Key Insights

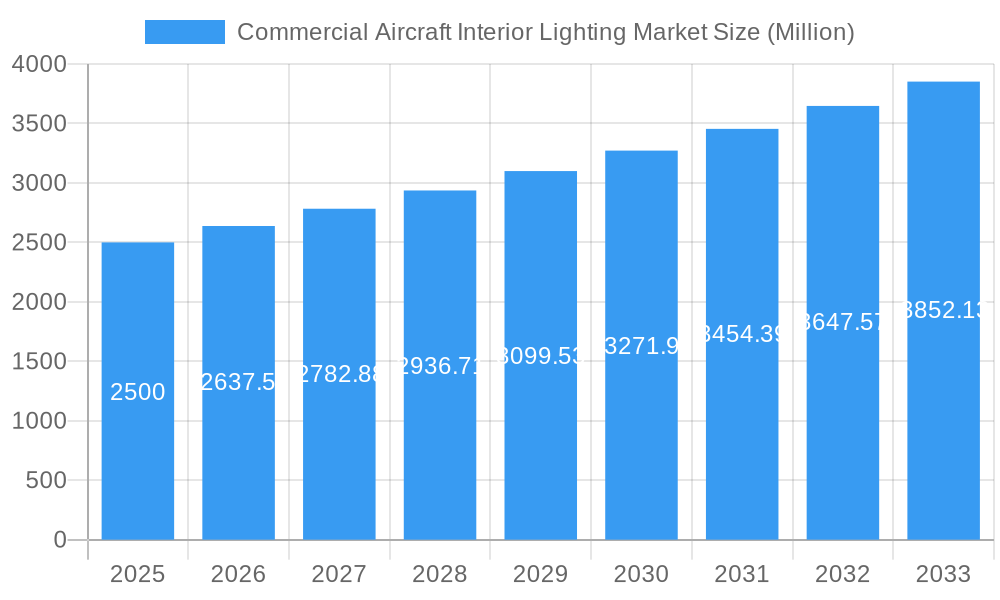

The commercial aircraft interior lighting market is experiencing robust growth, driven by increasing air passenger traffic, a rising demand for enhanced passenger comfort and experience, and the integration of advanced lighting technologies. The market's Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors: the ongoing replacement of older aircraft with newer models featuring upgraded lighting systems, the increasing adoption of LED lighting due to its energy efficiency and longevity, and the growing demand for customizable lighting schemes to create a more personalized and appealing cabin atmosphere. Different aircraft types—narrow-body, wide-body, and regional—present distinct market segments with varying lighting needs. Similarly, lighting applications, such as reading lights, ceiling and wall lights, signage, lavatory lights, and floor path lighting, contribute to the market's diversity and complexity. Premium cabin classes (Business and First) typically feature more sophisticated and technologically advanced lighting systems compared to Economy Class, further segmenting the market. Leading companies like Astronics Corporation, Safran SA, and Collins Aerospace are actively involved in developing and supplying these lighting solutions, fostering innovation and competition within the market.

Commercial Aircraft Interior Lighting Market Market Size (In Billion)

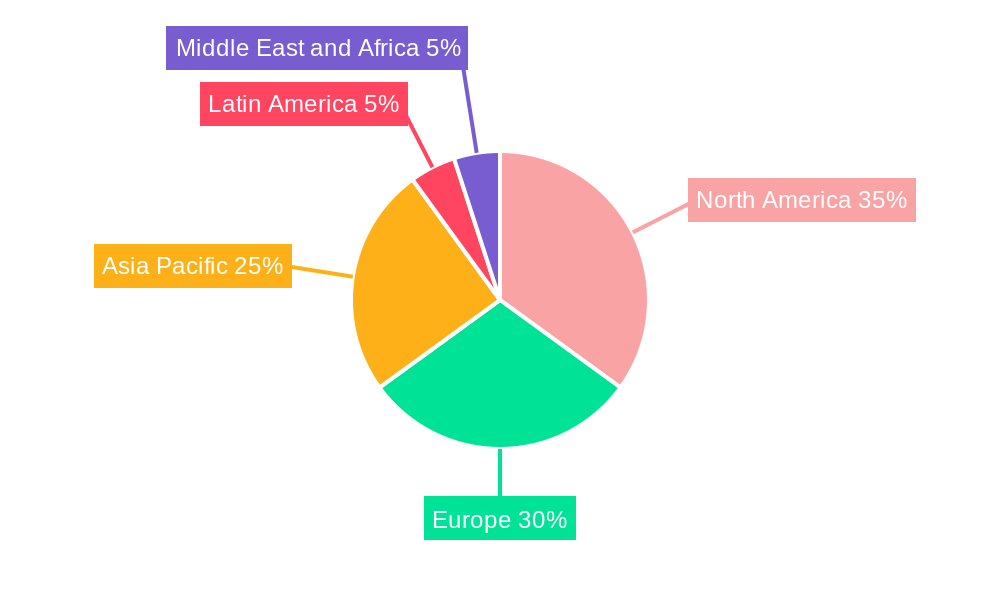

The geographical distribution of the market reflects the concentration of airline operations and aircraft manufacturing. North America and Europe currently hold significant market shares, driven by established aerospace industries and a large number of airline operators. However, the Asia-Pacific region is anticipated to exhibit strong growth, fueled by rapidly expanding air travel and investment in new aircraft fleets. Market restraints include the high initial investment costs associated with advanced lighting systems and potential supply chain disruptions impacting the availability of components. Nevertheless, the overall outlook for the commercial aircraft interior lighting market remains positive, with continued growth anticipated throughout the forecast period (2025-2033). The market is expected to reach a considerable size driven by the aforementioned factors and technological advancements that promise further improvements in passenger experience and operational efficiency.

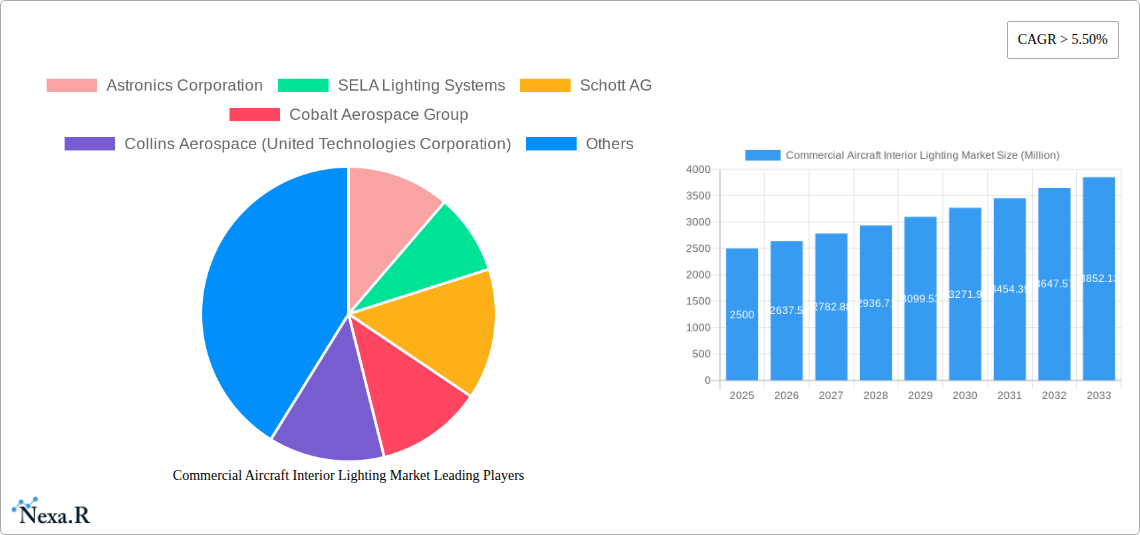

Commercial Aircraft Interior Lighting Market Company Market Share

Commercial Aircraft Interior Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Commercial Aircraft Interior Lighting Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, and key players. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by aircraft type (narrow-body, wide-body, regional), light type (reading lights, ceiling & wall lights, signage lights, lavatory lights, floor path lighting stripes), and cabin class (economy, business, first). The report is invaluable for industry professionals, investors, and stakeholders seeking to understand this dynamic market. The total market size in 2025 is estimated to be xx Million units.

Commercial Aircraft Interior Lighting Market Market Dynamics & Structure

The commercial aircraft interior lighting market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, driven by advancements in LED technology and energy efficiency, is a major growth driver. Stringent regulatory frameworks related to safety and environmental standards shape the market landscape. Competitive product substitutes, such as different types of lighting solutions, exist, but LED lighting currently dominates due to its superior performance. The end-user demographics are primarily airlines, aircraft manufacturers, and maintenance, repair, and overhaul (MRO) providers. M&A activity in the sector has been moderate, with a focus on strategic acquisitions to expand product portfolios and market reach. Over the historical period (2019-2024), approximately xx M&A deals were recorded.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: LED technology adoption is the primary driver, with focus on energy efficiency and customized lighting solutions.

- Regulatory Framework: Stringent safety and environmental regulations influence product development and adoption.

- Competitive Substitutes: Presence of alternative lighting technologies, but LED's dominance remains unchallenged.

- End-User Demographics: Airlines, aircraft manufacturers, and MRO providers constitute the primary end-users.

- M&A Trends: Moderate M&A activity, focusing on strategic acquisitions for portfolio expansion.

Commercial Aircraft Interior Lighting Market Growth Trends & Insights

The commercial aircraft interior lighting market has witnessed significant growth in recent years, driven by factors such as the increasing demand for air travel, technological advancements in LED lighting, and the rising focus on passenger experience. The market size has grown from xx Million units in 2019 to an estimated xx Million units in 2025, exhibiting a CAGR of xx% during the historical period. This growth is anticipated to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%. The adoption rate of advanced LED lighting systems has accelerated, driven by their energy efficiency and superior performance. Technological disruptions, such as the introduction of smart lighting systems and personalized cabin lighting, are reshaping the market. Shifting consumer behavior towards enhanced in-flight comfort and entertainment preferences is further fueling market expansion. Market penetration of LED lighting is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Commercial Aircraft Interior Lighting Market

North America and Europe currently dominate the commercial aircraft interior lighting market, driven by robust aircraft manufacturing activities and a high density of airline operations. Within these regions, the United States and Germany, respectively, hold leading positions. The wide-body aircraft segment accounts for the largest market share, followed by narrow-body and regional aircraft. In terms of light types, ceiling and wall lights command the highest share, owing to their widespread use across different cabin classes. The business and first-class segments contribute significantly to market revenue due to the demand for premium lighting solutions.

- Key Drivers in North America: Strong domestic air travel, significant aircraft manufacturing activities.

- Key Drivers in Europe: High density of airline operations, focus on passenger comfort and technological adoption.

- Wide-body Aircraft Dominance: Driven by higher passenger capacity and demand for enhanced lighting solutions.

- Ceiling & Wall Lights: Largest market share due to their essential role in cabin ambiance.

- Business & First Class Premiumization: High demand for superior lighting technologies in premium cabins.

Commercial Aircraft Interior Lighting Market Product Landscape

The commercial aircraft interior lighting market showcases continuous product innovation, with a focus on energy-efficient, customizable, and aesthetically pleasing designs. LED-based systems dominate, offering enhanced brightness, longer lifespan, and lower energy consumption compared to traditional lighting technologies. Recent innovations include smart lighting systems enabling personalized lighting control and ambient lighting adjustments based on flight phase. These advancements provide airlines with opportunities to enhance passenger comfort and brand image.

Key Drivers, Barriers & Challenges in Commercial Aircraft Interior Lighting Market

Key Drivers:

- Increasing air travel demand.

- Technological advancements in LED lighting (energy efficiency, customization).

- Focus on enhanced passenger experience.

- Stringent safety regulations driving adoption of advanced solutions.

Key Challenges:

- High initial investment costs for advanced lighting systems.

- Supply chain disruptions impacting component availability and lead times.

- Intense competition amongst established and emerging players.

- Regulatory compliance and certification requirements. (Estimated impact: xx% reduction in market growth in 2023)

Emerging Opportunities in Commercial Aircraft Interior Lighting Market

- Growth in low-cost carrier segments presents an opportunity for cost-effective lighting solutions.

- Development of smart lighting systems with integrated entertainment and communication features.

- Growing demand for personalized and customizable cabin lighting experiences.

- Expansion into emerging markets with increasing air travel.

Growth Accelerators in the Commercial Aircraft Interior Lighting Market Industry

Strategic partnerships between lighting manufacturers and aircraft manufacturers accelerate technology adoption and integration. Technological breakthroughs, such as the development of more energy-efficient and durable lighting solutions, fuel market growth. Expansion into new markets with emerging air travel demand creates further growth opportunities. The rising demand for improved passenger experience acts as a pivotal growth accelerator.

Key Players Shaping the Commercial Aircraft Interior Lighting Market Market

- Astronics Corporation

- SELA Lighting Systems

- Schott AG

- Cobalt Aerospace Group

- Collins Aerospace (United Technologies Corporation)

- Luminator Technology Group

- Safran SA

- Diehl Stiftung & Co KG

- Bruce Aerospac

- STG Aerospace Limited

- Cobham PLC

- Soderberg Manufacturing Co Inc

Notable Milestones in Commercial Aircraft Interior Lighting Market Sector

- June 2022: STG Aerospace's liTeMood LED system deployed by Delta Air Lines on its Airbus A330 fleet.

- February 2021: Diehl Aerospace signed a contract extension with Boeing for the Boeing 787 Dreamliner lighting system (expired end of 2022).

In-Depth Commercial Aircraft Interior Lighting Market Market Outlook

The commercial aircraft interior lighting market is poised for continued growth, driven by technological advancements, increasing air travel demand, and a rising focus on passenger experience. Strategic partnerships, market expansion into emerging economies, and the development of innovative lighting solutions will create significant opportunities for market players. The long-term outlook remains positive, with continued adoption of energy-efficient LED technology and a shift towards personalized and customized lighting experiences.

Commercial Aircraft Interior Lighting Market Segmentation

-

1. Light Type

- 1.1. Reading Lights

- 1.2. Ceiling and Wall Lights

- 1.3. Signage Lights

- 1.4. Lavatory Lights

- 1.5. Floor Path Lighting Stripes

-

2. Cabin Class

- 2.1. Economy Class

- 2.2. Business Class

- 2.3. First Class

Commercial Aircraft Interior Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Rest of Middle East

Commercial Aircraft Interior Lighting Market Regional Market Share

Geographic Coverage of Commercial Aircraft Interior Lighting Market

Commercial Aircraft Interior Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Narrow-body Aircraft Segment is Expected to Show the Highest Growth During the Forecasts Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Light Type

- 5.1.1. Reading Lights

- 5.1.2. Ceiling and Wall Lights

- 5.1.3. Signage Lights

- 5.1.4. Lavatory Lights

- 5.1.5. Floor Path Lighting Stripes

- 5.2. Market Analysis, Insights and Forecast - by Cabin Class

- 5.2.1. Economy Class

- 5.2.2. Business Class

- 5.2.3. First Class

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Light Type

- 6. North America Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Light Type

- 6.1.1. Reading Lights

- 6.1.2. Ceiling and Wall Lights

- 6.1.3. Signage Lights

- 6.1.4. Lavatory Lights

- 6.1.5. Floor Path Lighting Stripes

- 6.2. Market Analysis, Insights and Forecast - by Cabin Class

- 6.2.1. Economy Class

- 6.2.2. Business Class

- 6.2.3. First Class

- 6.1. Market Analysis, Insights and Forecast - by Light Type

- 7. Europe Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Light Type

- 7.1.1. Reading Lights

- 7.1.2. Ceiling and Wall Lights

- 7.1.3. Signage Lights

- 7.1.4. Lavatory Lights

- 7.1.5. Floor Path Lighting Stripes

- 7.2. Market Analysis, Insights and Forecast - by Cabin Class

- 7.2.1. Economy Class

- 7.2.2. Business Class

- 7.2.3. First Class

- 7.1. Market Analysis, Insights and Forecast - by Light Type

- 8. Asia Pacific Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Light Type

- 8.1.1. Reading Lights

- 8.1.2. Ceiling and Wall Lights

- 8.1.3. Signage Lights

- 8.1.4. Lavatory Lights

- 8.1.5. Floor Path Lighting Stripes

- 8.2. Market Analysis, Insights and Forecast - by Cabin Class

- 8.2.1. Economy Class

- 8.2.2. Business Class

- 8.2.3. First Class

- 8.1. Market Analysis, Insights and Forecast - by Light Type

- 9. Latin America Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Light Type

- 9.1.1. Reading Lights

- 9.1.2. Ceiling and Wall Lights

- 9.1.3. Signage Lights

- 9.1.4. Lavatory Lights

- 9.1.5. Floor Path Lighting Stripes

- 9.2. Market Analysis, Insights and Forecast - by Cabin Class

- 9.2.1. Economy Class

- 9.2.2. Business Class

- 9.2.3. First Class

- 9.1. Market Analysis, Insights and Forecast - by Light Type

- 10. Middle East and Africa Commercial Aircraft Interior Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Light Type

- 10.1.1. Reading Lights

- 10.1.2. Ceiling and Wall Lights

- 10.1.3. Signage Lights

- 10.1.4. Lavatory Lights

- 10.1.5. Floor Path Lighting Stripes

- 10.2. Market Analysis, Insights and Forecast - by Cabin Class

- 10.2.1. Economy Class

- 10.2.2. Business Class

- 10.2.3. First Class

- 10.1. Market Analysis, Insights and Forecast - by Light Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astronics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SELA Lighting Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schott AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cobalt Aerospace Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Collins Aerospace (United Technologies Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Luminator Technology Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Safran SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Diehl Stiftung & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bruce Aerospac

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STG Aerospace Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cobham PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Soderberg Manufacturing Co Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Astronics Corporation

List of Figures

- Figure 1: Global Commercial Aircraft Interior Lighting Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Light Type 2025 & 2033

- Figure 3: North America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Light Type 2025 & 2033

- Figure 4: North America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Cabin Class 2025 & 2033

- Figure 5: North America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Cabin Class 2025 & 2033

- Figure 6: North America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Aircraft Interior Lighting Market Revenue (undefined), by Light Type 2025 & 2033

- Figure 9: Europe Commercial Aircraft Interior Lighting Market Revenue Share (%), by Light Type 2025 & 2033

- Figure 10: Europe Commercial Aircraft Interior Lighting Market Revenue (undefined), by Cabin Class 2025 & 2033

- Figure 11: Europe Commercial Aircraft Interior Lighting Market Revenue Share (%), by Cabin Class 2025 & 2033

- Figure 12: Europe Commercial Aircraft Interior Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Commercial Aircraft Interior Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue (undefined), by Light Type 2025 & 2033

- Figure 15: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue Share (%), by Light Type 2025 & 2033

- Figure 16: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue (undefined), by Cabin Class 2025 & 2033

- Figure 17: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue Share (%), by Cabin Class 2025 & 2033

- Figure 18: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Aircraft Interior Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Light Type 2025 & 2033

- Figure 21: Latin America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Light Type 2025 & 2033

- Figure 22: Latin America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Cabin Class 2025 & 2033

- Figure 23: Latin America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Cabin Class 2025 & 2033

- Figure 24: Latin America Commercial Aircraft Interior Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Commercial Aircraft Interior Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue (undefined), by Light Type 2025 & 2033

- Figure 27: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue Share (%), by Light Type 2025 & 2033

- Figure 28: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue (undefined), by Cabin Class 2025 & 2033

- Figure 29: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue Share (%), by Cabin Class 2025 & 2033

- Figure 30: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Aircraft Interior Lighting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 2: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 3: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 5: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 6: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 10: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 11: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 17: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 18: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: India Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 25: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 26: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: Brazil Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Mexico Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Light Type 2020 & 2033

- Table 31: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Cabin Class 2020 & 2033

- Table 32: Global Commercial Aircraft Interior Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Egypt Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East Commercial Aircraft Interior Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft Interior Lighting Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Commercial Aircraft Interior Lighting Market?

Key companies in the market include Astronics Corporation, SELA Lighting Systems, Schott AG, Cobalt Aerospace Group, Collins Aerospace (United Technologies Corporation), Luminator Technology Group, Safran SA, Diehl Stiftung & Co KG, Bruce Aerospac, STG Aerospace Limited, Cobham PLC, Soderberg Manufacturing Co Inc.

3. What are the main segments of the Commercial Aircraft Interior Lighting Market?

The market segments include Light Type, Cabin Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Narrow-body Aircraft Segment is Expected to Show the Highest Growth During the Forecasts Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In June 2022, STG Aerospace, an aircraft cabin lighting company, announced that Delta Air Lines had deployed its liTeMood LED system onboard Airbus A330-200 and -300 fleets as part of a major cabin upgrade program to harmonize its 42 Airbus A330 fleet with their newly delivered widebodies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Aircraft Interior Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Aircraft Interior Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Aircraft Interior Lighting Market?

To stay informed about further developments, trends, and reports in the Commercial Aircraft Interior Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence