Key Insights

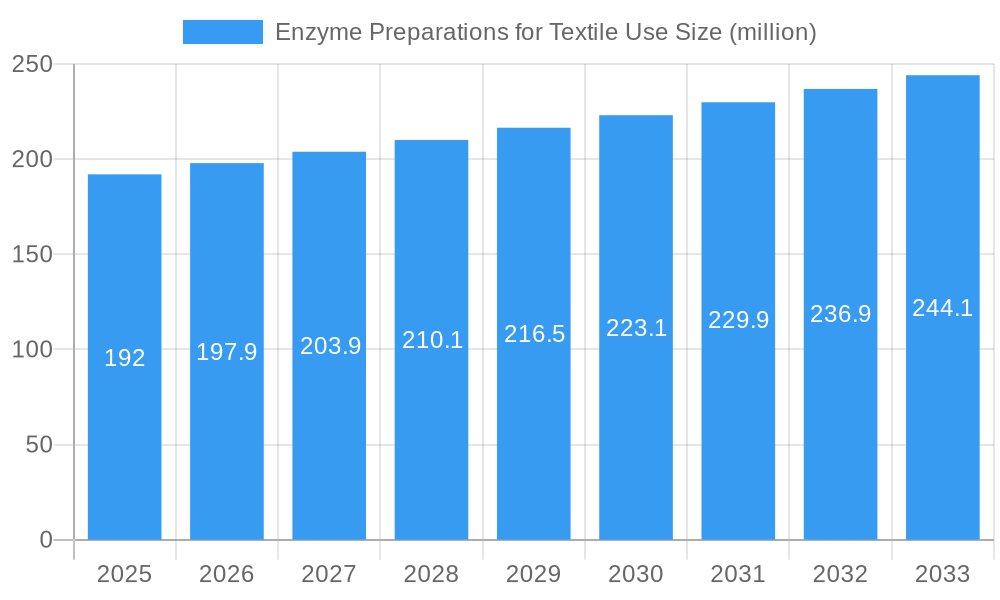

The global enzyme preparations for textile use market is poised for steady growth, projected to reach approximately USD 192 million in 2025 with a Compound Annual Growth Rate (CAGR) of 3.1% extending to 2033. This sustained expansion is primarily fueled by the textile industry's increasing demand for sustainable and eco-friendly processing solutions. Enzymes offer a compelling alternative to harsh chemicals, reducing water consumption, energy usage, and effluent discharge. Key drivers include the growing consumer preference for organically produced textiles and the stringent environmental regulations being implemented worldwide, particularly in developed economies. Furthermore, advancements in enzyme technology, leading to more efficient and specialized enzyme formulations, are opening up new application avenues and improving process economics for textile manufacturers. The biopolishing segment, aimed at enhancing fabric softness and appearance while reducing pilling, is expected to be a significant contributor to market growth.

Enzyme Preparations for Textile Use Market Size (In Million)

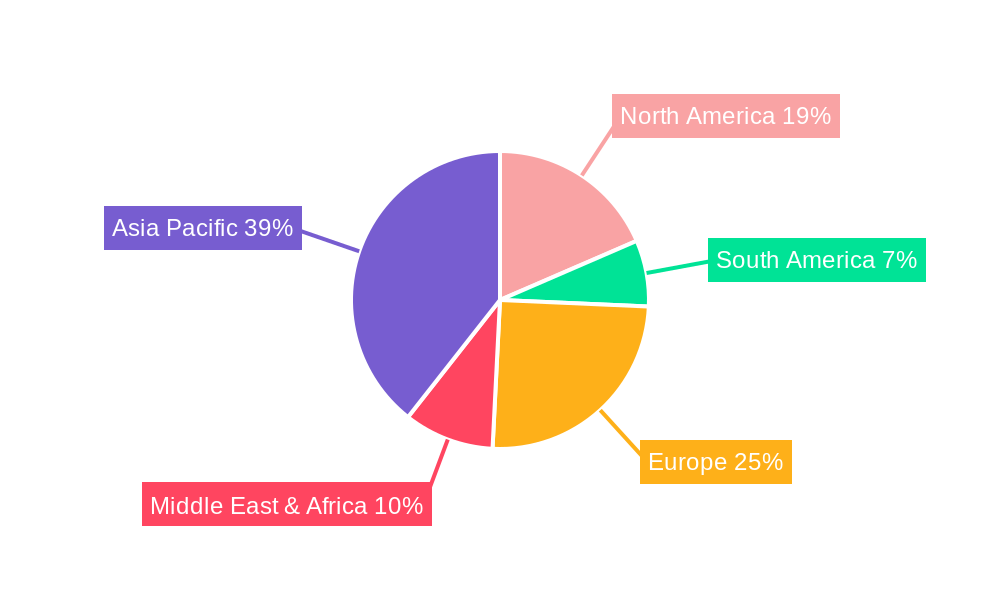

The market is segmented into various enzyme types and applications, with Cellulase and Amylase dominating due to their widespread use in desizing and biopolishing, respectively. The "Others" category for applications, encompassing processes like enzyme bleaching and specialized finishing treatments, is also anticipated to grow as innovation continues. Geographically, the Asia Pacific region, led by China and India, is expected to maintain its position as the largest market due to the region's significant textile manufacturing base and increasing adoption of advanced processing technologies. North America and Europe, driven by sustainability initiatives and technological adoption, will also represent substantial markets. While the market is robust, potential restraints include the fluctuating raw material costs for enzyme production and the initial investment required for integrating enzyme-based processes, which can be a barrier for smaller manufacturers. However, the long-term benefits in terms of cost savings and environmental compliance are expected to outweigh these challenges, ensuring continued market development.

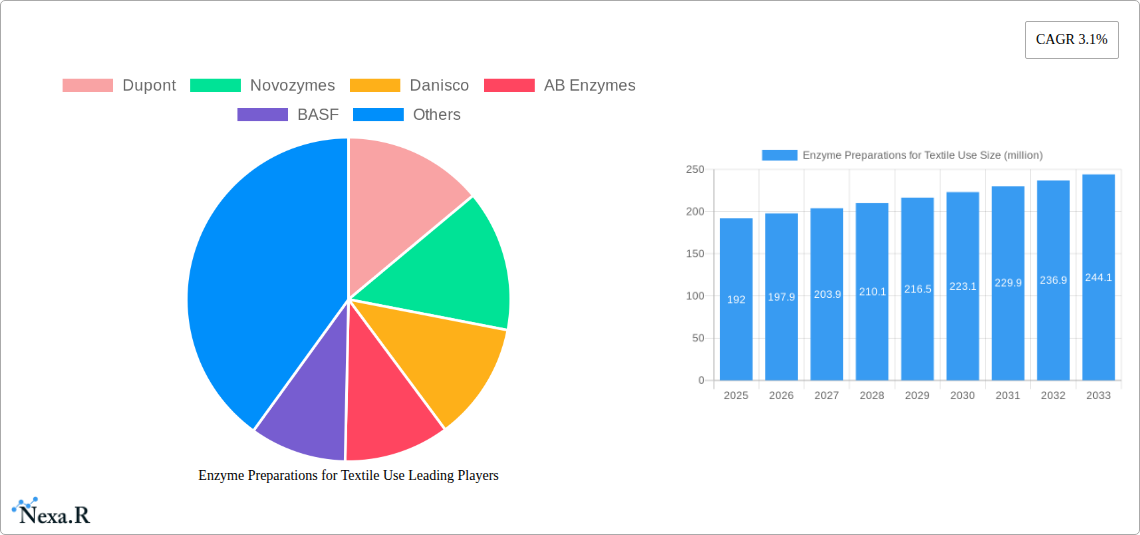

Enzyme Preparations for Textile Use Company Market Share

This report delivers an in-depth analysis of the global Enzyme Preparations for Textile Use Market, a critical segment within the broader Textile Biotechnology and Industrial Enzyme sectors. It forecasts robust growth driven by increasing demand for sustainable textile processing, enhanced fabric quality, and innovative applications. The study encompasses historical data from 2019-2024, a base year of 2025, and projects growth through 2033. With an estimated market size of $650 million in 2025, the report provides critical insights for manufacturers, suppliers, and stakeholders navigating this dynamic landscape.

Enzyme Preparations for Textile Use Market Dynamics & Structure

The Enzyme Preparations for Textile Use Market is characterized by moderate to high concentration, with leading players such as Dupont, Novozymes, Danisco, and AB Enzymes holding significant market share. Technological innovation is a primary driver, focusing on developing enzymes with higher efficiency, specificity, and tolerance to varying processing conditions. Regulatory frameworks, particularly those promoting eco-friendly textile manufacturing, are increasingly influencing product development and adoption. Competitive product substitutes, primarily traditional chemical treatments, are gradually being displaced by the superior sustainability and performance of enzymatic solutions. End-user demographics are shifting towards textile manufacturers prioritizing cost-effectiveness, environmental compliance, and premium fabric finishes. Mergers and acquisitions (M&A) trends are evident as companies seek to expand their product portfolios and geographical reach. For instance, the acquisition of textile enzyme divisions by larger chemical or biotechnology firms has been observed, aiming to integrate advanced enzyme technologies into their existing offerings. The market share of major players in 2024 was estimated at approximately 55%. Barriers to innovation include the high cost of R&D for novel enzyme discovery and the need for extensive validation to meet stringent textile industry standards.

Enzyme Preparations for Textile Use Growth Trends & Insights

The Enzyme Preparations for Textile Use Market is projected to experience substantial growth, driven by a confluence of factors that are reshaping textile manufacturing. The market size, estimated at $650 million in the base year of 2025, is expected to ascend significantly throughout the forecast period, with an anticipated Compound Annual Growth Rate (CAGR) of 7.8%. This growth trajectory is underpinned by the increasing adoption of enzymatic processes across various textile applications, replacing harsh chemical treatments with more sustainable and efficient alternatives. For instance, the adoption rate for biopolishing using cellulases has surged by over 15% in the last three years alone, as brands and manufacturers respond to consumer demand for softer, pilled-free fabrics. Technological disruptions, such as the development of highly specific enzymes for targeted functionalities like color fastness enhancement or stain removal, are further fueling market penetration. Consumer behavior shifts, characterized by a growing preference for eco-conscious products and transparency in supply chains, are compelling textile producers to embrace greener processing methods. This has led to a market penetration of enzymatic solutions for desizing and bleaching reaching approximately 40% and 30% respectively in developed economies. The increasing awareness of the environmental impact of traditional textile chemicals, coupled with stringent environmental regulations in key markets like Europe and North America, is a major catalyst. Furthermore, advancements in enzyme immobilization techniques and downstream processing are improving the cost-effectiveness and reusability of enzymes, making them more attractive for large-scale industrial applications. The exploration of novel enzyme sources and genetic engineering to enhance enzyme performance and broaden their applicability in challenging textile substrates will also play a pivotal role in market expansion.

Dominant Regions, Countries, or Segments in Enzyme Preparations for Textile Use

The Application segment of Biopolishing is emerging as a dominant driver within the Enzyme Preparations for Textile Use Market. In 2025, Biopolishing is estimated to command a market share of approximately 35%, driven by its crucial role in enhancing fabric aesthetics and longevity, particularly for cotton and its blends. Key drivers for this dominance include the growing demand for premium apparel with superior hand-feel and reduced pilling, a trend amplified by fashion-conscious consumers and the athleisure wear market. Economic policies in major textile-producing regions that encourage sustainable manufacturing practices also bolster the adoption of biopolishing enzymes. For instance, government incentives for eco-friendly textile processing in countries like Bangladesh and Vietnam are indirectly promoting enzymatic solutions.

Within the Types of enzyme preparations, Cellulase is the leading segment, projected to hold a significant market share in 2025. Cellulases are indispensable for biopolishing, denim finishing, and bio-stonewashing, applications experiencing robust demand. The growth potential for cellulases is further fueled by ongoing research into developing genetically modified cellulase variants with enhanced activity at lower temperatures and pH levels, thereby reducing energy consumption and improving processing efficiency.

Geographically, Asia-Pacific is the dominant region in the Enzyme Preparations for Textile Use Market. The region's status as a global textile manufacturing hub, coupled with its large domestic markets and increasing focus on upgrading production processes, positions it for continued leadership. Countries like China, India, and Bangladesh are experiencing substantial growth in the adoption of enzyme-based textile treatments due to the presence of a large manufacturing base and growing environmental awareness. The infrastructure development in these regions, supporting advanced textile production facilities, further accentuates this dominance. The market share for Asia-Pacific in 2025 is estimated at 48%.

Enzyme Preparations for Textile Use Product Landscape

The product landscape for Enzyme Preparations for Textile Use is marked by continuous innovation in developing highly specific and efficient enzymatic solutions. Innovations focus on enzymes tailored for distinct textile applications, including cellulases for biopolishing and denim finishing, amylases for desizing, and catalases for peroxide removal post-bleaching. Performance metrics are increasingly stringent, with an emphasis on reduced water consumption, lower energy requirements, and improved fabric quality. Unique selling propositions revolve around eco-friendliness, biodegradability, and the ability to achieve superior finishes compared to traditional chemical methods. Technological advancements include the development of multi-enzyme systems for synergistic effects and enzymes engineered for greater stability and reusability, driving cost-effectiveness for textile manufacturers.

Key Drivers, Barriers & Challenges in Enzyme Preparations for Textile Use

Key Drivers:

- Sustainability Mandates: Growing global pressure for eco-friendly manufacturing processes, driven by consumer demand and regulatory frameworks, is a primary accelerator.

- Enhanced Fabric Quality: The ability of enzymes to improve fabric feel, appearance, and durability, such as reducing pilling and creating unique denim finishes, is a strong market pull.

- Cost-Effectiveness: While initial investment can be higher, the long-term benefits of reduced water, energy, and chemical consumption make enzymes cost-effective.

- Technological Advancements: Continuous R&D leading to more efficient, specific, and stable enzyme formulations.

Barriers & Challenges:

- Initial Investment Cost: The upfront cost of enzymatic processing equipment and enzyme formulations can be a deterrent for some smaller manufacturers.

- Technical Expertise: A need for skilled personnel to effectively manage and optimize enzymatic processes.

- Variability in Natural Fibers: The inherent variability in natural fibers can sometimes pose challenges for consistent enzymatic performance.

- Supply Chain Disruptions: Potential for disruptions in the supply of raw materials for enzyme production and the logistics of enzyme delivery, impacting an estimated 15% of global supply chains.

- Regulatory Hurdles for New Enzyme Strains: Obtaining regulatory approval for novel enzyme strains can be a time-consuming process.

Emerging Opportunities in Enzyme Preparations for Textile Use

Emerging opportunities lie in the development of enzymes for niche textile applications, such as advanced functional finishes for smart textiles and performance wear. The untapped potential in developing regions with rapidly expanding textile industries presents significant growth avenues. Innovations in enzyme recycling and immobilization technologies offer the prospect of further reducing processing costs and enhancing sustainability. Evolving consumer preferences for personalized and sustainable fashion also create a demand for specialized enzymatic treatments that can achieve unique aesthetic effects. The integration of enzyme technology with digital process control systems for optimized application is another key emerging area.

Growth Accelerators in the Enzyme Preparations for Textile Use Industry

Long-term growth in the Enzyme Preparations for Textile Use Industry will be significantly accelerated by breakthroughs in synthetic biology and genetic engineering, enabling the design of tailor-made enzymes with unprecedented efficiency and specificity. Strategic partnerships between enzyme manufacturers and leading textile brands will foster innovation and drive market adoption by creating demand for sustainable solutions. Furthermore, market expansion strategies focusing on educating smaller and medium-sized enterprises (SMEs) about the benefits and implementation of enzymatic processes will unlock new customer segments. The development of biodegradable enzyme carriers and novel delivery systems will also contribute to sustained growth.

Key Players Shaping the Enzyme Preparations for Textile Use Market

- Dupont

- Novozymes

- Danisco

- AB Enzymes

- BASF

- VTR

- ENZYMES.BIO

- Infinita Biotech

- SunHY

- Sunson

- Lumis

- Jiangyin BSDZYME

- Buckman

- Refnol Resins & Chemicals

- Aum Enzymes

- Advanced Enzyme Technologies

- Maps Enzymes

- Zytex Biotech

Notable Milestones in Enzyme Preparations for Textile Use Sector

- 2019: Launch of a new generation of highly stable cellulases for denim finishing, offering improved wash-down effects and reduced processing time.

- 2020: Introduction of a novel enzymatic desizing agent with enhanced compatibility with various sizing materials, leading to cleaner fabrics and reduced effluent load.

- 2021: Expansion of Novozymes' textile enzyme portfolio to include solutions for advanced bio-scouring and bio-bleaching, further promoting sustainable cotton processing.

- 2022: Increased investment in R&D by major players focusing on enzymes for functional textiles, such as water-repellent or antimicrobial finishes.

- 2023: Significant growth in the adoption of enzyme-based solutions for biopolishing in the fast-fashion sector due to demand for premium feel and reduced environmental impact.

- 2024: Emergence of more bio-based enzyme production platforms, aiming to reduce the carbon footprint associated with enzyme manufacturing.

In-Depth Enzyme Preparations for Textile Use Market Outlook

The future outlook for the Enzyme Preparations for Textile Use Market is exceptionally promising. Growth accelerators such as advancements in bioengineering, the increasing global emphasis on circular economy principles in manufacturing, and the continuous demand for high-performance, eco-friendly textiles will propel market expansion. Strategic collaborations between technology providers, textile manufacturers, and fashion brands will be instrumental in driving widespread adoption. The market is poised to witness innovation in areas like enzyme-assisted dyeing, waste valorization in textiles, and personalized fabric treatments, creating significant strategic opportunities for early adopters and agile market players.

Enzyme Preparations for Textile Use Segmentation

-

1. Application

- 1.1. Biopolishing

- 1.2. Desizing

- 1.3. Enzyme Bleaching

- 1.4. Others

-

2. Types

- 2.1. Cellulase

- 2.2. Amylase

- 2.3. Catalase

- 2.4. Pectinase

- 2.5. Others

Enzyme Preparations for Textile Use Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enzyme Preparations for Textile Use Regional Market Share

Geographic Coverage of Enzyme Preparations for Textile Use

Enzyme Preparations for Textile Use REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biopolishing

- 5.1.2. Desizing

- 5.1.3. Enzyme Bleaching

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cellulase

- 5.2.2. Amylase

- 5.2.3. Catalase

- 5.2.4. Pectinase

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biopolishing

- 6.1.2. Desizing

- 6.1.3. Enzyme Bleaching

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cellulase

- 6.2.2. Amylase

- 6.2.3. Catalase

- 6.2.4. Pectinase

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biopolishing

- 7.1.2. Desizing

- 7.1.3. Enzyme Bleaching

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cellulase

- 7.2.2. Amylase

- 7.2.3. Catalase

- 7.2.4. Pectinase

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biopolishing

- 8.1.2. Desizing

- 8.1.3. Enzyme Bleaching

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cellulase

- 8.2.2. Amylase

- 8.2.3. Catalase

- 8.2.4. Pectinase

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biopolishing

- 9.1.2. Desizing

- 9.1.3. Enzyme Bleaching

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cellulase

- 9.2.2. Amylase

- 9.2.3. Catalase

- 9.2.4. Pectinase

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Enzyme Preparations for Textile Use Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biopolishing

- 10.1.2. Desizing

- 10.1.3. Enzyme Bleaching

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cellulase

- 10.2.2. Amylase

- 10.2.3. Catalase

- 10.2.4. Pectinase

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dupont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novozymes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Danisco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AB Enzymes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VTR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ENZYMES.BIO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Infinita Biotech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SunHY

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sunson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lumis

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jiangyin BSDZYME

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Buckman

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Refnol Resins & Chemicals

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aum Enzymes

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Advanced Enzyme Technologies

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Maps Enzymes

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Zytex Biotech

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Dupont

List of Figures

- Figure 1: Global Enzyme Preparations for Textile Use Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Enzyme Preparations for Textile Use Revenue (million), by Application 2025 & 2033

- Figure 3: North America Enzyme Preparations for Textile Use Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Enzyme Preparations for Textile Use Revenue (million), by Types 2025 & 2033

- Figure 5: North America Enzyme Preparations for Textile Use Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Enzyme Preparations for Textile Use Revenue (million), by Country 2025 & 2033

- Figure 7: North America Enzyme Preparations for Textile Use Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Enzyme Preparations for Textile Use Revenue (million), by Application 2025 & 2033

- Figure 9: South America Enzyme Preparations for Textile Use Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Enzyme Preparations for Textile Use Revenue (million), by Types 2025 & 2033

- Figure 11: South America Enzyme Preparations for Textile Use Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Enzyme Preparations for Textile Use Revenue (million), by Country 2025 & 2033

- Figure 13: South America Enzyme Preparations for Textile Use Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Enzyme Preparations for Textile Use Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Enzyme Preparations for Textile Use Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Enzyme Preparations for Textile Use Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Enzyme Preparations for Textile Use Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Enzyme Preparations for Textile Use Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Enzyme Preparations for Textile Use Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Enzyme Preparations for Textile Use Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Enzyme Preparations for Textile Use Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Enzyme Preparations for Textile Use Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Enzyme Preparations for Textile Use Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Enzyme Preparations for Textile Use Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Enzyme Preparations for Textile Use Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Enzyme Preparations for Textile Use Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Enzyme Preparations for Textile Use Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Enzyme Preparations for Textile Use Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Enzyme Preparations for Textile Use Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Enzyme Preparations for Textile Use Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Enzyme Preparations for Textile Use Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Enzyme Preparations for Textile Use Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Enzyme Preparations for Textile Use Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enzyme Preparations for Textile Use?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Enzyme Preparations for Textile Use?

Key companies in the market include Dupont, Novozymes, Danisco, AB Enzymes, BASF, VTR, ENZYMES.BIO, Infinita Biotech, SunHY, Sunson, Lumis, Jiangyin BSDZYME, Buckman, Refnol Resins & Chemicals, Aum Enzymes, Advanced Enzyme Technologies, Maps Enzymes, Zytex Biotech.

3. What are the main segments of the Enzyme Preparations for Textile Use?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 192 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enzyme Preparations for Textile Use," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enzyme Preparations for Textile Use report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enzyme Preparations for Textile Use?

To stay informed about further developments, trends, and reports in the Enzyme Preparations for Textile Use, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence