Key Insights

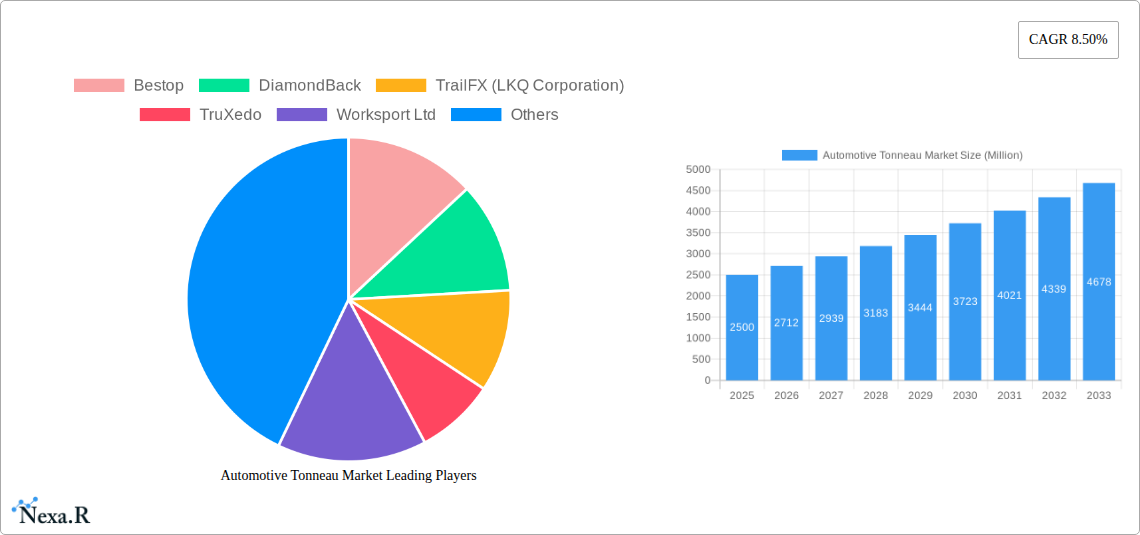

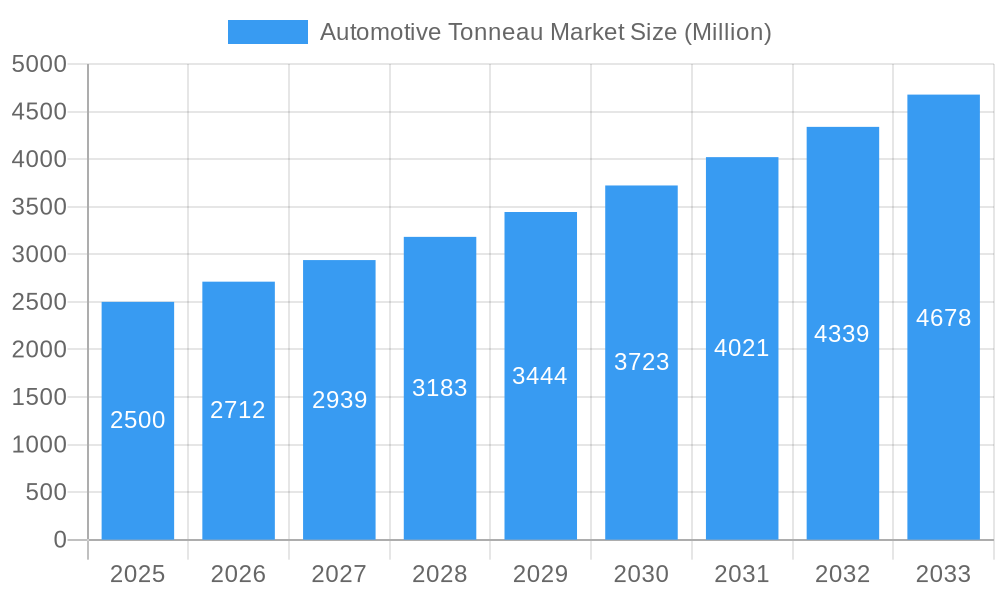

The Automotive Tonneau Market is experiencing robust growth, projected to reach a significant size with a Compound Annual Growth Rate (CAGR) of 8.50%. This expansion is primarily fueled by a rising demand for enhanced vehicle utility, cargo security, and improved fuel efficiency across diverse vehicle types. The increasing proliferation of pickup trucks and commercial vehicles, coupled with a growing emphasis on aftermarket customization and protection for vehicles, acts as a strong catalyst for market adoption. Furthermore, advancements in tonneau cover materials and designs, offering greater durability, ease of use, and aesthetic appeal, are also contributing to the positive market trajectory. The market's dynamism is further supported by ongoing innovations in smart features and integrated functionalities, appealing to a tech-savvy consumer base.

Automotive Tonneau Market Market Size (In Billion)

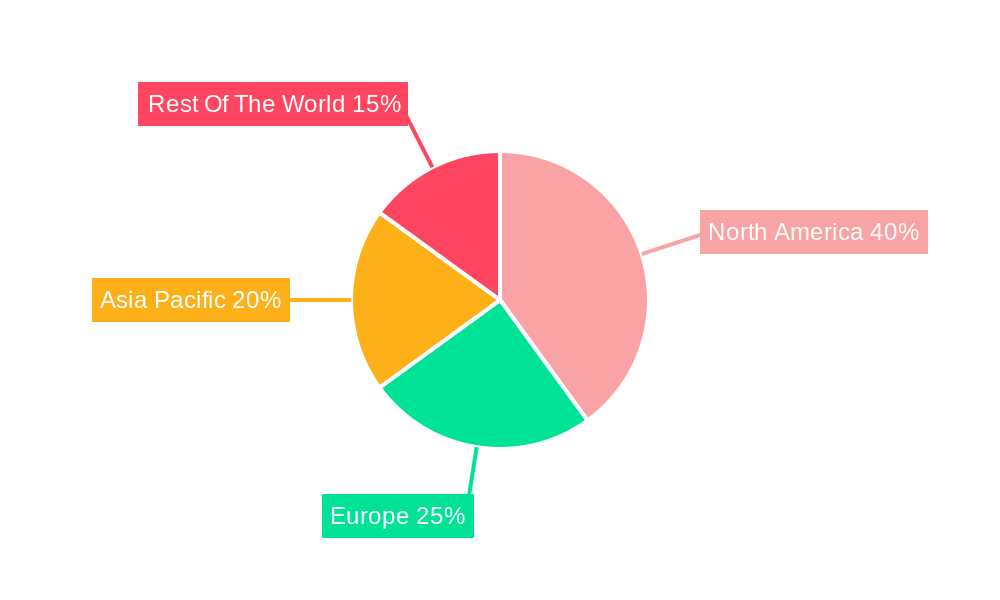

The market segmentation reveals distinct growth opportunities across different product types and sales channels. Hard cover tonneau covers are likely to command a substantial share due to their superior security and durability, while soft covers offer a more budget-friendly and flexible option. The sales channel landscape is characterized by the strong presence of Original Equipment Manufacturers (OEMs), integrating tonneau covers as factory-fitted accessories, and a thriving aftermarket segment catering to personalized upgrades. Passenger cars and commercial vehicles both represent significant end-user segments, with commercial vehicles often demanding robust and secure cargo solutions. Geographically, North America is expected to lead the market, driven by its high concentration of pickup truck ownership and a strong aftermarket culture. Asia Pacific is poised for rapid growth, fueled by an expanding automotive industry and increasing disposable incomes.

Automotive Tonneau Market Company Market Share

Automotive Tonneau Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This report offers an in-depth analysis of the global automotive tonneau market, providing critical insights into market dynamics, growth trends, regional dominance, product innovation, key drivers, emerging opportunities, and a detailed competitive landscape. With a focus on the study period of 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report is an essential resource for industry professionals seeking to understand the evolution and future trajectory of this dynamic market. We present all quantitative data in Million units, ensuring clarity and precision.

Automotive Tonneau Market Market Dynamics & Structure

The automotive tonneau market exhibits a dynamic structure, influenced by a blend of technological advancements, evolving consumer preferences, and strategic consolidations. Market concentration varies across regions, with established players like Bestop, DiamondBack, and TruXedo holding significant sway, particularly in the aftermarket segment. Technological innovation is a primary driver, with a steady influx of new materials and smart features, such as integrated lighting and remote operation, enhancing product appeal. Regulatory frameworks, while generally permissive, can influence material choices and safety standards. Competitive product substitutes, including cargo organizers and bed caps, pose a constant challenge, necessitating continuous product differentiation. End-user demographics are broadening, with increasing demand from both commercial vehicle operators for enhanced cargo security and passenger car owners seeking aesthetic upgrades and weather protection. Mergers and acquisitions (M&A) are a recurring theme, with companies like TruckHero strategically expanding their portfolio and market reach to capture greater market share. The parent market, the broader automotive accessories industry, significantly impacts tonneau cover sales through vehicle production volumes and aftermarket spending trends.

- Market Concentration: Moderate to high in developed regions, with consolidation trends driven by M&A activity.

- Technological Innovation: Driven by demand for enhanced security, weatherproofing, and smart features.

- Regulatory Frameworks: Generally supportive, with potential for future regulations on materials or energy efficiency.

- Competitive Substitutes: Cargo liners, toolboxes, and bed caps.

- End-User Demographics: Expanding from commercial users to recreational and passenger car segments.

- M&A Trends: Active consolidation to enhance product portfolios and market penetration.

- Child Market Influence: The pick-up truck segment is the most significant driver for tonneau cover adoption within the broader automotive aftermarket.

Automotive Tonneau Market Growth Trends & Insights

The automotive tonneau market is poised for robust growth, propelled by a confluence of factors that are reshaping consumer behavior and vehicle utility. The market size evolution is a testament to the increasing recognition of tonneau covers as essential accessories for both functional and aesthetic enhancement. Adoption rates are accelerating, particularly among truck owners who value enhanced cargo security, improved fuel efficiency through reduced aerodynamic drag, and protection against the elements. Technological disruptions are playing a pivotal role, with the emergence of smart tonneau covers that integrate features like solar power generation, remote locking systems, and LED lighting captivating consumer interest. For instance, the September 2022 agreement between Hyundai Motor and Worksport to manufacture a solar-powered tonneau cover highlights this innovative trend, offering up to 650 watts of power. Consumer behavior shifts are evident in the growing demand for premium, durable, and technologically advanced tonneau solutions that not only protect cargo but also contribute to a vehicle's overall appeal and functionality. The rise in electric vehicles (EVs) also presents a unique opportunity, with companies like Rivian Automotive announcing the introduction of R1T Electric Tonneau Covers by 2024, catering to the specific needs of EV owners. The aftermarket segment, in particular, is experiencing significant expansion as consumers seek to personalize and upgrade their vehicles. The forecast period is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% for the global automotive tonneau market. By 2025, the market size is projected to reach approximately 18.5 Million units, with steady growth anticipated through 2033.

Dominant Regions, Countries, or Segments in Automotive Tonneau Market

North America stands as the dominant region in the automotive tonneau market, largely driven by the entrenched culture of pick-up truck ownership and a robust aftermarket industry. The United States, in particular, represents a substantial portion of this dominance, fueled by a strong economy and a high propensity for vehicle customization. Within segments, the Hard Cover type is experiencing significant growth, accounting for an estimated 58% of the market share in 2025, owing to their superior security and durability. The AfterMarket sales channel is another key driver, representing approximately 72% of market revenue in 2025, as vehicle owners increasingly seek to personalize and enhance their existing vehicles. Commercial Vehicles, specifically pick-up trucks used for professional purposes, constitute a substantial user base, accounting for around 65% of tonneau cover installations in 2025. Key drivers in this region include favorable economic policies that support vehicle sales and customization, extensive highway infrastructure facilitating transportation and logistics (where cargo security is paramount), and a deep-seated consumer interest in enhancing the functionality and aesthetics of their vehicles. The high disposable income and a strong affinity for outdoor activities further bolster demand for tonneau covers that provide utility and protection. The growth potential in North America is substantial, with continuous innovation and increasing consumer awareness ensuring sustained market expansion.

Automotive Tonneau Market Product Landscape

The automotive tonneau market is characterized by a vibrant product landscape driven by continuous innovation. Hard covers, including roll-up, tri-fold, and one-piece designs, offer superior security and weather protection, with advancements in materials like aluminum and composite plastics enhancing durability and reducing weight. Soft covers, such as roll-up and snap-on variants, provide a more budget-friendly option with improved ease of use. Emerging product innovations include electrically operated tonneau covers, as exemplified by Rivian's R1T Electric Tonneau Cover, and solar-powered options developed in partnership with companies like Worksport. These advanced features offer enhanced convenience, energy generation capabilities, and a unique selling proposition in the competitive market.

Key Drivers, Barriers & Challenges in Automotive Tonneau Market

The automotive tonneau market is propelled by several key drivers. The growing demand for enhanced cargo security and protection against weather elements in pick-up trucks is a primary force. Increased customization trends in the automotive aftermarket, coupled with a desire for improved vehicle aesthetics and aerodynamics, further fuel demand. Technological advancements, such as the integration of smart features and the development of lighter, more durable materials, also act as significant growth accelerators.

However, the market faces certain barriers and challenges. Fluctuations in raw material prices, particularly for aluminum and plastics, can impact manufacturing costs and profit margins. Intense competition within the aftermarket segment can lead to price wars, squeezing profitability for some players. Supply chain disruptions, as experienced globally in recent years, can affect production timelines and product availability. Furthermore, the significant upfront cost of some high-end tonneau covers can deter price-sensitive consumers, limiting broader adoption in certain economic climates.

Emerging Opportunities in Automotive Tonneau Market

Emerging opportunities in the automotive tonneau market lie in the expanding electric vehicle (EV) segment. As EV adoption grows, so does the demand for specialized accessories that complement their unique features. The development of lightweight, aerodynamically optimized tonneau covers for EVs can contribute to increased range and efficiency. Furthermore, the integration of smart technologies, such as solar power generation and advanced security features, presents a significant avenue for growth. Untapped markets in developing regions, with a growing middle class and increasing pick-up truck sales, offer substantial expansion potential. Evolving consumer preferences for sustainable and technologically integrated automotive solutions will continue to drive innovation and create new product niches.

Growth Accelerators in the Automotive Tonneau Market Industry

Several catalysts are accelerating the long-term growth of the automotive tonneau market. Technological breakthroughs in material science, leading to lighter, stronger, and more weather-resistant tonneau covers, are enhancing product performance and appeal. Strategic partnerships between tonneau cover manufacturers and automotive OEMs, as seen with Hyundai and Worksport, are crucial for integrating advanced features and ensuring market penetration from the factory. Market expansion strategies, including targeting new geographical regions and developing specialized products for niche vehicle segments, are vital for sustained growth. The increasing focus on vehicle customization and personalization by consumers worldwide provides a fertile ground for the continuous development and adoption of innovative tonneau cover solutions.

Key Players Shaping the Automotive Tonneau Market Market

- Bestop

- DiamondBack

- TrailFX (LKQ Corporation)

- TruXedo

- Worksport Ltd

- TruckHero

- Roll-N-Loc

- Agri-Cover Inc

- SnugTop

- Rugged Liner Inc

Notable Milestones in Automotive Tonneau Market Sector

- September 2023: Rivian Automotive announced the introduction of its R1T Electric Tonneau Cover, with plans for wider availability by 2024, marking a significant step in EV-specific tonneau solutions.

- February 2023: Magna International established a new business unit dedicated to powered aluminum tonneau covers in Canada, indicating strategic investment in advanced tonneau technology.

- September 2022: Hyundai Motor entered into an agreement with Worksport to manufacture a tonneau cover capable of capturing solar energy and generating up to 650 watts of power, highlighting the growing integration of renewable energy in vehicle accessories.

In-Depth Automotive Tonneau Market Market Outlook

The automotive tonneau market is on an upward trajectory, with future growth fueled by a strong emphasis on innovation and evolving consumer demands. The increasing integration of smart technologies, such as solar power generation and advanced remote access, is set to redefine product offerings and capture new market segments. The burgeoning electric vehicle market presents a substantial opportunity for specialized, lightweight, and aerodynamically optimized tonneau covers that enhance vehicle efficiency. Strategic collaborations between manufacturers and automotive brands will continue to be pivotal in driving adoption and market penetration. Furthermore, the expanding global middle class and increasing preference for vehicle customization in emerging economies present significant untapped potential for market expansion. The industry is poised for sustained growth driven by these forward-looking strategies and a commitment to delivering enhanced functionality and value to consumers.

Automotive Tonneau Market Segmentation

-

1. Type

- 1.1. Hard Cover

- 1.2. Soft Cover

-

2. Sales Channel

- 2.1. Original Equipment Manufacturers(OEMs)

- 2.2. AfterMarket

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Tonneau Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest Of The World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Tonneau Market Regional Market Share

Geographic Coverage of Automotive Tonneau Market

Automotive Tonneau Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sale of Pick-Up Trucks Across the Globe

- 3.3. Market Restrains

- 3.3.1. Rapid Technological Advancement May Increase the Cost

- 3.4. Market Trends

- 3.4.1. Rise in Sale of Pick-up Truck Across the Globe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Tonneau Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hard Cover

- 5.1.2. Soft Cover

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Original Equipment Manufacturers(OEMs)

- 5.2.2. AfterMarket

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest Of The World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Tonneau Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hard Cover

- 6.1.2. Soft Cover

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Original Equipment Manufacturers(OEMs)

- 6.2.2. AfterMarket

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Tonneau Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hard Cover

- 7.1.2. Soft Cover

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Original Equipment Manufacturers(OEMs)

- 7.2.2. AfterMarket

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Tonneau Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hard Cover

- 8.1.2. Soft Cover

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Original Equipment Manufacturers(OEMs)

- 8.2.2. AfterMarket

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest Of The World Automotive Tonneau Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hard Cover

- 9.1.2. Soft Cover

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Original Equipment Manufacturers(OEMs)

- 9.2.2. AfterMarket

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bestop

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DiamondBack

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TrailFX (LKQ Corporation)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TruXedo

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Worksport Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 TruckHero

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Roll-N-Loc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Agri-Cover Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SnugTop

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rugged Liner Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Bestop

List of Figures

- Figure 1: Global Automotive Tonneau Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Tonneau Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Tonneau Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Tonneau Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 5: North America Automotive Tonneau Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Automotive Tonneau Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Tonneau Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Tonneau Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Tonneau Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Tonneau Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Automotive Tonneau Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Tonneau Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 13: Europe Automotive Tonneau Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: Europe Automotive Tonneau Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Tonneau Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Tonneau Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Tonneau Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Tonneau Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Tonneau Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Tonneau Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 21: Asia Pacific Automotive Tonneau Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 22: Asia Pacific Automotive Tonneau Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Tonneau Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Tonneau Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Tonneau Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest Of The World Automotive Tonneau Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest Of The World Automotive Tonneau Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest Of The World Automotive Tonneau Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Rest Of The World Automotive Tonneau Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Rest Of The World Automotive Tonneau Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest Of The World Automotive Tonneau Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest Of The World Automotive Tonneau Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest Of The World Automotive Tonneau Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Tonneau Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Tonneau Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Automotive Tonneau Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Tonneau Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Tonneau Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Tonneau Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Global Automotive Tonneau Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Tonneau Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Tonneau Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Tonneau Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Global Automotive Tonneau Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Tonneau Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Tonneau Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Tonneau Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 24: Global Automotive Tonneau Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Automotive Tonneau Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Tonneau Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Automotive Tonneau Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 33: Global Automotive Tonneau Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Tonneau Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: South America Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Automotive Tonneau Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Tonneau Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Automotive Tonneau Market?

Key companies in the market include Bestop, DiamondBack, TrailFX (LKQ Corporation), TruXedo, Worksport Ltd, TruckHero, Roll-N-Loc, Agri-Cover Inc, SnugTop, Rugged Liner Inc.

3. What are the main segments of the Automotive Tonneau Market?

The market segments include Type, Sales Channel, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sale of Pick-Up Trucks Across the Globe.

6. What are the notable trends driving market growth?

Rise in Sale of Pick-up Truck Across the Globe.

7. Are there any restraints impacting market growth?

Rapid Technological Advancement May Increase the Cost.

8. Can you provide examples of recent developments in the market?

September 2023: Rivian Automotive announced to introduction R1T Electric Tonneau Cover. The company announced to introduction of electric Tonneau cover by 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Tonneau Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Tonneau Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Tonneau Market?

To stay informed about further developments, trends, and reports in the Automotive Tonneau Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence