Key Insights

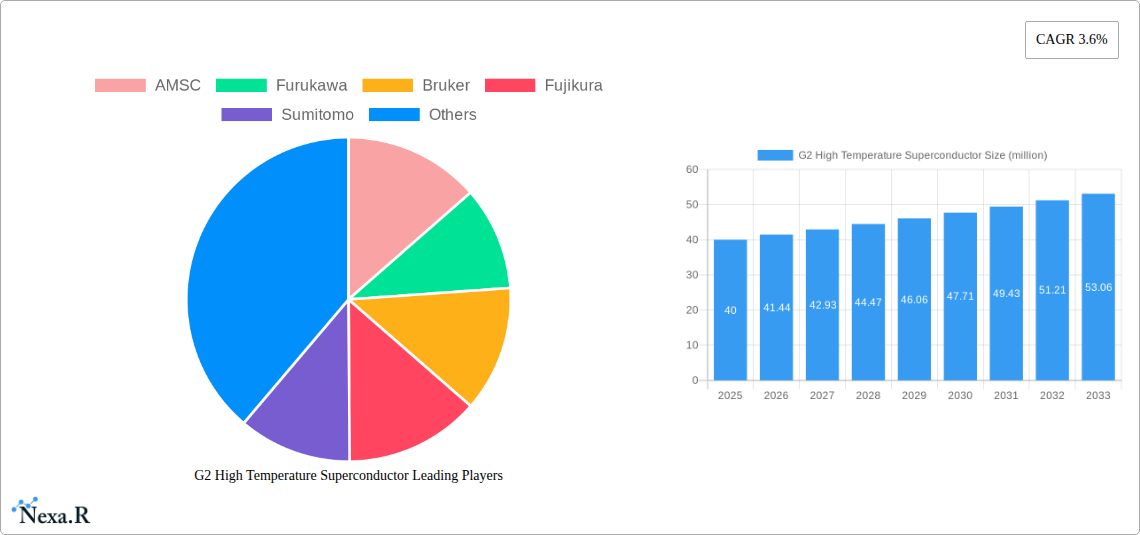

The Global G2 High Temperature Superconductor market is poised for robust growth, projected to reach an estimated $40 million by 2025 and expand at a compound annual growth rate (CAGR) of 3.6% through 2033. This upward trajectory is underpinned by significant advancements in superconducting materials and an increasing demand for high-performance solutions across critical sectors. The primary drivers fueling this expansion include the burgeoning adoption of electric vehicles, where lightweight and efficient superconducting components can revolutionize power transmission and energy storage. Furthermore, the medical equipment sector is increasingly leveraging HTS technology for advanced imaging systems like MRI machines, promising higher resolution and faster scan times. Industrial applications, including high-field magnets for particle accelerators and fusion research, also represent a substantial growth avenue, pushing the boundaries of scientific exploration and industrial processes.

G2 High Temperature Superconductor Market Size (In Million)

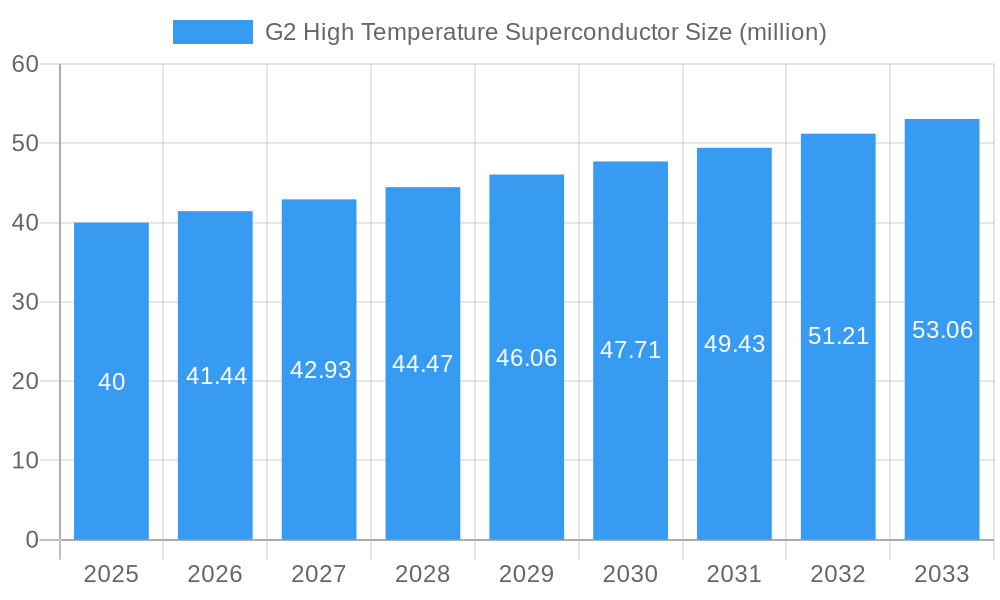

The market's evolution is characterized by a strong trend towards the widespread adoption of ReBCO (Rare-earth Barium Copper Oxide) superconductors, which offer superior performance characteristics and ease of manufacturing compared to older generations. This technological progression is enabling new applications and improving the efficiency and reliability of existing ones. However, challenges such as the high initial cost of superconducting materials and the need for sophisticated cryogenic cooling systems remain as key restraints. Despite these hurdles, ongoing research and development, coupled with economies of scale, are expected to gradually mitigate these cost barriers. The competitive landscape features key players like AMSC, Furukawa, and Bruker, actively investing in innovation and strategic partnerships to capture market share across diverse applications and rapidly developing regional markets such as Asia Pacific, driven by strong manufacturing capabilities and growing technological adoption.

G2 High Temperature Superconductor Company Market Share

G2 High Temperature Superconductor Market Report: Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive G2 High Temperature Superconductor market report delves into the intricate dynamics, robust growth trajectory, and future potential of this transformative technology. Analyzing key market segments, dominant regions, and influential players, this report provides invaluable insights for industry stakeholders seeking to navigate and capitalize on the evolving superconductor landscape. The study encompasses a detailed examination of the market from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025 to 2033, incorporating historical data from 2019 to 2024.

G2 High Temperature Superconductor Market Dynamics & Structure

The G2 High Temperature Superconductor (HTS) market exhibits a moderately concentrated structure, with a few key players dominating innovation and production. Technological innovation serves as a primary driver, pushing the boundaries of critical temperature, magnetic field tolerance, and current carrying capacity. Regulatory frameworks are progressively evolving to support the adoption of superconducting technologies, particularly in energy and medical applications, albeit with regional variations. Competitive product substitutes, while present in niche areas, struggle to match the performance advantages offered by HTS materials in high-demand applications. End-user demographics are shifting towards sectors requiring high efficiency and compact solutions. Mergers and acquisitions (M&A) are notable, reflecting consolidation and strategic investment in advanced materials science.

- Market Concentration: A significant portion of the HTS market share is held by leading manufacturers, indicating strong R&D investment and established production capabilities.

- Technological Innovation Drivers: Advancements in material science, such as improved fabrication techniques for REBCO (Rare-earth Barium Copper Oxide) tapes, are crucial for performance enhancements.

- Regulatory Frameworks: Government incentives and standards for energy efficiency and medical imaging are indirectly supporting HTS adoption.

- Competitive Product Substitutes: High-performance conventional conductors and emerging advanced materials present indirect competition, but often lack the power density and energy savings of HTS.

- End-User Demographics: Growth is fueled by sectors like electric power transmission, fusion energy, and advanced medical diagnostics.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies seek to secure intellectual property and expand their product portfolios.

G2 High Temperature Superconductor Growth Trends & Insights

The G2 High Temperature Superconductor market is poised for robust and sustained growth, driven by an escalating demand for energy efficiency, advanced medical diagnostics, and novel industrial applications. The market size is projected to witness a significant upward trajectory, fueled by increasing adoption rates across diverse sectors. Technological disruptions, particularly in the development of cost-effective and scalable HTS wire manufacturing, are pivotal in accelerating this growth. Consumer behavior shifts are also playing a role, with a growing emphasis on performance, reliability, and reduced environmental impact, all of which are core advantages of HTS technology. The integration of advanced materials into existing infrastructure and the development of entirely new superconducting applications are expected to redefine energy transmission, power storage, and scientific instrumentation.

- Market Size Evolution: The global market for G2 High Temperature Superconductors is anticipated to expand from an estimated $3,500 million in 2025 to over $12,000 million by 2033, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of approximately 16%.

- Adoption Rates: Adoption rates are accelerating, particularly in the power sector for grid stabilization and energy transmission, and in the medical sector for next-generation MRI machines.

- Technological Disruptions: Breakthroughs in material deposition techniques and the development of new HTS compositions are lowering manufacturing costs and improving performance characteristics.

- Consumer Behavior Shifts: Increasing awareness of energy conservation, the need for compact and powerful medical devices, and the pursuit of enhanced scientific research capabilities are driving demand.

- Market Penetration: While still in its nascent stages for some applications, market penetration is expected to deepen significantly as cost efficiencies improve and reliability is proven in large-scale deployments.

- Parent Market Influence: The overarching demand for advanced materials and energy-efficient solutions within the broader materials and energy sectors acts as a significant parent market driver.

- Child Market Opportunities: Emerging applications in areas like electric aviation, advanced particle accelerators, and high-speed rail present substantial child market growth potential.

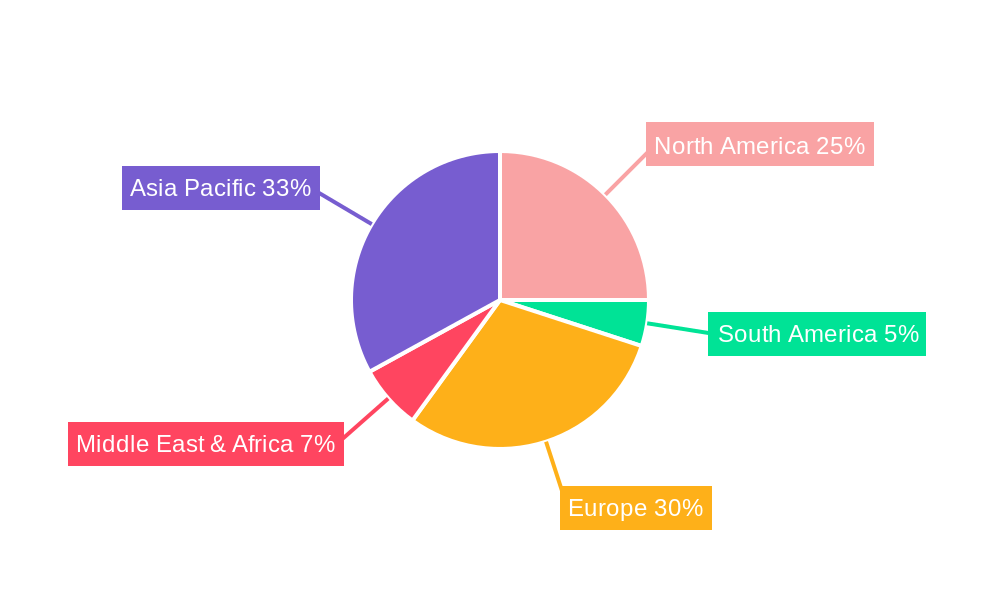

Dominant Regions, Countries, or Segments in G2 High Temperature Superconductor

The Electric Equipment segment, particularly within the Application categorization, stands out as the dominant force propelling the G2 High Temperature Superconductor market forward. This dominance is primarily attributed to the urgent global need for more efficient and reliable power grids. Regions with advanced technological infrastructure and substantial investments in energy modernization are leading this growth. Among countries, Japan and South Korea have historically been at the forefront of superconductor research and development, with significant contributions from companies like Furukawa Electric and Sumitomo Electric. However, the United States is increasingly asserting its influence through substantial government funding for fusion energy and advanced grid projects.

The ReBCO (Rare-earth Barium Copper Oxide) type of high-temperature superconductor is the prevailing technology driving these advancements, owing to its superior performance characteristics at accessible cryogenic temperatures. The parent market for electric equipment is vast, encompassing everything from power generation and transmission to distribution and end-user appliances. The growth of this segment directly translates to increased demand for HTS solutions that can handle higher currents, reduce energy loss, and enable more compact designs for transformers, fault current limiters, and superconducting generators.

- Dominant Segment: Electric Equipment, driven by applications in power transmission and distribution, superconducting generators, and fault current limiters.

- Key Drivers in Electric Equipment:

- Grid Modernization: The necessity to upgrade aging power grids and enhance their resilience against disruptions.

- Energy Efficiency: Reduction of transmission losses, leading to significant cost savings and environmental benefits.

- Compact Designs: Enabling smaller, lighter, and more powerful electrical components for improved space utilization.

- Increased Power Capacity: Facilitating the transmission of larger amounts of power over existing infrastructure.

- Dominant Type: ReBCO (Rare-earth Barium Copper Oxide) superconductors, offering superior performance for demanding applications.

- Leading Regions: North America and Asia-Pacific, with strong R&D capabilities and significant investments in energy infrastructure.

- Influential Countries: Japan, South Korea, and the United States are key players in innovation and market adoption.

- Market Share (Electric Equipment): Estimated to hold over 50% of the total HTS market share, projected to grow steadily.

- Growth Potential (Electric Equipment): High, driven by ongoing investments in smart grids and renewable energy integration.

- Parent Market Impact: The massive global market for electrical infrastructure directly influences the demand for advanced materials like HTS.

- Child Market Development: The success in electric equipment is paving the way for expanded use in other areas like electric propulsion and advanced computing.

G2 High Temperature Superconductor Product Landscape

The G2 High Temperature Superconductor product landscape is characterized by continuous innovation in material synthesis and fabrication, leading to enhanced performance metrics. ReBCO tapes, offering high critical current densities and magnetic field resilience, are at the forefront. These products are finding increasing application in high-field magnets for MRI and NMR, superconducting power cables for efficient energy transmission, and components for fusion reactors. Unique selling propositions include superior energy efficiency, significantly reduced thermal losses compared to conventional conductors, and the ability to generate extremely powerful magnetic fields in compact volumes. Technological advancements focus on reducing manufacturing costs, improving uniformity, and developing flexible and durable superconducting wires.

Key Drivers, Barriers & Challenges in G2 High Temperature Superconductor

Key Drivers: The G2 High Temperature Superconductor market is propelled by the relentless pursuit of energy efficiency and the demand for high-performance applications. Technological advancements in material science, particularly in the cost-effective production of ReBCO tapes, are a primary growth accelerator. Government initiatives supporting research and development in superconductivity, coupled with the need for advanced solutions in sectors like renewable energy integration and fusion power, further fuel market expansion.

Barriers & Challenges: Despite its potential, the HTS market faces significant challenges. High manufacturing costs remain a primary barrier to widespread adoption, particularly for large-scale infrastructure projects. The complex supply chain for rare earth elements and other critical materials can also lead to price volatility and availability issues. Developing standardized testing and certification protocols for HTS components is an ongoing process. Furthermore, the specialized knowledge and infrastructure required for designing, installing, and maintaining superconducting systems present a challenge for market penetration.

Emerging Opportunities in G2 High Temperature Superconductor

Emerging opportunities in the G2 High Temperature Superconductor sector lie in the development of superconductivity for electric aviation, advanced energy storage solutions, and next-generation scientific instrumentation. The miniaturization of superconducting magnets opens doors for portable medical devices and more powerful and compact research tools. Furthermore, the increasing focus on sustainability and decarbonization creates a fertile ground for HTS applications in areas like carbon capture and advanced propulsion systems. Untapped markets in developing economies with rapidly growing energy demands also present significant potential.

Growth Accelerators in the G2 High Temperature Superconductor Industry

Growth accelerators in the G2 High Temperature Superconductor industry include continued investment in R&D, fostering breakthroughs in material properties and manufacturing processes. Strategic partnerships between material suppliers, component manufacturers, and end-users are crucial for accelerating the adoption cycle and driving down costs. Market expansion strategies, particularly in the renewable energy sector for grid stabilization and energy storage, will be pivotal. The development of pilot projects and demonstration initiatives showcasing the tangible benefits of HTS technology will further catalyze widespread adoption and investment.

Key Players Shaping the G2 High Temperature Superconductor Market

- AMSC

- Furukawa

- Bruker

- Fujikura

- Sumitomo

- SuNam

- SHSC

- Innost

- THEVA

- STI

Notable Milestones in G2 High Temperature Superconductor Sector

- 2019: Continued advancements in ReBCO tape uniformity and performance by key manufacturers, leading to improved reliability in applications.

- 2020: Increased government funding for fusion energy research, with superconductivity playing a critical role in magnet development.

- 2021: Successful demonstrations of HTS power cables in urban environments, showcasing reduced energy losses and increased capacity.

- 2022: Breakthroughs in low-cost fabrication techniques for HTS wires, bringing them closer to price parity with conventional conductors in certain applications.

- 2023: Growing interest and early-stage development in HTS-based electric propulsion systems for aerospace and maritime applications.

- 2024: Enhanced development and adoption of HTS magnets for next-generation medical imaging equipment, offering higher resolution and faster scan times.

In-Depth G2 High Temperature Superconductor Market Outlook

The future outlook for the G2 High Temperature Superconductor market is exceptionally bright, driven by a confluence of technological innovation and global demand for advanced, efficient solutions. Key growth accelerators, including ongoing R&D advancements and strategic market expansion initiatives, will continue to shape the industry. The increasing integration of HTS into critical infrastructure, such as modernized power grids and advanced scientific research facilities, will solidify its position as a transformative technology. Strategic partnerships and the development of compelling pilot projects will further unlock market potential, ensuring sustained growth and paving the way for groundbreaking applications across diverse sectors. The market is expected to witness continued expansion, driven by both evolutionary improvements in existing applications and revolutionary new uses of superconducting technology.

G2 High Temperature Superconductor Segmentation

-

1. Application

- 1.1. Electric Equipment

- 1.2. Medical Equipment

- 1.3. Industrial Equipment

- 1.4. Others

-

2. Types

- 2.1. ReBCO

- 2.2. Others

G2 High Temperature Superconductor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

G2 High Temperature Superconductor Regional Market Share

Geographic Coverage of G2 High Temperature Superconductor

G2 High Temperature Superconductor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electric Equipment

- 5.1.2. Medical Equipment

- 5.1.3. Industrial Equipment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. ReBCO

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electric Equipment

- 6.1.2. Medical Equipment

- 6.1.3. Industrial Equipment

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. ReBCO

- 6.2.2. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electric Equipment

- 7.1.2. Medical Equipment

- 7.1.3. Industrial Equipment

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. ReBCO

- 7.2.2. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electric Equipment

- 8.1.2. Medical Equipment

- 8.1.3. Industrial Equipment

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. ReBCO

- 8.2.2. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electric Equipment

- 9.1.2. Medical Equipment

- 9.1.3. Industrial Equipment

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. ReBCO

- 9.2.2. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific G2 High Temperature Superconductor Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electric Equipment

- 10.1.2. Medical Equipment

- 10.1.3. Industrial Equipment

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. ReBCO

- 10.2.2. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AMSC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Furukawa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bruker

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujikura

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sumitomo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SuNam

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SHSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Innost

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 THEVA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AMSC

List of Figures

- Figure 1: Global G2 High Temperature Superconductor Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America G2 High Temperature Superconductor Revenue (million), by Application 2025 & 2033

- Figure 3: North America G2 High Temperature Superconductor Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America G2 High Temperature Superconductor Revenue (million), by Types 2025 & 2033

- Figure 5: North America G2 High Temperature Superconductor Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America G2 High Temperature Superconductor Revenue (million), by Country 2025 & 2033

- Figure 7: North America G2 High Temperature Superconductor Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America G2 High Temperature Superconductor Revenue (million), by Application 2025 & 2033

- Figure 9: South America G2 High Temperature Superconductor Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America G2 High Temperature Superconductor Revenue (million), by Types 2025 & 2033

- Figure 11: South America G2 High Temperature Superconductor Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America G2 High Temperature Superconductor Revenue (million), by Country 2025 & 2033

- Figure 13: South America G2 High Temperature Superconductor Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe G2 High Temperature Superconductor Revenue (million), by Application 2025 & 2033

- Figure 15: Europe G2 High Temperature Superconductor Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe G2 High Temperature Superconductor Revenue (million), by Types 2025 & 2033

- Figure 17: Europe G2 High Temperature Superconductor Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe G2 High Temperature Superconductor Revenue (million), by Country 2025 & 2033

- Figure 19: Europe G2 High Temperature Superconductor Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa G2 High Temperature Superconductor Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa G2 High Temperature Superconductor Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa G2 High Temperature Superconductor Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa G2 High Temperature Superconductor Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa G2 High Temperature Superconductor Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa G2 High Temperature Superconductor Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific G2 High Temperature Superconductor Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific G2 High Temperature Superconductor Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific G2 High Temperature Superconductor Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific G2 High Temperature Superconductor Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific G2 High Temperature Superconductor Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific G2 High Temperature Superconductor Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global G2 High Temperature Superconductor Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global G2 High Temperature Superconductor Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global G2 High Temperature Superconductor Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global G2 High Temperature Superconductor Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global G2 High Temperature Superconductor Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global G2 High Temperature Superconductor Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global G2 High Temperature Superconductor Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global G2 High Temperature Superconductor Revenue million Forecast, by Country 2020 & 2033

- Table 40: China G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific G2 High Temperature Superconductor Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the G2 High Temperature Superconductor?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the G2 High Temperature Superconductor?

Key companies in the market include AMSC, Furukawa, Bruker, Fujikura, Sumitomo, SuNam, SHSC, Innost, THEVA, STI.

3. What are the main segments of the G2 High Temperature Superconductor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 40 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "G2 High Temperature Superconductor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the G2 High Temperature Superconductor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the G2 High Temperature Superconductor?

To stay informed about further developments, trends, and reports in the G2 High Temperature Superconductor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence