Key Insights

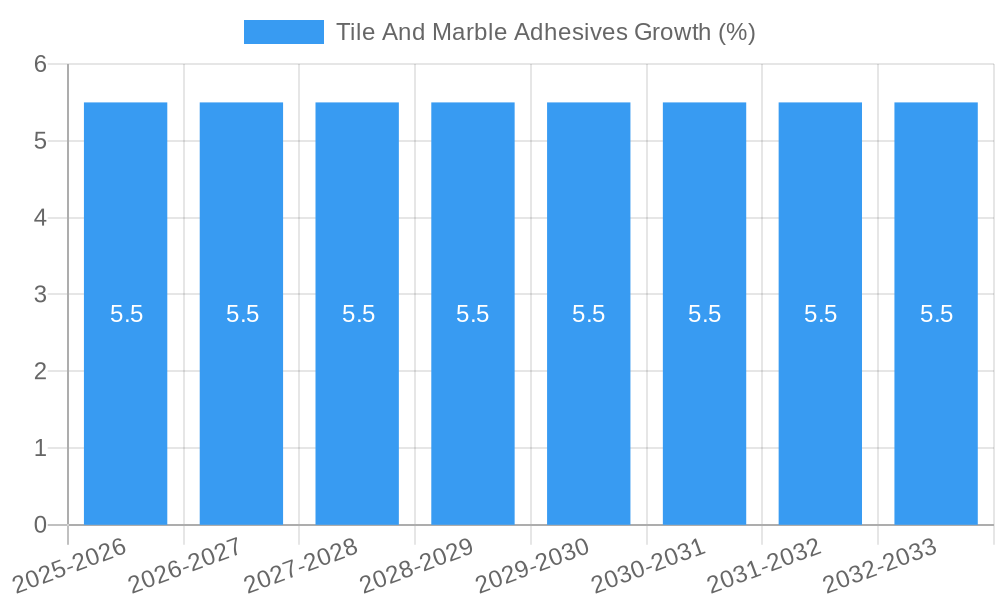

The global Tile and Marble Adhesives market is projected to reach an impressive valuation of approximately $7,800 million by 2025, driven by sustained growth and increasing construction activities worldwide. This robust market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of around 5.5% from 2025 to 2033, signaling a healthy upward trajectory. Key growth drivers include the burgeoning residential construction sector, fueled by urbanization and rising disposable incomes, alongside significant investments in non-residential projects such as commercial complexes, hospitality venues, and public infrastructure. The adoption of advanced adhesive technologies, offering enhanced durability, faster setting times, and superior bonding strength for diverse tile and marble applications, is also a significant catalyst. Furthermore, the growing trend towards aesthetic enhancements in interiors and exteriors, with tiles and marble being preferred materials for their elegance and longevity, directly contributes to market expansion.

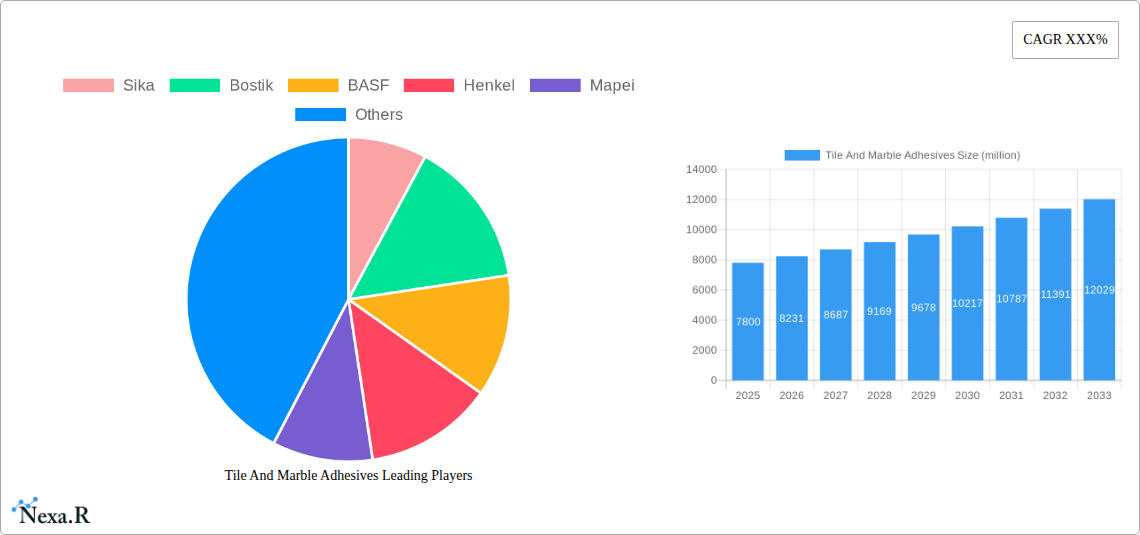

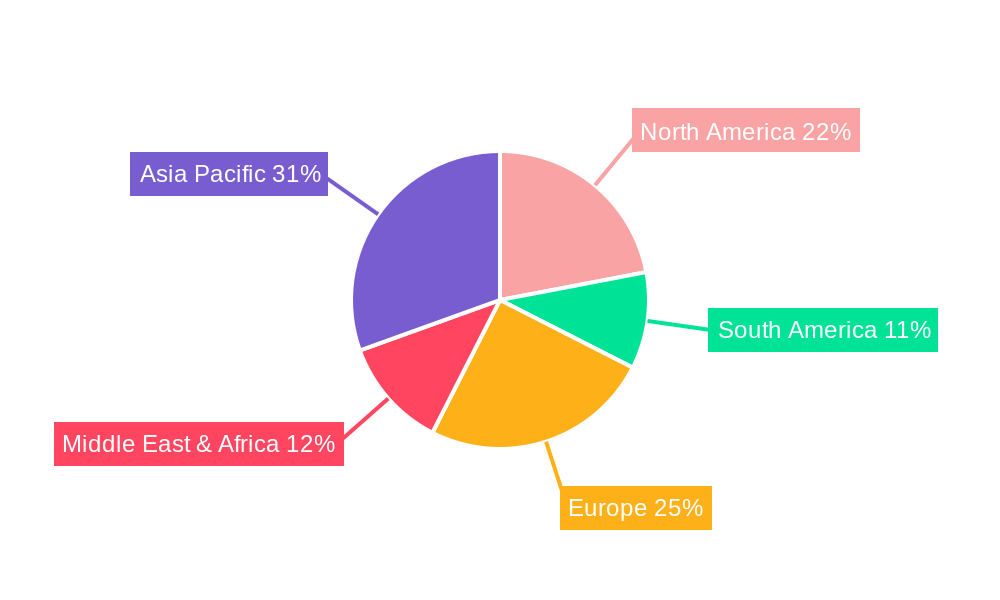

The market is segmented into cementitious and polymeric types, with both categories witnessing steady demand. Cementitious adhesives remain a popular choice for their cost-effectiveness and broad applicability, while polymeric adhesives are gaining traction for specialized applications requiring superior flexibility, water resistance, and performance in challenging environments. Regionally, Asia Pacific is expected to lead the market in terms of growth and volume, owing to rapid infrastructure development and a large consumer base, particularly in China and India. North America and Europe, while mature markets, continue to exhibit steady growth, driven by renovation and refurbishment projects, alongside new construction endeavors. Key industry players like Sika, Bostik, BASF, Henkel, and Mapei are actively engaged in research and development, focusing on sustainable and high-performance adhesive solutions to cater to evolving market demands and stringent environmental regulations. Restraints such as fluctuating raw material prices and intense competition present challenges, but the overall outlook for the Tile and Marble Adhesives market remains exceptionally positive, supported by strong underlying demand and continuous innovation.

Comprehensive Report: Tile and Marble Adhesives Market Analysis 2019-2033

This in-depth report provides a detailed examination of the global Tile and Marble Adhesives Market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the Historical Period (2019–2024), Base Year (2025), Estimated Year (2025), and an extensive Forecast Period (2025–2033), this analysis is an indispensable resource for manufacturers, distributors, investors, and industry stakeholders seeking to navigate this evolving sector. We leverage advanced analytical methodologies to dissect market segmentation by Application (Residential, Non-residential) and Type (Cement Type, Polymeric Type), and delve into the competitive landscape shaped by industry leaders such as Sika, Bostik, BASF, Henkel, Mapei, Saint-Gobain, H.B. Fuller, ARDEX ENDURA, Fosroc, and TAMMY.

Tile And Marble Adhesives Market Dynamics & Structure

The global Tile and Marble Adhesives market is characterized by a moderately concentrated structure, with a few key players holding significant market share, but also a robust presence of regional manufacturers. Technological innovation is a primary driver, fueled by the demand for enhanced performance characteristics like faster curing times, improved flexibility, and greater durability. The development of advanced formulations, including polymer-modified cementitious adhesives and single-component reactive adhesives, addresses the growing need for efficient and reliable installation solutions. Regulatory frameworks, particularly concerning environmental impact and VOC emissions, are increasingly influencing product development and adoption, pushing manufacturers towards sustainable and low-emission solutions.

- Market Concentration: Dominated by a mix of multinational corporations and specialized regional players, with the top 5 companies accounting for an estimated 45-55% of the global market share.

- Technological Innovation Drivers:

- Development of high-performance, rapid-setting adhesives for faster project completion.

- Introduction of flexible adhesives for substrates prone to movement and expansion.

- Focus on eco-friendly and low-VOC adhesive formulations.

- Advancements in moisture-resistant and chemical-resistant adhesives for specialized applications.

- Regulatory Frameworks: Stringent regulations on Volatile Organic Compounds (VOCs) and sustainable building practices are promoting the adoption of water-based and low-VOC adhesives.

- Competitive Product Substitutes: While direct substitutes are limited, traditional cementitious mortars with admixtures and epoxy-based adhesives offer alternative solutions for specific applications, though often with higher costs or different performance profiles.

- End-User Demographics: A growing demand from both residential renovation and new construction, alongside a significant contribution from commercial and institutional projects (e.g., retail spaces, healthcare facilities, public infrastructure).

- M&A Trends: The market has witnessed strategic acquisitions aimed at expanding product portfolios, gaining access to new geographical regions, and enhancing technological capabilities. For instance, acquisitions in the past two years have focused on companies with expertise in high-performance polymeric adhesives and sustainable product lines. The volume of M&A deals in the last five years has been approximately 12-15 globally.

Tile And Marble Adhesives Growth Trends & Insights

The global Tile and Marble Adhesives market is poised for substantial growth, driven by the ongoing expansion of the construction industry worldwide and an increasing consumer preference for aesthetically pleasing and durable tiling solutions. The market size is projected to escalate significantly from an estimated XX million units in the base year of 2025 to XX million units by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately 5.5-6.5%. This upward trend is propelled by a confluence of factors including urbanization, rising disposable incomes, and a surge in home renovation activities, particularly in emerging economies.

The adoption rates for advanced adhesive technologies are on the rise. While traditional cement-based adhesives continue to hold a significant share due to their cost-effectiveness, polymeric adhesives are witnessing accelerated adoption owing to their superior flexibility, water resistance, and bonding strength, making them ideal for a wider range of substrates and demanding environments. This shift is also influenced by evolving consumer behavior, which increasingly prioritizes aesthetic appeal, longevity, and ease of installation. Consumers are more informed and actively seek out products that offer superior performance and contribute to the overall value and lifespan of their tiling projects.

Technological disruptions are playing a pivotal role in reshaping the market. Innovations such as rapid-setting adhesives that enable faster project completion without compromising on quality are gaining traction, especially in commercial and high-traffic areas. Furthermore, the development of specialized adhesives tailored for specific tile materials (e.g., large format tiles, natural stones) and substrates (e.g., heated floors, exterior facades) is expanding the application scope and driving market demand. The growing emphasis on sustainable construction practices is also a significant influencer, leading to increased demand for low-VOC and eco-friendly adhesive formulations. Manufacturers are investing heavily in R&D to offer products that meet stringent environmental standards while delivering enhanced performance and ease of use, thereby catering to the evolving preferences of environmentally conscious consumers and regulatory bodies. The market penetration of advanced polymeric adhesives is expected to grow by an estimated 10-15% over the forecast period.

Dominant Regions, Countries, or Segments in Tile And Marble Adhesives

The global Tile and Marble Adhesives market exhibits distinct regional dominance, primarily driven by the robust construction sectors in Asia Pacific and North America. Within the Application segment, Residential applications currently represent the larger market share, fueled by extensive home renovation activities and new housing construction in developing economies. However, the Non-residential segment is expected to witness a higher growth rate, propelled by significant investments in commercial infrastructure, hospitality, and public spaces across major economies.

The Type segment is dominated by Cement Type adhesives, owing to their established track record, cost-effectiveness, and widespread availability, particularly in price-sensitive markets. Nevertheless, Polymeric Type adhesives are rapidly gaining traction and are projected to exhibit a faster CAGR. This surge is attributed to their superior performance characteristics, including enhanced flexibility, water resistance, and adhesion to a wider range of substrates, making them indispensable for modern construction projects demanding higher durability and aesthetic precision.

Asia Pacific stands out as the dominant region, largely due to the rapid urbanization and massive infrastructure development in countries like China, India, and Southeast Asian nations. Government initiatives promoting affordable housing and the expansion of commercial real estate further bolster demand.

- Key Drivers in Asia Pacific:

- Rapid urbanization and population growth.

- Significant government investment in infrastructure development.

- Growth in the middle-class population leading to increased residential construction and renovation.

- Rising disposable incomes supporting investments in premium and durable tiling solutions.

- Increased adoption of advanced construction techniques and materials.

In terms of specific countries, China leads the global market, followed by the United States. The construction boom in China, coupled with its status as a manufacturing hub for tiles and marbles, creates a massive demand for adhesives. The US market benefits from a mature construction sector, significant renovation activities, and a strong emphasis on high-quality finishes.

- Dominance Factors:

- Market Share: Asia Pacific accounts for an estimated 35-40% of the global market share, with China alone contributing over 20%. North America follows with approximately 25-30%.

- Growth Potential: Emerging economies in Asia Pacific and Latin America offer the highest growth potential due to ongoing construction and increasing disposable incomes.

- Technological Adoption: Developed regions like North America and Europe are at the forefront of adopting advanced polymeric adhesives, driving innovation and higher-value sales.

- Economic Policies: Favorable government policies supporting construction and infrastructure projects directly influence market expansion.

- Infrastructure Development: Ongoing projects in commercial, residential, and public sectors are major determinants of regional market dominance.

Tile And Marble Adhesives Product Landscape

The Tile and Marble Adhesives market is characterized by a dynamic product landscape driven by continuous innovation aimed at enhancing performance, application ease, and sustainability. Leading manufacturers are introducing advanced formulations that cater to specific installation challenges and substrate requirements. These include rapid-setting, high-strength adhesives ideal for large-format tiles and heavy stone installations, as well as flexible, crack-bridging adhesives designed to accommodate substrate movement and prevent tile failure. Furthermore, there is a growing emphasis on developing environmentally friendly products with low volatile organic compound (VOC) emissions and enhanced water and chemical resistance for demanding applications like swimming pools and commercial kitchens.

Key Drivers, Barriers & Challenges in Tile And Marble Adhesives

Key Drivers:

- Growing Construction Industry: Robust growth in residential and non-residential construction globally, particularly in emerging economies, is the primary catalyst.

- Increasing Renovation and Remodeling Activities: Consumers are investing in upgrading their living and working spaces, driving demand for aesthetically pleasing and durable tiling solutions.

- Technological Advancements: Development of high-performance, easy-to-use, and specialized adhesives (e.g., rapid-setting, flexible) caters to evolving construction needs.

- Urbanization: Rapid urbanization leads to increased demand for new housing and commercial infrastructure.

- Focus on Durability and Aesthetics: Growing consumer preference for long-lasting and visually appealing tiled surfaces.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials such as polymers and cement can impact manufacturing costs and profitability.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of raw materials and finished products, leading to delays and increased costs.

- Stringent Environmental Regulations: While a driver for innovation, meeting increasingly strict environmental standards can require significant R&D investment and may increase production costs.

- Skilled Labor Shortage: The availability of skilled installers who can properly apply advanced adhesives can be a limiting factor in some regions.

- Competition from Traditional Methods: In some markets, traditional mortar and grout methods, though less effective, may still be preferred due to familiarity and perceived lower cost. The impact of raw material price increases can be estimated at 5-10% on profit margins if not effectively managed.

Emerging Opportunities in Tile And Marble Adhesives

Emerging opportunities in the Tile and Marble Adhesives market lie in the development and promotion of sustainable and eco-friendly adhesive solutions. The increasing global focus on green building initiatives and stringent environmental regulations presents a significant avenue for manufacturers offering low-VOC and water-based formulations. Furthermore, the growing trend towards large-format tiles and the increasing use of natural stones in both residential and commercial spaces create a demand for specialized, high-performance adhesives that can ensure secure and durable installations. The untapped potential in emerging economies, particularly in Africa and parts of Southeast Asia, where construction activities are rapidly expanding, also presents substantial growth opportunities for market players.

Growth Accelerators in the Tile And Marble Adhesives Industry

The Tile and Marble Adhesives industry's long-term growth is significantly accelerated by several key factors. Continued innovation in polymer science is leading to the development of adhesives with enhanced properties such as superior flexibility, improved adhesion to challenging substrates, and faster curing times, thereby enhancing installation efficiency. Strategic partnerships and collaborations between adhesive manufacturers and tile producers or construction companies are also crucial, facilitating market penetration and the development of integrated solutions. Furthermore, aggressive market expansion strategies, including the establishment of local manufacturing facilities and distribution networks in high-growth regions, are vital for capturing market share and catering to regional demands effectively.

Key Players Shaping the Tile And Marble Adhesives Market

- Sika

- Bostik

- BASF

- Henkel

- Mapei

- Saint-Gobain

- H.B. Fuller

- ARDEX ENDURA

- Fosroc

- TAMMY

Notable Milestones in Tile And Marble Adhesives Sector

- 2019: Launch of advanced polymer-modified cementitious adhesives offering enhanced flexibility and water resistance by a leading global player.

- 2020: Increased focus on developing low-VOC and eco-friendly adhesive formulations in response to growing environmental awareness and regulations.

- 2021: Several key players acquired smaller specialty adhesive companies to broaden their product portfolios and technological capabilities.

- 2022: Introduction of rapid-setting adhesives designed for large-format tile installations, reducing project timelines.

- 2023: Innovations in adhesives for heated flooring systems and exterior cladding applications gained significant traction.

- Q1 2024: Release of new generation of single-component, moisture-curing polyurethane adhesives offering superior bond strength and durability.

In-Depth Tile And Marble Adhesives Market Outlook

The outlook for the Tile and Marble Adhesives market remains highly promising, driven by sustained global construction growth and evolving consumer demands for superior aesthetics and durability. Growth accelerators include ongoing technological advancements in adhesive formulations, leading to more versatile, efficient, and sustainable products. Strategic market expansion, particularly into developing regions with burgeoning construction sectors, and collaborations between key industry players will further fuel expansion. The increasing adoption of advanced polymeric adhesives, replacing traditional methods due to their enhanced performance characteristics, signals a strong upward trajectory. The market is well-positioned for robust growth, offering significant opportunities for innovation and investment in the coming years.

Tile And Marble Adhesives Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Non-residential

-

2. Type

- 2.1. Cement Type

- 2.2. Polymeric Type

Tile And Marble Adhesives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tile And Marble Adhesives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Non-residential

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cement Type

- 5.2.2. Polymeric Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Non-residential

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cement Type

- 6.2.2. Polymeric Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Non-residential

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cement Type

- 7.2.2. Polymeric Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Non-residential

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cement Type

- 8.2.2. Polymeric Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Non-residential

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cement Type

- 9.2.2. Polymeric Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tile And Marble Adhesives Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Non-residential

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cement Type

- 10.2.2. Polymeric Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sika

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bostik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henkel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mapei

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saint-Gobain

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 H.B. Fuller

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ARDEX ENDURA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fosroc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TAMMY

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sika

List of Figures

- Figure 1: Global Tile And Marble Adhesives Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tile And Marble Adhesives Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tile And Marble Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tile And Marble Adhesives Revenue (million), by Type 2024 & 2032

- Figure 5: North America Tile And Marble Adhesives Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Tile And Marble Adhesives Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tile And Marble Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tile And Marble Adhesives Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tile And Marble Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tile And Marble Adhesives Revenue (million), by Type 2024 & 2032

- Figure 11: South America Tile And Marble Adhesives Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Tile And Marble Adhesives Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tile And Marble Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tile And Marble Adhesives Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tile And Marble Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tile And Marble Adhesives Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Tile And Marble Adhesives Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Tile And Marble Adhesives Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tile And Marble Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tile And Marble Adhesives Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tile And Marble Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tile And Marble Adhesives Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Tile And Marble Adhesives Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Tile And Marble Adhesives Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tile And Marble Adhesives Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tile And Marble Adhesives Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tile And Marble Adhesives Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tile And Marble Adhesives Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Tile And Marble Adhesives Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Tile And Marble Adhesives Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tile And Marble Adhesives Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tile And Marble Adhesives Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Tile And Marble Adhesives Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Tile And Marble Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Tile And Marble Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Tile And Marble Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Tile And Marble Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tile And Marble Adhesives Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tile And Marble Adhesives Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Tile And Marble Adhesives Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tile And Marble Adhesives Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tile And Marble Adhesives?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Tile And Marble Adhesives?

Key companies in the market include Sika, Bostik, BASF, Henkel, Mapei, Saint-Gobain, H.B. Fuller, ARDEX ENDURA, Fosroc, TAMMY.

3. What are the main segments of the Tile And Marble Adhesives?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tile And Marble Adhesives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tile And Marble Adhesives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tile And Marble Adhesives?

To stay informed about further developments, trends, and reports in the Tile And Marble Adhesives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence