Key Insights

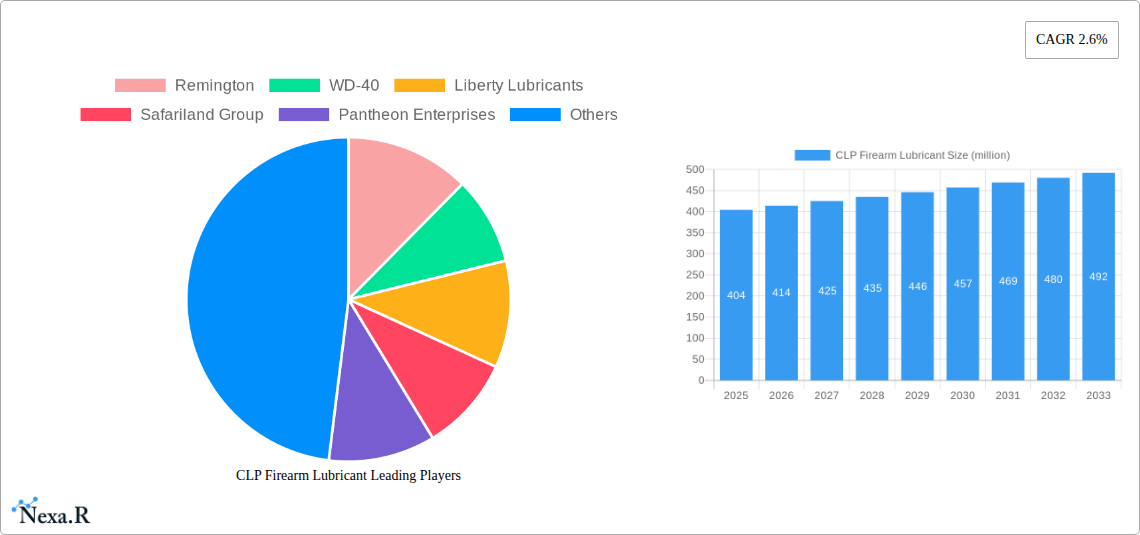

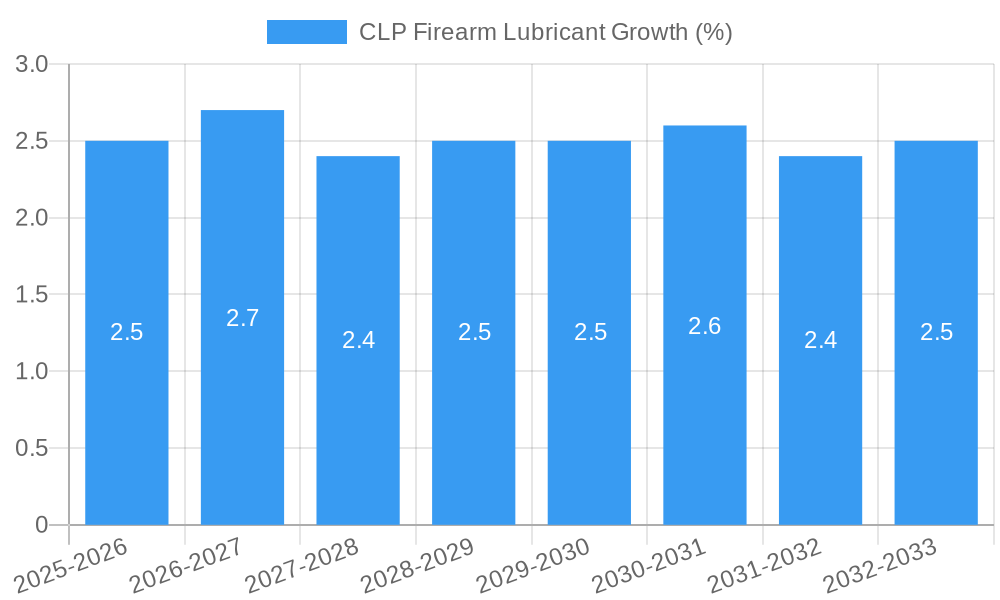

The global CLP Firearm Lubricant market is projected to reach a valuation of approximately $404 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.6% through 2033. This consistent growth is underpinned by several key drivers, primarily the increasing demand from law enforcement and military sectors for effective firearm maintenance and operational readiness. These organizations rely heavily on high-performance CLP (Clean, Lubricate, Protect) products to ensure the reliability and longevity of their weapons in diverse and often challenging environments. Furthermore, the expanding shooting sports enthusiast base, driven by recreational activities and competitive shooting, also contributes significantly to market expansion. As more individuals engage in shooting sports, the need for regular and effective firearm cleaning and lubrication solutions grows in parallel. The market is also experiencing a rise in demand for advanced formulations that offer enhanced protection against corrosion, extreme temperatures, and wear, pushing manufacturers to innovate and cater to these evolving user requirements.

The CLP Firearm Lubricant market is segmented by application into Law Enforcement, Military, Security Personnel, Shooting Sports, and Others, with Law Enforcement and Military expected to dominate market share due to their substantial procurement volumes and stringent operational demands. By type, the market is characterized by CLP Oil, CLP Grease, and CLP Aerosol Spray, with aerosol sprays holding a significant share due to their ease of application and convenience. Key players like WD-40, Safariland Group, Otis Technology, and Ballistol are actively shaping the market through product development, strategic partnerships, and global distribution networks. Emerging trends include a growing interest in eco-friendly and biodegradable lubricant formulations, driven by increasing environmental awareness and regulatory pressures, as well as the development of specialized CLP solutions tailored for specific firearm types and operating conditions. Restraints such as the availability of multi-purpose lubricants and potential price sensitivities in certain consumer segments are factors that market players will need to strategically address to maintain growth momentum.

CLP Firearm Lubricant Market Dynamics & Structure

The global CLP Firearm Lubricant market is characterized by a moderately concentrated structure, with key players like Remington, WD-40, Liberty Lubricants, Safariland Group, Pantheon Enterprises, Muscle Products, Lucas Oil, FrogLube, Otis Technology, MPT Industries, Mil-Comm, Ballistol, SPS Marketing, G96 Products, Breakthrough Clean, Sage & Braker, Hot Shot, Radcolube, Corrosion Technologies, and Renewable Lubricants vying for significant market share. Technological innovation remains a primary driver, with continuous research and development focused on enhancing cleaning, lubrication, and protection properties, particularly in extreme conditions. Regulatory frameworks, largely driven by environmental concerns and product safety standards, are also shaping market trends, influencing ingredient formulations and packaging. Competitive product substitutes, such as traditional gun oils and specialized cleaning solvents, present a constant challenge, necessitating a focus on the multi-functional benefits of CLP lubricants. End-user demographics are diversifying, with growth observed not only in traditional military and law enforcement segments but also in the burgeoning shooting sports and civilian self-defense markets. Mergers and acquisitions (M&A) activity is on the rise, as larger entities seek to consolidate market share and acquire innovative technologies, evidenced by an estimated XX M&A deal volume in the historical period. Innovation barriers, including the high cost of R&D and stringent efficacy testing requirements, are significant factors influencing the pace of new product introductions.

- Market Concentration: Moderate, with a few leading players holding substantial market share.

- Technological Innovation: Driven by demand for enhanced performance in harsh environments and eco-friendly formulations.

- Regulatory Frameworks: Influencing ingredient choices and product safety certifications.

- Competitive Landscape: Characterized by a mix of established brands and emerging niche players.

- End-User Demographics: Expanding beyond professional users to include civilian shooters and hobbyists.

- M&A Trends: Increasing as companies seek strategic growth and technological integration.

CLP Firearm Lubricant Growth Trends & Insights

The global CLP Firearm Lubricant market is projected for robust growth, with an estimated market size of $XXX million in the base year 2025, expected to expand at a Compound Annual Growth Rate (CAGR) of XX% over the forecast period of 2025–2033. This growth trajectory is underpinned by several key trends. A significant driver is the increasing adoption rates across various applications, particularly within the Law Enforcement and Military sectors, where reliable firearm maintenance is paramount for operational readiness. The Shooting Sports segment also contributes substantially, fueled by a growing global interest in recreational shooting and competitive events. Furthermore, technological disruptions are playing a crucial role. Innovations in synthetic lubricants and biodegradable formulations are not only enhancing product performance, offering superior protection against corrosion and wear, but also addressing growing environmental concerns. Consumer behavior shifts are also evident, with a heightened awareness among users regarding the importance of specialized firearm lubricants for extending weapon lifespan and ensuring optimal functionality. This translates to a greater willingness to invest in premium CLP products. The market penetration of advanced CLP formulations is expected to deepen as awareness of their multi-functional benefits—cleaning, lubricating, and protecting in a single application—becomes more widespread. Historically, the market has seen steady growth from 2019–2024, with the estimated market size reaching $XXX million by the end of 2024. The base year of 2025 marks a pivotal point for accelerated expansion. The continuous need for effective firearm maintenance solutions, coupled with advancements in chemical engineering, will solidify the market's upward trend.

Dominant Regions, Countries, or Segments in CLP Firearm Lubricant

The Military application segment is poised to be a dominant force in the global CLP Firearm Lubricant market, driving significant growth throughout the forecast period (2025–2033). This dominance stems from a confluence of factors, including substantial defense budgets, ongoing geopolitical tensions, and the critical need for maintaining operational readiness of military arsenals worldwide. Governments are increasingly investing in advanced firearm maintenance solutions to ensure the reliability and longevity of their equipment in diverse and challenging environments. The Law Enforcement sector also represents a substantial and consistently growing market, driven by rising crime rates and the continuous need for effective law enforcement tools. Security personnel worldwide rely heavily on CLP lubricants for their sidearms, rifles, and other firearms.

The Shooting Sports segment, while perhaps smaller in individual transaction value compared to military procurements, exhibits rapid growth. This is fueled by an increasing global participation in recreational shooting, competitive marksmanship, and the expanding civilian ownership of firearms for sport and self-defense. Economic policies supporting the firearms industry, coupled with robust infrastructure for shooting ranges and competitions, further bolster this segment's expansion.

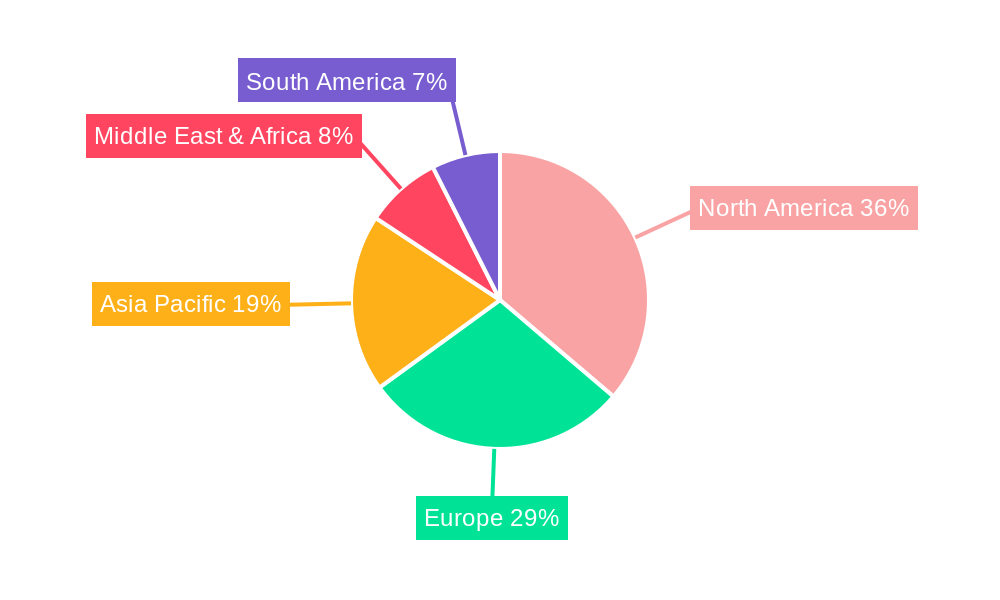

Geographically, North America, particularly the United States, is expected to remain a leading region. This is attributable to its large civilian gun ownership base, strong shooting sports culture, and significant defense spending. European countries with a strong tradition of hunting and sport shooting, along with those with active military and law enforcement forces, also represent crucial markets. Emerging economies in Asia-Pacific and Latin America are anticipated to show accelerated growth due to increasing firearm adoption and a growing awareness of proper maintenance practices.

The CLP Aerosol Spray type is projected to dominate the product landscape, owing to its convenience, ease of application, and widespread availability. Its suitability for quick field maintenance and its appeal to both professional and civilian users contribute to its leading position.

- Dominant Application: Military, followed closely by Law Enforcement and Shooting Sports.

- Key Regional Markets: North America (especially USA), Europe, and growing influence from Asia-Pacific and Latin America.

- Dominant Product Type: CLP Aerosol Spray due to ease of use and accessibility.

- Growth Drivers: Defense spending, law enforcement needs, growing shooting sports participation, and civilian firearm ownership.

- Economic Policies: Favorable regulations and government support for the firearms and defense industries.

- Infrastructure: Availability of shooting ranges, training facilities, and defense procurement channels.

CLP Firearm Lubricant Product Landscape

The CLP Firearm Lubricant product landscape is defined by an ongoing surge in innovation, focusing on enhanced performance and user convenience. Manufacturers are actively developing formulations that offer superior corrosion resistance, reduced friction, and extended lubrication intervals, even in extreme temperature and environmental conditions. Unique selling propositions often revolve around biodegradable or eco-friendly ingredients, catering to a growing segment of environmentally conscious consumers and military mandates. Technological advancements include the incorporation of nano-lubricants and advanced synthetic esters, promising to extend firearm lifespan and improve operational reliability. Applications are diverse, ranging from routine cleaning and lubrication for daily carry firearms to specialized maintenance for high-performance precision rifles and heavy-duty military equipment. Performance metrics such as wear reduction, heat dissipation, and resistance to fouling are key differentiators.

Key Drivers, Barriers & Challenges in CLP Firearm Lubricant

Key Drivers:

- Increased Firearm Ownership: Growing civilian ownership for self-defense and sport shooting worldwide fuels demand.

- Military and Law Enforcement Modernization: Continuous upgrades and maintenance of extensive firearm inventories necessitate high-quality CLP lubricants.

- Technological Advancements: Development of advanced, eco-friendly, and high-performance formulations.

- Growing Awareness of Firearm Maintenance: Users recognize the importance of proper lubrication for weapon longevity and reliability.

- Geopolitical Instability: Increased defense spending and security concerns globally.

Key Barriers & Challenges:

- Regulatory Hurdles: Stringent environmental regulations and product safety standards can increase R&D costs and time-to-market.

- Price Sensitivity: While performance is key, cost remains a consideration, particularly in civilian markets, leading to competition from lower-priced alternatives.

- Supply Chain Disruptions: Global supply chain volatility can impact raw material availability and production costs, estimated to affect XX% of manufacturers during the historical period.

- Competition from Substitutes: Traditional gun oils and separate cleaning agents offer alternatives, requiring CLP manufacturers to emphasize their multi-functional advantages.

- Counterfeit Products: The proliferation of counterfeit lubricants can damage brand reputation and user trust.

Emerging Opportunities in CLP Firearm Lubricant

Emerging opportunities in the CLP Firearm Lubricant industry lie in the development of advanced, sustainable formulations that meet increasingly stringent environmental regulations and cater to consumer demand for eco-friendly products. The expansion of CLP lubricants into specialized niche markets, such as antique firearm restoration and the maintenance of advanced sporting optics, presents untapped potential. Furthermore, the growing adoption of smart firearms and their integration with digital maintenance logs could open avenues for lubricants with intelligent properties or specific compatibility requirements. The increasing trend towards online retail and direct-to-consumer sales channels also offers opportunities for direct engagement with customers and personalized product offerings.

Growth Accelerators in the CLP Firearm Lubricant Industry

Key growth accelerators for the CLP Firearm Lubricant industry include significant advancements in material science leading to the development of next-generation synthetic lubricants with unparalleled performance characteristics. Strategic partnerships between lubricant manufacturers and firearm OEMs (Original Equipment Manufacturers) are crucial for co-developing specialized products and gaining market access. Furthermore, aggressive market expansion strategies targeting emerging economies, where firearm ownership is on the rise and awareness of proper maintenance is growing, will act as major catalysts for long-term growth. Educational initiatives highlighting the benefits of using specialized CLP lubricants over general-purpose alternatives will also contribute to market penetration.

Key Players Shaping the CLP Firearm Lubricant Market

- Remington

- WD-40

- Liberty Lubricants

- Safariland Group

- Pantheon Enterprises

- Muscle Products

- Lucas Oil

- FrogLube

- Otis Technology

- MPT Industries

- Mil-Comm

- Ballistol

- SPS Marketing

- G96 Products

- Breakthrough Clean

- Sage & Braker

- Hot Shot

- Radcolube

- Corrosion Technologies

- Renewable Lubricants

Notable Milestones in CLP Firearm Lubricant Sector

- 2019: Introduction of advanced bio-based CLP formulations by several niche manufacturers, responding to environmental concerns.

- 2020: Increased military procurement contracts for advanced CLP lubricants for deployed forces, driven by operational requirements.

- 2021: Significant M&A activity, with larger chemical companies acquiring specialized lubricant producers to expand their portfolios.

- 2022: Launch of new aerosol spray formulations with improved nozzle designs for precise application and reduced waste.

- 2023: Growing emphasis on nano-technology in CLP formulations, promising enhanced wear protection and extreme temperature performance.

- 2024 (Estimated): Launch of integrated cleaning and lubrication kits by major firearm accessory brands.

In-Depth CLP Firearm Lubricant Market Outlook

The CLP Firearm Lubricant market outlook is exceptionally positive, driven by persistent demand from defense, law enforcement, and the rapidly expanding shooting sports sectors. Growth accelerators such as breakthroughs in sustainable lubricant technology and strategic collaborations with firearm manufacturers will continue to propel the industry forward. The focus on enhanced performance, user safety, and environmental responsibility will shape future product development, creating lucrative opportunities for companies that can innovate and adapt. Market expansion into underserved regions and the development of specialized product lines for emerging firearm technologies will further solidify the sector's upward trajectory.

CLP Firearm Lubricant Segmentation

-

1. Application

- 1.1. Law Enforcement

- 1.2. Military

- 1.3. Security Personnel

- 1.4. Shooting Sports

- 1.5. Others

-

2. Types

- 2.1. CLP Oil

- 2.2. CLP Grease

- 2.3. CLP Aerosol Spray

- 2.4. Others

CLP Firearm Lubricant Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

CLP Firearm Lubricant REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Law Enforcement

- 5.1.2. Military

- 5.1.3. Security Personnel

- 5.1.4. Shooting Sports

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. CLP Oil

- 5.2.2. CLP Grease

- 5.2.3. CLP Aerosol Spray

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Law Enforcement

- 6.1.2. Military

- 6.1.3. Security Personnel

- 6.1.4. Shooting Sports

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. CLP Oil

- 6.2.2. CLP Grease

- 6.2.3. CLP Aerosol Spray

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Law Enforcement

- 7.1.2. Military

- 7.1.3. Security Personnel

- 7.1.4. Shooting Sports

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. CLP Oil

- 7.2.2. CLP Grease

- 7.2.3. CLP Aerosol Spray

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Law Enforcement

- 8.1.2. Military

- 8.1.3. Security Personnel

- 8.1.4. Shooting Sports

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. CLP Oil

- 8.2.2. CLP Grease

- 8.2.3. CLP Aerosol Spray

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Law Enforcement

- 9.1.2. Military

- 9.1.3. Security Personnel

- 9.1.4. Shooting Sports

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. CLP Oil

- 9.2.2. CLP Grease

- 9.2.3. CLP Aerosol Spray

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific CLP Firearm Lubricant Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Law Enforcement

- 10.1.2. Military

- 10.1.3. Security Personnel

- 10.1.4. Shooting Sports

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. CLP Oil

- 10.2.2. CLP Grease

- 10.2.3. CLP Aerosol Spray

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Remington

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WD-40

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liberty Lubricants

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Safariland Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pantheon Enterprises

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Muscle Products

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lucas Oil

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FrogLube

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Otis Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MPT Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mil-Comm

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ballistol

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SPS Marketing

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 G96 Products

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Breakthrough Clean

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sage & Braker

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hot Shot

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Radcolube

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Corrosion Technologies

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Renewable Lubricants

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Remington

List of Figures

- Figure 1: Global CLP Firearm Lubricant Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global CLP Firearm Lubricant Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America CLP Firearm Lubricant Revenue (million), by Application 2024 & 2032

- Figure 4: North America CLP Firearm Lubricant Volume (K), by Application 2024 & 2032

- Figure 5: North America CLP Firearm Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America CLP Firearm Lubricant Volume Share (%), by Application 2024 & 2032

- Figure 7: North America CLP Firearm Lubricant Revenue (million), by Types 2024 & 2032

- Figure 8: North America CLP Firearm Lubricant Volume (K), by Types 2024 & 2032

- Figure 9: North America CLP Firearm Lubricant Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America CLP Firearm Lubricant Volume Share (%), by Types 2024 & 2032

- Figure 11: North America CLP Firearm Lubricant Revenue (million), by Country 2024 & 2032

- Figure 12: North America CLP Firearm Lubricant Volume (K), by Country 2024 & 2032

- Figure 13: North America CLP Firearm Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America CLP Firearm Lubricant Volume Share (%), by Country 2024 & 2032

- Figure 15: South America CLP Firearm Lubricant Revenue (million), by Application 2024 & 2032

- Figure 16: South America CLP Firearm Lubricant Volume (K), by Application 2024 & 2032

- Figure 17: South America CLP Firearm Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America CLP Firearm Lubricant Volume Share (%), by Application 2024 & 2032

- Figure 19: South America CLP Firearm Lubricant Revenue (million), by Types 2024 & 2032

- Figure 20: South America CLP Firearm Lubricant Volume (K), by Types 2024 & 2032

- Figure 21: South America CLP Firearm Lubricant Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America CLP Firearm Lubricant Volume Share (%), by Types 2024 & 2032

- Figure 23: South America CLP Firearm Lubricant Revenue (million), by Country 2024 & 2032

- Figure 24: South America CLP Firearm Lubricant Volume (K), by Country 2024 & 2032

- Figure 25: South America CLP Firearm Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America CLP Firearm Lubricant Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe CLP Firearm Lubricant Revenue (million), by Application 2024 & 2032

- Figure 28: Europe CLP Firearm Lubricant Volume (K), by Application 2024 & 2032

- Figure 29: Europe CLP Firearm Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe CLP Firearm Lubricant Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe CLP Firearm Lubricant Revenue (million), by Types 2024 & 2032

- Figure 32: Europe CLP Firearm Lubricant Volume (K), by Types 2024 & 2032

- Figure 33: Europe CLP Firearm Lubricant Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe CLP Firearm Lubricant Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe CLP Firearm Lubricant Revenue (million), by Country 2024 & 2032

- Figure 36: Europe CLP Firearm Lubricant Volume (K), by Country 2024 & 2032

- Figure 37: Europe CLP Firearm Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe CLP Firearm Lubricant Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa CLP Firearm Lubricant Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa CLP Firearm Lubricant Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa CLP Firearm Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa CLP Firearm Lubricant Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa CLP Firearm Lubricant Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa CLP Firearm Lubricant Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa CLP Firearm Lubricant Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa CLP Firearm Lubricant Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa CLP Firearm Lubricant Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa CLP Firearm Lubricant Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa CLP Firearm Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa CLP Firearm Lubricant Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific CLP Firearm Lubricant Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific CLP Firearm Lubricant Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific CLP Firearm Lubricant Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific CLP Firearm Lubricant Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific CLP Firearm Lubricant Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific CLP Firearm Lubricant Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific CLP Firearm Lubricant Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific CLP Firearm Lubricant Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific CLP Firearm Lubricant Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific CLP Firearm Lubricant Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific CLP Firearm Lubricant Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific CLP Firearm Lubricant Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CLP Firearm Lubricant Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global CLP Firearm Lubricant Volume K Forecast, by Region 2019 & 2032

- Table 3: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 5: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 7: Global CLP Firearm Lubricant Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global CLP Firearm Lubricant Volume K Forecast, by Region 2019 & 2032

- Table 9: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 11: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 13: Global CLP Firearm Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global CLP Firearm Lubricant Volume K Forecast, by Country 2019 & 2032

- Table 15: United States CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 23: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 25: Global CLP Firearm Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global CLP Firearm Lubricant Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 35: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 37: Global CLP Firearm Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global CLP Firearm Lubricant Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 59: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 61: Global CLP Firearm Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global CLP Firearm Lubricant Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global CLP Firearm Lubricant Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global CLP Firearm Lubricant Volume K Forecast, by Application 2019 & 2032

- Table 77: Global CLP Firearm Lubricant Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global CLP Firearm Lubricant Volume K Forecast, by Types 2019 & 2032

- Table 79: Global CLP Firearm Lubricant Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global CLP Firearm Lubricant Volume K Forecast, by Country 2019 & 2032

- Table 81: China CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific CLP Firearm Lubricant Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific CLP Firearm Lubricant Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CLP Firearm Lubricant?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the CLP Firearm Lubricant?

Key companies in the market include Remington, WD-40, Liberty Lubricants, Safariland Group, Pantheon Enterprises, Muscle Products, Lucas Oil, FrogLube, Otis Technology, MPT Industries, Mil-Comm, Ballistol, SPS Marketing, G96 Products, Breakthrough Clean, Sage & Braker, Hot Shot, Radcolube, Corrosion Technologies, Renewable Lubricants.

3. What are the main segments of the CLP Firearm Lubricant?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 404 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CLP Firearm Lubricant," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CLP Firearm Lubricant report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CLP Firearm Lubricant?

To stay informed about further developments, trends, and reports in the CLP Firearm Lubricant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence