Key Insights

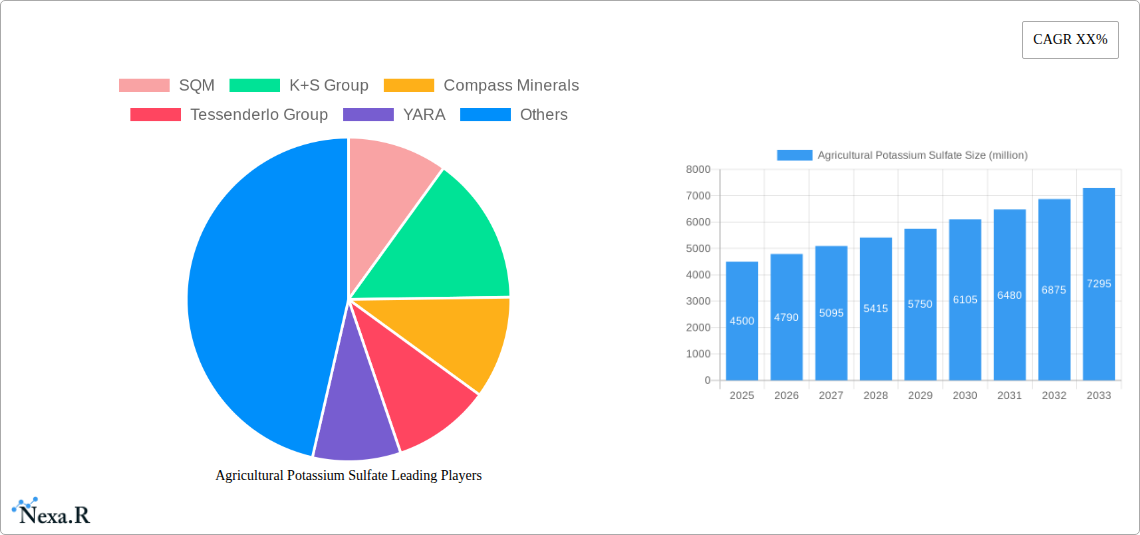

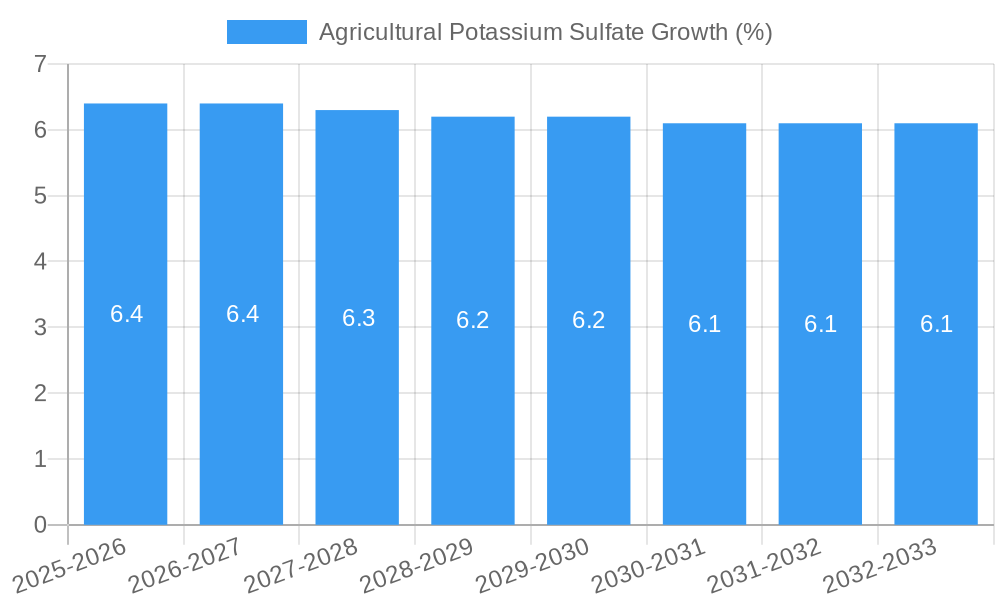

The global Agricultural Potassium Sulfate market is poised for significant expansion, projected to reach approximately $4,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth is primarily fueled by the escalating global demand for higher crop yields and improved food quality, directly correlating with the increasing population and evolving dietary habits. Potassium sulfate, a premium source of potassium and sulfur for plants, plays a crucial role in enhancing plant resilience against stress, improving water use efficiency, and boosting the overall quality and shelf-life of produce. The agricultural sector's increasing adoption of modern farming practices, including precision agriculture and the use of specialty fertilizers, further amplifies the demand for potassium sulfate over traditional potassium chloride (MOP) due to its lower salt index and suitability for chloride-sensitive crops. Key drivers include the growing emphasis on sustainable agriculture, the need to replenish soil nutrients depleted by intensive farming, and government initiatives promoting efficient fertilizer use.

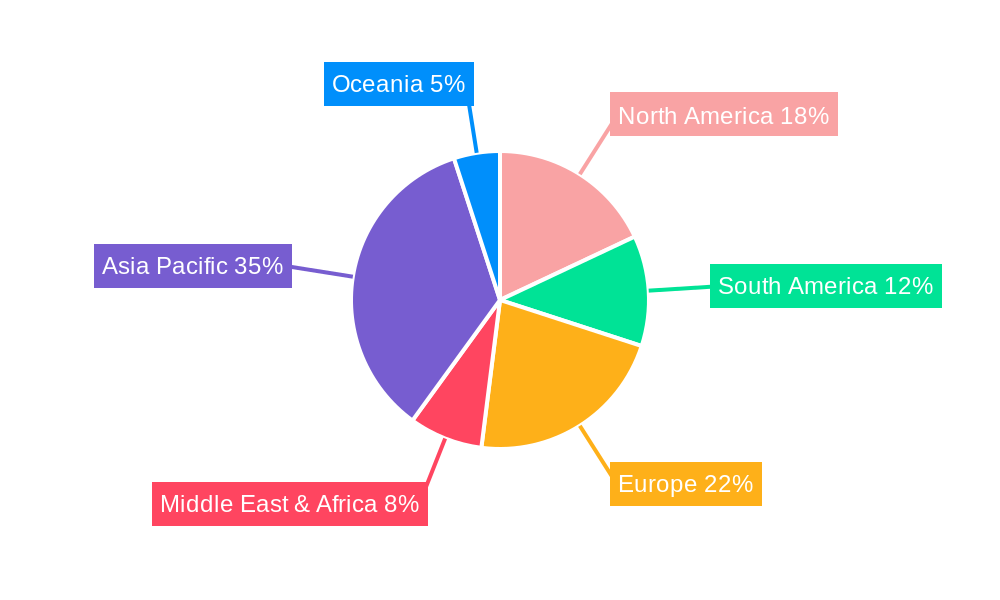

The market segmentation reveals distinct areas of opportunity. In terms of application, Oil Crops and Fruit and Vegetable Crops are expected to dominate, driven by their high-value nature and the critical need for optimal nutrient management to ensure market competitiveness. Seasoning Crops also present a growing segment as consumer preferences lean towards flavorful and high-quality herbs and spices. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market, owing to its vast agricultural land, substantial food production needs, and increasing awareness of advanced fertilization techniques. North America and Europe, while mature markets, will continue to exhibit steady growth, driven by technological advancements in agriculture and a strong focus on crop quality. The competitive landscape features established players like SQM, K+S Group, and Compass Minerals, all actively investing in R&D and expanding production capacities to meet the burgeoning global demand for this essential agricultural nutrient.

Agricultural Potassium Sulfate Market Report: Unlocking Global Crop Productivity

This comprehensive report delivers an in-depth analysis of the global Agricultural Potassium Sulfate market, spanning from 2019 to 2033, with a base and estimated year of 2025. It provides critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, leading players, and notable milestones. Designed for industry professionals, investors, and researchers, this report leverages high-traffic keywords to ensure maximum search engine visibility and deliver actionable intelligence. The analysis encompasses both parent and child market perspectives, offering a granular view of the potassium sulfate fertilizer sector. All quantitative data is presented in million units.

Agricultural Potassium Sulfate Market Dynamics & Structure

The global Agricultural Potassium Sulfate market exhibits a moderate concentration, characterized by the presence of a few dominant players alongside a growing number of regional manufacturers. Technological innovation, particularly in enhanced nutrient delivery and sustainable production methods, serves as a key driver for market expansion. Regulatory frameworks surrounding fertilizer production and application, while varied by region, are increasingly emphasizing environmental sustainability and soil health, influencing product development and market access. Competitive product substitutes, primarily other potassium fertilizers like Muriate of Potash (MOP), present a constant challenge, though Potassium Sulfate offers distinct advantages in chloride-sensitive crops and saline soils. End-user demographics are shifting towards larger-scale agricultural operations seeking optimized crop yields and improved quality, alongside a growing segment of specialty crop growers prioritizing premium produce. Mergers and acquisitions (M&A) are sporadic but significant, aimed at consolidating market share, expanding product portfolios, and gaining access to new geographical markets.

- Market Concentration: Moderate to High concentration among top players.

- Technological Innovation Drivers: Advanced granulation, controlled-release formulations, and efficiency enhancement.

- Regulatory Frameworks: Increasing focus on environmental impact and nutrient management.

- Competitive Product Substitutes: Muriate of Potash (MOP), Potassium Nitrate.

- End-User Demographics: Large-scale commercial farms, specialty crop growers, and horticulture.

- M&A Trends: Strategic acquisitions for market consolidation and portfolio expansion, with an estimated 5-7 significant deals annually in the last historical period.

Agricultural Potassium Sulfate Growth Trends & Insights

The Agricultural Potassium Sulfate market is projected to witness robust growth, driven by the escalating demand for enhanced crop yields and improved food quality to meet the needs of a burgeoning global population. The market size is anticipated to expand from an estimated $X,XXX million in 2025 to $Y,YYY million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately Z.ZZ% over the forecast period. Adoption rates are steadily increasing, particularly in regions with intensive agricultural practices and a higher prevalence of chloride-sensitive crops. Technological disruptions are focusing on the development of more efficient and environmentally friendly potassium sulfate formulations. Consumer behavior shifts are indirectly influencing the market, as demand for healthier, residue-free produce necessitates the use of premium fertilizers that minimize adverse environmental impacts. The market penetration of agricultural potassium sulfate is expected to rise, driven by increased awareness of its benefits over alternative potassium sources.

- Market Size Evolution: From an estimated $X,XXX million (2025) to $Y,YYY million (2033).

- CAGR (2025-2033): Approximately Z.ZZ%.

- Adoption Rates: Steadily increasing, driven by precision agriculture and specialty crop cultivation.

- Technological Disruptions: Focus on water-soluble, low-chloride, and bio-enhanced formulations.

- Consumer Behavior Shifts: Demand for premium quality produce, driving demand for superior nutrient management.

- Market Penetration: Expected to grow by an estimated 15-20% by 2033.

Dominant Regions, Countries, or Segments in Agricultural Potassium Sulfate

The Fruit and Vegetable Crops segment, within the Application category, is a dominant force in the global Agricultural Potassium Sulfate market. This dominance is fueled by the inherent sensitivity of many fruit and vegetable varieties to chloride, making potassium sulfate the preferred choice for optimal growth, improved flavor, and enhanced shelf-life. Regions with high concentrations of fruit and vegetable production, such as Europe, North America, and parts of Asia, are consequently leading the market.

In Europe, stringent regulations on food quality and safety, coupled with advanced horticultural practices, create a strong demand for high-grade potassium sulfate. The region's emphasis on sustainable agriculture further bolsters the adoption of sulfate-based fertilizers. North America, with its vast commercial fruit and vegetable farms, exhibits significant consumption, driven by the pursuit of maximizing yield and maintaining competitive market positioning. Asia, particularly countries like China and India, is witnessing rapid growth due to the expansion of their horticulture sectors and increasing disposable incomes, which in turn drives demand for higher-quality produce.

Within the Types, Crystalline Potassium Sulfate often holds a leading position due to its high purity and solubility, making it ideal for fertigation systems widely employed in fruit and vegetable cultivation.

- Dominant Application Segment: Fruit and Vegetable Crops.

- Key Drivers: Chloride sensitivity of crops, demand for improved quality and shelf-life, advanced horticultural practices.

- Market Share (Estimated): Approximately 35-40% of the total application market.

- Growth Potential: High, driven by increasing global demand for fruits and vegetables.

- Dominant Region: Europe.

- Key Drivers: Strict food quality regulations, sustainable agriculture initiatives, advanced farming technologies.

- Market Share (Estimated): Approximately 25-30% of the global market.

- Growth Potential: Moderate to High, with a focus on premium and organic produce.

- Dominant Type: Crystalline Potassium Sulfate.

- Key Drivers: High solubility, purity, suitability for fertigation.

- Market Share (Estimated): Approximately 60-65% of the total types market.

Agricultural Potassium Sulfate Product Landscape

The Agricultural Potassium Sulfate product landscape is characterized by continuous innovation aimed at enhancing nutrient efficiency and minimizing environmental impact. Products range from highly pure crystalline forms, ideal for sensitive irrigation systems, to granular and powdered formulations catering to diverse application methods. Key innovations include the development of slow-release and controlled-release potassium sulfate, ensuring a steady supply of nutrients to plants and reducing leaching. Specialty formulations incorporating micronutrients or humic substances are also gaining traction, offering tailored solutions for specific soil conditions and crop requirements. Performance metrics such as solubility, particle size distribution, and nutrient content are critical differentiators, directly impacting crop uptake and overall agricultural productivity. The unique selling proposition lies in its chloride-free nature, making it a superior choice for crops like tobacco, potatoes, and certain fruits and vegetables that suffer yield or quality degradation in the presence of chlorides.

Key Drivers, Barriers & Challenges in Agricultural Potassium Sulfate

Key Drivers:

- Growing Global Food Demand: The increasing world population necessitates higher agricultural yields, driving demand for efficient fertilizers.

- Premiumization of Crops: Demand for higher quality fruits, vegetables, and specialty crops mandates the use of chloride-free fertilizers for optimal taste and appearance.

- Advancements in Precision Agriculture: Technologies enabling targeted nutrient application favor water-soluble and efficient fertilizers like potassium sulfate.

- Environmental Regulations: Stricter environmental laws are encouraging the use of fertilizers with lower environmental footprints, benefiting potassium sulfate's reputation.

- Soil Health Concerns: Growing awareness of soil degradation promotes the use of fertilizers that do not contribute to salinization or chloride accumulation.

Key Barriers & Challenges:

- Higher Cost Compared to MOP: Potassium sulfate is generally more expensive than Muriate of Potash, presenting a price barrier for some farmers.

- Competition from MOP: Muriate of Potash remains the most widely used potassium fertilizer due to its lower cost, despite its chloride content.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and pricing of raw materials and finished products.

- Limited Awareness in Developing Regions: In some emerging markets, awareness of the benefits of potassium sulfate over conventional fertilizers is still low.

- Regulatory Hurdles in Certain Regions: Varying fertilizer registration processes and import/export restrictions can hinder market access. The estimated impact of these challenges on market growth could range from 5-10% annually.

Emerging Opportunities in Agricultural Potassium Sulfate

Emerging opportunities in the Agricultural Potassium Sulfate market are centered around sustainable agriculture, specialty crop cultivation, and technological integration. The rising trend of organic farming presents a significant avenue, as potassium sulfate is often permitted and preferred in organic production systems due to its natural origin. The expansion of hydroponic and aeroponic farming systems creates a demand for highly soluble and pure potassium sulfate formulations for precise nutrient delivery. Furthermore, the increasing adoption of biostimulants and soil conditioners can be synergistically combined with potassium sulfate applications, creating value-added product offerings. Untapped markets in regions with evolving agricultural practices and a growing middle class are ripe for penetration, driven by a rising demand for diverse and high-quality produce.

Growth Accelerators in the Agricultural Potassium Sulfate Industry

Long-term growth in the Agricultural Potassium Sulfate industry will be propelled by continuous technological breakthroughs in production and formulation. Innovations in direct extraction methods and more efficient synthesis processes can lead to cost reductions, making potassium sulfate more competitive. Strategic partnerships between fertilizer manufacturers, agricultural technology providers, and research institutions are crucial for developing and promoting advanced fertilizer solutions. Market expansion strategies focusing on educating farmers about the long-term benefits of potassium sulfate for soil health and crop quality, particularly in developing economies, will be instrumental. The growing emphasis on circular economy principles within agriculture could also lead to new opportunities for nutrient recovery and recycling, further enhancing the sustainability profile of potassium sulfate.

Key Players Shaping the Agricultural Potassium Sulfate Market

- SQM

- K+S Group

- Compass Minerals

- Tessenderlo Group

- YARA

- Rusal

- Sesoda

- Migao Group

- Archean Group

Notable Milestones in Agricultural Potassium Sulfate Sector

- 2019: Increased investment in sustainable production technologies by major players.

- 2020: Growing consumer demand for chloride-free produce boosts market interest.

- 2021: Launch of advanced slow-release potassium sulfate formulations by several key companies.

- 2022: M&A activities focused on expanding production capacity and market reach.

- 2023: Increased regulatory focus on nutrient efficiency and environmental impact of fertilizers.

- 2024: Significant research and development in bio-enhanced potassium sulfate products.

In-Depth Agricultural Potassium Sulfate Market Outlook

The future outlook for the Agricultural Potassium Sulfate market is exceptionally promising, driven by an overarching trend towards sustainable and high-performance agriculture. Growth accelerators such as ongoing technological advancements in fertilizer production and application, coupled with strategic market expansion initiatives, are poised to redefine the industry landscape. The increasing global emphasis on food security, crop quality, and environmental stewardship directly translates into a higher demand for premium, chloride-free potassium sources. Strategic partnerships and the development of integrated crop management solutions will further solidify potassium sulfate's position as a vital nutrient for modern farming. The market is expected to witness sustained growth, offering significant opportunities for innovation and investment in the coming years, with an estimated market potential exceeding $10,000 million by 2033.

Agricultural Potassium Sulfate Segmentation

-

1. Application

- 1.1. Oil Crops

- 1.2. Fruit and Vegetable Crops

- 1.3. Seasoning Crops

- 1.4. Other

-

2. Types

- 2.1. Crystalline Potassium Sulfate

- 2.2. Powdered Potassium Sulfate

Agricultural Potassium Sulfate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agricultural Potassium Sulfate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil Crops

- 5.1.2. Fruit and Vegetable Crops

- 5.1.3. Seasoning Crops

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Crystalline Potassium Sulfate

- 5.2.2. Powdered Potassium Sulfate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil Crops

- 6.1.2. Fruit and Vegetable Crops

- 6.1.3. Seasoning Crops

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Crystalline Potassium Sulfate

- 6.2.2. Powdered Potassium Sulfate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil Crops

- 7.1.2. Fruit and Vegetable Crops

- 7.1.3. Seasoning Crops

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Crystalline Potassium Sulfate

- 7.2.2. Powdered Potassium Sulfate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil Crops

- 8.1.2. Fruit and Vegetable Crops

- 8.1.3. Seasoning Crops

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Crystalline Potassium Sulfate

- 8.2.2. Powdered Potassium Sulfate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil Crops

- 9.1.2. Fruit and Vegetable Crops

- 9.1.3. Seasoning Crops

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Crystalline Potassium Sulfate

- 9.2.2. Powdered Potassium Sulfate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Agricultural Potassium Sulfate Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil Crops

- 10.1.2. Fruit and Vegetable Crops

- 10.1.3. Seasoning Crops

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Crystalline Potassium Sulfate

- 10.2.2. Powdered Potassium Sulfate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SQM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 K+S Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Compass Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tessenderlo Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 YARA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rusal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sesoda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Migao Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Archean Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 SQM

List of Figures

- Figure 1: Global Agricultural Potassium Sulfate Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Agricultural Potassium Sulfate Revenue (million), by Application 2024 & 2032

- Figure 3: North America Agricultural Potassium Sulfate Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Agricultural Potassium Sulfate Revenue (million), by Types 2024 & 2032

- Figure 5: North America Agricultural Potassium Sulfate Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Agricultural Potassium Sulfate Revenue (million), by Country 2024 & 2032

- Figure 7: North America Agricultural Potassium Sulfate Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Agricultural Potassium Sulfate Revenue (million), by Application 2024 & 2032

- Figure 9: South America Agricultural Potassium Sulfate Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Agricultural Potassium Sulfate Revenue (million), by Types 2024 & 2032

- Figure 11: South America Agricultural Potassium Sulfate Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Agricultural Potassium Sulfate Revenue (million), by Country 2024 & 2032

- Figure 13: South America Agricultural Potassium Sulfate Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Agricultural Potassium Sulfate Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Agricultural Potassium Sulfate Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Agricultural Potassium Sulfate Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Agricultural Potassium Sulfate Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Agricultural Potassium Sulfate Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Agricultural Potassium Sulfate Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Agricultural Potassium Sulfate Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Agricultural Potassium Sulfate Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Agricultural Potassium Sulfate Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Agricultural Potassium Sulfate Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Agricultural Potassium Sulfate Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Agricultural Potassium Sulfate Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Agricultural Potassium Sulfate Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Agricultural Potassium Sulfate Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Agricultural Potassium Sulfate Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Agricultural Potassium Sulfate Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Agricultural Potassium Sulfate Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Agricultural Potassium Sulfate Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Agricultural Potassium Sulfate Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Agricultural Potassium Sulfate Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Agricultural Potassium Sulfate Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Agricultural Potassium Sulfate Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Agricultural Potassium Sulfate Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Agricultural Potassium Sulfate Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Agricultural Potassium Sulfate Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Agricultural Potassium Sulfate Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Agricultural Potassium Sulfate Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Agricultural Potassium Sulfate Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Potassium Sulfate?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Agricultural Potassium Sulfate?

Key companies in the market include SQM, K+S Group, Compass Minerals, Tessenderlo Group, YARA, Rusal, Sesoda, Migao Group, Archean Group.

3. What are the main segments of the Agricultural Potassium Sulfate?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Potassium Sulfate," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Potassium Sulfate report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Potassium Sulfate?

To stay informed about further developments, trends, and reports in the Agricultural Potassium Sulfate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence