Key Insights

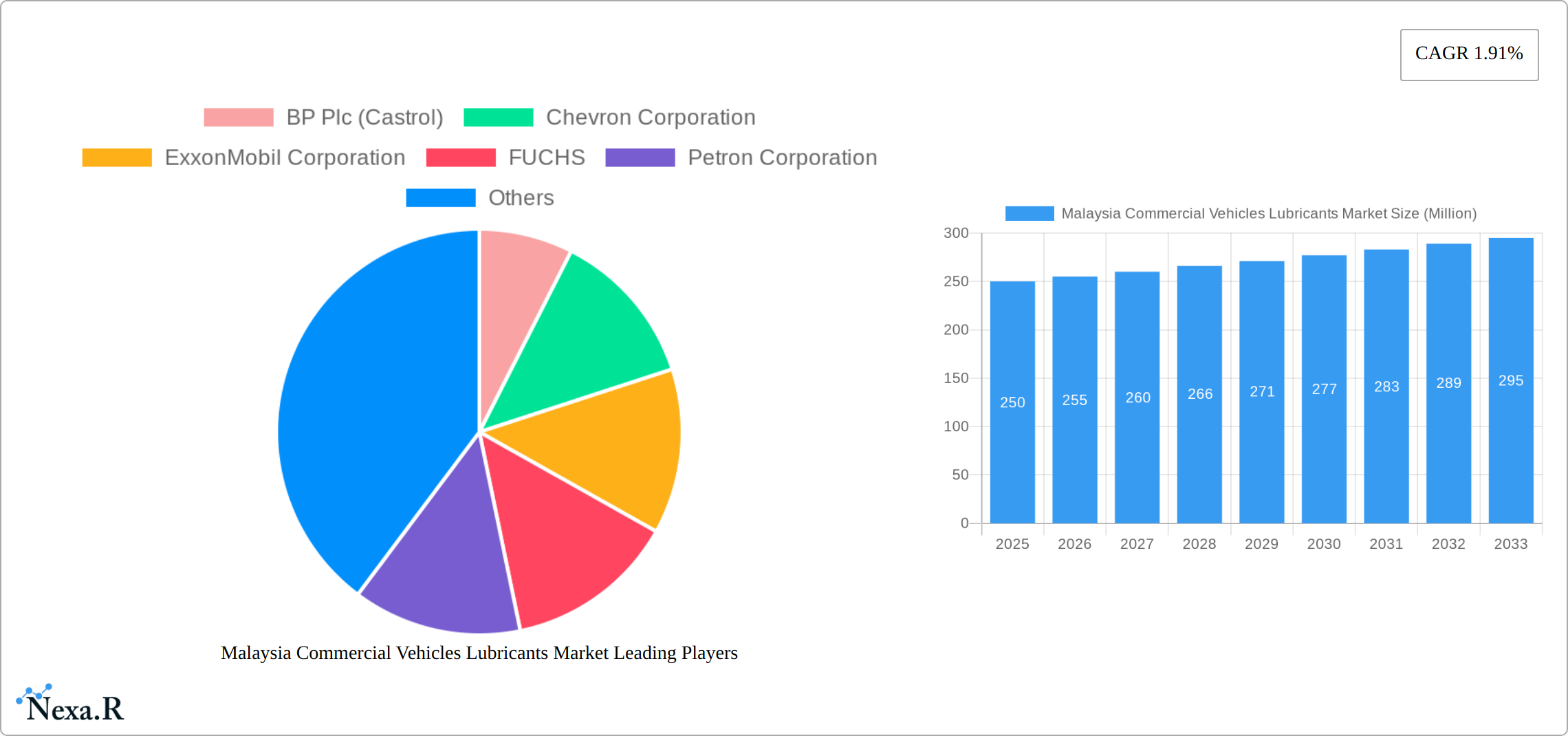

The Malaysia Commercial Vehicles Lubricants Market is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 1.91% from 2025 to 2033. This growth is fueled by several key factors. The expanding logistics and transportation sector in Malaysia, driven by e-commerce boom and infrastructure development, necessitates a higher demand for commercial vehicle lubricants. Furthermore, the increasing adoption of advanced lubricant technologies, focused on improving fuel efficiency and extending engine life, is stimulating market expansion. Stringent emission regulations are also pushing the adoption of higher-quality, environmentally friendly lubricants, creating further growth opportunities. Major players like BP Plc (Castrol), Chevron Corporation, ExxonMobil Corporation, and others are actively competing in this market, investing in research and development to meet evolving customer needs and regulatory compliance. The market is segmented based on lubricant type (engine oil, gear oil, etc.), vehicle type (trucks, buses, etc.), and distribution channels. While precise market size data for 2025 is unavailable, considering the CAGR and a likely starting point from 2024 data (which we will estimate for illustrative purposes only, not as factual data) and applying reasonable growth based on regional trends, one could project a substantial market value and size for the years indicated in the market analysis provided in the chart below.

The market, however, faces certain challenges. Fluctuations in crude oil prices directly impact lubricant production costs, affecting profitability. The competitive landscape, with numerous international and local players, leads to price pressure. Furthermore, economic downturns can dampen demand for commercial vehicles, indirectly impacting lubricant sales. Despite these restraints, the long-term outlook for the Malaysia Commercial Vehicles Lubricants Market remains positive, underpinned by the country's robust economic growth and ongoing infrastructural projects. The focus on sustainable practices and the increasing awareness of the importance of preventative maintenance within the commercial vehicle sector will further enhance the market's growth trajectory in the coming years.

Malaysia Commercial Vehicles Lubricants Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysia Commercial Vehicles Lubricants Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The market size is presented in million units.

Malaysia Commercial Vehicles Lubricants Market Dynamics & Structure

The Malaysian commercial vehicles lubricants market is characterized by a moderately concentrated landscape, with both global and local players vying for market share. Technological innovation, primarily driven by the need for enhanced fuel efficiency and reduced emissions, is a key driver. Stringent environmental regulations imposed by the Malaysian government are also shaping the market, pushing manufacturers towards the development of more sustainable lubricant formulations. The market faces competition from substitute products, such as bio-lubricants, but these remain niche players. The end-user demographics are largely influenced by the growth of the logistics and transportation sectors. M&A activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, contributing to market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on fuel efficiency, emission reduction, and extended drain intervals.

- Regulatory Framework: Stringent environmental regulations driving demand for eco-friendly lubricants.

- Competitive Substitutes: Bio-lubricants and other emerging alternatives pose a minor threat.

- End-User Demographics: Primarily logistics, transportation, and construction industries.

- M&A Activity: xx deals between 2019 and 2024, resulting in moderate consolidation.

Malaysia Commercial Vehicles Lubricants Market Growth Trends & Insights

The Malaysian commercial vehicles lubricants market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is primarily attributed to the increasing number of commercial vehicles on Malaysian roads, driven by economic expansion and infrastructure development. Technological disruptions, such as the adoption of advanced lubricant formulations with improved performance characteristics, have further fueled market growth. Shifting consumer preferences towards higher-quality, longer-lasting lubricants also contribute. The market penetration rate for premium lubricants is expected to increase from xx% in 2024 to xx% by 2033, driven by rising awareness of the benefits of these products. The forecast period (2025-2033) projects a CAGR of xx%, with the market size expected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Malaysia Commercial Vehicles Lubricants Market

The Klang Valley region dominates the Malaysian commercial vehicles lubricants market, accounting for xx% of the total market share in 2024. This dominance is attributed to its high concentration of commercial activities, robust infrastructure, and significant presence of logistics and transportation hubs. Other key regions include Penang, Johor Bahru, and Sabah. Growth in these regions is driven by industrialization, infrastructural projects, and economic development initiatives. The heavy-duty vehicle segment holds the largest market share, driven by the increasing demand for freight transportation and construction activities.

- Key Drivers in Klang Valley: High commercial activity, robust infrastructure, logistics hubs.

- Key Drivers in other regions: Industrialization, infrastructure development, economic growth.

- Segment Dominance: Heavy-duty vehicle segment leads due to high demand in logistics and construction.

Malaysia Commercial Vehicles Lubricants Market Product Landscape

The Malaysian commercial vehicles lubricants market is characterized by a dynamic and evolving product portfolio designed to meet the rigorous demands of diverse vehicle types and operational needs. Key product categories include high-performance engine oils, robust gear oils, and advanced transmission fluids, all engineered to optimize performance and longevity. Recent technological advancements are prominently featuring the introduction of low-sulfur and low-viscosity lubricant formulations. These innovations are crucial for enhancing fuel efficiency, thereby contributing to reduced operational costs for fleet owners, and simultaneously supporting the nation's commitment to lowering emissions. Furthermore, many leading products incorporate sophisticated additive packages. These advanced additives are designed to deliver superior protection against wear and tear, significantly extend oil drain intervals, and maintain peak engine performance under challenging conditions. The unique selling propositions that resonate most strongly with fleet operators and end-users often revolve around demonstrably superior performance under heavy loads, extended operational life between maintenance services, and an increasing emphasis on environmentally responsible and sustainable lubricant formulations that minimize ecological impact.

Key Drivers, Barriers & Challenges in Malaysia Commercial Vehicles Lubricants Market

Key Drivers:

- Robust Fleet Expansion: Continued economic growth, coupled with ambitious infrastructure development projects across Malaysia, is fueling a significant expansion in the commercial vehicle fleet. This directly translates to an increased demand for lubricants.

- Stringent Environmental Regulations: The Malaysian government's commitment to environmental protection is leading to increasingly stringent emission standards. This regulatory push compels the adoption of advanced, high-performance lubricants that can help vehicles meet these tougher requirements.

- Growing Operator Sophistication: There is a discernible rise in the awareness and understanding among fleet operators regarding the tangible benefits of utilizing premium lubricants. This includes recognizing the long-term cost savings derived from improved fuel efficiency, reduced maintenance, and extended engine life.

Key Challenges:

- Crude Oil Price Volatility: The global price of crude oil, a primary feedstock for lubricant production, is subject to considerable fluctuations. This volatility directly impacts raw material costs and, consequently, the pricing and profitability of lubricant manufacturers.

- Intense Market Competition: The Malaysian lubricant market is highly competitive, with a significant presence of both established multinational corporations and agile domestic players vying for market share. This necessitates continuous innovation and aggressive market strategies.

- Supply Chain Vulnerabilities: Global and regional supply chain disruptions, whether due to geopolitical events, logistical bottlenecks, or natural disasters, can pose a risk to the consistent availability of lubricants, potentially impacting operational continuity for fleet operators.

Emerging Opportunities in Malaysia Commercial Vehicles Lubricants Market

Emerging opportunities include:

- Growing demand for bio-based and sustainable lubricants.

- Expansion into the electric vehicle (EV) lubricants segment.

- Development of advanced lubricant solutions for emerging transportation technologies.

Growth Accelerators in the Malaysia Commercial Vehicles Lubricants Market Industry

Long-term growth will be driven by:

Technological advancements in lubricant formulations leading to improved efficiency and performance. Strategic partnerships between lubricant manufacturers and vehicle OEMs. Government initiatives promoting sustainable transportation and logistics.

Key Players Shaping the Malaysia Commercial Vehicles Lubricants Market Market

- BP Plc (Castrol)

- Chevron Corporation

- ExxonMobil Corporation

- FUCHS

- Petron Corporation

- PETRONAS Lubricants International

- Royal Dutch Shell Plc

- TotalEnergies

- UMW HOLDINGS BERHAD

- Valvoline Inc

Notable Milestones in Malaysia Commercial Vehicles Lubricants Market Sector

- September 2021: ExxonMobil Asia Pacific Pte Ltd enhanced fleet management solutions with the launch of the MobilSM Fleet Care (MFC) program, aiming to provide comprehensive support and optimization for commercial fleets.

- October 2021: Valvoline and Cummins solidified their strategic alliance through an extended collaboration, a move anticipated to strengthen Valvoline's market penetration and product offerings within the commercial vehicle segment.

- January 2022: ExxonMobil undertook a significant internal reorganization of its business lines, a strategic adjustment that could potentially influence its long-term vision and operational focus within the competitive lubricants sector.

In-Depth Malaysia Commercial Vehicles Lubricants Market Market Outlook

The Malaysian commercial vehicles lubricants market is projected to experience a trajectory of robust and sustained growth throughout the forecast period. This positive outlook is underpinned by several key factors: the ongoing expansion of the Malaysian economy, continued investment in national infrastructural development, and the accelerating adoption of advanced lubricant technologies that promise enhanced efficiency and durability. Strategic alliances, joint ventures, and substantial investments in cutting-edge research and development will be pivotal in shaping the competitive dynamics of this market. Companies that prioritize the development and marketing of sustainable, high-performance lubricant solutions are strategically positioned to capture significant market share and achieve a distinct competitive advantage. The market presents substantial and lucrative opportunities for both established industry giants and agile new entrants who can effectively anticipate and adapt to the ever-evolving demands and technological advancements within the commercial vehicle lubricants sector.

Malaysia Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Malaysia Commercial Vehicles Lubricants Market Segmentation By Geography

- 1. Malaysia

Malaysia Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BP Plc (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExxonMobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUCHS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PETRONAS Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UMW HOLDINGS BERHAD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valvoline Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP Plc (Castrol)

List of Figures

- Figure 1: Malaysia Commercial Vehicles Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Commercial Vehicles Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Commercial Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Commercial Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Malaysia Commercial Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Malaysia Commercial Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Malaysia Commercial Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 1.91%.

2. Which companies are prominent players in the Malaysia Commercial Vehicles Lubricants Market?

Key companies in the market include BP Plc (Castrol), Chevron Corporation, ExxonMobil Corporation, FUCHS, Petron Corporation, PETRONAS Lubricants International, Royal Dutch Shell Plc, TotalEnergies, UMW HOLDINGS BERHAD, Valvoline Inc.

3. What are the main segments of the Malaysia Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.September 2021: ExxonMobil Asia Pacific Pte Ltd established the MobilSM Fleet Care (MFC) program for its lubricant clients, which provides fleet owners and operators with a holistic picture of their fleet's operating performance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Malaysia Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence