Key Insights

The Automotive Automated Parking System (AAPS) market is experiencing robust growth, driven by increasing urbanization, limited parking space in densely populated areas, and the rising adoption of smart city initiatives. The market, valued at approximately $XX million in 2025 (assuming a logical value based on the provided CAGR of 16.96% and a starting point in 2019), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors. Technological advancements are leading to more efficient, reliable, and cost-effective AAPS solutions. Furthermore, the integration of these systems with smart city infrastructure, enabling features like real-time parking availability and seamless payment options, enhances their appeal. The growing demand for improved traffic management and reduced congestion in urban areas is another significant driver. While the initial investment cost for implementing AAPS can be substantial, the long-term benefits, including reduced operational costs and increased parking capacity utilization, are driving adoption across residential and commercial sectors. The market segmentation highlights a strong demand across both residential (e.g., apartment complexes, high-rise buildings) and commercial (e.g., shopping malls, hospitals) applications, with hardware and software components contributing equally to overall market value. Geographic analysis indicates strong potential across North America, Europe, and Asia-Pacific regions, with developing economies in Asia-Pacific expected to experience rapid growth due to increased construction and infrastructure development. However, challenges such as high initial investment costs, complex integration requirements, and potential maintenance issues could act as restraints to market growth.

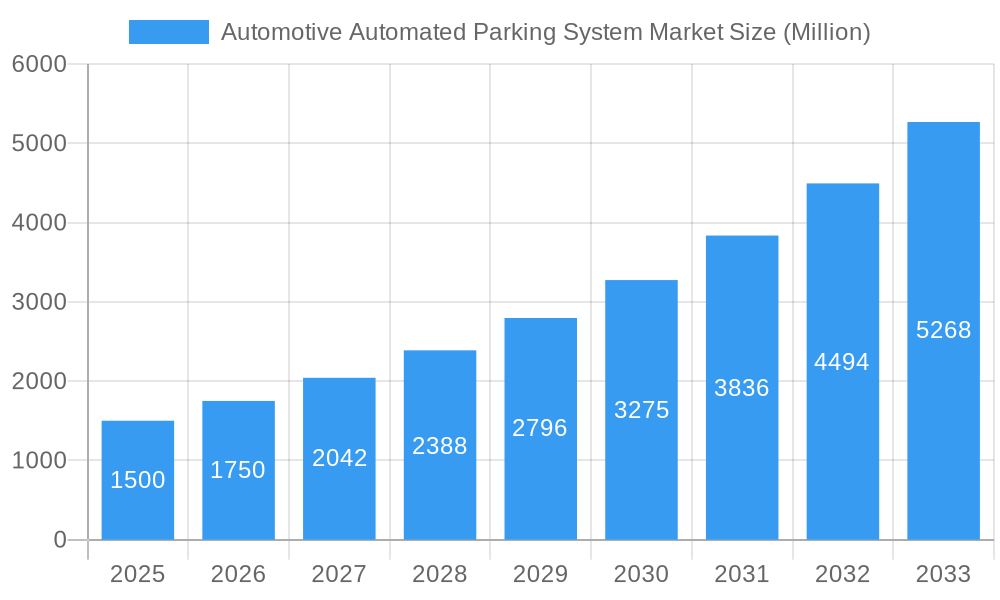

Automotive Automated Parking System Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established players and emerging companies. Key players like Skyline Parking, Unitronics Corporation, and Klaus Multiparking are continuously investing in research and development to improve their offerings and expand their market share. The strategic partnerships and collaborations between AAPS providers and technology companies are further shaping the market dynamics. The ongoing expansion into new geographic markets, combined with the integration of advanced technologies such as AI and IoT, will be crucial in determining the future growth trajectory of the AAPS market. The forecast period will likely witness increased consolidation as larger players acquire smaller companies to expand their product portfolios and geographical reach. The ongoing development of advanced features, such as automated valet parking and improved user interfaces, will contribute to market growth and attract a wider range of customers.

Automotive Automated Parking System Market Company Market Share

Automotive Automated Parking System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Automotive Automated Parking System Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The report leverages extensive market research, quantitative data, and qualitative analysis to deliver actionable insights for industry professionals and stakeholders. The parent market is the broader Automated Parking Systems Market, while the child market is specifically focused on Automotive applications. The market is projected to reach xx Million units by 2033.

Automotive Automated Parking System Market Dynamics & Structure

The Automotive Automated Parking System Market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in AI and sensor technologies, is a primary driver of growth. Stringent safety regulations and evolving urban planning necessitate the adoption of automated parking solutions. Competition from traditional parking systems and the availability of alternative parking solutions create pressure. End-users are diverse, encompassing residential complexes, commercial buildings, and airports. The market has witnessed several mergers and acquisitions (M&A) activities in recent years, driven by companies seeking to expand their product portfolio and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Advancements in AI, sensor technology, and robotics are key drivers.

- Regulatory Framework: Stringent safety and environmental regulations influence market growth.

- Competitive Substitutes: Traditional parking systems, valet services, and ride-sharing applications pose competition.

- End-User Demographics: Growth is driven by increasing urbanization, high vehicle ownership in urban areas, and the need for efficient space utilization.

- M&A Trends: XX M&A deals recorded between 2019-2024, indicating consolidation within the market. (Example: Fauceria's acquisition of Hella Electronics in 2022).

Automotive Automated Parking System Market Growth Trends & Insights

The Automotive Automated Parking System market is experiencing robust growth, driven by several key factors. Increasing urbanization and a surge in vehicle ownership, particularly in densely populated metropolitan areas, are creating a critical need for efficient and space-saving parking solutions. This demand is further amplified by the rising convenience expectations of drivers. The market exhibited a strong CAGR of [Insert Precise CAGR for 2019-2024]% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of [Insert Precise CAGR for 2025-2033]% during the forecast period (2025-2033). This growth is fueled by significant technological advancements, including the development of more sophisticated sensor technologies, refined algorithms, and the seamless integration of artificial intelligence (AI) for improved system control and management. Furthermore, the increasing adoption of autonomous vehicles is accelerating market expansion, creating new opportunities and challenges.

Market penetration saw a significant increase, rising from [Insert Precise Percentage] % in 2019 to [Insert Precise Percentage]% in 2024. This upward trend is expected to continue, with projections indicating a market penetration of [Insert Precise Percentage]% by 2033. The market is segmented by system type (hardware and software) and end-user (residential, commercial, and industrial). The commercial sector currently holds the dominant market share, accounting for approximately [Insert Precise Percentage]% of total revenue in 2025. The increasing adoption of automated parking systems in industrial settings, such as warehouses and logistics centers, is also a noteworthy trend contributing to this growth.

Dominant Regions, Countries, or Segments in Automotive Automated Parking System Market

North America currently holds the largest market share, driven by strong economic growth, favorable regulatory environments, and high adoption rates in major urban centers. Within North America, the United States and Canada are key contributors. Europe is another significant market, with Germany and the UK leading the adoption of automated parking systems. The Asia-Pacific region is expected to experience significant growth in the coming years, driven by rapid urbanization and increasing vehicle ownership in developing economies such as China and India. The commercial segment holds the largest market share, followed by the residential segment.

- Key Drivers (North America): Strong economic growth, supportive government policies, high vehicle ownership, and advanced infrastructure.

- Key Drivers (Europe): High population density in urban areas, stringent environmental regulations promoting efficient parking solutions, and robust technological innovation.

- Key Drivers (Asia-Pacific): Rapid urbanization, rising middle-class disposable incomes, increasing vehicle ownership, and government investments in infrastructure development.

- Segment Dominance: The commercial segment (office buildings, shopping malls, airports) dominates due to higher installation budgets and strong ROI.

Automotive Automated Parking System Market Product Landscape

Automated parking systems are increasingly sophisticated, incorporating advanced technologies like AI, machine learning, and sensor fusion for enhanced accuracy, efficiency, and safety. Products range from fully automated robotic systems to semi-automated guided systems. Unique selling propositions include improved space utilization, reduced parking search times, enhanced security, and integration with smart city infrastructure. Key performance indicators include parking capacity, throughput rate, system uptime, and energy efficiency.

Key Drivers, Barriers & Challenges in Automotive Automated Parking System Market

Key Drivers:

- Rapid urbanization and escalating vehicle ownership in major cities globally.

- Growing consumer preference for convenient and time-efficient parking experiences.

- Continuous advancements in AI, sensor technology, and robotics, leading to more reliable and efficient systems.

- Government initiatives and regulations promoting sustainable urban development and smart city initiatives.

- Integration with emerging mobility services like ride-sharing and autonomous vehicle fleets.

Key Challenges:

- Substantial initial investment costs associated with system installation and ongoing maintenance.

- Addressing potential safety concerns and ensuring high system reliability.

- Complexities involved in integrating automated parking systems with existing urban infrastructure.

- Intense competition from alternative parking solutions and disruptive technologies.

- Supply chain vulnerabilities and their impact on component availability and manufacturing costs. The impact of these disruptions resulted in an estimated loss of [Insert Precise Number] Million units in sales during 2024.

Emerging Opportunities in Automotive Automated Parking System Market

- Synergistic integration with smart city infrastructure to provide real-time parking availability data and improve overall traffic management.

- Development of cost-effective and scalable automated parking solutions tailored for smaller residential and commercial buildings.

- Expansion into developing economies experiencing rapid urbanization and rising vehicle ownership.

- Focus on enhancing user experience through the development of advanced features such as seamless autonomous vehicle integration and intuitive mobile applications.

- Exploring innovative revenue models such as subscription services and dynamic pricing.

Growth Accelerators in the Automotive Automated Parking System Market Industry

Technological breakthroughs in AI, sensor fusion, and robotics continue to drive growth. Strategic partnerships between system integrators, technology providers, and parking operators facilitate market expansion. Government initiatives and supportive policies play a crucial role in accelerating adoption. Expanding into new geographic markets and developing innovative business models further enhance market growth.

Key Players Shaping the Automotive Automated Parking System Market Market

- Skyline Parking

- Unitronics Corporation

- Klaus Multiparking

- Dayang Parking Company Ltd

- Fata Automation

- Lodgie Industries

- Eito and Global

- ShinMaywa Industries

- Citylift

- Westfalia Parking

- Wohr Parking

- ParkPlus Inc

- [Add other relevant key players]

Notable Milestones in Automotive Automated Parking System Market Sector

- January 2022: Fauceria's acquisition of 79.5% stakes in Hella Electronics significantly expanded its portfolio in automated parking systems, highlighting the strategic importance of this market segment.

- February 2022: The partnership between Nvidia and Jaguar Land Rover to develop software-defined features for automated driving indirectly boosts the market for related parking systems, showcasing the interconnectedness of these technologies.

- [Add other significant milestones and relevant news]

In-Depth Automotive Automated Parking System Market Market Outlook

The Automotive Automated Parking System Market is poised for significant growth in the coming years, driven by technological advancements, supportive government policies, and increasing urbanization. Strategic partnerships, investments in R&D, and market expansion into untapped regions present lucrative opportunities for key players. The market is projected to witness substantial expansion, with increased adoption in both residential and commercial sectors. The focus on sustainability and intelligent transportation systems will further propel market growth.

Automotive Automated Parking System Market Segmentation

-

1. System

- 1.1. Hardware

- 1.2. Software

-

2. End User

- 2.1. Residential

- 2.2. Commercial

Automotive Automated Parking System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Automated Parking System Market Regional Market Share

Geographic Coverage of Automotive Automated Parking System Market

Automotive Automated Parking System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Rest of the World Automotive Automated Parking System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Skyline Parking

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unitronics Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Klaus Multiparking

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dayang Parking Company Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fata Automation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lodgie Industries

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Eito and Global

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ShinMaywa Industries

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Citylift

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Westfalia Parking

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Wohr Parking

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 ParkPlus Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Skyline Parking

List of Figures

- Figure 1: Global Automotive Automated Parking System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 3: North America Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 9: Europe Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 10: Europe Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 15: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 16: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Automated Parking System Market Revenue (Million), by System 2025 & 2033

- Figure 21: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by System 2025 & 2033

- Figure 22: Rest of the World Automotive Automated Parking System Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Automotive Automated Parking System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Automated Parking System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 2: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Automotive Automated Parking System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 5: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 11: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 18: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Automated Parking System Market Revenue Million Forecast, by System 2020 & 2033

- Table 26: Global Automotive Automated Parking System Market Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Global Automotive Automated Parking System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Automotive Automated Parking System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Automated Parking System Market?

The projected CAGR is approximately 16.96%.

2. Which companies are prominent players in the Automotive Automated Parking System Market?

Key companies in the market include Skyline Parking, Unitronics Corporation, Klaus Multiparking, Dayang Parking Company Ltd, Fata Automation, Lodgie Industries, Eito and Global, ShinMaywa Industries, Citylift, Westfalia Parking, Wohr Parking, ParkPlus Inc.

3. What are the main segments of the Automotive Automated Parking System Market?

The market segments include System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Increasing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In February 2022, Nvidia and Jaguar Land Rover announced a partnership to develop software-defined features to improve automated driving in their vehicle from 2025. The emphasis is on AI-based features, including advanced visualization and driver and occupant monitoring through the Drive IX software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Automated Parking System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Automated Parking System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Automated Parking System Market?

To stay informed about further developments, trends, and reports in the Automotive Automated Parking System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence