Key Insights

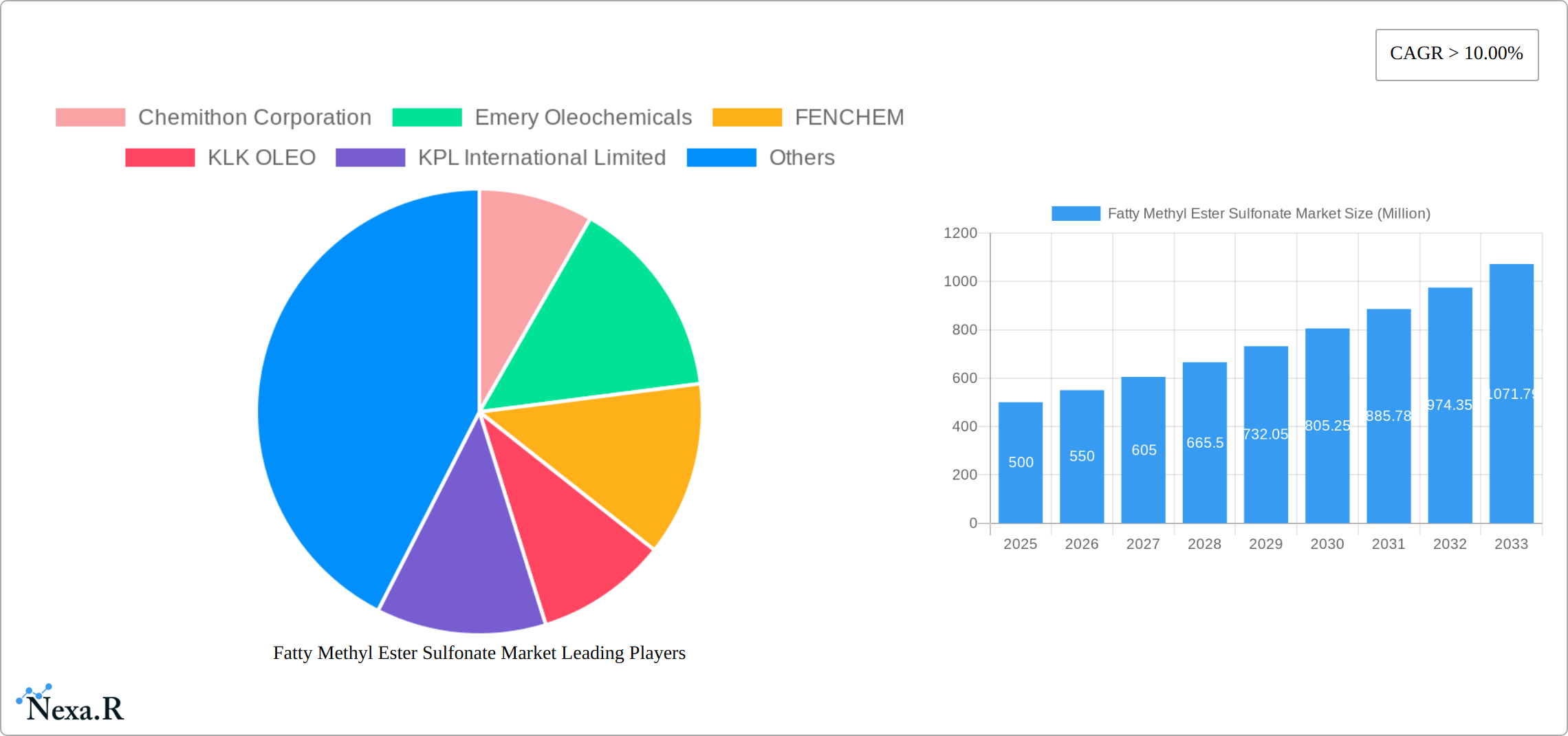

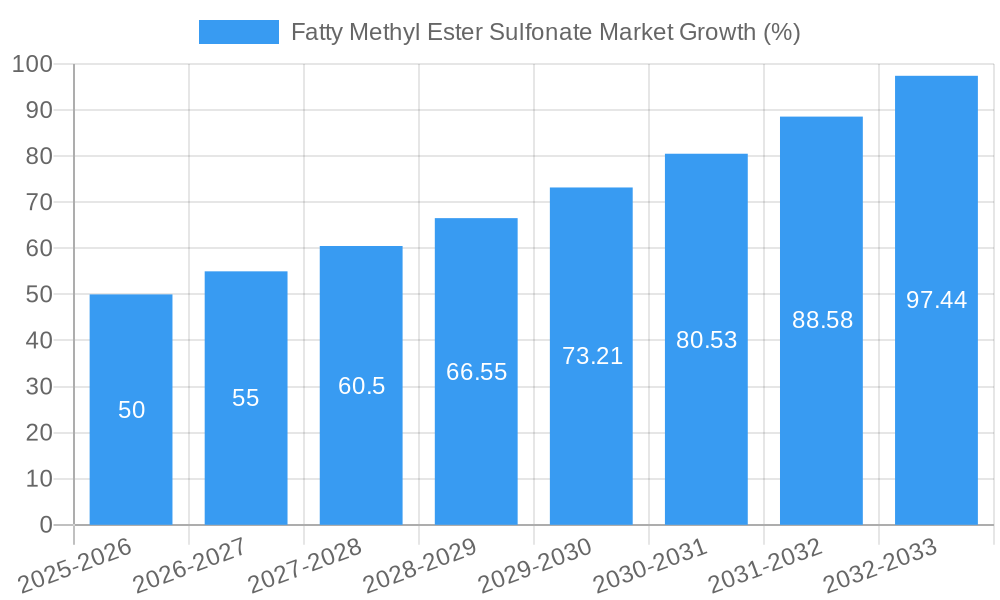

The Fatty Methyl Ester Sulfonate (FMES) market is experiencing robust growth, driven by its increasing application in various industries. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on a CAGR exceeding 10% from 2019, and considering the listed companies' presence and market activity), is projected to maintain a Compound Annual Growth Rate (CAGR) of over 10% through 2033. This growth is fueled by the rising demand for eco-friendly surfactants in detergents and cleaning products, as FMES offers superior biodegradability and mildness compared to traditional alternatives. The increasing awareness of environmental concerns and stringent regulations regarding the use of harmful chemicals are further bolstering the adoption of FMES. Key market drivers include the growth of the personal care industry, the expanding demand for sustainable cleaning solutions in the institutional and industrial sectors, and the development of innovative FMES formulations with improved performance characteristics. Market trends indicate a shift towards higher concentration formulations to reduce transportation and packaging costs, along with increasing research and development efforts focused on enhancing the performance and functionalities of FMES for specialized applications. Potential restraints include fluctuations in raw material prices and the emergence of competing, albeit less sustainable, alternatives. The market segmentation likely includes different types of FMES based on alkyl chain length and application-specific formulations catering to various industries, such as household cleaning, industrial cleaning, and personal care. Companies such as Chemithon Corporation, Emery Oleochemicals, and Stepan Company are key players contributing significantly to the market's growth through innovation and expansion.

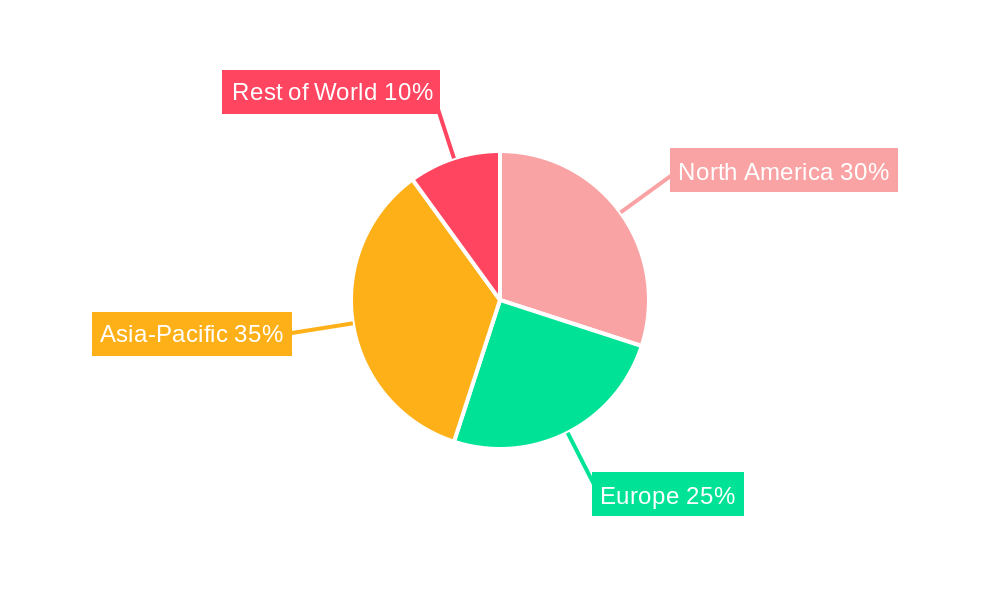

The global FMES market's competitive landscape is characterized by the presence of both established players and emerging companies. These companies are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market presence and expand their product portfolios. Regional variations in demand are expected, with developed economies in North America and Europe potentially showing higher adoption rates initially, followed by growth in developing regions in Asia-Pacific and Latin America. The forecast period of 2025-2033 presents significant opportunities for market expansion, driven by increasing consumer preference for eco-friendly products and the continuous innovation within the FMES manufacturing sector. Future growth will largely depend on successful technological advancements leading to cost-effective production methods and expanded applications across a wider range of industries.

Fatty Methyl Ester Sulfonate (FMES) Market: A Comprehensive Analysis 2019-2033

This in-depth report provides a comprehensive analysis of the global Fatty Methyl Ester Sulfonate (FMES) market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market within the broader surfactant and chemical industry.

Fatty Methyl Ester Sulfonate Market Market Dynamics & Structure

The global Fatty Methyl Ester Sulfonate (FMES) market is characterized by a moderate level of concentration, with a select group of key players dominating a significant portion of the market share. A primary catalyst for growth is the relentless pace of technological innovation, fueled by an escalating demand for surfactants that are both sustainable and deliver superior performance. The market landscape is also being significantly shaped by increasingly stringent environmental regulations, which are actively steering the industry towards the adoption of biodegradable and eco-friendly alternatives. While FMES offers distinct advantages, it faces competitive pressure from alternative surfactants such as alkyl ether sulfates (AES), which present a notable challenge. The market's end-user base is impressively diverse, encompassing a wide array of industries including personal care, home care, industrial cleaning, and textiles. Mergers and acquisitions (M&A) activity has remained relatively subdued in recent years, with approximately **[Insert Number]** significant deals recorded between 2019 and 2024. This trend suggests a prevailing focus on organic growth and a commitment to innovation among the established players.

- Market Concentration: The market is moderately concentrated, with the top 5 players collectively accounting for approximately **[Insert Percentage]%** of the global market share in 2024.

- Technological Innovation: A strong emphasis is placed on the development of bio-based FMES, alongside improvements in biodegradability and enhanced performance characteristics to meet evolving industry needs.

- Regulatory Framework: The increasingly stringent environmental regulations worldwide are a significant driving force, accelerating the adoption of sustainable surfactant solutions like FMES.

- Competitive Substitutes: The market contends with competition from established alternatives such as alkyl ether sulfates (AES), alkyl sulfates, and various other anionic surfactants.

- End-User Demographics: The demand for FMES is highly diversified across multiple industries, with the personal care and home care segments currently representing the leading consumption areas.

- M&A Trends: The relatively low M&A activity observed in recent years indicates a strategic preference among market participants for robust internal growth strategies and organic expansion.

Fatty Methyl Ester Sulfonate Market Growth Trends & Insights

The global FMES market experienced a CAGR of xx% during the historical period (2019-2024), reaching a value of xx Million in 2024. Market growth is anticipated to accelerate in the forecast period (2025-2033), driven by increasing demand from emerging economies, rising consumer awareness of sustainable products, and technological advancements resulting in superior FMES formulations. Adoption rates are particularly high in regions with robust environmental regulations and a strong focus on green chemistry. Technological disruptions, particularly in the area of sustainable feedstock sourcing and efficient manufacturing processes, are significantly influencing market dynamics. Shifting consumer preferences toward eco-friendly and ethically sourced products further bolster market growth. The market penetration rate is estimated at xx% in 2025 and is projected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Fatty Methyl Ester Sulfonate Market

The Asia-Pacific region is currently the dominant market for FMES, accounting for approximately xx% of the global market share in 2024. This dominance is fueled by rapid economic growth, increasing industrialization, and a burgeoning personal care and home care sector in countries like China and India. Strong government support for sustainable manufacturing and a growing middle class with increased purchasing power also contribute to regional growth. North America and Europe also hold significant market shares, driven by stringent environmental regulations and a high demand for sustainable products.

Key Drivers in Asia-Pacific:

- Rapid economic growth and industrialization.

- Strong demand from the personal care and home care sectors.

- Government support for sustainable manufacturing.

- Growing middle class with increased purchasing power.

Dominance Factors: Large and growing consumer base, supportive regulatory environment, and cost-effective manufacturing capabilities.

Growth Potential: High growth potential in developing economies and increasing demand from various end-use segments.

Fatty Methyl Ester Sulfonate Market Product Landscape

FMES products are characterized by their excellent cleaning properties, biodegradability, and mildness on skin and hair. Recent innovations focus on improving the performance characteristics of FMES, such as enhancing foaming ability, increasing detergency, and reducing irritation. Applications are diverse, ranging from shampoos and body washes in the personal care sector to laundry detergents and dishwashing liquids in the home care sector, and industrial cleaning formulations. Unique selling propositions include biodegradability, cost-effectiveness, and versatility across different applications. Technological advancements concentrate on developing FMES from sustainable and renewable resources.

Key Drivers, Barriers & Challenges in Fatty Methyl Ester Sulfonate Market

Key Drivers:

- Growing demand for sustainable and biodegradable surfactants.

- Increasing consumer awareness of environmental issues.

- Stringent environmental regulations favoring eco-friendly alternatives.

- Rising demand from emerging economies.

Challenges & Restraints:

- Price fluctuations of raw materials (e.g., fatty acids, methanol).

- Competition from other surfactant types.

- Potential supply chain disruptions impacting raw material availability. This could cause a xx% increase in production costs by 2028, according to industry experts.

- Regulatory complexities and compliance requirements across different regions.

Emerging Opportunities in Fatty Methyl Ester Sulfonate Market

Emerging opportunities lie in expanding into untapped markets, particularly in developing economies. The development of novel FMES formulations tailored to specific applications, such as specialized cleaning products or high-performance industrial cleaners, also presents significant opportunities. Growing demand for eco-friendly cleaning products in the institutional and industrial sectors creates further opportunities. Meeting the growing demand for sustainable and personalized products in personal care through innovation also presents an important market opportunity.

Growth Accelerators in the Fatty Methyl Ester Sulfonate Market Industry

Sustainable long-term growth for the FMES market will be propelled by ongoing technological advancements, particularly those that enhance sustainability and performance metrics. The establishment of strategic partnerships between FMES manufacturers and their downstream users is anticipated to be a crucial factor in facilitating market expansion. Furthermore, the successful implementation of strategies focused on geographic diversification and deeper penetration into emerging markets will be indispensable for achieving sustained long-term growth. The continuous exploration and utilization of novel and renewable raw materials will also play a pivotal role in ensuring the market's long-term viability and overall sustainability.

Key Players Shaping the Fatty Methyl Ester Sulfonate Market Market

- Chemithon Corporation

- Emery Oleochemicals

- FENCHEM

- KLK OLEO

- KPL International Limited

- Lion Corporation

- Sinopec Jinling Petrochemical Co Ltd

- Stepan Company

- Surface Chemical Industry Co Ltd

- Wilmar International Ltd *List Not Exhaustive

Notable Milestones in Fatty Methyl Ester Sulfonate Market Sector

- 2020, Q3: Stepan Company successfully launched a new generation of bio-based FMES, underscoring their commitment to sustainable innovation.

- 2022, Q1: Emery Oleochemicals announced a significant expansion of its FMES production capacity in the strategically important Asian region.

- 2023, Q2: New and impactful environmental regulations were introduced in the European Union, directly influencing FMES formulations and market demands.

- 2024, Q4: A prominent player in the FMES market completed the acquisition of a smaller competitor, signaling consolidation and strategic growth. (Specific transaction details remain confidential).

In-Depth Fatty Methyl Ester Sulfonate Market Market Outlook

The future trajectory of the FMES market appears exceptionally promising, predominantly driven by the persistent and growing demand for surfactants that are both environmentally responsible and offer superior performance characteristics. Strategic investments in research and development (R&D), with a particular focus on pioneering product formulations and implementing sustainable manufacturing processes, will be instrumental in shaping future market growth. Companies that demonstrate agility in adapting to evolving environmental regulations and a keen understanding of shifting consumer preferences will be strategically positioned to secure substantial market share. Expanding their presence in emerging markets and meticulously establishing robust and resilient supply chains will be critical success factors for achieving enduring prosperity in this dynamic and competitive market. The market is poised for significant expansion, with projections indicating a market valuation of **[Insert Value]** Million by the year 2033.

Fatty Methyl Ester Sulfonate Market Segmentation

-

1. End-user Industry

- 1.1. Detergents

- 1.2. Personal Care

- 1.3. Others

Fatty Methyl Ester Sulfonate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fatty Methyl Ester Sulfonate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Fatty Methyl Ester Sulfonate from Detergents; Rising Demand from Personal Care Industry

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Fatty Methyl Ester Sulfonate from Detergents; Rising Demand from Personal Care Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Detergents Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Detergents

- 5.1.2. Personal Care

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Detergents

- 6.1.2. Personal Care

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Detergents

- 7.1.2. Personal Care

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Detergents

- 8.1.2. Personal Care

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Detergents

- 9.1.2. Personal Care

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Fatty Methyl Ester Sulfonate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Detergents

- 10.1.2. Personal Care

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chemithon Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emery Oleochemicals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FENCHEM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KLK OLEO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KPL International Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lion Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sinopec Jinling Petrochemical Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stepan Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Surface Chemical Industry Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wilmar International Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Chemithon Corporation

List of Figures

- Figure 1: Global Fatty Methyl Ester Sulfonate Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Fatty Methyl Ester Sulfonate Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 3: Asia Pacific Fatty Methyl Ester Sulfonate Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 4: Asia Pacific Fatty Methyl Ester Sulfonate Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Fatty Methyl Ester Sulfonate Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Fatty Methyl Ester Sulfonate Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 7: North America Fatty Methyl Ester Sulfonate Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 8: North America Fatty Methyl Ester Sulfonate Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Fatty Methyl Ester Sulfonate Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Fatty Methyl Ester Sulfonate Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 11: Europe Fatty Methyl Ester Sulfonate Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 12: Europe Fatty Methyl Ester Sulfonate Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Fatty Methyl Ester Sulfonate Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Fatty Methyl Ester Sulfonate Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: South America Fatty Methyl Ester Sulfonate Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: South America Fatty Methyl Ester Sulfonate Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America Fatty Methyl Ester Sulfonate Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Fatty Methyl Ester Sulfonate Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Middle East and Africa Fatty Methyl Ester Sulfonate Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Middle East and Africa Fatty Methyl Ester Sulfonate Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Middle East and Africa Fatty Methyl Ester Sulfonate Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Fatty Methyl Ester Sulfonate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Fatty Methyl Ester Sulfonate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fatty Methyl Ester Sulfonate Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Fatty Methyl Ester Sulfonate Market?

Key companies in the market include Chemithon Corporation, Emery Oleochemicals, FENCHEM, KLK OLEO, KPL International Limited, Lion Corporation, Sinopec Jinling Petrochemical Co Ltd, Stepan Company, Surface Chemical Industry Co Ltd, Wilmar International Ltd*List Not Exhaustive.

3. What are the main segments of the Fatty Methyl Ester Sulfonate Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Fatty Methyl Ester Sulfonate from Detergents; Rising Demand from Personal Care Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Detergents Segment.

7. Are there any restraints impacting market growth?

; Increasing Demand for Fatty Methyl Ester Sulfonate from Detergents; Rising Demand from Personal Care Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fatty Methyl Ester Sulfonate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fatty Methyl Ester Sulfonate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fatty Methyl Ester Sulfonate Market?

To stay informed about further developments, trends, and reports in the Fatty Methyl Ester Sulfonate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence