Key Insights

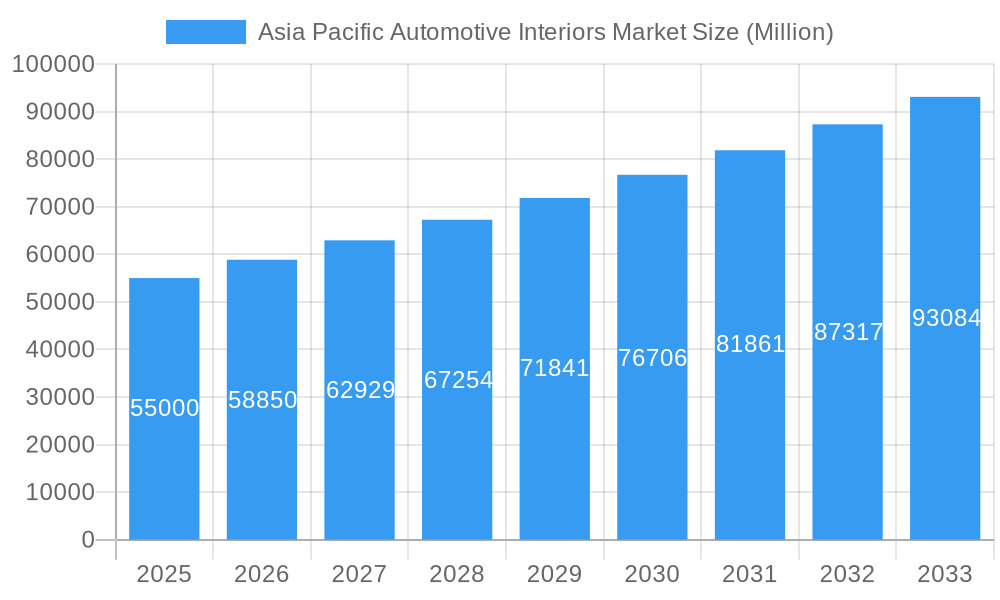

The Asia Pacific Automotive Interiors Market is projected for substantial growth, exhibiting a compound annual growth rate (CAGR) of 10.6%. With a market size of $18 billion in the base year of 2024, the market is expected to expand significantly throughout the forecast period. This expansion is primarily driven by increasing consumer demand for enhanced in-car experiences, including advanced infotainment systems, ambient lighting, and premium comfort features like ergonomic flooring and refined interior panels. The growing middle class across Asia Pacific, particularly in China, India, and Southeast Asia, is prioritizing vehicle aesthetics and technological integration, leading to higher adoption rates for premium interior components. Furthermore, the region’s robust automotive production hubs, including Japan and South Korea, are spearheading innovation in interior design and functionality, fueled by rising disposable incomes, a preference for connected car technologies, and evolving safety regulations promoting advanced materials.

Asia Pacific Automotive Interiors Market Market Size (In Billion)

Key market trends supporting this growth include the rising prevalence of electric vehicles (EVs), which demand lightweight and sustainable interior materials, and the increasing integration of AI and machine learning for personalized cabin experiences and enhanced safety. While rapid technological advancements and expanding production capabilities present significant opportunities, the market faces challenges such as fluctuating raw material prices and intense competition. However, strategic collaborations between automakers and technology providers, alongside a focus on customization and user-centric design, are anticipated to mitigate these challenges and sustain market growth across all vehicle segments.

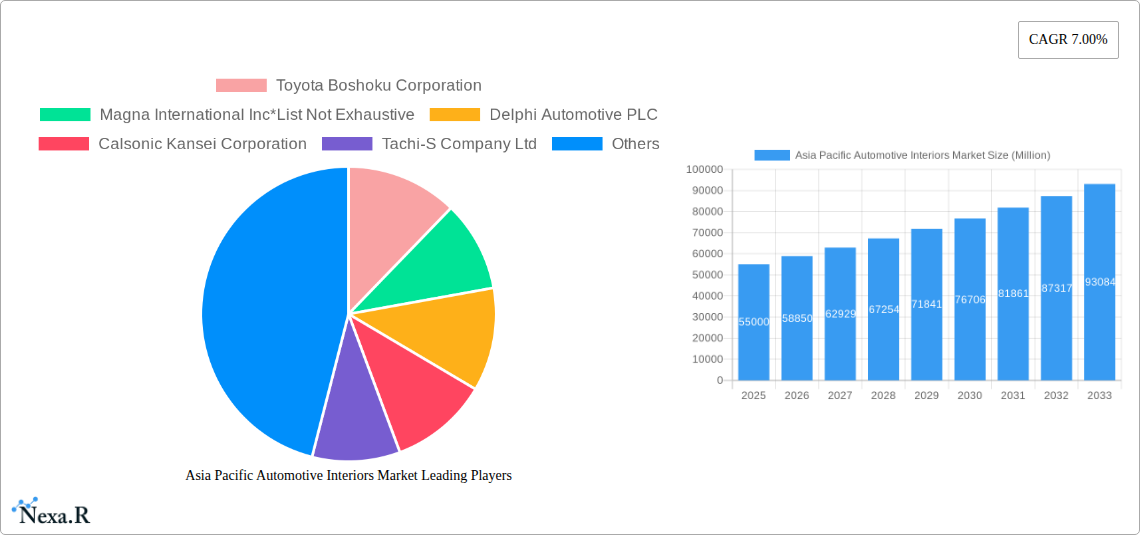

Asia Pacific Automotive Interiors Market Company Market Share

This report provides a comprehensive analysis of the Asia Pacific Automotive Interiors Market, focusing on evolving consumer preferences, technological innovation, and industry dynamics. With a base year of 2024 and a forecast period extending to 2033, this report offers critical insights for stakeholders. The analysis covers market dynamics, growth trends, regional landscapes, product offerings, key drivers, challenges, emerging opportunities, and influential market players. All market size values are presented in billion units.

Asia Pacific Automotive Interiors Market Market Dynamics & Structure

The Asia Pacific automotive interiors market is characterized by a moderate to high level of concentration, with a few global players holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for advanced infotainment systems, enhanced comfort features, and sustainable materials. Regulatory frameworks, particularly concerning safety standards and emissions, also play a crucial role in shaping product development and manufacturing processes. Competitive product substitutes are emerging, driven by the rise of electric vehicles (EVs) and the increasing adoption of shared mobility services, necessitating continuous innovation from traditional interior component manufacturers. End-user demographics are shifting, with a growing middle class in emerging economies demanding premium features and personalized interior experiences. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain access to new technologies, and consolidate their market positions.

- Market Concentration: Dominated by established Tier 1 suppliers and automotive OEMs, but with increasing participation from specialized technology providers.

- Technological Innovation Drivers: Advancements in display technology, material science (e.g., sustainable and lightweight materials), connectivity features, and autonomous driving integration.

- Regulatory Frameworks: Stringent safety regulations (e.g., airbag deployment standards, fire retardancy), environmental mandates (e.g., VOC emissions), and evolving cybersecurity requirements for connected car interiors.

- Competitive Product Substitutes: Development of integrated digital cockpits, virtual interfaces, and modular interior designs to adapt to new vehicle architectures.

- End-User Demographics: Growing demand for customization, premium finishes, ambient lighting, and advanced ergonomic designs, particularly from younger demographics and affluent consumers in key Asian markets.

- M&A Trends: Strategic acquisitions to acquire advanced technologies, expand geographical reach, and secure supply chain resilience. For instance, the acquisition of smaller technology firms by larger automotive suppliers to bolster their digital capabilities.

Asia Pacific Automotive Interiors Market Growth Trends & Insights

The Asia Pacific automotive interiors market is poised for substantial growth, projected to expand significantly in terms of volume and value over the forecast period. This expansion is underpinned by robust automotive production figures across the region, particularly in countries like China, India, and Southeast Asian nations. The increasing disposable income and a burgeoning middle class are fueling demand for passenger cars with enhanced interior features and a focus on comfort and premium aesthetics. Furthermore, the rapid adoption of electric vehicles (EVs) is a significant growth catalyst, as EV manufacturers often prioritize innovative interior designs to differentiate their offerings, incorporating advanced materials, minimalist aesthetics, and integrated digital experiences.

Technological disruptions are rapidly reshaping the market. The integration of sophisticated infotainment systems, including large touchscreens, augmented reality (AR) heads-up displays (HUDs), and advanced voice recognition, is becoming a standard expectation. Interior lighting is evolving beyond basic illumination to incorporate customizable ambient lighting solutions that enhance the cabin ambiance and passenger experience. The demand for smart surfaces, integrating haptic feedback and interactive controls, is also on the rise. Consumer behavior shifts are evident, with a growing emphasis on personalized and connected in-car experiences. Passengers expect their vehicles to be extensions of their digital lives, demanding seamless connectivity, entertainment options, and productivity tools. The "second living space" concept for vehicles is gaining traction, pushing manufacturers to create more comfortable, functional, and aesthetically pleasing interior environments.

The adoption rate of advanced interior components is projected to accelerate, driven by both OEM mandates and consumer demand. The market penetration of advanced driver-assistance systems (ADAS) is also indirectly influencing interior design, with the need for intuitive displays and control interfaces. The overall market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033, reaching an estimated XX million units by the end of the forecast period. This growth trajectory indicates a highly dynamic and promising market for automotive interior component manufacturers and suppliers.

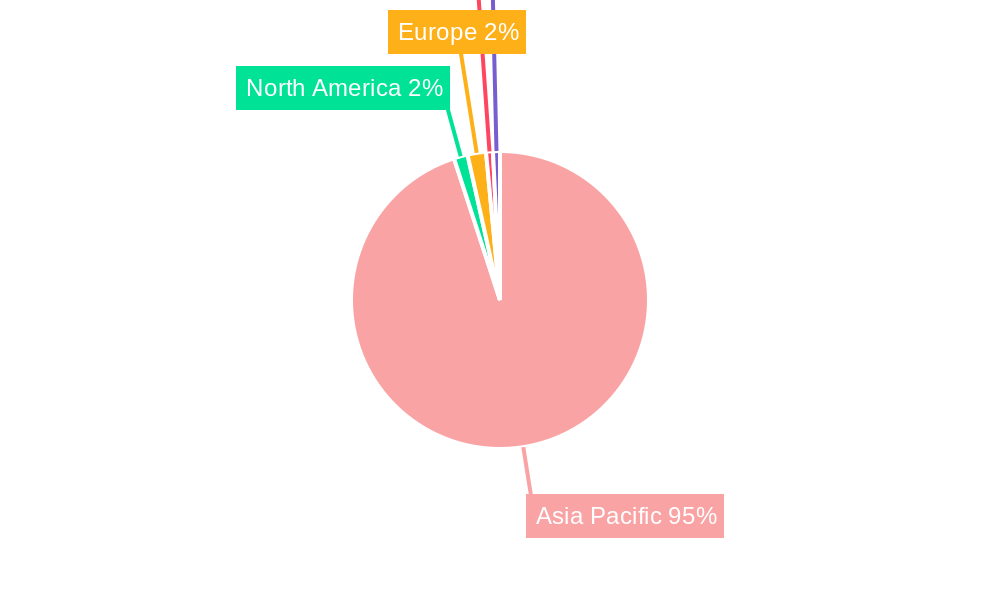

Dominant Regions, Countries, or Segments in Asia Pacific Automotive Interiors Market

The Asia Pacific Automotive Interiors Market is demonstrably driven by the Passenger Cars segment, which constitutes the largest share of the market. Within this broad category, specific countries like China and India stand out as dominant forces. China's sheer automotive production volume and its rapidly evolving consumer preferences for premium and technologically advanced interiors make it a powerhouse. India, with its burgeoning middle class and a growing appetite for personal mobility, represents a high-growth market with increasing demand for sophisticated interior features.

Dominant Vehicle Type: Passenger Cars:

- Accounting for over 85% of the total market volume, passenger cars are the primary focus for interior innovation and production.

- Key drivers include increasing urbanization, rising disposable incomes, and a growing desire for personal transportation.

- The demand for enhanced comfort, advanced infotainment, and premium aesthetics is particularly strong in this segment.

Dominant Country: China:

- Represents approximately 55% of the Asia Pacific automotive interiors market volume.

- Driven by a massive domestic auto market, significant EV adoption, and aggressive technological integration by local and international OEMs.

- Government policies promoting electric vehicles and intelligent mobility further fuel demand for advanced interior components.

Dominant Country: India:

- Expected to grow at a CAGR of 9.5% during the forecast period, surpassing some established markets in growth rate.

- Fueled by a large and young population, increasing purchasing power, and a shift towards more feature-rich vehicles.

- Infrastructure development and government initiatives like "Make in India" are supporting domestic manufacturing and component supply.

Dominant Component Type: Infotainment System:

- This segment is experiencing rapid growth, driven by consumer demand for connectivity, entertainment, and navigation.

- Advancements in screen technology, UI/UX design, and integration with mobile devices are key factors.

- The increasing penetration of smart features and connected car services directly translates to higher demand for sophisticated infotainment solutions.

Dominant Component Type: Instrument Panels:

- Instrument panels are evolving from traditional analog displays to advanced digital cockpits and virtual displays.

- The integration of ADAS information, customizable layouts, and augmented reality features is driving innovation and market share.

- Material innovation, such as soft-touch finishes and sustainable alternatives, also plays a crucial role in this segment.

The growth in these dominant regions and segments is propelled by supportive economic policies, rapid infrastructure development, a robust manufacturing ecosystem, and evolving consumer aspirations for a more connected, comfortable, and personalized in-car experience.

Asia Pacific Automotive Interiors Market Product Landscape

The Asia Pacific automotive interiors market is characterized by a diverse and rapidly evolving product landscape. Innovations are centered on enhancing passenger experience through advanced technology and premium materials. Infotainment systems are at the forefront, with larger, higher-resolution displays, enhanced processing power for seamless user interfaces, and integration of augmented reality features. Instrument panels are transitioning to fully digital cockpits, offering customizable layouts and critical driver information. Interior lighting is becoming more sophisticated, with programmable ambient lighting systems that can adapt to driving modes or user preferences, enhancing cabin aesthetics and mood. Body panels and door panels are seeing increased use of lightweight, sustainable, and recycled materials, contributing to fuel efficiency and environmental responsibility. Flooring solutions are also evolving, with a focus on durability, noise reduction, and aesthetic appeal, often incorporating advanced textiles and composite materials.

Key Drivers, Barriers & Challenges in Asia Pacific Automotive Interiors Market

Key Drivers: The primary forces propelling the Asia Pacific automotive interiors market include the burgeoning middle class and increasing disposable incomes, leading to higher demand for personal vehicles. The rapid growth of the electric vehicle (EV) sector necessitates innovative and often premium interior designs to attract consumers. Technological advancements, such as sophisticated infotainment systems, advanced lighting solutions, and connected car features, are key differentiators and drivers of consumer preference. Government initiatives promoting automotive manufacturing and EV adoption further bolster market growth.

Key Barriers & Challenges: Supply chain disruptions, particularly exacerbated by global geopolitical events and component shortages (e.g., semiconductors), pose a significant challenge. Stringent and evolving regulatory frameworks concerning safety, emissions, and material composition can increase R&D and manufacturing costs. Intense competition from both established players and new entrants, especially in the EV space, puts pressure on pricing and profit margins. The high cost of implementing advanced technologies and the need for specialized manufacturing processes can also act as barriers to entry for smaller players. Furthermore, the shift towards autonomous driving may require significant redesign of traditional interior layouts, presenting a strategic challenge for adaptation.

Emerging Opportunities in Asia Pacific Automotive Interiors Market

Emerging opportunities lie in the growing demand for personalized and customizable interior experiences. The increasing adoption of shared mobility services presents a niche for durable, easily cleanable, and modular interior designs. The push for sustainability is creating a significant market for recycled, bio-based, and lightweight interior materials, offering eco-conscious consumers attractive options. The integration of advanced HMI (Human-Machine Interface) technologies beyond touchscreens, such as gesture control and advanced voice recognition, presents a frontier for innovation. Furthermore, smart cabin technologies that monitor passenger well-being and adapt cabin environment (e.g., air quality, temperature) are poised for significant growth.

Growth Accelerators in the Asia Pacific Automotive Interiors Market Industry

Growth in the Asia Pacific automotive interiors market is being significantly accelerated by the robust expansion of the electric vehicle (EV) segment. OEMs are increasingly differentiating their EV offerings through unique and technologically advanced interior designs, often featuring minimalist aesthetics, large integrated displays, and sustainable materials. Strategic partnerships between traditional interior suppliers and technology companies are fostering innovation in areas like advanced HMI, connected car features, and in-cabin entertainment. Market expansion strategies by major automotive players into emerging economies within the Asia Pacific region, coupled with increasing localization of production, are further fueling demand for interior components.

Key Players Shaping the Asia Pacific Automotive Interiors Market Market

- Toyota Boshoku Corporation

- Magna International Inc

- Delphi Automotive PLC

- Calsonic Kansei Corporation

- Tachi-S Company Ltd

- Hyundai Mobis Co Limited

- Continental AG

- Lear Corporation

- Panasonic Corporation

Notable Milestones in Asia Pacific Automotive Interiors Market Sector

- 2023: Significant increase in collaborations between Tier 1 suppliers and tech startups focused on AI-powered in-cabin experience.

- 2023: Launch of new sustainable interior material solutions, including recycled plastics and plant-based composites, by major manufacturers.

- 2023: Widespread adoption of larger and more integrated infotainment displays (15-inch and above) in newly launched passenger vehicles across key markets.

- 2024: Increased investment in R&D for advanced HMI technologies, including gesture control and enhanced voice recognition, in anticipation of next-generation vehicle platforms.

- 2024: Several M&A activities focused on acquiring companies specializing in in-cabin sensing technologies and ambient lighting systems.

In-Depth Asia Pacific Automotive Interiors Market Market Outlook

The Asia Pacific automotive interiors market is set for sustained growth, driven by the escalating demand for advanced in-car technologies, premium comfort features, and sustainable materials. The ongoing EV revolution acts as a major catalyst, compelling manufacturers to innovate interior designs that enhance user experience and reflect the futuristic nature of electric mobility. Strategic alliances and technological advancements in HMI and connectivity will be crucial in capturing future market share. Emerging economies within the region, coupled with a growing consumer preference for personalized and intelligent cabin environments, present significant untapped potential, paving the way for a dynamic and rapidly evolving market landscape.

Asia Pacific Automotive Interiors Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Infotainment System

- 2.2. Instrument Panels

- 2.3. Interior Lighting

- 2.4. Body Panels

- 2.5. Door Panels

- 2.6. Flooring

- 2.7. Others

Asia Pacific Automotive Interiors Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Automotive Interiors Market Regional Market Share

Geographic Coverage of Asia Pacific Automotive Interiors Market

Asia Pacific Automotive Interiors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Infrastructure and Growing Construction Activities are Driving the Demand for Used Trucks; Cost Effectiveness and Affordability are Fueling the Demand for Used Trucks

- 3.3. Market Restrains

- 3.3.1. Stringent Emission and Safety Standards Present Challenges for the Market

- 3.4. Market Trends

- 3.4.1. Infotainment System Dominates the Automotive Interiors Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Automotive Interiors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Infotainment System

- 5.2.2. Instrument Panels

- 5.2.3. Interior Lighting

- 5.2.4. Body Panels

- 5.2.5. Door Panels

- 5.2.6. Flooring

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toyota Boshoku Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Magna International Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delphi Automotive PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Calsonic Kansei Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tachi-S Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Mobis Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lear Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Toyota Boshoku Corporation

List of Figures

- Figure 1: Asia Pacific Automotive Interiors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Automotive Interiors Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Asia Pacific Automotive Interiors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Automotive Interiors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Automotive Interiors Market?

The projected CAGR is approximately 10.6%.

2. Which companies are prominent players in the Asia Pacific Automotive Interiors Market?

Key companies in the market include Toyota Boshoku Corporation, Magna International Inc*List Not Exhaustive, Delphi Automotive PLC, Calsonic Kansei Corporation, Tachi-S Company Ltd, Hyundai Mobis Co Limited, Continental AG, Lear Corporation, Panasonic Corporation.

3. What are the main segments of the Asia Pacific Automotive Interiors Market?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Infrastructure and Growing Construction Activities are Driving the Demand for Used Trucks; Cost Effectiveness and Affordability are Fueling the Demand for Used Trucks.

6. What are the notable trends driving market growth?

Infotainment System Dominates the Automotive Interiors Market.

7. Are there any restraints impacting market growth?

Stringent Emission and Safety Standards Present Challenges for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Automotive Interiors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Automotive Interiors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Automotive Interiors Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Automotive Interiors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence