Key Insights

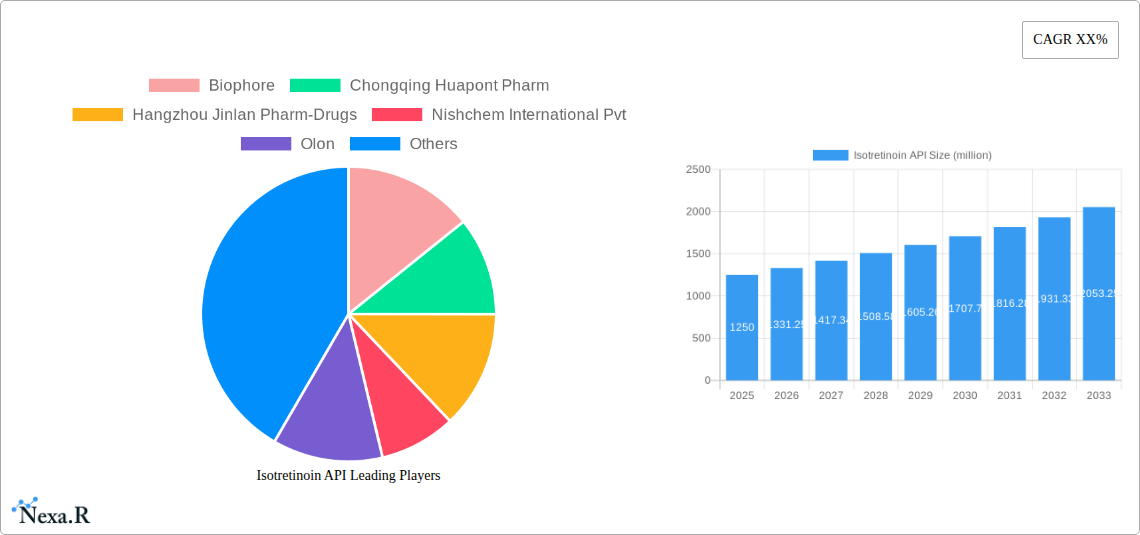

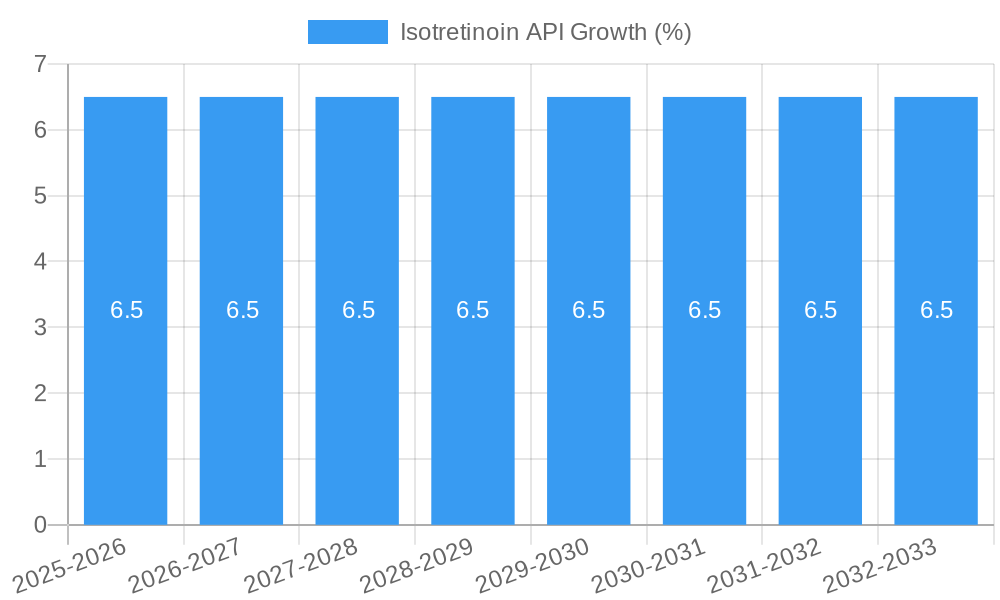

The global Isotretinoin API market is poised for substantial growth, projected to reach an estimated market size of $1,250 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.5% projected over the forecast period of 2025-2033. This expansion is primarily driven by the persistent and increasing prevalence of severe nodular acne and other dermatological conditions, for which Isotretinoin remains a cornerstone treatment. The growing awareness among patients and healthcare professionals regarding the efficacy of Isotretinoin in managing refractory acne cases, coupled with advancements in drug formulation and manufacturing processes leading to higher purity levels (98% and 99%), further fuel market demand. The pharmaceutical industry represents the dominant application segment, leveraging the API for the production of various dosage forms. Research organizations also contribute to market activity through ongoing studies into potential new applications and improved therapeutic profiles.

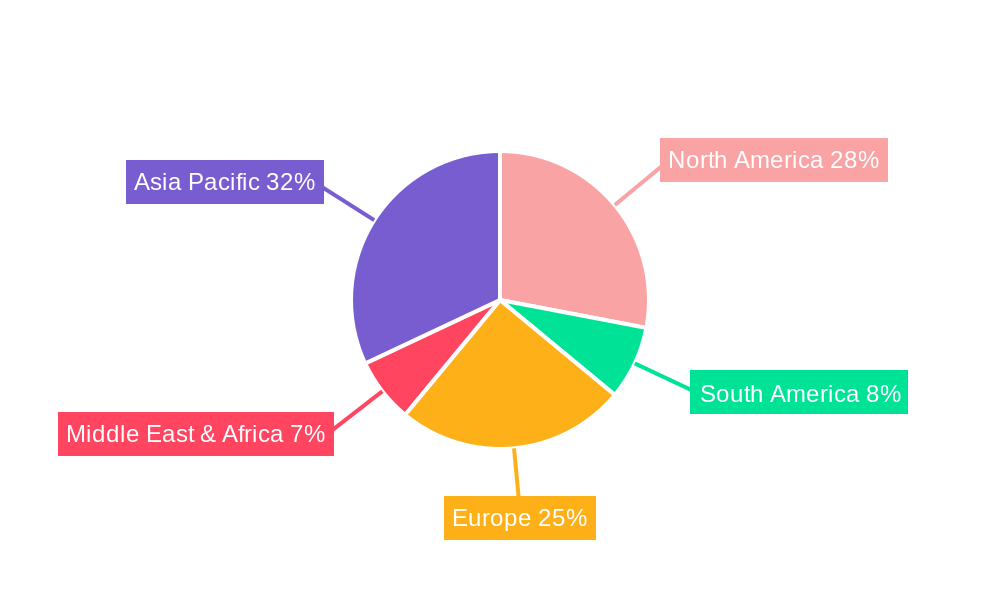

The market's trajectory is characterized by several key trends, including a growing emphasis on stringent regulatory compliance and the development of higher-purity Isotretinoin APIs to meet evolving pharmaceutical standards. Geographically, Asia Pacific, particularly China and India, is emerging as a significant manufacturing hub and a rapidly growing consumer market due to increasing healthcare expenditure and a burgeoning population. Conversely, the market faces restraints such as the potential for adverse side effects associated with Isotretinoin use, which necessitate careful patient monitoring and adherence to strict prescribing guidelines. The high cost of production for high-purity APIs and the availability of alternative acne treatments, though often less potent for severe cases, also present challenges. Nevertheless, the unwavering demand for effective acne therapies and the ongoing research and development activities are expected to sustain a positive market outlook for Isotretinoin API manufacturers.

Isotretinoin API Market Dynamics & Structure

The global Isotretinoin API market is characterized by a moderately concentrated landscape, with key players investing heavily in advanced manufacturing processes and stringent quality control measures. Technological innovation is primarily driven by the pursuit of higher purity grades and more efficient synthesis routes, crucial for meeting the escalating demands of the pharmaceutical industry. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a pivotal role in shaping market access and product development, with a strong emphasis on safety and efficacy. Competitive product substitutes are minimal, given Isotretinoin's unique therapeutic profile for severe acne. End-user demographics are largely driven by the prevalence of dermatological conditions and increasing patient access to effective treatments. Mergers and acquisitions (M&A) trends are moderate, focusing on strategic consolidation to enhance supply chain resilience and expand geographical reach.

- Market Concentration: Dominated by a few established API manufacturers, with increasing entry of specialized firms.

- Technological Innovation: Focus on improving synthesis yields, reducing impurities, and developing cost-effective production methods.

- Regulatory Frameworks: Strict adherence to Good Manufacturing Practices (GMP) and pharmacopoeial standards is essential.

- Competitive Product Substitutes: Limited direct substitutes, emphasizing Isotretinoin's specific efficacy.

- End-User Demographics: Driven by acne prevalence and demand from dermatological treatments.

- M&A Trends: Strategic acquisitions aimed at bolstering production capacity and market penetration.

Isotretinoin API Growth Trends & Insights

The Isotretinoin API market has witnessed robust growth over the historical period of 2019–2024, driven by a confluence of factors including the increasing prevalence of severe acne and the growing demand for effective pharmaceutical treatments. The pharmaceutical industry remains the primary consumer, leveraging Isotretinoin for the formulation of essential medications. The market size is projected to continue its upward trajectory, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is underpinned by an increased adoption rate of Isotretinoin-based therapies, particularly in emerging economies where access to advanced dermatological treatments is improving.

Technological disruptions, while not revolutionary, have focused on optimizing production processes to enhance purity and reduce manufacturing costs. The development of Purity 99% grades has become a key differentiator, meeting the highest pharmaceutical standards. Consumer behavior shifts are also playing a role, with a greater awareness among individuals about effective acne treatment options, leading to increased consultation with dermatologists and subsequent prescription of Isotretinoin.

Market Penetration for Isotretinoin API within its target applications is estimated to be XX% in the base year of 2025. This penetration is expected to grow as more pharmaceutical companies expand their product portfolios and geographical reach. The market's evolution is further influenced by advancements in drug delivery systems and combination therapies, which, while not directly altering the API itself, can indirectly influence demand by enhancing the overall efficacy and patient experience of Isotretinoin treatments. The shift towards more specialized and personalized medicine also presents opportunities, as Isotretinoin continues to be a cornerstone therapy for specific severe dermatological conditions. The overall market sentiment remains positive, supported by consistent demand and ongoing research into optimizing its therapeutic applications.

Dominant Regions, Countries, or Segments in Isotretinoin API

The Isotretinoin API market is experiencing robust growth, with the Pharmaceutical Industry segment undeniably leading the charge in both regional dominance and overall market share. This segment’s supremacy is a direct consequence of Isotretinoin's critical role as an Active Pharmaceutical Ingredient (API) in the production of life-changing medications for severe dermatological conditions like cystic acne. The demand from pharmaceutical manufacturers for high-purity Isotretinoin, particularly Purity 99%, is substantial and consistently growing.

North America and Europe currently represent the dominant geographical regions. This dominance is fueled by several factors:

- Strong Healthcare Infrastructure: Advanced healthcare systems and widespread access to dermatological specialists ensure a high diagnosis rate and prescription volume for Isotretinoin.

- High Disposable Income: Allowing patients to afford sophisticated treatments.

- Favorable Regulatory Environments: While stringent, regulatory bodies in these regions (e.g., FDA in the US, EMA in Europe) provide clear guidelines and support for the development and manufacturing of high-quality APIs.

- Presence of Key Pharmaceutical Players: Major pharmaceutical companies with extensive R&D and manufacturing capabilities are headquartered in these regions, driving significant demand.

The Purity 99% segment within the Isotretinoin API market is also a key driver of growth and dominance. Pharmaceutical companies are increasingly demanding the highest purity grades to meet stringent regulatory requirements and ensure patient safety and therapeutic efficacy. This preference for higher purity directly influences manufacturing processes and investment in advanced purification technologies.

Key Drivers for Pharmaceutical Industry Dominance:

- High global prevalence of severe acne.

- Established therapeutic efficacy of Isotretinoin.

- Continuous investment in research and development of Isotretinoin-based formulations.

- Strong market penetration in developed economies.

Market Share and Growth Potential: The Pharmaceutical Industry segment is estimated to hold over XX% of the total Isotretinoin API market share in the base year of 2025 and is projected to grow at a CAGR of XX% during the forecast period. This growth is expected to be sustained by an increase in the number of generic drug manufacturers and expansion into emerging markets.

While Research Organizations also contribute to the demand for Isotretinoin API, their market share is significantly smaller compared to the pharmaceutical industry. Their consumption is primarily for preclinical and clinical research, drug discovery, and understanding the molecular mechanisms of Isotretinoin. The Others segment, which could encompass veterinary applications or specialized industrial uses, has a negligible impact on the overall market size.

The dominance of the Pharmaceutical Industry, coupled with the increasing demand for Purity 99%, solidifies these segments as the primary growth engines for the Isotretinoin API market.

Isotretinoin API Product Landscape

The Isotretinoin API product landscape is defined by its high pharmaceutical grade and consistent quality. Manufacturers primarily offer Isotretinoin in two key purity levels: Purity 98% and Purity 99%, with the latter gaining significant traction due to stringent pharmaceutical industry demands. Key product innovations revolve around optimizing synthesis routes to achieve higher yields and reduce impurities, thereby enhancing drug safety and efficacy. Manufacturers are also focused on ensuring stable supply chains and robust quality control mechanisms to meet the rigorous standards of global pharmaceutical clients. The unique selling proposition of Isotretinoin API lies in its established therapeutic benefits for severe acne and related dermatological conditions, making it an indispensable component in numerous dermatological formulations.

Key Drivers, Barriers & Challenges in Isotretinoin API

The Isotretinoin API market is propelled by several key drivers, foremost among them being the persistent high prevalence of severe acne and other dermatological conditions globally. The proven efficacy of Isotretinoin as a treatment option, coupled with an increasing awareness of its therapeutic benefits among patients and healthcare professionals, fuels sustained demand. Furthermore, advancements in manufacturing technologies enabling higher purity grades and more cost-effective production processes act as significant economic drivers. Expanding healthcare access and rising disposable incomes in emerging economies also contribute to market growth by increasing patient affordability and treatment uptake.

However, the market is not without its barriers and challenges. Stringent regulatory approvals and compliance requirements for API production, including rigorous quality control and safety monitoring, present significant hurdles. The complex manufacturing process and the need for specialized equipment can lead to high initial investment costs. Supply chain disruptions, geopolitical instability, and raw material price fluctuations can impact production stability and cost-effectiveness. Moreover, potential side effects associated with Isotretinoin therapy, although well-managed with proper monitoring, can lead to cautious prescribing and alternative treatment considerations, posing a competitive restraint.

Emerging Opportunities in Isotretinoin API

Emerging opportunities in the Isotretinoin API market lie in the growing demand for higher purity grades, particularly Purity 99%, driven by increasingly stringent pharmaceutical regulations worldwide. The expansion of the pharmaceutical industry into emerging economies, where the prevalence of dermatological conditions is rising and healthcare access is improving, presents a significant untapped market. Innovative drug delivery systems that enhance the bioavailability and reduce side effects of Isotretinoin-based formulations represent another area of potential growth. Furthermore, research into novel therapeutic applications for Isotretinoin beyond severe acne, such as in certain oncological or dermatological research settings, could unlock new market segments and drive further demand for high-quality API.

Growth Accelerators in the Isotretinoin API Industry

The Isotretinoin API industry's long-term growth is significantly accelerated by strategic partnerships between API manufacturers and pharmaceutical companies, fostering collaboration in product development and market penetration. Continuous investment in research and development to optimize synthesis pathways, improve API purity, and reduce manufacturing costs are crucial growth accelerators. Furthermore, the expansion of manufacturing capacities and the establishment of robust global supply chains by key players ensure reliable product availability, catering to the ever-growing demand from the pharmaceutical sector. The increasing focus on generic drug manufacturing in various regions also contributes to sustained demand for Isotretinoin API.

Key Players Shaping the Isotretinoin API Market

- Biophore

- Chongqing Huapont Pharm

- Hangzhou Jinlan Pharm-Drugs

- Nishchem International Pvt

- Olon

- Siegfried

- Xi'an Sgonek Biological Technology

- Focus Herb

- Shanxi Bio-Technology

- Samex Overseas

- ZHISHANG CHEMICAL

- Natural Field

- Wuhan Senwayer Century Chemical

- Asia Pioneer

Notable Milestones in Isotretinoin API Sector

- 2019: Increased focus on GMP compliance and quality assurance across the supply chain.

- 2020: Supply chain resilience measures implemented due to global health events.

- 2021: Growing demand for Purity 99% grades from major pharmaceutical clients.

- 2022: Investment in advanced synthesis technologies for improved yield and purity.

- 2023: Expansion of manufacturing capabilities by leading API producers.

- 2024: Enhanced regulatory adherence and documentation for global market access.

In-Depth Isotretinoin API Market Outlook

The future outlook for the Isotretinoin API market is exceptionally promising, driven by sustained demand from the Pharmaceutical Industry for its critical role in treating severe acne. Growth accelerators such as ongoing technological advancements in API synthesis, leading to higher purity (Purity 99%) and cost efficiencies, will further fuel market expansion. Strategic collaborations and increasing penetration into emerging markets with growing healthcare infrastructure and rising disposable incomes will also contribute significantly. The market is poised for continued steady growth, with manufacturers focusing on robust quality control and supply chain management to meet the evolving needs of a global patient population.

Isotretinoin API Segmentation

-

1. Application

- 1.1. Pharmaceutical Industry

- 1.2. Research Organization

- 1.3. Others

-

2. Types

- 2.1. Purity 98%

- 2.2. Purity 99%

Isotretinoin API Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Isotretinoin API REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical Industry

- 5.1.2. Research Organization

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Purity 98%

- 5.2.2. Purity 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical Industry

- 6.1.2. Research Organization

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Purity 98%

- 6.2.2. Purity 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical Industry

- 7.1.2. Research Organization

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Purity 98%

- 7.2.2. Purity 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical Industry

- 8.1.2. Research Organization

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Purity 98%

- 8.2.2. Purity 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical Industry

- 9.1.2. Research Organization

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Purity 98%

- 9.2.2. Purity 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Isotretinoin API Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical Industry

- 10.1.2. Research Organization

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Purity 98%

- 10.2.2. Purity 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biophore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chongqing Huapont Pharm

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hangzhou Jinlan Pharm-Drugs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nishchem International Pvt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Olon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siegfried

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xi'an Sgonek Biological Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Focus Herb

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanxi Bio-Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samex Overseas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZHISHANG CHEMICAL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Natural Field

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wuhan Senwayer Century Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Asia Pioneer

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Biophore

List of Figures

- Figure 1: Global Isotretinoin API Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Isotretinoin API Revenue (million), by Application 2024 & 2032

- Figure 3: North America Isotretinoin API Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Isotretinoin API Revenue (million), by Types 2024 & 2032

- Figure 5: North America Isotretinoin API Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Isotretinoin API Revenue (million), by Country 2024 & 2032

- Figure 7: North America Isotretinoin API Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Isotretinoin API Revenue (million), by Application 2024 & 2032

- Figure 9: South America Isotretinoin API Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Isotretinoin API Revenue (million), by Types 2024 & 2032

- Figure 11: South America Isotretinoin API Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Isotretinoin API Revenue (million), by Country 2024 & 2032

- Figure 13: South America Isotretinoin API Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Isotretinoin API Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Isotretinoin API Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Isotretinoin API Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Isotretinoin API Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Isotretinoin API Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Isotretinoin API Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Isotretinoin API Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Isotretinoin API Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Isotretinoin API Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Isotretinoin API Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Isotretinoin API Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Isotretinoin API Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Isotretinoin API Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Isotretinoin API Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Isotretinoin API Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Isotretinoin API Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Isotretinoin API Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Isotretinoin API Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Isotretinoin API Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Isotretinoin API Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Isotretinoin API Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Isotretinoin API Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Isotretinoin API Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Isotretinoin API Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Isotretinoin API Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Isotretinoin API Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Isotretinoin API Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Isotretinoin API Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Isotretinoin API?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Isotretinoin API?

Key companies in the market include Biophore, Chongqing Huapont Pharm, Hangzhou Jinlan Pharm-Drugs, Nishchem International Pvt, Olon, Siegfried, Xi'an Sgonek Biological Technology, Focus Herb, Shanxi Bio-Technology, Samex Overseas, ZHISHANG CHEMICAL, Natural Field, Wuhan Senwayer Century Chemical, Asia Pioneer.

3. What are the main segments of the Isotretinoin API?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Isotretinoin API," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Isotretinoin API report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Isotretinoin API?

To stay informed about further developments, trends, and reports in the Isotretinoin API, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence