Key Insights

The European Unmanned Helicopter (UHS) market is experiencing significant expansion, fueled by growing adoption across diverse sectors. With an estimated market size of $5.39 billion in 2025 and a robust Compound Annual Growth Rate (CAGR) of 15.3%, the industry is projected for substantial value growth. Key drivers include escalating demand for efficient surveillance and reconnaissance in military operations, particularly amidst evolving geopolitical landscapes. Furthermore, burgeoning civil and commercial applications, such as precision agriculture, infrastructure inspection, emergency medical services, and logistics, are propelling this positive trajectory. The inherent versatility of unmanned helicopters in accessing challenging terrain and executing time-sensitive tasks makes them indispensable for enhancing operational efficiency and cost reduction for both businesses and government agencies.

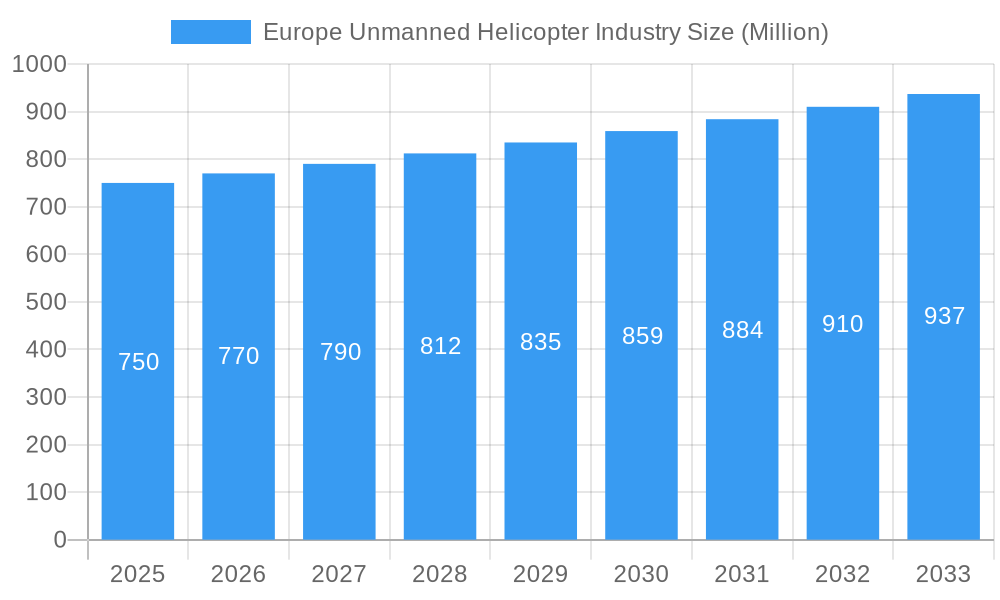

Europe Unmanned Helicopter Industry Market Size (In Billion)

Market growth is further bolstered by ongoing technological advancements in autonomous flight, enhanced payload capacity, and improved sensor integration, which are expanding the operational capabilities of UHS. While the market is segmented by Maximum Take-off Weight (MTOW) into Light, Medium, and Heavy Helicopters, the increasing sophistication across all categories is notable. Potential restraints, including stringent regulatory frameworks, the requirement for skilled operators, and concerns surrounding cybersecurity and data privacy, may temper growth. However, proactive engagement from key industry players such as Airbus SE, Leonardo SpA, and The Boeing Company, alongside supportive government initiatives in countries like the United Kingdom and Germany, are expected to mitigate these challenges and ensure continued market expansion. The forecast period from 2025 to 2033 indicates a sustained upward trend, with Europe emerging as a critical hub for both innovation and deployment of unmanned helicopter technology.

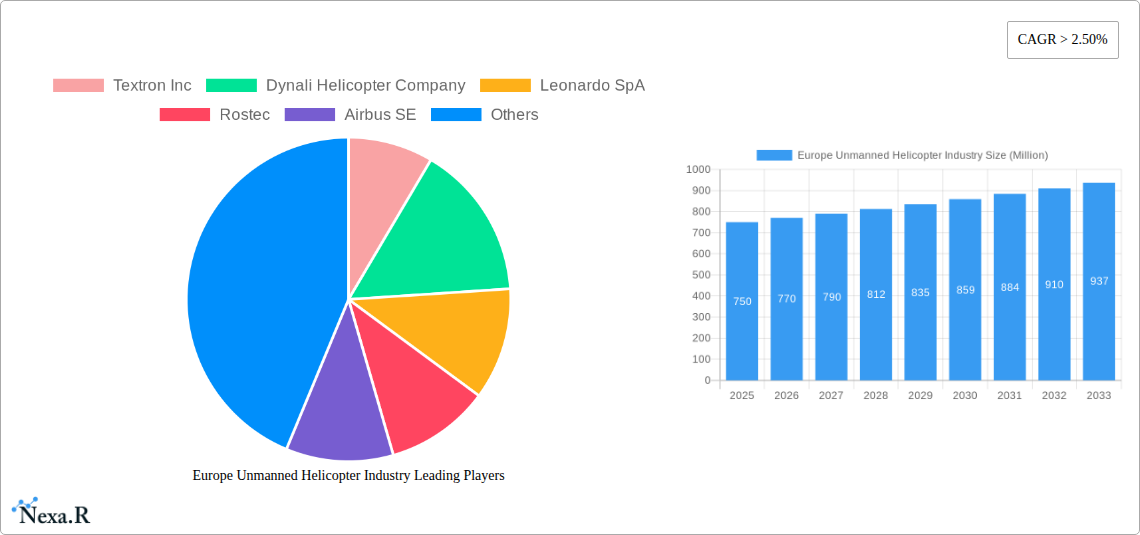

Europe Unmanned Helicopter Industry Company Market Share

This report offers a comprehensive, SEO-optimized analysis of the Europe Unmanned Helicopter Industry, covering market dynamics, growth trends, regional insights, product landscape, key drivers, challenges, emerging opportunities, and a detailed future outlook. Utilizing high-traffic keywords like "unmanned helicopters Europe," "drone helicopter market," "military drones," "civilian drones," and "VTOL technology," this report is designed for maximum search engine visibility and engagement with industry professionals, investors, and stakeholders. We meticulously examine parent and child market segments, providing a holistic view of this rapidly evolving sector. All quantitative values are presented in billion units.

Europe Unmanned Helicopter Industry Market Dynamics & Structure

The Europe Unmanned Helicopter Industry is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing adoption across diverse applications. Market concentration is moderately fragmented, with a few prominent players like Airbus SE, Leonardo S.p.A., and The Boeing Company holding significant market share in larger helicopter segments, while specialized manufacturers such as Dynali Helicopter Company and Alpi Aviation srl cater to niche markets. Technological innovation is primarily driven by advancements in AI-powered autonomous flight, enhanced sensor integration, extended endurance capabilities, and miniaturization of components. Regulatory frameworks, though evolving, remain a critical factor influencing market entry and operational deployment, with a focus on safety, airspace management, and data security. Competitive product substitutes, primarily fixed-wing drones and advanced conventional helicopters, are present but are increasingly being differentiated by the unique vertical take-off and landing (VTOL) capabilities of unmanned helicopters. End-user demographics are expanding beyond traditional military applications to include a growing number of civil and commercial sectors, such as logistics, agriculture, infrastructure inspection, and emergency services. Mergers and acquisitions (M&A) trends are on the rise as larger aerospace companies seek to acquire specialized drone technology and market expertise. We anticipate approximately 5-7 significant M&A deals within the forecast period, further consolidating market positions. Barriers to innovation include the high cost of R&D, stringent certification processes, and the need for robust cybersecurity measures.

- Market Concentration: Moderately fragmented with key players and niche specialists.

- Technological Innovation Drivers: AI autonomy, advanced sensors, endurance, VTOL capabilities.

- Regulatory Frameworks: Evolving but critical for market access and operations.

- Competitive Product Substitutes: Fixed-wing drones, conventional helicopters.

- End-User Demographics: Expanding from military to civil and commercial sectors.

- M&A Trends: Increasing activity for technology acquisition and market expansion.

Europe Unmanned Helicopter Industry Growth Trends & Insights

The Europe Unmanned Helicopter Industry is poised for substantial growth, driven by increasing demand for advanced aerial capabilities across both defense and civilian sectors. The market size is projected to evolve from approximately 1,200 million units in the historical period (2019-2024) to an estimated 2,500 million units in the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5%. This growth trajectory is fueled by a consistent rise in adoption rates, particularly within military applications for ISR (Intelligence, Surveillance, and Reconnaissance), logistics, and combat support missions. Civil and commercial adoption is accelerating, propelled by the efficiency gains offered by unmanned helicopters in areas such as precision agriculture (crop monitoring, spraying), infrastructure inspection (pipelines, power lines, wind turbines), search and rescue operations, and last-mile delivery services. Technological disruptions, including the integration of advanced propulsion systems for increased flight time, sophisticated AI for autonomous navigation and mission planning, and enhanced payload capacities, are redefining operational possibilities. Consumer behavior shifts are also playing a role, with a growing appreciation for the cost-effectiveness and reduced risk associated with unmanned aerial systems compared to manned operations. Market penetration is expected to deepen significantly as regulatory hurdles are progressively addressed and the proven reliability and versatility of unmanned helicopters become more widely recognized. The development of sophisticated flight control systems and redundant safety features are crucial for building trust and facilitating broader adoption, especially in densely populated areas.

Dominant Regions, Countries, or Segments in Europe Unmanned Helicopter Industry

Within the Europe Unmanned Helicopter Industry, the Military application segment stands out as the primary driver of market growth, commanding an estimated 65% of the total market value in the base year of 2025. This dominance is attributed to ongoing geopolitical tensions, the need for enhanced national security, and the integration of advanced unmanned aerial systems (UAS) into modern defense strategies. Key countries leading in military adoption include the United Kingdom, France, Germany, and Italy, owing to their substantial defense budgets and commitment to technological modernization. Economic policies supporting defense procurement and a focus on developing indigenous drone capabilities further bolster this segment.

In terms of product segments, Light Helicopters (Maximum Take-off Weight: < 150 kg) are projected to exhibit the highest growth potential, driven by their versatility, cost-effectiveness, and ease of deployment for a wide range of civilian and commercial tasks. This sub-segment is expected to grow at a CAGR of approximately 9.2% over the forecast period. Factors such as simplified regulatory requirements for smaller UAS, miniaturization of technology, and increasing demand from small and medium-sized enterprises (SMEs) for specialized aerial services are contributing to this expansion. Applications like aerial surveying, environmental monitoring, and small-scale logistics are increasingly relying on light unmanned helicopters.

Furthermore, the Civil and Commercial application segment, while currently smaller than the military segment, is experiencing a remarkable expansion. This growth is spurred by a confluence of factors including increasing investment in drone technology, development of sophisticated operational frameworks, and a growing awareness of the economic benefits. Countries like the Netherlands, Sweden, and Switzerland are emerging as hubs for innovation in commercial drone applications, focusing on logistics and specialized inspection services. Infrastructure development, particularly in urban air mobility (UAM) concepts, is also creating a fertile ground for commercial unmanned helicopter adoption. The market share of this segment is projected to increase from approximately 35% in the base year to over 40% by 2033, reflecting its significant growth potential.

- Dominant Application Segment: Military (estimated 65% market share in 2025).

- Leading Countries (Military): UK, France, Germany, Italy.

- Fastest Growing Product Segment: Light Helicopters (< 150 kg Maximum Take-off Weight).

- Emerging Commercial Hubs: Netherlands, Sweden, Switzerland.

- Key Growth Drivers (Civil/Commercial): Investment, regulatory clarity, economic benefits.

Europe Unmanned Helicopter Industry Product Landscape

The Europe Unmanned Helicopter Industry is witnessing a wave of product innovations focused on enhancing autonomy, endurance, and payload versatility. Manufacturers are developing advanced AI algorithms for sophisticated navigation, obstacle avoidance, and autonomous mission execution, significantly reducing pilot workload and expanding operational envelopes. Significant advancements in battery technology and hybrid-electric propulsion systems are leading to extended flight times, with some platforms achieving over 4 hours of continuous operation. Payload integration is becoming more modular and adaptable, allowing for rapid configuration changes to accommodate diverse sensor packages for aerial imaging, LiDAR scanning, thermal sensing, and delivery payloads. Performance metrics are consistently improving, with increased speed, altitude ceilings, and operational stability in adverse weather conditions. Unique selling propositions often lie in specialized VTOL capabilities combined with the stability of helicopter flight, enabling precise hovering for detailed inspections or targeted operations.

Key Drivers, Barriers & Challenges in Europe Unmanned Helicopter Industry

Key Drivers:

- Technological Advancements: Continued progress in AI, sensor technology, battery life, and lightweight materials.

- Defense Modernization: Ongoing investment in military ISR, logistics, and tactical support capabilities.

- Civilian Efficiency Gains: Demand for cost-effective and efficient solutions in logistics, agriculture, and infrastructure inspection.

- Regulatory Evolution: Gradual establishment of clear operational frameworks and airspace integration policies.

- Growing Investment: Increased venture capital and strategic investments in drone technology companies.

Barriers & Challenges:

- Regulatory Hurdles: Complex and varying national regulations, limitations on Beyond Visual Line of Sight (BVLOS) operations, and airspace integration challenges.

- Public Perception & Safety Concerns: Addressing societal concerns regarding privacy, noise pollution, and potential misuse.

- Cybersecurity Threats: Protecting critical data and control systems from malicious attacks.

- Supply Chain Disruptions: Reliance on global supply chains for specialized components can lead to delays and cost fluctuations.

- Skilled Workforce Shortage: Demand for trained pilots, technicians, and data analysts is outstripping supply.

- High Initial Investment Costs: The upfront cost of advanced unmanned helicopter systems can be a deterrent for some smaller organizations.

Emerging Opportunities in Europe Unmanned Helicopter Industry

Emerging opportunities in the Europe Unmanned Helicopter Industry are largely concentrated in the expansion of autonomous logistics networks, particularly for last-mile delivery in urban and remote areas, potentially reaching 500 million units in new applications by 2033. The development of AI-driven agricultural solutions, including precision crop monitoring and automated spraying, presents a significant untapped market. Furthermore, the increasing need for infrastructure integrity management, especially for critical assets like bridges, railways, and renewable energy installations, is creating demand for specialized inspection drones. The burgeoning interest in urban air mobility (UAM), though still in its nascent stages, represents a future growth frontier for larger unmanned helicopter platforms. Finally, leveraging unmanned helicopters for emergency response and disaster management, including search and rescue, aerial reconnaissance, and delivery of critical supplies to affected regions, offers substantial humanitarian and commercial potential.

Growth Accelerators in the Europe Unmanned Helicopter Industry Industry

Several key catalysts are accelerating the growth of the Europe Unmanned Helicopter Industry. Technological breakthroughs in battery energy density and electric propulsion systems are directly translating into longer flight durations and greater operational range, making unmanned helicopters viable for more complex missions. Strategic partnerships between established aerospace manufacturers and innovative drone technology startups are fostering rapid development and market entry. For instance, collaborations focused on developing integrated autonomous systems and advanced sensor payloads are critical. Market expansion strategies are also playing a vital role, as companies explore new application areas and geographical markets, facilitated by increasingly favorable regulatory environments in certain regions. The development of standardized communication protocols and interoperability standards for UAS will further reduce integration complexities and accelerate adoption.

Key Players Shaping the Europe Unmanned Helicopter Industry Market

- Textron Inc

- Dynali Helicopter Company

- Leonardo SpA

- Rostec

- Airbus SE

- Enstrom Helicopter Corp

- Alpi Aviation srl

- Heli-Sport sr

- Robinson Helicopter Company

- The Boeing Company

- MD HELICOPTERS INC

Notable Milestones in Europe Unmanned Helicopter Industry Sector

- 2020, November: Leonardo successfully completes flight tests for its AWHERO uncrewed helicopter demonstrator, showcasing advanced autonomous capabilities.

- 2021, March: Airbus Helicopters showcases its VSR700 uncrewed helicopter, highlighting its potential for maritime surveillance and logistics.

- 2022, June: Dynali Helicopter Company announces advancements in its H3 Sport and T20 models, focusing on increased payload capacity and endurance for commercial applications.

- 2022, October: The European Union Aviation Safety Agency (EASA) publishes updated guidelines for drone operations, paving the way for more extensive commercial use.

- 2023, April: Textron Inc. continues to integrate advanced autonomy features into its unmanned helicopter platforms for military clients, enhancing operational efficiency.

- 2023, September: Alpi Aviation srl receives certifications for new commercial drone operations, expanding its service offerings in aerial inspection and surveying.

- 2024, February: Robinson Helicopter Company and MD Helicopters Inc. are reportedly exploring collaborations on next-generation unmanned rotorcraft technologies.

In-Depth Europe Unmanned Helicopter Industry Market Outlook

The future of the Europe Unmanned Helicopter Industry is exceptionally promising, driven by a convergence of technological innovation and expanding market demands. Growth accelerators such as advancements in AI for autonomous operations, development of sustainable propulsion systems, and strategic industry partnerships will continue to propel the market forward. The increasing integration of unmanned helicopters into both defense and civilian infrastructure, from sophisticated ISR missions to last-mile delivery networks, points to significant long-term growth potential. Opportunities in emerging applications like precision agriculture, disaster management, and potentially urban air mobility will unlock new revenue streams and further solidify the industry's economic importance. Strategic opportunities lie in developing end-to-end solutions that address regulatory compliance, cybersecurity, and data analytics, thereby providing comprehensive value propositions to end-users. The industry is on a strong trajectory to become a cornerstone of future aerial operations across Europe.

Europe Unmanned Helicopter Industry Segmentation

-

1. Maximum Take-off Weight

- 1.1. Light Helicopters

- 1.2. Medium Helicopters

- 1.3. Heavy Helicopters

-

2. Application

- 2.1. Military

- 2.2. Civil and Commercial

Europe Unmanned Helicopter Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Russia

- 1.7. Rest of Europe

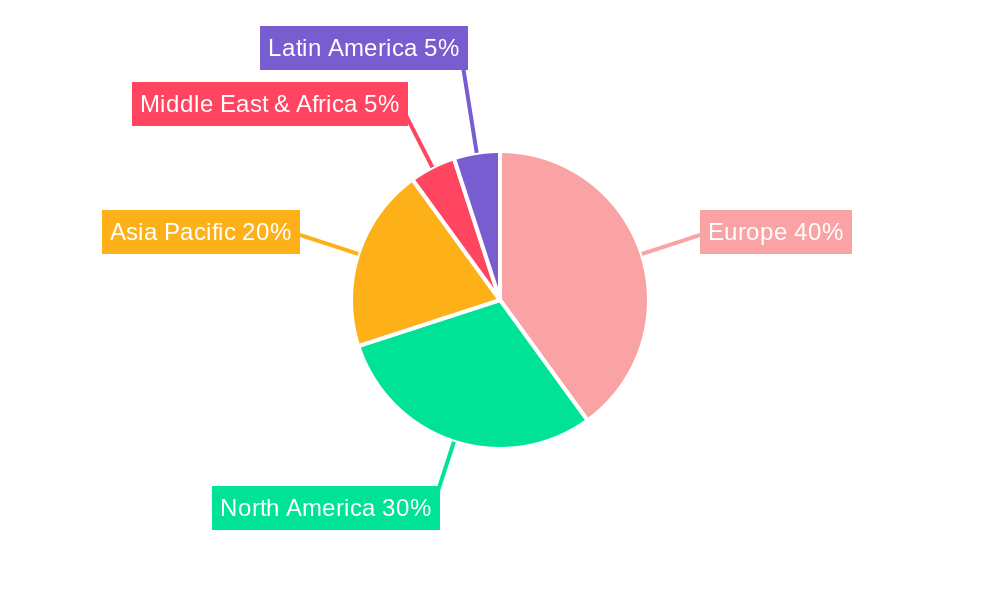

Europe Unmanned Helicopter Industry Regional Market Share

Geographic Coverage of Europe Unmanned Helicopter Industry

Europe Unmanned Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Helicopters to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 5.1.1. Light Helicopters

- 5.1.2. Medium Helicopters

- 5.1.3. Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Civil and Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dynali Helicopter Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leonardo SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rostec

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enstrom Helicopter Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alpi Aviation srl

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heli-Sport sr

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robinson Helicopter Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MD HELICOPTERS INC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Europe Unmanned Helicopter Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Unmanned Helicopter Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 2: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 5: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: France Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Germany Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Unmanned Helicopter Industry?

The projected CAGR is approximately 15.3%.

2. Which companies are prominent players in the Europe Unmanned Helicopter Industry?

Key companies in the market include Textron Inc, Dynali Helicopter Company, Leonardo SpA, Rostec, Airbus SE, Enstrom Helicopter Corp, Alpi Aviation srl, Heli-Sport sr, Robinson Helicopter Company, The Boeing Company, MD HELICOPTERS INC.

3. What are the main segments of the Europe Unmanned Helicopter Industry?

The market segments include Maximum Take-off Weight, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Helicopters to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Unmanned Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Unmanned Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Unmanned Helicopter Industry?

To stay informed about further developments, trends, and reports in the Europe Unmanned Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence