Key Insights

The Canadian automotive actuators market is projected for substantial growth, with an estimated market size of $23576.68 million by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This expansion is driven by the increasing integration of Advanced Driver-Assistance Systems (ADAS) and the rising demand for Electric Vehicles (EVs). EVs, in particular, necessitate a higher volume and diverse range of actuators for critical functions such as battery thermal management, regenerative braking, and electric power steering. Evolving consumer preferences for enhanced comfort, safety, and convenience features, including automated seating and power closure systems, further stimulate demand for advanced actuator applications. The market encompasses both passenger cars and commercial vehicles, with electrical actuators leading due to their superior efficiency, reliability, and compatibility with EV platforms.

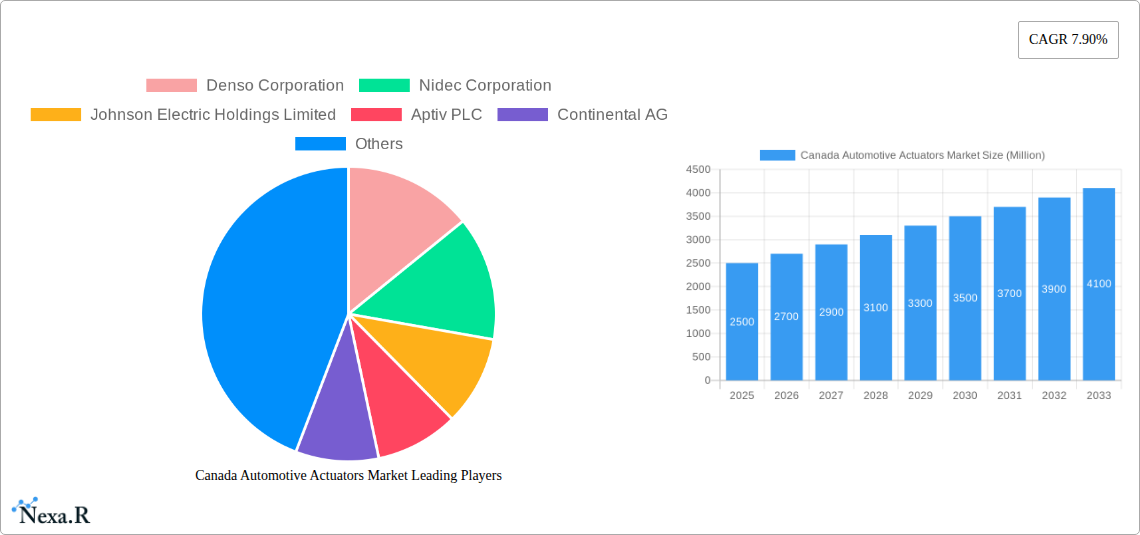

Canada Automotive Actuators Market Market Size (In Billion)

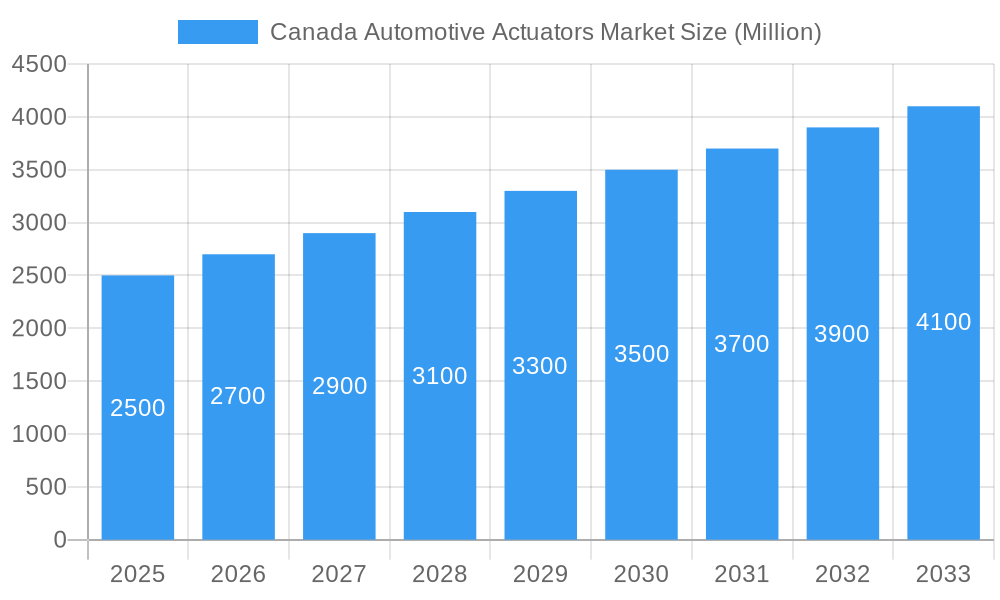

Key factors propelling the Canadian automotive actuators market include stringent government mandates for fuel efficiency and emission reduction, which are driving the adoption of technologies like electronic throttle control and variable valve timing actuators. Additionally, the growing emphasis on automotive cybersecurity indirectly boosts actuator demand by requiring more sophisticated and secure system integrations. Conversely, significant market restraints include the high initial investment required for advanced actuator system development and implementation, alongside the need for specialized manufacturing expertise. Potential challenges also arise from the sensitivity of complex electronic actuators to electromagnetic interference and persistent supply chain vulnerabilities for essential electronic components. Despite these obstacles, major global corporations such as Denso Corporation, Nidec Corporation, and Continental AG are actively pursuing research and development to introduce innovative solutions, focusing on enhanced performance, energy efficiency, and cost-effectiveness to address market complexities and leverage emerging opportunities.

Canada Automotive Actuators Market Company Market Share

Canada Automotive Actuators Market Report: Driving Innovation in Vehicle Performance & Safety

This comprehensive report provides an in-depth analysis of the Canada Automotive Actuators Market, forecasting its trajectory from 2019 to 2033. We meticulously examine the market dynamics, growth trends, product landscape, and key players shaping this crucial sector of the automotive industry. Focusing on parent and child markets, this study offers invaluable insights for stakeholders seeking to capitalize on opportunities within Canada's evolving automotive actuator landscape. All values are presented in Million units for clarity and precision.

Canada Automotive Actuators Market Market Dynamics & Structure

The Canada Automotive Actuators Market is characterized by a moderate to high level of concentration, with a few key global players dominating market share. Technological innovation remains a primary driver, fueled by the increasing demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and enhanced vehicle comfort and safety features. Regulatory frameworks, particularly those promoting emissions reduction and road safety, are indirectly influencing actuator development and adoption. Competitive product substitutes, while evolving, are largely confined within specific actuator technologies. End-user demographics are shifting towards younger, tech-savvy consumers who prioritize sophisticated vehicle features. Merger and acquisition (M&A) trends are anticipated to continue as larger players seek to consolidate their market position and acquire specialized technologies.

- Market Concentration: Dominated by global OEMs and Tier-1 suppliers with established R&D capabilities.

- Technological Innovation Drivers: ADAS integration, EV powertrain advancements, autonomous driving technologies, and the pursuit of fuel efficiency and reduced emissions.

- Regulatory Frameworks: Stringent safety regulations and evolving environmental standards push for more precise and efficient actuation systems.

- Competitive Product Substitutes: While distinct actuator types serve different functions, advancements in electrification are gradually displacing some traditional hydraulic and pneumatic applications.

- End-User Demographics: Growing demand for personalized vehicle experiences and safety-centric features.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand product portfolios, and strengthen market presence.

Canada Automotive Actuators Market Growth Trends & Insights

The Canada Automotive Actuators Market is poised for substantial growth driven by the relentless pursuit of automotive innovation and increasing consumer demand for advanced vehicle functionalities. Fueled by the burgeoning adoption of electric vehicles and the proliferation of sophisticated driver-assistance systems, the market is experiencing a significant upswing. The forecast period anticipates a robust Compound Annual Growth Rate (CAGR) of approximately XX% for the Canada Automotive Actuators Market. This expansion is underpinned by the increasing integration of electrical actuators, which offer superior precision, efficiency, and control, aligning perfectly with the demands of modern vehicle architectures. Consumer behavior is demonstrably shifting towards vehicles equipped with features that enhance safety, comfort, and fuel efficiency, thereby directly boosting the demand for various actuator types such as throttle actuators for optimized engine performance, seat adjustment actuators for enhanced passenger comfort, and brake actuators for superior stopping power and regenerative braking systems in EVs.

The market penetration of advanced actuator technologies is projected to accelerate as manufacturers increasingly prioritize lightweighting and energy efficiency in vehicle design. This trend is particularly pronounced in the passenger car segment, where the integration of smart actuators contributes to a more refined driving experience and improved overall vehicle performance. Furthermore, evolving traffic management systems and the drive towards intelligent transportation infrastructure are indirectly spurring the demand for actuators that enable features like adaptive cruise control and automated parking. The ongoing evolution of automotive software and hardware integration will continue to create new avenues for actuator applications, further solidifying the market's growth trajectory. The base year of 2025 marks a critical point where electrification and automation trends are solidifying, setting a strong foundation for sustained market expansion through 2033.

Dominant Regions, Countries, or Segments in Canada Automotive Actuators Market

Within the Canada Automotive Actuators Market, the Passenger Car segment, specifically powered by Electrical Actuators, stands out as the primary growth engine. This dominance is propelled by several interconnected factors that underscore the evolving automotive landscape.

Vehicle Type Dominance: Passenger Cars:

- Market Share: Passenger cars consistently represent the largest portion of vehicle sales in Canada, naturally translating into higher demand for their associated components, including actuators.

- Technological Adoption: Passenger car manufacturers are at the forefront of adopting advanced technologies, from luxury features to safety innovations, all of which heavily rely on sophisticated actuators.

- EV Transition: The rapid growth of the electric vehicle (EV) market, which primarily comprises passenger cars, is a significant catalyst, as EVs are inherently reliant on electrical actuators for various functions like powertrain management, thermal control, and regenerative braking.

Actuator Type Dominance: Electrical Actuators:

- Precision and Efficiency: Electrical actuators offer superior precision, faster response times, and higher energy efficiency compared to their hydraulic and pneumatic counterparts, making them ideal for the complex control systems in modern vehicles.

- Integration with Electronics: Their seamless integration with vehicle electronic control units (ECUs) and advanced software makes them indispensable for features like ADAS, autonomous driving, and personalized cabin settings.

- Electrification Trend: The overarching shift towards electrification in the automotive industry inherently favors electrical actuators, as they are more compatible with EV powertrains and battery systems.

Application Type Drivers within Passenger Cars:

- Throttle Actuator: While traditional internal combustion engines are being phased out, advanced electronic throttle control systems are still crucial for optimizing performance and emissions in remaining ICE vehicles and play a role in hybrid powertrains.

- Seat Adjustment Actuator: The demand for enhanced passenger comfort and personalized driving experiences drives the widespread adoption of power-adjustable seats, controlled by numerous seat adjustment actuators.

- Brake Actuator: The evolution towards electronic braking systems (EBS) and regenerative braking in EVs significantly boosts the demand for sophisticated brake actuators that enable precise and rapid braking control.

- Closure Actuator: Power liftgates, automatic doors, and soft-close mechanisms, increasingly prevalent in passenger cars for convenience and luxury, are powered by closure actuators.

The dominance of these segments is further reinforced by government incentives for EV adoption, stricter safety mandates requiring advanced braking and ADAS functionalities, and the general consumer expectation for a feature-rich and safe driving experience in passenger vehicles. The Canadian market's emphasis on comfort, safety, and technological advancement in its personal transportation choices firmly positions passenger cars equipped with electrical actuators across various critical applications as the leading segment.

Canada Automotive Actuators Market Product Landscape

The Canada Automotive Actuators Market is witnessing a surge in product innovation, with a strong emphasis on miniaturization, increased power density, and enhanced control precision. Electrical actuators, particularly brushless DC (BLDC) motors and stepper motors, are at the forefront of this evolution, enabling advanced functionalities across various applications. Innovations in materials science are contributing to lighter, more durable actuator components, while sophisticated algorithms are enhancing their responsiveness and energy efficiency. Key product developments include highly integrated actuator modules for ADAS, compact and powerful actuators for EV powertrains, and intelligent actuators for adaptive seating and advanced climate control systems. The unique selling proposition of these advanced actuators lies in their ability to seamlessly integrate with vehicle electronics, providing precise control for critical functions, thereby improving safety, performance, and passenger comfort.

Key Drivers, Barriers & Challenges in Canada Automotive Actuators Market

The Canada Automotive Actuators Market is propelled by several key drivers. The accelerating adoption of Electric Vehicles (EVs) is a primary catalyst, as EVs inherently require a greater number and variety of actuators for powertrain management, thermal control, and regenerative braking. Furthermore, the increasing integration of Advanced Driver-Assistance Systems (ADAS) and the gradual move towards autonomous driving technologies necessitate highly precise and responsive actuators for steering, braking, and throttle control. Growing consumer demand for enhanced vehicle comfort and convenience features, such as power seats, liftgates, and adjustable steering columns, also fuels market expansion.

However, the market faces significant barriers and challenges. The high cost of developing and implementing advanced actuator technologies can be a restraint, particularly for smaller automotive manufacturers. Supply chain disruptions, including the availability of raw materials and semiconductors, continue to pose a challenge, impacting production timelines and costs. Stringent regulatory requirements for automotive safety and emissions necessitate rigorous testing and validation, adding to development expenses. Moreover, intense competition among established players and emerging entrants puts pressure on pricing and profit margins.

Emerging Opportunities in Canada Automotive Actuators Market

Emerging opportunities in the Canada Automotive Actuators Market are closely tied to the burgeoning electrification and automation trends. The increasing complexity of EV thermal management systems presents a significant opportunity for specialized thermal actuators. The growing demand for in-cabin personalization and modular interior designs will drive the need for versatile and adaptive actuators for seating, lighting, and HVAC systems. Furthermore, the development of smart city initiatives and connected vehicle technologies opens avenues for actuators that enable vehicle-to-infrastructure (V2I) communication and advanced traffic management applications.

Growth Accelerators in the Canada Automotive Actuators Market Industry

Several catalysts are accelerating growth in the Canada Automotive Actuators Market. Technological breakthroughs in miniaturization and power efficiency of electric motors are enabling more compact and integrated actuator solutions. Strategic partnerships between actuator manufacturers and automotive OEMs are fostering collaborative development, leading to faster innovation cycles and tailored solutions. The ongoing push for vehicle lightweighting, achieved through advanced materials and integrated actuator designs, contributes to fuel efficiency and reduced emissions, further boosting demand. Market expansion strategies, including the development of actuators for emerging vehicle segments like commercial electric vans and specialized mobility solutions, are also playing a crucial role.

Key Players Shaping the Canada Automotive Actuators Market Market

- Denso Corporation

- Nidec Corporation

- Johnson Electric Holdings Limited

- Aptiv PLC

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Hitachi Lt

- Stoneridge Inc

- Mitsubishi Electric

Notable Milestones in Canada Automotive Actuators Market Sector

- 2019-2024: Increased focus on electrification leading to higher adoption of electrical actuators in new vehicle models.

- 2021: Significant supply chain disruptions for semiconductors impacting actuator production globally and in Canada.

- 2022: Growing government incentives for EV adoption driving demand for actuator-rich electric vehicles.

- 2023: Advancements in AI and machine learning enabling more sophisticated control algorithms for actuators in ADAS.

- 2024: Intensified research and development in actuators for advanced battery thermal management systems in EVs.

In-Depth Canada Automotive Actuators Market Market Outlook

The future outlook for the Canada Automotive Actuators Market is exceptionally promising, driven by transformative forces within the automotive industry. The sustained growth of EVs and the relentless advancement of ADAS technologies are set to be the primary growth accelerators, demanding an ever-increasing sophistication and volume of actuators. Strategic partnerships between established automotive giants and innovative actuator suppliers will be crucial in co-developing next-generation solutions. The market's expansion will be further fueled by a commitment to vehicle lightweighting and energy efficiency, leading to the adoption of more integrated and power-dense actuator designs. Exploring untapped markets in commercial electric mobility and specialized autonomous vehicle applications presents significant strategic opportunities for market players.

Canada Automotive Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Actuators Type

- 2.1. Electrical actuators

- 2.2. Hydraulic actuators

- 2.3. Pneumatic actuators

-

3. Application Type

- 3.1. Throttle Actuator

- 3.2. Seat Adjustment Actuator

- 3.3. Brake Actuator

- 3.4. Closure Actuator

- 3.5. Other

Canada Automotive Actuators Market Segmentation By Geography

- 1. Canada

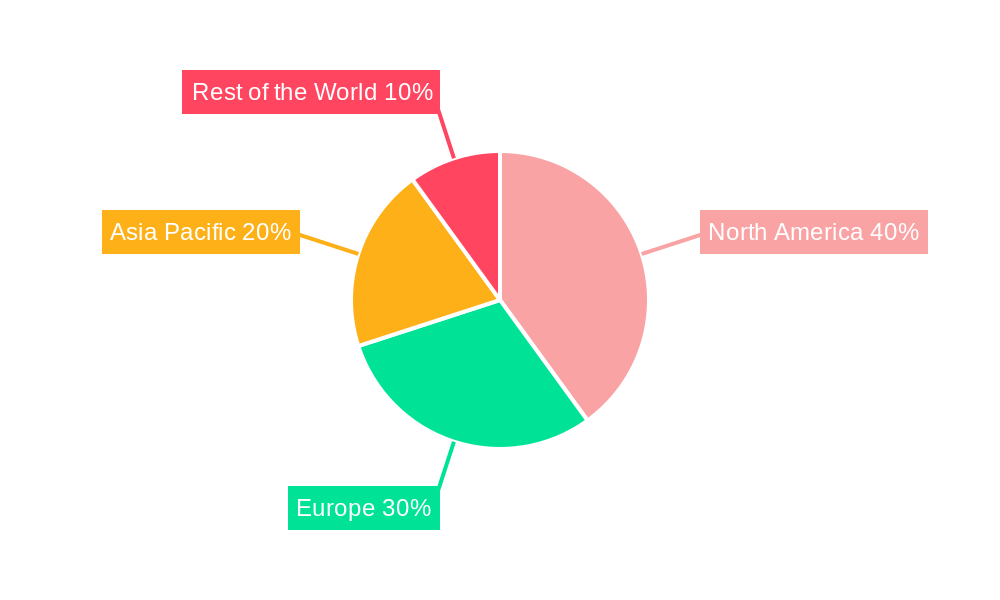

Canada Automotive Actuators Market Regional Market Share

Geographic Coverage of Canada Automotive Actuators Market

Canada Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electrification of Vehicles

- 3.3. Market Restrains

- 3.3.1. Precise Testing and Validation

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Actuators Type

- 5.2.1. Electrical actuators

- 5.2.2. Hydraulic actuators

- 5.2.3. Pneumatic actuators

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Throttle Actuator

- 5.3.2. Seat Adjustment Actuator

- 5.3.3. Brake Actuator

- 5.3.4. Closure Actuator

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Electric Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Lt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stoneridge Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Canada Automotive Actuators Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Canada Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 3: Canada Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Actuators Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canada Automotive Actuators Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Canada Automotive Actuators Market Revenue million Forecast, by Actuators Type 2020 & 2033

- Table 7: Canada Automotive Actuators Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canada Automotive Actuators Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Actuators Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Actuators Market?

Key companies in the market include Denso Corporation, Nidec Corporation, Johnson Electric Holdings Limited, Aptiv PLC, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Hitachi Lt, Stoneridge Inc, Mitsubishi Electric.

3. What are the main segments of the Canada Automotive Actuators Market?

The market segments include Vehicle Type, Actuators Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23576.68 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electrification of Vehicles.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Precise Testing and Validation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence