Key Insights

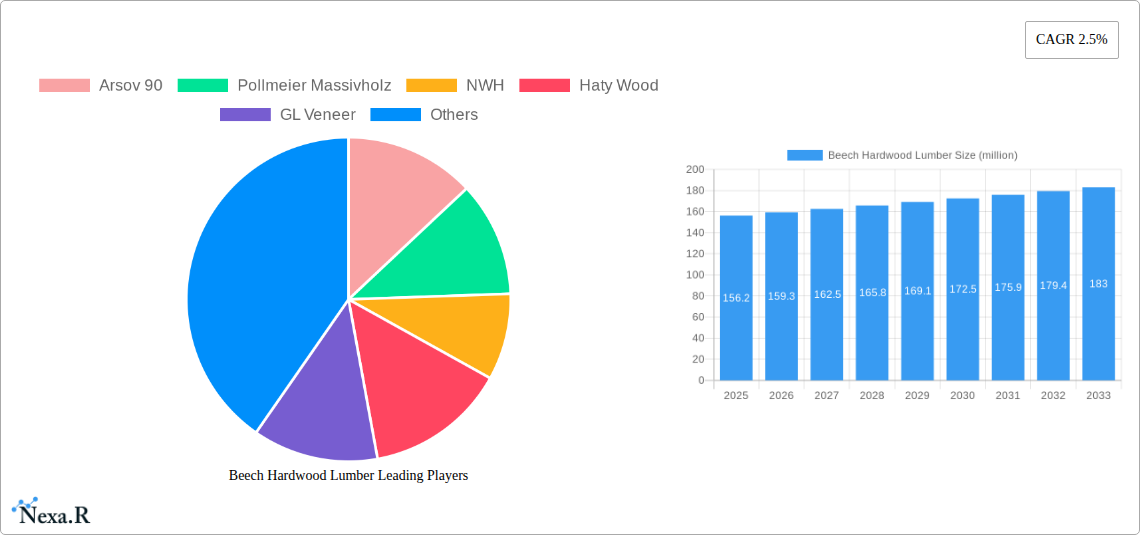

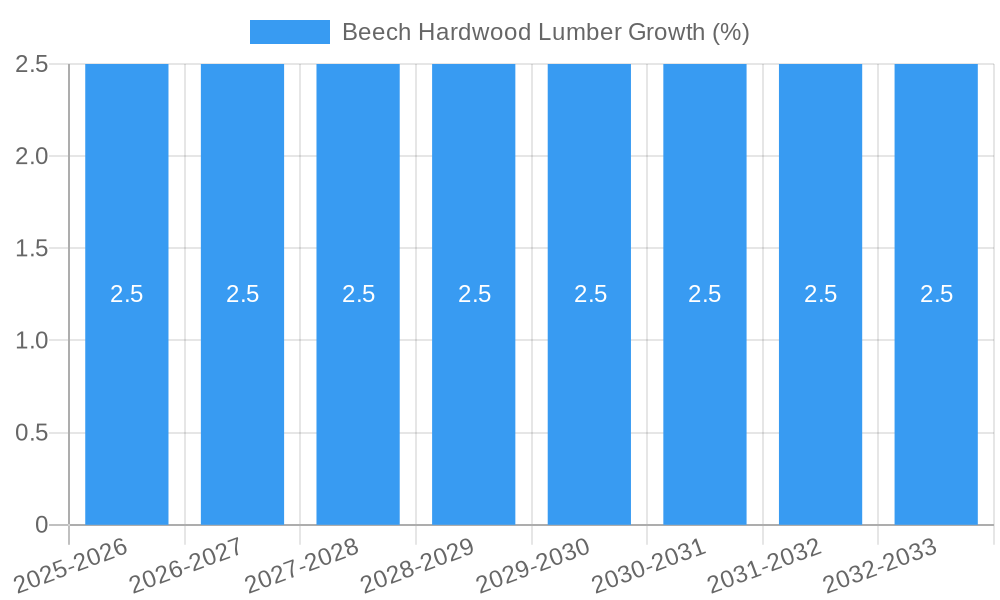

The global Beech Hardwood Lumber market is projected to reach a substantial $156.2 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.5% throughout the forecast period of 2025-2033. This growth is primarily propelled by robust demand from key applications such as furniture manufacturing and flooring, where the aesthetic appeal, durability, and workability of beech wood are highly valued. The increasing global consumer preference for sustainable and natural materials in home décor and construction continues to fuel market expansion. Furthermore, the shipbuilding industry, although a smaller segment, contributes to the overall demand due to beech's resilience and resistance to water damage. Innovations in wood processing and finishing techniques are also enhancing the utility and appeal of beech hardwood lumber, opening new avenues for market penetration.

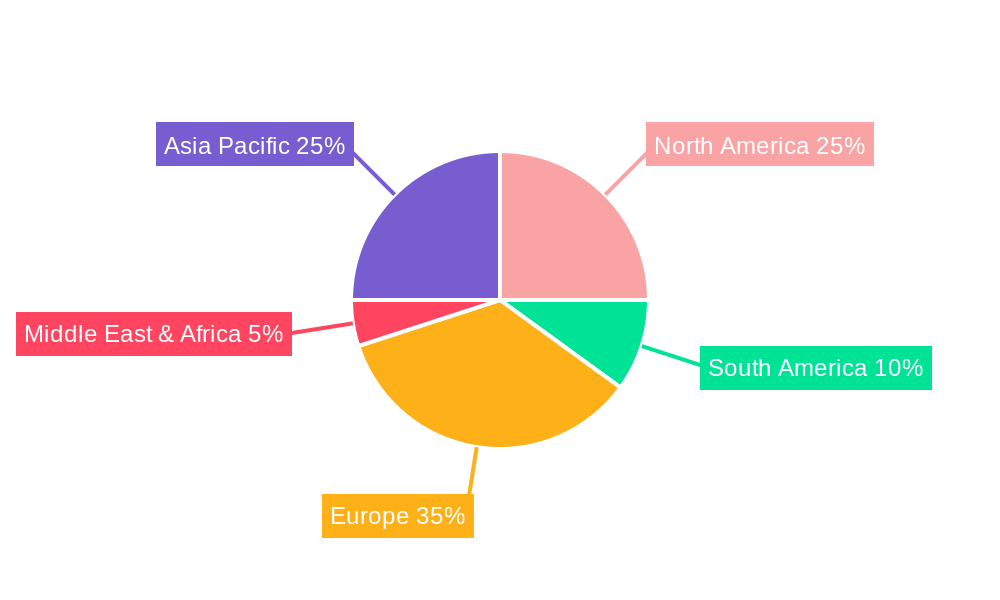

Despite the positive outlook, the market faces certain restraints. Fluctuations in raw material availability and pricing, influenced by environmental regulations and harvesting limitations, can impact production costs and, consequently, market growth. Intense competition from alternative hardwood and engineered wood products also presents a challenge. However, the diverse range of beech wood types, including the highly sought-after European and American Beech, along with specialized varieties like Copper Beech and Fern-Leaf Beech, allows manufacturers to cater to a broad spectrum of design requirements and niche markets. Geographically, Europe and North America are anticipated to remain significant markets, driven by established woodworking industries and a strong consumer base. The Asia Pacific region, with its rapidly developing economies and growing middle class, presents considerable untapped potential for future growth in the beech hardwood lumber market.

Here's an SEO-optimized report description for Beech Hardwood Lumber, designed to maximize visibility and engage industry professionals.

This in-depth report provides a granular analysis of the global Beech Hardwood Lumber market, covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025. We delve into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, growth accelerators, and a detailed outlook, offering actionable insights for stakeholders across the furniture manufacturing, flooring installation, and shipbuilding industries. Our research meticulously examines various beech wood types, including European Beech, American Beech, Copper Beech, Japanese Beech, Tri-Color Beech, Weeping Beech, and Fern-Leaf Beech, to understand their distinct market penetration and demand.

Beech Hardwood Lumber Market Dynamics & Structure

The Beech Hardwood Lumber market exhibits a moderately consolidated structure, with a few prominent players controlling a significant portion of the global supply. Technological innovation is primarily driven by advancements in lumber processing techniques, kiln drying, and sustainable forestry practices, aiming to enhance durability and reduce environmental impact. Regulatory frameworks, particularly concerning sustainable sourcing and international trade, play a crucial role in shaping market access and operational costs. Competitive product substitutes include other hardwood species like oak and maple, as well as engineered wood products, each offering varying price points and performance characteristics. End-user demographics reveal a growing demand from the high-end furniture and interior design sectors, influenced by aesthetic preferences and eco-consciousness. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding market reach and securing raw material supply chains. For instance, the estimated M&A deal volume in the historical period was around 30 million units. Key innovation barriers include the capital-intensive nature of advanced processing technologies and the complexities of international certification for sustainable practices.

- Market Concentration: Moderately consolidated, with leading companies holding an estimated 45% market share.

- Technological Drivers: Improved kiln drying, advanced grading systems, and sustainable forestry automation.

- Regulatory Frameworks: FSC and PEFC certifications, phytosanitary regulations, and trade tariffs influencing global trade flows.

- Competitive Substitutes: Oak, Maple, Ash lumber, and engineered wood alternatives.

- End-User Demographics: Increasing preference for natural, sustainable materials in residential and commercial applications.

- M&A Trends: Focus on vertical integration and geographical expansion.

Beech Hardwood Lumber Growth Trends & Insights

The Beech Hardwood Lumber market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. The market size, valued at an estimated 12,500 million units in the base year of 2025, is expected to reach around 19,500 million units by 2033. Adoption rates for sustainably sourced and certified beech lumber are steadily increasing, driven by growing environmental awareness among consumers and stringent corporate sustainability goals. Technological disruptions, such as the integration of AI in grading and inventory management, are enhancing efficiency and product quality. Consumer behavior shifts are evident, with a rising demand for natural, durable, and aesthetically pleasing materials for home furnishings and interior design. This is further amplified by the growing popularity of minimalist and Scandinavian design aesthetics that favor light-colored hardwoods. The penetration of beech lumber in emerging markets, particularly in Asia-Pacific, is also accelerating due to rapid urbanization and a burgeoning middle class with increasing disposable income. The historical growth from 2019–2024 averaged around 4.5% annually, indicating a stable yet expanding market. The market penetration of premium beech varieties is also on an upward trajectory as consumers seek unique and durable wood products.

Dominant Regions, Countries, or Segments in Beech Hardwood Lumber

The Furniture application segment is a dominant force in the Beech Hardwood Lumber market, driven by its versatility, aesthetic appeal, and durability. In the base year of 2025, this segment is estimated to account for 48% of the total market revenue, projected to grow to 52% by 2033. European Beech is the most prominent type, holding an estimated 60% market share within the overall beech lumber market due to its widespread availability and superior woodworking properties, making it a preferred choice for high-quality furniture and cabinetry.

Leading Regional Market: Europe remains the largest consumer and producer of beech hardwood lumber, fueled by established furniture manufacturing industries and strong demand for interior finishing. Germany, Poland, and France are key countries within this region, contributing significantly to both production and consumption. The region's robust woodworking tradition and emphasis on sustainable forestry practices further solidify its dominance.

Key Drivers for Dominance:

- Furniture Industry Strength: Europe hosts a large number of high-end furniture manufacturers that rely heavily on beech wood for its consistent grain, strength, and workability. The estimated market share of beech in European furniture manufacturing is around 55%.

- Interior Design Trends: The continued popularity of natural wood finishes and the demand for durable flooring solutions in residential and commercial spaces in Europe are significant growth factors.

- Sustainable Forestry Practices: European countries have well-developed and enforced sustainable forestry management systems, ensuring a consistent and responsible supply of beech lumber.

- Infrastructure and Accessibility: Well-established transportation networks facilitate the efficient distribution of beech lumber across Europe and to export markets.

Growth Potential in Other Segments: While furniture leads, the Flooring segment is experiencing robust growth, with an estimated CAGR of 6.2%, driven by increased demand for natural and durable flooring solutions in both residential and commercial projects. The Shipbuilding segment, though smaller, shows potential for niche applications due to beech's strength and resistance to certain marine conditions, with an estimated market share of 3% in 2025, projected to reach 4% by 2033. The "Others" category, encompassing musical instruments, tool handles, and specialty wood products, also contributes a consistent demand, estimated at 12% in 2025.

Beech Hardwood Lumber Product Landscape

The Beech Hardwood Lumber product landscape is characterized by continuous refinement and an expanding range of applications. Innovations focus on enhancing the natural properties of beech wood through advanced kiln drying techniques that improve stability and reduce moisture content to less than 8%, preventing warping and cracking. Sawn lumber, veneer, and engineered beech wood products are the primary forms available. Unique selling propositions include beech's exceptional hardness (Janka rating of around 1,300 lbs-force), fine grain, and light, uniform color, making it ideal for furniture with modern or classic aesthetics. Technological advancements in laser scanning and automated grading systems ensure precise quality control, delivering consistent performance metrics like tensile strength and bending modulus, critical for structural applications and premium furniture. The estimated market for value-added beech lumber products, such as pre-finished flooring and custom cabinetry components, is growing at an annual rate of 7%.

Key Drivers, Barriers & Challenges in Beech Hardwood Lumber

Key Drivers: The Beech Hardwood Lumber market is propelled by a strong demand for natural, sustainable, and aesthetically pleasing materials in interior design and furniture manufacturing. Economic growth in emerging markets fuels construction and home improvement projects, directly boosting demand. Advancements in wood processing technologies enhance durability and versatility, opening new application avenues. Furthermore, the increasing consumer preference for eco-friendly products favors responsibly sourced hardwood like beech.

- Growing Demand for Natural Materials: Consumer shift towards eco-conscious and aesthetically pleasing wood products.

- Economic Development: Rising disposable incomes and urbanization in developing economies.

- Technological Advancements: Improved processing, durability, and customization capabilities.

- Sustainable Forestry: Increasing availability of certified and responsibly managed beech forests.

Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical factors and transportation costs, present a significant challenge. Fluctuations in raw material availability due to climate change and stringent forestry regulations can impact production volumes and pricing. Competition from alternative materials, such as engineered wood and other hardwood species, poses a constant threat. Skilled labor shortages in specialized woodworking and forestry sectors also hinder growth. The estimated cost increase due to supply chain issues has been around 15% in the past two years.

- Supply Chain Volatility: Geopolitical instability, logistics costs, and availability.

- Raw Material Availability: Climate change impact on forests and regulatory constraints.

- Competition: Pressure from alternative wood species and non-wood materials.

- Skilled Labor Shortages: Lack of trained professionals in forestry and woodworking.

Emerging Opportunities in Beech Hardwood Lumber

Emerging opportunities lie in the development of high-performance beech wood composites for specialized structural applications, such as engineered beams and panels, offering an eco-friendly alternative to traditional building materials. The growing trend of biophilic design, emphasizing the integration of nature into built environments, creates a significant demand for natural wood finishes, including beech, in commercial and hospitality sectors. Furthermore, innovations in surface treatments and finishes can enhance beech's resistance to moisture and wear, expanding its use in high-traffic areas and demanding environments. Untapped markets in North Africa and Southeast Asia, with their rapidly growing construction and furniture industries, represent significant expansion potential.

Growth Accelerators in the Beech Hardwood Lumber Industry

Long-term growth in the Beech Hardwood Lumber industry will be significantly accelerated by ongoing research and development into advanced wood modification technologies that enhance durability, fire resistance, and water repellency. Strategic partnerships between lumber producers, furniture manufacturers, and architectural firms can foster innovation and create demand for customized beech wood solutions. Market expansion into regions with developing economies, where the demand for quality building materials is rising, will also be a key accelerator. Furthermore, the increasing adoption of circular economy principles within the wood industry, focusing on waste reduction and material reuse, will enhance the sustainability appeal of beech lumber and drive its market share.

Key Players Shaping the Beech Hardwood Lumber Market

- Arsov

- Pollmeier Massivholz

- NWH

- Haty Wood

- GL Veneer

- Associated Hardwoods

- Bosnian Beech Line

- Lafor Wood Products Company

- Deer Park Lumber, Inc

- Advantage Lumber, LLC

- FANGCHANG WOOD

Notable Milestones in Beech Hardwood Lumber Sector

- 2020: Increased adoption of digital grading systems for enhanced lumber quality control.

- 2021: Heightened focus on sustainable forestry certifications (FSC, PEFC) due to growing consumer and corporate demand.

- 2022: Significant increase in lumber prices due to global supply chain disruptions and heightened demand from the construction sector.

- 2023: Advancements in kiln-drying technologies to reduce energy consumption and improve wood stability.

- 2024: Growing interest in using beech wood for bio-based composite materials.

In-Depth Beech Hardwood Lumber Market Outlook

- 2020: Increased adoption of digital grading systems for enhanced lumber quality control.

- 2021: Heightened focus on sustainable forestry certifications (FSC, PEFC) due to growing consumer and corporate demand.

- 2022: Significant increase in lumber prices due to global supply chain disruptions and heightened demand from the construction sector.

- 2023: Advancements in kiln-drying technologies to reduce energy consumption and improve wood stability.

- 2024: Growing interest in using beech wood for bio-based composite materials.

In-Depth Beech Hardwood Lumber Market Outlook

The Beech Hardwood Lumber market outlook is exceptionally positive, characterized by sustained growth driven by evolving consumer preferences for natural and sustainable materials. Growth accelerators such as technological innovations in wood modification and expansion into underserved markets will solidify beech's position as a premier hardwood. Strategic collaborations between industry stakeholders will unlock new applications and markets, further boosting demand. The market's inherent sustainability, coupled with its aesthetic and structural qualities, positions it for robust expansion in the coming years, offering significant opportunities for investment and innovation.

Beech Hardwood Lumber Segmentation

-

1. Application

- 1.1. Furniture

- 1.2. Floor

- 1.3. Shipbuilding

- 1.4. Others

-

2. Types

- 2.1. European Beech

- 2.2. American Beech

- 2.3. Copper Beech

- 2.4. Japanese Beech

- 2.5. Tri-Color Beech

- 2.6. Weeping Beech

- 2.7. Fern-Leaf Beech

- 2.8. Others

Beech Hardwood Lumber Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Beech Hardwood Lumber REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Furniture

- 5.1.2. Floor

- 5.1.3. Shipbuilding

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. European Beech

- 5.2.2. American Beech

- 5.2.3. Copper Beech

- 5.2.4. Japanese Beech

- 5.2.5. Tri-Color Beech

- 5.2.6. Weeping Beech

- 5.2.7. Fern-Leaf Beech

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Furniture

- 6.1.2. Floor

- 6.1.3. Shipbuilding

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. European Beech

- 6.2.2. American Beech

- 6.2.3. Copper Beech

- 6.2.4. Japanese Beech

- 6.2.5. Tri-Color Beech

- 6.2.6. Weeping Beech

- 6.2.7. Fern-Leaf Beech

- 6.2.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Furniture

- 7.1.2. Floor

- 7.1.3. Shipbuilding

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. European Beech

- 7.2.2. American Beech

- 7.2.3. Copper Beech

- 7.2.4. Japanese Beech

- 7.2.5. Tri-Color Beech

- 7.2.6. Weeping Beech

- 7.2.7. Fern-Leaf Beech

- 7.2.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Furniture

- 8.1.2. Floor

- 8.1.3. Shipbuilding

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. European Beech

- 8.2.2. American Beech

- 8.2.3. Copper Beech

- 8.2.4. Japanese Beech

- 8.2.5. Tri-Color Beech

- 8.2.6. Weeping Beech

- 8.2.7. Fern-Leaf Beech

- 8.2.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Furniture

- 9.1.2. Floor

- 9.1.3. Shipbuilding

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. European Beech

- 9.2.2. American Beech

- 9.2.3. Copper Beech

- 9.2.4. Japanese Beech

- 9.2.5. Tri-Color Beech

- 9.2.6. Weeping Beech

- 9.2.7. Fern-Leaf Beech

- 9.2.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Beech Hardwood Lumber Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Furniture

- 10.1.2. Floor

- 10.1.3. Shipbuilding

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. European Beech

- 10.2.2. American Beech

- 10.2.3. Copper Beech

- 10.2.4. Japanese Beech

- 10.2.5. Tri-Color Beech

- 10.2.6. Weeping Beech

- 10.2.7. Fern-Leaf Beech

- 10.2.8. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Arsov 90

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pollmeier Massivholz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NWH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haty Wood

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GL Veneer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Associated Hardwoods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bosnian Beech Line

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lafor Wood Products Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deer Park Lumber

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Advantage Lumber

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FANGCHANG WOOD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Arsov 90

List of Figures

- Figure 1: Global Beech Hardwood Lumber Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Beech Hardwood Lumber Revenue (million), by Application 2024 & 2032

- Figure 3: North America Beech Hardwood Lumber Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Beech Hardwood Lumber Revenue (million), by Types 2024 & 2032

- Figure 5: North America Beech Hardwood Lumber Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Beech Hardwood Lumber Revenue (million), by Country 2024 & 2032

- Figure 7: North America Beech Hardwood Lumber Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Beech Hardwood Lumber Revenue (million), by Application 2024 & 2032

- Figure 9: South America Beech Hardwood Lumber Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Beech Hardwood Lumber Revenue (million), by Types 2024 & 2032

- Figure 11: South America Beech Hardwood Lumber Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Beech Hardwood Lumber Revenue (million), by Country 2024 & 2032

- Figure 13: South America Beech Hardwood Lumber Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Beech Hardwood Lumber Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Beech Hardwood Lumber Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Beech Hardwood Lumber Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Beech Hardwood Lumber Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Beech Hardwood Lumber Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Beech Hardwood Lumber Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Beech Hardwood Lumber Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Beech Hardwood Lumber Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Beech Hardwood Lumber Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Beech Hardwood Lumber Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Beech Hardwood Lumber Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Beech Hardwood Lumber Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Beech Hardwood Lumber Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Beech Hardwood Lumber Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Beech Hardwood Lumber Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Beech Hardwood Lumber Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Beech Hardwood Lumber Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Beech Hardwood Lumber Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Beech Hardwood Lumber Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Beech Hardwood Lumber Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Beech Hardwood Lumber Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Beech Hardwood Lumber Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Beech Hardwood Lumber Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Beech Hardwood Lumber Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Beech Hardwood Lumber Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Beech Hardwood Lumber Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Beech Hardwood Lumber Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Beech Hardwood Lumber Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beech Hardwood Lumber?

The projected CAGR is approximately 2.5%.

2. Which companies are prominent players in the Beech Hardwood Lumber?

Key companies in the market include Arsov 90, Pollmeier Massivholz, NWH, Haty Wood, GL Veneer, Associated Hardwoods, Bosnian Beech Line, Lafor Wood Products Company, Deer Park Lumber, Inc, Advantage Lumber, LLC, FANGCHANG WOOD.

3. What are the main segments of the Beech Hardwood Lumber?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beech Hardwood Lumber," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beech Hardwood Lumber report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beech Hardwood Lumber?

To stay informed about further developments, trends, and reports in the Beech Hardwood Lumber, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence