Key Insights

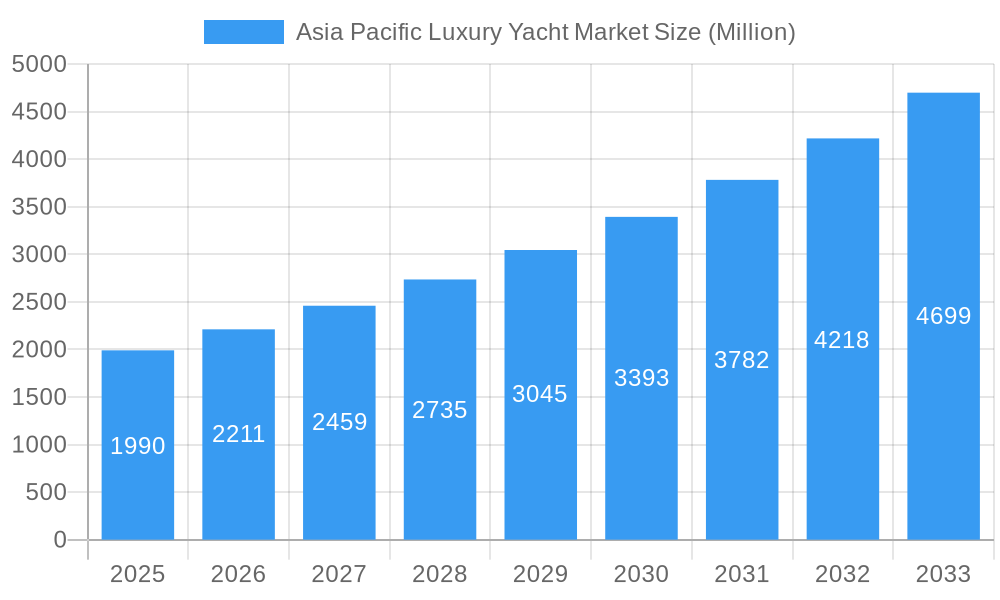

The Asia Pacific luxury yacht market is poised for remarkable expansion, projected to reach USD 1.99 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.30% anticipated through 2033. This robust growth trajectory is fueled by a confluence of factors, primarily the burgeoning wealth and increasing disposable income across key nations like China, India, and Southeast Asian countries. A rising class of affluent individuals is increasingly seeking exclusive leisure experiences, with luxury yachting emerging as a prominent symbol of status and a preferred mode of nautical recreation. The market is witnessing a strong demand for both sailing and motorized luxury yachts, indicating a diverse range of preferences among buyers. Notably, mid-sized yachts (20 to 50 meters) are expected to dominate the landscape, catering to a balance of luxury, maneuverability, and operational feasibility. The application segment is seeing a healthy split between commercial uses, such as charter services, and private ownership, reflecting the dual appeal of these vessels for both investment and personal enjoyment.

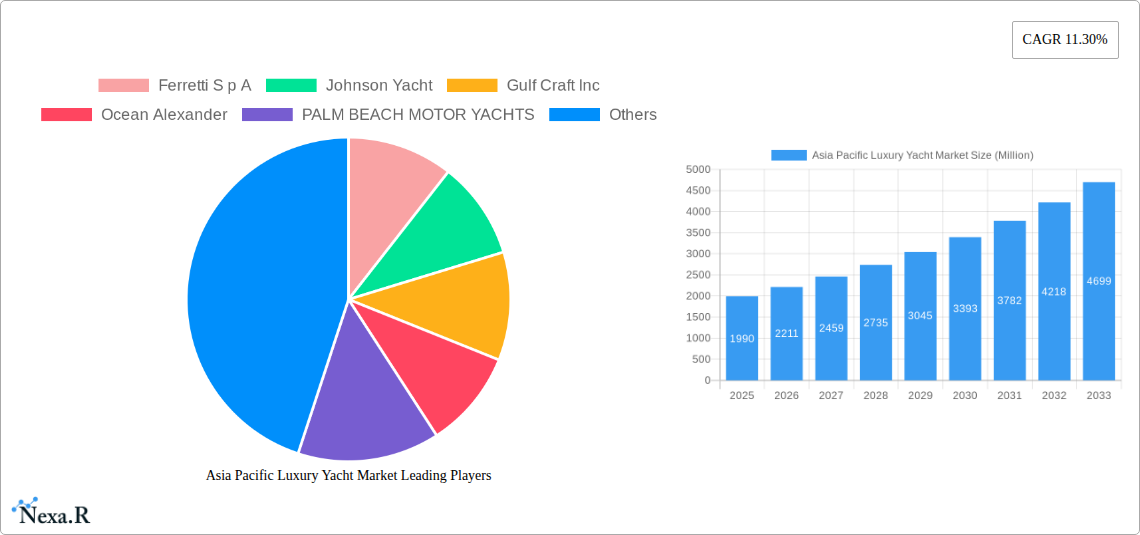

Asia Pacific Luxury Yacht Market Market Size (In Billion)

Further driving the market's ascent are evolving consumer trends that prioritize bespoke experiences and cutting-edge technology. Manufacturers are responding with innovative designs, advanced features, and enhanced customization options, creating highly desirable products for the discerning Asia Pacific clientele. The growing popularity of nautical tourism and the development of sophisticated marina infrastructure in countries like Singapore, Thailand, and Australia are also playing a significant role in boosting market accessibility and appeal. While the market is experiencing substantial tailwinds, potential restraints such as complex import regulations in certain regions and the high cost of ownership and maintenance could pose challenges. However, the overwhelming positive economic sentiment, coupled with a growing appreciation for the maritime lifestyle, suggests these hurdles will likely be overcome, paving the way for sustained and significant growth in the Asia Pacific luxury yacht sector.

Asia Pacific Luxury Yacht Market Company Market Share

This report offers an in-depth analysis of the Asia Pacific Luxury Yacht Market, encompassing a detailed examination of its dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this research provides invaluable insights for stakeholders seeking to capitalize on the burgeoning opportunities within this high-value sector. We delve into both parent and child market segments to provide a holistic view of the industry's evolution and potential. All values are presented in Million units, with the exception of CAGR and market share percentages.

Asia Pacific Luxury Yacht Market Market Dynamics & Structure

The Asia Pacific Luxury Yacht Market is characterized by a moderately concentrated structure, with a few key global players holding significant market share, alongside a growing number of regional manufacturers and custom builders. Technological innovation is a primary driver, fueled by advancements in marine engineering, hull design, propulsion systems, and integrated smart technologies that enhance performance, efficiency, and onboard comfort. The regulatory framework varies across the region, with some nations implementing stricter environmental standards and safety regulations, while others offer incentives for marine tourism and yacht ownership. Competitive product substitutes primarily include high-end resort experiences and other luxury leisure assets, though the unique appeal of yachting remains distinct. End-user demographics are increasingly sophisticated, comprising high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) seeking exclusive leisure, privacy, and status. Mergers and Acquisitions (M&A) trends are on the rise as established players seek to expand their geographical reach and product portfolios, while smaller, innovative companies are acquired for their technological prowess. For instance, recent M&A activities have seen strategic investments by major European shipyards into Asian distribution networks. Barriers to innovation often stem from the high cost of research and development for specialized marine components and the long lead times associated with custom yacht construction.

- Market Concentration: Dominated by a mix of established global luxury yacht brands and emerging regional players.

- Technological Innovation Drivers: Advancements in hull efficiency, sustainable propulsion, advanced navigation systems, and smart yacht integration.

- Regulatory Frameworks: Evolving environmental, safety, and import/export regulations across various APAC nations.

- Competitive Product Substitutes: Luxury hotels, private villas, exclusive travel experiences, and other high-value assets.

- End-User Demographics: Predominantly HNWIs and UHNWIs with a preference for bespoke experiences and privacy.

- M&A Trends: Increasing consolidation to gain market access, technological capabilities, and brand equity. For example, a significant acquisition in 2023 saw a European superyacht builder acquire a controlling stake in a leading Asian shipyard to bolster its presence.

Asia Pacific Luxury Yacht Market Growth Trends & Insights

The Asia Pacific Luxury Yacht Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is driven by a confluence of economic prosperity, a growing affluent population, and a rising appreciation for bespoke leisure experiences. Market size evolution indicates a steady upward trajectory, moving from approximately $xx Million units in 2019 to an estimated $xx Million units by 2033. Adoption rates for luxury yachts are steadily increasing, particularly in emerging economies within the region, as more individuals attain the financial capacity and desire for ownership. Technological disruptions are playing a significant role, with the integration of cutting-edge navigation, entertainment, and sustainability features becoming standard expectations. Innovations such as hybrid propulsion systems, advanced hull materials for enhanced fuel efficiency, and sophisticated AI-driven onboard management systems are setting new benchmarks. Consumer behavior shifts are also evident, with a growing demand for personalized customization, eco-conscious yachting options, and an emphasis on seamless ownership experiences. The appeal of chartering luxury yachts for exclusive holidays and business events is also gaining traction, further contributing to market penetration. The region's extensive coastlines, pristine islands, and burgeoning marine tourism infrastructure create an ideal environment for yacht ownership and exploration. Furthermore, government initiatives promoting maritime tourism and luxury lifestyle offerings in countries like Thailand, Indonesia, and Australia are acting as significant growth catalysts. The increasing availability of advanced marina facilities and skilled maintenance services is also bolstering confidence among potential buyers. The desire for privacy and the ability to create unique travel itineraries unconstrained by typical tourism infrastructure are strong motivators for luxury yacht acquisition and chartering.

Dominant Regions, Countries, or Segments in Asia Pacific Luxury Yacht Market

The Motorized Luxury Yacht segment, specifically within the 20 to 50 Meters size category, is currently driving significant growth in the Asia Pacific Luxury Yacht Market. This dominance is particularly pronounced in key countries such as Australia, China, and Southeast Asian nations like Thailand and Indonesia. Australia, with its established yachting culture, extensive coastline, and robust economy, consistently leads in terms of both ownership and chartering of luxury motor yachts. Its well-developed marina infrastructure and a strong demand for recreational boating contribute to its leadership position. China's rapidly expanding affluent population and increasing disposable income have made it a crucial growth market, with a surging interest in larger, more opulent motor yachts for private use and corporate entertaining. Southeast Asian countries, benefiting from their appeal as exotic travel destinations and supportive government policies for luxury tourism, are witnessing substantial growth in both sales and charter activities.

The dominance of Motorized Luxury Yachts in the 20-50 meter range is attributed to several factors. These vessels offer a compelling balance of size, luxury, performance, and usability, making them ideal for private cruising, island hopping, and entertaining. They provide ample space for amenities and comfort while remaining manageable for owners or with a professional crew. The Commercial application segment, particularly for charter operations catering to the growing tourism sector, is a significant contributor to the dominance of this segment. High-end charter companies are investing heavily in modern, well-equipped motor yachts to attract discerning international and domestic clientele.

- Dominant Yacht Type: Motorized Luxury Yacht – offering superior speed, comfort, and a wider range of amenities.

- Dominant Size Segment: 20 to 50 Meters – providing an ideal balance of spaciousness, luxury, and operational feasibility.

- Key Countries Driving Growth:

- Australia: Mature market with high disposable income, extensive coastlines, and established yachting infrastructure.

- China: Rapidly growing affluent population, increasing demand for luxury goods and experiences.

- Southeast Asia (Thailand, Indonesia, Singapore): Emerging luxury tourism hubs, attractive cruising grounds, and supportive government policies.

- Dominant Application: Commercial (charter) and Private ownership, with chartering playing a crucial role in market penetration and revenue generation.

- Key Drivers of Dominance:

- Economic Policies: Favorable import duties and incentives for luxury tourism in some nations.

- Infrastructure Development: Growth in high-end marinas and support services.

- Consumer Preferences: Demand for privacy, exclusivity, and bespoke travel experiences.

- Rising Disposable Income: Increased affordability for HNWIs and UHNWIs.

Asia Pacific Luxury Yacht Market Product Landscape

The product landscape of the Asia Pacific Luxury Yacht Market is characterized by a relentless pursuit of innovation, focusing on enhanced performance, cutting-edge technology, and sustainable design. Key product innovations include the integration of advanced navigation and communication systems, sophisticated entertainment suites, and intelligent onboard automation. Builders are increasingly incorporating eco-friendly technologies, such as hybrid propulsion, solar energy integration, and waste management systems, to appeal to environmentally conscious buyers. Performance metrics are continually being optimized through advanced hull designs and lighter, stronger composite materials. Unique selling propositions often lie in the level of customization offered, allowing clients to tailor every aspect of their yacht, from interior design to specific functionalities. Technological advancements are also seen in the development of more efficient and quieter engines, advanced stabilization systems for smoother rides, and sophisticated security features.

Key Drivers, Barriers & Challenges in Asia Pacific Luxury Yacht Market

Key Drivers:

- Economic Growth and Wealth Accumulation: The burgeoning wealth of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) across the Asia Pacific region is the primary driver for luxury yacht acquisition.

- Growing Maritime Tourism Industry: Increased investment in tourism infrastructure, including high-end marinas and exclusive destinations, is boosting the appeal of yachting as a leisure activity.

- Technological Advancements: Innovations in design, propulsion, and onboard technology are creating more appealing and efficient yachts.

- Desire for Privacy and Exclusivity: Luxury yachts offer an unparalleled level of privacy and a unique platform for bespoke travel experiences.

Key Barriers & Challenges:

- High Acquisition and Maintenance Costs: The significant financial outlay required for purchasing and maintaining a luxury yacht remains a considerable barrier for many potential buyers.

- Complex Regulatory and Import/Export Procedures: Navigating diverse and sometimes stringent regulations across different countries can be challenging. For example, import duties in some markets can add substantially to the overall cost.

- Limited Availability of Skilled Labor and Infrastructure: A shortage of experienced crew and specialized maintenance personnel, along with insufficient advanced marina facilities in certain areas, can hinder growth.

- Economic Volatility and Geopolitical Instability: Global economic downturns or regional conflicts can impact discretionary spending on luxury goods. Supply chain disruptions, as witnessed in recent years, can also lead to extended delivery times and increased costs.

Emerging Opportunities in Asia Pacific Luxury Yacht Market

Emerging opportunities in the Asia Pacific Luxury Yacht Market lie in the untapped potential of emerging economies within the region, such as Vietnam and the Philippines, which are developing their luxury tourism offerings. There is a growing demand for sustainable and eco-friendly yachting solutions, presenting an opportunity for manufacturers to innovate in green technologies. The rise of experiential luxury travel is creating a demand for charter yachts that offer unique itineraries and onboard activities. Furthermore, advancements in digitalization and AI integration offer opportunities to enhance the ownership and operational experience through smart yacht management systems and personalized digital services. The increasing interest in smaller, more accessible luxury day boats and performance yachts among a younger demographic also presents a new market segment to explore.

Growth Accelerators in the Asia Pacific Luxury Yacht Market Industry

Long-term growth in the Asia Pacific Luxury Yacht Market will be significantly accelerated by continued economic expansion and the creation of wealth, leading to a larger pool of potential buyers. Strategic partnerships between yacht manufacturers and luxury tourism operators will foster integrated travel experiences, making yacht ownership and chartering more attractive. Market expansion strategies focused on developing new cruising grounds and enhancing infrastructure in less-explored coastal regions will open up new avenues for growth. Furthermore, the ongoing technological breakthroughs in sustainable propulsion and advanced materials will not only drive innovation but also cater to evolving consumer preferences for environmentally responsible luxury. The increasing sophistication of financial solutions and financing options tailored for luxury assets will also play a crucial role in facilitating acquisitions.

Key Players Shaping the Asia Pacific Luxury Yacht Market Market

- Ferretti S p A

- Johnson Yacht

- Gulf Craft Inc

- Ocean Alexander

- PALM BEACH MOTOR YACHTS

- Fincantieri Yachts

- Superyacht Australia

- Horizon Yacht

- Heysea Yachts Company Limited

- Riviera Australia Pty Ltd

- Azimut Benetti

- Oceanco Yacht

- Sanlorenzo Asia

- Sunseeker

- Grand Banks Yachts

Notable Milestones in Asia Pacific Luxury Yacht Market Sector

- 2019: Significant increase in luxury yacht charter bookings in Southeast Asia driven by rising tourism.

- 2020: Introduction of new sustainable hull designs by several manufacturers to meet growing environmental concerns.

- 2021: Several Asian shipyards reported increased order books for mid-sized luxury motor yachts.

- 2022: Major European yacht builders expanded their presence in key APAC markets through strategic partnerships and dealership networks.

- 2023: Launch of innovative hybrid propulsion systems in new yacht models, enhancing efficiency and reducing emissions.

- 2024: Increased investment in AI-powered smart yacht technology, offering enhanced navigation and onboard management.

In-Depth Asia Pacific Luxury Yacht Market Market Outlook

The future outlook for the Asia Pacific Luxury Yacht Market remains exceptionally positive, driven by sustained economic growth and a deepening appreciation for bespoke luxury experiences. Growth accelerators such as technological advancements in sustainable marine solutions and expanding maritime infrastructure will continue to fuel expansion. Strategic partnerships between yacht builders and the burgeoning luxury tourism sector are expected to create integrated lifestyle offerings, making yachting more accessible and appealing. The increasing focus on personalization and the demand for unique, private travel experiences will ensure a strong and consistent market for both new builds and charters. The Asia Pacific region is poised to become an even more dominant force in the global luxury yacht industry.

Asia Pacific Luxury Yacht Market Segmentation

-

1. Yacht Type

- 1.1. Sailing Luxury Yacht

- 1.2. Motorized Luxury Yacht

- 1.3. Other Types

-

2. Size

- 2.1. Up to 20 Meters

- 2.2. 20 to 50 Meters

- 2.3. Above 50 Meters

-

3. Application

- 3.1. Commercial

- 3.2. Private

Asia Pacific Luxury Yacht Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Luxury Yacht Market Regional Market Share

Geographic Coverage of Asia Pacific Luxury Yacht Market

Asia Pacific Luxury Yacht Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry is Expected to Boost the Luxury Yacht Market

- 3.3. Market Restrains

- 3.3.1. Luxury Yacht Charter and Used Yacht to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Motorized Luxury Yacht Type Segment to Fuel the Market Demand -

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Luxury Yacht Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Yacht Type

- 5.1.1. Sailing Luxury Yacht

- 5.1.2. Motorized Luxury Yacht

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Up to 20 Meters

- 5.2.2. 20 to 50 Meters

- 5.2.3. Above 50 Meters

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Private

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Yacht Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ferretti S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Yacht

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Craft Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ocean Alexander

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PALM BEACH MOTOR YACHTS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fincantieri Yachts

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Superyacht Australia*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Horizon Yacht

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heysea Yachts Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riviera Australia Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Azimut Benetti

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oceanco Yacht

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sanlorenzo Asia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sunseeker

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Grand Banks Yachts

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ferretti S p A

List of Figures

- Figure 1: Asia Pacific Luxury Yacht Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Luxury Yacht Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 2: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Size 2020 & 2033

- Table 3: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Yacht Type 2020 & 2033

- Table 6: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Size 2020 & 2033

- Table 7: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Luxury Yacht Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Luxury Yacht Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Luxury Yacht Market?

The projected CAGR is approximately 11.30%.

2. Which companies are prominent players in the Asia Pacific Luxury Yacht Market?

Key companies in the market include Ferretti S p A, Johnson Yacht, Gulf Craft Inc, Ocean Alexander, PALM BEACH MOTOR YACHTS, Fincantieri Yachts, Superyacht Australia*List Not Exhaustive, Horizon Yacht, Heysea Yachts Company Limited, Riviera Australia Pty Ltd, Azimut Benetti, Oceanco Yacht, Sanlorenzo Asia, Sunseeker, Grand Banks Yachts.

3. What are the main segments of the Asia Pacific Luxury Yacht Market?

The market segments include Yacht Type, Size, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry is Expected to Boost the Luxury Yacht Market.

6. What are the notable trends driving market growth?

Motorized Luxury Yacht Type Segment to Fuel the Market Demand -.

7. Are there any restraints impacting market growth?

Luxury Yacht Charter and Used Yacht to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Luxury Yacht Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Luxury Yacht Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Luxury Yacht Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Luxury Yacht Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence