Key Insights

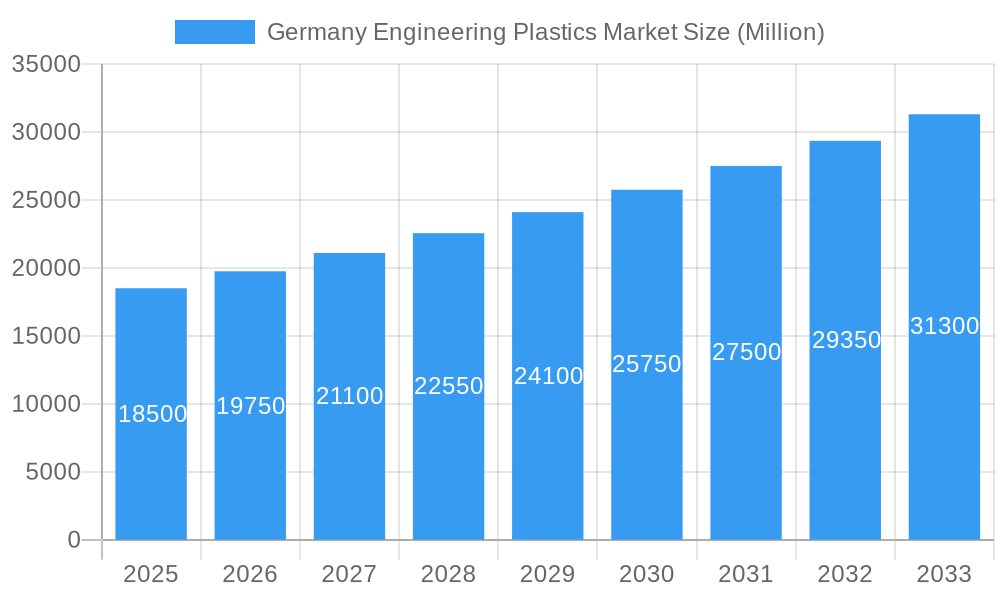

The German engineering plastics market is set for significant growth, fueled by increasing demand across key industries. With a projected market size of $122.98 billion in 2025, the sector is expected to achieve a Compound Annual Growth Rate (CAGR) of 10% by 2033. This expansion is largely driven by the automotive sector's need for lightweight, durable materials for fuel efficiency and performance, and the aerospace industry's requirement for advanced polymers in structural components. The electrical and electronics sector's ongoing innovation in consumer electronics and industrial machinery also boosts demand for engineering plastics due to their superior insulation, thermal resistance, and mechanical strength. The building and construction industry further contributes through applications in insulation, piping, and durable architectural elements.

Germany Engineering Plastics Market Market Size (In Billion)

The market features a diverse range of resins, with Fluoropolymers (PTFE, PVDF, ETFE), Polycarbonate (PC), Polyethylene Terephthalate (PET), and Polyoxymethylene (POM) leading due to their excellent chemical resistance, high-temperature stability, and impact strength. Key players are investing in R&D for sustainable and high-performance solutions. Restraints include fluctuating raw material prices and stringent environmental regulations, necessitating investment in eco-friendly processes. Despite these challenges, the demand for advanced material solutions in Germany ensures a dynamic and promising future for the engineering plastics market.

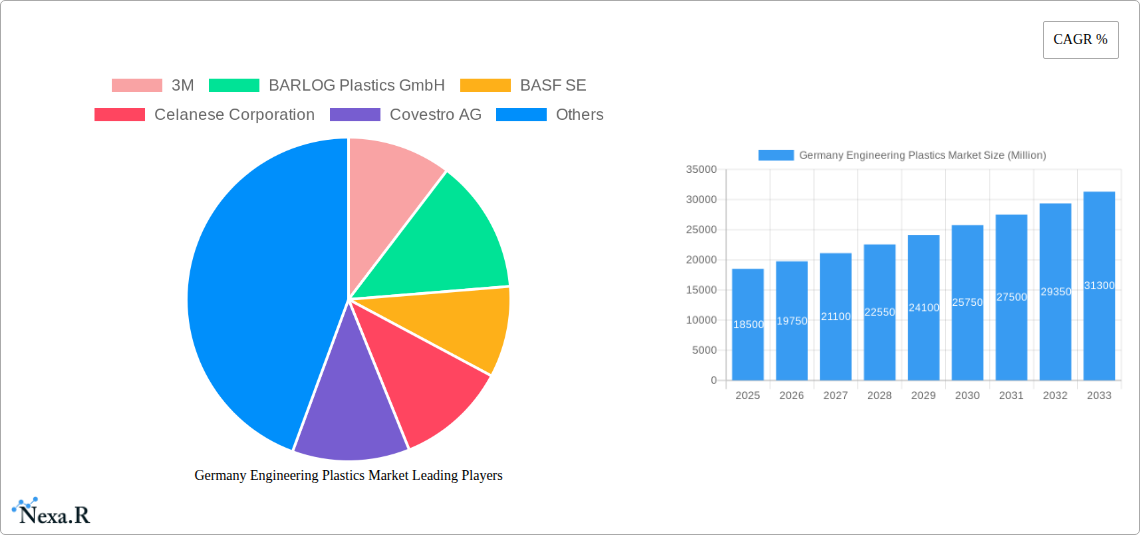

Germany Engineering Plastics Market Company Market Share

This comprehensive, SEO-optimized report details the Germany Engineering Plastics Market, analyzing its dynamics, growth, and future potential from 2019 to 2033, with a base year of 2025. It examines market size evolution, technological advancements, regulatory landscapes, and competitive strategies within the German high-performance polymers sector, offering a robust outlook for the European engineered thermoplastics market. Key segments covered include automotive plastics, aerospace materials, electrical and electronics components, and construction polymers. Discover growth drivers, emerging opportunities, and challenges in Germany's significant chemical market. All quantitative data is presented in billion units.

Germany Engineering Plastics Market Market Dynamics & Structure

The Germany Engineering Plastics Market is characterized by a high degree of technological innovation and a mature, yet dynamic, competitive landscape. Market concentration is influenced by a few dominant players, such as BASF SE, Covestro AG, and Celanese Corporation, alongside specialized manufacturers. Technological innovation is primarily driven by the demand for lighter, stronger, and more sustainable materials, particularly in the automotive engineering plastics and aerospace applications sectors. Strict regulatory frameworks concerning environmental impact and material safety are key influences, pushing manufacturers towards bio-based and recycled thermoplastics. Competitive product substitutes, including advanced composites and metals, necessitate continuous R&D investment to maintain market share. End-user demographics, heavily skewed towards industries demanding high performance and reliability, dictate product development. Mergers and acquisitions (M&A) play a significant role in consolidating market power and expanding product portfolios. For instance, the acquisition of DuPont's Mobility & Materials business by Celanese Corporation in November 2022 highlights this trend. Barriers to innovation include high R&D costs and lengthy product qualification cycles within stringent industries.

- Market Concentration: Dominated by a few large chemical companies and a significant number of niche players.

- Technological Innovation Drivers: Demand for lightweighting, enhanced thermal and mechanical properties, sustainability, and electrification.

- Regulatory Frameworks: Strict EU and German environmental and safety regulations driving adoption of sustainable and compliant materials.

- Competitive Product Substitutes: Advanced composites, specialty alloys, and traditional materials.

- End-User Demographics: Predominantly industries with high-performance requirements, including automotive, aerospace, and electronics.

- M&A Trends: Consolidation of market share and expansion of product offerings through strategic acquisitions.

Germany Engineering Plastics Market Growth Trends & Insights

The Germany Engineering Plastics Market is projected for substantial growth, fueled by persistent demand across its key end-user industries. The market size evolution is expected to witness a steady upward trajectory from 2019 through 2033, with the forecast period of 2025–2033 indicating robust expansion. Adoption rates for advanced engineering plastics, particularly those offering superior performance characteristics like Polycarbonate (PC) and Polyamide (PA), are escalating. Technological disruptions, such as advancements in material science leading to improved flame retardant plastics and high-temperature polymers, are reshaping product development. Consumer behavior shifts, particularly the increasing emphasis on sustainability and circular economy principles, are driving demand for recycled and bio-based engineering thermoplastics. For example, BASF's introduction of sustainable POM products in October 2022 exemplifies this trend towards reduced carbon footprints and reliance on fossil resources. The overall market penetration of engineering plastics is set to increase as their benefits in terms of weight reduction, design flexibility, and cost-effectiveness become more widely recognized and adopted across diverse industrial applications. The CAGR is estimated to be xx% during the forecast period.

Dominant Regions, Countries, or Segments in Germany Engineering Plastics Market

The Automotive segment stands out as a dominant force within the Germany Engineering Plastics Market, significantly driving growth and innovation. German automotive manufacturers, renowned globally for their high-quality vehicles, have consistently been early adopters of advanced materials to achieve lighter weight, improved fuel efficiency, enhanced safety, and superior aesthetics. The demand for Polycarbonate (PC) for lighting systems and interior components, Polyamide (PA) 6 and PA 66 for under-the-hood applications and structural parts, and Polyoxymethylene (POM) for precision components is exceptionally high. The push towards electric vehicles (EVs) further amplifies the need for specialized engineering plastics for battery components, charging infrastructure, and lightweight body parts, positioning Germany's automotive sector as a critical hub for EV plastics.

Key Drivers for Automotive Dominance:

- Lightweighting initiatives: Essential for improving fuel economy and EV range.

- Stringent safety regulations: Driving demand for high-impact and flame-retardant materials.

- Electrification of vehicles: Creating new applications for specialized plastics in batteries, power electronics, and charging systems.

- Premiumization of vehicle interiors: Increasing use of advanced plastics for aesthetic appeal and durability.

- Strong domestic automotive manufacturing base: Proximity to major OEMs and Tier 1 suppliers fosters close collaboration and rapid adoption of new materials.

Beyond automotive, the Electrical and Electronics sector is another significant growth area, driven by the demand for high-performance, insulating, and flame-retardant materials for consumer electronics, industrial equipment, and renewable energy components. The Building and Construction sector is increasingly incorporating engineering plastics for energy-efficient windows, insulation, and durable piping systems.

Leading Resin Types within the Dominant Segments:

- Polyamide (PA) (PA 6, PA 66): Dominant in automotive under-the-hood components, structural parts, and electrical connectors.

- Polycarbonate (PC): Widely used in automotive lighting, glazing, electronics housings, and medical devices.

- Polyoxymethylene (POM): Preferred for precision mechanical parts, gears, and fuel system components due to its excellent wear resistance and low friction.

- Styrene Copolymers (ABS and SAN): Popular for interior automotive parts, consumer electronics casings, and packaging.

- Fluoropolymers (PTFE, PVDF): Crucial for high-performance applications in aerospace, chemical processing, and demanding electrical insulation due to their exceptional chemical resistance and thermal stability.

The parent market for automotive engineering plastics in Germany is expected to continue its robust growth, with child markets such as EV components and advanced driver-assistance systems (ADAS) emerging as significant sub-segments. The combined market share of these key segments is estimated to be xx% of the total Germany Engineering Plastics Market.

Germany Engineering Plastics Market Product Landscape

The Germany Engineering Plastics Market is defined by a continuous stream of product innovations focused on enhancing performance, sustainability, and application breadth. Key product developments include advanced polycarbonates like Covestro AG’s Makrolon 3638, specifically engineered for demanding healthcare and life sciences applications, demonstrating improved biocompatibility and sterilizability for drug delivery devices and biopharmaceutical manufacturing. Furthermore, the introduction of sustainable Polyoxymethylene (POM) grades by BASF SE, such as Ultraform LowPCF and Ultraform BMB, highlights a significant push towards reducing carbon footprints and utilizing biomass-balanced feedstocks, aligning with industry-wide sustainability goals. Performance metrics such as improved tensile strength, heat deflection temperature, and chemical resistance are consistently being refined, enabling wider adoption in challenging environments.

Key Drivers, Barriers & Challenges in Germany Engineering Plastics Market

The Germany Engineering Plastics Market is propelled by several key drivers. The relentless pursuit of lightweighting in the automotive and aerospace sectors to improve fuel efficiency and reduce emissions is a primary catalyst. Technological advancements in material science, leading to enhanced mechanical properties, thermal stability, and chemical resistance, further fuel demand. The growing emphasis on sustainability, including the use of recycled and bio-based engineered thermoplastics, driven by regulatory pressures and consumer preferences, represents a significant growth accelerator. Additionally, the electrification of vehicles and the expansion of renewable energy infrastructure create new application opportunities.

- Technological Drivers: Lightweighting, improved performance characteristics (strength, heat resistance, chemical resistance), advanced manufacturing processes (e.g., 3D printing with engineering plastics).

- Economic Drivers: Growing demand from key industries like automotive and electronics, increasing R&D investments.

- Policy-Driven Factors: Stricter environmental regulations, incentives for sustainable materials, and support for circular economy initiatives.

However, the market faces significant barriers and challenges. High raw material costs and volatile pricing can impact profitability and market competitiveness. Stringent regulatory compliance, particularly concerning REACH and environmental standards, adds complexity and cost to product development and manufacturing. Intense competition from both established players and emerging manufacturers, as well as from alternative materials, necessitates continuous innovation and cost optimization. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and production delays.

- Supply Chain Issues: Vulnerability to global disruptions, leading to potential shortages and price volatility.

- Regulatory Hurdles: Navigating complex and evolving environmental and safety regulations.

- Competitive Pressures: Intense competition from global players and material substitutes.

- Cost Volatility: Fluctuations in raw material prices impacting production costs.

Emerging Opportunities in Germany Engineering Plastics Market

Emerging opportunities in the Germany Engineering Plastics Market are primarily centered around the growing demand for sustainable solutions and innovative applications. The expansion of the electric vehicle (EV) market presents a significant avenue for growth, with a rising need for specialized engineering plastics in battery systems, charging infrastructure, and lightweight vehicle components. Furthermore, the increasing focus on circular economy principles is creating opportunities for recycled and bio-based engineering thermoplastics, as manufacturers seek to reduce their environmental footprint. The healthcare sector, with its stringent requirements for biocompatibility and sterilization, offers potential for high-performance polycarbonates and fluoropolymers. The digitalization trend, including advancements in 3D printing, is also opening new avenues for customized and complex plastic part manufacturing.

- Electric Vehicle Components: Battery casings, charging connectors, lightweight body parts.

- Sustainable Materials: Recycled and bio-based engineering thermoplastics.

- Healthcare Applications: Medical devices, drug delivery systems, diagnostic equipment.

- 3D Printing: Customized and complex part production for various industries.

Growth Accelerators in the Germany Engineering Plastics Market Industry

Several catalysts are accelerating long-term growth within the Germany Engineering Plastics Market. Significant technological breakthroughs in polymer science are enabling the development of materials with unprecedented properties, such as higher temperature resistance, enhanced durability, and improved sustainability profiles. Strategic partnerships and collaborations between chemical manufacturers, OEMs, and research institutions are fostering innovation and accelerating the commercialization of new products and applications. Market expansion strategies, including increased investment in R&D and the exploration of new geographical markets, are also contributing to sustained growth. The increasing adoption of Industry 4.0 principles and advanced manufacturing techniques is further optimizing production processes and enabling greater customization.

Key Players Shaping the Germany Engineering Plastics Market Market

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty S A

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Röhm GmbH

- Trinse

Notable Milestones in Germany Engineering Plastics Market Sector

- February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing. This launch highlights the growing demand for specialized, high-performance plastics in the medical sector.

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition significantly enhanced Celanese's product portfolio of engineered thermoplastics, integrating well-recognized brands and intellectual properties, thereby consolidating its market position.

- October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions. These product launches underscore the industry's commitment to sustainability and reduced environmental impact.

In-Depth Germany Engineering Plastics Market Market Outlook

The future outlook for the Germany Engineering Plastics Market is exceptionally promising, driven by the continued integration of advanced materials across critical sectors. Growth accelerators such as the escalating demand for lightweight solutions in the automotive and aerospace industries, coupled with the rapid expansion of the electric vehicle market, will remain paramount. Emerging opportunities in sustainable plastics, including recycled and bio-based alternatives, will reshape the market landscape as environmental consciousness intensifies. Strategic partnerships and ongoing technological innovation in material science will unlock new applications and performance benchmarks. The market is poised for sustained expansion, offering significant opportunities for players who can adapt to evolving regulatory demands and leverage the increasing need for high-performance, eco-friendly polymer solutions.

Germany Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Germany Engineering Plastics Market Segmentation By Geography

- 1. Germany

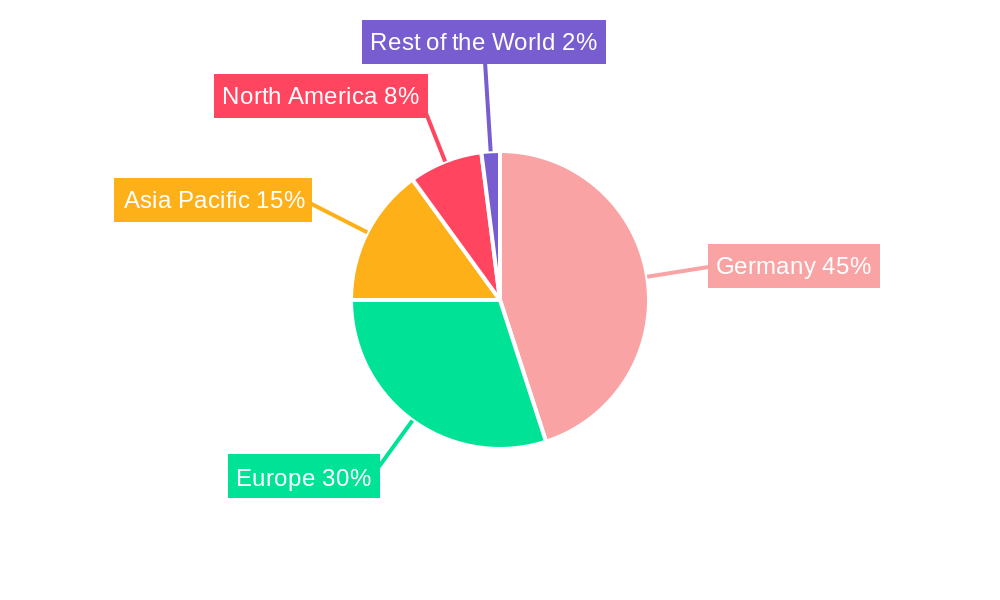

Germany Engineering Plastics Market Regional Market Share

Geographic Coverage of Germany Engineering Plastics Market

Germany Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Engineering Plastics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 3M

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BARLOG Plastics GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Celanese Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covestro AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domo Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DuBay Polymer GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Equipolymers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evonik Industries AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupa Azoty S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indorama Ventures Public Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 INEOS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LANXESS

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Röhm GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Trinse

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 3M

List of Figures

- Figure 1: Germany Engineering Plastics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Engineering Plastics Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Engineering Plastics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Germany Engineering Plastics Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 3: Germany Engineering Plastics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Engineering Plastics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Germany Engineering Plastics Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Germany Engineering Plastics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Engineering Plastics Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Germany Engineering Plastics Market?

Key companies in the market include 3M, BARLOG Plastics GmbH, BASF SE, Celanese Corporation, Covestro AG, Domo Chemicals, DuBay Polymer GmbH, Equipolymers, Evonik Industries AG, Grupa Azoty S A, Indorama Ventures Public Company Limited, INEOS, LANXESS, Röhm GmbH, Trinse.

3. What are the main segments of the Germany Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.98 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing.November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.October 2022: BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and support the reduction of greenhouse gas (GHG) emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Germany Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence