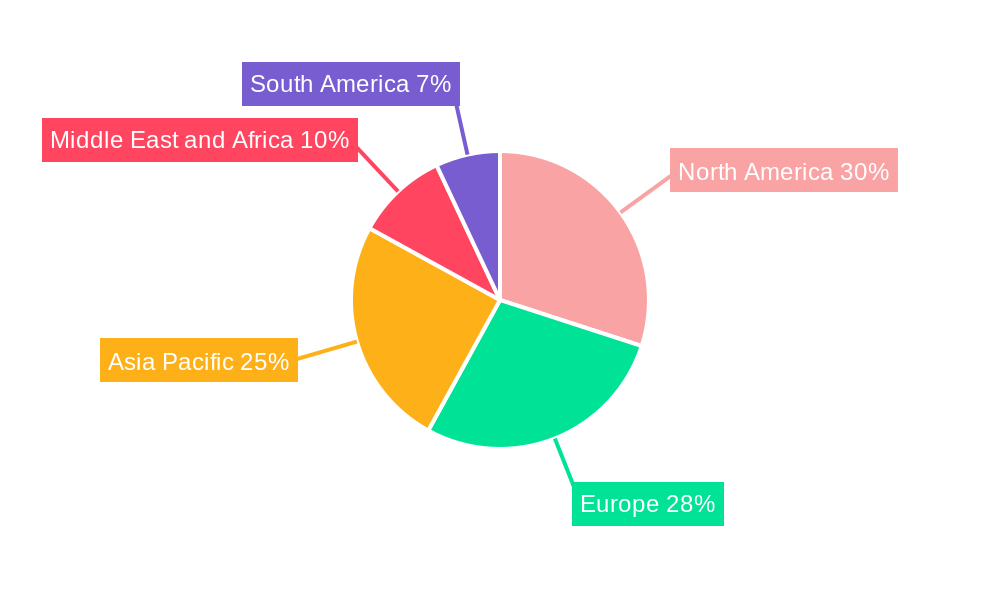

Key market drivers include expanding healthcare infrastructure, especially in emerging economies, and increased investment in state-of-the-art ultrasound equipment by diagnostic centers and hospitals. The market is segmented by product type into Non-sterile and Sterile gels, with Sterile gels anticipated to hold a larger share due to stringent infection control standards. Hospitals and clinics are the primary end-users, followed by diagnostic centers, reflecting the broad application of ultrasound in both inpatient and outpatient settings. Geographically, North America and Europe are expected to lead, supported by robust healthcare systems and high disposable incomes. The Asia Pacific region is forecast for the fastest growth, driven by rising healthcare expenditure, a growing patient population, and expanding medical facilities. Potential restraints, such as the availability of reusable coupling devices and price sensitivity in certain markets, may slightly temper growth, but the fundamental demand for effective ultrasound coupling agents remains strong.

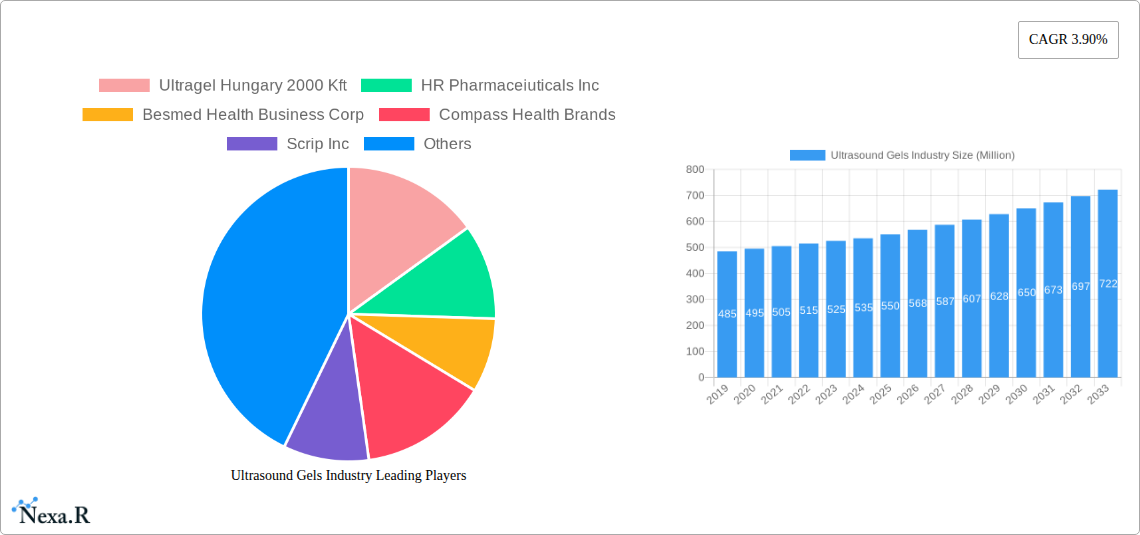

Ultrasound Gels Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Ultrasound Gels Industry, providing crucial insights into market dynamics, growth trends, regional performance, product innovation, and the competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for understanding the current and future potential of the ultrasound gel market. The analysis is segmented by product type (Non-sterile, Sterile) and end-user segments (Hospitals/Clinics, Diagnostic Centers, Other End Users), presenting quantitative and qualitative data for informed strategic decision-making.

Ultrasound Gels Industry Market Dynamics & Structure

The Ultrasound Gels Industry exhibits a moderately concentrated market structure, with a blend of established global manufacturers and emerging regional players. Technological innovation remains a pivotal driver, pushing advancements in gel formulations for enhanced conductivity, patient comfort, and therapeutic efficacy. Regulatory frameworks, particularly those governing medical device consumables and their safety, significantly influence product development and market entry. Competitive product substitutes, while limited in direct efficacy for ultrasound imaging, exist in the form of alternative coupling agents in niche applications. End-user demographics are increasingly influenced by the growing adoption of diagnostic imaging in both developed and developing economies, coupled with an aging global population requiring more frequent medical assessments. Mergers and acquisitions (M&A) trends, though not overtly aggressive, indicate strategic consolidation aimed at expanding product portfolios and market reach. For instance, a predicted xx number of M&A deals are anticipated within the forecast period, driven by companies seeking to capitalize on synergistic product offerings or gain access to new geographic markets. Innovation barriers primarily revolve around stringent regulatory approvals and the cost associated with clinical trials and advanced material research.

- Market Concentration: Moderately concentrated with key global players and a growing number of regional manufacturers.

- Technological Innovation Drivers: Focus on improved acoustic coupling, hypoallergenic formulations, and specialized gels for advanced imaging modalities.

- Regulatory Frameworks: Stringent adherence to medical device regulations (e.g., FDA, CE marking) is paramount.

- Competitive Product Substitutes: Limited direct substitutes for standard diagnostic ultrasound, but alternative coupling agents exist for specific applications.

- End-User Demographics: Driven by increasing diagnostic imaging demand, aging populations, and a rise in preventative healthcare.

- M&A Trends: Strategic consolidations aimed at portfolio expansion and market penetration.

- Innovation Barriers: High cost of R&D, extensive clinical trials, and complex regulatory approval processes.

Ultrasound Gels Industry Growth Trends & Insights

The Ultrasound Gels Industry is poised for robust expansion, driven by a confluence of factors including escalating demand for diagnostic imaging, advancements in ultrasound technology, and a growing awareness of preventative healthcare. The market size is projected to grow from an estimated xx million units in 2025 to xx million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Adoption rates are steadily increasing across hospitals, clinics, and standalone diagnostic centers globally, spurred by the cost-effectiveness and non-invasiveness of ultrasound procedures compared to other imaging modalities. Technological disruptions, such as the development of smart gel dispensers and warming technologies, are enhancing user experience and procedural efficiency, contributing to higher adoption. Consumer behavior shifts are also playing a role, with a greater emphasis on patient comfort and safety leading to a demand for premium, hypoallergenic, and sterile ultrasound gels. The increasing prevalence of chronic diseases and the growing need for real-time monitoring in various medical fields further fuel the demand for ultrasound services and, consequently, ultrasound gels. The market penetration of specialized ultrasound gels for specific applications, like cardiac or obstetric imaging, is also on the rise, indicating a maturing market segment that caters to specialized needs. The growing emphasis on point-of-care diagnostics and portable ultrasound devices further broadens the applicability and demand for ultrasound gels.

Dominant Regions, Countries, or Segments in Ultrasound Gels Industry

The Hospitals/Clinics end-user segment is unequivocally the dominant force driving growth within the Ultrasound Gels Industry, projecting a market share of approximately xx% by 2033. This dominance stems from the foundational role hospitals and clinics play in delivering a vast spectrum of diagnostic and therapeutic ultrasound services. The consistent volume of procedures performed, ranging from routine prenatal scans to complex diagnostic imaging for various organ systems, ensures a perpetual demand for ultrasound gels. Furthermore, the increasing integration of advanced ultrasound technologies in hospital settings, such as 3D/4D imaging and interventional ultrasound, necessitates the use of high-performance, often sterile, ultrasound gels. Economic policies in developed nations that prioritize healthcare infrastructure development and technological adoption further bolster this segment's growth. In contrast, Diagnostic Centers, while significant, represent a secondary market, often serving specialized imaging needs or acting as referral centers. Other End Users, including veterinary clinics and research institutions, contribute to market volume but at a comparatively lower scale. Geographically, North America and Europe currently lead the market due to well-established healthcare systems, high disposable incomes, and early adoption of advanced medical technologies. However, the Asia Pacific region is emerging as a high-growth powerhouse, driven by rapidly expanding healthcare infrastructure, increasing medical tourism, and a burgeoning middle class with greater access to healthcare services. Government initiatives aimed at improving diagnostic capabilities and a rising burden of chronic diseases in these regions are key accelerators for ultrasound gel consumption in hospitals and clinics.

- Dominant End-User Segment: Hospitals/Clinics, commanding an estimated xx% market share by 2033.

- Key Drivers for Hospitals/Clinics: High volume of diagnostic and therapeutic procedures, integration of advanced ultrasound technologies, and increasing focus on patient outcomes.

- Geographic Dominance: North America and Europe lead, with Asia Pacific exhibiting the highest growth potential.

- Regional Growth Factors: Investments in healthcare infrastructure, rising per capita income, and increased prevalence of chronic diseases in emerging economies.

- Market Share Projections: Hospitals/Clinics are projected to maintain their leading position throughout the forecast period.

Ultrasound Gels Industry Product Landscape

The Ultrasound Gels Industry is characterized by continuous product innovation aimed at enhancing diagnostic accuracy and patient comfort. Key innovations include the development of sterile ultrasound gels, crucial for invasive procedures and immunocompromised patients, and advanced formulations offering superior acoustic coupling, reducing image artifacts, and ensuring clear visualization. Non-sterile gels, while more cost-effective, cater to routine diagnostic applications. Performance metrics are increasingly focused on viscosity control for optimal application and spreadability, hypoallergenic properties to minimize patient sensitivity, and long-lasting conductivity for uninterrupted imaging sessions. Unique selling propositions often revolve around specialized formulations, such as latex-free, paraben-free, or fragrance-free options, catering to a wider range of patient needs. Technological advancements also extend to packaging and delivery systems, with the introduction of dispensers designed for ease of use and reduced wastage.

Key Drivers, Barriers & Challenges in Ultrasound Gels Industry

The key drivers propelling the Ultrasound Gels Industry include the escalating global demand for diagnostic imaging, driven by an aging population and the rising incidence of chronic diseases. Technological advancements in ultrasound equipment necessitate improved contact media, thereby fueling innovation in gel formulations. Government initiatives to improve healthcare access and infrastructure in developing nations further contribute to market growth.

- Technological Advancements: Improved ultrasound imaging capabilities require superior contact gels.

- Growing Demand for Diagnostics: Aging populations and increasing chronic disease prevalence drive procedural volumes.

- Healthcare Infrastructure Development: Expansion of healthcare facilities globally.

- Cost-Effectiveness of Ultrasound: Compared to other imaging modalities, ultrasound remains a cost-efficient choice.

The key challenges and restraints include stringent regulatory compliance requirements and the cost associated with obtaining approvals, which can hinder new product launches. Supply chain disruptions, exacerbated by global events, can impact raw material availability and pricing. Intense competition among manufacturers, particularly in mature markets, can lead to price pressures.

- Regulatory Hurdles: Stringent approval processes for medical devices.

- Supply Chain Volatility: Potential disruptions in raw material sourcing.

- Price Competition: Saturated markets lead to competitive pricing strategies.

- Raw Material Costs: Fluctuations in the cost of key ingredients.

Emerging Opportunities in Ultrasound Gels Industry

Emerging opportunities in the Ultrasound Gels Industry lie in the development of specialty gels for advanced ultrasound applications, such as contrast-enhanced ultrasound and therapeutic ultrasound. The growing demand for biodegradable and eco-friendly gel formulations presents a significant untapped market. Furthermore, the expansion of telehealth and portable ultrasound devices in remote or underserved areas opens avenues for innovative, user-friendly gel delivery systems. The integration of smart technologies, like temperature-controlled dispensers, also represents a burgeoning opportunity to enhance user experience and improve diagnostic accuracy.

Growth Accelerators in the Ultrasound Gels Industry Industry

Technological breakthroughs in biocompatible materials and advanced emulsification techniques are key growth accelerators, promising enhanced performance and patient comfort. Strategic partnerships between gel manufacturers and ultrasound equipment developers can foster synergistic product development and market penetration. Market expansion strategies targeting emerging economies, where healthcare infrastructure is rapidly developing, represent another significant growth catalyst. The increasing adoption of point-of-care ultrasound devices in diverse medical settings further amplifies the demand for specialized and readily available ultrasound gels.

Key Players Shaping the Ultrasound Gels Industry Market

- Ultragel Hungary 2000 Kft

- HR Pharmaceiuticals Inc

- Besmed Health Business Corp

- Compass Health Brands

- Scrip Inc

- Medline Industries LP

- OJI Group (TELE-PAPER (M) SDN BHD)

- Parker Laboratories Inc

- Sonogel Vertriebs GmbH

- National Therapy Products Inc

Notable Milestones in Ultrasound Gels Industry Sector

- November 2022: Parker Laboratories Inc. showcased its wide range of ultrasound and electromedical contact media and leading lines of institutional cleaners and disinfectants at MEDICA 2022.

- February 2022: YUSO technology launched a Smart Ultrasound Gel Dispenser, which is used to assist the sonographer in squeezing the ultrasound gel instead of the hand, and there's a heating function to warm the gel as well.

In-Depth Ultrasound Gels Industry Market Outlook

The Ultrasound Gels Industry is set for sustained growth, driven by the unwavering demand for diagnostic imaging and ongoing technological advancements. Future market potential lies in the development of novel gel formulations catering to specialized ultrasound modalities and the increasing preference for eco-friendly and patient-centric products. Strategic opportunities include expanding presence in rapidly developing economies and forging collaborations with key stakeholders in the healthcare ecosystem to drive innovation and market adoption. The emphasis on improved patient experience and enhanced diagnostic accuracy will continue to shape product development and market strategies.

Ultrasound Gels Industry Segmentation

-

1. Product Type

- 1.1. Non-sterile

- 1.2. Sterile

-

2. End User

- 2.1. Hospitals/Clinics

- 2.2. Diagnostic Centers

- 2.3. Other End Users

Ultrasound Gels Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Ultrasound Gels Industry Regional Market Share

Geographic Coverage of Ultrasound Gels Industry

Ultrasound Gels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Ultrasound Procedures; Advancements in Ultrasound Gels Preparations

- 3.3. Market Restrains

- 3.3.1. Use of Other Alternative Products

- 3.4. Market Trends

- 3.4.1. Sterile Ultrasound Gels Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Non-sterile

- 5.1.2. Sterile

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals/Clinics

- 5.2.2. Diagnostic Centers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Non-sterile

- 6.1.2. Sterile

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals/Clinics

- 6.2.2. Diagnostic Centers

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Non-sterile

- 7.1.2. Sterile

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals/Clinics

- 7.2.2. Diagnostic Centers

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Non-sterile

- 8.1.2. Sterile

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals/Clinics

- 8.2.2. Diagnostic Centers

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Non-sterile

- 9.1.2. Sterile

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals/Clinics

- 9.2.2. Diagnostic Centers

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Ultrasound Gels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Non-sterile

- 10.1.2. Sterile

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals/Clinics

- 10.2.2. Diagnostic Centers

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ultragel Hungary 2000 Kft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HR Pharmaceiuticals Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Besmed Health Business Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Compass Health Brands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Scrip Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medline Industries LP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OJI Group (TELE-PAPER (M) SDN BHD)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parker Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sonogel Vertriebs GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 National Therapy Products Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ultragel Hungary 2000 Kft

List of Figures

- Figure 1: Global Ultrasound Gels Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Ultrasound Gels Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Ultrasound Gels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Ultrasound Gels Industry Revenue (million), by End User 2025 & 2033

- Figure 5: North America Ultrasound Gels Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Ultrasound Gels Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America Ultrasound Gels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ultrasound Gels Industry Revenue (million), by Product Type 2025 & 2033

- Figure 9: Europe Ultrasound Gels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Ultrasound Gels Industry Revenue (million), by End User 2025 & 2033

- Figure 11: Europe Ultrasound Gels Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Ultrasound Gels Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Ultrasound Gels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Ultrasound Gels Industry Revenue (million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Ultrasound Gels Industry Revenue (million), by End User 2025 & 2033

- Figure 17: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Ultrasound Gels Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Ultrasound Gels Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Ultrasound Gels Industry Revenue (million), by End User 2025 & 2033

- Figure 23: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Ultrasound Gels Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Ultrasound Gels Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: South America Ultrasound Gels Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Ultrasound Gels Industry Revenue (million), by End User 2025 & 2033

- Figure 29: South America Ultrasound Gels Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Ultrasound Gels Industry Revenue (million), by Country 2025 & 2033

- Figure 31: South America Ultrasound Gels Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global Ultrasound Gels Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global Ultrasound Gels Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 11: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 12: Global Ultrasound Gels Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Germany Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 21: Global Ultrasound Gels Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: China Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Japan Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Australia Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 29: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 30: Global Ultrasound Gels Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: GCC Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Global Ultrasound Gels Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 35: Global Ultrasound Gels Industry Revenue million Forecast, by End User 2020 & 2033

- Table 36: Global Ultrasound Gels Industry Revenue million Forecast, by Country 2020 & 2033

- Table 37: Brazil Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Ultrasound Gels Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Gels Industry?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Ultrasound Gels Industry?

Key companies in the market include Ultragel Hungary 2000 Kft, HR Pharmaceiuticals Inc, Besmed Health Business Corp, Compass Health Brands, Scrip Inc, Medline Industries LP, OJI Group (TELE-PAPER (M) SDN BHD), Parker Laboratories Inc, Sonogel Vertriebs GmbH, National Therapy Products Inc.

3. What are the main segments of the Ultrasound Gels Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 351.3 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Ultrasound Procedures; Advancements in Ultrasound Gels Preparations.

6. What are the notable trends driving market growth?

Sterile Ultrasound Gels Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Use of Other Alternative Products.

8. Can you provide examples of recent developments in the market?

November 2022: Parker Laboratories Inc. showcased its wide range of ultrasound and electromedical contact media and leading lines of institutional cleaners and disinfectants at MEDICA 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Gels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Gels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Gels Industry?

To stay informed about further developments, trends, and reports in the Ultrasound Gels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence