Key Insights

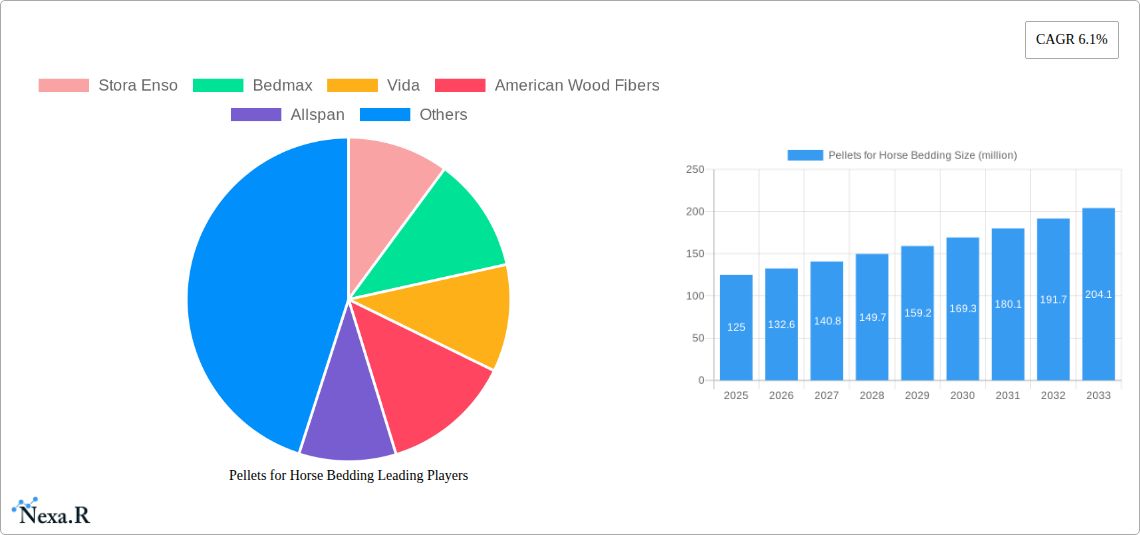

The global market for Pellets for Horse Bedding is poised for robust expansion, projected to reach an estimated market size of $125 million and grow at a Compound Annual Growth Rate (CAGR) of 6.1% during the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing adoption of horse ownership for recreational purposes and professional equestrian activities. As more individuals engage in horse riding and competitive events, the demand for efficient, hygienic, and environmentally friendly bedding solutions naturally escalates. Pellets offer distinct advantages over traditional bedding materials, including superior absorbency, reduced dust content that benefits respiratory health in horses, and easier waste management, making them a preferred choice for both farm owners and equestrian clubs. The focus on animal welfare and sustainable practices within the equine industry further amplifies the market's upward trajectory.

Pellets for Horse Bedding Market Size (In Million)

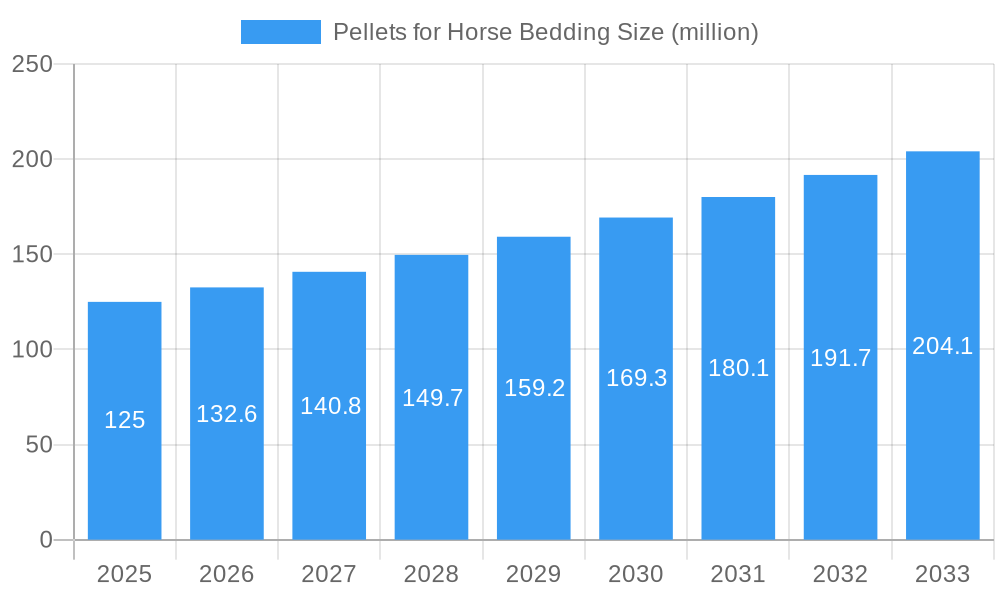

The market's expansion is also influenced by evolving trends such as the development of innovative pellet formulations and improved manufacturing processes that enhance performance and cost-effectiveness. Companies are investing in research and development to create specialized pellet types catering to different horse breeds and stable environments. While the market is experiencing strong growth, potential restraints such as fluctuating raw material prices (primarily wood) and the initial cost perception compared to conventional bedding might present challenges. However, the long-term benefits of reduced labor, lower disposal costs, and improved stall conditions are expected to outweigh these concerns, driving sustained demand. Key players like Stora Enso, Bedmax, and Vida are actively competing through product innovation and strategic market penetration, further shaping the competitive landscape and contributing to the overall market dynamism.

Pellets for Horse Bedding Company Market Share

This in-depth report provides an unparalleled analysis of the global Pellets for Horse Bedding market, meticulously covering its present state, historical performance, and future projections. Designed for industry professionals, investors, and stakeholders, this report offers actionable insights and a competitive edge through a detailed examination of market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, opportunities, and leading players.

Pellets for Horse Bedding Market Dynamics & Structure

The Pellets for Horse Bedding market exhibits a moderately concentrated structure, with key players like Stora Enso, Bedmax, and Vida holding significant influence. Technological innovation is a primary driver, with advancements focusing on absorbency, dust reduction, and environmental sustainability. Regulatory frameworks, while generally supportive, can vary across regions, impacting production standards and material sourcing. Competitive product substitutes, such as straw, shavings, and other natural bedding materials, necessitate continuous product differentiation and value proposition enhancement. End-user demographics are diverse, ranging from individual horse owners to large-scale equestrian facilities, each with distinct purchasing priorities. Mergers and acquisitions (M&A) activity, while not consistently high, has played a role in consolidating market share and expanding geographical reach. For instance, over the historical period (2019-2024), there were approximately 5-8 significant M&A deals valued in the tens of millions of dollars, aimed at acquiring new technologies or expanding distribution networks. Innovation barriers primarily revolve around the cost of advanced manufacturing processes and the need for consistent raw material supply.

- Market Concentration: Moderate, with a few dominant manufacturers.

- Technological Innovation Drivers: Enhanced absorbency, dust control, eco-friendly production.

- Regulatory Frameworks: Influences production standards and raw material sourcing.

- Competitive Substitutes: Straw, shavings, other natural bedding.

- End-User Demographics: Individual owners, equestrian clubs, professional stables.

- M&A Trends: Strategic acquisitions for technology and market expansion.

Pellets for Horse Bedding Growth Trends & Insights

The global Pellets for Horse Bedding market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by an increasing awareness of the benefits of pelletized bedding, including superior absorbency, reduced waste, and improved stall hygiene, leading to higher adoption rates among horse owners and equestrian facilities. The market size, estimated at approximately USD 850 million in the base year of 2025, is expected to grow substantially. Technological disruptions are transforming production methods, with a focus on optimizing pellet density and particle size for maximum efficiency and comfort. Consumer behavior shifts are evident, with a growing preference for sustainable and eco-friendly products, driving demand for bedding derived from responsibly managed forest resources. The penetration of pellet bedding is steadily increasing, particularly in developed equestrian markets where horse welfare and stable management are paramount. The historical period (2019-2024) saw a CAGR of around 4.8%, laying a strong foundation for future growth. The perceived value proposition of reduced labor for mucking out, improved air quality in stables, and easier disposal of waste further contributes to this upward trend. The market is also benefiting from increased participation in equestrian sports and recreational riding globally, translating to a larger base of potential end-users. Innovations in pellet manufacturing, such as advanced drying techniques and binding agents, are enhancing product performance and further solidifying their position as a premium bedding choice. The shift from traditional bedding materials is gradual but consistent, driven by the tangible benefits offered by wood pellet bedding.

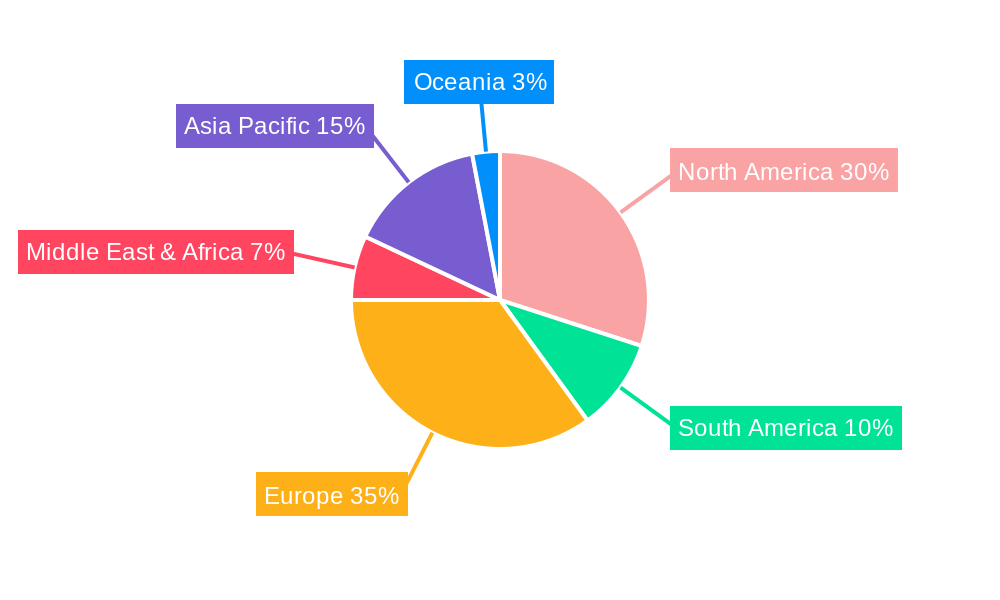

Dominant Regions, Countries, or Segments in Pellets for Horse Bedding

The European region is currently the dominant force in the Pellets for Horse Bedding market, driven by a well-established equestrian culture and stringent environmental regulations that favor sustainable bedding solutions. Within Europe, countries like the UK, Germany, and France are leading the charge due to their significant horse populations and the presence of numerous professional equestrian facilities. The application segment of Equestrian Clubs is a primary growth driver, accounting for an estimated 55% of the market share in 2025, due to the high volume of horses housed and the demand for efficient and hygienic bedding solutions. The 6 mm type of pellets also holds a dominant position due to its optimal size for absorbency and dust control, representing approximately 70% of the market in the base year. Key drivers in this region include supportive government policies promoting sustainable forestry and waste management, coupled with robust infrastructure for production and distribution. The economic prosperity in these nations also allows for higher discretionary spending on equine care. The market share of Europe is estimated at 45% of the global market in 2025, with North America following closely at 35%. The growth potential in Europe remains strong, supported by ongoing investments in equestrian infrastructure and a continuous drive for improved animal welfare standards. The dominance of equestrian clubs is further amplified by the professional management and operational efficiencies they seek, which pellet bedding directly addresses. The specific characteristics of 6 mm pellets, such as their fine particle size and high surface area, contribute to their superior absorption capabilities, making them the preferred choice for managing equine waste effectively and minimizing odor.

- Dominant Region: Europe

- Leading Countries: UK, Germany, France

- Dominant Application Segment: Equestrian Club (approx. 55% market share in 2025)

- Dominant Product Type: 6 mm pellets (approx. 70% market share in 2025)

- Key Growth Drivers in Europe:

- Strong equestrian culture and high horse population.

- Stringent environmental regulations favoring sustainable products.

- Economic prosperity and higher spending on equine welfare.

- Developed infrastructure for production and distribution.

Pellets for Horse Bedding Product Landscape

The product landscape for Pellets for Horse Bedding is characterized by continuous innovation aimed at enhancing performance and user experience. Manufacturers are focusing on producing pellets with optimal moisture content for superior absorbency, effectively managing ammonia and odor control within stables. The dominant type, 6 mm pellets, are engineered for maximum surface area to efficiently absorb liquids, thus reducing the frequency of stall mucking and associated labor costs. Beyond standard wood pellets, advancements include the development of specific formulations utilizing kiln-dried wood for reduced moisture and enhanced absorbency. Unique selling propositions often revolve around stringent quality control processes, ensuring a dust-free product that promotes better respiratory health for horses and stable staff. Technological advancements in pelletizing machinery and raw material processing are leading to more consistent product quality and improved durability, preventing excessive breakdown within the stable environment.

Key Drivers, Barriers & Challenges in Pellets for Horse Bedding

Key Drivers:

- Superior Absorbency & Odor Control: Significantly reduces ammonia levels and improves air quality, leading to healthier horses.

- Reduced Waste & Ease of Disposal: Pellets break down into fine ash when wet, making mucking out more efficient and disposal simpler.

- Sustainability & Eco-Friendliness: Derived from renewable resources, often from by-products of the timber industry, appealing to environmentally conscious consumers.

- Dust Reduction: Properly manufactured pellets are virtually dust-free, benefiting horses with respiratory issues and stable staff.

- Cost-Effectiveness in the Long Run: While initial cost might be higher, the reduced labor and waste disposal contribute to overall savings.

Barriers & Challenges:

- Initial Cost Perception: Higher upfront cost compared to traditional bedding like straw or shavings can deter some buyers.

- Supply Chain Volatility: Reliance on wood by-products can be subject to fluctuations in the timber industry.

- Competition from Traditional Bedding: Established user bases and lower perceived cost of straw and shavings present ongoing competition.

- Moisture Sensitivity: In very damp environments, pellets can break down faster if not managed properly, requiring careful stall management.

- Regional Availability & Logistics: Transportation costs can impact affordability in remote areas, limiting market penetration.

Emerging Opportunities in Pellets for Horse Bedding

Emerging opportunities in the Pellets for Horse Bedding market lie in the development of specialized formulations tailored to specific equine needs, such as hypoallergenic pellets for sensitive horses or those with advanced odor-neutralizing properties. Untapped markets in developing economies with growing equestrian participation present significant growth potential. The integration of smart technology, perhaps in the form of bedding moisture sensors linked to pellet replenishment schedules, could offer a niche but valuable innovation. Furthermore, exploring alternative sustainable raw materials beyond traditional wood, such as agricultural by-products, could open new avenues and appeal to a broader consumer base seeking diverse eco-friendly options. The increasing demand for premium equine care products and services is a fertile ground for market expansion.

Growth Accelerators in the Pellets for Horse Bedding Industry

Growth accelerators in the Pellets for Horse Bedding industry are multi-faceted, encompassing technological breakthroughs in manufacturing that enhance absorbency and reduce dust to unprecedented levels. Strategic partnerships between pellet manufacturers and equestrian associations or prominent stables can significantly boost market penetration and brand awareness. Market expansion strategies, such as targeted educational campaigns highlighting the long-term economic and health benefits of pellet bedding, are crucial for overcoming initial cost barriers. The increasing global focus on animal welfare and sustainable practices by regulatory bodies and consumer groups acts as a powerful catalyst, driving demand for products that align with these values.

Key Players Shaping the Pellets for Horse Bedding Market

- Stora Enso

- Bedmax

- Vida

- American Wood Fibers

- Allspan

- Proteq Equine Bedding

- Bodens Group

- Guardian

- Sundown Products

- Royal Wood Shavings

- Brandenburg Group

Notable Milestones in Pellets for Horse Bedding Sector

- 2019: Introduction of enhanced dust-filtering technology in pellet production, significantly reducing respiratory irritants.

- 2020: Increased adoption of kiln-dried wood for bedding pellets, boosting absorbency by up to 20%.

- 2021: Major manufacturers begin obtaining eco-certifications for sustainable forestry practices.

- 2022: First successful large-scale trials of recycled wood by-products for pellet bedding production.

- 2023: Significant investment in automation within production facilities, leading to improved product consistency and capacity.

- 2024: Launch of specialized, highly absorbent pellet formulations targeting specific equine health needs.

In-Depth Pellets for Horse Bedding Market Outlook

The Pellets for Horse Bedding market outlook is exceptionally positive, driven by sustained growth accelerators such as continuous technological innovation, strategic market expansion, and a strong consumer preference for sustainable and high-performance equine products. Future market potential is projected to be substantial, fueled by an increasing global equestrian population and a growing emphasis on animal welfare. Strategic opportunities lie in further product diversification, exploring novel raw material sources, and leveraging digital platforms for direct-to-consumer sales and enhanced customer engagement. The long-term trend clearly favors pellet bedding as the premium and environmentally responsible choice for horse owners worldwide.

Pellets for Horse Bedding Segmentation

-

1. Application

- 1.1. Farm

- 1.2. Equestrian Club

-

2. Types

- 2.1. 6 mm

- 2.2. Others

Pellets for Horse Bedding Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pellets for Horse Bedding Regional Market Share

Geographic Coverage of Pellets for Horse Bedding

Pellets for Horse Bedding REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Farm

- 5.1.2. Equestrian Club

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 6 mm

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Farm

- 6.1.2. Equestrian Club

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 6 mm

- 6.2.2. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Farm

- 7.1.2. Equestrian Club

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 6 mm

- 7.2.2. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Farm

- 8.1.2. Equestrian Club

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 6 mm

- 8.2.2. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Farm

- 9.1.2. Equestrian Club

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 6 mm

- 9.2.2. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pellets for Horse Bedding Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Farm

- 10.1.2. Equestrian Club

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 6 mm

- 10.2.2. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stora Enso

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bedmax

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vida

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Wood Fibers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Allspan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Proteq Equine Bedding

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bodens Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guardian

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sundown Products

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Royal Wood Shavings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Brandenburg Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Stora Enso

List of Figures

- Figure 1: Global Pellets for Horse Bedding Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Pellets for Horse Bedding Revenue (million), by Application 2025 & 2033

- Figure 3: North America Pellets for Horse Bedding Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Pellets for Horse Bedding Revenue (million), by Types 2025 & 2033

- Figure 5: North America Pellets for Horse Bedding Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Pellets for Horse Bedding Revenue (million), by Country 2025 & 2033

- Figure 7: North America Pellets for Horse Bedding Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Pellets for Horse Bedding Revenue (million), by Application 2025 & 2033

- Figure 9: South America Pellets for Horse Bedding Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Pellets for Horse Bedding Revenue (million), by Types 2025 & 2033

- Figure 11: South America Pellets for Horse Bedding Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Pellets for Horse Bedding Revenue (million), by Country 2025 & 2033

- Figure 13: South America Pellets for Horse Bedding Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Pellets for Horse Bedding Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Pellets for Horse Bedding Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Pellets for Horse Bedding Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Pellets for Horse Bedding Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Pellets for Horse Bedding Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Pellets for Horse Bedding Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Pellets for Horse Bedding Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Pellets for Horse Bedding Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Pellets for Horse Bedding Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Pellets for Horse Bedding Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Pellets for Horse Bedding Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Pellets for Horse Bedding Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Pellets for Horse Bedding Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Pellets for Horse Bedding Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Pellets for Horse Bedding Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Pellets for Horse Bedding Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Pellets for Horse Bedding Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Pellets for Horse Bedding Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Pellets for Horse Bedding Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Pellets for Horse Bedding Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Pellets for Horse Bedding Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Pellets for Horse Bedding Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Pellets for Horse Bedding Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Pellets for Horse Bedding Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Pellets for Horse Bedding Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Pellets for Horse Bedding Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Pellets for Horse Bedding Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pellets for Horse Bedding?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Pellets for Horse Bedding?

Key companies in the market include Stora Enso, Bedmax, Vida, American Wood Fibers, Allspan, Proteq Equine Bedding, Bodens Group, Guardian, Sundown Products, Royal Wood Shavings, Brandenburg Group.

3. What are the main segments of the Pellets for Horse Bedding?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 125 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pellets for Horse Bedding," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pellets for Horse Bedding report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pellets for Horse Bedding?

To stay informed about further developments, trends, and reports in the Pellets for Horse Bedding, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence