Key Insights

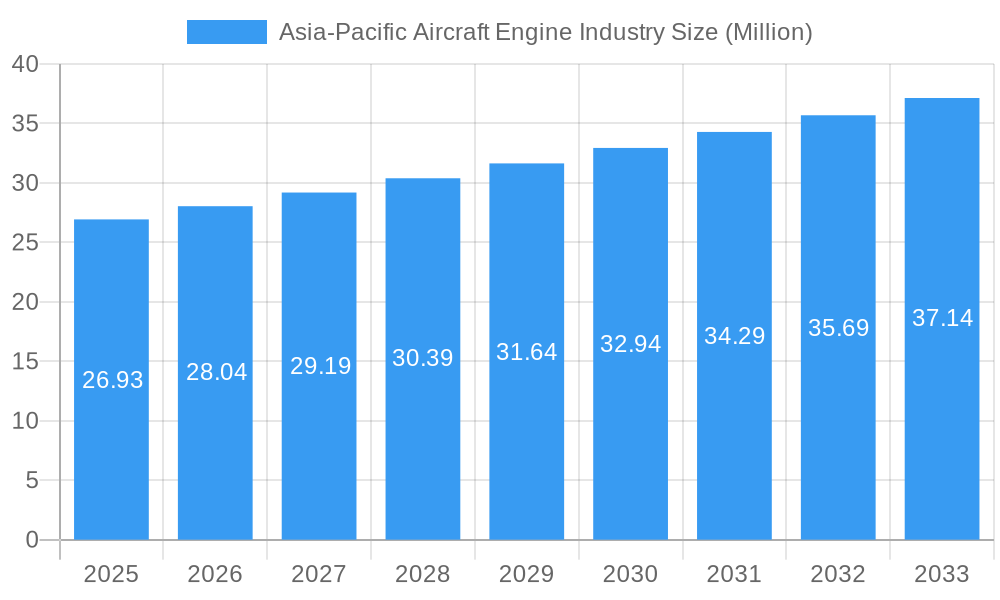

The Asia-Pacific aircraft engine industry is poised for robust expansion, projected to reach an estimated market size of USD 26.93 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.15% throughout the forecast period of 2025-2033. This significant growth is primarily fueled by escalating air travel demand across the region, driven by expanding middle classes, increasing tourism, and robust economic development in key nations like China and India. Furthermore, substantial investments in modernizing aging fleets with more fuel-efficient and technologically advanced engines are acting as a significant catalyst. The commercial aviation segment, in particular, is expected to dominate, supported by airlines' continuous efforts to enhance operational efficiency and passenger experience through new aircraft acquisitions and engine upgrades. Military aviation also presents a strong growth avenue, with governments prioritizing defense modernization, leading to increased demand for advanced and reliable propulsion systems for their air forces.

Asia-Pacific Aircraft Engine Industry Market Size (In Million)

The market dynamics are further shaped by evolving technological trends, including the increasing adoption of lightweight materials, advancements in engine architecture for improved fuel economy and reduced emissions, and the growing focus on sustainable aviation fuels. Emerging technologies like hybrid-electric and electric propulsion systems, although still in nascent stages for commercial applications, are also garnering significant attention and investment, signaling a future shift in engine technology. Key restraints that could impact growth include stringent environmental regulations, the high cost of research and development, and potential geopolitical instability that could disrupt supply chains and international trade. However, the strategic presence of leading global and regional players, including CFM International, General Electric Company, Pratt & Whitney, Rolls-Royce plc, and Aero Engine Corporation of China, coupled with significant indigenous manufacturing capabilities in countries like China and India, positions the Asia-Pacific region as a pivotal hub for innovation and production within the global aircraft engine landscape.

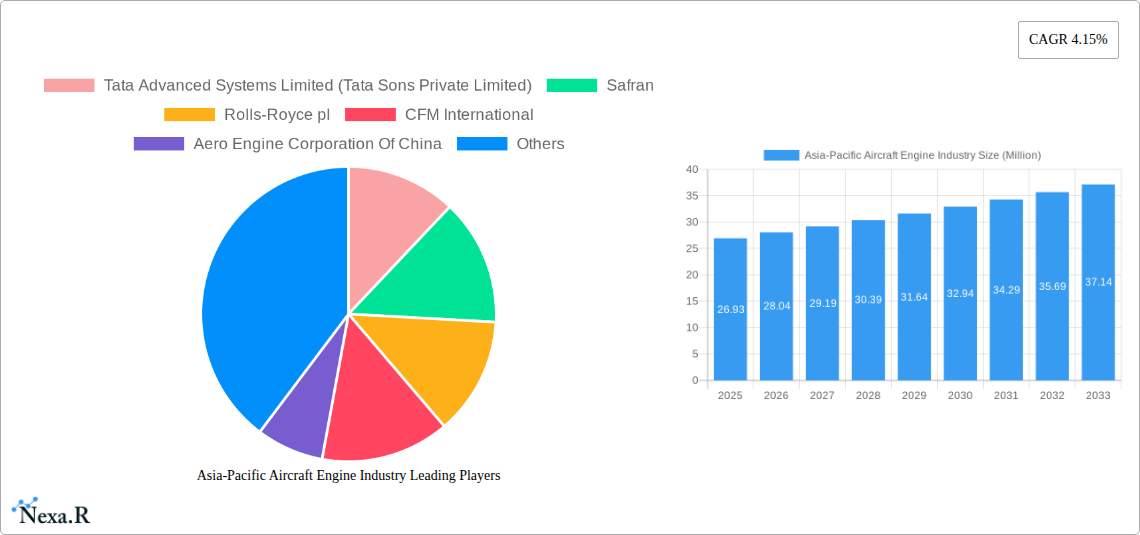

Asia-Pacific Aircraft Engine Industry Company Market Share

Here is a comprehensive and SEO-optimized report description for the Asia-Pacific Aircraft Engine Industry, designed for maximum visibility and engagement:

Asia-Pacific Aircraft Engine Industry Market Dynamics & Structure

The Asia-Pacific Aircraft Engine Industry is characterized by a dynamic market structure, heavily influenced by increasing air travel demand and significant investments in aerospace manufacturing. Market concentration is moderate, with major global players like General Electric Company, Pratt and Whitney (RTX Corporation), and Rolls-Royce plc holding substantial shares, alongside emerging regional powerhouses such as CFM International, Aero Engine Corporation Of China, and Hindustan Aeronautics Limited. Technological innovation is a primary driver, propelled by the pursuit of fuel efficiency, reduced emissions, and enhanced performance, particularly in turbofan engines vital for commercial aviation. Regulatory frameworks, including stringent environmental standards and aviation safety certifications, shape product development and market entry. Competitive product substitutes are primarily driven by advancements in engine technology within existing categories rather than entirely new engine types. End-user demographics are shifting towards a larger proportion of commercial aviation traffic, fueled by a growing middle class across countries like China and India, alongside sustained demand from military aviation for enhanced defense capabilities. Mergers and acquisitions (M&A) trends, while less frequent than in mature markets, are strategically aimed at bolstering manufacturing capabilities, expanding service networks, and acquiring advanced technologies. For instance, strategic alliances and joint ventures are common, fostering collaboration between established OEMs and local manufacturing partners like Tata Advanced Systems Limited. Innovation barriers include high R&D costs, complex certification processes, and the long development cycles inherent in aerospace.

- Market Concentration: Moderate, with significant global OEMs and growing regional influence.

- Technological Innovation Drivers: Fuel efficiency, reduced emissions, performance enhancement, advanced materials.

- Regulatory Frameworks: Stringent safety, environmental, and emissions standards (e.g., ICAO CAEP).

- Competitive Product Substitutes: Primarily driven by next-generation engine designs within existing categories.

- End-User Demographics: Growing commercial aviation segment, robust military aviation demand.

- M&A Trends: Strategic, focusing on capability enhancement and technology acquisition.

Asia-Pacific Aircraft Engine Industry Growth Trends & Insights

The Asia-Pacific Aircraft Engine Industry is poised for substantial growth, driven by robust demand across its diverse end-user segments. The market size evolution is projected to witness a significant upward trajectory throughout the forecast period of 2025–2033, supported by a projected Compound Annual Growth Rate (CAGR) of approximately xx% from the base year 2025. This expansion is primarily fueled by the burgeoning commercial aviation sector, a direct consequence of rapid economic development and increasing disposable incomes in key economies such as China and India. The adoption rates of newer, more fuel-efficient turbofan engines are escalating as airlines prioritize operational cost savings and compliance with evolving environmental regulations. Technological disruptions, including advancements in materials science, additive manufacturing, and hybrid-electric propulsion concepts, are gradually influencing the design and manufacturing processes, promising greater efficiency and sustainability. Consumer behavior shifts are evident in the growing preference for air travel as a primary mode of transportation for both leisure and business. Furthermore, governments in the region are actively promoting aerospace manufacturing and MRO (Maintenance, Repair, and Overhaul) capabilities, fostering a more localized and resilient supply chain. The forecast period will likely see a significant increase in the number of aircraft deliveries, directly translating to a higher demand for both new engines and aftermarket services. The "Rest of Asia-Pacific" segment, encompassing countries like Indonesia and Vietnam, is also expected to contribute significantly to overall market growth due to improving aviation infrastructure and increasing air connectivity. The military aviation segment, while smaller in volume, remains a critical growth area, driven by defense modernization programs and geopolitical considerations across the region. The transition from older engine models to advanced turbofan and, to some extent, next-generation turboprop engines for regional aviation, underscores the market's dynamic nature and its responsiveness to evolving technological and economic landscapes. The projected market value in the forecast period is expected to reach hundreds of millions of units, reflecting the scale of this vital industry.

Dominant Regions, Countries, or Segments in Asia-Pacific Aircraft Engine Industry

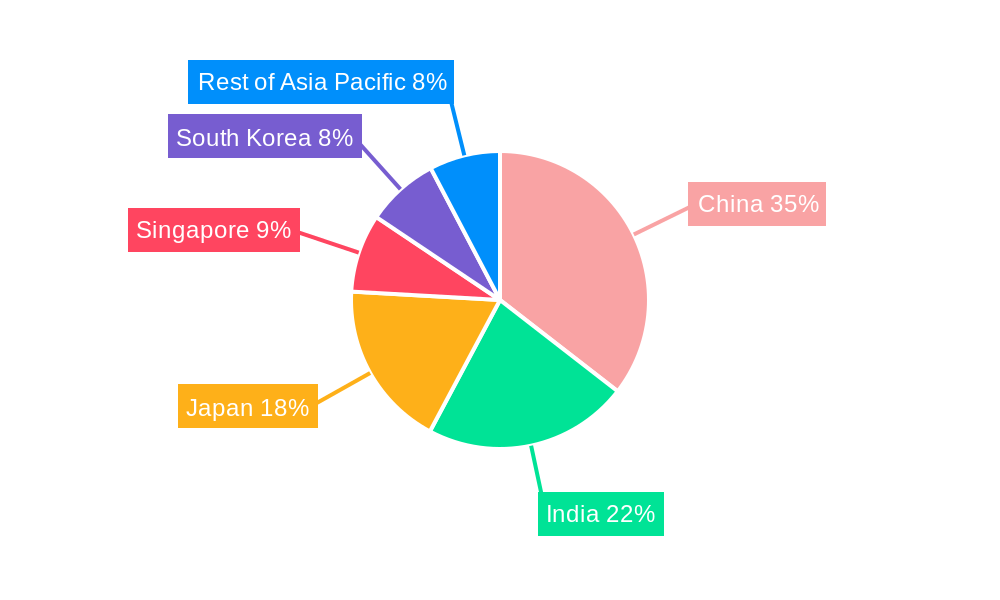

The Asia-Pacific Aircraft Engine Industry is predominantly driven by Commercial Aviation within the Turbofan Engine Type, with China and India emerging as the most significant geographical markets. This dominance is underpinned by a confluence of powerful economic, demographic, and strategic factors.

Commercial Aviation: This segment accounts for the largest share of the market, propelled by a rapidly expanding middle class, burgeoning tourism, and increasing business travel across the region. Airlines are undertaking massive fleet expansions and modernizations, leading to a surge in demand for new aircraft and, consequently, their engines. The sheer volume of passenger and cargo traffic anticipated over the forecast period firmly establishes commercial aviation as the primary growth engine.

Turbofan Engines: Within the engine types, turbofan engines are the undisputed leaders, powering the vast majority of commercial airliners. Their efficiency, power, and range are perfectly suited for the long-haul and high-frequency routes that characterize Asia-Pacific air travel. While turboprops are crucial for regional aviation and turboshafts for helicopters, their market share is considerably smaller compared to the ubiquitous turbofan. Piston engines, primarily found in smaller general aviation aircraft, represent an even more niche segment.

China: As the world's second-largest economy, China's demand for air travel is immense and continues to grow. Significant government investment in aviation infrastructure, including airport development and domestic aircraft manufacturing initiatives, further bolsters the aircraft engine market. Chinese airlines are among the largest operators of Boeing and Airbus aircraft, driving substantial orders for GE Company and CFM International engines. Furthermore, China's ambition to develop its own indigenous aerospace capabilities, spearheaded by entities like the Aero Engine Corporation of China, is a significant factor shaping the future landscape.

India: India's aviation market is recognized as one of the fastest-growing globally. A young demographic, increasing disposable incomes, and a strong emphasis on air connectivity for economic development have led to exponential growth in passenger numbers. Major Indian carriers, such as Air India, are placing substantial orders for new aircraft equipped with advanced engines, as evidenced by recent large deals involving GE Company. Hindustan Aeronautics Limited also plays a crucial role in the Indian market, particularly in the military aviation sector and in supporting MRO activities.

The "Rest of Asia-Pacific," while fragmented, also presents considerable growth potential, with countries like Singapore serving as important hubs for MRO services and regional aviation. South Korea, with its advanced manufacturing capabilities and significant defense spending, also contributes to the regional market. However, the sheer scale of passenger traffic and fleet expansion in China and India solidifies their positions as the dominant geographies in this sector.

Asia-Pacific Aircraft Engine Industry Product Landscape

The Asia-Pacific Aircraft Engine Industry is witnessing a pronounced shift towards more fuel-efficient and environmentally friendly propulsion systems. Turbofan engines, particularly advanced models with higher bypass ratios and sophisticated materials, dominate the commercial aviation sector, offering significant improvements in performance and reduced operational costs. Innovations are focused on enhancing thrust-to-weight ratios, reducing noise pollution, and lowering carbon emissions through technologies like ceramic matrix composites (CMCs) and advanced aerodynamic designs. For military applications, a blend of high-performance turbofans and specialized turboshaft engines for rotorcraft are in demand, emphasizing reliability, multi-fuel capability, and advanced sensor integration. The product landscape is being shaped by increasing demand for reliable aftermarket services, including engine maintenance, repair, and overhaul (MRO), with companies like ST Engineering playing a vital role.

Key Drivers, Barriers & Challenges in Asia-Pacific Aircraft Engine Industry

Key Drivers: The Asia-Pacific Aircraft Engine Industry is propelled by a surge in air travel demand, driven by economic growth and a rising middle class, particularly in China and India. Government support for aviation infrastructure and manufacturing, coupled with defense modernization programs in military aviation, further fuels market expansion. Technological advancements focusing on fuel efficiency and reduced emissions are also critical growth accelerators.

Barriers & Challenges: High R&D expenditure and long product development cycles for new engine technologies present significant barriers. Stringent regulatory approvals and certification processes add to lead times and costs. Supply chain disruptions, geopolitical uncertainties, and intense competition from established global players and emerging regional manufacturers also pose considerable challenges. Skilled labor shortages in specialized manufacturing and MRO roles can also impact growth.

Emerging Opportunities in Asia-Pacific Aircraft Engine Industry

Emerging opportunities in the Asia-Pacific Aircraft Engine Industry lie in the growing demand for sustainable aviation fuels (SAFs) and the development of hybrid-electric and electric propulsion systems for future aircraft. The increasing focus on MRO services, driven by the expanding regional fleet, presents significant avenues for aftermarket providers. Furthermore, the "Rest of Asia-Pacific" region offers untapped markets with developing aviation infrastructure, promising substantial growth potential for engine manufacturers and service providers. Collaboration with local entities for technology transfer and indigenous manufacturing also presents a key opportunity.

Growth Accelerators in the Asia-Pacific Aircraft Engine Industry Industry

Growth in the Asia-Pacific Aircraft Engine Industry is being significantly accelerated by major fleet expansion programs undertaken by leading airlines in China and India, demanding a substantial number of new aircraft and their associated engines. Strategic partnerships and joint ventures between global engine manufacturers and regional aerospace companies, such as collaborations involving Tata Advanced Systems Limited and Safran, are bolstering local manufacturing capabilities and expanding service networks. Investments in next-generation engine technologies, focusing on improved fuel efficiency and reduced environmental impact, are not only meeting regulatory demands but also driving operational cost savings for airlines, thereby acting as powerful catalysts for sustained market growth.

Key Players Shaping the Asia-Pacific Aircraft Engine Industry Market

- Tata Advanced Systems Limited (Tata Sons Private Limited)

- Safran

- Rolls-Royce plc

- CFM International

- Aero Engine Corporation Of China

- MTU Aero Engines AG

- Ishikawajima Harima Heavy Industries Co Limited

- JSC UEC-Aviadvigatel

- Thompson Aero Seating Limited

- General Electric Company

- Pratt and Whitney (RTX Corporation)

- Hindustan Aeronautics Limited

Notable Milestones in Asia-Pacific Aircraft Engine Industry Sector

- February 2023: Air India placed a definitive order for 40 GEnx-1B and 20 GE9X engines and a multi-year TrueChoice engine services agreement with GE Company.

- June 2022: ST Engineering announced that their Commercial Aerospace business signed a five-year agreement with Safran Aircraft Engines, a world-leading aerospace engine manufacturer, for ST Engineering to provide engine maintenance (shop visit) offload for the CFM56-5B and -7B engines.

In-Depth Asia-Pacific Aircraft Engine Industry Market Outlook

The Asia-Pacific Aircraft Engine Industry is set for a period of robust expansion, driven by the insatiable demand for air travel and aggressive fleet modernization initiatives. Future market potential is anchored in the ongoing commitment to advanced turbofan technology, which offers superior fuel efficiency and reduced environmental impact, aligning with global sustainability goals. Strategic opportunities lie in the development and integration of sustainable aviation fuels and the nascent stages of hybrid-electric propulsion, positioning key players for future market leadership. The increasing emphasis on MRO services, especially in rapidly growing aviation markets, presents a significant and stable revenue stream. As regional economies continue to flourish, the demand for both commercial and military aircraft will remain strong, ensuring sustained growth for the aircraft engine sector in this dynamic region.

Asia-Pacific Aircraft Engine Industry Segmentation

-

1. Engine Type

- 1.1. Turbofan

- 1.2. Turboprop

- 1.3. Turboshaft

- 1.4. Piston

-

2. End User

- 2.1. Commercial Aviation

- 2.2. Military Aviation

- 2.3. General Aviation

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. South Korea

- 3.6. Rest of Asia-Pacific

Asia-Pacific Aircraft Engine Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Singapore

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Aircraft Engine Industry Regional Market Share

Geographic Coverage of Asia-Pacific Aircraft Engine Industry

Asia-Pacific Aircraft Engine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Turbofan Engine is expected to Dominate the Market during the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Turbofan

- 5.1.2. Turboprop

- 5.1.3. Turboshaft

- 5.1.4. Piston

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial Aviation

- 5.2.2. Military Aviation

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Singapore

- 5.3.5. South Korea

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Singapore

- 5.4.5. South Korea

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. China Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Turbofan

- 6.1.2. Turboprop

- 6.1.3. Turboshaft

- 6.1.4. Piston

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial Aviation

- 6.2.2. Military Aviation

- 6.2.3. General Aviation

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Singapore

- 6.3.5. South Korea

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. India Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Turbofan

- 7.1.2. Turboprop

- 7.1.3. Turboshaft

- 7.1.4. Piston

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial Aviation

- 7.2.2. Military Aviation

- 7.2.3. General Aviation

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Singapore

- 7.3.5. South Korea

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Japan Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Turbofan

- 8.1.2. Turboprop

- 8.1.3. Turboshaft

- 8.1.4. Piston

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial Aviation

- 8.2.2. Military Aviation

- 8.2.3. General Aviation

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Singapore

- 8.3.5. South Korea

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. Singapore Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Turbofan

- 9.1.2. Turboprop

- 9.1.3. Turboshaft

- 9.1.4. Piston

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial Aviation

- 9.2.2. Military Aviation

- 9.2.3. General Aviation

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Singapore

- 9.3.5. South Korea

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. South Korea Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 10.1.1. Turbofan

- 10.1.2. Turboprop

- 10.1.3. Turboshaft

- 10.1.4. Piston

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial Aviation

- 10.2.2. Military Aviation

- 10.2.3. General Aviation

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Singapore

- 10.3.5. South Korea

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 11. Rest of Asia Pacific Asia-Pacific Aircraft Engine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Engine Type

- 11.1.1. Turbofan

- 11.1.2. Turboprop

- 11.1.3. Turboshaft

- 11.1.4. Piston

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Commercial Aviation

- 11.2.2. Military Aviation

- 11.2.3. General Aviation

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Singapore

- 11.3.5. South Korea

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Engine Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Tata Advanced Systems Limited (Tata Sons Private Limited)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Safran

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Rolls-Royce pl

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 CFM International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aero Engine Corporation Of China

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MTU Aero Engines AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ishikawajima Harima Heavy Industries Co Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 JSC UEC-Aviadvigatel

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Thompson Aero Seating Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 General Electric Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Pratt and Whitney (RTX Corporation)

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Hindustan Aeronautics Limited

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Tata Advanced Systems Limited (Tata Sons Private Limited)

List of Figures

- Figure 1: Asia-Pacific Aircraft Engine Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Aircraft Engine Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 2: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 6: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 10: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 14: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 18: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 22: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 26: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Aircraft Engine Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Aircraft Engine Industry?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Asia-Pacific Aircraft Engine Industry?

Key companies in the market include Tata Advanced Systems Limited (Tata Sons Private Limited), Safran, Rolls-Royce pl, CFM International, Aero Engine Corporation Of China, MTU Aero Engines AG, Ishikawajima Harima Heavy Industries Co Limited, JSC UEC-Aviadvigatel, Thompson Aero Seating Limited, General Electric Company, Pratt and Whitney (RTX Corporation), Hindustan Aeronautics Limited.

3. What are the main segments of the Asia-Pacific Aircraft Engine Industry?

The market segments include Engine Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.93 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Turbofan Engine is expected to Dominate the Market during the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Air India placed a definitive order for 40 GEnx-1B and 20 GE9X engines and a multi-year TrueChoice engine services agreement with GE Company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Aircraft Engine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Aircraft Engine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Aircraft Engine Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Aircraft Engine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence