Key Insights

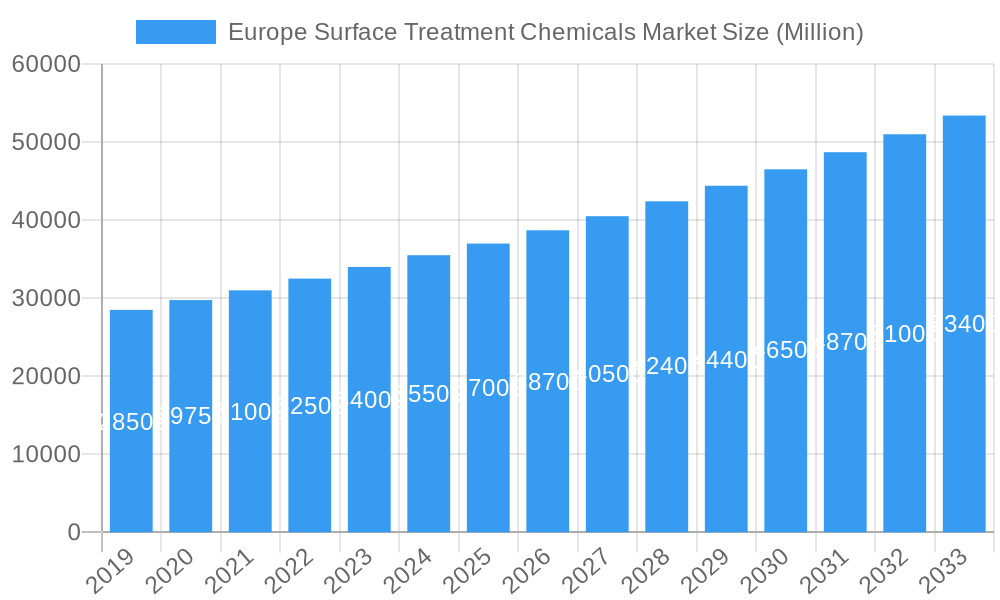

The Europe Surface Treatment Chemicals Market is projected to experience substantial growth, reaching a market size of 111.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7% through 2033. Key drivers include escalating demand from the automotive, construction, and electronics sectors, which depend on advanced treatments for durability, aesthetics, and performance. The automotive industry's focus on increased production, lightweighting, and corrosion resistance is a significant contributor. The burgeoning construction sector, driven by infrastructure development and urbanization, also fuels demand for protective surface treatments. Furthermore, the electronics industry's continuous innovation and miniaturization necessitate specialized treatments for component protection and conductivity.

Europe Surface Treatment Chemicals Market Market Size (In Billion)

Key market trends include the rising adoption of eco-friendly and sustainable solutions, spurred by stringent environmental regulations and consumer awareness. This encompasses a shift towards water-based formulations, low-VOC products, and chrome-free coatings. Technological advancements in application methods, such as electroplating and powder coating, are improving efficiency and stimulating demand. The increasing need for high-performance coatings offering anti-corrosion, wear resistance, and aesthetic appeal across various applications is another major growth catalyst. Market restraints involve fluctuating raw material prices and the substantial capital investment required for advanced treatment technologies. However, strategic initiatives focused on product innovation, geographical expansion, and collaborations are expected to overcome these challenges and ensure sustained market expansion.

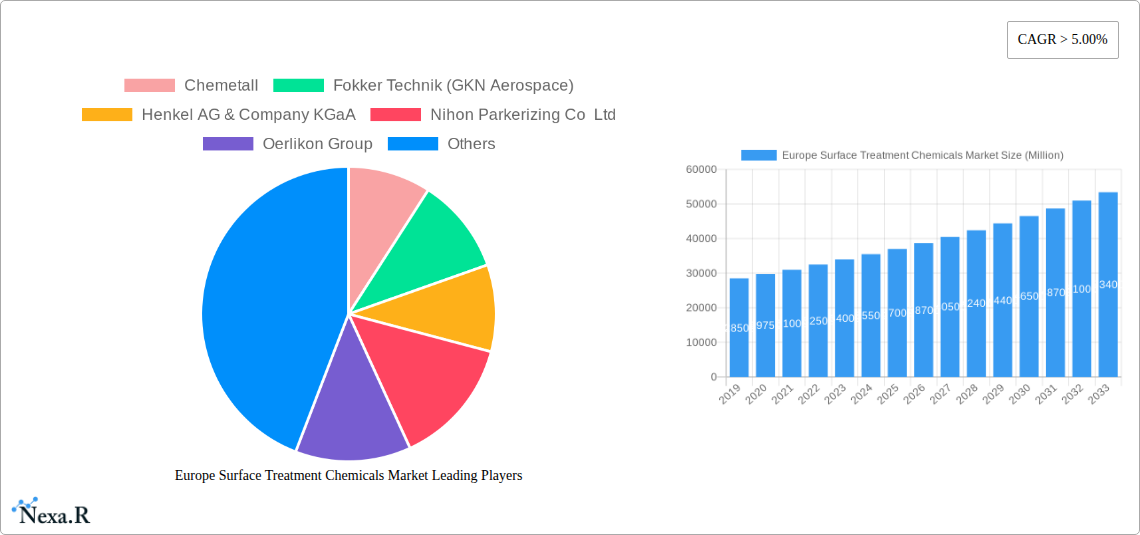

Europe Surface Treatment Chemicals Market Company Market Share

Europe Surface Treatment Chemicals Market: Comprehensive Analysis & Forecast (2019-2033)

Unlock critical insights into the dynamic Europe Surface Treatment Chemicals Market. This in-depth report analyzes market size, growth trends, competitive landscape, and future opportunities from 2019–2033, with a deep dive into the Base Year: 2025 and a robust Forecast Period: 2025–2033. Explore the intricate interplay of parent market drivers and child market segments, including Plating Chemicals, Cleaners, Conversion Coatings, Other Chemical Types, and the impact across Metals, Plastics, Other Base Materials. Discover how Automotive & Transportation, Construction, Electronics, Industrial Machinery, Other End-user Industries are shaping demand for essential surface treatment solutions. This report is your definitive guide to understanding market concentration, technological innovation, regulatory frameworks, and the strategic moves of key players like Chemetall, Fokker Technik (GKN Aerospace), Henkel AG & Company KGaA, Nihon Parkerizing Co Ltd, Oerlikon Group, Quaker Chemical Corporation, Socomore The Surface Company, Solvay SA. Valued in Million units, this report provides actionable intelligence for stakeholders aiming to capitalize on the burgeoning Europe surface treatment chemicals sector.

Europe Surface Treatment Chemicals Market Market Dynamics & Structure

The Europe Surface Treatment Chemicals Market is characterized by a moderately concentrated structure, with a few major global players holding significant market share. Technological innovation remains a primary driver, with continuous advancements in eco-friendly formulations, high-performance coatings, and automated application processes. Stringent regulatory frameworks, particularly concerning environmental impact and worker safety (e.g., REACH compliance), are shaping product development and adoption rates. Competitive product substitutes, including alternative finishing techniques and materials, pose a constant challenge, pushing manufacturers to enhance the value proposition of their chemical offerings. End-user demographics are shifting towards industries with higher demands for durability, aesthetics, and specialized functionalities, such as advanced automotive coatings and corrosion-resistant electronics. Mergers and acquisitions (M&A) trends are prevalent as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by key players, but with increasing opportunities for specialized niche providers.

- Technological Innovation Drivers: Focus on sustainability, enhanced performance (corrosion resistance, wear resistance), and smart coatings.

- Regulatory Frameworks: Stringent environmental regulations (e.g., VOC reduction, heavy metal restrictions) and safety standards are critical influencing factors.

- Competitive Product Substitutes: Development of advanced material science and alternative finishing processes present ongoing competition.

- End-User Demographics: Growing demand from the automotive, aerospace, construction, and electronics sectors.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings are common.

Europe Surface Treatment Chemicals Market Growth Trends & Insights

The Europe Surface Treatment Chemicals Market has witnessed consistent growth, driven by industrial expansion and increasing demand for enhanced material properties. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a valuation of xx Million units by 2033. Adoption rates for advanced surface treatment solutions are on the rise, particularly in sectors prioritizing durability, aesthetics, and specialized functionalities. Technological disruptions, such as the development of nanotechnology-based coatings and smart surface treatments that offer self-healing or anti-microbial properties, are significantly impacting market evolution. Consumer behavior shifts, influenced by a growing emphasis on product lifespan, environmental sustainability, and premium finishes, are also playing a crucial role. The increasing awareness of the critical role surface treatment plays in protecting assets, extending product life, and improving performance across diverse applications, from automotive components to construction materials and electronic devices, underpins this sustained growth trajectory. The ongoing shift towards more sustainable and environmentally friendly chemical formulations is also a significant trend, pushing innovation and influencing purchasing decisions across all end-user industries.

Dominant Regions, Countries, or Segments in Europe Surface Treatment Chemicals Market

The Automotive & Transportation industry stands out as a dominant end-user segment within the Europe Surface Treatment Chemicals Market, primarily driven by the region's robust automotive manufacturing base and stringent quality standards. The demand for advanced surface treatments in this sector is fueled by the need for enhanced corrosion resistance, improved paint adhesion, and aesthetic appeal in vehicles. Germany, with its strong automotive industry, is a leading country driving demand for plating chemicals and conversion coatings. The Metals base material segment is also a significant contributor, given the widespread use of metallic components across various industries.

- Automotive & Transportation:

- Key drivers include stringent OEM specifications for durability and aesthetics.

- High demand for pre-treatment chemicals, electroplating solutions, and paint pre-treatment coatings.

- Growing adoption of electric vehicles (EVs) is spurring new surface treatment requirements for battery components and lightweight materials.

- Metals:

- Largest base material segment due to extensive use of steel, aluminum, and other alloys.

- Continuous demand for corrosion protection and wear resistance.

- Applications range from structural components to intricate machinery parts.

- Plating Chemicals:

- A major chemical type, essential for providing protective and decorative finishes.

- Growth driven by automotive, aerospace, and electronics sectors.

- Innovation focuses on chrome-free alternatives and high-performance alloys.

- Germany:

- Leading market due to its strong automotive and industrial machinery manufacturing base.

- High investment in R&D for advanced surface treatment solutions.

- Strict environmental regulations promote the adoption of eco-friendly chemicals.

Europe Surface Treatment Chemicals Market Product Landscape

The Europe Surface Treatment Chemicals Market product landscape is characterized by a constant stream of innovations aimed at enhancing performance, sustainability, and cost-effectiveness. Key advancements include the development of low-VOC (Volatile Organic Compound) cleaners, eco-friendly conversion coatings free from hexavalent chromium, and highly durable plating chemicals offering superior corrosion resistance. Nanotechnology is also playing an increasingly important role, enabling the creation of ultra-thin, yet highly protective, coatings with unique properties like self-cleaning or enhanced hardness. These innovations cater to the evolving needs of industries such as automotive, aerospace, and electronics, where stringent performance metrics and environmental compliance are paramount.

Key Drivers, Barriers & Challenges in Europe Surface Treatment Chemicals Market

Key Drivers:

- Increasing demand for enhanced product lifespan and durability: Driven by industries like automotive, aerospace, and construction seeking to reduce maintenance costs and improve reliability.

- Stringent environmental regulations: Pushing manufacturers towards greener, safer, and more sustainable surface treatment chemicals and processes.

- Technological advancements in coatings: Development of high-performance, specialized coatings offering superior protection and aesthetic appeal.

- Growth in key end-user industries: Expansion of manufacturing sectors like automotive, electronics, and industrial machinery.

Barriers & Challenges:

- High cost of R&D and compliance: Developing and obtaining regulatory approval for new, environmentally compliant chemicals can be expensive.

- Supply chain disruptions: Volatility in raw material prices and availability can impact production costs and lead times.

- Competition from alternative finishing technologies: Non-chemical finishing methods and advancements in material science can pose competitive threats.

- Skilled labor shortage: A lack of trained professionals for the application and management of complex surface treatment processes.

Emerging Opportunities in Europe Surface Treatment Chemicals Market

Emerging opportunities within the Europe Surface Treatment Chemicals Market are largely centered around sustainable chemistry and specialized applications. The transition towards electric vehicles (EVs) presents a significant avenue, with new requirements for battery component protection and lightweight material treatments. The growing focus on circular economy principles is also driving demand for recyclable and biodegradable surface treatment solutions. Furthermore, the aerospace sector's continued emphasis on weight reduction and corrosion prevention, alongside the electronics industry's need for advanced passivation and protective coatings, offers substantial growth potential for innovative chemical formulations. The development of smart coatings with integrated functionalities, such as self-healing or antimicrobial properties, represents a nascent but promising area for future expansion.

Growth Accelerators in the Europe Surface Treatment Chemicals Market Industry

Long-term growth in the Europe Surface Treatment Chemicals Market will be significantly accelerated by ongoing technological breakthroughs in material science and chemical engineering. The relentless pursuit of eco-friendly alternatives to hazardous chemicals, such as hexavalent chromium and certain solvents, is a primary catalyst, driving innovation and market adoption of compliant products. Strategic partnerships between chemical manufacturers and end-user industries will foster tailored solutions and expedite the integration of new technologies. Furthermore, market expansion strategies targeting emerging economies within Europe and a focus on providing comprehensive surface treatment solutions, rather than just individual chemicals, will play a crucial role in driving sustained growth and market penetration.

Key Players Shaping the Europe Surface Treatment Chemicals Market Market

- Chemetall

- Fokker Technik (GKN Aerospace)

- Henkel AG & Company KGaA

- Nihon Parkerizing Co Ltd

- Oerlikon Group

- Quaker Chemical Corporation

- Socomore The Surface Company

- Solvay SA

Notable Milestones in Europe Surface Treatment Chemicals Market Sector

- October 2022: Surface treatment specialists Okuno Chemical Industries Co. Ltd. and SurTec made an announcement to expand their surface finishers business in Europe. This acquisition will help both companies to benefit from development and product expansion.

In-Depth Europe Surface Treatment Chemicals Market Market Outlook

The future outlook for the Europe Surface Treatment Chemicals Market is exceptionally promising, driven by a confluence of factors. Accelerating innovation in sustainable chemistry, particularly the development of chrome-free and VOC-compliant solutions, will continue to propel market growth. The increasing demand for high-performance coatings in the automotive and aerospace sectors, coupled with the burgeoning electronics industry's need for specialized treatments, presents significant strategic opportunities. Furthermore, a growing emphasis on product longevity and asset protection across industrial applications will solidify the market's importance. Companies that invest in R&D, embrace regulatory compliance, and forge strong collaborations with end-users are best positioned to capitalize on the expanding market potential and achieve sustained success.

Europe Surface Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Plating Chemicals

- 1.2. Cleaners

- 1.3. Conversion Coatings

- 1.4. Other Chemical Types

-

2. Base Material

- 2.1. Metals

- 2.2. Plastics

- 2.3. Other Base Materials

-

3. End-user Industry

- 3.1. Automotive & Transportation

- 3.2. Construction

- 3.3. Electronics

- 3.4. Industrial Machinery

- 3.5. Other End-user Industries

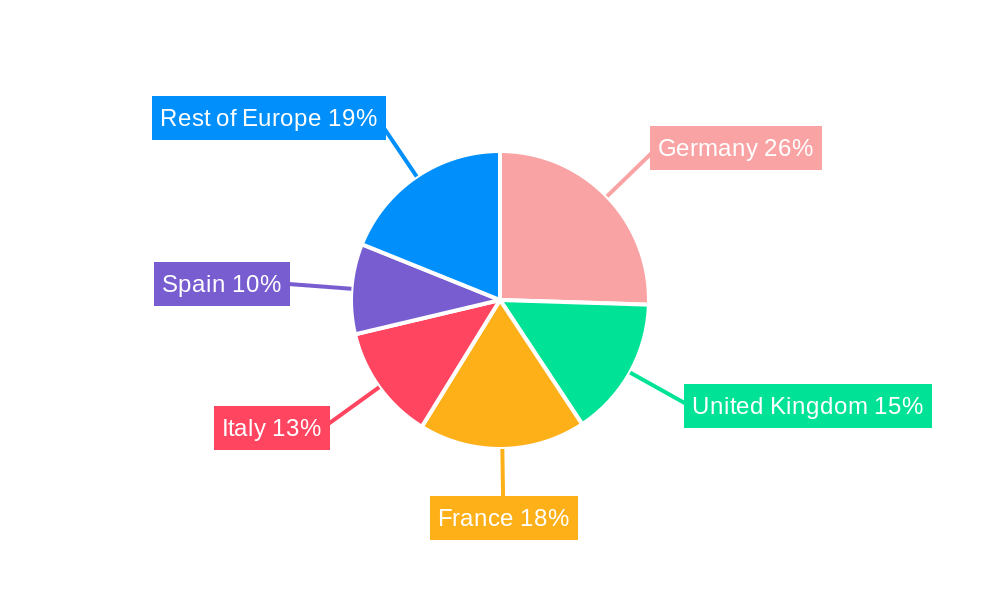

Europe Surface Treatment Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Surface Treatment Chemicals Market Regional Market Share

Geographic Coverage of Europe Surface Treatment Chemicals Market

Europe Surface Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers

- 3.4. Market Trends

- 3.4.1. Strong Demand from the Automotive and Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Plating Chemicals

- 5.1.2. Cleaners

- 5.1.3. Conversion Coatings

- 5.1.4. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Base Material

- 5.2.1. Metals

- 5.2.2. Plastics

- 5.2.3. Other Base Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive & Transportation

- 5.3.2. Construction

- 5.3.3. Electronics

- 5.3.4. Industrial Machinery

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Germany Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Plating Chemicals

- 6.1.2. Cleaners

- 6.1.3. Conversion Coatings

- 6.1.4. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Base Material

- 6.2.1. Metals

- 6.2.2. Plastics

- 6.2.3. Other Base Materials

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive & Transportation

- 6.3.2. Construction

- 6.3.3. Electronics

- 6.3.4. Industrial Machinery

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. United Kingdom Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Plating Chemicals

- 7.1.2. Cleaners

- 7.1.3. Conversion Coatings

- 7.1.4. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Base Material

- 7.2.1. Metals

- 7.2.2. Plastics

- 7.2.3. Other Base Materials

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive & Transportation

- 7.3.2. Construction

- 7.3.3. Electronics

- 7.3.4. Industrial Machinery

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. France Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Plating Chemicals

- 8.1.2. Cleaners

- 8.1.3. Conversion Coatings

- 8.1.4. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Base Material

- 8.2.1. Metals

- 8.2.2. Plastics

- 8.2.3. Other Base Materials

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive & Transportation

- 8.3.2. Construction

- 8.3.3. Electronics

- 8.3.4. Industrial Machinery

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Italy Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Plating Chemicals

- 9.1.2. Cleaners

- 9.1.3. Conversion Coatings

- 9.1.4. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Base Material

- 9.2.1. Metals

- 9.2.2. Plastics

- 9.2.3. Other Base Materials

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive & Transportation

- 9.3.2. Construction

- 9.3.3. Electronics

- 9.3.4. Industrial Machinery

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Spain Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Plating Chemicals

- 10.1.2. Cleaners

- 10.1.3. Conversion Coatings

- 10.1.4. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Base Material

- 10.2.1. Metals

- 10.2.2. Plastics

- 10.2.3. Other Base Materials

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive & Transportation

- 10.3.2. Construction

- 10.3.3. Electronics

- 10.3.4. Industrial Machinery

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Rest of Europe Europe Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Plating Chemicals

- 11.1.2. Cleaners

- 11.1.3. Conversion Coatings

- 11.1.4. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by Base Material

- 11.2.1. Metals

- 11.2.2. Plastics

- 11.2.3. Other Base Materials

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Automotive & Transportation

- 11.3.2. Construction

- 11.3.3. Electronics

- 11.3.4. Industrial Machinery

- 11.3.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Chemetall

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fokker Technik (GKN Aerospace)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Henkel AG & Company KGaA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nihon Parkerizing Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Oerlikon Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Quaker Chemical Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Socomore The Surface Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Solvay SA*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Chemetall

List of Figures

- Figure 1: Global Europe Surface Treatment Chemicals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 3: Germany Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: Germany Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 5: Germany Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 6: Germany Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Germany Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Germany Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Germany Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Kingdom Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 11: United Kingdom Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: United Kingdom Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 13: United Kingdom Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 14: United Kingdom Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: United Kingdom Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: United Kingdom Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 17: United Kingdom Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: France Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 19: France Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: France Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 21: France Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 22: France Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: France Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: France Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: France Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Italy Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 27: Italy Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: Italy Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 29: Italy Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 30: Italy Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Italy Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Italy Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Italy Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Spain Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 35: Spain Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: Spain Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 37: Spain Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 38: Spain Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Spain Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Spain Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Spain Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Europe Europe Surface Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 43: Rest of Europe Europe Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 44: Rest of Europe Europe Surface Treatment Chemicals Market Revenue (billion), by Base Material 2025 & 2033

- Figure 45: Rest of Europe Europe Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 46: Rest of Europe Europe Surface Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 47: Rest of Europe Europe Surface Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Rest of Europe Europe Surface Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Europe Europe Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 3: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 7: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 10: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 11: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 15: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 18: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 19: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 23: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 26: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Base Material 2020 & 2033

- Table 27: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Europe Surface Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Surface Treatment Chemicals Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Europe Surface Treatment Chemicals Market?

Key companies in the market include Chemetall, Fokker Technik (GKN Aerospace), Henkel AG & Company KGaA, Nihon Parkerizing Co Ltd, Oerlikon Group, Quaker Chemical Corporation, Socomore The Surface Company, Solvay SA*List Not Exhaustive.

3. What are the main segments of the Europe Surface Treatment Chemicals Market?

The market segments include Chemical Type, Base Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers.

6. What are the notable trends driving market growth?

Strong Demand from the Automotive and Transportation Industry.

7. Are there any restraints impacting market growth?

Growing Personal Care Industry in the Asia-Pacific Region; Other Drivers.

8. Can you provide examples of recent developments in the market?

October 2022: Surface treatment specialists Okuno Chemical Industries Co. Ltd. and SurTec made an announcement to expand their surface finishers business in Europe. This acquisition will help both companies to benefit from development and product expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Surface Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Surface Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Surface Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Surface Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence