Key Insights

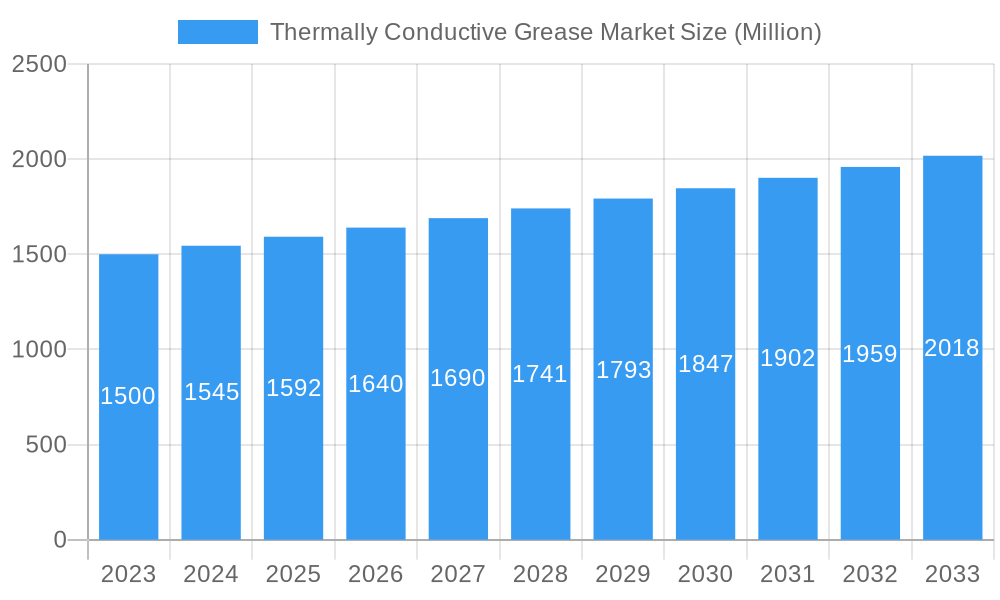

The global Thermally Conductive Grease market is projected for significant expansion, estimated to reach $9.24 billion by 2025 and exhibit a Compound Annual Growth Rate (CAGR) of 13.37% through 2033. This growth is propelled by the increasing need for effective heat dissipation solutions across various expanding industries. Key market drivers include the rising adoption of advanced electronics in automotive, particularly electric vehicles (EVs) and sophisticated driver-assistance systems, where thermal management is critical for performance and durability. The rapidly growing telecommunications sector, fueled by 5G infrastructure deployment and data center expansion, also presents a substantial growth opportunity, demanding reliable thermal management for high-performance networking equipment. Advancements in power electronics, essential for energy efficiency and grid stability, and the dynamic LED lighting market, requiring brighter and more durable illumination, further contribute to the market's positive trajectory.

Thermally Conductive Grease Market Market Size (In Billion)

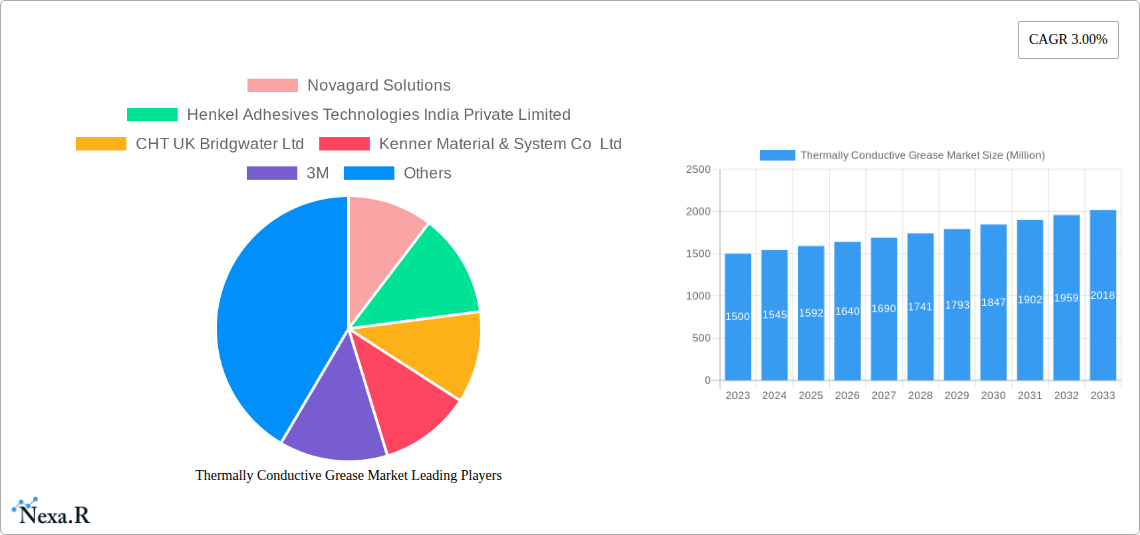

The market is segmented into Silicone-based and Non-silicone-based greases. Silicone-based options are often preferred for their wide temperature range and electrical insulation properties, while non-silicone alternatives address specific niche demands. Leading companies such as Novagard Solutions, Henkel Adhesives Technologies India Private Limited, CHT UK Bridgwater Ltd, Kenner Material & System Co Ltd, 3M, PARKER HANNIFIN CORP, Boyd Corporation, Momentive, Chemtronics, and MG Chemicals are actively engaged in innovation and competition to secure market share. Geographically, Asia Pacific, led by China and India, is expected to dominate due to its extensive manufacturing base and rapid technology adoption. North America and Europe also offer considerable opportunities, driven by advancements in automotive and industrial electronics. However, potential restraints, such as the cost of some advanced formulations and the development of alternative thermal management solutions, may influence market dynamics, necessitating ongoing innovation and cost optimization by market players.

Thermally Conductive Grease Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Thermally Conductive Grease market, examining its evolution, current status, and projected growth. Covering the historical period from 2019 to 2024 and forecasting through 2033, with a base year of 2025, this study offers crucial insights for stakeholders in thermal management solutions, electronic component cooling, and heat dissipation materials. We dissect the market by grease type, including silicone-based grease and non-silicone-based grease, and by end-user industry, encompassing automotive electronics, telecommunication, power electronics, LED lighting, and other end-user industries. Uncover market dynamics, growth trends, dominant regions, product landscape, key drivers, challenges, emerging opportunities, and the influential players shaping this critical sector.

Thermally Conductive Grease Market Dynamics & Structure

The thermally conductive grease market exhibits a moderately concentrated structure, with key players investing heavily in research and development to enhance thermal conductivity and application-specific formulations. Technological innovation is a significant driver, propelled by the increasing demand for efficient heat dissipation in high-performance electronics and the miniaturization of components. Regulatory frameworks, particularly concerning environmental compliance and material safety, are also influencing product development and market access. Competitive product substitutes, such as thermal pads and phase change materials, exert pressure, necessitating continuous innovation and cost optimization within the grease segment. End-user demographics reveal a growing reliance on advanced electronics across various sectors, fueling the demand for superior thermal management. Mergers and acquisitions (M&A) trends are observable as larger entities seek to consolidate market share and expand their product portfolios, with approximately 5-10% of market participants engaging in M&A activities annually. Barriers to innovation include the high cost of specialized raw materials and the lengthy validation processes for new formulations in critical industries.

- Market Concentration: Moderately concentrated with strategic M&A activity.

- Technological Innovation: Driven by demand for higher thermal conductivity and miniaturization.

- Regulatory Influence: Focus on environmental compliance and material safety.

- Competitive Landscape: Presence of alternative thermal management solutions.

- End-User Demand: Growth fueled by advanced electronics across sectors.

- M&A Trends: Increasing consolidation and portfolio expansion.

- Innovation Barriers: High raw material costs and rigorous validation cycles.

Thermally Conductive Grease Market Growth Trends & Insights

The global thermally conductive grease market is poised for robust growth, projected to expand significantly from its estimated market size of $XXX million in 2025. This expansion is underpinned by the escalating demand for effective thermal management solutions across a burgeoning array of electronic devices and industrial applications. The adoption rates for these specialized greases are increasing exponentially, driven by the relentless trend of miniaturization in electronics, leading to higher power densities and consequently, greater heat generation. Technological disruptions, such as the development of advanced nanoparticle-infused greases, are enhancing thermal performance and creating new application possibilities. Consumer behavior shifts, particularly the increasing consumer reliance on sophisticated and powerful portable electronics, further amplify the need for efficient cooling. The CAGR for the forecast period is estimated to be between XX% and XX%, indicating substantial market penetration over the next decade. Innovations in material science are leading to greases with improved dielectric properties, higher operating temperature ranges, and enhanced longevity, directly influencing market adoption and consumer preference. The increasing complexity of power electronics in electric vehicles and renewable energy systems is also a significant growth catalyst.

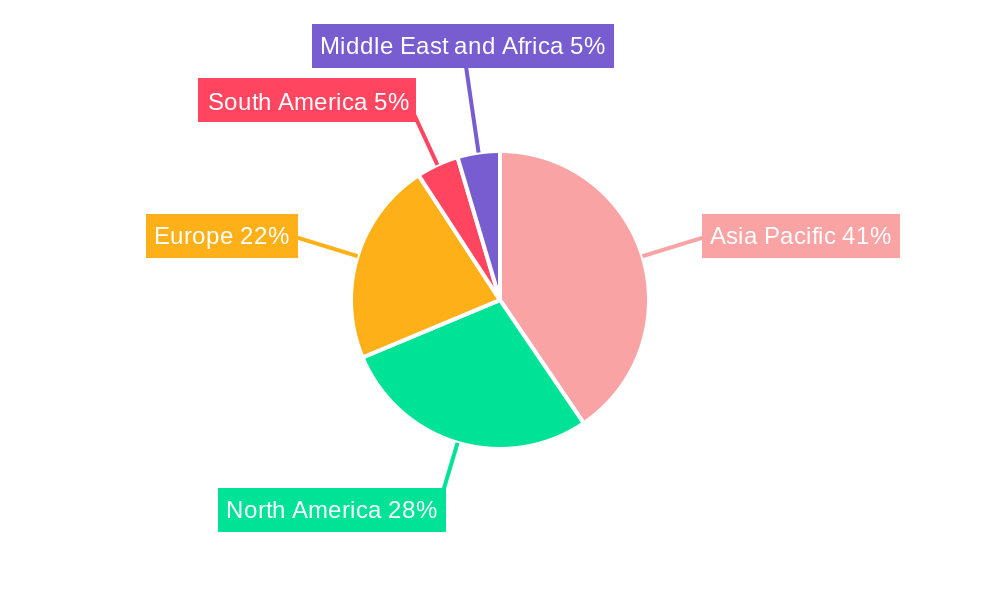

Dominant Regions, Countries, or Segments in Thermally Conductive Grease Market

Within the thermally conductive grease market, Silicone-based Grease consistently emerges as the dominant segment due to its established performance, versatility, and cost-effectiveness in a wide range of applications. The Automotive Electronics end-user industry also plays a pivotal role in driving regional market growth, particularly in North America and Asia Pacific. The increasing penetration of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates sophisticated thermal management for batteries, powertrains, and infotainment systems, creating substantial demand. Asia Pacific, led by countries like China, South Korea, and Japan, represents a significant growth hub, owing to its manufacturing prowess in electronics and the rapid expansion of its automotive and telecommunication sectors. Economic policies supporting manufacturing and technological advancement, coupled with robust infrastructure development for 5G networks and smart cities, further propel the demand for advanced thermal solutions in this region. North America's strong presence in the aerospace, defense, and advanced electronics sectors, alongside a burgeoning EV market, also contributes significantly to regional dominance. Europe's focus on sustainability and energy efficiency, particularly in power electronics and renewable energy, further solidifies its position in the market.

- Dominant Grease Type: Silicone-based Grease.

- Key End-User Industry: Automotive Electronics.

- Leading Regions: Asia Pacific and North America.

- Key Drivers in Asia Pacific: Electronics manufacturing, EV market growth, 5G deployment.

- Key Drivers in North America: Aerospace, defense, advanced electronics, EV adoption.

- Growth Potential: Driven by technological integration and sustainability initiatives.

Thermally Conductive Grease Market Product Landscape

The thermally conductive grease market is characterized by a dynamic product landscape featuring continuous innovation in formulation and application. Leading companies are focusing on developing high-performance greases with improved thermal conductivity values, measured in W/mK, exceeding XX W/mK for specialized applications. Innovations include the incorporation of advanced fillers such as ceramic nanoparticles, boron nitride, and metal oxides to enhance heat transfer capabilities. Furthermore, research is directed towards creating greases with enhanced dielectric strength, low oil bleed, and improved long-term stability under extreme temperature conditions. Unique selling propositions include greases tailored for specific substrates, low outgassing properties for vacuum applications, and electrically conductive variants for shielding purposes. Technological advancements are enabling greases to meet the increasingly stringent thermal management demands of power-dense processors, high-frequency communication modules, and advanced lighting solutions.

Key Drivers, Barriers & Challenges in Thermally Conductive Grease Market

Key Drivers: The burgeoning demand for effective thermal management in miniaturized electronics, the rapid expansion of the electric vehicle (EV) market, and the growth of telecommunication infrastructure (e.g., 5G deployment) are primary growth drivers. Technological advancements in material science enabling higher thermal conductivity and specialized formulations also propel market growth.

Barriers & Challenges: High manufacturing costs associated with advanced filler materials and complex formulations pose a significant barrier. Supply chain disruptions for critical raw materials, coupled with stringent regulatory compliance for specific industries, present ongoing challenges. Intense competition from alternative thermal management solutions, such as thermal pads and phase change materials, necessitates continuous product differentiation and cost-effectiveness. The need for extensive product testing and validation in critical applications also creates a lengthy market entry process.

Emerging Opportunities in Thermally Conductive Grease Market

Emerging opportunities lie in the development of next-generation thermally conductive greases with ultra-high thermal conductivity for advanced computing and AI hardware. The growing demand for efficient cooling in renewable energy systems, such as solar inverters and wind turbines, presents a significant untapped market. Furthermore, innovative applications in wearable technology and medical devices, requiring biocompatible and highly efficient thermal management solutions, offer substantial growth potential. The increasing adoption of smart city infrastructure and IoT devices will also drive demand for reliable thermal solutions in compact electronic modules.

Growth Accelerators in the Thermally Conductive Grease Market Industry

Long-term growth in the thermally conductive grease market is being accelerated by breakthroughs in nanotechnology, leading to the development of greases with unprecedented thermal performance. Strategic partnerships between grease manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing tailored solutions and ensuring seamless integration. Market expansion strategies, including targeting emerging economies and developing specialized product lines for niche applications, are also key accelerators. The ongoing global push towards electrification and digitalization across all sectors will continue to fuel the fundamental need for superior thermal management.

Key Players Shaping the Thermally Conductive Grease Market Market

- Novagard Solutions

- Henkel Adhesives Technologies India Private Limited

- CHT UK Bridgwater Ltd

- Kenner Material & System Co Ltd

- 3M

- PARKER HANNIFIN CORP

- Boyd Corporation

- Momentive

- Chemtronics

- MG Chemicals

Notable Milestones in Thermally Conductive Grease Market Sector

- 2023 (Q4): Launch of advanced nanoparticle-infused thermally conductive greases with enhanced W/mK ratings.

- 2024 (Q1): Major automotive electronics supplier integrates novel silicone-free thermally conductive grease for EV battery thermal management.

- 2024 (Q2): Acquisition of a niche thermal interface material producer by a leading chemical conglomerate, signaling market consolidation.

- 2024 (Q3): Development of bio-based thermally conductive greases with improved sustainability profiles gains traction.

- 2025 (Q1): Introduction of ultra-low oil bleed thermally conductive greases for high-reliability aerospace applications.

In-Depth Thermally Conductive Grease Market Market Outlook

The thermally conductive grease market is set for sustained growth, driven by the unrelenting demand for efficient thermal management in an increasingly electronic world. Key growth accelerators include continuous technological advancements in material science, particularly in nanotechnology, and strategic collaborations between manufacturers and end-users. The global transition towards electrification, coupled with the pervasive digitalization of industries, will ensure a consistent demand for high-performance thermal interface materials. Emerging opportunities in renewable energy, advanced computing, and specialized industrial applications offer significant potential for market expansion. Stakeholders can anticipate a dynamic market with ongoing innovation and strategic market development activities shaping the future landscape.

Thermally Conductive Grease Market Segmentation

-

1. Grease Type

- 1.1. Silicone-based Grease

- 1.2. Non-silicone-based Grease

-

2. End-user Industry

- 2.1. Automotive Electronics

- 2.2. Telecommunication

- 2.3. Power Electronics

- 2.4. LED Lighting

- 2.5. Other End-user Industries

Thermally Conductive Grease Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Thermally Conductive Grease Market Regional Market Share

Geographic Coverage of Thermally Conductive Grease Market

Thermally Conductive Grease Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Electrical and Electronics Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Inconsistent Performance of Thermally Conductive Grease; Impact of the COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Application of Silicon-based Thermally Conductive Grease

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grease Type

- 5.1.1. Silicone-based Grease

- 5.1.2. Non-silicone-based Grease

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive Electronics

- 5.2.2. Telecommunication

- 5.2.3. Power Electronics

- 5.2.4. LED Lighting

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grease Type

- 6. Asia Pacific Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grease Type

- 6.1.1. Silicone-based Grease

- 6.1.2. Non-silicone-based Grease

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive Electronics

- 6.2.2. Telecommunication

- 6.2.3. Power Electronics

- 6.2.4. LED Lighting

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Grease Type

- 7. North America Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grease Type

- 7.1.1. Silicone-based Grease

- 7.1.2. Non-silicone-based Grease

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive Electronics

- 7.2.2. Telecommunication

- 7.2.3. Power Electronics

- 7.2.4. LED Lighting

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Grease Type

- 8. Europe Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grease Type

- 8.1.1. Silicone-based Grease

- 8.1.2. Non-silicone-based Grease

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive Electronics

- 8.2.2. Telecommunication

- 8.2.3. Power Electronics

- 8.2.4. LED Lighting

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Grease Type

- 9. South America Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grease Type

- 9.1.1. Silicone-based Grease

- 9.1.2. Non-silicone-based Grease

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive Electronics

- 9.2.2. Telecommunication

- 9.2.3. Power Electronics

- 9.2.4. LED Lighting

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Grease Type

- 10. Middle East and Africa Thermally Conductive Grease Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grease Type

- 10.1.1. Silicone-based Grease

- 10.1.2. Non-silicone-based Grease

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive Electronics

- 10.2.2. Telecommunication

- 10.2.3. Power Electronics

- 10.2.4. LED Lighting

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Grease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novagard Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Henkel Adhesives Technologies India Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHT UK Bridgwater Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kenner Material & System Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PARKER HANNIFIN CORP *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Momentive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chemtronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MG Chemicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Novagard Solutions

List of Figures

- Figure 1: Global Thermally Conductive Grease Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Thermally Conductive Grease Market Revenue (billion), by Grease Type 2025 & 2033

- Figure 3: Asia Pacific Thermally Conductive Grease Market Revenue Share (%), by Grease Type 2025 & 2033

- Figure 4: Asia Pacific Thermally Conductive Grease Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Thermally Conductive Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Thermally Conductive Grease Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Thermally Conductive Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Thermally Conductive Grease Market Revenue (billion), by Grease Type 2025 & 2033

- Figure 9: North America Thermally Conductive Grease Market Revenue Share (%), by Grease Type 2025 & 2033

- Figure 10: North America Thermally Conductive Grease Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Thermally Conductive Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Thermally Conductive Grease Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Thermally Conductive Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Thermally Conductive Grease Market Revenue (billion), by Grease Type 2025 & 2033

- Figure 15: Europe Thermally Conductive Grease Market Revenue Share (%), by Grease Type 2025 & 2033

- Figure 16: Europe Thermally Conductive Grease Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Thermally Conductive Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Thermally Conductive Grease Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Thermally Conductive Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Thermally Conductive Grease Market Revenue (billion), by Grease Type 2025 & 2033

- Figure 21: South America Thermally Conductive Grease Market Revenue Share (%), by Grease Type 2025 & 2033

- Figure 22: South America Thermally Conductive Grease Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Thermally Conductive Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Thermally Conductive Grease Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Thermally Conductive Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Thermally Conductive Grease Market Revenue (billion), by Grease Type 2025 & 2033

- Figure 27: Middle East and Africa Thermally Conductive Grease Market Revenue Share (%), by Grease Type 2025 & 2033

- Figure 28: Middle East and Africa Thermally Conductive Grease Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Thermally Conductive Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Thermally Conductive Grease Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Thermally Conductive Grease Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 2: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Thermally Conductive Grease Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 5: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Thermally Conductive Grease Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 13: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Thermally Conductive Grease Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 19: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Thermally Conductive Grease Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 27: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Thermally Conductive Grease Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Thermally Conductive Grease Market Revenue billion Forecast, by Grease Type 2020 & 2033

- Table 33: Global Thermally Conductive Grease Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Thermally Conductive Grease Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Thermally Conductive Grease Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermally Conductive Grease Market?

The projected CAGR is approximately 13.37%.

2. Which companies are prominent players in the Thermally Conductive Grease Market?

Key companies in the market include Novagard Solutions, Henkel Adhesives Technologies India Private Limited, CHT UK Bridgwater Ltd, Kenner Material & System Co Ltd, 3M, PARKER HANNIFIN CORP *List Not Exhaustive, Boyd Corporation, Momentive, Chemtronics, MG Chemicals.

3. What are the main segments of the Thermally Conductive Grease Market?

The market segments include Grease Type, End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 9.24 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Electrical and Electronics Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Application of Silicon-based Thermally Conductive Grease.

7. Are there any restraints impacting market growth?

; Inconsistent Performance of Thermally Conductive Grease; Impact of the COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermally Conductive Grease Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermally Conductive Grease Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermally Conductive Grease Market?

To stay informed about further developments, trends, and reports in the Thermally Conductive Grease Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence