Key Insights

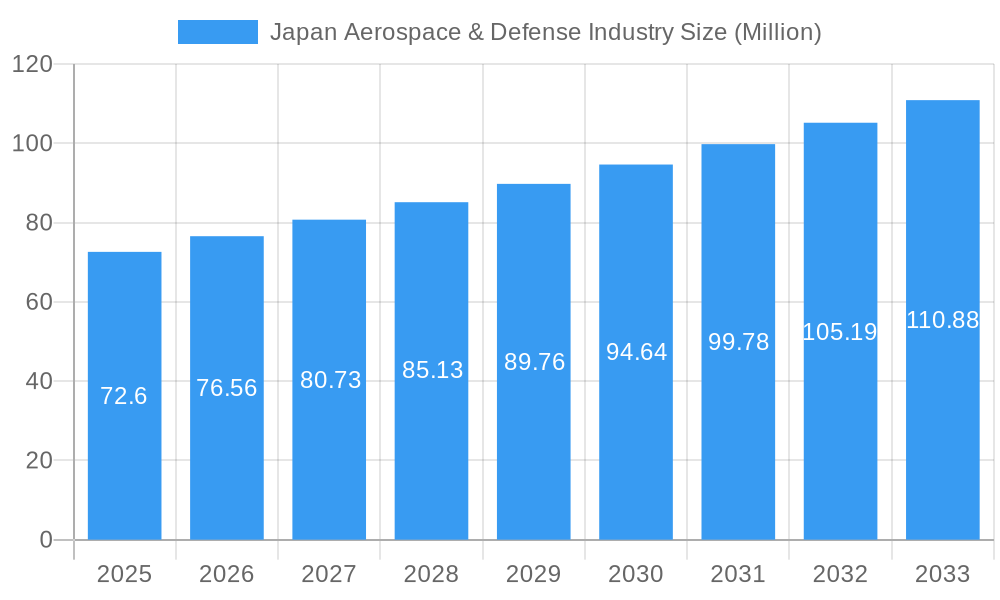

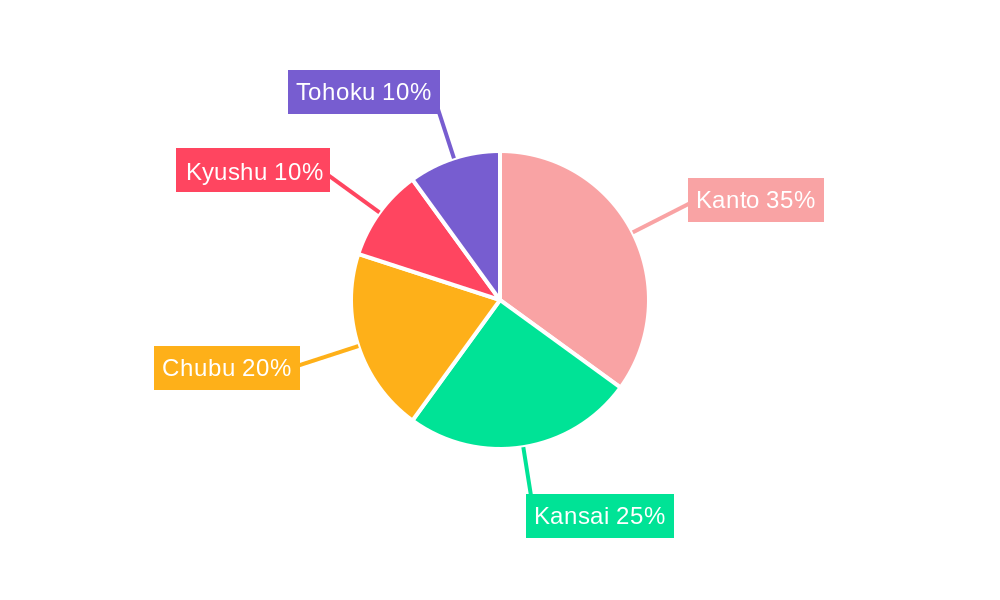

The Japan Aerospace & Defense industry, valued at $72.60 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.28% from 2025 to 2033. This expansion is driven by several key factors. Increased government spending on defense modernization, particularly in response to evolving geopolitical landscapes and regional security concerns, fuels significant demand for advanced aerospace and defense technologies. Furthermore, Japan's burgeoning space exploration ambitions, coupled with a focus on technological innovation within its domestic aerospace sector, contribute substantially to market growth. The industry's segmentation highlights the significant roles played by aerospace and defense sectors, encompassing manufacturing, maintenance, repair, and overhaul (MRO) services across terrestrial, aerial, and naval platforms. Key players like Thales, Lockheed Martin, and Mitsubishi Heavy Industries are at the forefront, leveraging their expertise to meet the growing demands. The regional concentration within Japan, with key regions like Kanto, Kansai, and Chubu leading the charge, underscores the geographical distribution of this dynamic sector.

Japan Aerospace & Defense Industry Market Size (In Million)

The industry's growth trajectory is expected to remain positive throughout the forecast period (2025-2033). However, potential restraints include global economic uncertainties, fluctuating raw material prices, and the competitive landscape dominated by both domestic and international players. Successfully navigating these challenges will require strategic partnerships, technological advancements, and a focus on operational efficiency. Continuous investment in research and development (R&D) is vital to maintaining a competitive edge in the global market, pushing technological innovation and solidifying Japan's position as a significant contributor to the international aerospace and defense arena. The industry's success hinges on its ability to adapt to changing global dynamics and sustain its momentum in technological advancement.

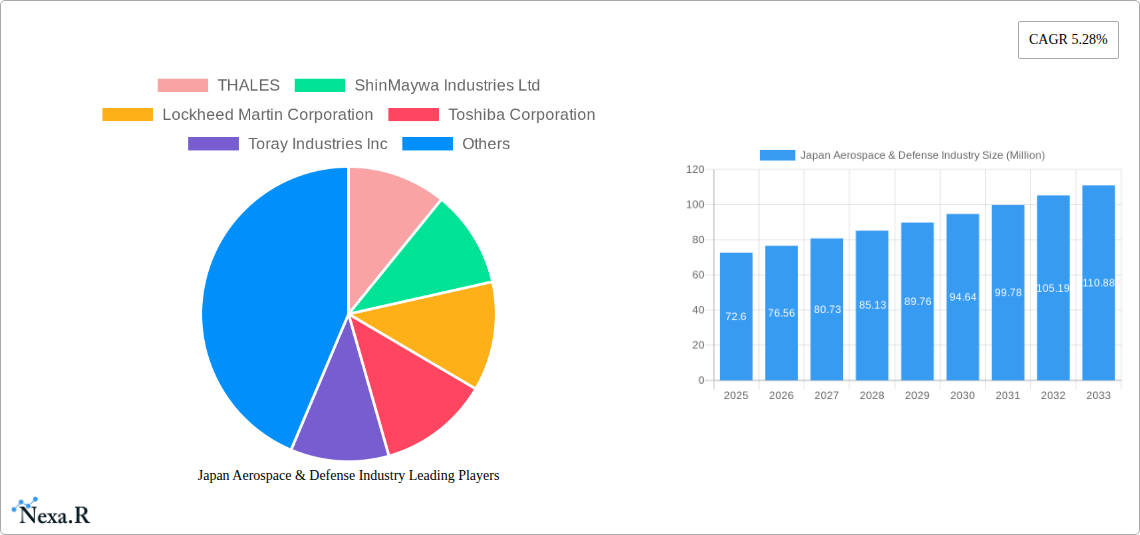

Japan Aerospace & Defense Industry Company Market Share

Japan Aerospace & Defense Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Aerospace & Defense Industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report leverages rigorous research and data analysis to deliver a clear understanding of market dynamics, growth trends, and future opportunities. The report meticulously analyzes the parent market (Aerospace & Defense) and its child markets (Manufacturing, MRO, Terrestrial, Aerial, and Naval platforms) within the Japanese context. Market values are presented in millions of units.

Japan Aerospace & Defense Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market structure of the Japanese aerospace and defense industry. We examine market concentration, identifying key players and their respective market shares. The report also explores technological innovation drivers, such as advancements in materials science, AI, and autonomous systems, and how these impact the industry. Further, we delve into the regulatory frameworks governing the sector, including export controls and defense procurement policies. An assessment of competitive product substitutes and their market impact is included. Finally, the report examines end-user demographics (military branches, government agencies, etc.) and analyzes M&A trends with quantitative data on deal volumes and qualitative insights on integration challenges.

- Market Concentration: The Japanese aerospace and defense market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Mitsubishi Heavy Industries and Kawasaki Heavy Industries, for example, hold approximately xx% and xx% of the market respectively (2025 Estimate).

- Technological Innovation Drivers: Advancements in unmanned aerial vehicles (UAVs), hypersonic technology, and cyber security are key innovation drivers.

- Regulatory Framework: Stringent export controls and government oversight significantly influence market dynamics.

- M&A Activity: The number of M&A deals in the sector averaged xx annually during the historical period (2019-2024), with a projected increase to xx annually during the forecast period (2025-2033). Integration challenges following M&A activity often involve cultural differences and regulatory approvals.

Japan Aerospace & Defense Industry Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, encompassing historical data (2019-2024), the base year (2025), and future projections (2025-2033). We examine market size evolution, analyzing factors such as government spending on defense, technological advancements, and economic growth. The adoption rates of new technologies and their impact on market growth are thoroughly examined. Furthermore, we explore shifts in consumer behavior (military procurement priorities) and their influence on market demand. Key performance indicators, including the Compound Annual Growth Rate (CAGR) and market penetration rates, are provided to illustrate the growth trajectory. The analysis draws upon various sources, including industry reports, government publications, and expert interviews. The estimated CAGR for the forecast period (2025-2033) is projected at xx%.

Dominant Regions, Countries, or Segments in Japan Aerospace & Defense Industry

This section identifies the leading regions, countries, or segments within the Japanese aerospace and defense industry driving market growth. We analyze the dominance of specific sectors (Aerospace vs. Defense), service types (Manufacturing vs. MRO), and platforms (Terrestrial, Aerial, Naval). Key factors contributing to their leading positions are explored, including economic policies, government procurement strategies, and infrastructure development. Market share data and growth potential projections for each dominant segment are presented.

- Dominant Sector: Defense consistently holds a larger share than Aerospace due to increased government expenditure.

- Dominant Service Type: Manufacturing accounts for the lion's share of the market, reflecting the substantial domestic production capacity.

- Dominant Platform: Aerial platforms (aircraft and UAVs) currently dominate the market, driven by modernization programs. However, naval platforms are showing significant growth potential.

- Key Drivers: Government investment in defense modernization, technological advancements, and a robust domestic manufacturing base are crucial drivers.

Japan Aerospace & Defense Industry Product Landscape

This section provides an overview of the product landscape, encompassing innovations, applications, and performance metrics. We highlight unique selling propositions (USPs) and technological advancements in key product areas, such as advanced materials, sensors, and communication systems. The focus is on showcasing how these innovations are enhancing the performance and capabilities of aerospace and defense products.

Key Drivers, Barriers & Challenges in Japan Aerospace & Defense Industry

This section identifies and analyzes the key drivers and barriers affecting the Japanese aerospace and defense industry's growth.

Key Drivers:

- Increased government spending on defense modernization.

- Technological advancements in areas like AI and autonomous systems.

- Growing geopolitical tensions in the Asia-Pacific region.

Key Challenges:

- Supply chain disruptions impacting component availability and production timelines. (e.g., xx% of critical components are sourced internationally, creating vulnerability).

- Stringent regulatory hurdles for technology transfer and export controls.

- Intense competition from international players.

Emerging Opportunities in Japan Aerospace & Defense Industry

This section highlights emerging trends and opportunities for growth, including untapped market segments, innovative applications, and evolving consumer preferences. We identify areas with significant growth potential, such as the increasing demand for UAVs and cybersecurity solutions.

Growth Accelerators in the Japan Aerospace & Defense Industry Industry

Long-term growth in the Japanese aerospace and defense industry will be significantly propelled by technological breakthroughs in areas like hypersonic technology and AI integration, strategic partnerships fostering technological collaboration and market expansion, and increased government investment in R&D.

Key Players Shaping the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Japan Aerospace & Defense Industry Sector

- 2022: Announcement of a major defense budget increase by the Japanese government.

- 2023: Successful test flight of a new domestically developed UAV.

- 2024: Launch of a strategic partnership between a Japanese and a US aerospace company.

In-Depth Japan Aerospace & Defense Industry Market Outlook

The Japanese aerospace and defense industry is poised for significant growth over the next decade, driven by government investment, technological advancements, and geopolitical considerations. Strategic opportunities abound for companies focusing on innovation, strategic partnerships, and expanding into emerging segments within the industry. The focus on modernization and the increasing need for advanced defense capabilities will ensure continued market expansion.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Japan Aerospace & Defense Industry

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ShinMaywa Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toray Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Steel Works Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kawasaki Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Northrop Grumman Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Boeing Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mitsubishi Heavy Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence