Key Insights

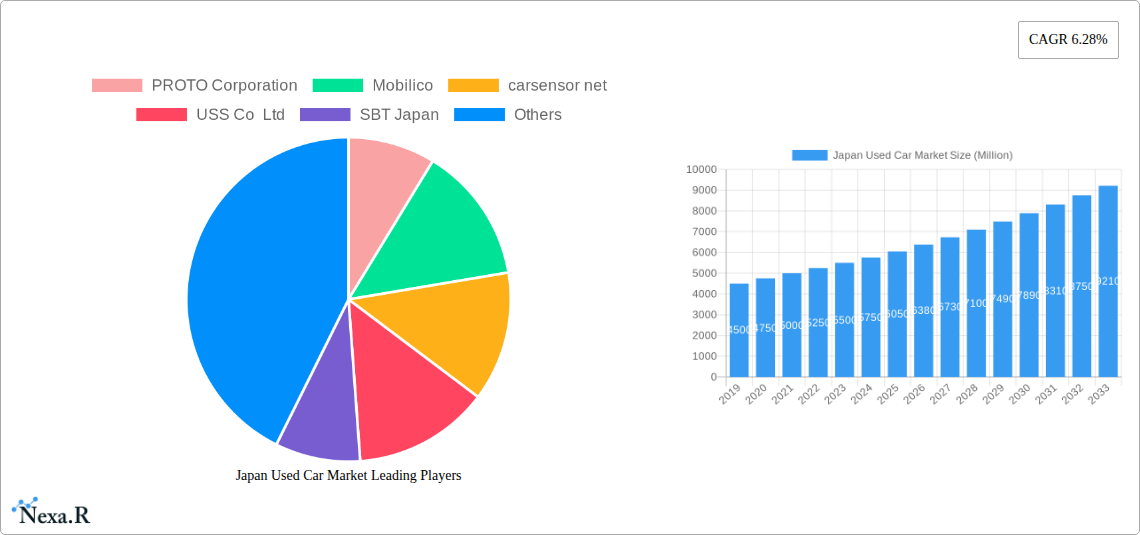

The Japan Used Car Market is projected to expand significantly, with an estimated market size of ¥6.67 billion by 2024, growing at a Compound Annual Growth Rate (CAGR) of 6.38% through 2033. Key growth drivers include increasing demand for cost-effective and sustainable transportation, a rising preference for pre-owned vehicles, and the proliferation of transparent online purchasing platforms. Government initiatives supporting vehicle longevity and the circular economy also bolster market vitality. Evolving consumer preferences, with SUVs and MPVs gaining popularity alongside sedans and hatchbacks, reflect changing Japanese lifestyles.

Japan Used Car Market Market Size (In Billion)

Digitalization is a defining trend, enhancing the used car transaction process through online booking and OEM-certified dealerships, fostering trust and convenience. While economic fluctuations and evolving emissions regulations may present challenges, the overall outlook remains strong, driven by channel innovation and sustained consumer demand for value in automotive solutions.

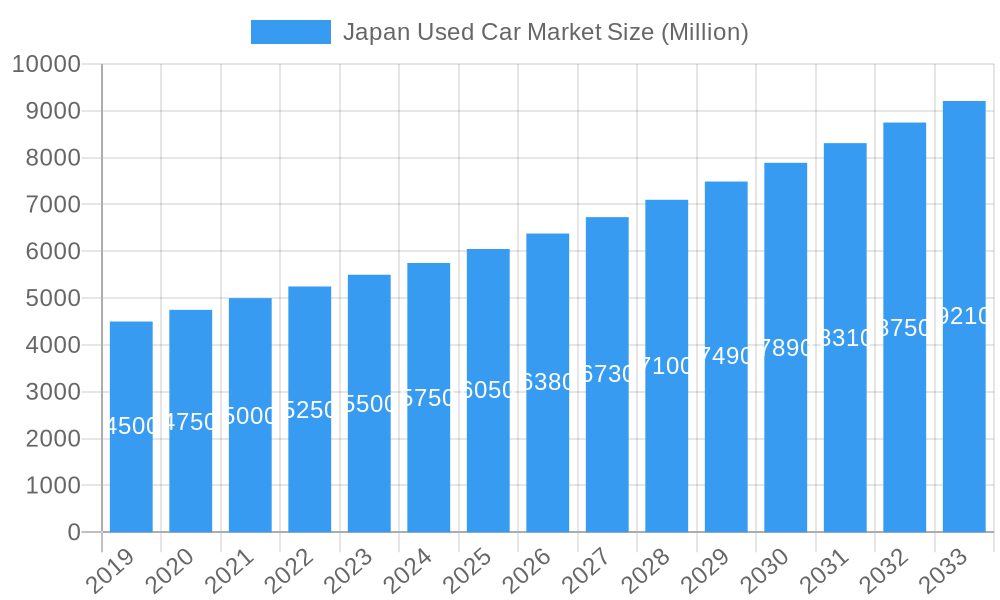

Japan Used Car Market Company Market Share

This comprehensive report delivers critical insights into the dynamics, growth trajectory, and competitive landscape of the Japan Used Car Market. It examines market concentration, technological advancements, regulatory environments, and consumer behavior, providing essential intelligence for industry professionals, investors, and stakeholders. The report utilizes high-impact keywords and detailed data across parent and child market segments for unparalleled visibility and actionable strategies.

Japan Used Car Market Market Dynamics & Structure

The Japan Used Car Market exhibits a moderately concentrated structure, with key players like USS Co Ltd and PROTO Corporation dominating auction and online platforms. Technological innovation, particularly in digital inspection tools and online marketplaces, is a significant driver, lowering transaction barriers and enhancing transparency. Regulatory frameworks, while generally supportive of the used car trade, are constantly evolving to address issues of vehicle history reporting and environmental standards. Competitive product substitutes include new vehicle sales and the burgeoning ride-sharing sector, though the affordability and accessibility of used cars maintain their strong appeal. End-user demographics are diverse, ranging from budget-conscious individuals and young families to enthusiasts seeking specialized vehicles. Mergers and acquisitions (M&A) trends are observed as larger entities seek to consolidate market share and expand their service offerings.

- Market Concentration: Dominated by auction houses and major online portals.

- Technological Innovation: Digitalization of inspection, online sales platforms, and AI-driven pricing are key enablers.

- Regulatory Frameworks: Focus on vehicle safety, emissions, and consumer protection.

- Competitive Product Substitutes: New car sales, car-sharing services.

- End-User Demographics: Broad appeal across income brackets and age groups.

- M&A Trends: Consolidation to achieve economies of scale and broader geographical reach.

Japan Used Car Market Growth Trends & Insights

The Japan Used Car Market is poised for substantial growth, driven by a confluence of economic, technological, and behavioral shifts. The market size evolution indicates a steady upward trend, fueled by increasing adoption rates of online purchasing channels and a growing preference for cost-effective vehicle solutions. Technological disruptions, such as enhanced vehicle diagnostics and blockchain for vehicle history tracking, are further solidifying consumer trust and market efficiency. Consumer behavior is demonstrably shifting towards greater reliance on digital platforms for research, price comparison, and transaction finalization. The market penetration of online booking channels has witnessed a significant surge, reflecting a generational preference for convenience and transparency. Furthermore, the increasing demand for specific vehicle types, like SUVs and MPVs, is reshaping inventory dynamics. The underlying economic sentiment and government initiatives supporting domestic consumption also play a crucial role in sustaining this growth trajectory. The CAGR for the Japan Used Car Market is projected to be robust, underscoring the sector's resilience and future potential.

Dominant Regions, Countries, or Segments in Japan Used Car Market

The Japan Used Car Market is experiencing dynamic growth across various segments, with particular dominance observed in key vehicle types and booking channels. Among vehicle types, the Sports Utility Vehicle (SUV) segment is a significant growth driver, reflecting global trends and the Japanese consumer's preference for versatility and comfort. Hatchbacks and Sedans also maintain a strong presence due to their practicality and widespread appeal. The Online booking channel has emerged as the most dominant, capitalizing on convenience, wider selection, and competitive pricing. This shift is further empowered by the increasing trust in digital platforms for vehicle transactions.

- Vehicle Type Dominance:

- Sports Utility Vehicle (SUV): High growth potential driven by lifestyle preferences and family needs.

- Hatchbacks & Sedans: Consistent demand due to affordability and practicality.

- Booking Channel Dominance:

- Online: Rapidly growing due to accessibility, transparency, and a vast inventory.

- Multi-Brand Dealerships: Offer diverse choices and competitive pricing, contributing significantly to market volume.

- Transaction Type Influence:

- Full Payment: Remains a preferred method for many, reflecting financial prudence.

- Finance: Growing in popularity, especially among younger buyers and for higher-value vehicles.

- Key Drivers:

- Economic Policies: Government incentives for domestic consumption and trade-in programs boost demand.

- Infrastructure: Well-developed logistics networks facilitate nationwide delivery of used vehicles.

- Consumer Behavior: Increasing comfort with online transactions and a focus on value for money.

- Market Share: Online platforms and multi-brand dealerships hold significant combined market share.

- Growth Potential: The shift towards online channels and the enduring popularity of SUVs indicate strong future growth.

Japan Used Car Market Product Landscape

The product landscape of the Japan Used Car Market is characterized by a diverse offering of reliable and well-maintained pre-owned vehicles. Innovations in vehicle inspection technologies, such as advanced diagnostic tools and virtual walk-arounds, enhance the appeal and transparency of used car listings. The performance metrics of these vehicles are often backed by detailed service histories and stringent quality checks, ensuring customer satisfaction. Unique selling propositions often revolve around specific models with proven durability, fuel efficiency, or unique features. Technological advancements in areas like autonomous driving features and advanced safety systems are increasingly present in the used car inventory, catering to a more sophisticated buyer.

Key Drivers, Barriers & Challenges in Japan Used Car Market

Key Drivers:

- Affordability: Used cars offer a significantly lower entry price point compared to new vehicles.

- Wide Selection: Extensive inventory across various makes, models, and price ranges caters to diverse consumer needs.

- Technological Advancement: Digital platforms and inspection tools enhance transparency and convenience.

- Environmental Consciousness: Consumers opting for used vehicles contribute to reduced manufacturing emissions.

- Reliability of Japanese Cars: Renowned for their durability, Japanese used cars hold their value well.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in new car production can indirectly impact used car supply.

- Regulatory Hurdles: Evolving emission standards and inspection requirements can pose challenges.

- Consumer Trust: Ensuring consistent transparency and fair pricing across all transactions remains paramount.

- Geographical Limitations: Efficient nationwide logistics and delivery for all regions.

- Competitive Pressure: Intense competition among dealerships and online platforms.

Emerging Opportunities in Japan Used Car Market

Emerging opportunities within the Japan Used Car Market lie in the expansion of specialized online marketplaces catering to niche segments, such as classic cars or electric vehicles. The increasing consumer demand for eco-friendly options presents a significant opening for the promotion and sale of used hybrid and electric vehicles, supported by accessible charging infrastructure. Furthermore, the integration of advanced data analytics and AI can lead to more personalized recommendations and predictive maintenance services for used car buyers, enhancing customer loyalty. The potential for cross-border sales, particularly to regions with high demand for reliable Japanese used cars, also represents an untapped market.

Growth Accelerators in the Japan Used Car Market Industry

Growth in the Japan Used Car Market is being significantly accelerated by technological breakthroughs that enhance transparency and efficiency. The widespread adoption of online auction platforms and digital retailing tools streamlines the buying and selling process, making it more accessible and convenient for consumers. Strategic partnerships between established dealerships and innovative tech companies are fostering new service models, such as enhanced vehicle history verification and virtual test drives. Market expansion strategies, including the development of seamless cross-regional logistics and financing solutions, are also playing a crucial role in driving long-term growth by reaching a broader customer base.

Key Players Shaping the Japan Used Car Market Market

- PROTO Corporation

- Mobilico

- carsensor net

- USS Co Ltd

- SBT Japan

- Crown Japan

- Yokohama Toyopet

- ORIX Auto Corporation

- Autocom Japan Inc

- Trust Co Ltd

Notable Milestones in Japan Used Car Market Sector

- August 2022: Lexus, the Japanese luxury carmaker, announced a new initiative for the sale and purchase of used Lexus vehicles. The new Lexus Certified Program will allow existing Lexus owners to sell their vehicles and new buyers to obtain pre-owned vehicles that have passed a rigorous inspection.

- January 2022: Carused.jp launched a new partner program. As authorized partners of the company, sellers will be certified local agents who will provide the service of importing cars to local customers under the Carused.jp brand.

In-Depth Japan Used Car Market Market Outlook

The Japan Used Car Market is projected for sustained and robust growth in the coming years, driven by an increasing preference for value and convenience among consumers. Future market potential is strongly tied to the continued digitalization of the sales process, with online platforms becoming the primary touchpoint for many buyers. Strategic opportunities include enhancing the financing and warranty options for used vehicles, thereby reducing perceived risks for consumers. The market is also expected to benefit from advancements in vehicle reconditioning and certification processes, further bolstering consumer confidence. The industry's ability to adapt to evolving environmental regulations and to effectively market used EVs will also be critical for long-term success.

Japan Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicle

- 1.4. Multi-purpose Vehicle (MPV)

-

2. Booking Channel

- 2.1. Online

- 2.2. OEM Certified/Authorized Dealerships

- 2.3. Multi-Brand Dealerships

-

3. Transaction Type

- 3.1. Full Payment

- 3.2. Finance

Japan Used Car Market Segmentation By Geography

- 1. Japan

Japan Used Car Market Regional Market Share

Geographic Coverage of Japan Used Car Market

Japan Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Growing Online Used Car Sales Aiding the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle

- 5.1.4. Multi-purpose Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Booking Channel

- 5.2.1. Online

- 5.2.2. OEM Certified/Authorized Dealerships

- 5.2.3. Multi-Brand Dealerships

- 5.3. Market Analysis, Insights and Forecast - by Transaction Type

- 5.3.1. Full Payment

- 5.3.2. Finance

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PROTO Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mobilico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 carsensor net

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 USS Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SBT Japan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Japan*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokohama Toyopet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ORIX Auto Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autocom Japan Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trust Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PROTO Corporation

List of Figures

- Figure 1: Japan Used Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Japan Used Car Market Revenue billion Forecast, by Booking Channel 2020 & 2033

- Table 3: Japan Used Car Market Revenue billion Forecast, by Transaction Type 2020 & 2033

- Table 4: Japan Used Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Japan Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Japan Used Car Market Revenue billion Forecast, by Booking Channel 2020 & 2033

- Table 7: Japan Used Car Market Revenue billion Forecast, by Transaction Type 2020 & 2033

- Table 8: Japan Used Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Used Car Market?

The projected CAGR is approximately 6.38%.

2. Which companies are prominent players in the Japan Used Car Market?

Key companies in the market include PROTO Corporation, Mobilico, carsensor net, USS Co Ltd, SBT Japan, Crown Japan*List Not Exhaustive, Yokohama Toyopet, ORIX Auto Corporation, Autocom Japan Inc, Trust Co Ltd.

3. What are the main segments of the Japan Used Car Market?

The market segments include Vehicle Type, Booking Channel, Transaction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Growing Online Used Car Sales Aiding the Market.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Lexus, the Japanese luxury carmaker, announced a new initiative for the sale and purchase of used Lexus vehicles. The new Lexus Certified Program will allow the existing Lexus owners to sell their vehicles and new buyers to obtain pre-owned vehicles that have passed a rigorous inspection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Used Car Market?

To stay informed about further developments, trends, and reports in the Japan Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence