Key Insights

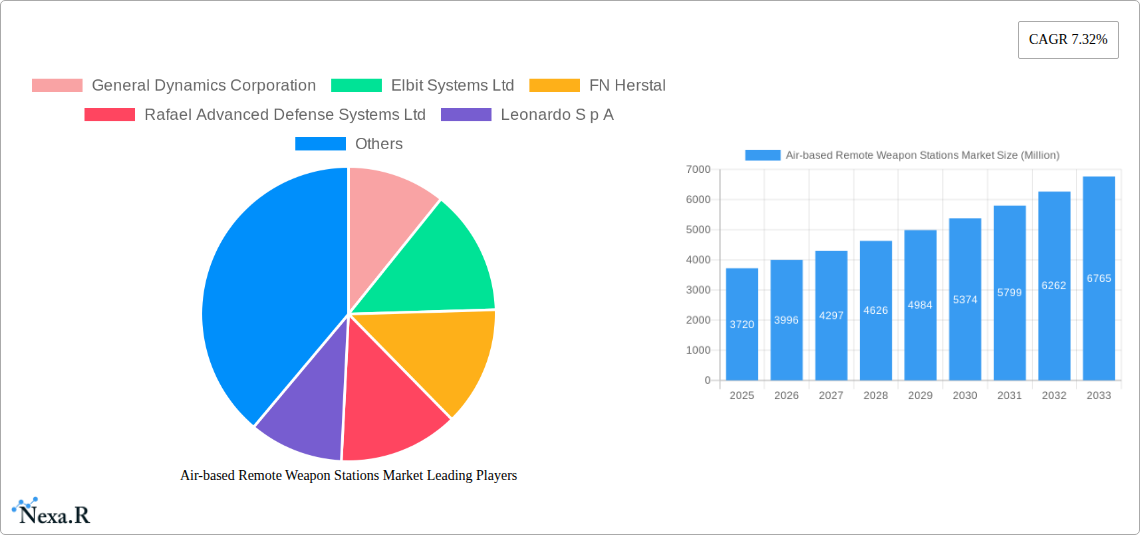

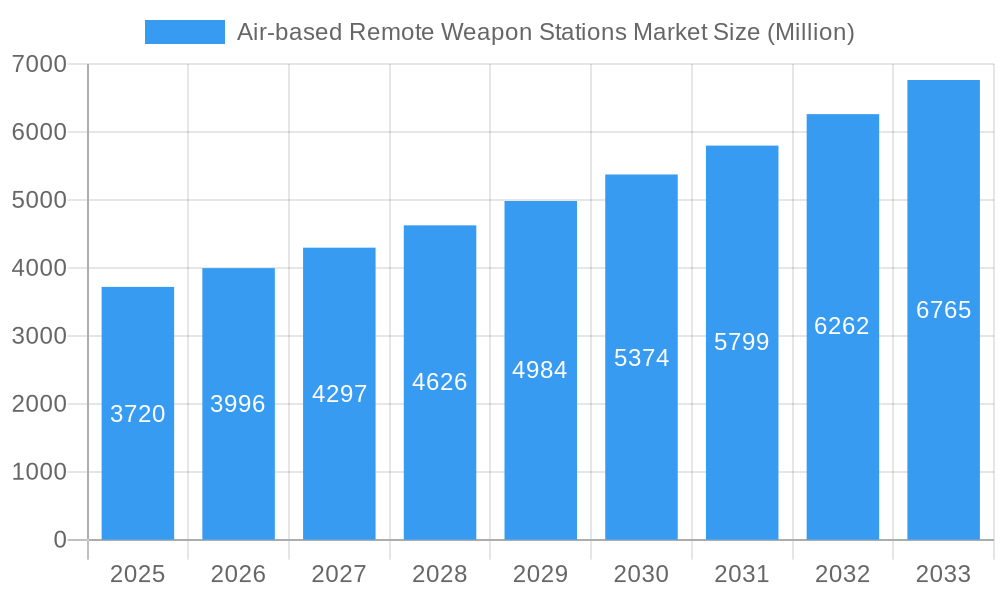

The Air-based Remote Weapon Stations (RWS) market is experiencing robust growth, projected to reach a substantial size, driven by increasing demand for enhanced situational awareness and precision strike capabilities in both manned and unmanned aerial vehicles. The market's Compound Annual Growth Rate (CAGR) of 7.32% from 2019 to 2024 indicates a consistent upward trajectory. This growth is fueled by several key factors. Firstly, the rising adoption of unmanned aerial vehicles (UAVs) across military and civilian sectors necessitates reliable and effective weapon systems for surveillance, reconnaissance, and targeted engagements. Secondly, technological advancements in areas such as sensor integration, improved targeting systems, and enhanced control mechanisms are leading to more sophisticated and effective RWS. Furthermore, the ongoing geopolitical instability and increased defense spending globally are contributing to heightened demand for advanced defense technologies, including air-based RWS. The market segmentation reveals significant opportunities within weapon systems, encompassing both light and heavy weaponry integrated into a variety of platforms, including aircraft, helicopters, and UAVs. Key players in this market are continuously investing in research and development to improve their product offerings and secure a competitive edge. The North American market, particularly the United States, holds a significant share, owing to its strong defense industrial base and substantial defense spending. However, the Asia-Pacific region is also exhibiting impressive growth, driven by increased military modernization efforts in countries like China and India.

Air-based Remote Weapon Stations Market Market Size (In Billion)

The market's future growth prospects remain positive, though several restraining factors need consideration. These include the high initial investment costs associated with RWS integration, the need for skilled personnel to operate these complex systems, and the potential for regulatory hurdles in certain regions. However, ongoing technological advancements and the increasing acceptance of UAVs are likely to mitigate these challenges. The market's evolution will be shaped by continued investment in artificial intelligence (AI) and autonomous capabilities, resulting in increasingly autonomous weapon systems. Furthermore, the integration of advanced sensors and data analytics will play a crucial role in enhancing the precision and effectiveness of air-based RWS. The ongoing focus on lightweight and modular designs will also contribute to wider adoption across various aerial platforms. Competitive dynamics will be defined by collaborations and mergers, technological innovation, and a focus on providing cost-effective solutions.

Air-based Remote Weapon Stations Market Company Market Share

Air-based Remote Weapon Stations Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Air-based Remote Weapon Stations (RWS) market, encompassing its parent market (defense systems) and child markets (aircraft weapon systems, UAV weapon systems). The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. We project a market value of xx Million units by 2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand the current market landscape and future growth opportunities within the Air-based RWS sector.

Air-based Remote Weapon Stations Market Market Dynamics & Structure

The Air-based Remote Weapon Stations market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in areas like AI-powered targeting and advanced sensor integration, is a primary growth driver. Stringent regulatory frameworks concerning weapon systems development and deployment significantly influence market dynamics. The market faces competition from alternative weapon delivery systems, although air-based RWS maintain advantages in certain applications. End-user demographics, largely comprised of military and defense forces globally, shape demand. M&A activity within the defense sector, with an estimated xx deals in the past five years, has consolidated the market, fostering innovation and improving technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on AI-powered targeting, improved sensor fusion, and enhanced operator interfaces.

- Regulatory Framework: Stringent export controls and safety standards impact market access.

- Competitive Substitutes: Alternative weapon delivery systems (e.g., guided munitions) present some competition.

- End-User Demographics: Predominantly military and defense forces of developed and developing nations.

- M&A Trends: Consolidation through mergers and acquisitions drives technological advancement and market expansion.

Air-based Remote Weapon Stations Market Growth Trends & Insights

The Air-based Remote Weapon Stations market has experienced steady growth throughout the historical period (2019-2024), driven by increasing defense budgets and rising demand for advanced weapon systems. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. Adoption rates are expected to increase significantly in regions experiencing geopolitical instability and those upgrading their existing military capabilities. Technological disruptions, such as the integration of unmanned aerial vehicles (UAVs) and autonomous systems, are transforming the market landscape. Shifts in consumer (military) behavior, reflecting increasing preferences for precision-guided munitions and improved situational awareness, will further drive market expansion. Market penetration is expected to reach xx% by 2033.

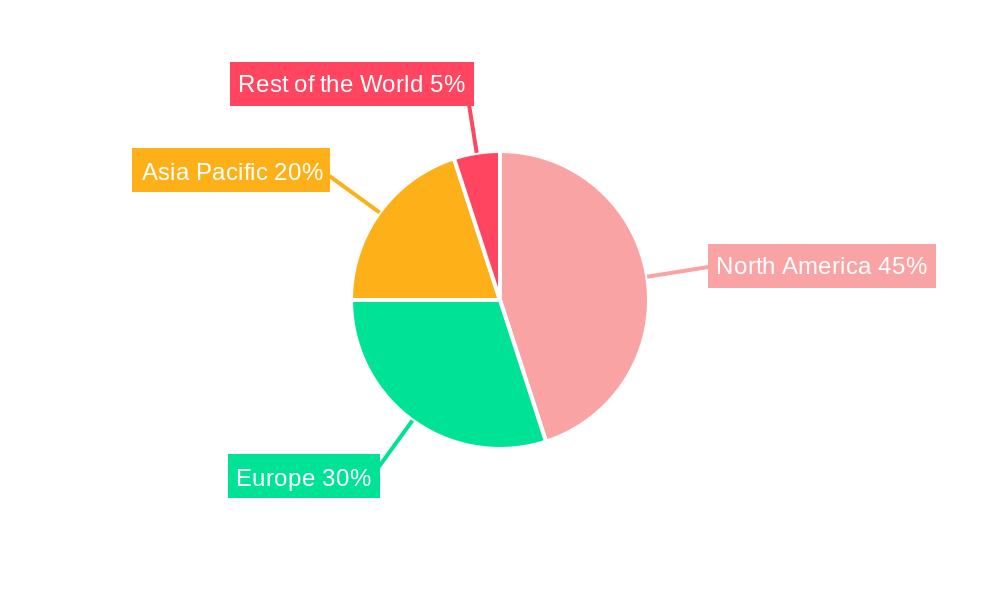

Dominant Regions, Countries, or Segments in Air-based Remote Weapon Stations Market

North America currently dominates the Air-based Remote Weapon Stations market, driven by strong defense spending and technological leadership. Europe follows closely, with significant contributions from countries like France, Germany, and the UK. The Asia-Pacific region is experiencing the fastest growth, fueled by increased defense budgets and modernization efforts in countries such as India and China. Within segments, the Weaponry component segment holds the largest market share, followed by Vision Systems. Aircraft and Helicopters platforms account for a substantial market share, with the Unmanned Aerial Vehicle (UAV) segment demonstrating the highest growth potential.

- Key Drivers (North America): High defense budgets, technological advancements, and strong domestic demand.

- Key Drivers (Europe): Significant defense spending, collaborative defense programs, and a robust aerospace industry.

- Key Drivers (Asia-Pacific): Rising defense budgets, geopolitical instability, and modernization efforts.

- Segment Dominance: Weaponry and Aircraft platforms currently hold the largest market shares.

- Growth Potential: UAV segment exhibits the highest growth potential due to increasing adoption in various defense applications.

Air-based Remote Weapon Stations Market Product Landscape

The Air-based Remote Weapon Stations market features a diverse range of products, encompassing various weapon configurations (e.g., machine guns, cannons), advanced vision systems (thermal imaging, laser rangefinders), and stabilization mechanisms. Products are designed to offer enhanced precision, improved situational awareness, and increased operator safety. Unique selling propositions often include integration capabilities with different aircraft platforms, modularity for easy customization, and advanced control systems. Technological advancements are focused on reducing size and weight, improving accuracy, and incorporating AI capabilities for autonomous target acquisition.

Key Drivers, Barriers & Challenges in Air-based Remote Weapon Stations Market

Key Drivers:

- Increasing defense budgets globally.

- Growing demand for enhanced situational awareness and precision-guided munitions.

- Technological advancements leading to improved RWS capabilities.

- Adoption of UAVs and other unmanned platforms.

Key Challenges and Restraints:

- High development and procurement costs.

- Stringent regulatory frameworks and export controls.

- Dependence on complex supply chains susceptible to disruptions.

- Intense competition among established defense contractors. This competition could potentially lead to a xx% price reduction by 2033.

Emerging Opportunities in Air-based Remote Weapon Stations Market

- Integration of AI and machine learning for autonomous target recognition and engagement.

- Development of lighter, more compact RWS suitable for smaller UAVs.

- Expansion into emerging markets with growing defense budgets.

- Development of RWS with improved cybersecurity features to mitigate cyber threats.

Growth Accelerators in the Air-based Remote Weapon Stations Market Industry

Technological breakthroughs, particularly in sensor technology, AI, and automation, are driving long-term growth. Strategic partnerships and joint ventures between defense contractors and technology companies are accelerating innovation. Expansion into new applications, such as border security and counter-terrorism operations, is creating new market opportunities. Governments' focus on modernizing their armed forces further fuels market expansion.

Key Players Shaping the Air-based Remote Weapon Stations Market Market

- General Dynamics Corporation

- Elbit Systems Ltd

- FN Herstal

- Rafael Advanced Defense Systems Ltd

- Leonardo S p A

- Saab A

- Duke Robotics Inc

- Singapore Technologies Engineering Ltd

- BAE Systems plc

Notable Milestones in Air-based Remote Weapon Stations Market Sector

- December 2022: Elbit Systems Ltd. announced the supply of Skylark I LEX Unmanned Aerial Systems to the Australian army, boosting the UAV-based RWS market segment.

- October 2022: The Indian government's approval of the Weapon Systems (WS) branch signifies increased investment and focus on modernizing the Indian Air Force's capabilities, including RWS.

In-Depth Air-based Remote Weapon Stations Market Market Outlook

The Air-based Remote Weapon Stations market is poised for continued growth, driven by technological advancements, increasing defense spending, and the rising adoption of UAVs. Strategic partnerships, focusing on integrating advanced technologies such as AI and improved sensor capabilities, will create lucrative opportunities for market players. The focus on precision-guided munitions and enhanced situational awareness systems will further contribute to market expansion, presenting significant opportunities for companies to develop innovative and advanced RWS.

Air-based Remote Weapon Stations Market Segmentation

-

1. Component

- 1.1. Weaponry

- 1.2. Vision Systems

-

2. Platform

- 2.1. Aircraft

- 2.2. Helicopters

- 2.3. Unmanned Aerial Vehicles

Air-based Remote Weapon Stations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Air-based Remote Weapon Stations Market Regional Market Share

Geographic Coverage of Air-based Remote Weapon Stations Market

Air-based Remote Weapon Stations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Helicopters Segment is Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air-based Remote Weapon Stations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Weaponry

- 5.1.2. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Aircraft

- 5.2.2. Helicopters

- 5.2.3. Unmanned Aerial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Air-based Remote Weapon Stations Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Weaponry

- 6.1.2. Vision Systems

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Aircraft

- 6.2.2. Helicopters

- 6.2.3. Unmanned Aerial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Air-based Remote Weapon Stations Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Weaponry

- 7.1.2. Vision Systems

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Aircraft

- 7.2.2. Helicopters

- 7.2.3. Unmanned Aerial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Air-based Remote Weapon Stations Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Weaponry

- 8.1.2. Vision Systems

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Aircraft

- 8.2.2. Helicopters

- 8.2.3. Unmanned Aerial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Air-based Remote Weapon Stations Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Weaponry

- 9.1.2. Vision Systems

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Aircraft

- 9.2.2. Helicopters

- 9.2.3. Unmanned Aerial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 General Dynamics Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elbit Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FN Herstal

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rafael Advanced Defense Systems Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Leonardo S p A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Saab A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Duke Robotics Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Singapore Technologies Engineering Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BAE Systems plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Air-based Remote Weapon Stations Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air-based Remote Weapon Stations Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Air-based Remote Weapon Stations Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Air-based Remote Weapon Stations Market Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Air-based Remote Weapon Stations Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Air-based Remote Weapon Stations Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Air-based Remote Weapon Stations Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Air-based Remote Weapon Stations Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Air-based Remote Weapon Stations Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Air-based Remote Weapon Stations Market Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Air-based Remote Weapon Stations Market Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Air-based Remote Weapon Stations Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Air-based Remote Weapon Stations Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Air-based Remote Weapon Stations Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Air-based Remote Weapon Stations Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Air-based Remote Weapon Stations Market Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia Pacific Air-based Remote Weapon Stations Market Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia Pacific Air-based Remote Weapon Stations Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Air-based Remote Weapon Stations Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Air-based Remote Weapon Stations Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Rest of the World Air-based Remote Weapon Stations Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Air-based Remote Weapon Stations Market Revenue (Million), by Platform 2025 & 2033

- Figure 23: Rest of the World Air-based Remote Weapon Stations Market Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Rest of the World Air-based Remote Weapon Stations Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Air-based Remote Weapon Stations Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 11: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 19: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Air-based Remote Weapon Stations Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Component 2020 & 2033

- Table 26: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 27: Global Air-based Remote Weapon Stations Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air-based Remote Weapon Stations Market?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Air-based Remote Weapon Stations Market?

Key companies in the market include General Dynamics Corporation, Elbit Systems Ltd, FN Herstal, Rafael Advanced Defense Systems Ltd, Leonardo S p A, Saab A, Duke Robotics Inc, Singapore Technologies Engineering Ltd, BAE Systems plc.

3. What are the main segments of the Air-based Remote Weapon Stations Market?

The market segments include Component, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Helicopters Segment is Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Elbit Systems Ltd. announced it will supply the Skylark I LEX Unmanned Aerial Systems to the Australian army. Skylark I-LEX is designed for the in-house operation by the moving forces and features a 40-km Line Of Sight range that makes it useful for several roles, including force protection and reconnaissance operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air-based Remote Weapon Stations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air-based Remote Weapon Stations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air-based Remote Weapon Stations Market?

To stay informed about further developments, trends, and reports in the Air-based Remote Weapon Stations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence