Key Insights

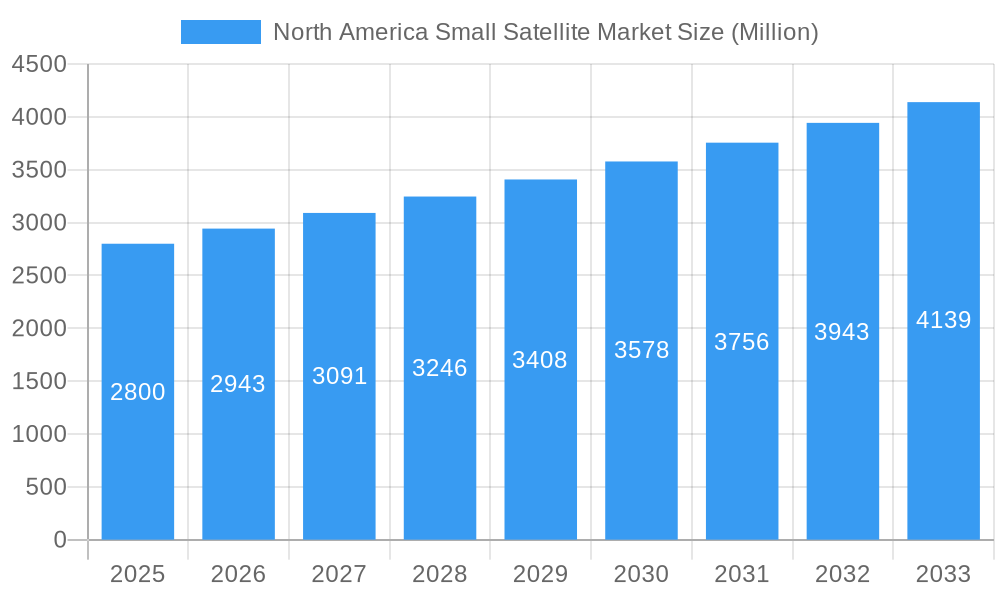

The North American small satellite market is poised for substantial expansion, projected to reach an estimated $XX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.18% through 2033. This growth trajectory is fueled by a confluence of factors, primarily the escalating demand for advanced communication services, critical Earth observation data for climate monitoring and resource management, and precise navigation systems. The increasing miniaturization of satellite technology, coupled with reduced launch costs, has democratized access to space, enabling a surge in small satellite constellations. Commercial entities are aggressively investing in these constellations for a range of applications, from global internet connectivity and IoT solutions to sophisticated imaging and remote sensing. Furthermore, government and military agencies are leveraging small satellites for enhanced intelligence, surveillance, and reconnaissance (ISR) capabilities, contributing significantly to market momentum. The United States, Canada, and Mexico form the core of this dynamic regional market, with ongoing technological advancements in propulsion systems, such as electric and gas-based technologies, promising further efficiencies and capabilities.

North America Small Satellite Market Market Size (In Billion)

The market's expansion is further propelled by ongoing advancements in data analytics and artificial intelligence, which are enabling more effective utilization of the vast amounts of data generated by small satellite constellations. Applications like precision agriculture, disaster management, and urban planning are increasingly relying on timely and granular satellite imagery and data. While the market exhibits strong growth, certain restraints, such as the increasing complexity of space debris management and evolving regulatory frameworks, warrant careful consideration. However, the overarching trend points towards a highly innovative and competitive landscape, with key players like Space Exploration Technologies Corp., Planet Labs Inc., and Spire Global Inc. driving technological breakthroughs and market penetration across various applications including communication, Earth observation, and navigation, across all orbit classes (LEO, MEO, GEO) and end-user segments (Commercial, Military & Government).

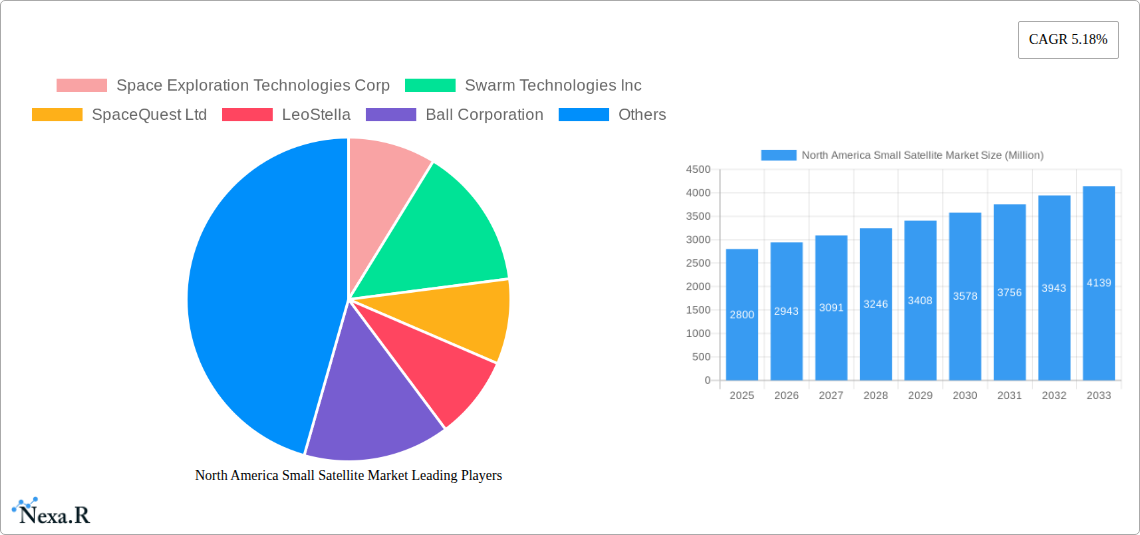

North America Small Satellite Market Company Market Share

North America Small Satellite Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the North America Small Satellite Market, meticulously examining market dynamics, growth trends, segmentation, product landscape, and key industry players. With a focus on the period from 2019 to 2033, and a base year of 2025, this report delivers critical insights for stakeholders navigating this rapidly evolving sector. Discover the intricate interplay of technological advancements, regulatory shifts, and commercial opportunities shaping the future of small satellites across North America.

North America Small Satellite Market Market Dynamics & Structure

The North America small satellite market is characterized by a dynamic interplay of increasing technological sophistication, a burgeoning demand for specialized data, and evolving regulatory landscapes. Market concentration is moderately high, with key players investing heavily in R&D to maintain a competitive edge. Technological innovation is primarily driven by miniaturization, improved sensor capabilities, and advancements in propulsion systems, enabling more sophisticated applications and orbital maneuvers. The regulatory framework, while supportive of innovation, is continually adapting to address space debris mitigation and spectrum allocation challenges. Competitive product substitutes include larger, traditional satellites for certain applications, but the cost-effectiveness and rapid deployment capabilities of small satellites are increasingly outmaneuvering these alternatives for many use cases. End-user demographics span a wide spectrum, from commercial enterprises seeking Earth observation data for agriculture and disaster management to government and military entities requiring intelligence, surveillance, and reconnaissance (ISR) capabilities. Mergers and acquisitions (M&A) trends are on the rise as established aerospace companies seek to integrate nascent small satellite capabilities and startups aim to scale their operations. For instance, recent M&A activities reflect a growing consolidation within the industry.

- Market Concentration: Moderate to High, driven by key players like SpaceX and Spire Global.

- Technological Innovation Drivers: Miniaturization, AI integration for data processing, enhanced propulsion, and advanced sensor technology.

- Regulatory Framework: Evolving to address space traffic management, debris mitigation, and spectrum licensing.

- Competitive Product Substitutes: Traditional larger satellites, terrestrial-based sensing networks.

- End-User Demographics: Commercial (telecommunications, agriculture, insurance, mining), Military & Government (ISR, communication, navigation), Scientific research.

- M&A Trends: Increasing consolidation, strategic partnerships, and venture capital investments.

North America Small Satellite Market Growth Trends & Insights

The North America small satellite market is experiencing robust growth, projected to expand significantly from its current valuation. This expansion is fueled by a confluence of factors including the relentless pursuit of cost-effective space-based solutions and the increasing demand for real-time data across various sectors. The adoption rate of small satellites is accelerating as their reliability and capabilities mature, challenging the dominance of traditional, larger satellite constellations. Technological disruptions, such as the advent of sophisticated miniaturized sensors and advanced electric propulsion systems, are enabling a wider array of applications, from high-resolution Earth observation to complex communication networks. Consumer behavior shifts are also playing a crucial role, with industries becoming more data-dependent and expecting faster, more accessible insights. The development of reusable rocket technology has dramatically reduced launch costs, further democratizing access to space for small satellite deployment. This has led to a proliferation of small satellite constellations designed for specific purposes, such as low-latency global internet services and precise environmental monitoring. The increasing demand for specialized data, from precision agriculture to infrastructure monitoring and national security, is driving innovation and market penetration.

- Market Size Evolution: The market is projected to witness a substantial increase in value and deployment volume, driven by increasing payload capacity and decreasing launch costs.

- Adoption Rates: Rapidly growing across commercial and government sectors, driven by demonstrated ROI and enhanced capabilities.

- Technological Disruptions: Advancements in AI for onboard data processing, next-generation sensor technology, and modular satellite design are reshaping market offerings.

- Consumer Behavior Shifts: Growing reliance on real-time, high-resolution geospatial data for decision-making in diverse industries.

- Market Penetration: Expected to deepen as affordability and accessibility improve, making space-based solutions viable for a broader range of applications and smaller organizations.

- CAGR: Estimated to be in the double digits during the forecast period.

Dominant Regions, Countries, or Segments in North America Small Satellite Market

Within the North American small satellite market, the United States stands as the undisputed leader, driving innovation, investment, and deployment. This dominance is underpinned by a robust ecosystem of private space companies, significant government funding for research and development, and a strong demand for space-based data from both commercial and military sectors. The U.S. government, through agencies like NASA and the Department of Defense, is a major customer and enabler of small satellite technology, fostering advancements in areas such as Earth observation and communications.

Among the segments, Earth Observation is currently the most dominant application. This is driven by the growing need for high-resolution imagery for applications in precision agriculture, environmental monitoring, urban planning, disaster response, and infrastructure management. The ability of small satellites to provide frequent revisit rates and detailed insights is proving invaluable for these industries.

In terms of orbit class, LEO (Low Earth Orbit) reigns supreme. The advantages of LEO for small satellites include shorter communication latency, higher resolution for Earth observation due to proximity, and reduced launch costs compared to higher orbits. LEO constellations are ideal for applications requiring global coverage and rapid data acquisition.

The Commercial end-user segment is exhibiting the most significant growth momentum. Private companies are investing heavily in small satellite constellations to offer innovative services, ranging from global internet connectivity to specialized data analytics. This commercial drive is pushing the boundaries of satellite technology and applications.

Regarding propulsion technology, Electric propulsion systems are gaining prominence due to their high specific impulse, enabling efficient and precise orbital maneuvering and station-keeping for small satellites, thereby extending their operational lifespan and mission capabilities.

- Dominant Country: United States, due to strong R&D, significant government investment, and a thriving private sector.

- Dominant Application: Earth Observation, driven by diverse commercial and government needs for high-resolution, frequent data.

- Dominant Orbit Class: LEO, offering cost-effectiveness, low latency, and high resolution for small satellites.

- Dominant End User: Commercial sector, fueled by innovative service offerings and data-driven business models.

- Dominant Propulsion Tech: Electric Propulsion, offering efficiency and precision for orbital operations.

North America Small Satellite Market Product Landscape

The product landscape of the North America small satellite market is characterized by increasing diversification and specialization. Innovations are focused on enhancing payload capabilities, improving satellite lifespan, and reducing overall costs. Small satellites are now equipped with advanced sensors capable of capturing hyperspectral, multispectral, and high-resolution imagery. Communication satellites are leveraging miniaturized phased-array antennas for high-bandwidth data transmission. Navigation payloads are becoming more sophisticated, contributing to enhanced positioning accuracy. The performance metrics are continuously improving, with faster data processing, greater power efficiency, and enhanced orbital maneuverability becoming standard. Unique selling propositions often revolve around rapid deployment, cost-effectiveness, and the ability to form large, interconnected constellations for comprehensive global coverage. Technological advancements are also seen in modular satellite designs, allowing for easier upgrades and customization.

Key Drivers, Barriers & Challenges in North America Small Satellite Market

The North America small satellite market is propelled by several key drivers. The escalating demand for Earth observation data across various industries like agriculture, insurance, and urban planning is a primary growth engine. Reduced launch costs, largely due to advancements in reusable rocket technology, have made space more accessible. Government initiatives and increased defense spending on surveillance and reconnaissance further bolster the market. Furthermore, the burgeoning demand for global internet connectivity is driving the deployment of large small satellite constellations.

However, the market faces significant barriers and challenges. The increasing density of satellites in orbit raises concerns about space debris and the need for robust space traffic management systems. Regulatory hurdles related to spectrum allocation and licensing can impede rapid deployment. Supply chain issues for specialized components can lead to production delays. Intense competition among a growing number of players can impact pricing and profitability. Ensuring the long-term sustainability and survivability of small satellites in the harsh space environment also remains a technical challenge.

Emerging Opportunities in North America Small Satellite Market

Emerging opportunities in the North America small satellite market are diverse and promising. The expansion of Internet of Things (IoT) connectivity on a global scale presents a vast untapped market for small satellites to provide seamless connectivity in remote or underserved areas. The development of in-orbit servicing and manufacturing capabilities for small satellites offers potential for extending satellite lifespans and performing on-orbit repairs, reducing waste and costs. The increasing focus on climate change monitoring and environmental sustainability is creating a demand for more sophisticated Earth observation satellites capable of tracking deforestation, pollution levels, and climate patterns with unprecedented accuracy. Furthermore, the application of artificial intelligence (AI) and machine learning (ML) for onboard data processing and autonomous satellite operations is opening new avenues for more intelligent and efficient space missions. The potential for space-based edge computing is another significant opportunity, enabling real-time data analysis and decision-making directly from orbit.

Growth Accelerators in the North America Small Satellite Market Industry

Several growth accelerators are poised to significantly propel the North America small satellite market forward. Technological breakthroughs in miniaturization, sensor technology, and advanced propulsion systems are continually enhancing the capabilities and reducing the cost of small satellites. The development of next-generation launch vehicles that offer increased payload capacity and reduced launch windows will further democratize access to space. Strategic partnerships between satellite manufacturers, data analytics providers, and end-user industries are fostering innovative applications and market penetration. The increasing investment in national security and defense applications, including intelligence, surveillance, and reconnaissance (ISR), is a major catalyst. Furthermore, the growing global demand for reliable and ubiquitous communication services, particularly in developing regions, is a significant market expansion strategy. The ongoing evolution of regulatory frameworks to support commercial space activities also acts as a crucial accelerator.

Key Players Shaping the North America Small Satellite Market Market

- Space Exploration Technologies Corp

- Swarm Technologies Inc

- SpaceQuest Ltd

- LeoStella

- Ball Corporation

- Planet Labs Inc

- Spire Global Inc

- Capella Space Corp

- National Aeronautics and Space Administration (NASA)

Notable Milestones in North America Small Satellite Market Sector

- April 2022: Rocket Lab successfully launched BlackSky 16 and 17 satellites, expanding the company's constellation from 12 to 14 high-resolution satellites.

- April 2022: Swarm Technologies successfully launched 12 'picosatellites' on the Transporter 4 mission, enhancing their low-data-rate communications network.

- February 2022: SpaceX's Falcon 9 rocket successfully launched 49 more Starlink internet satellites, significantly bolstering their global satellite internet constellation.

In-Depth North America Small Satellite Market Market Outlook

The future outlook for the North America small satellite market is exceptionally bright, driven by sustained innovation and increasing demand. Growth accelerators such as advancements in AI for onboard data processing and the expansion of global IoT networks are set to redefine satellite capabilities. The increasing focus on environmental monitoring and climate change solutions presents significant opportunities for Earth observation small satellites. Strategic partnerships between established aerospace firms and emerging startups will continue to foster novel applications and market penetration. The robust defense spending in North America will remain a key driver for ISR small satellite deployments. Furthermore, the ongoing development of more efficient and cost-effective launch solutions will continue to make space accessible to a wider array of commercial and governmental entities, solidifying the market's upward trajectory and promising substantial future potential.

North America Small Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

North America Small Satellite Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

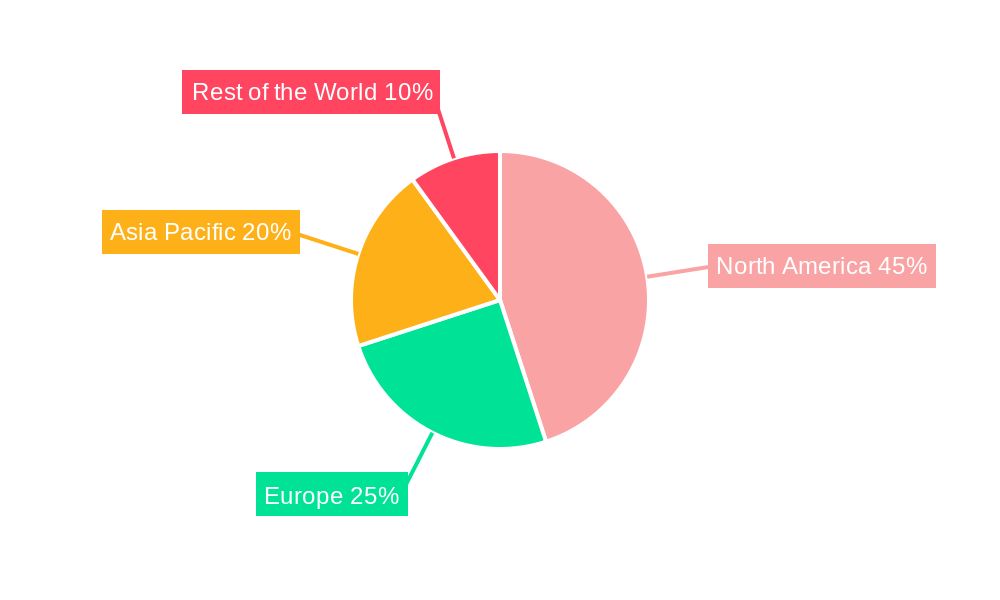

North America Small Satellite Market Regional Market Share

Geographic Coverage of North America Small Satellite Market

North America Small Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. LEO satellites are driving the demand for small satellites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Swarm Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SpaceQuest Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LeoStella

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ball Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Planet Labs Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Spire Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Capella Space Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 National Aeronautics and Space Administration (NASA)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Small Satellite Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Small Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: North America Small Satellite Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Small Satellite Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 3: North America Small Satellite Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: North America Small Satellite Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 5: North America Small Satellite Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Small Satellite Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Small Satellite Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 8: North America Small Satellite Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: North America Small Satellite Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 10: North America Small Satellite Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small Satellite Market?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the North America Small Satellite Market?

Key companies in the market include Space Exploration Technologies Corp, Swarm Technologies Inc, SpaceQuest Ltd, LeoStella, Ball Corporation, Planet Labs Inc, Spire Global Inc, Capella Space Corp, National Aeronautics and Space Administration (NASA).

3. What are the main segments of the North America Small Satellite Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

LEO satellites are driving the demand for small satellites.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2022: The company expanded its constellation from 12 to 14 high-resolution satellites following the successful RocketLab launch. The rocket launched BlackSky 16, and 17 satellites.April 2022: Swarm Technologies 12 'picosatellites' on the Transporter 4 mission for low-data-rate communications network have been launched.February 2022: In February 2022, 49 more Starlink internet satellites are launched by SpaceX's Falcon 9 rocket.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small Satellite Market?

To stay informed about further developments, trends, and reports in the North America Small Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence