Key Insights

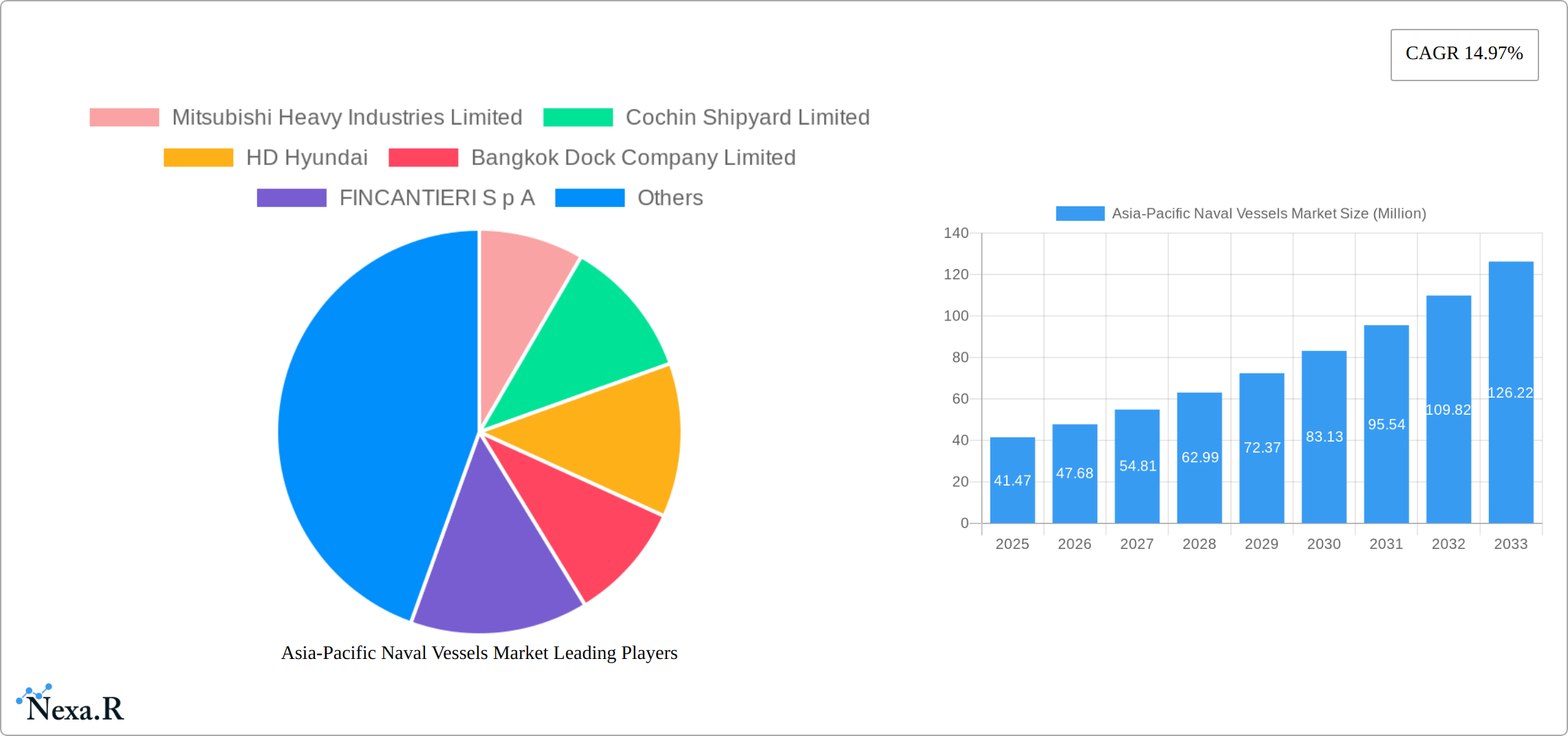

The Asia-Pacific Naval Vessels Market is poised for significant growth, with a projected market size of $41.47 million in 2025 and a compound annual growth rate (CAGR) of 14.97% through the forecast period from 2025 to 2033. This expansion is driven by increasing geopolitical tensions, the need for naval modernization, and substantial investments in defense infrastructure across key countries such as China, Japan, India, and South Korea. The market is segmented by vessel type, including submarines, frigates, corvettes, aircraft carriers, destroyers, and other vessel types, with each segment contributing to the overall market dynamics. Major players like Mitsubishi Heavy Industries Limited, HD Hyundai, and China State Shipbuilding Corporation are intensifying their efforts to capture a larger share of this lucrative market through technological advancements and strategic partnerships.

The Asia-Pacific region's naval vessels market is characterized by a diverse range of trends and restraints that shape its trajectory. Key trends include the integration of advanced technologies such as stealth capabilities, unmanned systems, and enhanced communication systems, which are pivotal in modern naval warfare. On the other hand, restraints such as high costs of development and maintenance, along with regulatory challenges, can impede market growth. The market's growth is particularly pronounced in countries like China and India, where naval expansion is a priority. The regional market data highlights significant growth in China, Japan, and India, underscoring their strategic focus on enhancing naval capabilities. This robust growth trajectory is expected to continue, driven by ongoing naval modernization programs and increasing defense budgets across the region.

Asia-Pacific Naval Vessels Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Naval Vessels Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and stakeholders seeking a detailed understanding of this dynamic market. The market is segmented by Vessel Type: Submarines, Frigates, Corvettes, Aircraft Carriers, Destroyers, and Other Vessel Types. The total market size is projected to reach xx Million units by 2033.

Asia-Pacific Naval Vessels Market Dynamics & Structure

The Asia-Pacific naval vessels market is characterized by a moderately concentrated landscape, with several large players and a number of smaller, specialized shipbuilders. Market concentration is influenced by government procurement policies and the complexities of naval vessel construction. Technological innovation, particularly in areas like stealth technology, autonomous systems, and advanced weaponry, is a key driver. Stringent regulatory frameworks governing naval vessel construction and export control significantly impact market dynamics. The market also witnesses competition from alternative platforms such as unmanned aerial vehicles and cyber warfare capabilities. End-user demographics, predominantly driven by the needs of national navies across the region, heavily influence demand. The market has seen a moderate level of M&A activity, primarily focused on consolidation within the shipbuilding sector.

- Market Concentration: Moderately concentrated, with a few dominant players controlling a significant market share (estimated at xx%).

- Technological Innovation: Key drivers include advancements in stealth technology, autonomous systems, and AI-integrated weaponry.

- Regulatory Framework: Stringent regulations govern vessel construction and export, impacting market access and growth.

- Competitive Substitutes: Emerging technologies like unmanned systems and cyber warfare pose competitive challenges.

- M&A Activity: Moderate levels of mergers and acquisitions, driven by consolidation efforts within the industry. An estimated xx M&A deals occurred between 2019 and 2024.

Asia-Pacific Naval Vessels Market Growth Trends & Insights

The Asia-Pacific naval vessels market witnessed robust growth from 2019 to 2024, fueled by escalating geopolitical tensions, the imperative to modernize aging fleets, and substantial increases in regional defense budgets. The market reached an estimated value of xx Million units in 2025, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during the historical period. This expansion is further accelerated by technological advancements, such as the integration of AI, autonomous systems, and advanced sensor technologies into naval vessels. A notable shift in naval force priorities towards enhanced capabilities and platform diversification is also a significant driver. While the penetration of cutting-edge technologies remains relatively low, adoption is projected to surge significantly between 2025 and 2033. Regional power dynamics, territorial disputes, and the escalating need for robust maritime security further underpin this growth trajectory. The increasing demand for coastal defense and anti-submarine warfare capabilities is also a major contributor to market expansion.

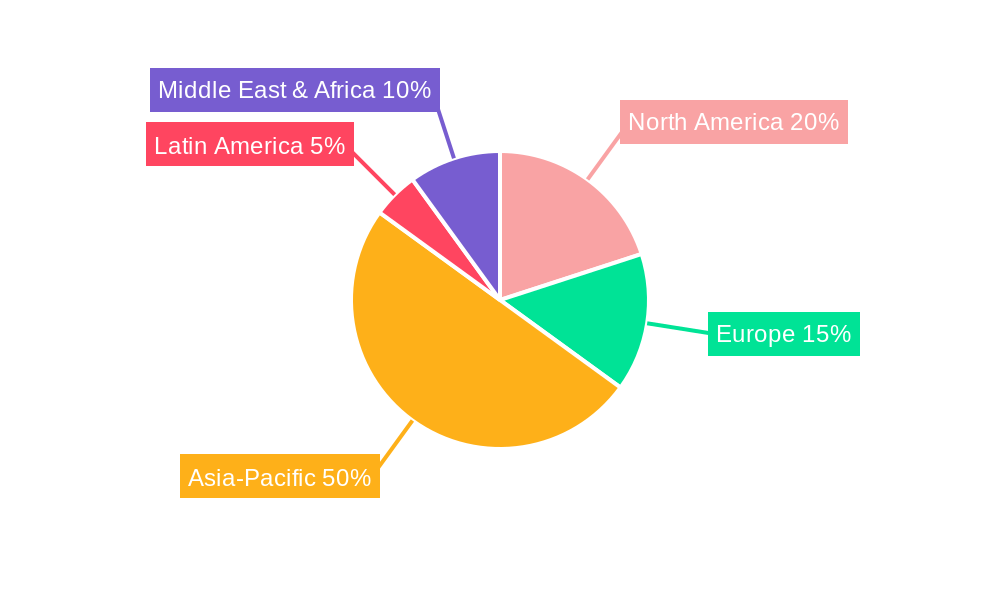

Dominant Regions, Countries, or Segments in Asia-Pacific Naval Vessels Market

Within the Asia-Pacific region, several countries are driving market growth, with India and China exhibiting the highest demand for naval vessels. The Frigates segment holds a significant market share, followed by Corvettes and Destroyers. India's focus on the "Make in India" initiative is a significant factor driving growth, while China's continuous modernization of its naval fleet also contributes substantially. Other key countries driving the market include Japan, South Korea, Australia, and Singapore.

- Key Drivers: Increased defense budgets, modernization of naval fleets, geopolitical tensions, and regional power dynamics.

- Dominant Segment: Frigates hold the largest market share due to their versatility and adaptability to various roles.

- Growth Potential: High growth potential is observed in the Submarines and Aircraft Carrier segments, driven by strategic requirements.

- Regional Dominance: India and China represent the largest markets due to their significant naval expansion plans.

Asia-Pacific Naval Vessels Market Product Landscape

The Asia-Pacific naval vessels market encompasses a diverse array of vessels, ranging from conventional frigates and destroyers to sophisticated submarines and aircraft carriers. Ongoing innovation emphasizes enhancing stealth capabilities, integrating advanced sensor and communication systems, and incorporating unmanned surface and underwater vehicles (USVs and UUVs) for improved operational efficiency and effectiveness. Key features driving demand include enhanced survivability, sophisticated combat management systems, advanced electronic warfare capabilities, and increased platform automation. The market is also witnessing the growing adoption of hybrid and electric propulsion systems, minimizing environmental impact and enhancing operational flexibility. The trend toward modular design is gaining traction, allowing for easier upgrades and customization of vessels to meet specific operational needs.

Key Drivers, Barriers & Challenges in Asia-Pacific Naval Vessels Market

Key Drivers: Increased geopolitical tensions, rising defense budgets, modernization of existing fleets, technological advancements (like AI and autonomous systems), and the need for maritime security and dominance.

Key Challenges and Restraints: High construction costs, long lead times for vessel delivery, complex regulatory frameworks, potential supply chain disruptions, geopolitical instability, and intense competition among shipbuilders. These factors can significantly impact project timelines and budgets.

Emerging Opportunities in Asia-Pacific Naval Vessels Market

Emerging opportunities exist in the development of advanced autonomous and unmanned naval vessels, the integration of AI-powered combat management systems, and the deployment of cyber warfare defense capabilities. Untapped markets in Southeast Asia present significant growth potential. Furthermore, the growing focus on environmental sustainability opens opportunities for eco-friendly propulsion systems and greener shipbuilding practices.

Growth Accelerators in the Asia-Pacific Naval Vessels Market Industry

Several factors are accelerating growth within the Asia-Pacific naval vessels market. These include: significant technological breakthroughs in shipbuilding materials and propulsion systems (such as the development of lighter, stronger materials and more efficient propulsion technologies); strategic partnerships and collaborations between defense contractors and technology providers; expansion into new market segments, such as the adoption of smaller, more agile vessels for coastal defense and asymmetric warfare; and government initiatives promoting indigenous shipbuilding capabilities and technological self-reliance. Increased investment in research and development, particularly in areas such as artificial intelligence and autonomous systems, is further fueling market expansion. Furthermore, the growing focus on cybersecurity for naval vessels is creating new opportunities for vendors specializing in cyber defense solutions.

Key Players Shaping the Asia-Pacific Naval Vessels Market Market

- Mitsubishi Heavy Industries Limited

- Cochin Shipyard Limited

- HD Hyundai

- Bangkok Dock Company Limited

- FINCANTIERI S p A

- Garden Reach Shipbuilders and Engineers Limited

- thyssenkrupp AG

- Singapore Technologies Engineering Limited

- ASC Pty Ltd

- Mazagon Dock Shipbuilders Limited

- LARSEN & TOUBRO LIMITED

- Navantia S A SM E

- China State Shipbuilding Corporation

- Boustead Heavy Industries Corporation Berhad

- Kawasaki Heavy Industries Ltd

- PT PAL Indonesia

Notable Milestones in Asia-Pacific Naval Vessels Market Sector

- September 2022: India’s first indigenously built aircraft carrier, INS Vikrant, commissioned under the Make in India initiative. This significantly boosted the domestic shipbuilding industry and showcased technological advancements.

- April 2023: Hyundai Heavy Industries launched the Chungnam frigate (FFX) in South Korea. This launch marks a step forward in the modernization of the Republic of Korea Navy and highlights the region's continued investment in naval capabilities.

In-Depth Asia-Pacific Naval Vessels Market Market Outlook

The Asia-Pacific naval vessels market is projected to experience sustained growth throughout the forecast period, driven by the ongoing modernization initiatives of regional navies, escalating geopolitical uncertainties, and continuous technological advancements. Strategic partnerships, investments in domestic shipbuilding capabilities, and exploration of emerging market segments will be critical for capitalizing on the opportunities within this dynamic sector. The market's future potential remains substantial, with significant opportunities for innovative companies specializing in advanced technologies and sustainable shipbuilding practices. The increasing focus on green technologies and the reduction of carbon footprint in naval operations will also shape the future landscape of the market.

Asia-Pacific Naval Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Submarines

- 1.2. Frigates

- 1.3. Corvettes

- 1.4. Aircraft Carrier

- 1.5. Destroyers

- 1.6. Other Vessel Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Singapore

- 2.1.7. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Naval Vessels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Singapore

- 1.7. Rest of Asia Pacific

Asia-Pacific Naval Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Submarines

- 5.1.2. Frigates

- 5.1.3. Corvettes

- 5.1.4. Aircraft Carrier

- 5.1.5. Destroyers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Singapore

- 5.2.1.7. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. China Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Heavy Industries Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cochin Shipyard Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HD Hyundai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bangkok Dock Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 FINCANTIERI S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Garden Reach Shipbuilders and Engineers Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 thyssenkrupp AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Singapore Technologies Engineering Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ASC Pty Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mazagon Dock Shipbuilders Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LARSEN & TOUBRO LIMITED

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Navantia S A SM E

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 China State Shipbuilding Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Boustead Heavy Industries Corporation Berhad

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kawasaki Heavy Industries Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 PT PAL Indonesia

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Asia-Pacific Naval Vessels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Naval Vessels Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Naval Vessels Market?

The projected CAGR is approximately 14.97%.

2. Which companies are prominent players in the Asia-Pacific Naval Vessels Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, HD Hyundai, Bangkok Dock Company Limited, FINCANTIERI S p A, Garden Reach Shipbuilders and Engineers Limited, thyssenkrupp AG, Singapore Technologies Engineering Limited, ASC Pty Ltd, Mazagon Dock Shipbuilders Limited, LARSEN & TOUBRO LIMITED, Navantia S A SM E, China State Shipbuilding Corporation, Boustead Heavy Industries Corporation Berhad, Kawasaki Heavy Industries Ltd, PT PAL Indonesia.

3. What are the main segments of the Asia-Pacific Naval Vessels Market?

The market segments include Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The Chungnam is the first of six vessels that comprise the Ulsan-class FFX Batch III, which will be inducted into the Republic of Korea (ROK) Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Naval Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Naval Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Naval Vessels Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Naval Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence