Key Insights

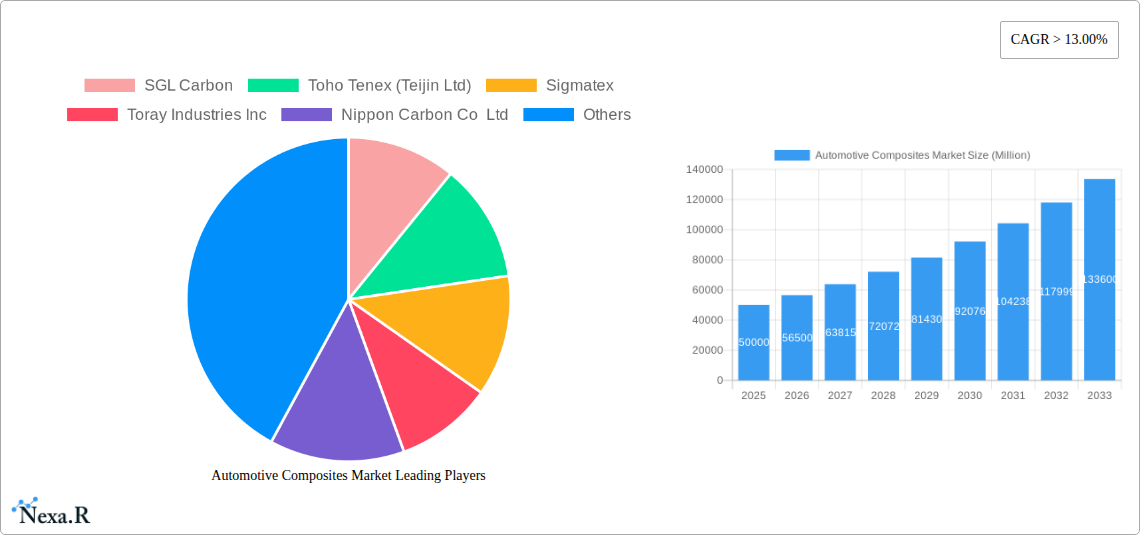

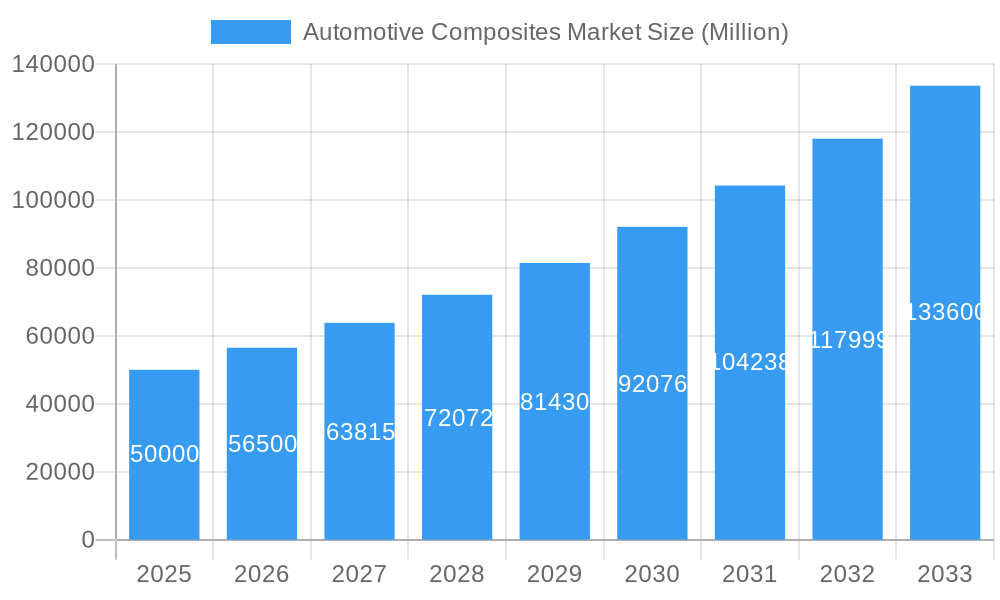

The automotive composites market is experiencing robust growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce carbon emissions. A CAGR exceeding 13% from 2019 to 2033 indicates a significant expansion, with the market expected to reach a substantial size. This growth is fueled by several key factors. Firstly, stringent government regulations regarding fuel economy and greenhouse gas emissions are pushing automakers to adopt lightweight materials like carbon fiber and thermoplastic polymers. Secondly, the rising popularity of electric vehicles (EVs) further enhances the demand for composites, as they offer advantages in battery packaging and overall vehicle design. The adoption of advanced manufacturing techniques, such as automated fiber placement and resin transfer molding, is also contributing to the market expansion, enabling faster and more cost-effective production. Key application segments include structural assembly, powertrain components, and interior and exterior parts, with thermoset and thermoplastic polymers, along with carbon and glass fibers, being the prominent materials. Leading companies such as SGL Carbon, Toray Industries, and Hexcel Corporation are driving innovation and expanding their market share through strategic partnerships and technological advancements. Regional growth is expected to be strongest in the Asia-Pacific region, driven by increasing vehicle production in countries like China and India.

Automotive Composites Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and specialized material suppliers. While established players hold significant market share, smaller companies focusing on niche applications and innovative materials are also emerging. Despite the promising outlook, challenges remain. High material costs, particularly for carbon fiber, and the complexities associated with composite manufacturing can hinder widespread adoption. However, ongoing research and development efforts aimed at reducing costs and improving manufacturing processes are addressing these limitations. The continued focus on sustainability and the growing demand for advanced vehicle features are expected to further fuel the market's expansion in the coming years, resulting in a significant increase in market value and a wider range of applications across the automotive industry.

Automotive Composites Market Company Market Share

Automotive Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Composites Market, encompassing market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by application (Structural Assembly, Powertrain Component, Interior, Exterior) and material (Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber). Key players analyzed include SGL Carbon, Toho Tenex (Teijin Ltd), Sigmatex, Toray Industries Inc, Nippon Carbon Co Ltd, Nippon Sheet Glass Company Limited, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, Solvay, and mouldCAM Pty Ltd. The report offers valuable insights for automotive manufacturers, material suppliers, and industry investors seeking to navigate this rapidly evolving market. The total market size is predicted to reach xx Million units by 2033.

Automotive Composites Market Market Dynamics & Structure

The automotive composites market is characterized by moderate concentration, with several major players dominating specific segments. Technological innovation, particularly in lightweighting materials and manufacturing processes, is a key driver. Stringent regulatory frameworks focused on fuel efficiency and emissions are further pushing adoption. Competitive pressure from traditional materials like steel and aluminum remains significant, but composites offer advantages in terms of weight reduction and design flexibility. End-user demographics are shifting toward electric vehicles (EVs), which present both challenges and opportunities for composite material usage. M&A activity has been moderate in recent years (xx deals in the last 5 years), primarily focused on strategic partnerships and technology acquisitions.

- Market Concentration: Moderately concentrated, with leading players holding xx% market share collectively.

- Technological Innovation: Focus on lightweighting, high-strength materials, and improved manufacturing processes (e.g., automated fiber placement).

- Regulatory Framework: Increasingly stringent fuel efficiency and emission standards drive demand for lightweight composites.

- Competitive Substitutes: Steel, aluminum, and other traditional automotive materials present competition.

- End-User Demographics: Shift towards EVs creates both challenges and opportunities for composite applications.

- M&A Trends: Moderate activity, primarily focused on strategic alliances and technology acquisition. xx M&A deals predicted by 2033.

Automotive Composites Market Growth Trends & Insights

The automotive composites market is experiencing robust growth, driven by increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions. Adoption rates are rising steadily, particularly in high-value vehicle segments. Technological disruptions, such as the development of advanced fiber materials and innovative manufacturing techniques, are accelerating market expansion. Consumer preferences are shifting towards vehicles with improved fuel economy and enhanced performance, further stimulating market growth. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Market penetration is expected to increase from xx% in 2025 to xx% by 2033, driven by increasing adoption in various vehicle components.

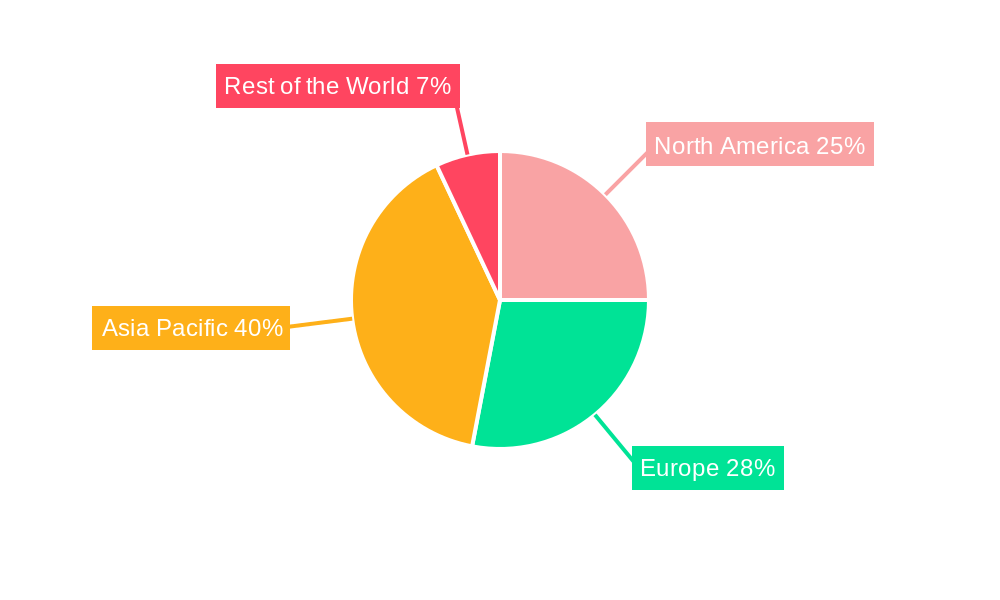

Dominant Regions, Countries, or Segments in Automotive Composites Market

North America and Europe currently dominate the automotive composites market, driven by strong automotive industries and significant investments in advanced materials research and development. Within the application segments, structural assembly (xx Million units in 2025) accounts for the largest share, followed by powertrain components (xx Million units in 2025). Carbon fiber (xx Million units in 2025) holds the largest material segment share due to its high strength-to-weight ratio. Asia-Pacific is projected to witness the fastest growth, fueled by rising vehicle production and increasing government support for the adoption of lightweight materials.

- Key Drivers in North America: Strong automotive industry, high R&D investments, and supportive government policies.

- Key Drivers in Europe: Established automotive industry, focus on sustainability, and stringent emission regulations.

- Key Drivers in Asia-Pacific: Rapidly growing automotive production, increasing demand for lightweight vehicles, and government incentives.

- Dominant Application: Structural Assembly.

- Dominant Material: Carbon Fiber.

Automotive Composites Market Product Landscape

The automotive composites market offers a diverse range of products, including prepreg materials, woven fabrics, and molded parts. Continuous innovation is leading to the development of high-performance materials with improved strength, stiffness, and durability. Unique selling propositions include enhanced lightweighting capabilities, design flexibility, and improved fuel efficiency. Technological advancements are focused on improving manufacturing processes, reducing costs, and enhancing recyclability.

Key Drivers, Barriers & Challenges in Automotive Composites Market

Key Drivers:

- Increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions.

- Growing adoption of electric vehicles, which require lightweight components for extended range.

- Technological advancements in composite materials and manufacturing processes.

Key Challenges:

- High cost of production compared to traditional materials (xx% higher cost currently).

- Complexity of manufacturing processes compared to traditional processes.

- Potential recyclability concerns regarding composite waste (xx% of composites currently recycled).

Emerging Opportunities in Automotive Composites Market

- Growing demand for lightweight and high-performance components in electric and hybrid vehicles.

- Development of sustainable and recyclable composite materials to address environmental concerns.

- Expansion into new applications, such as battery enclosures and fuel cell components.

Growth Accelerators in the Automotive Composites Market Industry

Technological advancements in materials science and manufacturing processes are key growth accelerators. Strategic partnerships between material suppliers and automotive manufacturers are fostering innovation and driving adoption. Government initiatives and supportive policies promoting lightweighting and sustainability are further catalyzing market growth. Expanding into new markets and applications, including commercial vehicles and other transportation segments, presents significant opportunities for expansion.

Key Players Shaping the Automotive Composites Market Market

- SGL Carbon

- Toho Tenex (Teijin Ltd)

- Sigmatex

- Toray Industries Inc

- Nippon Carbon Co Ltd

- Nippon Sheet Glass Company Limited

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- Solvay

- mouldCAM Pty Ltd

Notable Milestones in Automotive Composites Market Sector

- April 2021: Solvay introduces Amodel® Supreme PPA, a high-performance polyphthalamide for e-mobility applications.

- February 2021: Hexcel Corporation collaborates with NaCa Systems to develop a lightweight carbon fiber sports car seat.

- September 2020: Sigmatex launches a recycled carbon fiber non-woven fabric.

- September 2020: Mitsubishi Chemical partners with R3 Composites Corp. for advanced carbon-based composites.

- August 2020: SGL Carbon receives a multi-year order for carbon fiber profiles from Koller Kunststofftechnik GmbH for BMW.

- February 2020: SGL Carbon announces a new composite battery enclosure and glass fiber leaf spring.

In-Depth Automotive Composites Market Market Outlook

The automotive composites market is poised for sustained growth, driven by continuous technological advancements and increasing demand for lightweight, high-performance vehicles. Strategic collaborations between material suppliers and automotive manufacturers will further accelerate innovation and market penetration. Emerging applications in electric vehicles and the development of sustainable composite materials will open up new avenues for growth. The market's future potential is substantial, presenting significant opportunities for companies across the value chain.

Automotive Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Others

-

2. Material Type

- 2.1. Thermoset Polymer

- 2.2. Thermoplastic Polymer

- 2.3. Carbon Fiber

- 2.4. Glass Fiber

Automotive Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Composites Market Regional Market Share

Geographic Coverage of Automotive Composites Market

Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Thermoset Polymer

- 5.2.2. Thermoplastic Polymer

- 5.2.3. Carbon Fiber

- 5.2.4. Glass Fiber

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Structural Assembly

- 6.1.2. Powertrain Component

- 6.1.3. Interior

- 6.1.4. Exterior

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Thermoset Polymer

- 6.2.2. Thermoplastic Polymer

- 6.2.3. Carbon Fiber

- 6.2.4. Glass Fiber

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Structural Assembly

- 7.1.2. Powertrain Component

- 7.1.3. Interior

- 7.1.4. Exterior

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Thermoset Polymer

- 7.2.2. Thermoplastic Polymer

- 7.2.3. Carbon Fiber

- 7.2.4. Glass Fiber

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Structural Assembly

- 8.1.2. Powertrain Component

- 8.1.3. Interior

- 8.1.4. Exterior

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Thermoset Polymer

- 8.2.2. Thermoplastic Polymer

- 8.2.3. Carbon Fiber

- 8.2.4. Glass Fiber

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Structural Assembly

- 9.1.2. Powertrain Component

- 9.1.3. Interior

- 9.1.4. Exterior

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Thermoset Polymer

- 9.2.2. Thermoplastic Polymer

- 9.2.3. Carbon Fiber

- 9.2.4. Glass Fiber

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 SGL Carbon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toho Tenex (Teijin Ltd)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sigmatex

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toray Industries Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Carbon Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nippon Sheet Glass Company Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hexcel Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Solva

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 mouldCAM Pty Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 SGL Carbon

List of Figures

- Figure 1: Global Automotive Composites Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 3: North America Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 9: Europe Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: Europe Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 21: Rest of the World Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Rest of the World Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 23: Rest of the World Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 11: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 19: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 20: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: China Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 27: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 28: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: South America Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Automotive Composites Market?

Key companies in the market include SGL Carbon, Toho Tenex (Teijin Ltd), Sigmatex, Toray Industries Inc, Nippon Carbon Co Ltd, Nippon Sheet Glass Company Limited, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, Solva, mouldCAM Pty Ltd.

3. What are the main segments of the Automotive Composites Market?

The market segments include Application Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

In April 2021, Solvay introduces Amodel® Supreme PPA, a new line of high-performance polyphthalamide (PPA) compounds designed for demanding e-mobility and metal replacement applications. Amodel® Supreme PPA brings a higher level of performance to systems requiring exceptional thermal, mechanical, and electrical properties. Applications range from high-temperature automotive components used in electric drive units including e-motors, power electronics, housings for high-temperature electrical connectors, electric and electronic devices, and telecommunication equipment components that need excellent heat resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence