Key Insights

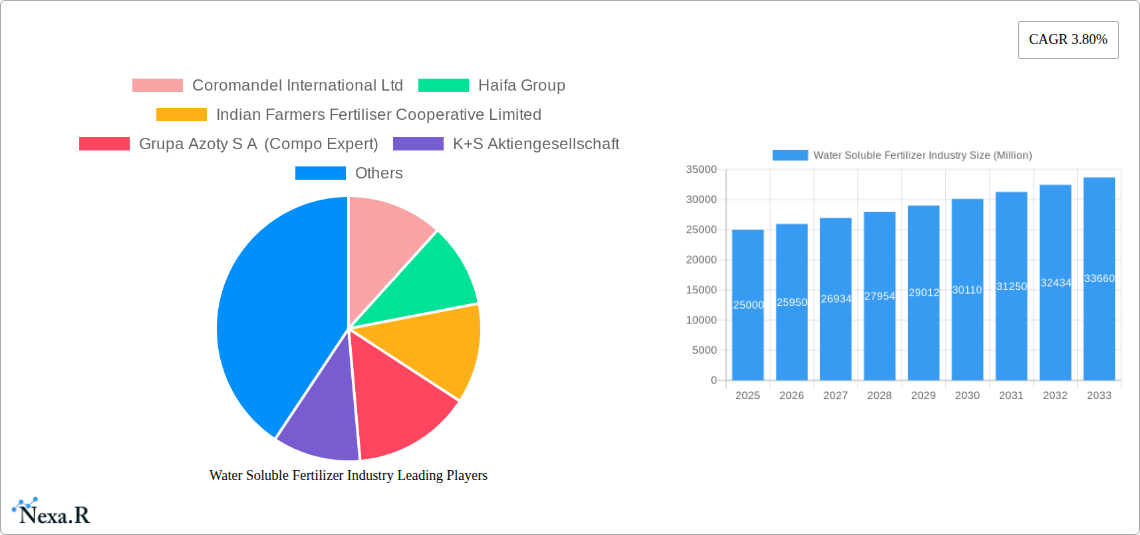

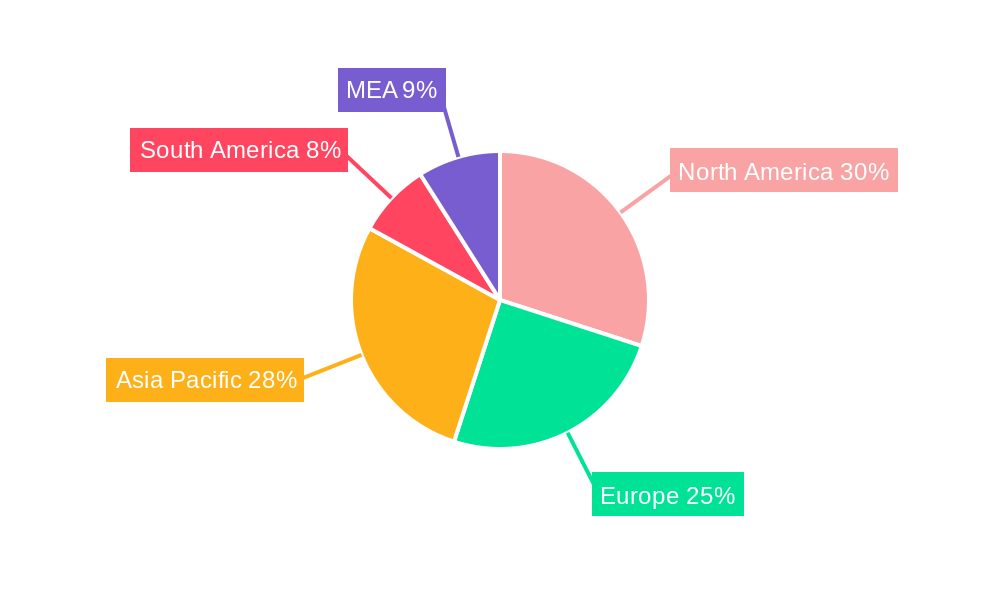

The water-soluble fertilizer market is experiencing robust growth, driven by the increasing demand for high-yielding crops and the rising adoption of precision agriculture techniques. A CAGR of 3.80% from 2019-2033 signifies a steadily expanding market, projected to reach significant value by 2033. Key drivers include the escalating global population requiring enhanced food production, the need for efficient nutrient delivery to plants, and the growing awareness among farmers regarding improved crop yields and reduced environmental impact compared to traditional fertilizers. The market is segmented by application mode (fertigation, foliar), crop type (field crops, horticultural crops, turf & ornamental), and fertilizer type (complex, straight, secondary macronutrients). Fertigation, owing to its precise application and efficient nutrient uptake, is a dominant application mode, while field crops constitute a substantial share of the crop-type segment. The prevalence of complex fertilizers, offering a balanced nutrient profile, further fuels market expansion. Geographic segmentation reveals strong growth across regions, with North America, Europe, and Asia-Pacific leading the market due to advanced agricultural practices and higher fertilizer consumption. However, emerging economies in regions like South America and MEA are also demonstrating significant potential for future growth, fuelled by increasing agricultural activities and government initiatives to enhance agricultural productivity.

Water Soluble Fertilizer Industry Market Size (In Billion)

The market faces certain restraints, primarily involving fluctuating raw material prices impacting production costs and the environmental concerns associated with improper fertilizer application. However, technological advancements such as controlled-release fertilizers and precision application technologies are mitigating these challenges. Major players like Coromandel International Ltd, Haifa Group, and Yara International AS are strategically investing in research and development to enhance product offerings, expand market reach, and strengthen their market positions. Competition is intense, with companies focusing on product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge. The future outlook for the water-soluble fertilizer market remains positive, driven by sustained demand, technological advancements, and favorable government policies promoting sustainable agricultural practices. Market expansion is expected to be particularly strong in developing countries witnessing rapid agricultural growth and increased adoption of modern farming techniques.

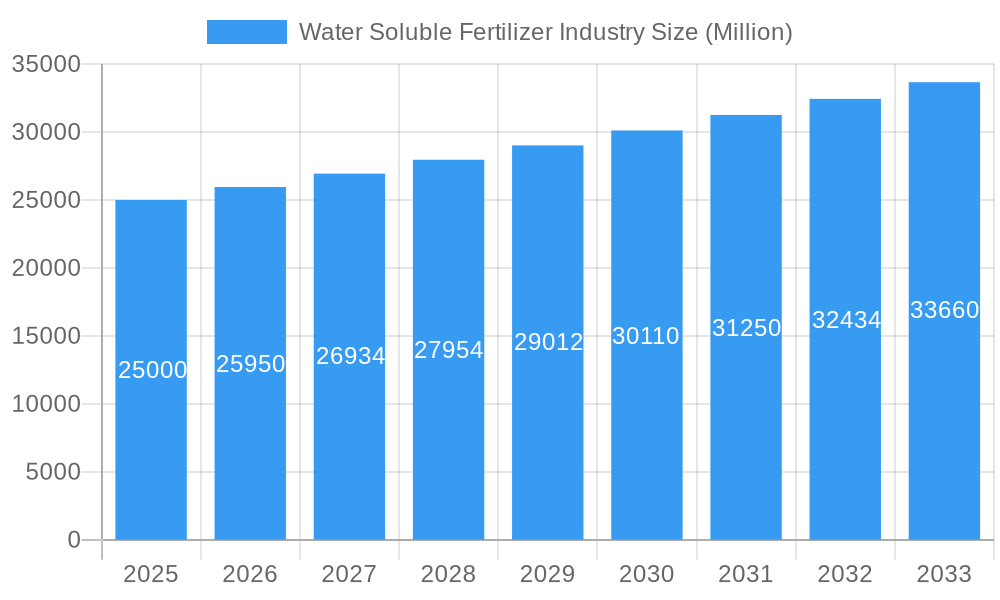

Water Soluble Fertilizer Industry Company Market Share

This comprehensive report provides an in-depth analysis of the water soluble fertilizer industry, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and stakeholders seeking to understand this dynamic market and capitalize on emerging opportunities. The report analyzes parent markets (fertilizers) and child markets (fertigation, foliar application, specific crop types) to provide a complete picture.

Water Soluble Fertilizer Industry Market Dynamics & Structure

The water soluble fertilizer market is characterized by a moderately concentrated structure, with key players like Coromandel International Ltd, Haifa Group, Indian Farmers Fertiliser Cooperative Limited, Grupa Azoty S A (Compo Expert), K+S Aktiengesellschaft, Yara International AS, ICL Group Ltd, BMS Micro-Nutrients NV, and Sociedad Quimica y Minera de Chile SA holding significant market share. Market concentration is influenced by factors like economies of scale in production and distribution, as well as the significant capital investments required for R&D and innovation. Technological innovation, driven by the need for higher efficiency and precision in fertilizer application, is a key driver.

- Market Concentration: xx% held by top 5 players in 2024 (estimated).

- Technological Innovation: Focus on controlled-release formulations, nanotechnology for enhanced nutrient uptake, and precision agriculture techniques.

- Regulatory Frameworks: Varying regulations across regions impacting product registration and environmental compliance. xx% increase in regulatory scrutiny expected by 2033.

- Competitive Product Substitutes: Traditional granular fertilizers, organic fertilizers pose competition, but water soluble fertilizers' efficiency and application versatility offer significant advantages.

- End-User Demographics: Predominantly agricultural producers (field crops, horticultural crops, turf & ornamental), with increasing demand from commercial and industrial growers.

- M&A Trends: Consolidation is expected to increase, driven by expansion goals and access to new technologies and markets. xx number of M&A deals in the fertilizer sector were recorded from 2019-2024.

Water Soluble Fertilizer Industry Growth Trends & Insights

The global water soluble fertilizer market is experiencing robust growth, driven by the increasing demand for high-yielding crops, the adoption of advanced farming practices, and the growing awareness of efficient nutrient management. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). Technological advancements such as improved formulations, controlled-release technologies, and precision application methods are further fueling market expansion. Consumer behavior shifts towards sustainable and efficient agriculture practices are also influencing growth. Adoption rates are increasing rapidly in developed and developing economies due to improved infrastructure and increased farmer awareness.

Dominant Regions, Countries, or Segments in Water Soluble Fertilizer Industry

The market is geographically diverse, with North America, Europe, and Asia-Pacific being the leading regions. Within application modes, fertigation holds the largest market share (xx%), followed by foliar application (xx%). In terms of crop type, field crops constitute a significant segment (xx%), with horticultural crops and turf & ornamental also contributing substantially. Complex fertilizers dominate the type segment (xx%), although the demand for straight and secondary macronutrient fertilizers is increasing.

- Key Drivers: Growing adoption of fertigation and foliar application techniques, rising demand for high-yielding crops in high-value horticulture, and government initiatives promoting efficient fertilizer use.

- Dominance Factors: High agricultural output, favorable climatic conditions, extensive irrigation infrastructure, and supportive government policies.

Water Soluble Fertilizer Industry Product Landscape

Water soluble fertilizers offer a wide range of formulations tailored to specific crop needs and application methods. Product innovation focuses on enhanced nutrient bioavailability, controlled-release technologies, and the inclusion of micronutrients to optimize crop yields. Unique selling propositions include improved nutrient uptake efficiency, reduced environmental impact compared to traditional fertilizers, and the ability to target specific nutrient deficiencies. Technological advancements include the use of nanotechnology and biostimulants to enhance fertilizer performance.

Key Drivers, Barriers & Challenges in Water Soluble Fertilizer Industry

Key Drivers:

- Increasing demand for higher crop yields and improved crop quality.

- Growing adoption of precision agriculture technologies.

- Government initiatives promoting sustainable agricultural practices.

- Rising awareness of efficient nutrient management.

Key Challenges & Restraints:

- Price volatility of raw materials.

- Stringent environmental regulations.

- Competition from traditional fertilizers.

- Supply chain disruptions.

Emerging Opportunities in Water Soluble Fertilizer Industry

- Untapped markets in developing countries with high agricultural potential.

- Growing demand for specialty fertilizers tailored to specific crop needs.

- Development of environmentally friendly and sustainable water soluble fertilizer formulations.

- Expanding application in hydroponics and soilless cultivation.

Growth Accelerators in the Water Soluble Fertilizer Industry Industry

Technological breakthroughs in controlled-release formulations, precision application technologies, and biofertilizers are key growth catalysts. Strategic partnerships between fertilizer manufacturers and agricultural technology companies are also driving innovation. Market expansion strategies focusing on emerging economies and underserved segments are crucial for long-term growth.

Key Players Shaping the Water Soluble Fertilizer Industry Market

- Coromandel International Ltd

- Haifa Group

- Indian Farmers Fertiliser Cooperative Limited

- Grupa Azoty S A (Compo Expert)

- K+S Aktiengesellschaft

- Yara International AS

- ICL Group Ltd

- BMS Micro-Nutrients NV

- Sociedad Quimica y Minera de Chile SA

Notable Milestones in Water Soluble Fertilizer Industry Sector

- April 2023: K+S acquired a 75% share of Industrial Commodities Holdings (Pty) Ltd's fertilizer business, expanding its presence in southern and eastern Africa.

- May 2022: ICL launched three new Solinure NPK formulations with increased trace elements.

- May 2022: ICL signed agreements to supply 600,000 metric tons of potash to India and 700,000 metric tons to China.

In-Depth Water Soluble Fertilizer Industry Market Outlook

The water soluble fertilizer market is poised for continued growth, driven by technological advancements, increasing demand from high-value crops, and supportive government policies. Strategic opportunities exist in developing sustainable formulations, expanding into emerging markets, and fostering collaborations across the agricultural value chain. The market is expected to see further consolidation, with larger players acquiring smaller companies to enhance their market presence and expand their product portfolio. Focus on precision agriculture and digital technologies will be key for future success.

Water Soluble Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Water Soluble Fertilizer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Water Soluble Fertilizer Industry Regional Market Share

Geographic Coverage of Water Soluble Fertilizer Industry

Water Soluble Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Water Soluble Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Coromandel International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haifa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Indian Farmers Fertiliser Cooperative Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Grupa Azoty S A (Compo Expert)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 K+S Aktiengesellschaft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yara International AS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ICL Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BMS Micro-Nutrients NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sociedad Quimica y Minera de Chile SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Coromandel International Ltd

List of Figures

- Figure 1: Global Water Soluble Fertilizer Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Water Soluble Fertilizer Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Water Soluble Fertilizer Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Water Soluble Fertilizer Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Water Soluble Fertilizer Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Water Soluble Fertilizer Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Water Soluble Fertilizer Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Water Soluble Fertilizer Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Water Soluble Fertilizer Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Water Soluble Fertilizer Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Water Soluble Fertilizer Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Water Soluble Fertilizer Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Water Soluble Fertilizer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Water Soluble Fertilizer Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Water Soluble Fertilizer Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Water Soluble Fertilizer Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Water Soluble Fertilizer Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Water Soluble Fertilizer Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Water Soluble Fertilizer Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Water Soluble Fertilizer Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Water Soluble Fertilizer Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Water Soluble Fertilizer Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Water Soluble Fertilizer Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Water Soluble Fertilizer Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Water Soluble Fertilizer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Water Soluble Fertilizer Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Water Soluble Fertilizer Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Water Soluble Fertilizer Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Water Soluble Fertilizer Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Water Soluble Fertilizer Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Water Soluble Fertilizer Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Water Soluble Fertilizer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Water Soluble Fertilizer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Water Soluble Fertilizer Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Water Soluble Fertilizer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Water Soluble Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Water Soluble Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Soluble Fertilizer Industry?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Water Soluble Fertilizer Industry?

Key companies in the market include Coromandel International Ltd, Haifa Group, Indian Farmers Fertiliser Cooperative Limited, Grupa Azoty S A (Compo Expert), K+S Aktiengesellschaft, Yara International AS, ICL Group Ltd, BMS Micro-Nutrients NV, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the Water Soluble Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of South African trading company Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future to be operated in a joint venture, under the name of FertivPty Ltd.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, in 2022 at USD 590 per ton.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water Soluble Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water Soluble Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water Soluble Fertilizer Industry?

To stay informed about further developments, trends, and reports in the Water Soluble Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence