Key Insights

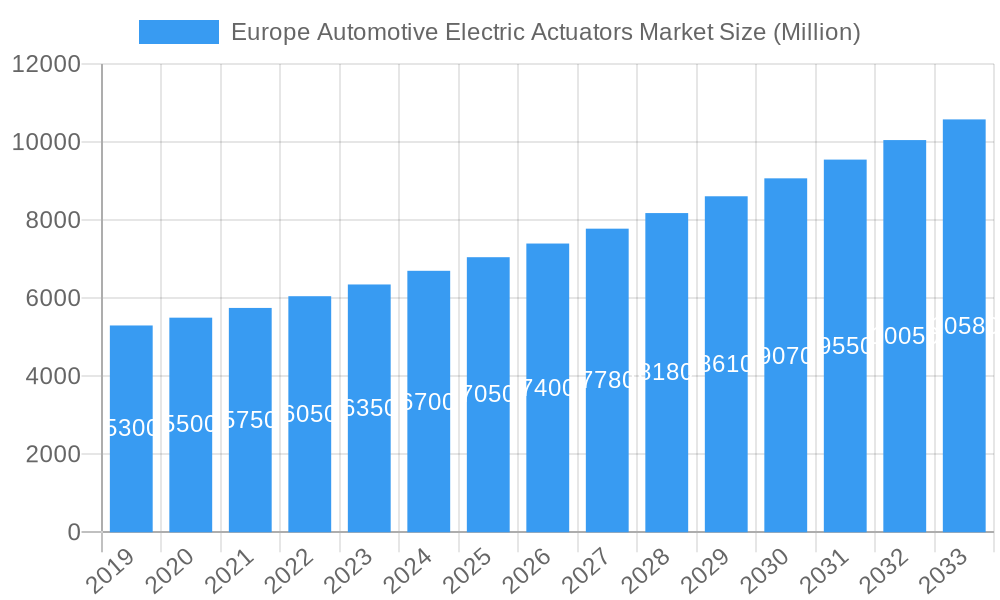

The European Automotive Electric Actuators Market is projected for substantial growth, fueled by increasing demand for sophisticated vehicle features and the pervasive integration of electronic systems in modern automobiles. With an estimated market size of USD 7.71 billion in 2025, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 14.9% from 2025 to 2033. This upward trend is significantly driven by the rising adoption of electric and hybrid electric vehicles, which necessitate a greater number of electric actuators. Key growth catalysts include stringent automotive emission regulations, growing consumer preferences for enhanced comfort, safety, and performance, and continuous advancements in actuator technology, leading to more compact, efficient, and precise solutions. The passenger car segment is expected to lead market expansion due to increasing feature content in premium and mid-range vehicles.

Europe Automotive Electric Actuators Market Market Size (In Billion)

The market's expansion is further influenced by the increasing sophistication of automotive applications, such as throttle, seat adjustment, brake, and closure actuators. These components are vital for enabling Advanced Driver-Assistance Systems (ADAS), autonomous driving capabilities, and personalized in-cabin experiences. Leading industry players are actively investing in research and development to introduce next-generation electric actuators offering superior energy efficiency and performance. However, challenges such as the higher initial cost of electric actuators compared to traditional mechanical systems and the need for extensive validation and standardization within the automotive supply chain may present restraints. Despite these hurdles, the overarching trend towards vehicle electrification and intelligent design positions the European Automotive Electric Actuators Market for sustained and significant growth, with Germany, the United Kingdom, and France leading regional adoption.

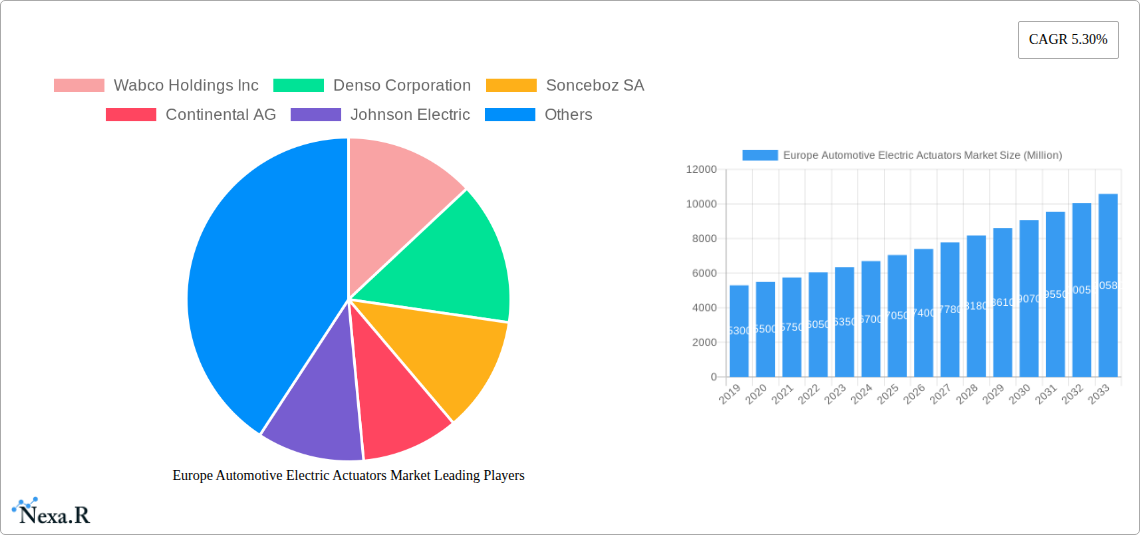

Europe Automotive Electric Actuators Market Company Market Share

This comprehensive report offers in-depth analysis of the Europe Automotive Electric Actuators Market, providing critical insights for stakeholders in this dynamic sector. Covering a study period from 2019 to 2033, with a base year of 2025, this report delivers precise projections for the forecast period 2025–2033, grounded in robust historical data from 2019–2024. We examine parent and child markets, identifying key growth drivers, technological innovations, and competitive landscapes. This report is essential for understanding the trajectory of electric actuators in European automotive manufacturing, encompassing passenger cars, commercial vehicles, and a wide array of applications.

Europe Automotive Electric Actuators Market Market Dynamics & Structure

The Europe Automotive Electric Actuators Market is characterized by a moderately concentrated structure, with leading players like Robert Bosch GmbH, Denso Corporation, and Continental AG holding significant market shares. Technological innovation remains a primary driver, propelled by the automotive industry's relentless pursuit of enhanced fuel efficiency, safety, and passenger comfort through electrification and advanced driver-assistance systems (ADAS). Stringent regulatory frameworks, particularly those mandating reduced emissions and increased safety standards, further catalyze the adoption of electric actuators. Competitive product substitutes, while present, are increasingly challenged by the superior performance and integration capabilities of electric solutions. End-user demographics are shifting towards a demand for more sophisticated, feature-rich vehicles, influencing actuator specifications. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to gain market access, acquire new technologies, and achieve economies of scale. For instance, the past five years have seen approximately 15-20 significant M&A deals, indicating strategic consolidation. Innovation barriers include high initial R&D costs for novel actuator designs and the need for extensive validation to meet automotive-grade reliability standards. The market is poised for substantial growth driven by these interwoven factors.

- Market Concentration: Moderate, with key players dominating specific segments.

- Technological Innovation Drivers: Electrification, ADAS integration, demand for fuel efficiency and comfort.

- Regulatory Frameworks: Emission standards (e.g., Euro 7), safety mandates (e.g., AEBS).

- Competitive Product Substitutes: Limited effectiveness against advanced electric actuator solutions.

- End-User Demographics: Growing demand for premium features and enhanced vehicle performance.

- M&A Trends: Strategic acquisitions to expand product portfolios and market reach.

Europe Automotive Electric Actuators Market Growth Trends & Insights

The Europe Automotive Electric Actuators Market is projected for robust expansion, with an estimated market size of USD 15,500 million units in 2025, expected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% to reach USD 28,800 million units by 2033. This significant growth is underpinned by the accelerating transition towards electric vehicles (EVs) and the increasing sophistication of internal combustion engine (ICE) vehicles integrating advanced technologies. The adoption rates of electric actuators are surging across various applications, including throttle control, seat adjustment, braking systems, and closure mechanisms. Technological disruptions, such as the development of smaller, more efficient, and integrated actuator modules, are reshaping the market landscape. Consumer behavior shifts towards prioritizing safety, convenience, and personalized driving experiences are directly translating into higher demand for electric actuators that enable these features. For example, advanced driver-assistance systems rely heavily on precise and rapid actuator responses, a trend gaining significant traction. Market penetration of electric actuators in new vehicle production is estimated to reach 75% by 2033, up from 50% in 2025. The increasing complexity of vehicle architectures, including the growing number of electronic control units (ECUs) and interconnected systems, further necessitates the widespread implementation of electric actuators for seamless operation and control. The electrification of powertrain components, such as electric turbochargers and variable valve timing systems, is also a substantial growth catalyst. Furthermore, the aftermarket segment for actuator replacement and upgrades is expected to witness steady growth as the vehicle parc ages. The ongoing evolution of autonomous driving technologies will introduce an even greater reliance on a multitude of highly responsive and reliable electric actuators, creating further avenues for market expansion.

Dominant Regions, Countries, or Segments in Europe Automotive Electric Actuators Market

Within the Europe Automotive Electric Actuators Market, Germany stands out as the dominant country, propelled by its position as a global automotive manufacturing powerhouse and a strong commitment to automotive innovation and sustainability. The country's high volume of passenger car production, coupled with a significant presence of premium automotive manufacturers investing heavily in electric and advanced vehicle technologies, fuels substantial demand for electric actuators.

Dominant Country: Germany

- Key Drivers:

- Automotive Manufacturing Hub: Germany hosts leading global automotive OEMs and a robust Tier 1 supplier ecosystem.

- Technological Leadership: Significant investment in R&D for electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

- Strong Consumer Demand for Advanced Features: High consumer willingness to adopt vehicles with enhanced safety, comfort, and performance.

- Favorable Regulatory Environment: Supportive policies for emissions reduction and EV adoption.

- High Vehicle Production Volumes: Consistent high output of passenger cars and commercial vehicles.

- Market Share: Estimated to hold approximately 35% of the European market.

- Growth Potential: Continued leadership driven by ongoing electrification and technological advancements.

- Key Drivers:

Dominant Vehicle Type: Passenger Car

- Key Drivers:

- High Production Volumes: Passenger cars constitute the largest segment of the automotive market.

- Feature Proliferation: Increasing integration of electric actuators for comfort (e.g., power seats, sunroofs, tailgates), safety (e.g., electronic parking brakes, active suspension), and performance (e.g., throttle actuators, variable valve timing).

- Electrification Trend: The rapid growth of electric vehicles, which inherently utilize a higher density of electric actuators.

- Market Share: Accounts for an estimated 70% of the electric actuator market within the automotive sector.

- Growth Potential: Sustained high growth driven by evolving consumer preferences and regulatory demands for cleaner and safer vehicles.

- Key Drivers:

Dominant Application Type: Throttle Actuator

- Key Drivers:

- Essential for Engine Management: Crucial for precise control of air intake in both ICE and EV powertrains (e.g., for thermal management or regenerative braking blending).

- Enabling Advanced Engine Technologies: Key for systems like variable valve timing and turbocharged engines.

- Integration with ADAS: Used in systems that require precise engine response for functions like adaptive cruise control.

- Market Share: Represents approximately 25% of the total automotive electric actuator market.

- Growth Potential: Steady growth, particularly with the refinement of ICE technology to meet emission standards and the integration into hybrid powertrains.

- Key Drivers:

Europe Automotive Electric Actuators Market Product Landscape

The product landscape of the Europe Automotive Electric Actuators Market is defined by an increasing emphasis on miniaturization, higher precision, enhanced durability, and seamless integration into complex vehicle architectures. Innovations are focused on developing more energy-efficient actuators with reduced power consumption, critical for maximizing EV range. Advanced materials and manufacturing techniques are enabling actuators with improved thermal management capabilities and extended operational lifespans. Unique selling propositions revolve around intelligent actuator modules that incorporate integrated sensors and control electronics, facilitating predictive maintenance and enhanced diagnostic capabilities. Technological advancements include the development of brushless DC motor-driven actuators for greater efficiency and longevity, as well as the incorporation of sophisticated control algorithms that allow for precise, dynamic adjustments in response to real-time vehicle conditions.

Key Drivers, Barriers & Challenges in Europe Automotive Electric Actuators Market

Key Drivers: The Europe Automotive Electric Actuators Market is propelled by the accelerating transition to electric vehicles (EVs), stringent emission regulations demanding greater fuel efficiency, and the growing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Consumer demand for enhanced safety, comfort, and personalized driving experiences further fuels the adoption of electric actuators for features like powered seats, automatic tailgates, and sophisticated braking systems.

Barriers & Challenges: Significant challenges include the high initial cost of R&D and production for novel actuator technologies, requiring substantial investment. The complex automotive supply chain, susceptible to disruptions, poses a constant risk. Stringent automotive quality and safety standards necessitate rigorous testing and validation, increasing lead times and costs. Intense competition among established players and emerging entrants can lead to price pressures. Furthermore, the need for interoperability and standardization across different vehicle platforms can be a technical hurdle.

Emerging Opportunities in Europe Automotive Electric Actuators Market

Emerging opportunities lie in the increasing demand for electric actuators in niche applications such as active aerodynamics for improved efficiency, advanced suspension systems for enhanced ride comfort, and intelligent door systems for improved ingress/egress. The growing focus on in-cabin experience is also creating opportunities for actuators that control features like massage seats, adaptive lighting, and climate control zones. Furthermore, the development of modular and scalable actuator solutions tailored for the specific needs of commercial vehicles, including trucks and buses, presents a significant untapped market. The aftermarket for electric actuator replacements and upgrades, driven by the aging vehicle parc, also offers considerable growth potential.

Growth Accelerators in the Europe Automotive Electric Actuators Market Industry

Growth accelerators for the Europe Automotive Electric Actuators Market include groundbreaking advancements in motor technology and control systems, leading to more compact, efficient, and powerful actuators. Strategic partnerships between actuator manufacturers and automotive OEMs are crucial for co-developing bespoke solutions that align with future vehicle architectures. The continuous expansion of charging infrastructure and supportive government policies promoting EV adoption worldwide are indirect but powerful growth catalysts. Furthermore, the increasing demand for connected car features, which often rely on precise actuator control for various functionalities, also acts as a significant growth accelerator.

Key Players Shaping the Europe Automotive Electric Actuators Market Market

- Wabco Holdings Inc

- Denso Corporation

- Sonceboz SA

- Continental AG

- Johnson Electric

- BorgWarner Inc

- Robert Bosch GmbH

- CTS Corporation

- Hella KGaA Hueck & Co

Notable Milestones in Europe Automotive Electric Actuators Market Sector

- 2023 Q3: Bosch launches new generation of compact, high-torque electric actuators for advanced braking systems.

- 2023 Q4: Continental announces strategic investment in advanced sensor integration for electric actuators.

- 2024 Q1: Denso expands its electric actuator portfolio for EV thermal management systems.

- 2024 Q2: BorgWarner acquires technology firm specializing in high-performance electric actuators for powertrains.

- 2024 Q3: Hella introduces innovative electric actuators for adaptive lighting systems, enhancing safety.

In-Depth Europe Automotive Electric Actuators Market Market Outlook

The future outlook for the Europe Automotive Electric Actuators Market remains exceptionally strong, driven by the sustained momentum of vehicle electrification and the increasing sophistication of automotive features. Growth accelerators, including technological breakthroughs in motor efficiency and control, coupled with strategic collaborations between suppliers and OEMs, will continue to propel market expansion. The burgeoning demand for advanced safety and comfort systems, alongside the evolving landscape of autonomous driving, ensures a consistent and escalating need for a diverse range of electric actuators. Manufacturers focusing on intelligent, integrated, and energy-efficient actuator solutions will be best positioned to capitalize on the immense growth potential and shape the future of automotive mobility.

Europe Automotive Electric Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Other

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Rest of Europe

Europe Automotive Electric Actuators Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

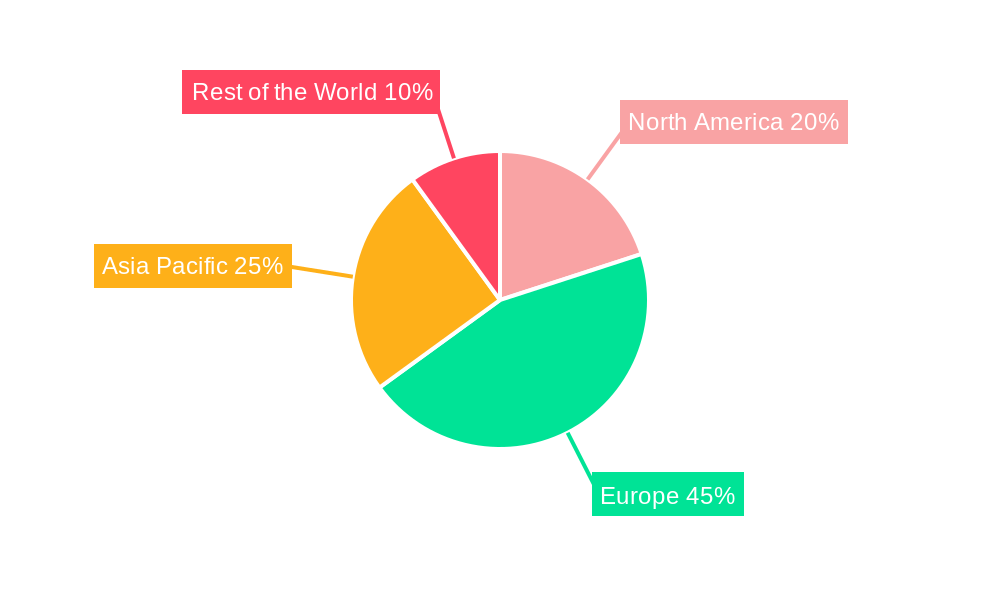

Europe Automotive Electric Actuators Market Regional Market Share

Geographic Coverage of Europe Automotive Electric Actuators Market

Europe Automotive Electric Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Electric Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Europe

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Europe

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wabco Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonceboz SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Continental AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CTS Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hella KGaA Hueck & Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wabco Holdings Inc

List of Figures

- Figure 1: Europe Automotive Electric Actuators Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Electric Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Europe 2020 & 2033

- Table 4: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Europe 2020 & 2033

- Table 8: Europe Automotive Electric Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive Electric Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Electric Actuators Market?

The projected CAGR is approximately 14.9%.

2. Which companies are prominent players in the Europe Automotive Electric Actuators Market?

Key companies in the market include Wabco Holdings Inc, Denso Corporation, Sonceboz SA, Continental AG, Johnson Electric, BorgWarner Inc, Robert Bosch GmbH, CTS Corporatio, Hella KGaA Hueck & Co.

3. What are the main segments of the Europe Automotive Electric Actuators Market?

The market segments include Vehicle Type, Application Type, Europe.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Electric Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Electric Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Electric Actuators Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Electric Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence