Key Insights

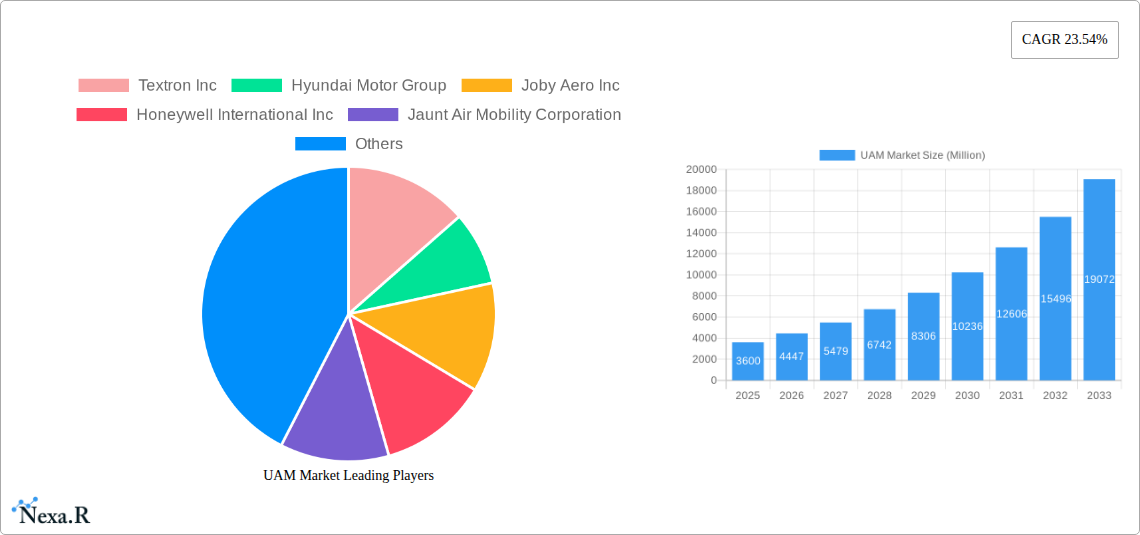

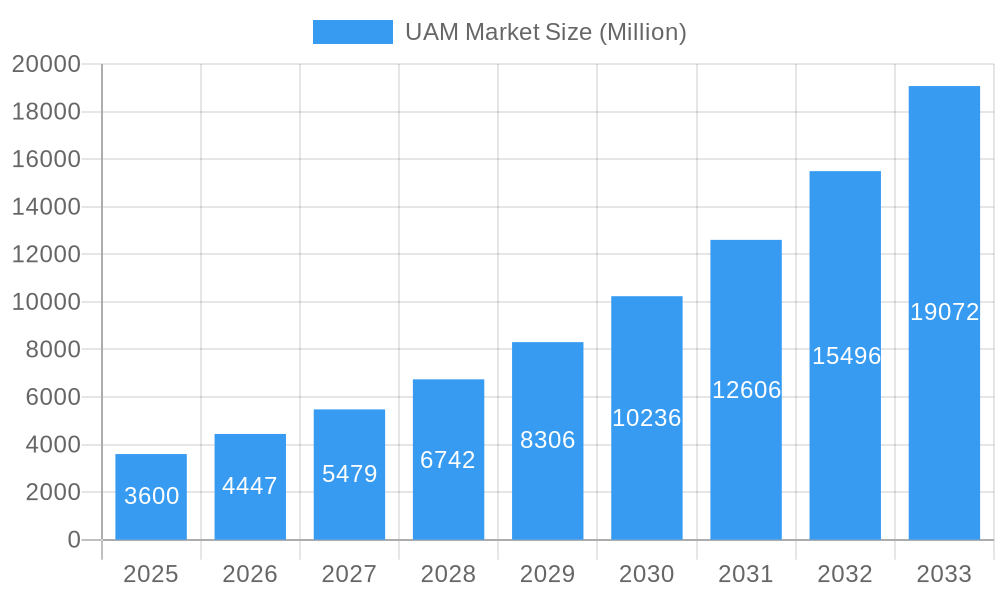

The Urban Air Mobility (UAM) market is poised for explosive growth, projected to reach a substantial size within the next decade. The market's 23.54% CAGR from 2019 to 2024 indicates a strong upward trajectory, driven by several key factors. Increasing urbanization and the consequent strain on existing ground transportation infrastructure are fueling the demand for faster, more efficient, and less congested urban commute solutions. Technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, battery technology, and autonomous flight systems are making UAM a more viable and safer reality. Government initiatives promoting sustainable transportation and investments in UAM infrastructure are also playing a crucial role in accelerating market adoption. The market segmentation reveals a strong focus on both piloted and autonomous vehicles across passenger transport and freighter applications, suggesting a diverse range of use cases emerging. Key players like Textron, Hyundai, Joby Aero, and Airbus are actively engaged in development and deployment, driving innovation and competition. The initial focus on passenger transport is expected to be followed by a significant expansion into freight and logistics, adding another layer of growth to the market.

UAM Market Market Size (In Billion)

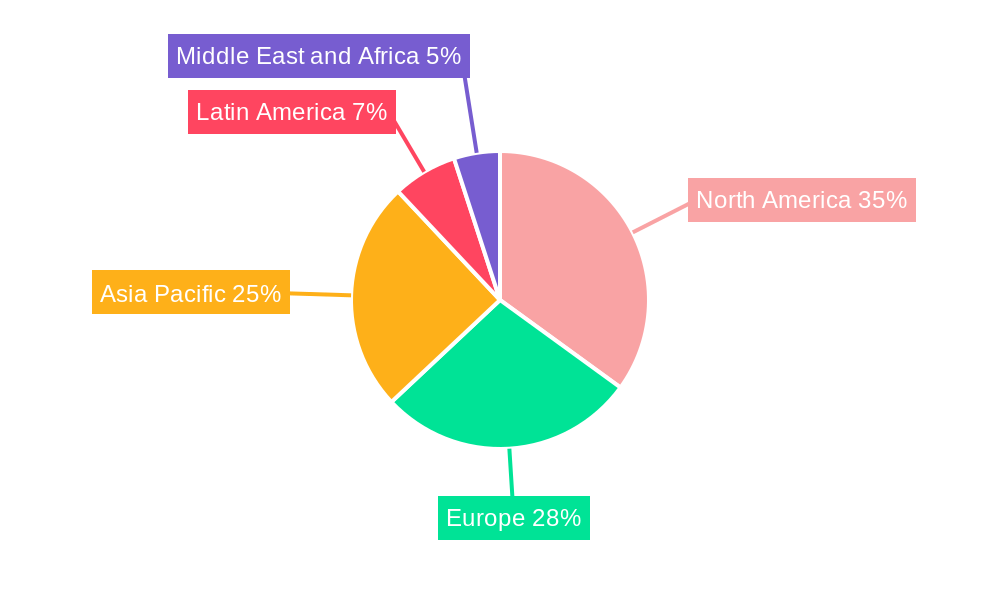

While the market shows remarkable promise, challenges remain. High initial investment costs for both aircraft development and infrastructure deployment pose a significant hurdle. Regulatory frameworks for UAM operations are still evolving, requiring close collaboration between industry stakeholders and governments to ensure safety and standardization. Public perception and acceptance of UAM technology also require careful consideration and proactive communication efforts. Despite these challenges, the long-term growth potential of the UAM market is substantial, driven by its ability to address critical urban mobility challenges and offer innovative transportation solutions. The competitive landscape is dynamic, with both established aerospace giants and innovative startups vying for market share, stimulating further innovation and accelerating the pace of adoption. Regional variations in market penetration will be influenced by factors such as regulatory environments, infrastructure development, and consumer adoption rates. North America and Europe are expected to lead in early adoption, followed by a rapid expansion in the Asia-Pacific region fueled by high population density and rapid urbanization.

UAM Market Company Market Share

This comprehensive report provides a detailed analysis of the Urban Air Mobility (UAM) market, encompassing its current dynamics, future growth trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the burgeoning UAM sector. The report covers both parent (Advanced Air Mobility) and child (Urban Air Mobility) markets, providing a holistic view of the industry landscape.

UAM Market Dynamics & Structure

The UAM market is characterized by a dynamic interplay of technological advancements, regulatory developments, and evolving consumer preferences. Market concentration is currently moderate, with several key players vying for market share, but the landscape is expected to evolve rapidly as new entrants emerge and consolidation occurs. Technological innovation, particularly in electric vertical take-off and landing (eVTOL) aircraft, is a major driver, while regulatory frameworks play a crucial role in shaping market growth. The presence of substitute modes of transportation (e.g., traditional aviation, high-speed rail) poses a competitive challenge. End-user demographics are expanding to encompass a broader range of consumers, from commuters to tourists. M&A activity is increasingly common, reflecting the high growth potential and the desire for consolidation within the sector.

- Market Concentration: Moderate, with significant potential for future consolidation (xx% market share held by top 5 players in 2025).

- Technological Innovation: Rapid advancement in battery technology, autonomous flight systems, and air traffic management solutions.

- Regulatory Frameworks: Evolving regulations regarding airspace management, safety certifications, and operational procedures impact market entry and growth.

- Competitive Substitutes: Traditional aviation, high-speed rail, and other ground transportation options.

- End-User Demographics: Expanding to include commuters, tourists, emergency services, and cargo transport.

- M&A Trends: Increasing activity reflecting the high-growth potential and industry consolidation. Estimated xx M&A deals in the forecast period.

UAM Market Growth Trends & Insights

The UAM market is poised for substantial growth, driven by increasing urbanization, traffic congestion, and the demand for faster and more efficient transportation solutions. The market size is projected to witness a significant expansion, fueled by increasing adoption rates of eVTOL aircraft and evolving consumer preferences for on-demand air travel. Technological disruptions, such as the development of autonomous flight systems and improved battery technologies, are further accelerating market growth. Shifts in consumer behavior, including a growing preference for sustainable and convenient transportation, are also contributing to market expansion. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million units by 2033. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in UAM Market

North America and Europe currently lead the UAM market, driven by robust technological development, favorable regulatory frameworks, and strong investor interest. However, Asia-Pacific is expected to experience rapid growth in the coming years, fueled by significant investment in infrastructure and expanding urban populations. Within the market segments, the passenger transport application currently holds the largest market share, followed by freighter applications. The autonomous segment is gaining traction but faces regulatory and technological hurdles.

- Leading Regions: North America and Europe (holding xx% and xx% market share respectively in 2025).

- Key Growth Drivers (North America): Strong technological advancements, substantial venture capital investment, and progressive regulatory environment.

- Key Growth Drivers (Europe): Government support for sustainable transportation initiatives and a large urban population base.

- Key Growth Drivers (Asia-Pacific): Rapid urbanization, increasing disposable incomes, and government initiatives promoting advanced transportation technologies.

- Segment Dominance: Passenger Transport (xx% market share in 2025), followed by the Freighter segment (xx% market share in 2025).

UAM Market Product Landscape

The UAM market features a diverse range of eVTOL aircraft, each offering unique selling propositions in terms of passenger capacity, range, speed, and operational efficiency. Key innovations include advancements in battery technology, autonomous flight systems, and noise reduction technologies. Performance metrics are constantly improving, leading to increased operational efficiency and enhanced passenger experience. These advancements focus on improving safety, reducing operational costs, and enhancing the overall passenger experience, leading to greater market adoption.

Key Drivers, Barriers & Challenges in UAM Market

Key Drivers: Technological advancements in battery technology, autonomous flight, and air traffic management systems are significant growth drivers. Furthermore, government initiatives promoting sustainable urban transportation and increasing urbanization are propelling market growth. Growing consumer demand for faster and more efficient commuting options further accelerates market expansion.

Key Barriers and Challenges: Regulatory hurdles, including certification processes and airspace management complexities, pose significant challenges. High initial investment costs for infrastructure development and vehicle production present substantial barriers to entry. Supply chain disruptions can affect production timelines and increase costs. Competition among established players and new entrants further adds to the market complexity. The impact of these barriers translates into delayed market penetration and increased development costs, resulting in a slower-than-predicted market growth, estimated to be xx% lower than initially projected.

Emerging Opportunities in UAM Market

Emerging opportunities include expanding into untapped markets such as rural areas and developing countries, providing essential transportation services in underserved regions. Innovative applications, like medical transport, package delivery, and tourism, are also opening up new market segments. Evolving consumer preferences, such as the demand for sustainable and personalized transportation, are also creating new opportunities for UAM service providers.

Growth Accelerators in the UAM Market Industry

Technological breakthroughs in battery technology, leading to increased range and reduced charging times, are key accelerators. Strategic partnerships between UAM companies, infrastructure developers, and aviation authorities are streamlining regulatory processes and facilitating market entry. Market expansion strategies, including collaborations with airlines and transportation networks, are creating new avenues for UAM deployment.

Key Players Shaping the UAM Market Market

- Textron Inc

- Hyundai Motor Group

- Joby Aero Inc

- Honeywell International Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Karem Aircraft Inc

- Guangzhou EHang Intelligent Technology Co Lt

- Safran SA

- PIPISTREL d o o

- Volocopter GmbH

- Embraer SA

- Opener Inc

- The Boeing Company

Notable Milestones in UAM Market Sector

- January 2023: Geely Aerofugia completes the test flight of its AE200 prototype flying car.

- August 2022: Geely Aerofugia unveils a full-size demonstrator for its TF-2 five-seater eVTOL.

- February 2022: Eve UAM LLC signs a partnership agreement with Skyports Pte Ltd for AAM development in Japan.

In-Depth UAM Market Market Outlook

The UAM market is poised for significant expansion, driven by continuous technological advancements, increasing regulatory clarity, and growing consumer acceptance. Strategic partnerships and collaborations will play a crucial role in accelerating market growth. The long-term potential of the UAM market is substantial, offering immense opportunities for innovation and investment. Focus on sustainable technologies, efficient infrastructure development, and addressing regulatory challenges will be crucial for realizing the full potential of the UAM market.

UAM Market Segmentation

-

1. Vehicle Type

- 1.1. Piloted

- 1.2. Autonomous

-

2. Application

- 2.1. Passenger Transport

- 2.2. Freighter

UAM Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

UAM Market Regional Market Share

Geographic Coverage of UAM Market

UAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Autonomous Segment is Projected to Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAM Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Transport

- 5.2.2. Freighter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America UAM Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Transport

- 6.2.2. Freighter

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe UAM Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Transport

- 7.2.2. Freighter

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific UAM Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Transport

- 8.2.2. Freighter

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Latin America UAM Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Transport

- 9.2.2. Freighter

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa UAM Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Transport

- 10.2.2. Freighter

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Motor Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jaunt Air Mobility Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbus SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Karem Aircraft Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guangzhou EHang Intelligent Technology Co Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Safran SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PIPISTREL d o o

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Volocopter GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Embraer SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Opener Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Boeing Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global UAM Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Latin America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Latin America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East and Africa UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East and Africa UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa UAM Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global UAM Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAM Market?

The projected CAGR is approximately 23.54%.

2. Which companies are prominent players in the UAM Market?

Key companies in the market include Textron Inc, Hyundai Motor Group, Joby Aero Inc, Honeywell International Inc, Jaunt Air Mobility Corporation, Airbus SE, Karem Aircraft Inc, Guangzhou EHang Intelligent Technology Co Lt, Safran SA, PIPISTREL d o o, Volocopter GmbH, Embraer SA, Opener Inc, The Boeing Company.

3. What are the main segments of the UAM Market?

The market segments include Vehicle Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Autonomous Segment is Projected to Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, Geely Aerofugia, a subsidiary of the Chinese automaker Geely, announced that it completed the test flight of its prototype flying car AE200, taking a step closer to its goal of delivering electric vertical take-off and landing (eVTOL) vehicles to market. This company first unveiled a full-size demonstrator for its TF-2 five-seater eVTOL in August 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAM Market?

To stay informed about further developments, trends, and reports in the UAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence