Key Insights

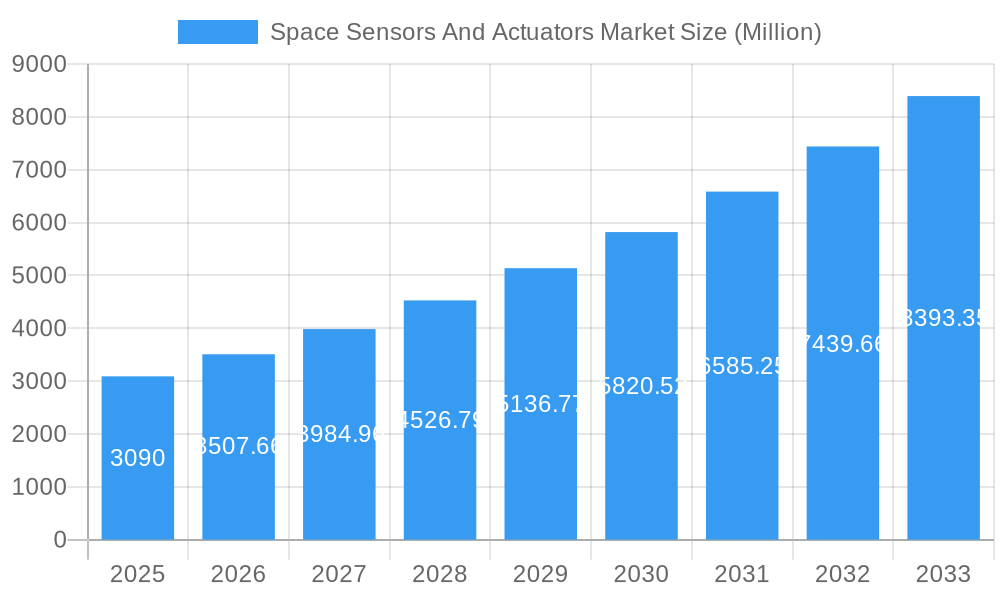

The global Space Sensors and Actuators market is poised for substantial expansion, projected to reach approximately \$3.09 billion in value by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 13.40% anticipated over the forecast period of 2025-2033. The primary drivers fueling this surge are the escalating investments in space exploration and defense, alongside the burgeoning demand for advanced satellite constellations and commercial space ventures. The increasing complexity and sophistication of space missions necessitate highly reliable and precise sensor and actuator technologies for critical functions such as navigation, attitude control, and data acquisition. Innovations in miniaturization, enhanced durability, and improved accuracy are continuously shaping the product landscape, enabling more ambitious and cost-effective space endeavors. The market is segmented across various product types, including advanced sensors and high-performance actuators, vital for the functioning of satellites, interplanetary spacecraft, probes, and launch vehicles.

Space Sensors And Actuators Market Market Size (In Billion)

The market's expansion is further propelled by several key trends. The miniaturization of components allows for lighter and more efficient spacecraft, reducing launch costs and increasing payload capacity. The rise of NewSpace companies and commercial space tourism is creating significant demand for off-the-shelf and customized sensor and actuator solutions. Furthermore, advancements in AI and machine learning are being integrated into space systems, requiring sophisticated sensing capabilities for autonomous operations and data processing. However, the market also faces certain restraints, including the high cost of research and development, stringent regulatory requirements, and the long lead times associated with space-qualified component production. Despite these challenges, the continuous innovation and the expanding applications of space technology across commercial, government, and defense sectors paint a promising picture for sustained market growth. The Asia Pacific region, particularly China, is expected to emerge as a significant growth engine, driven by substantial government initiatives and a rapidly developing space industry.

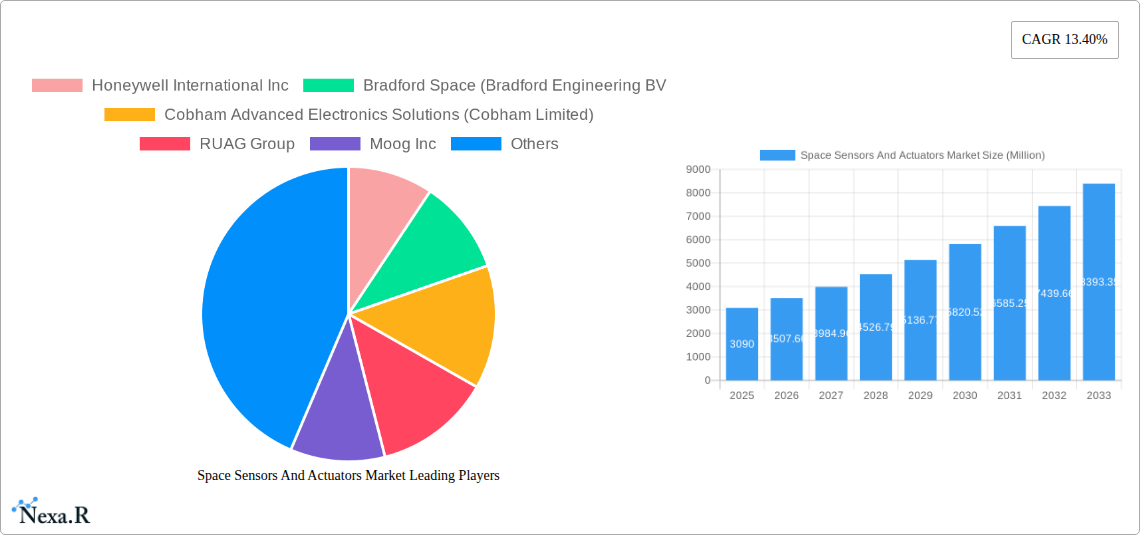

Space Sensors And Actuators Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Space Sensors and Actuators market, offering critical insights into its structure, dynamics, growth trajectory, and competitive landscape. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders seeking to understand and capitalize on the burgeoning opportunities in space exploration, satellite technology, and defense applications.

Space Sensors And Actuators Market Market Dynamics & Structure

The Space Sensors and Actuators market is characterized by a moderate to high market concentration, with key players investing heavily in research and development to maintain their competitive edge. Technological innovation is a primary driver, fueled by the increasing demand for more sophisticated, miniaturized, and radiation-hardened components essential for advanced space missions. Regulatory frameworks, driven by national space agencies and international collaborations, are evolving to support both commercial and governmental initiatives, ensuring safety and interoperability. Competitive product substitutes are emerging, particularly in commercial off-the-shelf (COTS) solutions adapted for space, though specialized, high-reliability components still dominate premium segments. End-user demographics are shifting, with a significant rise in demand from the commercial space sector, including satellite constellations for telecommunications, Earth observation, and internet services. Mergers and acquisitions (M&A) trends indicate strategic consolidation, as companies aim to expand their product portfolios and gain market share. For instance, the historical period saw notable M&A activities focused on acquiring niche technological expertise.

- Market Concentration: Dominated by a mix of large aerospace conglomerates and specialized component manufacturers.

- Technological Innovation Drivers: Miniaturization, enhanced accuracy, radiation hardening, increased power efficiency, and AI integration in sensor data processing.

- Regulatory Frameworks: Evolving standards for space debris mitigation, spectrum allocation, and national security considerations impacting component development and deployment.

- Competitive Product Substitutes: Increasing use of modified COTS components versus highly specialized, custom-engineered solutions.

- End-User Demographics: Growing influence of private satellite operators and constellation providers.

- M&A Trends: Strategic acquisitions focused on bolstering technological capabilities and market reach.

Space Sensors And Actuators Market Growth Trends & Insights

The global Space Sensors and Actuators market is poised for substantial growth, projected to expand significantly through the forecast period. This expansion is driven by a confluence of factors, including the rapid advancement of satellite technology, increasing governmental investments in defense and exploration, and the burgeoning NewSpace economy. The market size evolution is marked by a consistent upward trend, with CAGR estimated at 8.2% between 2025 and 2033. Adoption rates for advanced sensors and actuators are accelerating as missions become more complex, requiring higher precision and greater autonomy. Technological disruptions, such as the development of AI-enabled sensor fusion and highly adaptive actuator systems, are redefining mission capabilities and opening new avenues for market penetration. Consumer behavior shifts, particularly in the commercial sector, are characterized by a growing demand for cost-effective, high-performance solutions, pushing manufacturers to innovate in both design and production. Market penetration is deepening across all key segments, as the accessibility and affordability of space technologies continue to improve, making space exploration and utilization more widespread than ever before.

The increasing deployment of large satellite constellations for various applications, including broadband internet, Earth observation, and telecommunications, is a primary growth engine. These constellations require a massive number of standardized, yet high-reliability sensors and actuators, creating a sustained demand. Furthermore, national security concerns and geopolitical developments are driving increased defense spending on advanced surveillance, reconnaissance, and communication satellites, directly benefiting the space sensors and actuators market.

Space exploration initiatives, both governmental and private, are also significant contributors. Missions to the Moon, Mars, and beyond necessitate cutting-edge sensors for navigation, environmental monitoring, and operational control, as well as robust actuators for deployment, stabilization, and maneuvering. The development of reusable launch vehicles and the rise of space tourism are further diversifying the end-user base and expanding the applicability of these critical components.

The technological advancements in sensor technology, such as improved sensitivity, wider spectral ranges, and miniaturization, are enabling new applications and enhancing the performance of existing ones. Similarly, advancements in actuator technology, including greater precision, faster response times, and higher power density, are crucial for the successful execution of complex maneuvers and operational sequences in space.

Consumer behavior in the commercial space sector is increasingly focused on reducing mission costs without compromising reliability. This has led to a demand for more integrated sensor and actuator solutions and a greater acceptance of technologies that offer a balance between performance and cost-effectiveness. The ability to provide modular, scalable, and adaptable solutions will be key to capturing this segment of the market.

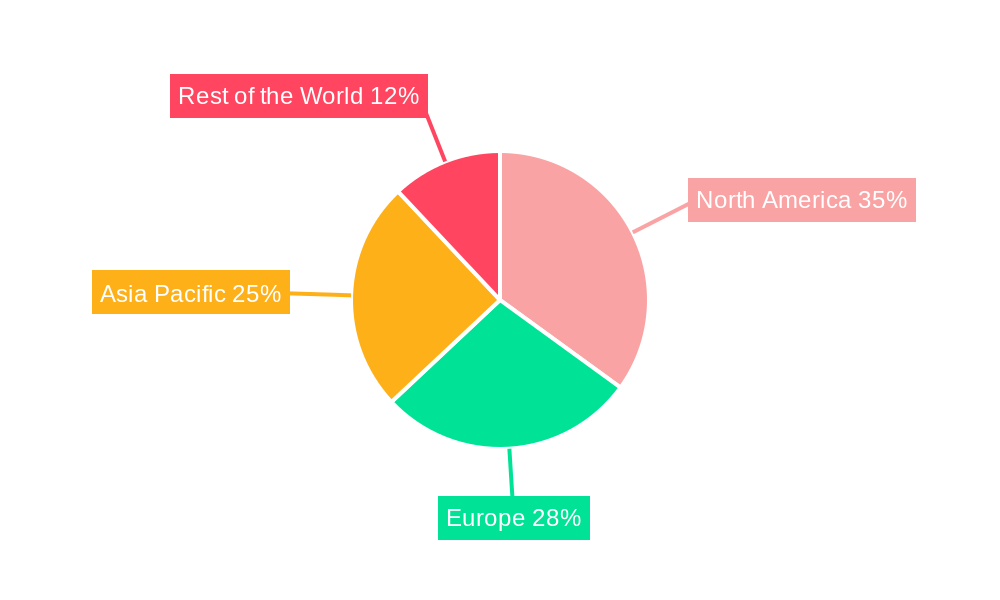

Dominant Regions, Countries, or Segments in Space Sensors And Actuators Market

The North America region is currently the dominant force in the global Space Sensors and Actuators market, primarily driven by the United States' extensive space programs and the robust presence of leading aerospace and defense companies. The region exhibits strong market share across multiple segments, particularly in Satellites, Launch Vehicles, and the Government and Defense end-user category. Key drivers for this dominance include substantial government funding for space exploration and defense initiatives, a well-established aerospace industrial base, and a high rate of technological innovation.

Within North America, the United States stands out as the leading country due to the combined might of NASA's ambitious missions and the significant defense budgets allocated by the Department of Defense. The country's private sector, including prominent companies like Honeywell International Inc., RTX Corporation, Maxar Technologies Inc., and TE Connectivity Ltd., is at the forefront of developing and deploying advanced space sensors and actuators. The demand for these components is further amplified by the rapid growth of the commercial space sector, with numerous companies investing in satellite constellations for telecommunications, Earth observation, and data services.

Analyzing by Product Type, Sensors represent a larger market share than actuators due to their fundamental role in data acquisition and mission execution across all space platforms. Satellites, in particular, rely heavily on a diverse array of sensors for navigation, attitude control, payload operations, and environmental monitoring.

Examining the Platform segment, Satellites command the highest market share, constituting the backbone of modern space infrastructure for communication, navigation, Earth observation, and scientific research. The increasing number of satellite launches, including large constellations, directly fuels the demand for space sensors and actuators.

The End User segment sees Government and Defense as a major driver, given their long-standing investments in space for national security, intelligence, and scientific endeavors. However, the Commercial segment is rapidly gaining ground, propelled by the proliferation of private satellite companies and the expanding applications of space-based data and services.

Economic policies in the United States, such as tax incentives for space-related businesses and federal contracts for R&D, further bolster the market. The extensive space infrastructure, including launch sites and research facilities, alongside a highly skilled workforce, creates a fertile ground for innovation and market growth. While other regions like Europe and Asia are making significant strides, North America's established ecosystem and continuous investment solidify its position as the leading market for space sensors and actuators.

Space Sensors And Actuators Market Product Landscape

The product landscape for space sensors and actuators is characterized by continuous innovation focused on enhancing performance, miniaturization, and reliability for extreme space environments. Key product advancements include the development of highly sensitive optical sensors for Earth observation and deep space imaging, sophisticated inertial measurement units (IMUs) for precise spacecraft navigation, and radiation-hardened microcontrollers for critical control functions. Actuators are evolving with faster response times, greater force output, and improved energy efficiency, enabling more dynamic spacecraft maneuvers and precise payload deployment. Applications span from attitude determination and control systems (ADCS) to robotic arm manipulation and thermal management systems. Unique selling propositions often lie in the ability of components to withstand harsh radiation, extreme temperatures, and vacuum conditions, while delivering unparalleled accuracy and longevity.

Key Drivers, Barriers & Challenges in Space Sensors And Actuators Market

Key Drivers:

- Growing Demand for Satellite Constellations: Proliferation of low-Earth orbit (LEO) satellites for broadband, Earth observation, and IoT services.

- Increased Government Spending: Rising defense budgets for surveillance, reconnaissance, and strategic space capabilities.

- Interplanetary Missions: Ambitious space exploration programs by NASA, ESA, and other agencies requiring advanced sensor and actuator technology.

- Technological Advancements: Miniaturization, increased processing power, AI integration, and improved radiation tolerance.

- Commercialization of Space: Rise of private space companies and the NewSpace economy, fostering innovation and demand.

Barriers & Challenges:

- High Development and Qualification Costs: Rigorous testing and certification processes for space-grade components are extremely expensive.

- Long Development Cycles: Bringing new space-qualified products to market can take many years.

- Supply Chain Volatility: Dependence on specialized raw materials and components, and potential disruptions.

- Stringent Regulatory Requirements: Compliance with national and international space policies can be complex and time-consuming.

- Talent Shortage: Demand for highly skilled engineers and technicians in specialized fields.

Emerging Opportunities in Space Sensors And Actuators Market

Emerging opportunities in the Space Sensors and Actuators market lie in the growing demand for CubeSats and small satellites, which require highly integrated and cost-effective sensor and actuator solutions. The expansion of in-orbit servicing, assembly, and manufacturing (ISAM) presents significant potential for specialized robotics, advanced sensors for docking and manipulation, and precise actuators for component assembly. Furthermore, the development of lunar and Martian exploration infrastructure, including rovers, landers, and habitats, will necessitate novel sensor suites for environmental monitoring, resource utilization, and operational control, alongside robust actuators for mobility and construction. The integration of Artificial Intelligence (AI) and machine learning into sensor data processing and actuator control offers the potential for autonomous operations and enhanced mission efficiency.

Growth Accelerators in the Space Sensors And Actuators Market Industry

Growth accelerators for the Space Sensors and Actuators market include significant advancements in materials science, enabling the development of lighter, stronger, and more resilient components. Strategic partnerships between established aerospace firms and innovative startups are fostering rapid technology transfer and market entry. Government funding for next-generation space technologies, coupled with supportive policies for the commercial space sector, acts as a powerful catalyst. The increasing focus on sustainability in space operations, such as debris removal and in-orbit servicing, is also creating new avenues for component development and deployment.

Key Players Shaping the Space Sensors And Actuators Market Market

- Honeywell International Inc.

- Bradford Space (Bradford Engineering BV)

- Cobham Advanced Electronics Solutions (Cobham Limited)

- RUAG Group

- Moog Inc.

- RTX Corporation

- STMicroelectronics NV

- Ametek Inc.

- Maxar Technologies Inc.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

Notable Milestones in Space Sensors And Actuators Market Sector

- 2023: Launch of James Webb Space Telescope's advanced optical sensors and fine guidance actuators, enabling unprecedented astronomical observations.

- 2022: SpaceX's Starship program makes significant progress, driving demand for highly reliable sensors and actuators for reusable launch vehicles.

- 2021: NASA's Perseverance rover successfully lands on Mars, showcasing advanced sensor suites for environmental analysis and sophisticated actuators for sample collection.

- 2020: Growing investment in commercial satellite constellations, such as Starlink and OneWeb, leading to mass production of standardized sensors and actuators.

- 2019: Development of next-generation miniaturized sensors for CubeSats, reducing size, weight, and power requirements for smaller satellites.

In-Depth Space Sensors And Actuators Market Market Outlook

The future outlook for the Space Sensors and Actuators market is exceptionally bright, fueled by sustained global investment in space exploration, defense, and commercial applications. Growth accelerators such as advancements in AI-driven autonomous systems, the increasing demand for in-orbit servicing, and the continued miniaturization of satellite technology will drive innovation and market expansion. Strategic partnerships and government initiatives aimed at fostering a robust space ecosystem will further amplify growth. The market is poised for transformative developments, offering significant opportunities for companies that can deliver reliable, high-performance, and cost-effective solutions for the evolving demands of the space industry.

Space Sensors And Actuators Market Segmentation

-

1. Product Type

- 1.1. Sensors

- 1.2. Actuators

-

2. Platform

- 2.1. Satellites

- 2.2. Capsules/Cargo Modules

- 2.3. Interplanetary Spacecraft & Probes

- 2.4. Rovers/Spacecraft Landers

- 2.5. Launch Vehicles

-

3. End User

- 3.1. Commercial

- 3.2. Government and Defense

Space Sensors And Actuators Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Space Sensors And Actuators Market Regional Market Share

Geographic Coverage of Space Sensors And Actuators Market

Space Sensors And Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Sensors Segment is Anticipated to Drive the Growth of the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sensors

- 5.1.2. Actuators

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Satellites

- 5.2.2. Capsules/Cargo Modules

- 5.2.3. Interplanetary Spacecraft & Probes

- 5.2.4. Rovers/Spacecraft Landers

- 5.2.5. Launch Vehicles

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Government and Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Sensors

- 6.1.2. Actuators

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Satellites

- 6.2.2. Capsules/Cargo Modules

- 6.2.3. Interplanetary Spacecraft & Probes

- 6.2.4. Rovers/Spacecraft Landers

- 6.2.5. Launch Vehicles

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Government and Defense

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Sensors

- 7.1.2. Actuators

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Satellites

- 7.2.2. Capsules/Cargo Modules

- 7.2.3. Interplanetary Spacecraft & Probes

- 7.2.4. Rovers/Spacecraft Landers

- 7.2.5. Launch Vehicles

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Government and Defense

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Sensors

- 8.1.2. Actuators

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Satellites

- 8.2.2. Capsules/Cargo Modules

- 8.2.3. Interplanetary Spacecraft & Probes

- 8.2.4. Rovers/Spacecraft Landers

- 8.2.5. Launch Vehicles

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Government and Defense

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Sensors

- 9.1.2. Actuators

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Satellites

- 9.2.2. Capsules/Cargo Modules

- 9.2.3. Interplanetary Spacecraft & Probes

- 9.2.4. Rovers/Spacecraft Landers

- 9.2.5. Launch Vehicles

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Government and Defense

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bradford Space (Bradford Engineering BV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cobham Advanced Electronics Solutions (Cobham Limited)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RUAG Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Moog Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 RTX Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ametek Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Maxar Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TE Connectivity Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Texas Instruments Incorporated

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Space Sensors And Actuators Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 13: Europe Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 14: Europe Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 21: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 29: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Rest of the World Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Space Sensors And Actuators Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 13: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 31: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Sensors And Actuators Market?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Space Sensors And Actuators Market?

Key companies in the market include Honeywell International Inc, Bradford Space (Bradford Engineering BV, Cobham Advanced Electronics Solutions (Cobham Limited), RUAG Group, Moog Inc, RTX Corporation, STMicroelectronics NV, Ametek Inc, Maxar Technologies Inc, TE Connectivity Ltd, Texas Instruments Incorporated.

3. What are the main segments of the Space Sensors And Actuators Market?

The market segments include Product Type, Platform, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.09 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Sensors Segment is Anticipated to Drive the Growth of the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Sensors And Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Sensors And Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Sensors And Actuators Market?

To stay informed about further developments, trends, and reports in the Space Sensors And Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence