Key Insights

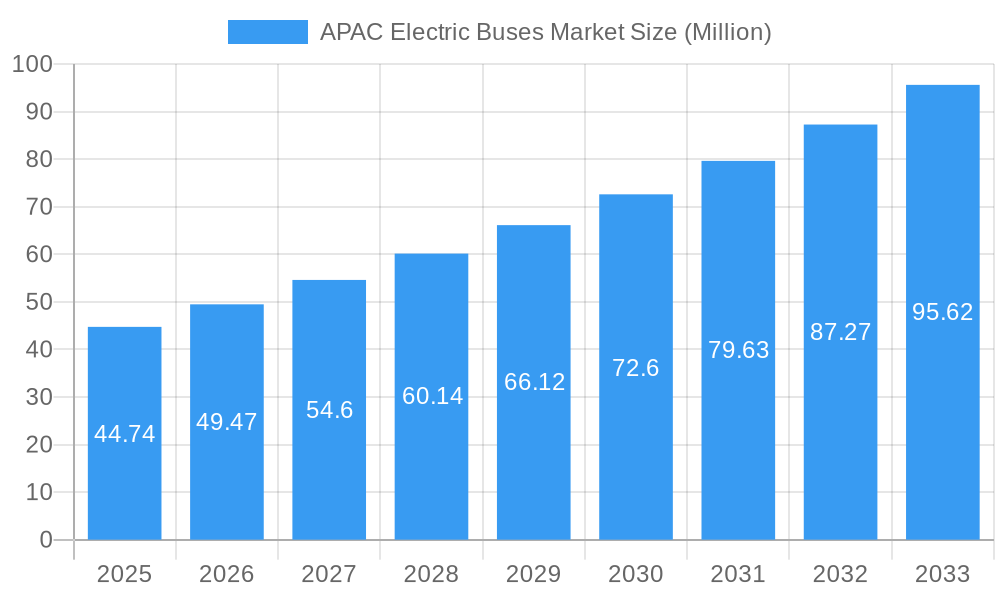

The APAC Electric Buses Market is poised for substantial growth, projected to reach a market size of USD 44.74 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 10.55% through 2033. This rapid expansion is primarily driven by a confluence of factors including stringent government regulations aimed at curbing vehicular emissions and promoting sustainable transportation, coupled with increasing investments in public transportation infrastructure across the region. The rising environmental consciousness among consumers and a growing demand for cleaner, quieter, and more efficient public transport solutions are further bolstering market penetration. Key trends include the rapid adoption of Battery Electric Buses due to advancements in battery technology and decreasing costs, alongside the strategic integration of DC/AC inverters and DC/DC converters to optimize power management and enhance operational efficiency.

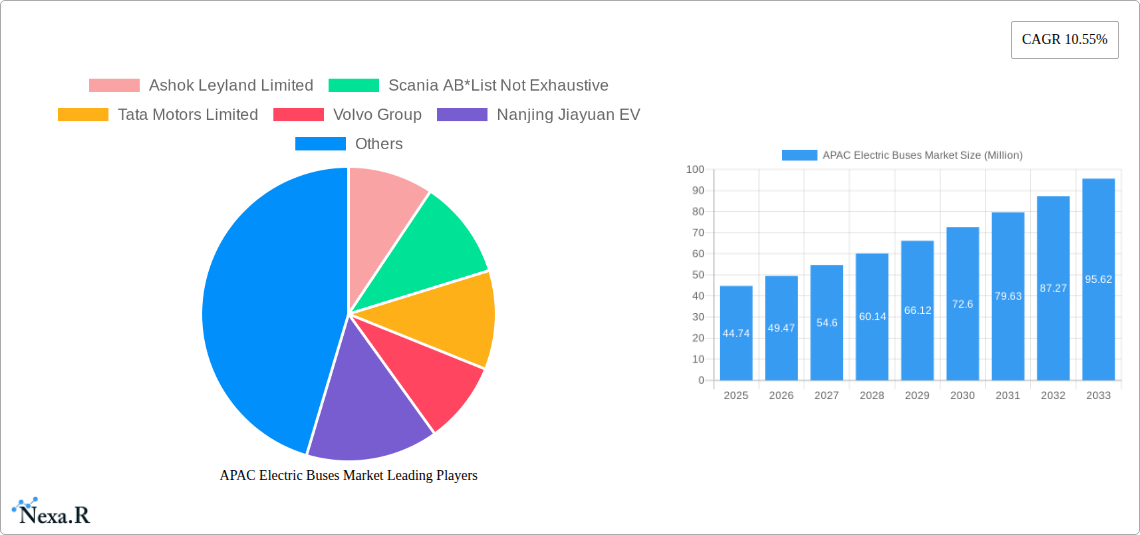

APAC Electric Buses Market Market Size (In Million)

The market's growth trajectory is further supported by supportive government policies, subsidies, and favorable financing options for electric bus procurement by fleet operators and government bodies. However, challenges such as the high initial cost of electric buses and the need for widespread charging infrastructure development, particularly in remote areas, present potential restraints. Despite these hurdles, the strong commitment from major automotive players like BYD Auto, Tata Motors, and Ashok Leyland, along with significant investments in research and development for next-generation electric bus technologies, are expected to overcome these limitations. Emerging economies within the APAC region are increasingly recognizing the long-term economic and environmental benefits of electrifying their bus fleets, signaling a robust future for the APAC electric bus market. The competitive landscape is characterized by intense innovation and strategic partnerships aimed at expanding production capacities and market reach.

APAC Electric Buses Market Company Market Share

APAC Electric Buses Market: Navigating a Transformative Era in Sustainable Public Transportation (2024-2033)

This comprehensive report provides an in-depth analysis of the APAC Electric Buses Market, a rapidly evolving sector driven by ambitious sustainability goals, technological advancements, and supportive government policies. Covering the period from 2019 to 2033, with a base year of 2025, this report offers critical insights into market dynamics, growth trends, key segments, product landscape, and the competitive environment. We explore the burgeoning demand for electric buses in Asia Pacific, the increasing adoption of zero-emission public transport, and the significant role of battery electric buses and plug-in hybrid electric buses in shaping urban mobility. The report meticulously details the market's trajectory, from historical performance (2019-2024) to future projections (2025-2033), providing actionable intelligence for stakeholders including government bodies, fleet operators, and manufacturers of electric bus components such as DC/AC inverters, DC/DC converters, E-motors, and AC/DC chargers.

APAC Electric Buses Market Dynamics & Structure

The APAC Electric Buses Market is characterized by a dynamic interplay of factors shaping its rapid growth. Market concentration, while evolving, is significant, with leading players investing heavily in R&D and manufacturing expansion. Technological innovation is a primary driver, fueled by advancements in battery technology, charging infrastructure, and powertrain efficiency, all crucial for the widespread adoption of electric public transit. Regulatory frameworks across APAC nations are increasingly supportive, with subsidies, tax incentives, and stringent emission standards compelling a shift away from conventional fossil fuel vehicles. Competitive product substitutes, though diminishing, still exist, primarily in the form of highly efficient diesel or CNG buses, but the long-term sustainability and operational cost benefits of electric buses are increasingly outweighing these. End-user demographics are primarily driven by urban population growth and the imperative to combat air pollution.

- Market Concentration: Dominated by a few key global and regional manufacturers, but with growing fragmentation as new players enter.

- Technological Innovation Drivers: Increasing battery energy density, faster charging solutions, vehicle-to-grid (V2G) capabilities, and lightweight materials.

- Regulatory Frameworks: Government mandates for fleet electrification, subsidies for electric bus purchases, and carbon emission reduction targets.

- Competitive Product Substitutes: While present, their long-term viability is challenged by the increasing cost-effectiveness and environmental benefits of electric buses.

- End-User Demographics: Urban centers with high population density, aging fleets, and strong environmental consciousness.

- M&A Trends: Expect to see strategic acquisitions and joint ventures aimed at expanding manufacturing capacity, securing supply chains, and accessing new markets.

APAC Electric Buses Market Growth Trends & Insights

The APAC Electric Buses Market is poised for unprecedented growth, driven by a confluence of factors that are fundamentally reshaping urban transportation. The market size is projected to experience a robust expansion over the forecast period, fueled by increasing government commitments to decarbonize public transport fleets and the growing awareness among consumers regarding environmental sustainability. Adoption rates for electric buses are accelerating across major economies in the region, driven by favorable total cost of ownership, reduced operational expenses due to lower energy and maintenance costs compared to diesel buses, and the intrinsic environmental benefits. Technological disruptions, such as the continuous improvements in battery technology leading to longer ranges and faster charging times, are crucial enablers. Furthermore, shifts in consumer behavior, with a growing preference for cleaner and quieter public transport options, are indirectly influencing policy decisions and fleet procurement.

The market penetration of electric buses in APAC is still in its nascent stages in many sub-regions, presenting a significant opportunity for growth. The overall market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period (2025-2033). By 2025, the market is estimated to reach a volume of 58,200 Million units in sales, and it is projected to expand to approximately 185,500 Million units by 2033. These figures underscore the transformative impact of electric mobility on the APAC region's public transportation sector. The demand for battery electric buses will continue to dominate, accounting for over 85% of the market share, while plug-in hybrid electric buses will serve as a transitional technology in certain geographies. The increasing integration of smart technologies, such as fleet management systems and real-time passenger information, further enhances the appeal and efficiency of electric bus operations. The ongoing investment in charging infrastructure, both public and private, is another critical factor supporting this upward growth trajectory. The desire to reduce urban air pollution and greenhouse gas emissions is a primary motivator for governments and municipal authorities to accelerate the electrification of their bus fleets, leading to significant procurement orders from leading manufacturers.

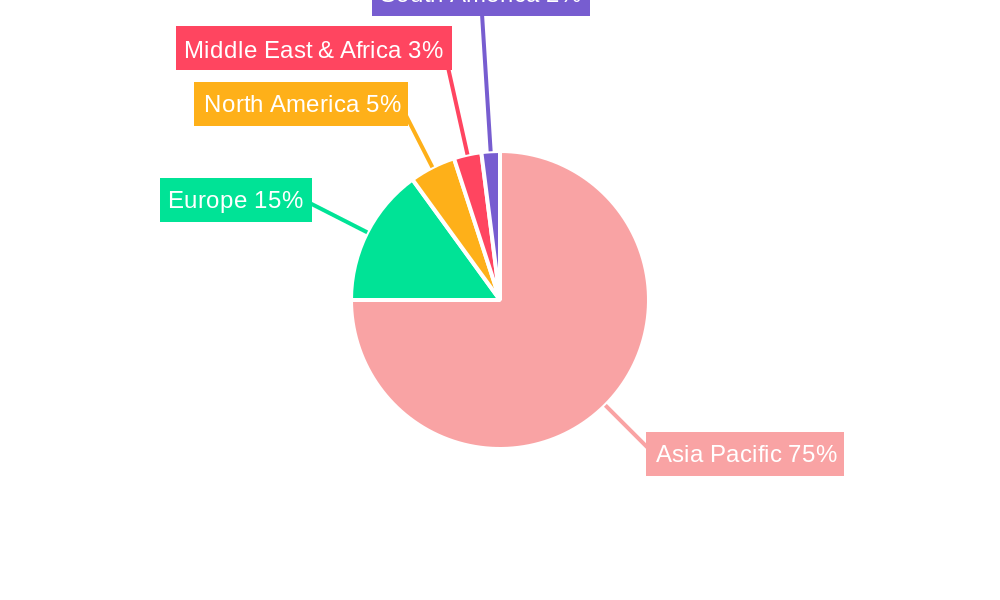

Dominant Regions, Countries, or Segments in APAC Electric Buses Market

The APAC Electric Buses Market is experiencing dynamic growth across various segments, with certain regions, countries, and specific product categories emerging as dominant forces. China stands out as the undisputed leader, driven by its massive domestic market, advanced manufacturing capabilities, and strong government support for electric vehicle adoption. The country's ambitious targets for fleet electrification and its extensive investment in charging infrastructure have propelled it to the forefront of the global electric bus landscape. Following China, India is rapidly emerging as a major player, with significant government initiatives like the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme and substantial orders being placed by public transport authorities. Countries like South Korea and Japan are also witnessing increasing adoption, driven by technological innovation and a strong emphasis on sustainable urban development.

Within vehicle types, the Battery Electric Bus segment is overwhelmingly dominant, driven by its zero-emission capabilities and lower operational costs over the vehicle's lifecycle. This segment is expected to capture over 85% of the market share throughout the forecast period. The Plug-in Hybrid Electric Bus segment, while smaller, plays a crucial role as a transitional technology, offering flexibility in regions where charging infrastructure is still under development.

In terms of power sources, the E-Motor is the core component and the most significant segment in terms of value and technological development. Advancements in e-motor efficiency and power density are directly contributing to the performance of electric buses. The AC/DC Charger segment is also experiencing substantial growth due to the expanding charging infrastructure required to support these fleets. The DC/DC Converter and DC/AC Inverter segments are critical for efficient power management within the electric powertrain.

The primary consumer segment driving this market is the Government, which plays a pivotal role through policy incentives, direct procurement, and setting fleet electrification targets. Fleet Operators, including public transportation agencies and private bus companies, are increasingly investing in electric buses to meet regulatory requirements, reduce operating costs, and enhance their corporate social responsibility profile. The estimated market share for electric buses in APAC is expected to reach over 30% of the total bus market by 2030. Key drivers for this dominance include:

- Government Subsidies and Incentives: Significant financial support from national and local governments in China, India, and other key markets.

- Urbanization and Population Growth: Increasing demand for public transportation in rapidly growing urban centers.

- Environmental Regulations and Air Quality Concerns: Stricter emission standards and a growing focus on combating urban pollution.

- Technological Advancements: Improvements in battery technology, charging speeds, and vehicle range making electric buses more viable.

- Lower Total Cost of Ownership: Reduced fuel and maintenance costs compared to traditional diesel buses.

APAC Electric Buses Market Product Landscape

The APAC electric bus product landscape is characterized by continuous innovation, focusing on enhancing performance, efficiency, and passenger experience. Manufacturers are introducing diverse models catering to various operational needs, from city transit buses to intercity coaches. Key product innovations include advancements in battery technology, leading to longer ranges and faster charging capabilities. For instance, the deployment of high-energy-density batteries allows for extended operational periods between charges, crucial for urban routes. Furthermore, the integration of smart technologies, such as advanced driver-assistance systems (ADAS) and intelligent fleet management solutions, is enhancing safety and operational efficiency. The focus is also on improving passenger comfort through advanced climate control systems and quieter cabin environments.

Key Drivers, Barriers & Challenges in APAC Electric Buses Market

The APAC Electric Buses Market is propelled by a set of powerful drivers that are accelerating its growth and transformation. Foremost among these are government mandates and incentives, which actively encourage the adoption of zero-emission public transportation. Technological advancements, particularly in battery technology and charging infrastructure, are making electric buses increasingly viable and cost-effective. The rising environmental consciousness and the global push towards decarbonization further bolster demand.

- Technological Drivers: Improved battery life, faster charging, enhanced motor efficiency.

- Economic Drivers: Reduced operational and maintenance costs, government subsidies and tax benefits.

- Policy-Driven Factors: Stringent emission regulations, urban air quality initiatives.

However, the market also faces significant barriers and challenges that need to be addressed for sustained growth. The high upfront cost of electric buses remains a primary concern, although declining battery costs and government subsidies are mitigating this. The availability and reliability of charging infrastructure, especially in less developed urban areas, are critical hurdles. Supply chain disruptions for key components like batteries and semiconductors can also impact production and delivery timelines.

- Supply Chain Issues: Dependence on critical raw materials for batteries and potential disruptions.

- Regulatory Hurdles: Inconsistent policies across different countries and regions.

- Competitive Pressures: Intense competition among established and emerging manufacturers.

- Infrastructure Development: Slow rollout of widespread and reliable charging networks.

- High Initial Investment: The upfront purchase price of electric buses can be a barrier for some operators.

Emerging Opportunities in the APAC Electric Buses Market

The APAC Electric Buses Market is ripe with emerging opportunities, driven by innovation and evolving market demands. The rapid urbanization across the region presents a continuous need for efficient and sustainable public transportation solutions. Opportunities abound in the development and deployment of advanced charging solutions, including fast-charging stations, battery-swapping technologies, and vehicle-to-grid (V2G) integration, which can enhance operational flexibility and grid stability. Furthermore, the growing demand for specialized electric bus applications, such as electric school buses and electric shuttle services for corporate campuses and tourist destinations, offers significant untapped potential. The increasing focus on smart city initiatives also creates avenues for integrating electric buses with broader intelligent transportation systems, enhancing traffic management and passenger convenience. The potential for second-life battery applications and battery recycling also presents a sustainable business model opportunity.

Growth Accelerators in the APAC Electric Buses Market Industry

Several key catalysts are accelerating the long-term growth of the APAC Electric Buses Market. The continuous innovation in battery technology, leading to higher energy densities, longer lifespans, and reduced costs, is a fundamental growth accelerator. Strategic partnerships and collaborations between bus manufacturers, battery suppliers, charging infrastructure providers, and fleet operators are crucial for creating integrated ecosystems and streamlining the adoption process. Government policies, including ambitious fleet electrification targets, favorable subsidies, and the development of supportive charging infrastructure, play a pivotal role in driving market expansion. Furthermore, the increasing corporate focus on Environmental, Social, and Governance (ESG) principles is encouraging private sector investment and procurement of electric buses, further accelerating the transition to sustainable urban mobility.

Key Players Shaping the APAC Electric Buses Market

- Ashok Leyland Limited

- Scania AB

- Tata Motors Limited

- Volvo Group

- Nanjing Jiayuan EV

- King Long United Automotive Co Limited

- Zhongtong Bus Holding Co Limited

- BYD Auto Co Limited

- Anhui Ankai Automobile Industries Co Limited

Notable Milestones in APAC Electric Buses Market Sector

- August 2022: Ashok Leyland's subsidiary Switch Mobility Ltd. secured an order to supply 200 air-conditioned electric double-decker buses from BEST in Mumbai. The buses, from the EiV22 family, are powered by a 231 kWh battery and will replace existing fossil fuel-powered double-decker buses.

- August 2022: CAUSIS E-Mobility, part of London-based CAUSIS Group, opened its office in Pune. In October 2021, the company signed an MoU with the Government of Maharashtra to set up its second electric bus manufacturing facility in India at Pune. They have secured an order to supply 700 electric buses to BEST in India and already operate a manufacturing facility in Jaipur.

- May 2022: Olectra Greentech Ltd. secured an order to supply 2100 electric buses to BEST in Mumbai, valued at INR 3675 million.

- August 2022: Switch Mobility Ltd. (Ashok Leyland Ltd.) won an order to supply 5000 electric buses to integrated Indian transport company Chalo. An MoU for an initial three-year period will see Chalo deploy Switch EiV12 electric buses across all Indian cities it operates in.

- July 2022: Tata Motors Ltd. bagged an order to supply 1500 electric buses to Delhi Transport Corporation (DTC). Tata Motors will supply, operate, and maintain 12-meter long electric buses built on the Starbus platform for 12 years.

- August 2022: The Volvo Eicher joint venture, VE Commercial Vehicles Ltd., floated a separate subsidiary for electric buses named VE Electro Mobility to raise capital and pursue aggressive expansion in the electromobility space.

- January 2022: CRRC Electric, a Chinese manufacturer, delivered 30 units of C11 electric buses to Seoul, South Korea. These buses are 11 meters in length.

- February 2022: Toyota, Isuzu, and Hino (Toyota subsidiary) announced plans to launch their first jointly developed electric bus in Japan by 2024.

In-Depth APAC Electric Buses Market Market Outlook

The APAC Electric Buses Market is set for a future characterized by rapid technological advancement, widespread adoption, and a significant contribution to sustainable urban development. The growth accelerators identified, including advancements in battery technology, strategic partnerships, and robust government support, are poised to create a market trajectory of sustained expansion. The increasing integration of electric buses into smart city ecosystems and the development of new business models, such as battery-as-a-service and innovative charging solutions, will further enhance market potential. Stakeholders can expect continued investment in manufacturing capacities, R&D for next-generation electric powertrains, and the expansion of charging infrastructure across the region, solidifying the electric bus as the dominant mode of public transportation in APAC in the coming decade.

APAC Electric Buses Market Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Bus

- 1.2. Plug-in Hybrid Electric Bus

-

2. Power Source

- 2.1. DC/AC Inverter

- 2.2. DC/DC Converter

- 2.3. DC/DC Boost Converter

- 2.4. E-Motor

- 2.5. AC/DC Charger

- 2.6. Motor Controller

-

3. Consumer

- 3.1. Government

- 3.2. Fleet Operators

APAC Electric Buses Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Electric Buses Market Regional Market Share

Geographic Coverage of APAC Electric Buses Market

APAC Electric Buses Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. Battery Electric Bus Segment to Play Prominent Role in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Bus

- 5.1.2. Plug-in Hybrid Electric Bus

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. DC/AC Inverter

- 5.2.2. DC/DC Converter

- 5.2.3. DC/DC Boost Converter

- 5.2.4. E-Motor

- 5.2.5. AC/DC Charger

- 5.2.6. Motor Controller

- 5.3. Market Analysis, Insights and Forecast - by Consumer

- 5.3.1. Government

- 5.3.2. Fleet Operators

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Battery Electric Bus

- 6.1.2. Plug-in Hybrid Electric Bus

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. DC/AC Inverter

- 6.2.2. DC/DC Converter

- 6.2.3. DC/DC Boost Converter

- 6.2.4. E-Motor

- 6.2.5. AC/DC Charger

- 6.2.6. Motor Controller

- 6.3. Market Analysis, Insights and Forecast - by Consumer

- 6.3.1. Government

- 6.3.2. Fleet Operators

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Battery Electric Bus

- 7.1.2. Plug-in Hybrid Electric Bus

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. DC/AC Inverter

- 7.2.2. DC/DC Converter

- 7.2.3. DC/DC Boost Converter

- 7.2.4. E-Motor

- 7.2.5. AC/DC Charger

- 7.2.6. Motor Controller

- 7.3. Market Analysis, Insights and Forecast - by Consumer

- 7.3.1. Government

- 7.3.2. Fleet Operators

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Battery Electric Bus

- 8.1.2. Plug-in Hybrid Electric Bus

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. DC/AC Inverter

- 8.2.2. DC/DC Converter

- 8.2.3. DC/DC Boost Converter

- 8.2.4. E-Motor

- 8.2.5. AC/DC Charger

- 8.2.6. Motor Controller

- 8.3. Market Analysis, Insights and Forecast - by Consumer

- 8.3.1. Government

- 8.3.2. Fleet Operators

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Battery Electric Bus

- 9.1.2. Plug-in Hybrid Electric Bus

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. DC/AC Inverter

- 9.2.2. DC/DC Converter

- 9.2.3. DC/DC Boost Converter

- 9.2.4. E-Motor

- 9.2.5. AC/DC Charger

- 9.2.6. Motor Controller

- 9.3. Market Analysis, Insights and Forecast - by Consumer

- 9.3.1. Government

- 9.3.2. Fleet Operators

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific APAC Electric Buses Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Battery Electric Bus

- 10.1.2. Plug-in Hybrid Electric Bus

- 10.2. Market Analysis, Insights and Forecast - by Power Source

- 10.2.1. DC/AC Inverter

- 10.2.2. DC/DC Converter

- 10.2.3. DC/DC Boost Converter

- 10.2.4. E-Motor

- 10.2.5. AC/DC Charger

- 10.2.6. Motor Controller

- 10.3. Market Analysis, Insights and Forecast - by Consumer

- 10.3.1. Government

- 10.3.2. Fleet Operators

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashok Leyland Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Scania AB*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tata Motors Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Volvo Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nanjing Jiayuan EV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 King Long United Automotive Co Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhongtong Bus Holding Co Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BYD Auto Co Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Anhui Ankai Automobile Industries Co Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ashok Leyland Limited

List of Figures

- Figure 1: Global APAC Electric Buses Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Electric Buses Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America APAC Electric Buses Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America APAC Electric Buses Market Revenue (Million), by Power Source 2025 & 2033

- Figure 5: North America APAC Electric Buses Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 6: North America APAC Electric Buses Market Revenue (Million), by Consumer 2025 & 2033

- Figure 7: North America APAC Electric Buses Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 8: North America APAC Electric Buses Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Electric Buses Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Electric Buses Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America APAC Electric Buses Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America APAC Electric Buses Market Revenue (Million), by Power Source 2025 & 2033

- Figure 13: South America APAC Electric Buses Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 14: South America APAC Electric Buses Market Revenue (Million), by Consumer 2025 & 2033

- Figure 15: South America APAC Electric Buses Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 16: South America APAC Electric Buses Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Electric Buses Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Electric Buses Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe APAC Electric Buses Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe APAC Electric Buses Market Revenue (Million), by Power Source 2025 & 2033

- Figure 21: Europe APAC Electric Buses Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 22: Europe APAC Electric Buses Market Revenue (Million), by Consumer 2025 & 2033

- Figure 23: Europe APAC Electric Buses Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 24: Europe APAC Electric Buses Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Electric Buses Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Electric Buses Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa APAC Electric Buses Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa APAC Electric Buses Market Revenue (Million), by Power Source 2025 & 2033

- Figure 29: Middle East & Africa APAC Electric Buses Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 30: Middle East & Africa APAC Electric Buses Market Revenue (Million), by Consumer 2025 & 2033

- Figure 31: Middle East & Africa APAC Electric Buses Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 32: Middle East & Africa APAC Electric Buses Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Electric Buses Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Electric Buses Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific APAC Electric Buses Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific APAC Electric Buses Market Revenue (Million), by Power Source 2025 & 2033

- Figure 37: Asia Pacific APAC Electric Buses Market Revenue Share (%), by Power Source 2025 & 2033

- Figure 38: Asia Pacific APAC Electric Buses Market Revenue (Million), by Consumer 2025 & 2033

- Figure 39: Asia Pacific APAC Electric Buses Market Revenue Share (%), by Consumer 2025 & 2033

- Figure 40: Asia Pacific APAC Electric Buses Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Electric Buses Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 3: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 4: Global APAC Electric Buses Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 7: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 8: Global APAC Electric Buses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 14: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 15: Global APAC Electric Buses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 21: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 22: Global APAC Electric Buses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 34: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 35: Global APAC Electric Buses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Electric Buses Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global APAC Electric Buses Market Revenue Million Forecast, by Power Source 2020 & 2033

- Table 44: Global APAC Electric Buses Market Revenue Million Forecast, by Consumer 2020 & 2033

- Table 45: Global APAC Electric Buses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Electric Buses Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Electric Buses Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the APAC Electric Buses Market?

Key companies in the market include Ashok Leyland Limited, Scania AB*List Not Exhaustive, Tata Motors Limited, Volvo Group, Nanjing Jiayuan EV, King Long United Automotive Co Limited, Zhongtong Bus Holding Co Limited, BYD Auto Co Limited, Anhui Ankai Automobile Industries Co Limited.

3. What are the main segments of the APAC Electric Buses Market?

The market segments include Vehicle Type, Power Source, Consumer.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

Battery Electric Bus Segment to Play Prominent Role in the Market.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

In August 2022, Ashok Leyland's subsidiary Switch Mobility Ltd. secured an order to supply 200 air-conditioned electric double-decker buses from BEST in Mumbai. The double-decker buses are from EiV22 family and are powered by a 231 kWh battery, The buses will replace the existing fossil fuel powered double-decker buses in the BEST fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Electric Buses Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Electric Buses Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Electric Buses Market?

To stay informed about further developments, trends, and reports in the APAC Electric Buses Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence