Key Insights

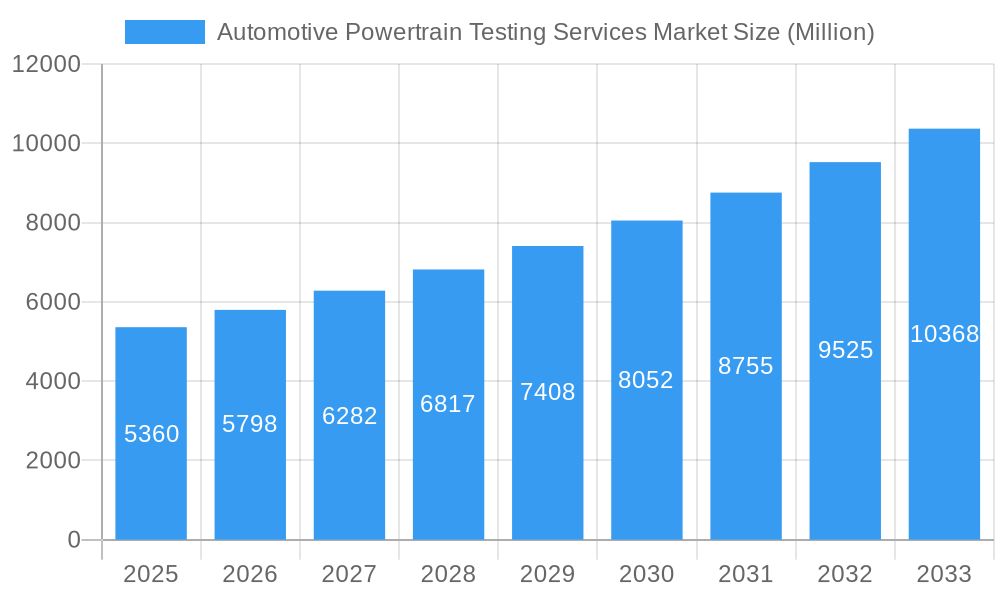

The Automotive Powertrain Testing Services market is experiencing robust growth, projected to reach a market size of $5.36 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.13% from 2025 to 2033. This expansion is driven by several key factors. The increasing complexity of powertrain systems, particularly with the rise of electric and hybrid vehicles, necessitates rigorous testing to ensure performance, durability, and safety. Stringent emission regulations globally are also pushing manufacturers to invest heavily in advanced testing methodologies to meet compliance standards. Furthermore, the ongoing trend of autonomous driving technologies demands comprehensive testing across various scenarios to guarantee safe and reliable operation. The market is segmented by process (designing, development, testing), software (calibration, vibration, others), application (interior, body & structure, powertrain, drivetrain), vehicle type (passenger cars, commercial vehicles), and propulsion type (internal combustion engine, electric & plug-in hybrid). The competitive landscape includes both large multinational corporations and specialized testing service providers, each contributing unique expertise and technologies. Geographic growth is expected to be widespread, with North America and Europe leading the market initially, followed by rapid expansion in the Asia-Pacific region driven by increasing vehicle production and infrastructure development.

Automotive Powertrain Testing Services Market Market Size (In Billion)

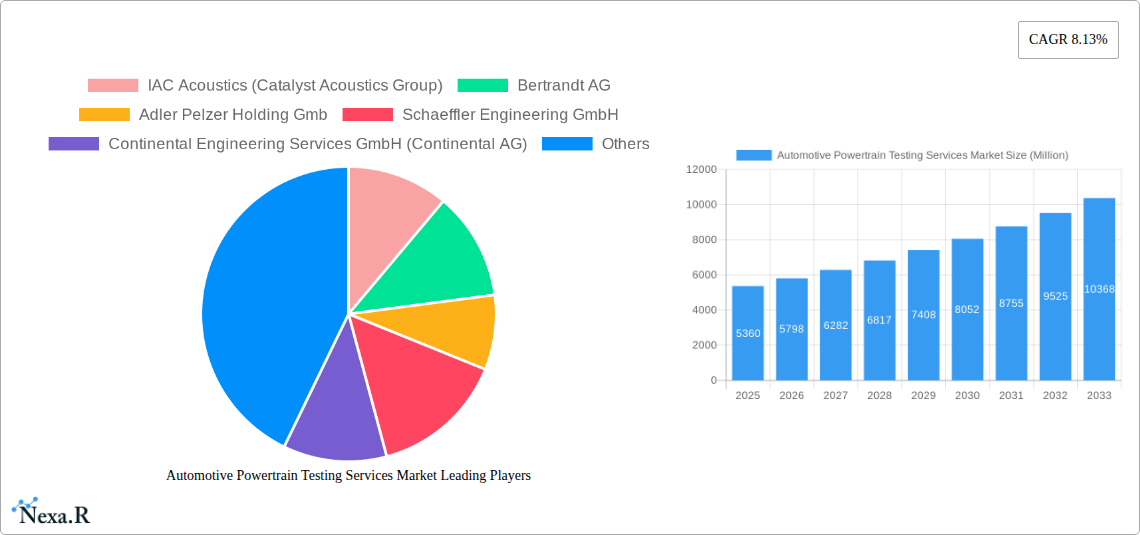

The dominance of established players like Robert Bosch GmbH, Continental Engineering Services GmbH, and AVL List GmbH underscores the importance of technological expertise and established customer relationships. However, the market also exhibits opportunities for smaller, specialized firms focusing on niche areas like electric powertrain testing or specific software solutions. The future trajectory of the market hinges on technological advancements in testing methodologies (e.g., virtual testing, AI-driven analysis), the evolving regulatory landscape, and the continued adoption of electric and autonomous vehicle technologies. Companies strategically investing in research and development and expanding their service portfolios to meet the evolving demands of the industry will be best positioned to capitalize on this growth.

Automotive Powertrain Testing Services Market Company Market Share

Automotive Powertrain Testing Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Automotive Powertrain Testing Services market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The parent market is the broader Automotive Testing Services market, while the child markets include segments by process, software, application, vehicle type, and propulsion type. This report is crucial for automotive manufacturers, testing service providers, investors, and industry stakeholders seeking to understand this rapidly evolving landscape. The global market size is estimated at xx Million units in 2025 and is projected to reach xx Million units by 2033.

Automotive Powertrain Testing Services Market Dynamics & Structure

The Automotive Powertrain Testing Services market is characterized by a moderately concentrated landscape, with several large players and a number of smaller specialized firms. Technological innovation, particularly in areas like electric and hybrid powertrains, is a major driver of market growth. Stringent regulatory frameworks concerning emissions and safety standards further fuel demand for advanced testing services. The market faces competition from substitute technologies focusing on simulation and virtual testing, although physical testing remains crucial for validation. The end-user demographic includes automotive OEMs, Tier 1 and Tier 2 suppliers, and independent testing laboratories. M&A activity is moderate, with strategic acquisitions aimed at expanding service capabilities and geographic reach. Deal volumes have averaged approximately xx per year in the historical period.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on electric vehicle (EV) and hybrid powertrain testing, driving adoption of advanced simulation and testing methodologies.

- Regulatory Framework: Stringent emission and safety regulations mandate comprehensive powertrain testing.

- Competitive Substitutes: Simulation and virtual testing are emerging as alternatives, but physical testing remains crucial.

- End-User Demographics: Primarily automotive OEMs, Tier 1 and Tier 2 suppliers, and independent testing labs.

- M&A Trends: Moderate activity, driven by strategic acquisitions to enhance service portfolios and geographical footprint.

Automotive Powertrain Testing Services Market Growth Trends & Insights

The Automotive Powertrain Testing Services market experienced robust growth during the historical period (2019-2024), driven by the global automotive production increase and the rising demand for electric and hybrid vehicles. The market size grew from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with the market size projected to reach xx Million units in 2033. Several factors are contributing to this growth trajectory. The increasing adoption of sophisticated testing methodologies for advanced powertrains, such as electric motors, fuel cell systems, and hybrid power units, is a key driver. The shift toward autonomous driving and connected cars demands rigorous testing of powertrain integration and performance within complex vehicle systems. Consumer preference for fuel-efficient and environmentally friendly vehicles is accelerating the adoption of electric and plug-in hybrid vehicles, further fueling demand for specialized testing services.

The market penetration of advanced testing technologies like Hardware-in-the-Loop (HIL) simulation is increasing steadily. The global market penetration of HIL simulation in powertrain testing was at xx% in 2024 and is expected to reach xx% by 2033. Furthermore, advancements in software-based testing solutions are streamlining testing processes and enabling greater efficiency. Technological disruptions, such as the increased use of artificial intelligence (AI) and machine learning (ML) in test data analysis, are also influencing market dynamics. The consumer preference for improved fuel efficiency and reduced emissions continues to be a key driver of market growth.

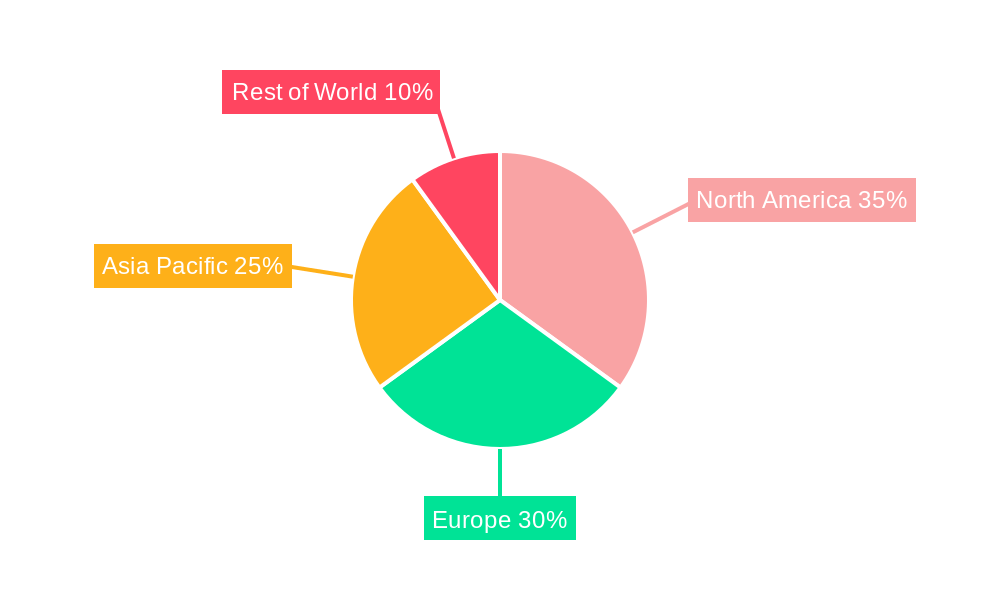

Dominant Regions, Countries, or Segments in Automotive Powertrain Testing Services Market

The Automotive Powertrain Testing Services market is geographically diverse, with significant regional variations in growth rates and market share. North America and Europe currently hold substantial market shares due to strong automotive manufacturing bases and stringent emission regulations. However, the Asia-Pacific region is expected to experience the most rapid growth in the coming years, driven by the burgeoning automotive industry in China and other developing economies. Within the segments, the Powertrain application segment holds the largest market share, followed by Drivetrain. The Testing process segment constitutes a significant portion of the overall market, driven by the need for validation and verification of powertrain components and systems. Passenger cars currently dominate the vehicle type segment, but Commercial Vehicles are expected to experience faster growth, fueled by increasing adoption of advanced powertrain technologies in commercial fleets. The Internal Combustion Engine segment still accounts for a larger market share, but the Electric and Plug-in Hybrid segment is exhibiting rapid growth and is poised to overtake it in the next decade.

- Key Growth Drivers:

- North America: Stringent emission regulations and substantial investments in automotive R&D.

- Europe: High adoption of electric and hybrid vehicles, coupled with government incentives.

- Asia-Pacific: Rapid growth of the automotive industry in countries like China and India.

- Dominant Segments:

- By Application: Powertrain (xx% Market Share), Drivetrain (xx% Market Share).

- By Process: Testing (xx% Market Share).

- By Vehicle Type: Passenger Cars (xx% Market Share).

- By Propulsion Type: Internal Combustion Engine (xx% Market Share).

Automotive Powertrain Testing Services Market Product Landscape

The Automotive Powertrain Testing Services market offers a wide array of testing services, ranging from component-level testing to complete system validation. The latest advancements include the integration of AI and ML algorithms for improved test data analysis and predictive maintenance. The unique selling propositions of different service providers are often based on their specialized expertise in specific powertrain technologies (e.g., electric motors, fuel cells), their advanced testing capabilities, and the efficiency of their processes. Technological advancements are continuously being made in areas such as Hardware-in-the-Loop (HIL) simulation, dynamometer testing, and emission measurement technologies, leading to faster, more accurate, and cost-effective testing solutions.

Key Drivers, Barriers & Challenges in Automotive Powertrain Testing Services Market

Key Drivers: The increasing demand for electric and hybrid vehicles, stringent emission regulations, and the growing complexity of modern powertrains are significant drivers of market growth. Advancements in testing technologies and the increasing adoption of digitalization and data analytics are further accelerating market expansion.

Key Challenges: Supply chain disruptions, particularly in the procurement of specialized testing equipment and skilled labor, pose a significant challenge. Regulatory compliance requirements, especially with respect to global harmonization of testing standards, can be burdensome and costly. Intense competition among providers, both from large established players and smaller niche specialists, puts pressure on pricing and profit margins. The increasing complexity of powertrains necessitates the development of sophisticated and expensive testing equipment, which poses a financial barrier for some smaller providers.

Emerging Opportunities in Automotive Powertrain Testing Services Market

Emerging opportunities lie in the expansion into new geographic markets, particularly in developing economies with growing automotive industries. The increasing demand for connected and autonomous vehicles presents opportunities to develop specialized testing services for the associated powertrain systems. The growth of electric and fuel cell powertrains offers significant potential for specialized testing providers with expertise in these areas. Finally, developing innovative and cost-effective testing methodologies to accommodate the increasing demand for faster and more efficient testing is an emerging opportunity.

Growth Accelerators in the Automotive Powertrain Testing Services Market Industry

The long-term growth of the Automotive Powertrain Testing Services market is driven by several factors. Technological breakthroughs in areas like HIL simulation and AI-powered data analytics are continuously improving the efficiency and accuracy of testing processes. Strategic partnerships between testing service providers and automotive OEMs are enabling the development of tailored solutions to meet specific customer needs. Government incentives and regulations promoting electric and hybrid vehicle adoption are also fostering market growth. Moreover, the expansion of testing services into new geographic markets is creating additional avenues for growth.

Key Players Shaping the Automotive Powertrain Testing Services Market Market

- IAC Acoustics (Catalyst Acoustics Group)

- Bertrandt AG

- Adler Pelzer Holding Gmb

- Schaeffler Engineering GmbH

- Continental Engineering Services GmbH (Continental AG)

- Spectris PLC

- EDAG Engineering Group AG

- Robert Bosch GmbH

- FEV Group GmbH

- AVL List GmbH

- Siemens Digital Industries Software (Siemens AG)

- Autoneum Holding Ltd

Notable Milestones in Automotive Powertrain Testing Services Market Sector

- February 2022: NVH (Noise, Vibration, and Harshness) and EMC (Electromagnetic Compatibility) testing commenced for the BMW i7, highlighting the focus on enhanced acoustic comfort in electric vehicles.

- September 2022: Dayin Technology partnered with BlackBerry to develop acoustic solutions for Great Wall Motors, signifying the growing importance of in-car audio quality.

- January 2023: BlackBerry and Magneti Marelli collaborated on enhanced in-car audio for SDVs, underscoring the increasing role of software-defined platforms in vehicle development and testing.

- February 2023: Warwick Acoustics commercialized its automotive in-car audio technology, showcasing the industry's commitment to sustainable and high-quality audio.

- January 2024: BlackBerry launched QNX Sound, a significant advancement in in-vehicle audio and acoustics technology, influencing the testing requirements for SDVs.

In-Depth Automotive Powertrain Testing Services Market Market Outlook

The future of the Automotive Powertrain Testing Services market is bright, driven by sustained growth in the global automotive industry, and the increasing adoption of electric and autonomous vehicles. This translates into increased opportunities for specialized testing services and continued demand for advanced technologies. Strategic partnerships, technological innovation, and the expansion into emerging markets will be crucial for achieving long-term success. Companies focusing on providing comprehensive, integrated solutions leveraging AI and data analytics will be best positioned to capitalize on this expanding market.

Automotive Powertrain Testing Services Market Segmentation

-

1. Process

- 1.1. Designing

- 1.2. Development

- 1.3. Testing

-

2. Software

- 2.1. Calibration

- 2.2. Vibration

- 2.3. Others

-

3. Application

- 3.1. Interior

- 3.2. Body and Structure

- 3.3. Powertrain

- 3.4. Drivetrain

-

4. Vehicle Type

- 4.1. Passenger Cars

- 4.2. Commercial Vehicle

-

5. Propulsion Type

- 5.1. Internal Combustion Engine

- 5.2. Electric and Plug-in Hybrid

Automotive Powertrain Testing Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

- 5. Middle East and Africa

- 6. South America

Automotive Powertrain Testing Services Market Regional Market Share

Geographic Coverage of Automotive Powertrain Testing Services Market

Automotive Powertrain Testing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investments in Refueling Infrastructure Is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth

- 3.4. Market Trends

- 3.4.1. Passenger Cars are Dominating the Automotive Acoustic Engineering Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Designing

- 5.1.2. Development

- 5.1.3. Testing

- 5.2. Market Analysis, Insights and Forecast - by Software

- 5.2.1. Calibration

- 5.2.2. Vibration

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Interior

- 5.3.2. Body and Structure

- 5.3.3. Powertrain

- 5.3.4. Drivetrain

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Passenger Cars

- 5.4.2. Commercial Vehicle

- 5.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.5.1. Internal Combustion Engine

- 5.5.2. Electric and Plug-in Hybrid

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.6.5. Middle East and Africa

- 5.6.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. North America Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Designing

- 6.1.2. Development

- 6.1.3. Testing

- 6.2. Market Analysis, Insights and Forecast - by Software

- 6.2.1. Calibration

- 6.2.2. Vibration

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Interior

- 6.3.2. Body and Structure

- 6.3.3. Powertrain

- 6.3.4. Drivetrain

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. Passenger Cars

- 6.4.2. Commercial Vehicle

- 6.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.5.1. Internal Combustion Engine

- 6.5.2. Electric and Plug-in Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Europe Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Designing

- 7.1.2. Development

- 7.1.3. Testing

- 7.2. Market Analysis, Insights and Forecast - by Software

- 7.2.1. Calibration

- 7.2.2. Vibration

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Interior

- 7.3.2. Body and Structure

- 7.3.3. Powertrain

- 7.3.4. Drivetrain

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. Passenger Cars

- 7.4.2. Commercial Vehicle

- 7.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.5.1. Internal Combustion Engine

- 7.5.2. Electric and Plug-in Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Asia Pacific Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Designing

- 8.1.2. Development

- 8.1.3. Testing

- 8.2. Market Analysis, Insights and Forecast - by Software

- 8.2.1. Calibration

- 8.2.2. Vibration

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Interior

- 8.3.2. Body and Structure

- 8.3.3. Powertrain

- 8.3.4. Drivetrain

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. Passenger Cars

- 8.4.2. Commercial Vehicle

- 8.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.5.1. Internal Combustion Engine

- 8.5.2. Electric and Plug-in Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Rest of the World Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Designing

- 9.1.2. Development

- 9.1.3. Testing

- 9.2. Market Analysis, Insights and Forecast - by Software

- 9.2.1. Calibration

- 9.2.2. Vibration

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Interior

- 9.3.2. Body and Structure

- 9.3.3. Powertrain

- 9.3.4. Drivetrain

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. Passenger Cars

- 9.4.2. Commercial Vehicle

- 9.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.5.1. Internal Combustion Engine

- 9.5.2. Electric and Plug-in Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Middle East and Africa Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Designing

- 10.1.2. Development

- 10.1.3. Testing

- 10.2. Market Analysis, Insights and Forecast - by Software

- 10.2.1. Calibration

- 10.2.2. Vibration

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Interior

- 10.3.2. Body and Structure

- 10.3.3. Powertrain

- 10.3.4. Drivetrain

- 10.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.4.1. Passenger Cars

- 10.4.2. Commercial Vehicle

- 10.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.5.1. Internal Combustion Engine

- 10.5.2. Electric and Plug-in Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. South America Automotive Powertrain Testing Services Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Process

- 11.1.1. Designing

- 11.1.2. Development

- 11.1.3. Testing

- 11.2. Market Analysis, Insights and Forecast - by Software

- 11.2.1. Calibration

- 11.2.2. Vibration

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Interior

- 11.3.2. Body and Structure

- 11.3.3. Powertrain

- 11.3.4. Drivetrain

- 11.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.4.1. Passenger Cars

- 11.4.2. Commercial Vehicle

- 11.5. Market Analysis, Insights and Forecast - by Propulsion Type

- 11.5.1. Internal Combustion Engine

- 11.5.2. Electric and Plug-in Hybrid

- 11.1. Market Analysis, Insights and Forecast - by Process

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 IAC Acoustics (Catalyst Acoustics Group)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bertrandt AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Adler Pelzer Holding Gmb

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Schaeffler Engineering GmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Continental Engineering Services GmbH (Continental AG)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Spectris PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EDAG Engineering Group AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Robert Bosch GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 FEV Group GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AVL List GmbH

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Siemens Digital Industries Software (Siemens AG)

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Autoneum Holding Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 IAC Acoustics (Catalyst Acoustics Group)

List of Figures

- Figure 1: Global Automotive Powertrain Testing Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 3: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 4: North America Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 5: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 6: North America Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 11: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: North America Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 15: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 16: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 17: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 18: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 23: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: Europe Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 27: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 28: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 29: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 30: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 35: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 36: Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 39: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 40: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 41: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 42: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 45: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 46: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 47: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 48: Rest of the World Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 51: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 52: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 53: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 54: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 55: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 56: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 57: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 58: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 59: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 60: Middle East and Africa Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Automotive Powertrain Testing Services Market Revenue (Million), by Process 2025 & 2033

- Figure 63: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Process 2025 & 2033

- Figure 64: South America Automotive Powertrain Testing Services Market Revenue (Million), by Software 2025 & 2033

- Figure 65: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Software 2025 & 2033

- Figure 66: South America Automotive Powertrain Testing Services Market Revenue (Million), by Application 2025 & 2033

- Figure 67: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 68: South America Automotive Powertrain Testing Services Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 69: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 70: South America Automotive Powertrain Testing Services Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 71: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 72: South America Automotive Powertrain Testing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 73: South America Automotive Powertrain Testing Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 3: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 8: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 9: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 17: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 18: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 21: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 29: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 30: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Asia Pacific Automotive Powertrain Testing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 40: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 41: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 44: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 46: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 47: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 48: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 49: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 50: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 51: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 52: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Software 2020 & 2033

- Table 53: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 55: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 56: Global Automotive Powertrain Testing Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Powertrain Testing Services Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Automotive Powertrain Testing Services Market?

Key companies in the market include IAC Acoustics (Catalyst Acoustics Group), Bertrandt AG, Adler Pelzer Holding Gmb, Schaeffler Engineering GmbH, Continental Engineering Services GmbH (Continental AG), Spectris PLC, EDAG Engineering Group AG, Robert Bosch GmbH, FEV Group GmbH, AVL List GmbH, Siemens Digital Industries Software (Siemens AG), Autoneum Holding Ltd.

3. What are the main segments of the Automotive Powertrain Testing Services Market?

The market segments include Process, Software, Application, Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Investments in Refueling Infrastructure Is Driving the Market Growth.

6. What are the notable trends driving market growth?

Passenger Cars are Dominating the Automotive Acoustic Engineering Services Market.

7. Are there any restraints impacting market growth?

Inadequate Regulatory Frameworks is Anticipated to Restrain the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2024: BlackBerry launched QNX Sound, a comprehensive audio and acoustics innovation platform designed for Software Defined Vehicles (SDVs). This platform aims to revolutionize the in-vehicle audio experience by integrating advanced audio processing, noise cancellation, and acoustic management capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Powertrain Testing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Powertrain Testing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Powertrain Testing Services Market?

To stay informed about further developments, trends, and reports in the Automotive Powertrain Testing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence