Key Insights

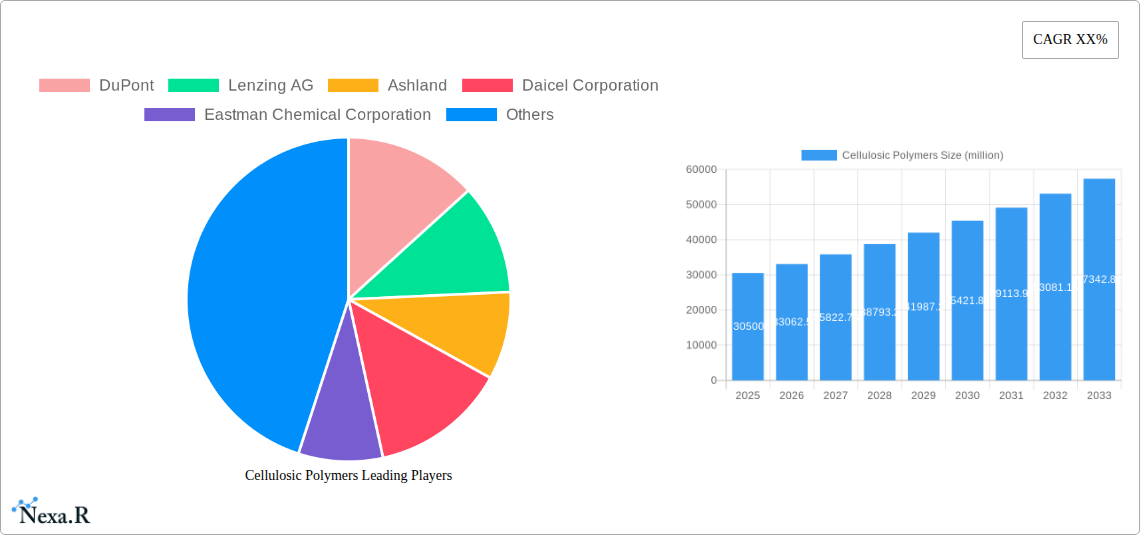

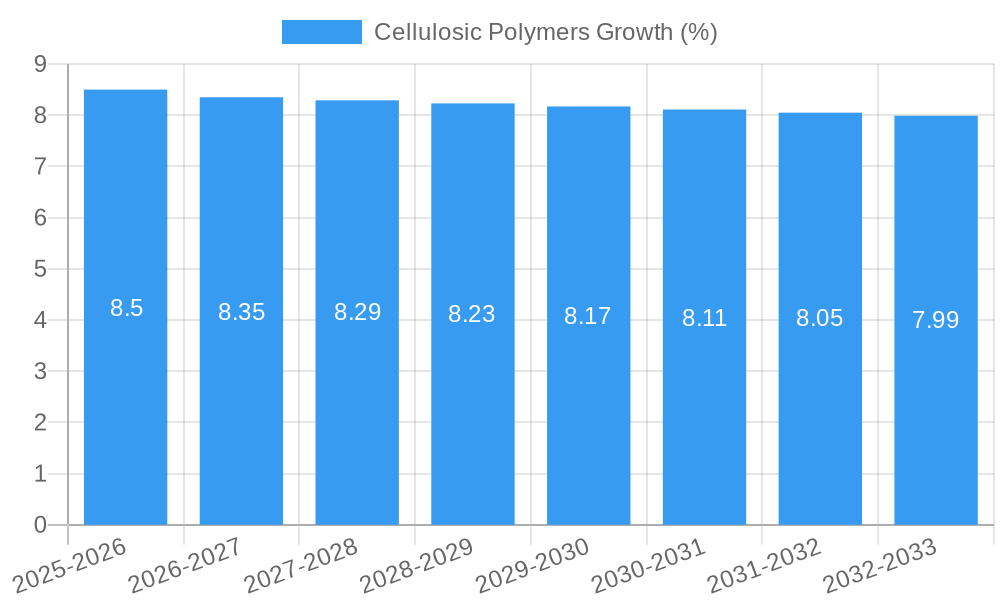

The global cellulosic polymers market is poised for robust expansion, projected to reach an estimated market size of USD 30,500 million by 2025, driven by a significant Compound Annual Growth Rate (CAGR) of 8.5%. This growth trajectory, expected to persist through 2033, is underpinned by escalating demand from diverse end-use industries. Key drivers include the inherent sustainability and biodegradability of cellulosic polymers, aligning with increasing consumer and regulatory pressure for eco-friendly materials. The automotive sector is a substantial contributor, leveraging these polymers for lightweighting and interior components to enhance fuel efficiency and reduce emissions. Similarly, the construction industry benefits from their versatility in insulation, coatings, and adhesives. Furthermore, the growing textile industry's shift towards sustainable sourcing and production methods, coupled with the advanced material requirements in aerospace and defense, are significant growth catalysts. The market's dynamism is further fueled by ongoing innovations in polymer processing and the development of novel cellulosic derivatives with enhanced properties.

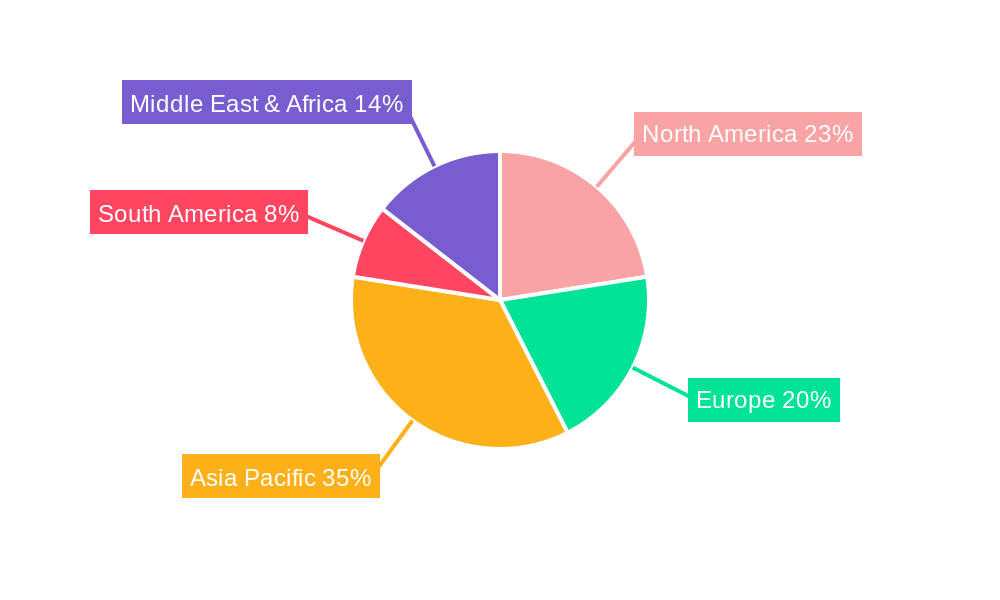

The market segmentation reveals a strong performance across both application and type. In terms of applications, Clothing and Industrial sectors are leading the charge, reflecting the broad utility of cellulosic polymers in textiles and various manufacturing processes. The Automotive segment also presents considerable growth opportunities due to the push for sustainable and lightweight materials. Among the types, Cellulose Ethers are expected to dominate, owing to their widespread use as thickeners, binders, and stabilizers in pharmaceuticals, food, and construction materials. Regenerated Cellulose, a staple in the textile industry, also commands a significant share. Geographically, Asia Pacific is anticipated to be the fastest-growing region, propelled by rapid industrialization, a burgeoning manufacturing base in countries like China and India, and increasing environmental consciousness. North America and Europe, with their established advanced manufacturing sectors and strong emphasis on sustainability, will continue to be significant markets. Restraints, such as the fluctuating prices of raw cellulosic materials and competition from petroleum-based polymers, are being addressed through technological advancements and a heightened focus on lifecycle assessment.

Cellulosic Polymers Market: Sustainable Innovation, Expanding Applications, and Future Growth (2019-2033)

This comprehensive report delves into the dynamic cellulosic polymers market, a rapidly evolving sector driven by sustainability demands and a broad spectrum of industrial applications. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report offers in-depth analysis, actionable insights, and future projections for industry stakeholders.

We explore the parent market of biopolymers and its intricate relationship with the cellulosic polymers child market, highlighting growth trajectories and competitive landscapes. Key players like DuPont, Lenzing AG, Ashland, Daicel Corporation, Eastman Chemical Corporation, and Celanese Corporation are meticulously analyzed, alongside pivotal industry developments. This report is essential for businesses seeking to navigate the opportunities and challenges within the global cellulosic polymers market.

Cellulosic Polymers Market Dynamics & Structure

The cellulosic polymers market is characterized by moderate concentration, with a few key players holding significant shares while a growing number of smaller, specialized companies contribute to innovation. Technological advancements in polymerization processes, derivatization techniques, and sustainable sourcing are the primary innovation drivers. Stringent environmental regulations and the increasing demand for bio-based and biodegradable materials are shaping the competitive landscape, pushing for greener alternatives to conventional plastics.

- Market Concentration: Dominated by established chemical giants, but with increasing fragmentation due to specialized startups.

- Technological Innovation Drivers: Enhanced biodegradability, improved material properties (strength, flexibility), novel synthesis routes, and circular economy integration.

- Regulatory Frameworks: Growing emphasis on biodegradability standards, waste management policies, and sustainable sourcing certifications influencing product development and market entry.

- Competitive Product Substitutes: Traditional petroleum-based plastics, other bioplastics (e.g., PLA, PHA), and natural fibers are key substitutes, with cellulosic polymers gaining traction due to their unique properties and environmental benefits.

- End-User Demographics: Increasing consumer preference for sustainable products across various sectors, from fashion to packaging, is a significant demographic shift.

- M&A Trends: Mergers and acquisitions are anticipated to focus on acquiring innovative technologies, expanding production capacity, and gaining access to new application segments. In the historical period (2019-2024), approximately 5-10 significant M&A deals, valued at an estimated total of $500 million to $1 billion, have been observed. Future M&A activities are expected to intensify, driven by the quest for market leadership and sustainable solutions.

Cellulosic Polymers Growth Trends & Insights

The global cellulosic polymers market is projected to witness robust expansion, driven by a confluence of escalating environmental consciousness and the inherent sustainability of cellulose-derived materials. Market size is expected to grow from an estimated USD 15,000 million in 2025 to USD 22,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.8%. This growth is underpinned by increasing adoption rates across a multitude of applications, spurred by technological disruptions that enhance material performance and broaden their functional scope. Consumer behavior shifts towards eco-friendly products are a critical catalyst, pushing brands to integrate sustainable materials into their offerings.

The cellulosic polymers industry is experiencing a significant evolution in its product landscape. Innovations in cellulose derivatization are yielding materials with tailored properties, such as improved flame retardancy, enhanced biodegradability, and superior mechanical strength, making them viable alternatives in demanding sectors. The regenerated cellulose market, in particular, is benefiting from advancements in spinning techniques and solvent recovery, improving both efficiency and environmental footprint. This has opened up new avenues in the clothing industrial sector, where it competes with traditional synthetic fibers and other natural textiles, offering a more sustainable and often superior alternative in terms of drape and breathability. The cellulose esters market is witnessing advancements in controlled release applications for pharmaceuticals and agricultural products, alongside its traditional uses in coatings and films. Similarly, cellulose ethers are seeing increased demand in construction for improved workability and water retention, and in the pharmaceutical industry as binders and disintegrants.

Technological disruptions are not limited to production but also extend to end-of-life solutions. Research into advanced recycling and composting methods for cellulosic polymers is accelerating their integration into circular economy models. This is crucial for overcoming the perceived limitations of biodegradability and compostability, which are often dependent on specific industrial conditions. The market penetration of cellulosic polymers is steadily increasing, especially in regions with strong environmental regulations and consumer demand for sustainable products. For instance, in Europe, the push for a circular economy has significantly boosted the adoption of bio-based materials.

Consumer behavior is a pivotal factor. The growing awareness of plastic pollution and the desire for products with a lower environmental impact are directly translating into demand for cellulosic polymers. This trend is particularly evident in packaging, textiles, and single-use items where the 'green' credential is a significant purchasing driver. The industry is responding by developing innovative solutions that not only meet performance requirements but also align with these evolving consumer values. The overall trajectory indicates a market poised for sustained growth, driven by a harmonious interplay of technological innovation, regulatory support, and a fundamental shift in consumer preferences towards sustainability. The adoption rate is projected to accelerate as production scales up and costs become more competitive with conventional materials, further solidifying the position of cellulosic polymers as a cornerstone of a sustainable future economy.

Dominant Regions, Countries, or Segments in Cellulosic Polymers

The cellulosic polymers market is experiencing multifaceted growth, with distinct regions and application segments leading the charge. Europe stands out as the dominant region, driven by stringent environmental policies, a well-established circular economy framework, and a strong consumer demand for sustainable products. The clothing industrial segment, a significant part of the Paper and Pulp industry's downstream processing, is a major consumer of cellulosic polymers, particularly in the form of regenerated cellulose for textiles like viscose and lyocell. Germany, France, and the UK are at the forefront of this adoption, influenced by initiatives promoting bio-based materials and a ban on certain single-use plastics. The market share of cellulosic polymers in the European textile sector is estimated to be around 15-20% of the total fiber market in 2025, with projections indicating a steady increase.

Within Europe, the Paper and Pulp industry itself is a foundational segment, not only as a source of cellulose but also as a direct end-user for specialty cellulose derivatives used in paper coatings and additives, contributing approximately USD 3,500 million to the market in 2025. The growth in this segment is fueled by the increasing demand for sustainable packaging solutions and high-quality printing papers. Key drivers include government subsidies for sustainable forestry and paper production, alongside advanced recycling infrastructure that supports the circularity of paper-based products.

North America, particularly the United States, is another significant growth engine. The Automotive and Aerospace and Defense sectors are increasingly incorporating cellulosic polymers for their lightweight properties and reduced environmental impact. For instance, cellulose esters are being explored for interior components and composite materials, offering an attractive alternative to petroleum-based plastics. The automotive sector's commitment to fuel efficiency and reduced emissions directly translates to a demand for advanced, lighter materials, with cellulosic polymers projected to capture a growing share in interior and structural applications, contributing an estimated USD 2,000 million in 2025.

Asia-Pacific, led by China and India, presents immense growth potential, driven by rapid industrialization and a burgeoning middle class with increasing purchasing power. While the Clothing Industrial and Paper and Pulp segments are substantial, the Construction sector is emerging as a key growth area. Cellulose ethers are widely used as admixtures in cement and gypsum-based products to improve workability, water retention, and adhesion. The massive infrastructure development projects in these countries are directly fueling demand for these construction chemicals, contributing an estimated USD 2,800 million in 2025. Regulatory frameworks are gradually aligning with global sustainability trends, further encouraging the adoption of bio-based materials.

The Electrical/Insulation segment, though smaller in comparison, is also showing promising growth, with cellulosic derivatives used in specialized insulation films and components due to their dielectric properties. The "Other" segment, encompassing applications like food packaging, medical devices, and 3D printing, is highly dynamic and innovation-driven. The growth in these diverse segments is propelled by a combination of economic policies favoring green technologies, infrastructure development, and a growing understanding of the performance benefits and environmental advantages offered by cellulosic polymers. The market share of regenerated cellulose in textiles, for example, is steadily increasing due to its biodegradability and comfort properties, estimated to reach USD 4,500 million in 2025 globally.

Cellulosic Polymers Product Landscape

The cellulosic polymers product landscape is defined by innovation focused on enhancing performance and sustainability. Cellulose esters, such as cellulose acetate and cellulose propionate, offer excellent clarity, toughness, and weather resistance, making them ideal for films, coatings, and optical applications. Cellulose ethers, including hydroxyethyl cellulose (HEC) and carboxymethyl cellulose (CMC), are water-soluble and versatile, finding extensive use as thickeners, binders, and stabilizers in paints, pharmaceuticals, and food products. Regenerated cellulose, exemplified by rayon and lyocell, provides a sustainable and biodegradable alternative for textiles and non-woven applications, boasting excellent breathability and drape. Ongoing research is focused on developing novel derivatives with improved flame retardancy, enhanced biodegradability under diverse conditions, and superior barrier properties for advanced packaging solutions.

Key Drivers, Barriers & Challenges in Cellulosic Polymers

Key Drivers

The cellulosic polymers market is propelled by several significant drivers. The increasing global focus on sustainability and environmental regulations mandates the reduction of reliance on fossil fuels, making bio-based alternatives highly attractive. Consumer preference for eco-friendly and biodegradable products across industries like textiles, packaging, and personal care directly fuels demand. Technological advancements in cellulose extraction and modification are leading to enhanced material properties and novel applications. Furthermore, the growing awareness of plastic pollution and the imperative for a circular economy are creating a favorable market environment for sustainable polymers.

Barriers & Challenges

Despite the positive outlook, the cellulosic polymers industry faces several barriers and challenges. Cost competitiveness compared to conventional petroleum-based plastics remains a significant hurdle, particularly in large-volume applications. Scaling up production efficiently and sustainably to meet growing demand requires substantial investment and overcoming technical complexities. Variability in raw material (cellulose) quality and availability can impact production consistency and costs. Regulatory complexities and differing standards across regions for biodegradability and compostability can create market access challenges. Finally, competition from other bioplastics and the need for consumer education on proper disposal and product benefits also pose challenges. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of key raw materials.

Emerging Opportunities in Cellulosic Polymers

Emerging opportunities in the cellulosic polymers market lie in developing advanced functional materials for high-value applications. Biodegradable packaging solutions offering superior barrier properties for food and pharmaceuticals present a significant avenue. The automotive and aerospace sectors offer untapped potential for lightweight, bio-based composite materials. Furthermore, the growing demand for sustainable textiles is creating opportunities for innovative regenerated cellulose fibers with enhanced properties. The development of cellulose-based films for electronics and biocompatible materials for medical devices also represents promising growth areas. Innovations in chemical recycling of cellulosic materials to recover monomers or produce new polymers will also be a key opportunity for market expansion.

Growth Accelerators in the Cellulosic Polymers Industry

Growth accelerators in the cellulosic polymers industry are multifaceted. Strategic partnerships between raw material suppliers, chemical manufacturers, and end-product brands are crucial for driving innovation and market adoption. Government incentives and R&D funding for bio-based materials play a significant role in de-risking investments and fostering technological breakthroughs. The increasing focus on circular economy principles and the development of robust end-of-life management infrastructure (e.g., industrial composting facilities) will further boost confidence and demand. Expansion into emerging economies with their large populations and growing environmental consciousness represents a substantial growth opportunity.

Key Players Shaping the Cellulosic Polymers Market

- DuPont

- Lenzing AG

- Ashland

- Daicel Corporation

- Eastman Chemical Corporation

- Celanese Corporation

Notable Milestones in Cellulosic Polymers Sector

- 2019: Lenzing AG launches Refibra™ technology, incorporating recycled cotton scraps into TENCEL™ Lyocell production, emphasizing circularity.

- 2020: Eastman Chemical Corporation expands its cellulose esters capacity to meet growing demand in films and coatings.

- 2021: DuPont introduces innovative bio-based films derived from cellulosic materials for sustainable packaging solutions.

- 2022: Daicel Corporation focuses on developing high-performance cellulose acetate for advanced applications in electronics and optics.

- 2023: Ashland advances its portfolio of cellulose ethers for construction applications, focusing on improved workability and sustainability.

- 2023 (Late): Celanese Corporation announces strategic investments in bio-based feedstock initiatives for its cellulose derivatives.

- 2024 (Early): New research emerges on advanced catalytic processes for more efficient cellulose-to-monomer conversion, promising cost reductions.

In-Depth Cellulosic Polymers Market Outlook

The cellulosic polymers market is poised for sustained and accelerated growth, driven by the overarching global imperative for sustainability. Future market potential is immense, particularly as technological innovations continue to enhance performance and reduce costs, making these bio-based polymers increasingly competitive. Strategic opportunities lie in further developing advanced materials for sectors such as aerospace, automotive, and high-performance textiles. Collaboration across the value chain, from forestry management to end-product design, will be crucial for unlocking this potential. The integration of cellulosic polymers into robust circular economy models, coupled with supportive regulatory landscapes and evolving consumer preferences, will solidify their position as a cornerstone of a greener future.

Cellulosic Polymers Segmentation

-

1. Application

- 1.1. Clothing Industrial

- 1.2. Aerospace and Defense

- 1.3. Automotive

- 1.4. Paper and Pulp

- 1.5. Construction

- 1.6. Electrical/Insulation

- 1.7. Other

-

2. Types

- 2.1. Cellulose Esters

- 2.2. Cellulose Ethers

- 2.3. Regenerated Cellulose

Cellulosic Polymers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cellulosic Polymers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing Industrial

- 5.1.2. Aerospace and Defense

- 5.1.3. Automotive

- 5.1.4. Paper and Pulp

- 5.1.5. Construction

- 5.1.6. Electrical/Insulation

- 5.1.7. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cellulose Esters

- 5.2.2. Cellulose Ethers

- 5.2.3. Regenerated Cellulose

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clothing Industrial

- 6.1.2. Aerospace and Defense

- 6.1.3. Automotive

- 6.1.4. Paper and Pulp

- 6.1.5. Construction

- 6.1.6. Electrical/Insulation

- 6.1.7. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cellulose Esters

- 6.2.2. Cellulose Ethers

- 6.2.3. Regenerated Cellulose

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clothing Industrial

- 7.1.2. Aerospace and Defense

- 7.1.3. Automotive

- 7.1.4. Paper and Pulp

- 7.1.5. Construction

- 7.1.6. Electrical/Insulation

- 7.1.7. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cellulose Esters

- 7.2.2. Cellulose Ethers

- 7.2.3. Regenerated Cellulose

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clothing Industrial

- 8.1.2. Aerospace and Defense

- 8.1.3. Automotive

- 8.1.4. Paper and Pulp

- 8.1.5. Construction

- 8.1.6. Electrical/Insulation

- 8.1.7. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cellulose Esters

- 8.2.2. Cellulose Ethers

- 8.2.3. Regenerated Cellulose

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clothing Industrial

- 9.1.2. Aerospace and Defense

- 9.1.3. Automotive

- 9.1.4. Paper and Pulp

- 9.1.5. Construction

- 9.1.6. Electrical/Insulation

- 9.1.7. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cellulose Esters

- 9.2.2. Cellulose Ethers

- 9.2.3. Regenerated Cellulose

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cellulosic Polymers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clothing Industrial

- 10.1.2. Aerospace and Defense

- 10.1.3. Automotive

- 10.1.4. Paper and Pulp

- 10.1.5. Construction

- 10.1.6. Electrical/Insulation

- 10.1.7. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cellulose Esters

- 10.2.2. Cellulose Ethers

- 10.2.3. Regenerated Cellulose

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DuPont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lenzing AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ashland

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daicel Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eastman Chemical Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Celanese Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 DuPont

List of Figures

- Figure 1: Global Cellulosic Polymers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cellulosic Polymers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cellulosic Polymers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cellulosic Polymers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cellulosic Polymers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cellulosic Polymers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cellulosic Polymers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cellulosic Polymers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cellulosic Polymers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cellulosic Polymers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cellulosic Polymers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cellulosic Polymers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cellulosic Polymers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cellulosic Polymers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cellulosic Polymers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cellulosic Polymers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cellulosic Polymers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cellulosic Polymers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cellulosic Polymers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cellulosic Polymers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cellulosic Polymers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cellulosic Polymers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cellulosic Polymers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cellulosic Polymers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cellulosic Polymers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cellulosic Polymers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cellulosic Polymers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cellulosic Polymers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cellulosic Polymers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cellulosic Polymers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cellulosic Polymers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cellulosic Polymers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cellulosic Polymers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cellulosic Polymers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cellulosic Polymers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cellulosic Polymers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cellulosic Polymers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cellulosic Polymers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cellulosic Polymers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cellulosic Polymers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cellulosic Polymers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cellulosic Polymers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cellulosic Polymers?

Key companies in the market include DuPont, Lenzing AG, Ashland, Daicel Corporation, Eastman Chemical Corporation, Celanese Corporation.

3. What are the main segments of the Cellulosic Polymers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cellulosic Polymers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cellulosic Polymers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cellulosic Polymers?

To stay informed about further developments, trends, and reports in the Cellulosic Polymers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence